Imagine a world where banking is no longer a destination but an invisible companion in every online interaction. From a quick tap to pay for your morning coffee to seamlessly financing a new gadget at checkout, Banking as a Service (BaaS) has woven financial tools directly into the fabric of our digital lives, transforming how we manage money with the ease and immediacy of everyday apps.

The BaaS market is projected to grow exponentially, projected to reach USD 74.55 billion by 2030, growing at a CAGR of 16.2% from 2022 to 2030. This rapid rise underscores a critical shift: traditional banking is no longer confined to bank branches and websites.

1. What is Banking as a Service (BaaS)?

1.1. Definition and Concept of BaaS

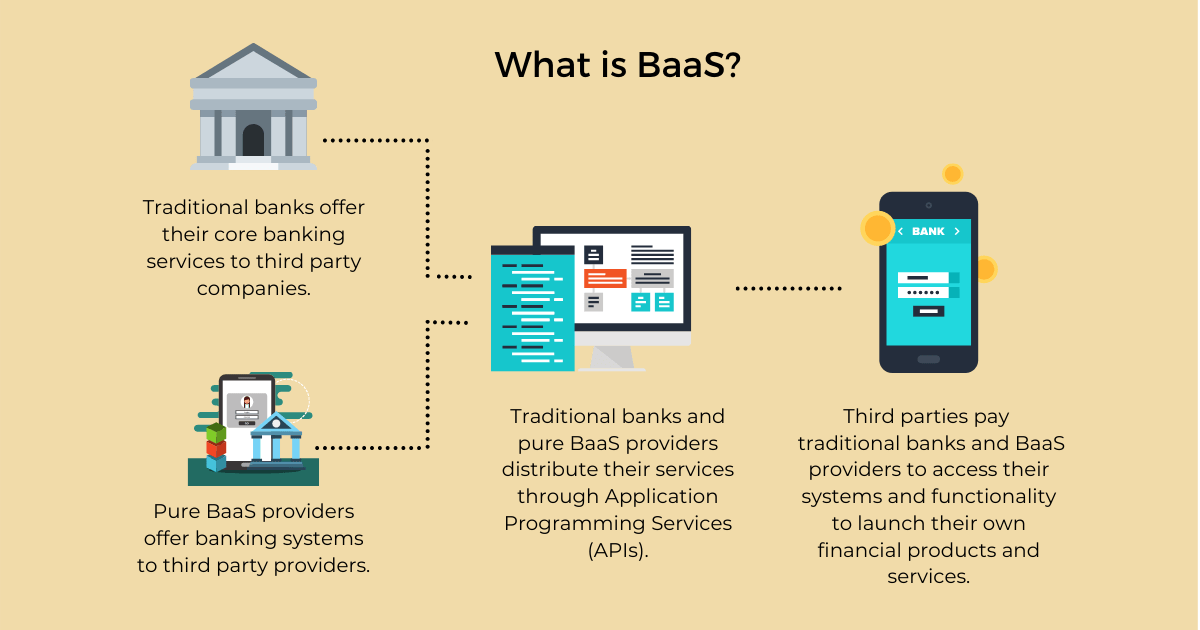

Banking as a Service (BaaS) is a financial technology model enabling non-banking businesses to offer banking services directly through their digital platforms.

By leveraging BaaS, companies can integrate services such as digital payments, lending, and digital wallets into their apps, creating a seamless and engaging customer experience. This embedded finance approach eliminates the need for businesses to hold a banking license, as BaaS providers manage the regulatory and security infrastructure.

