Insurance stands at the cusp of a profound evolution, catalyzed by the rapid advancements in technology. At the heart of this transformation lies Artificial Intelligence (AI), a force that is no longer confined to the realm of science fiction but is actively reshaping the very fabric of how insurers operate and engage with their clientele. AI’s remarkable capability to dissect and interpret extensive datasets, coupled with its aptitude for automating intricate processes, has moved beyond a mere futuristic concept to become a tangible reality that is redefining the operational landscape for insurance providers and their customers. This exploration will delve into the multitude of ways in which AI is being strategically deployed across the insurance value chain, offering crucial perspectives for insurance professionals seeking a comprehensive understanding and practical strategies for leveraging this potent technology.

Quick Introduction

The insurance sector is undergoing a significant shift, with Artificial Intelligence (AI) at the forefront of this change. AI’s ability to analyze vast data and automate complex tasks is revolutionizing how insurers operate and interact with customers. This transformation is enhancing efficiency, personalizing services, and creating new opportunities for growth and innovation within the insurance. Insurance professionals are increasingly recognizing AI as a critical tool for staying competitive and meeting the evolving demands of the market.

What is AI and Why Does It Matter in Insurance?

Definition von KI und ihren Kerntechnologien

Definition von KI und ihren Kerntechnologien

Artificial Intelligence (AI) enables machines to perform tasks requiring human intelligence, encompassing technologies like Machine Learning (ML), Natural Language Processing (NLP), and Computer Vision. These technologies allow insurers to automate, understand, and optimize critical processes. AI shifts insurance from reactive to predictive models, strengthening underwriting, customer service, and claims handling. Generative AI further personalizes interactions, driving innovation in risk management and service delivery.

The growing role of AI in transforming insurance

The insurance sector is undergoing a major transformation as AI integration enhances efficiency, customer experience, and innovation across the value chain. Traditionally reactive, insurers are now adopting proactive strategies through AI’s ability to process and analyze large volumes of data. Core functions like customer service, underwriting, risk assessment, and claims processing are being streamlined, while generative AI enables highly personalized customer interactions. This marks a fundamental shift from traditional models towards dynamic, predictive, and personalized insurance operations.

Key statistics or trends highlighting AI adoption in insurance

Surveys reveal that a majority of insurers are investing heavily in AI, with 76% implementing generative AI and 78% planning budget increases. Projections show the AI insurance market reaching USD 6.92 billion by 2028, highlighting significant anticipated growth. Executive leaders increasingly prioritize AI, even amid economic uncertainties. These trends confirm the sector’s strong belief in AI’s transformative potential and its role in future competitiveness.

2. Business Benefits of AI in Insurance

Benefit 1: Increased Efficiency

Benefit 1: Increased Efficiency

AI significantly boosts operational efficiency by automating key insurance tasks such as claims processing, underwriting, and customer service inquiries. It reduces manual errors, accelerates decision-making, and allows faster policy issuance. AI-powered chatbots also handle routine customer interactions, freeing human agents to manage complex cases. Overall, AI optimizes workflows, cuts operational bottlenecks, and improves productivity across the insurance sector.

Benefit 2: Cost Reduction

AI reduces costs by automating underwriting, claims processing, and fraud detection, leading to fewer errors and lower payroll expenses. Studies suggest AI adoption could cut claims costs by up to 40% by 2025. Automation minimizes manual labor needs and strengthens fraud prevention efforts, saving insurers billions. These efficiencies improve financial performance and enhance insurers’ bottom lines.

Benefit 3: Improved Customer Experience

AI improves customer experience by offering 24/7 chatbot support, faster claims settlements, and personalized policy recommendations. Companies like Lemonade demonstrate how AI can drastically reduce claims processing times to just seconds. AI enables insurers to deliver more tailored, responsive, and convenient services. As a result, customer satisfaction and loyalty are significantly strengthened.

Benefit 4: Enhanced Fraud Detection

AI enhances fraud detection by analyzing vast datasets to identify suspicious patterns with greater speed and accuracy than humans. Machine learning models are particularly effective in uncovering organized fraud rings and subtle anomalies. Companies like Zurich Insurance have seen a 10% rise in fraud detection rates using AI-based systems. This capability saves insurers billions annually while safeguarding honest policyholders.

Benefit 5: Personalized Services and Products

AI enables insurers to deliver highly personalized services by analyzing customer behavior, preferences, and risk profiles. It supports tailored coverage options and usage-based insurance pricing based on real-world activities. Companies like AXA use AI insights to offer customized policy recommendations. This shift away from standardized offerings strengthens customer engagement and enhances policy relevance.

