The banking industry stands at a pivotal juncture, undergoing a profound transformation driven by the rapid advancement and increasing adoption of Artificial Intelligence (AI). This evolution marks a significant shift from traditional banking practices towards an AI-driven future, promising unprecedented levels of efficiency and innovation across various operational domains. Financial institutions are progressively integrating a diverse range of AI technologies, including sophisticated machine learning algorithms, nuanced natural language processing, and versatile robotic process automation, to reshape their services and operations.

Decoding the Intelligence: Understanding AI and Its Core Technologies in Banking

What Exactly is Artificial Intelligence (AI)?

What Exactly is Artificial Intelligence (AI)?

Artificial Intelligence, at its core, represents a suite of technologies that empower computers and machines to execute a wide array of advanced functions, effectively mimicking human cognitive abilities. This encompasses the capacity to perceive and interpret visual information, comprehend and translate both spoken and written language, meticulously analyze intricate datasets, and formulate informed recommendations. The scope of AI is broad, spanning critical areas such as logical reasoning, continuous learning, complex problem-solving, environmental perception, and strategic decision-making. While the ultimate aspiration of AI research includes achieving artificial general intelligence (AGI) and even artificial superintelligence (ASI), the current landscape of AI in banking is predominantly characterized by artificial narrow intelligence (ANI), also known as weak AI. This form of AI excels at performing specific, well-defined tasks with remarkable efficiency and accuracy. Generative AI, another significant category, focuses on creating novel and realistic content, such as text, images, and audio, based on learned patterns from vast datasets.

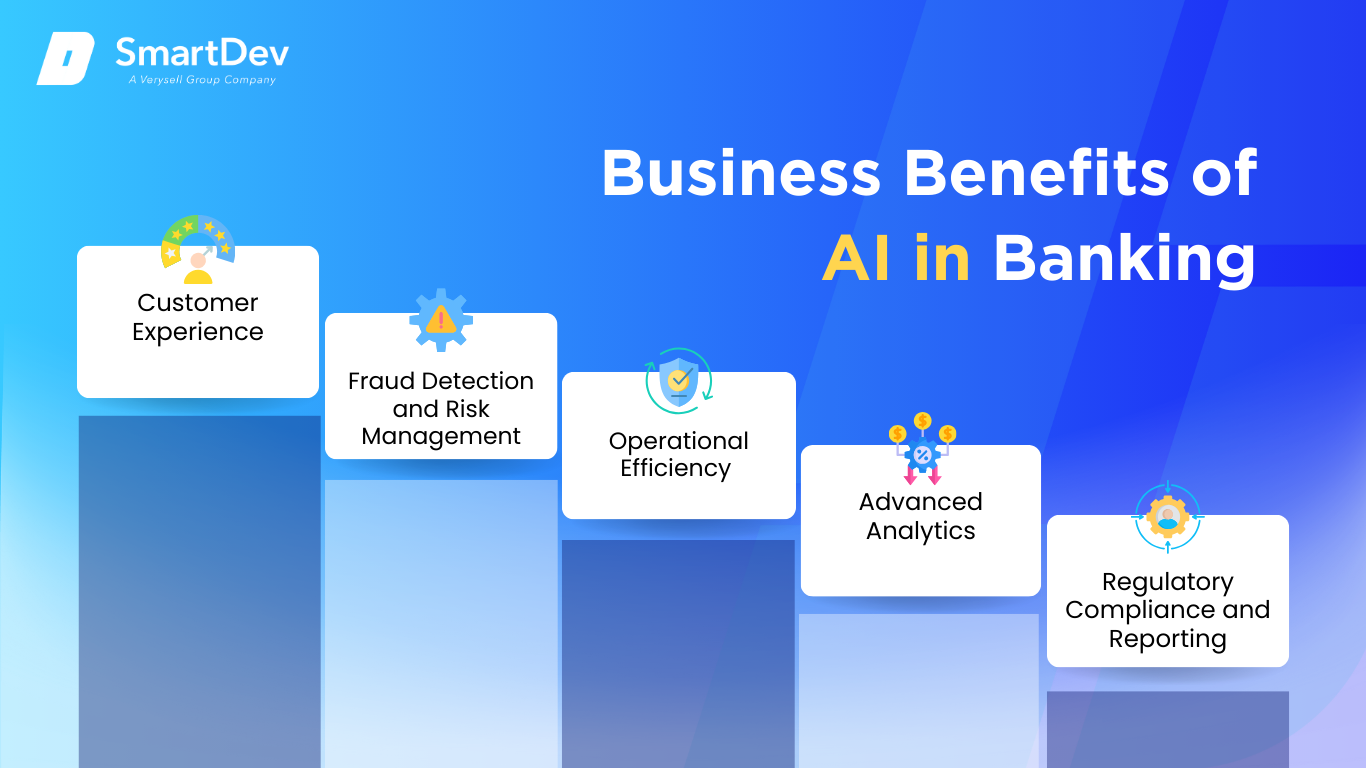

Benefits of AI in Banking

1. Enhanced Customer Service and Experience

1. Enhanced Customer Service and Experience

AI enables banks to provide personalized, 24/7 customer support through chatbots and virtual assistants. These tools can handle a wide range of queries—from balance inquiries to loan applications—without human intervention. Additionally, AI-driven analytics can help banks understand customer behavior and preferences, allowing them to tailor services and products accordingly. This improves customer satisfaction and loyalty, leading to greater retention and cross-selling opportunities.