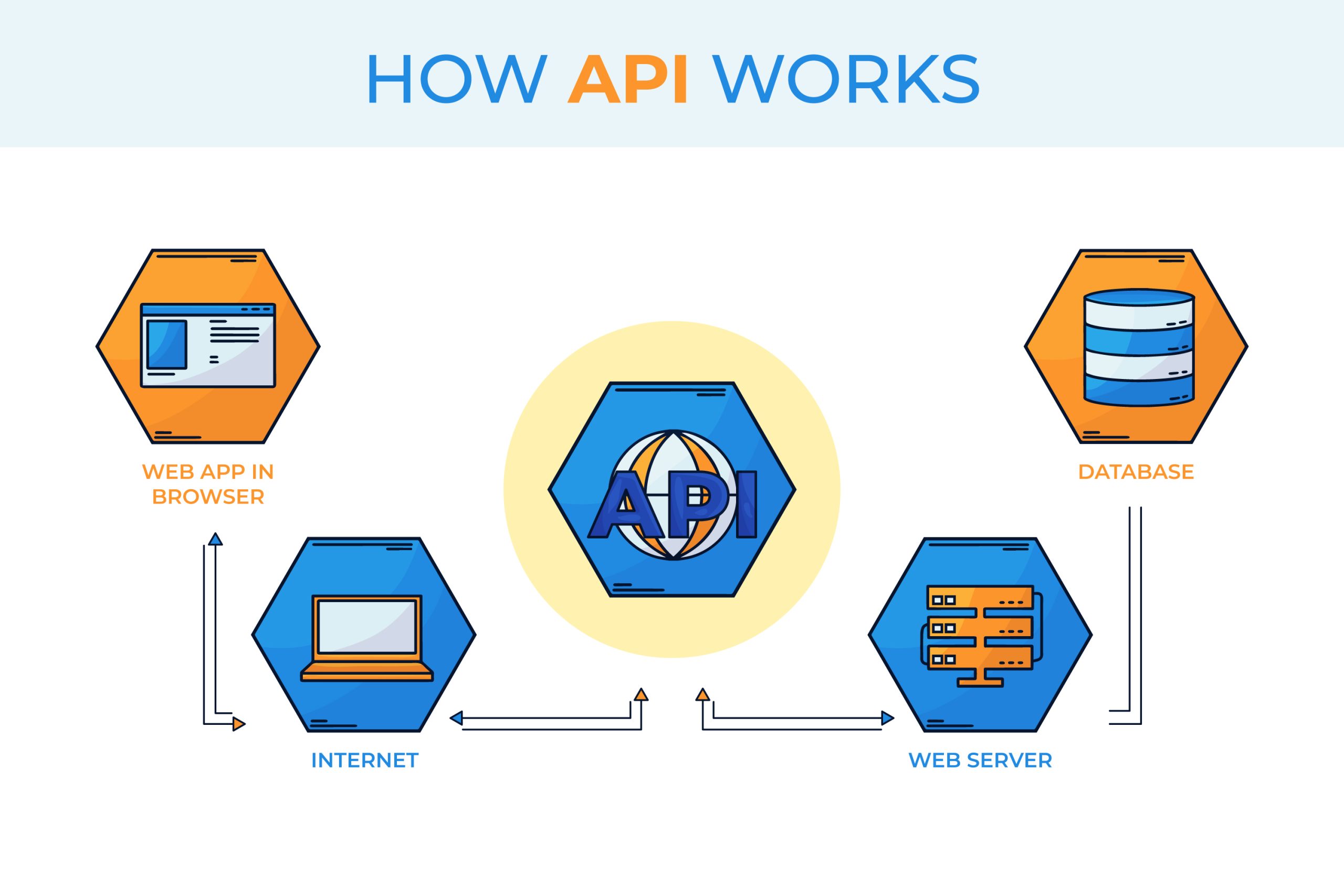

BaaS relies on API-driven technology, allowing companies to securely connect with licensed banks and financial institutions. APIs enable businesses to offer banking services in a flexible, modular way, adapting quickly to market changes and user needs. As a result, BaaS empowers companies to create new revenue streams while enhancing the convenience and accessibility of financial services for their users.

BaaS has gained popularity due to the growing demand for convenient, integrated financial solutions in sectors like retail, e-commerce, and fintech. BaaS also supports a diverse range of applications, from neobanks to embedded lending, offering flexible options for businesses across industries.

1.2. Historical Evolution of BaaS

The origins of BaaS trace back to traditional banking, where digital banking services were first offered online in the 1990s. As internet adoption increased, banks began offering basic online services like checking balances and transferring funds, laying the groundwork for the digital banking revolution. This shift helped banks reach users online, setting the stage for future innovations in fintech and API-driven finance.

The real transformation towards BaaS began in the 2010s, spurred by the rise of fintech companies and neobanks that prioritized mobile and digital-first experiences. These digital-native banks, like Revolut and N26, challenged traditional banking by offering more user-friendly and accessible services. They leveraged APIs to create seamless digital experiences, marking a significant shift toward embedded finance and modern financial ecosystems.

Regulatory changes, especially in Europe with the introduction of open banking, further accelerated BaaS adoption. Open banking regulations required traditional banks to share customer data (with consent) through APIs, fostering competition and innovation in financial services. Today, banks and fintech companies work together in BaaS partnerships, blending regulated banking infrastructure with agile technology solutions that support the demand for embedded finance.

As API technology advanced, traditional banks saw an opportunity to partner with fintech companies to reach a broader audience and expand their services. This collaboration has become the foundation of BaaS, combining the security and compliance of regulated banks with the flexibility of technology providers. The BaaS model is expected to continue evolving, driven by growing digital transformation trends and rising consumer expectations for fast, accessible financial services.

2. How BaaS APIs Work?

2.1. Mechanics of BaaS APIs

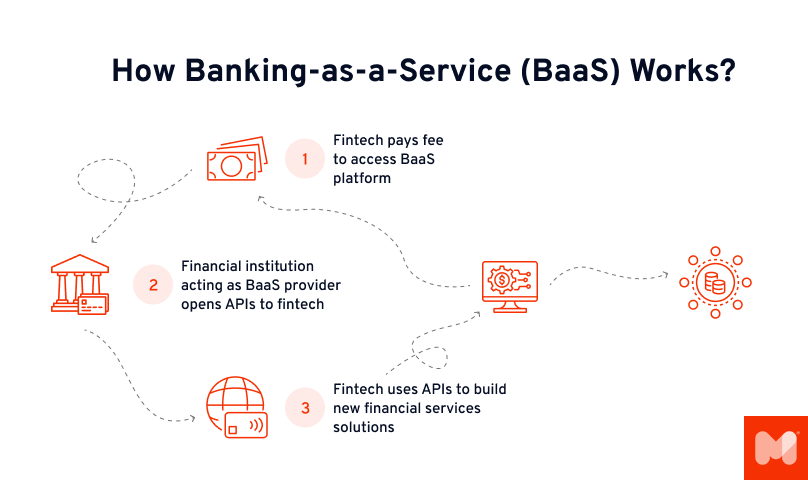

BaaS APIs (Application Programming Interfaces) are the backbone of Banking as a Service, enabling financial services to connect directly with non-banking platforms. APIs act as a bridge, securely linking banking infrastructure with third-party applications to facilitate seamless interactions. Through API technology, businesses can access banking functions like payments, account creation, and loans, embedding them directly into their websites or apps without the need for complex in-house development.