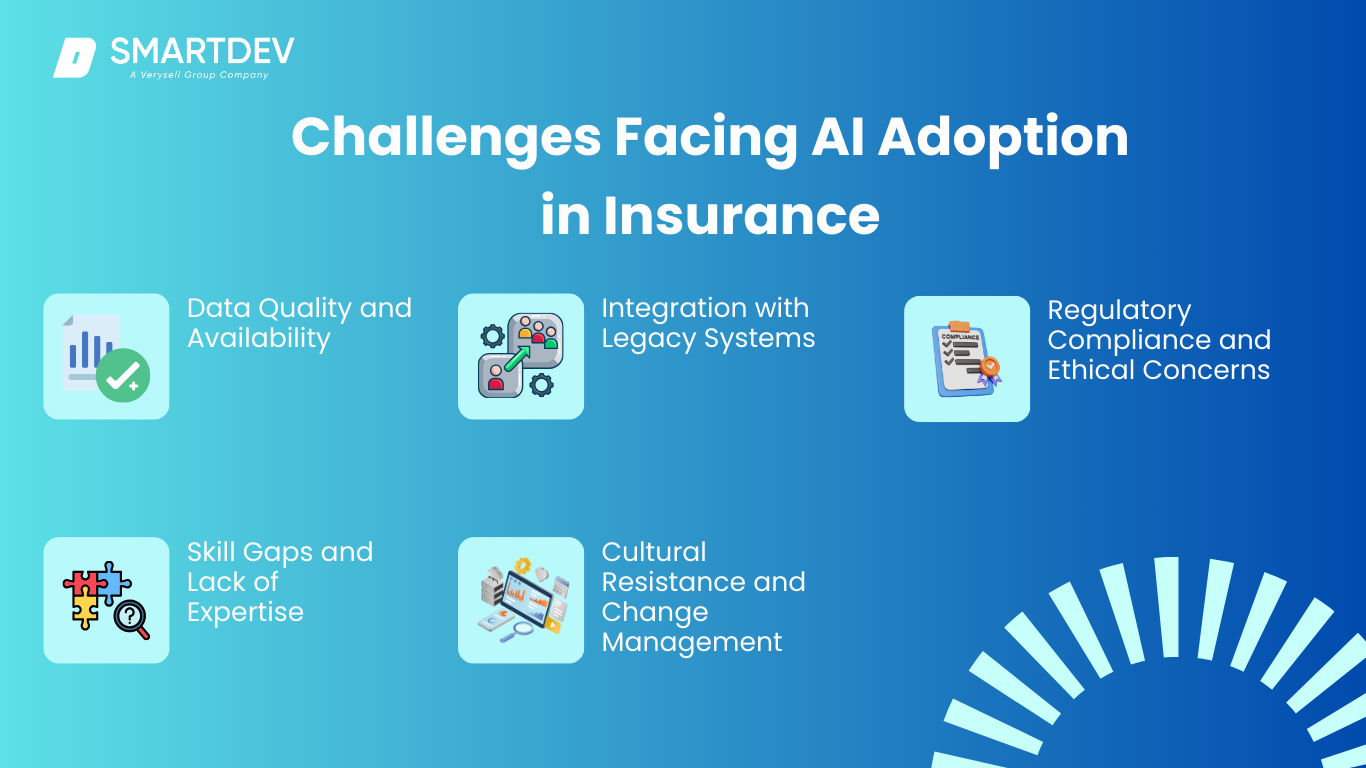

3. Challenges Facing AI Adoption in Insurance

Challenge 1: Data Quality and Availability

Challenge 1: Data Quality and Availability

AI relies on large, accurate, and accessible datasets, but many insurers struggle with fragmented and inconsistent data across systems. Poor data quality leads to inaccurate predictions in areas like risk assessment and pricing. Regulatory constraints and outdated infrastructure further complicate real-time data access. Without clean, well-organized data, AI adoption in insurance remains unreliable and limited.

Challenge 2: Integration with Legacy Systems

Many insurers still depend on outdated IT systems that are incompatible with modern AI technologies. Integrating AI with legacy infrastructure is costly, complex, and often requires major upgrades. Data silos and outdated formats hinder AI models from processing information effectively. This technical challenge acts as a major deterrent to AI implementation for many companies.

Challenge 3: Regulatory Compliance and Ethical Concerns

Insurance is a highly regulated industry, and AI must comply with numerous legal and ethical standards. Ensuring fairness, transparency, and avoiding algorithmic bias are significant challenges. Data privacy and security concerns further complicate AI deployment. Adherence to evolving regulations is essential to maintain customer trust and avoid legal risks.