2. Fraud Detection and Risk Management

AI significantly enhances a bank’s ability to detect and prevent fraud by analyzing vast amounts of transaction data in real time. Machine learning algorithms can identify suspicious patterns and flag anomalies that may indicate fraudulent activity. Moreover, predictive analytics enables banks to assess credit risk more accurately, allowing for better-informed lending decisions and reduced default rates. This proactive approach improves financial security and operational integrity.

3. Operational Efficiency and Cost Reduction

Through automation of routine tasks such as data entry, document verification, and compliance checks, AI can streamline operations and reduce manual workload. Robotic Process Automation (RPA) in particular allows banks to process transactions faster and with fewer errors. This leads to cost savings, increased productivity, and the reallocation of human resources to higher-value activities, ultimately improving overall operational performance.

4. Improved Decision-Making Through Advanced Analytics

AI provides banks with advanced data analytics capabilities that support strategic decision-making. By leveraging big data and AI algorithms, financial institutions can gain deeper insights into market trends, customer needs, and investment opportunities. This enables more accurate forecasting and better-informed business strategies, enhancing the bank’s competitive advantage in a rapidly evolving market.

5. Regulatory Compliance and Reporting

AI assists banks in meeting complex regulatory requirements by automating compliance monitoring and reporting processes. Natural Language Processing (NLP) can be used to analyze regulatory texts and ensure that internal policies are aligned with external mandates. Furthermore, AI systems can generate real-time compliance reports, identify potential non-compliance issues early, and reduce the risk of regulatory penalties, thereby safeguarding the bank’s reputation and financial stability.

Challenges Facing AI Adoption in Banking

1. Data Privacy and Security Concerns

1. Data Privacy and Security Concerns

AI in banking depends heavily on large-scale data collection and processing, which inherently raises substantial concerns about data privacy and security. Financial institutions must navigate complex regulatory frameworks such as the General Data Protection Regulation (GDPR) in the European Union or the California Consumer Privacy Act (CCPA) in the United States. These regulations impose strict guidelines on how customer data can be used, stored, and shared. Furthermore, cyber threats such as data breaches and identity theft pose significant risks, especially when handling sensitive personal and financial information. Any failure to protect data can not only result in severe legal and financial penalties but also irreparably damage customer trust. Ensuring end-to-end data security, including encrypted storage, secure data transmission, and access control, adds both cost and complexity to AI initiatives.

2. Integration with Legacy Systems

Many traditional banks continue to operate on legacy core banking systems that are decades old and not designed to support the computational demands or integration requirements of AI technologies. Integrating modern AI solutions with these systems often involves substantial reengineering or the creation of middleware layers, which can be resource-intensive and technically difficult. Additionally, legacy systems tend to lack flexibility, making it harder to scale AI applications or incorporate new functionalities over time. These integration challenges can delay digital transformation efforts, create inefficiencies, and hinder the real-time processing capabilities that AI systems typically require. For many institutions, the high cost and risk of transitioning from legacy systems act as a major barrier to full AI adoption.

3. Lack of Skilled Talent

Successfully implementing AI in banking demands a workforce proficient in data science, machine learning, artificial intelligence, and related fields. However, there is a notable global shortage of professionals with these specialized skills. Banks often find themselves competing with technology firms, startups, and consulting companies for a limited talent pool, driving up recruitment costs. Additionally, even when banks hire AI experts, integrating them into existing teams that may lack technical fluency can create coordination and communication challenges. Moreover, continuous innovation in AI necessitates ongoing training and upskilling of both technical and non-technical staff to ensure the organization remains competitive and compliant with evolving technologies. The scarcity of skilled talent significantly slows down implementation timelines and can limit the scope and success of AI-driven projects.

4. Ethical and Bias-Related Issues

AI systems, particularly those that involve decision-making processes such as credit scoring, fraud detection, and customer segmentation, can inadvertently reinforce existing biases in the data they are trained on. If the underlying datasets reflect historical inequalities or discriminatory practices, AI models may replicate and even amplify these issues. For instance, an AI-driven credit assessment tool could unfairly disadvantage certain demographic groups if trained on biased lending data. This not only raises ethical concerns but also opens banks to legal risks and regulatory scrutiny. Addressing algorithmic bias requires rigorous data auditing, fairness testing, and transparent model governance—processes that are still evolving and can be complex to implement. Developing explainable AI systems that regulators, customers, and internal stakeholders can understand adds another layer of difficulty.