Each BaaS API functions as a modular component, allowing businesses to pick and choose specific banking services to integrate. By tapping into these APIs, companies gain access to a bank’s licensed infrastructure and regulatory framework, enabling secure transactions and data management. This model is highly scalable and adaptable, helping companies provide custom financial solutions while leveraging the reliability and security of established banking systems.

2.2. Benefits of API Integration in BaaS

Integrating BaaS APIs offers several key benefits, enhancing both operational efficiency and customer satisfaction.

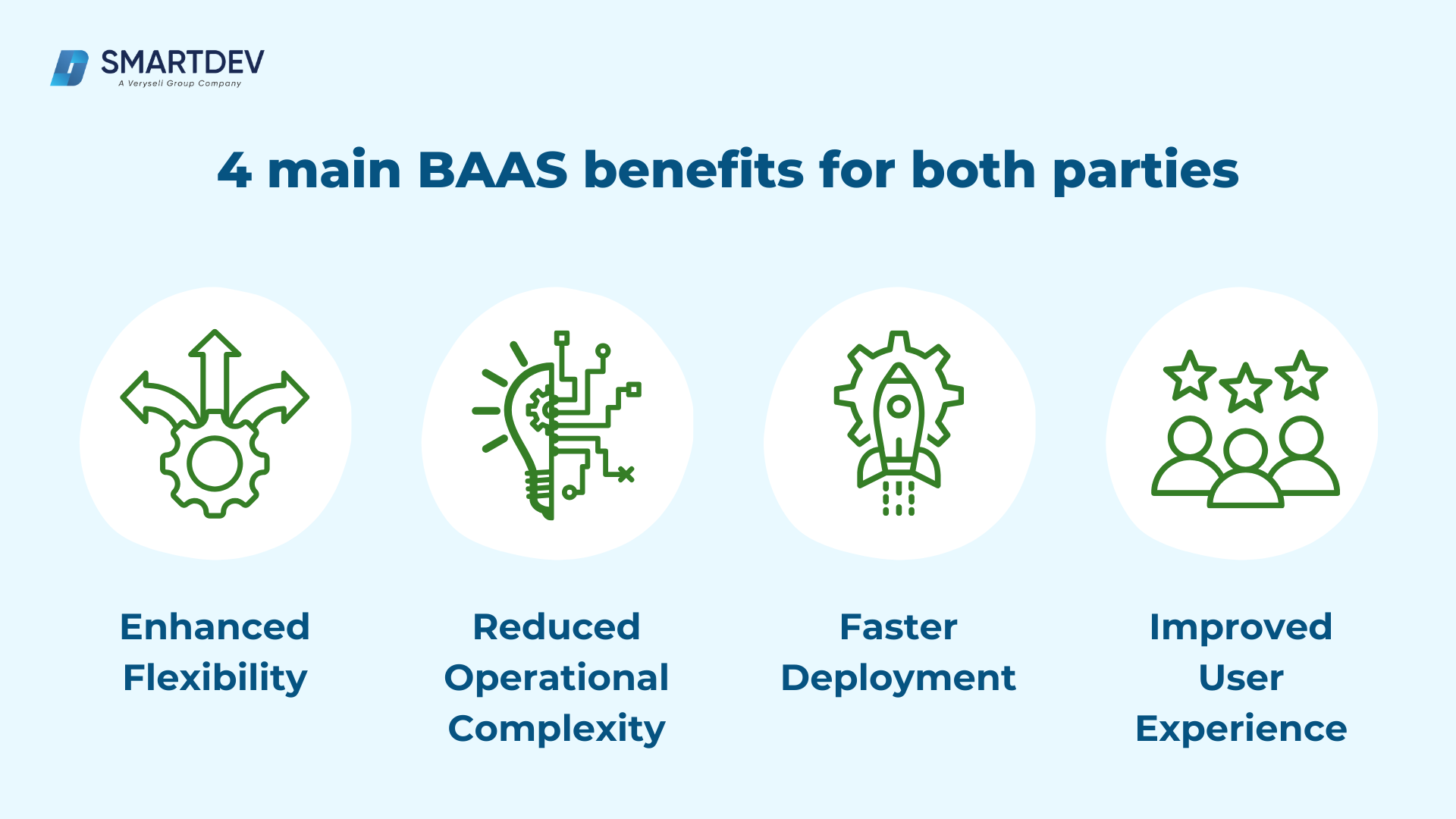

- Enhanced Flexibility

- BaaS APIs enable businesses to quickly adapt to changing market demands or introduce new services.

- Modular APIs support a faster time-to-market, allowing companies to launch financial services without rebuilding entire platforms.

- Reduced Operational Complexity

- BaaS providers handle underlying banking infrastructure, including compliance, security, and maintenance.

- This hands-off approach lets businesses focus on core operations, relying on trusted BaaS providers for regulatory compliance.

- According to Forrester, BaaS integration can lower operational costs, especially for startups and smaller businesses entering the financial sector.

- Faster Deployment

- Pre-built APIs are ready to integrate, minimizing development time and reducing downtime.

- BaaS APIs allow businesses to deliver high-quality financial solutions quickly, meeting modern user expectations for responsiveness and convenience.

- Improved User Experience

- API integration creates a seamless, in-app financial experience, removing the need to navigate multiple platforms.