Challenge 4: Skill Gaps and Lack of Expertise

There is a shortage of AI, machine learning, and data science expertise within the insurance sector. High demand across industries makes attracting and retaining skilled professionals difficult. Existing employees often require costly and time-consuming training to work effectively with AI tools. Without sufficient talent, building and maintaining AI solutions remains a major hurdle.

Challenge 5: Cultural Resistance and Change Management

Resistance to AI adoption often stems from fears of job displacement and distrust of automated decision-making. Leadership hesitation over costs and workflow disruption further slows AI initiatives. Successful integration requires a cultural shift toward innovation and adaptability. Clear communication, change management strategies, and employee training are essential for overcoming internal resistance.

4. Specific Applications of AI in Insurance

AI in Underwriting

AI is transforming underwriting by analyzing vast datasets to assess risks more precisely, enabling more accurate pricing and tailored policies. Machine learning models enhance human decision-making, while AI tools automate risk assessments using internal and external data. AI can even analyze property images and connected device data to detect specific risk factors. This shift turns underwriting into a faster, data-driven process that improves accuracy, efficiency, and personalization.

AI in Claims Processing

AI revolutionizes claims processing by analyzing multiple data sources to assess claim severity and recommend next steps. Automation reduces manual errors, speeds up claims workflows, and significantly enhances customer satisfaction. AI can also evaluate visual evidence to streamline damage assessments. Companies like Lemonade demonstrate how AI reduces average claim processing times to mere seconds, boosting efficiency and customer experience.

AI in Customer Service Chatbots

AI chatbots provide 24/7 customer support, instantly answering queries and helping customers navigate complex insurance processes. Powered by Natural Language Processing (NLP), these bots make interactions feel more human-like and intuitive. They handle routine tasks like billing inquiries and policy details, freeing human agents for more complex cases. Successful examples like GEICO’s “Kate” show how AI chatbots improve customer engagement and service efficiency.

AI in Risk Assessment

AI improves risk assessment by analyzing massive internal and external datasets faster and more accurately than traditional methods. It processes data from connected devices to provide real-time risk evaluations, helping insurers predict potential losses from events like natural disasters. Predictive models enable better underwriting and more competitive pricing. AI fundamentally enhances insurers’ ability to understand and manage diverse and evolving risks.

AI in Fraud Detection

AI plays a crucial role in detecting and preventing insurance fraud by analyzing large datasets for subtle patterns and anomalies. Machine learning algorithms are trained to identify complex fraud schemes often missed by human investigators. Predictive analytics anticipate suspicious claims before they escalate into losses. By leveraging AI, insurers can better protect their finances and customers while improving the overall integrity of the insurance system.

5. Examples of AI in Insurance

a) Real-World Case Studies

Several insurers have successfully implemented AI to enhance operations and customer service, such as GEICO’s “Kate” chatbot and Liberty Mutual’s Alexa Skills. Allstate uses an internal chatbot, ABIe, to assist agents, while Lemonade leverages AI for near-instant claims processing. Allianz Direct and major travel insurers have achieved major efficiency gains with AI-driven claims automation. These examples showcase how AI improves efficiency, customer engagement, and operational performance across the insurance sector.

b) Innovative AI Solutions

Insurers are increasingly deploying AI-driven personalization, real-time claims processing, and digital-first onboarding to enhance customer experiences. Continuous risk assessment allows insurers to adjust premiums dynamically as new information emerges. Generative AI, predictive analytics, and computer vision are further optimizing fraud detection, risk modeling, and pricing strategies. These innovations demonstrate how AI is transforming core insurance operations to be faster, smarter, and more customer-centric.

6. AI-Driven Innovations Transforming Insurance

Emerging Technologies in AI for Insurance

New AI technologies such as Generative AI, Explainable AI (XAI), AI Agents, and Multimodal AI are redefining insurance operations. Generative AI is being used for summarizing documents and assisting underwriting, while XAI ensures transparency and regulatory compliance. AI Agents automate back-office tasks, and Multimodal AI enhances fraud detection by analyzing diverse data types. Together, these technologies promise major efficiency, trust, and decision-making improvements across the insurance value chain.

Die Rolle der KI bei Nachhaltigkeitsbemühungen

AI is helping insurers model climate risks more accurately by analyzing weather, geographic, and environmental data. This enables better loss forecasting and the creation of eco-friendly insurance products, such as usage-based policies for electric vehicles. Insurers are also using AI to optimize resource allocation and reduce operational waste, supporting internal sustainability initiatives. As environmental concerns rise, AI’s role in promoting sustainable practices within insurance will continue to expand.