5. Regulatory Uncertainty

The regulatory environment surrounding AI in banking is still in a formative stage, with policymakers working to catch up with technological advancements. This uncertainty presents a challenge for banks looking to invest in AI, as they must balance innovation with compliance risk. Regulations on AI use in areas like automated decision-making, data usage, and consumer protection are often fragmented across jurisdictions, making it difficult for multinational banks to adopt uniform AI strategies. Additionally, evolving expectations from regulators regarding explainability, accountability, and fairness in AI further complicate implementation efforts. Until a clearer and more consistent regulatory framework emerges, many banks may adopt a cautious approach, limiting the scale and scope of their AI initiatives to minimize exposure to future regulatory actions.

Industry-Specific Innovation: Specific Applications of AI in Banking

Beyond the core functionalities, AI is driving specific innovations across various facets of the banking industry.

Beyond the core functionalities, AI is driving specific innovations across various facets of the banking industry.

AI-Powered Chatbots for Customer Support: Advanced AI-powered chatbots, leveraging the power of Natural Language Processing (NLP) and sophisticated machine learning algorithms, are transforming customer support in banking. These intelligent virtual assistants provide instant and highly personalized support to customers, adeptly handling a wide range of complex queries and ultimately leading to significant improvements in customer satisfaction. Several prominent examples illustrate the impact of these chatbots. Bank of America’s virtual assistant, Erica, stands out, having successfully managed over 50 million client requests in a single year and surpassing 1.5 billion interactions since its inception. Erica’s capabilities extend to managing tasks related to credit card debt reduction and providing crucial security updates. Capital One’s Eno represents another successful deployment, offering users the convenience of texting questions, receiving timely fraud alerts, and efficiently managing tasks such as credit card payments and balance checks.

AI for Loan Application Processing: AI is revolutionizing the traditionally cumbersome process of loan application processing by introducing automation and intelligence at various stages. AI algorithms automate the verification of applicant documents, accurately assess their creditworthiness by analyzing a wide array of financial data, and significantly reduce the overall processing times. A compelling case study from Wells Fargo demonstrates the transformative impact of AI in this area. By implementing an AI-powered automated loan processing system, Wells Fargo successfully reduced loan approval times from an average of 5 days down to a mere 10 minutes, leading to substantial improvements in customer satisfaction and operational efficiency.

AI in Algorithmic Trading: The financial markets are increasingly influenced by the sophisticated capabilities of AI in algorithmic trading.AI algorithms meticulously analyze intricate market trends, vast historical datasets, and various economic indicators to execute trading decisions with remarkable speed and precision, often surpassing human capabilities. Financial institutions like Goldman Sachs and JPMorgan Chase are at the forefront of leveraging AI to optimize their portfolio management strategies and enhance their algorithmic trading platforms, enabling them to make more informed and timely investment decisions.

Emerging AI Technologies Transforming Banking

The landscape of AI in banking is continuously evolving, with several emerging technologies poised to further revolutionize the industry.

The landscape of AI in banking is continuously evolving, with several emerging technologies poised to further revolutionize the industry.

Generative AI Applications: Generative AI, with its ability to create novel content, is opening up exciting new possibilities for banking.This includes the generation of personalized marketing materials, the automated creation of detailed financial reports, and even the assistance in code generation for software development. For instance, generative AI can analyze customer preferences to create highly targeted marketing campaigns or automate the drafting of initial financial reports, freeing up human analysts for more strategic tasks.

Computer Vision for Visual Data Analysis: Computer vision is expanding its role in banking by enabling sophisticated analysis of visual data. This includes advanced image recognition for more secure and efficient identity verification processes during customer onboarding, automated processing of various financial documents, and the analysis of visual patterns to detect fraudulent activities like forged signatures or tampered checks.

AI’s Role in Sustainability Efforts: AI is increasingly being recognized for its potential to contribute to sustainability initiatives within the banking sector. Predictive analytics powered by AI can help banks better forecast customer needs, thereby reducing unnecessary communication and the overproduction of marketing materials, leading to reduced waste. Furthermore, smart systems driven by AI can optimize energy consumption within banking operations, contributing to a more sustainable environmental footprint.For example, AI algorithms can analyze energy usage patterns and adjust cooling systems in data centers to minimize energy waste. AI also plays a crucial role in enabling green finance initiatives by analyzing complex data to assess the sustainability credentials of companies and projects, guiding investments towards environmentally responsible ventures.