- Streamlined banking interactions enhance customer engagement and loyalty, fostering a stronger relationship between businesses and users.

3. Types of BaaS Providers

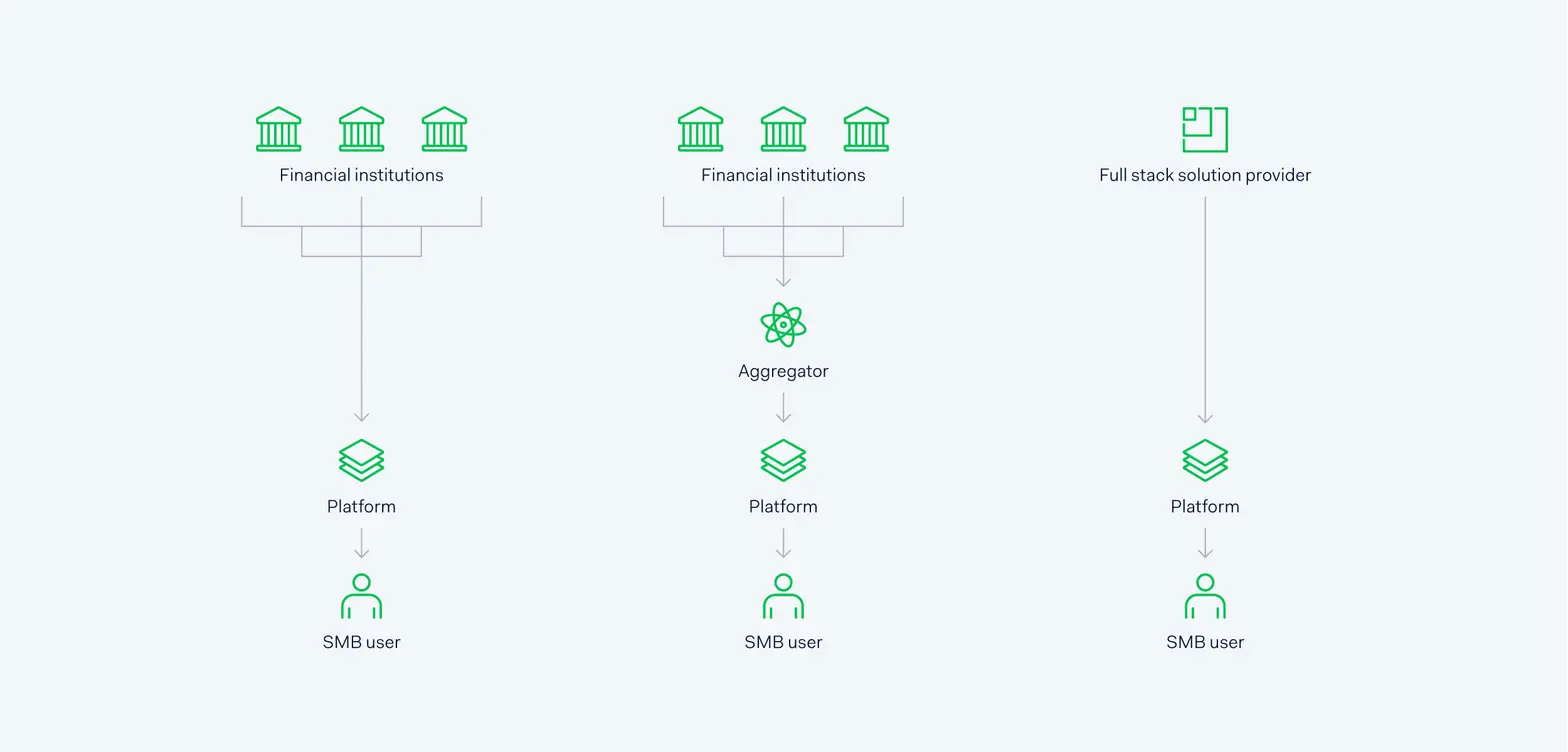

3.1. Direct Partnerships with Financial Institutions

In a direct partnership, businesses work directly with licensed financial institutions to integrate banking services into their own platforms. This type of BaaS provider model is ideal for companies that want to offer specific banking functionalities, such as payment processing or digital wallets, by tapping into the infrastructure of established banks.

Direct partnerships provide businesses with greater control over the banking experience, allowing them to tailor financial services to meet their customer needs while relying on the regulatory compliance and security provided by the partner bank.

Direct integration is often preferred by larger companies with specific requirements that need a custom approach. It allows them to maintain a close relationship with the financial institution, ensuring seamless coordination on regulatory updates and technology changes. For example, many neobanks and fintechs choose direct partnerships to access core banking capabilities and enhance their service offerings.

3.2. Aggregator Intermediaries

Aggregator intermediaries serve as connectors, linking businesses to multiple banks through a single API integration. This model is particularly useful for companies that want to offer a variety of banking services without managing multiple direct relationships.

Aggregators simplify the process by consolidating various bank APIs into one interface, reducing the technical complexity for businesses that want broad financial capabilities. Aggregators also handle compliance and regulatory requirements, making it easier for businesses to stay compliant without needing extensive legal resources.

This model offers companies a flexible approach to embedded finance, as they can expand their services by accessing a wide range of banking functions and selecting the best options from different banks. A popular example of an aggregator is Plaid, which connects businesses to various financial institutions, enabling services such as account linking, transaction history, and identity verification.