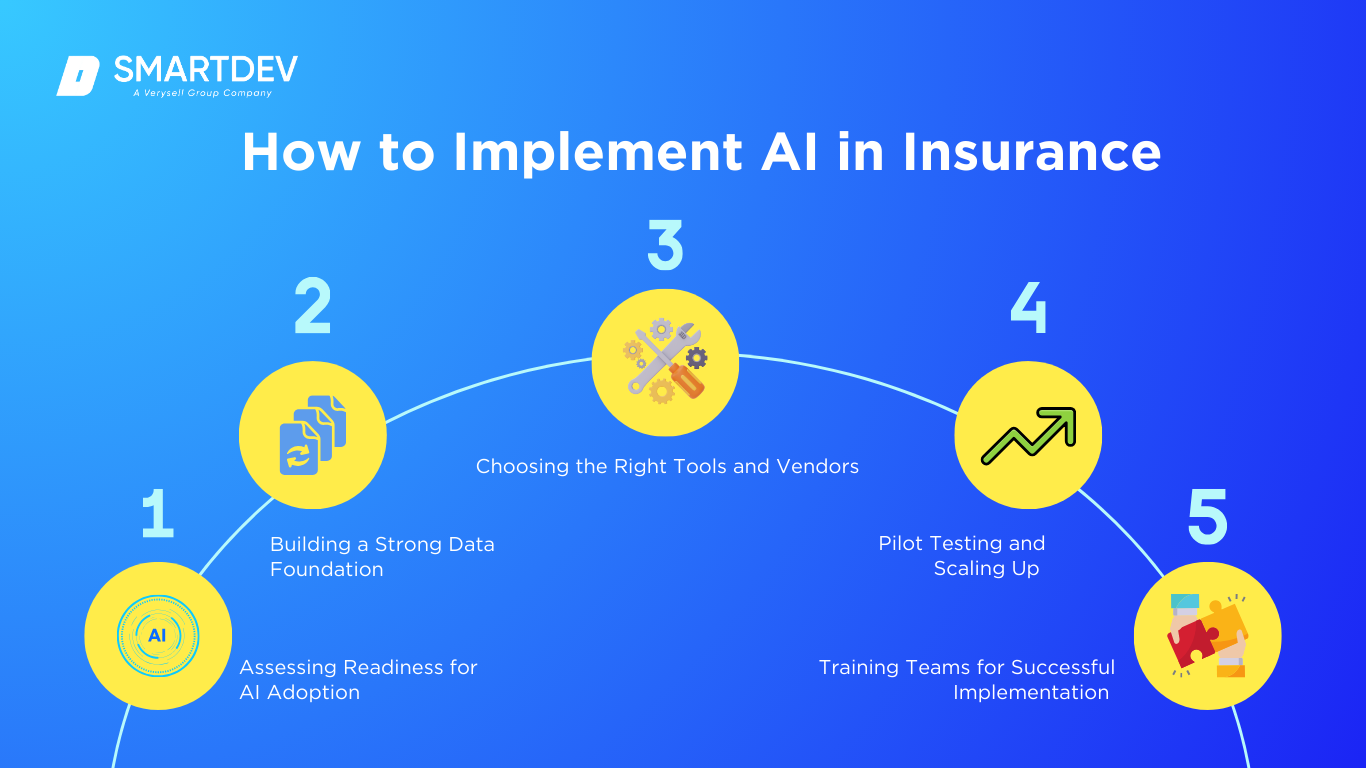

7. How to Implement AI in Insurance

Assessing Readiness for AI Adoption

Assessing Readiness for AI Adoption

Insurance companies considering AI adoption should first conduct a thorough assessment of their readiness. This involves evaluating their existing technological infrastructure, the quality and accessibility of their data, the skills and expertise of their current workforce, and their specific business needs and objectives.20 A clear understanding of these factors will help determine the most appropriate AI applications and the level of investment required.

Building a Strong Data Foundation

A critical foundation for any successful AI initiative in insurance is building a strong data foundation. This necessitates a significant focus on data governance, ensuring the quality and accuracy of data, and establishing effective data integration strategies to bring together information from various sources.2 High-quality, well-managed data is essential for training effective AI models and generating reliable insights.