How to Implement AI in Banking

Implementing AI successfully in a banking institution requires a strategic and phased approach.

Implementing AI successfully in a banking institution requires a strategic and phased approach.

Assessing Readiness for AI Adoption: The first critical step involves a thorough assessment of the institution’s readiness for AI adoption.75 This includes identifying specific business areas that are most suitable for AI integration, considering factors such as data availability, potential for automation, and strategic alignment with business goals.

Building a Strong Data Foundation: A robust data foundation is paramount for effective AI implementation.This entails establishing best practices for data collection, ensuring data quality through rigorous cleaning processes, and implementing effective data management strategies to make data accessible and usable for AI models.

Choosing the Right Tools and Vendors: Selecting the appropriate AI platforms and solutions that are specifically tailored to the unique needs and challenges of the banking industry is crucial. This involves a careful evaluation of various AI platforms and vendors, considering factors such as their expertise in the financial sector, the scalability and flexibility of their solutions, and their adherence to regulatory compliance standards.

Pilot Testing and Scaling Up: Before full-scale deployment, it is advisable to initiate AI implementation through small-scale pilot projects.This allows banks to test the effectiveness of AI solutions in a controlled environment, gather valuable feedback, and make necessary adjustments before gradually scaling up successful pilots to broader areas of the organization.

Training Teams for Successful Implementation: Equipping employees with the necessary skills and knowledge to work effectively alongside AI technologies is essential for successful implementation. This may involve upskilling existing staff through training programs or recruiting professionals with specialized AI expertise.

Measuring the Impact: Understanding the ROI of AI in Banking

Measuring the return on investment (ROI) of AI in banking is critical for demonstrating its value and justifying further investments. Key metrics to track include:

- Productivity Improvements: AI-driven automation of repetitive tasks and streamlining of workflows can lead to significant productivity gains across various banking operations.

- Cost Savings Achieved Through Automation: Implementing AI can lead to substantial cost reductions by minimizing the need for manual labor, reducing errors, and optimizing resource allocation.

- Case Studies Demonstrating ROI: Several banks have reported significant ROI from their AI initiatives. JPMorgan Chase has seen reduced fraud , while Gleematic achieved ROI in just three months in a loan processing automation project. Danske Bank saved millions by using AI to combat fraud , and RAZE Banking experienced a 45% reduction in fraudulent transactions.

Common Pitfalls and How to Avoid Them

Successfully navigating AI adoption requires awareness of common pitfalls and proactive strategies to mitigate them. Data quality issues and biases in training data can lead to inaccurate or unfair outcomes. Ensuring data quality through rigorous cleaning and validation processes and actively working to mitigate biases in algorithms are crucial steps. A lack of a clear strategy and well-defined objectives can also hinder AI initiatives. Banks should establish a comprehensive AI strategy with specific, measurable goals aligned with their overall business objectives. Integration challenges with existing legacy systems are common. A phased approach to integration, focusing on interoperability and potentially modernizing core systems, can help overcome these hurdles. Resistance to change within the organization can also impede adoption. Clear communication of the benefits of AI and comprehensive training programs can help foster a culture of acceptance and collaboration Finally, addressing ethical and regulatory compliance issues proactively is essential. Establishing clear ethical guidelines and ensuring compliance with relevant regulations from the outset can help avoid potential legal and reputational risks.

Future Trends of AI in Banking

The future of AI in banking promises even more transformative changes. Increased adoption of generative AI is expected to lead to more sophisticated applications in content creation, personalized services, and risk management. Greater emphasis will be placed on explainable AI (XAI) to enhance trust in AI-driven decisions and meet increasing regulatory demands for transparency. Federated learning, a decentralized approach to machine learning, is likely to gain traction, enabling collaborative AI development while preserving data privacy and security. The integration of AI with other emerging technologies, such as the Internet of Things (IoT) and blockchain, will unlock new possibilities for innovative banking solutions and enhanced security. Furthermore, the trend towards greater personalization and hyper-personalization driven by AI will continue to intensify, leading to more tailored and intuitive banking experiences for customers.

The future of AI in banking promises even more transformative changes. Increased adoption of generative AI is expected to lead to more sophisticated applications in content creation, personalized services, and risk management. Greater emphasis will be placed on explainable AI (XAI) to enhance trust in AI-driven decisions and meet increasing regulatory demands for transparency. Federated learning, a decentralized approach to machine learning, is likely to gain traction, enabling collaborative AI development while preserving data privacy and security. The integration of AI with other emerging technologies, such as the Internet of Things (IoT) and blockchain, will unlock new possibilities for innovative banking solutions and enhanced security. Furthermore, the trend towards greater personalization and hyper-personalization driven by AI will continue to intensify, leading to more tailored and intuitive banking experiences for customers.