3.3. Full-Stack BaaS Providers

Full-stack BaaS providers, like Adyen, offer end-to-end solutions that cover the entire banking stack, providing a comprehensive suite of banking services through a single platform. This model includes everything from account creation and payment processing to lending, all managed by the BaaS provider.

Full-stack providers typically have their own banking licenses or partner with multiple institutions, allowing businesses to offer financial services without the need to interact with individual banks. By opting for a full-stack provider, companies gain access to a complete banking infrastructure that is highly scalable and ready to deploy.

Adyen, for instance, provides businesses with an all-in-one solution for payments and financial services, making it easier for companies to expand globally and offer a consistent user experience. Full-stack BaaS providers are ideal for companies seeking rapid deployment and minimal complexity, as they consolidate banking functions, compliance, and security under one platform.

4. Key Features of BaaS Solutions

4.1. API-Based Services

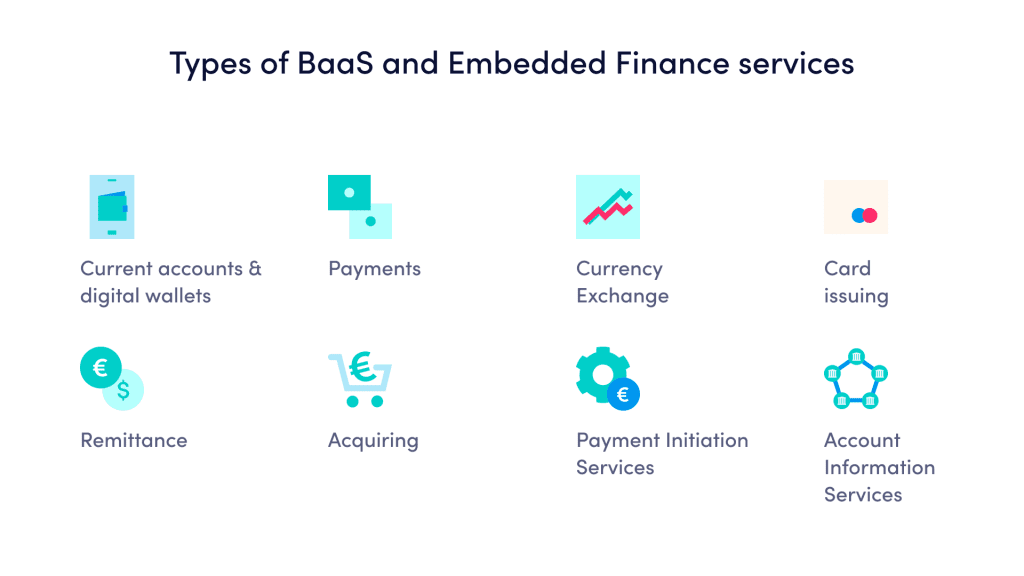

Banking as a Service (BaaS) solutions rely on API-based services that allow businesses to integrate a wide range of banking functionalities into their digital platforms. Through APIs, companies can offer essential services such as payments, lending, account creation, and digital wallets directly within their applications, creating a seamless financial experience for customers.

Payment APIs enable businesses to process transactions securely and efficiently, while lending APIs allow companies to offer credit options without needing a traditional banking license. Account creation APIs simplify onboarding, allowing users to set up accounts and access financial services in just a few clicks.

This modular API approach provides flexibility, allowing companies to select only the services they need, whether it’s processing payments, enabling peer-to-peer transfers, or issuing virtual debit cards. As demand for embedded finance continues to grow, BaaS API solutions offer a scalable, efficient way to enhance customer experience by delivering financial services directly within popular digital channels.

4.2. Compliance and Regulatory Needs

Compliance and regulatory adherence are critical aspects of any BaaS solution, as providers operate in a highly regulated industry. BaaS providers ensure that their APIs meet stringent financial regulations, including anti-money laundering (AML) protocols, Know Your Customer (KYC) requirements, and data protection standards like GDPR in Europe. These regulatory measures help ensure data security, protect against fraud, and maintain legal compliance across multiple jurisdictions.

BaaS providers manage the complex regulatory landscape, allowing non-banking companies to offer financial services without directly handling compliance. By partnering with licensed financial institutions and implementing industry-standard security practices, BaaS providers make it possible for companies to meet regulatory requirements and deliver secure, trusted banking services. For a deeper understanding of BaaS compliance standards, explore BankingTechnology’s insights on BaaS compliance.

4.3. Scalability and Market Reach

Scalability is a key advantage of BaaS, as it enables businesses to expand financial services quickly and effectively across different markets. BaaS solutions are designed for global scalability, allowing companies to enter new markets by offering financial services through a standardized API interface. This scalability is particularly beneficial for companies aiming for international growth, as BaaS providers often have infrastructure in multiple regions, allowing seamless expansion without the need for extensive regulatory adjustments.

BaaS providers support this global reach by handling region-specific compliance, currency conversions, and language localization, simplifying the complexities of operating in international markets. With a BaaS solution, businesses can rapidly deploy financial services to customers worldwide, adapting to local regulations and customer expectations while maintaining a consistent user experience.

By leveraging BaaS’s API-driven, compliant, and scalable features, companies can unlock new revenue streams, enhance customer engagement, and grow their market reach, supporting digital transformation in finance.