Choosing the Right Tools and Vendors

When embarking on AI implementation, it is crucial to choose the right tools and vendors. Insurance companies should carefully evaluate the various AI platforms and partners available, selecting those that best align with their specific business requirements and offer robust features for data security and regulatory compliance.20

Pilot Testing and Scaling Up

A recommended approach to AI implementation is to begin with pilot testing. This allows insurance companies to test the effectiveness of selected AI solutions on a smaller scale before committing to full-scale deployment across the organization.20 Successful pilot programs can provide valuable insights and help refine implementation strategies before broader rollout.

Training Teams for Successful Implementation

The successful adoption of AI in insurance also hinges on training teams for successful implementation. Investing in comprehensive training and upskilling programs for employees is essential to ensure that they can work effectively with new AI-powered tools and understand the insights generated.20 This includes not only technical training but also education on the ethical considerations and potential biases associated with AI.

8. Measuring the ROI of AI in Insurance

Wichtige Kennzahlen zur Erfolgsmessung

To demonstrate the value and justify further investment in AI, insurance companies must measure the return on investment (ROI) of their AI initiatives. This involves defining key performance indicators (KPIs) to track the success of AI deployments, such as reductions in operational costs, improvements in processing efficiency, and increases in customer satisfaction.20 Tracking metrics like claim cycle time, fraud detection rates, and customer retention can provide concrete evidence of AI’s impact.

Fallstudien zum ROI

Case studies that highlight specific instances of ROI achievement can further strengthen the business case for AI.

Häufige Fehler und wie man sie vermeidet

Finally, insurance companies should be aware of common pitfalls associated with AI adoption, such as underestimating the importance of data quality, encountering challenges with system integration, and overlooking ethical implications. Developing proactive strategies to avoid these pitfalls is crucial for ensuring a smooth and successful AI implementation journey.

9. Future Trends of AI in Insurance

Prognosen für das nächste Jahrzehnt

Prognosen für das nächste Jahrzehnt

Over the next decade, AI is anticipated to become even more deeply integrated across all facets of the insurance insurance’s value chain. This deeper integration will likely lead to the emergence of entirely new categories of insurance products, more sophisticated and personalized pricing models that reflect individual risk with greater accuracy, and an overall shift towards increasingly real-time service delivery that meets the immediate needs and expectations of customers.1 The increasing prevalence of connected devices, ranging from smartwatches and fitness trackers to smart home systems and connected vehicles, will generate an unprecedented volume of data. This data explosion, coupled with advancements in physical robotics and cognitive technologies, will further fuel the development and application of AI in the insurance sector.99 Insurers will gain the ability to understand their clients on a much deeper level, leading to more tailored and responsive insurance solutions.

How Businesses Can Stay Ahead of the Curve

To remain competitive and thrive in this evolving landscape, insurance businesses must adopt a proactive approach. This includes continuously monitoring the latest trends and innovations in AI, making strategic investments in talent development to build internal AI expertise, and fostering a culture of innovation that encourages experimentation and the adoption of new technologies.1 Embracing a mindset of continuous learning and adaptation will be paramount for insurance companies to not only keep pace with the rapid technological advancements but also to effectively leverage AI to gain a competitive edge and deliver superior value to their customers.

10. Fazit

Summary of Key Takeaways on AI Use Cases in Insurance

In summary, Artificial Intelligence presents a profound opportunity for the insurance to revolutionize its operations, enhance customer relationships, and achieve new levels of efficiency and profitability. From automating intricate underwriting processes and accelerating claims handling to providing personalized customer service through intelligent chatbots and bolstering fraud detection capabilities, the use cases for AI across the insurance value chain are both extensive and impactful. The insights gleaned from the current landscape and the projections for future trends underscore the critical role that AI will play in shaping the insurance sector in the years to come.

Call-to-Action for Businesses Considering AI Adoption

For insurance businesses that are considering embarking on their AI adoption journey, the time to act is now. By strategically assessing their readiness, building a robust data foundation, carefully selecting the right technology partners, and investing in the training and upskilling of their teams, insurers can navigate the challenges associated with AI implementation and begin to realize its significant benefits. Embracing a forward-looking perspective, continuously monitoring the evolving AI landscape, and fostering a culture of innovation will be key to staying ahead of the curve and unlocking the full potential of AI to drive future success in the dynamic world of insurance.

Quellen:

- https://www.gft.com/us/en/blog/how-insurers-can-use-ai-to-increase-profitable-growth

- https://www.cogentinfo.com/resources/the-impact-of-ai-on-future-insurance-sector

- https://www.datacamp.com/blog/ai-in-insurance

- https://marutitech.com/ai-insurance-implementation-challenges-solutions/

- https://www.johnsonlambert.com/insights/articles/insurance-companies-assess-mitigate-artificial-intelligence-risks/