5. BaaS Use Cases

5.1. Who Leverages BaaS?

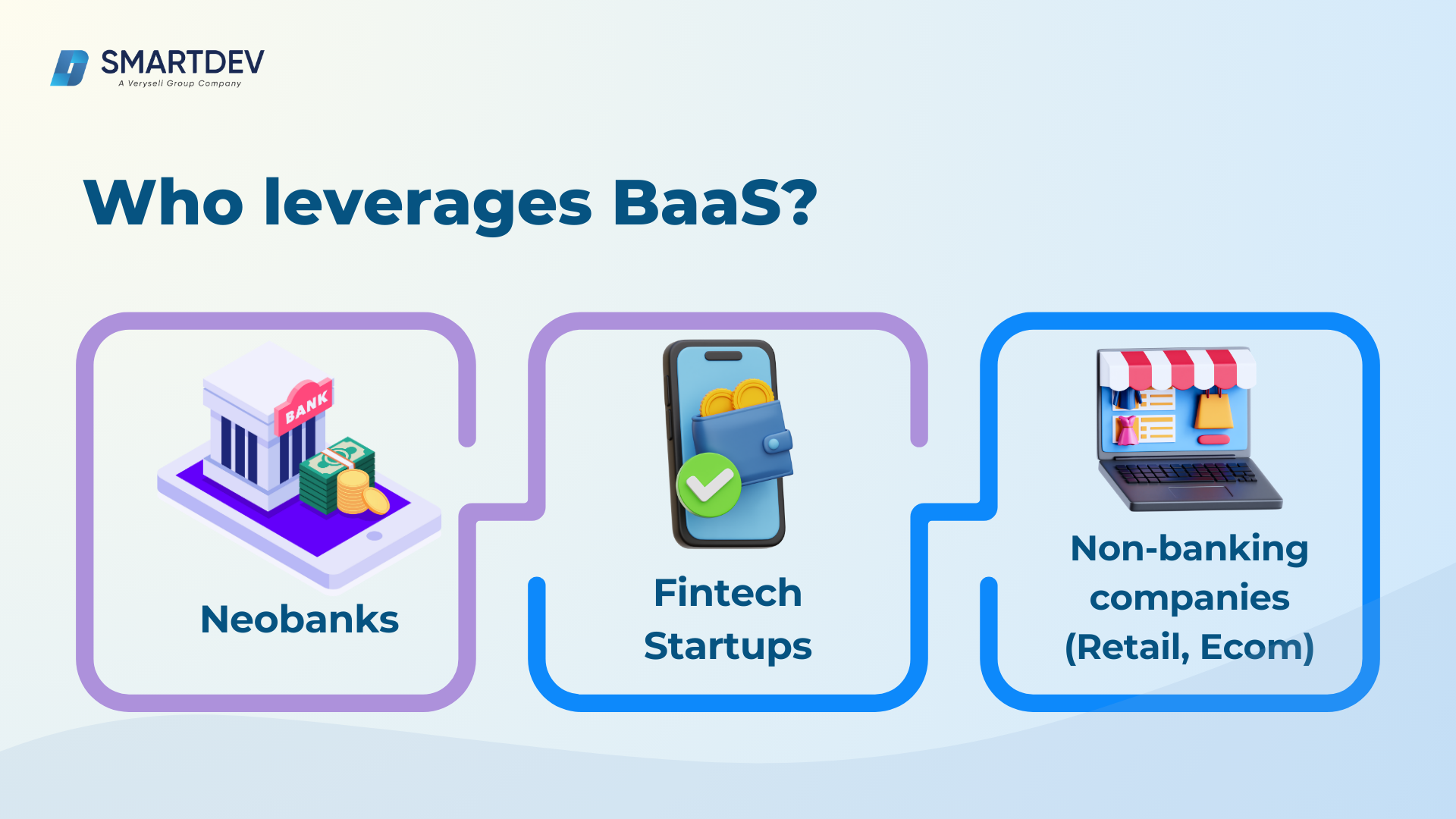

Banking as a Service (BaaS) has become essential for various industries, including neobanks, fintech startups, and even non-banking companies like retail and e-commerce brands.

Neobanks, which operate solely through digital platforms, use BaaS to offer full-service banking without the infrastructure of a traditional bank.

Fintech startups leverage BaaS to rapidly launch new financial products, from digital wallets to lending solutions, improving customer engagement and expanding their service range. Even non-banking companies—such as retailers, travel companies, and e-commerce platforms—integrate BaaS to embed financial services like payment processing and financing options within their platforms, creating a seamless customer journey.

By integrating BaaS, these businesses provide “embedded finance,” where users can access banking services without leaving the application, resulting in a more cohesive and efficient user experience. This approach enables companies to increase customer loyalty, expand revenue streams, and differentiate themselves in a competitive market.

5.2. Examples of Embedded Finance

Embedded finance spans a wide range of industries and business needs, allowing companies to integrate financial services directly within their platforms to create seamless, value-added customer experiences. Here’s a look at the main types of embedded finance, with real-world examples highlighting their applications.

a. Embedded Lending

Embedded lending enables businesses to offer credit options such as loans, car financing, or credit cards directly within their services. By providing these options at the point of need, businesses enhance customer convenience and create new revenue opportunities.

- Example: Asda, a leading UK supermarket, integrated Aro’s embedded lending technology into its Asda Money platform. By combining first-party customer data with one of the largest lending panels in the UK, Asda allows customers to check loan eligibility within its platform, providing a faster, smoother lending experience.

b. Embedded Payments

Embedded payments streamline the checkout process, reducing friction and boosting conversion rates with features like single-click purchasing and integrated payment options. As consumers grow accustomed to seamless digital transactions, embedded payments have become essential for retail and e-commerce businesses.

- Example: Stripe and Shop Pay, provided by Shopify, are prime examples of embedded payments. Shop Pay allows users to save their payment details for a faster checkout experience across any retailer offering Shop Pay. This one-click solution simplifies purchasing, increasing customer satisfaction and loyalty.

c. Embedded Investments

Embedded investments make it easier for consumers to access stock trading and investment options directly through digital platforms. With investing becoming more mainstream, businesses can integrate investment services, giving users the flexibility to manage investments without leaving the app.

- Example: Robinhood, Cash App, and Acorns offer embedded investment solutions, allowing users to buy, sell, and manage investments within a single platform. Without needing an external broker, customers can seamlessly engage in stock trading, contributing to a more accessible investment experience.

d. Embedded Insurance

Embedded insurance is often presented as an upsell at checkout, enabling customers to add insurance coverage to high-value purchases for additional peace of mind. This feature is popular among retailers selling big-ticket items, as it allows for an additional revenue stream and enhances customer trust.

- Example: IKEA’s HEMSÄKER insurance solution allows customers to purchase insurance on home goods directly through IKEA. While the insurance service is managed by a third-party provider, it’s fully branded as an IKEA product, creating a cohesive experience for customers.

e. Embedded Banking

Embedded banking refers to offering traditional banking services, such as checking accounts and debit cards, within non-banking environments. This allows businesses to enhance customer loyalty and engagement by offering financial tools relevant to their audience.

- Example: Shopify’s Balance platform provides small business owners with access to a business bank account without leaving the Shopify ecosystem. Balance encourages business owners to separate their finances, simplifying expense tracking and business management.

6. Benefits of BaaS for Businesses

6.1. Enhanced User Engagement

Banking as a Service (BaaS) significantly enhances user engagement by embedding financial services directly into digital platforms, creating a seamless experience where customers can access financial tools without leaving their favorite apps.

For example, integrating BaaS enables customers to open accounts, make payments, or access loans directly within an e-commerce app or digital wallet, streamlining their financial interactions.

6.2. Revenue Generation

BaaS provides businesses with new revenue opportunities by enabling them to offer financial services like payment processing, lending, and credit options directly within their platforms.

For instance, Shopify uses BaaS to offer “Shopify Payments,” enabling merchants to handle transactions seamlessly and generate revenue through transaction fees. In 2022, Shopify Payments processed over $120 billion in transactions, contributing significantly to Shopify’s overall revenue.

6.3. Customer Retention

Embedded finance through BaaS has a strong impact on customer retention by fostering a more cohesive and personalized experience. When customers can manage their finances in-app, they are more likely to stay loyal to that platform, reducing churn and increasing customer lifetime value.

For example, by offering Uber Money, Uber allows its drivers to instantly access earnings and manage finances directly within the app, which helps improve loyalty and driver retention. As a result, Uber drivers are more inclined to stay with the platform, with retention rates increasing by an estimated 15% due to the financial tools offered through Uber Money.

7. Market Trends and Future Outlook for BaaS

7.1. Adoption and Growth Statistics

Banking as a Service (BaaS) is rapidly gaining traction, with significant growth anticipated over the next decade. The global BaaS market was valued at approximately $19.65 billion in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 16.2%, reaching around $74.55 billion by 2030. This surge in adoption reflects the rising demand for embedded finance across industries as businesses seek to provide seamless financial services within their digital platforms.

Grand View Research highlights that BaaS is being embraced by both fintech startups and non-banking companies, allowing them to enter the financial space without a banking license.

This growth is driven by consumer demand for convenient financial solutions and the increasing digitalization of finance. With more companies offering embedded finance options, BaaS will continue to grow, supported by advancements in API technology and a shift towards a digital-first approach in financial services.

7.2. BaaS and Digital Transformation

BaaS plays a pivotal role in accelerating digital transformation, particularly for traditional banks seeking to remain competitive against fintech players. By adopting BaaS, traditional banks can leverage API-driven solutions to expand their offerings, streamline operations, and improve customer engagement. BaaS allows these banks to quickly integrate innovative services, such as digital wallets, real-time payments, and instant lending, without overhauling their entire legacy infrastructure.

For fintech startups, BaaS provides the foundational infrastructure needed to bring financial services to market rapidly, enabling them to innovate and scale without the constraints of traditional banking regulations. According to McKinsey, BaaS empowers both banks and non-banking businesses to meet customer expectations for integrated financial experiences, ultimately driving a more interconnected financial ecosystem.

As BaaS adoption grows, it is set to redefine the financial services landscape by enabling banks, fintechs, and non-traditional companies to embrace digital transformation and offer financial products directly within their platforms. The future of BaaS is marked by continuous growth and innovation, positioning it as a cornerstone of embedded finance and the digital banking evolution.

8. How to Choose the Right BaaS Provider?

8.1. Selection Criteria for BaaS Providers

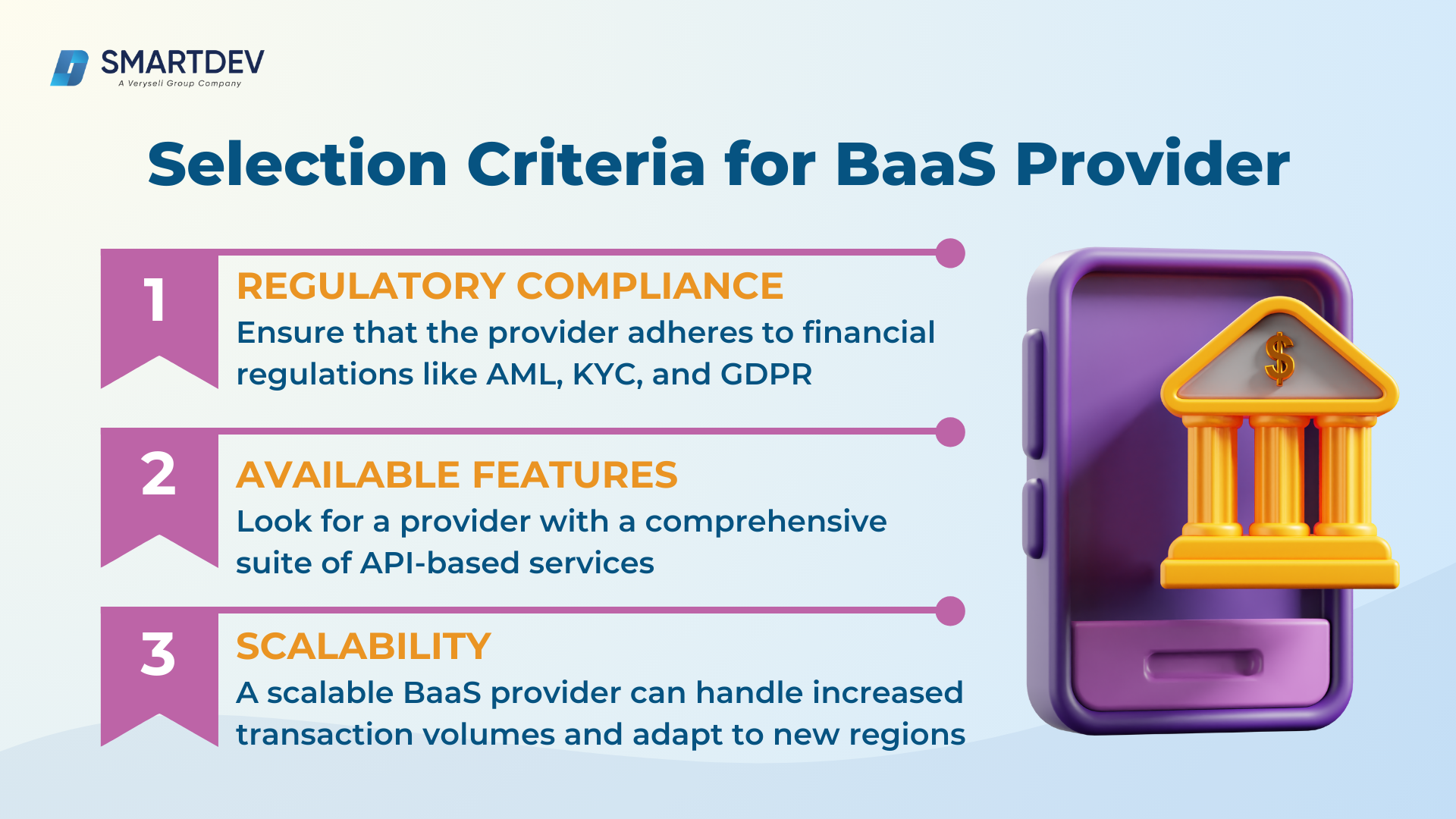

Choosing the right Banking as a Service (BaaS) provider is essential for businesses aiming to deliver secure, scalable, and feature-rich financial services. Key selection criteria include:

- Regulatory Compliance: Ensure that the provider adheres to financial regulations like AML, KYC, and GDPR to protect customer data and meet legal standards. Strong compliance protocols reduce the risk of legal issues, allowing businesses to operate confidently across regions.

- Available Features: Look for a provider with a comprehensive suite of API-based services, such as payments, lending, digital wallets, and account management. A provider with a broad feature set enables businesses to offer diverse financial services that enhance the user experience and drive customer engagement.

- Scalability: As businesses expand, they need a BaaS provider that can support growth across multiple markets without compromising service quality. A scalable BaaS provider can handle increased transaction volumes and adapt to new regions, ensuring continuous performance and compliance.

8.2. Comparison of Leading BaaS Providers

- Adyen: Known for its global scalability, Adyen offers a full-stack solution, covering payment processing, risk management, and lending. Adyen’s API-based infrastructure is ideal for businesses seeking a unified, cross-border financial solution that meets international compliance standards.

- Solarisbank: Solarisbank provides a licensed banking infrastructure with a focus on the European market. Offering services like account creation, payments, and digital banking, Solarisbank’s customizable APIs support regulatory compliance and offer a strong foundation for businesses aiming to expand across Europe.

- Railsr (formerly Railsbank): Railsr is a flexible BaaS provider specializing in payment, credit, and digital wallet solutions. Railsr’s modular approach allows businesses to tailor financial services to their needs, with strong customer support and a focus on usability, making it popular with startups and mid-sized enterprises.

Choosing the right BaaS provider is crucial for embedding financial services that drive growth and enhance customer engagement. SmartDev offers tailored BaaS solutions to meet your business needs, from regulatory compliance to feature-rich APIs for seamless integration. To discover how SmartDev can empower your business with innovative fintech solutions, schedule a meeting for more information!