Introduction

Health insurance is under pressure, from rising medical costs to administrative inefficiencies and growing demands for personalized care. Artificial intelligence (AI) is emerging as a transformative force, streamlining operations, enhancing fraud detection, and improving customer experiences. This guide explores how AI-driven use cases are revolutionizing health insurance, offering strategic advantages for insurers and better outcomes for policyholders.

What is AI and Why Does It Matter in Health Insurance?

Definition of AI and Its Core Technologies

Artificial intelligence (AI) refers to computer systems designed to perform tasks that typically require human intelligence, such as learning, reasoning, problem-solving, and decision-making. According to IBM, AI encompasses various technologies that enable machines to sense, comprehend, act, and learn with human-like intelligence.

In the context of health insurance, AI leverages technologies like machine learning, natural language processing (NLP), and computer vision to automate and enhance processes such as claims processing, fraud detection, customer service, and risk assessment. By analyzing vast amounts of data, AI enables insurers to make more informed decisions, reduce costs, and improve service quality.

The Growing Role of AI in Transforming Health Insurance

AI is reshaping health insurance by automating routine tasks, allowing human resources to focus on more complex issues. For instance, AI-powered chatbots handle customer inquiries, providing instant responses and freeing up customer service representatives for more nuanced interactions.

Predictive analytics, a subset of AI, enables insurers to assess risk more accurately by analyzing historical data and identifying patterns. This leads to more precise underwriting and personalized policy offerings, enhancing customer satisfaction and loyalty.

Moreover, AI facilitates real-time fraud detection by monitoring claims for unusual patterns and flagging potentially fraudulent activities. This proactive approach not only saves costs but also maintains the integrity of the insurance system.

Key Statistics and Trends Highlighting AI Adoption in Health Insurance

The adoption of AI in health insurance is accelerating. According to a McKinsey report, insurers could save up to $300 million in administrative costs for every $10 billion in revenue by integrating AI into their operations. Additionally, AI-driven tools can potentially reduce medical costs by up to $970 million in the same revenue bracket.

A survey by Risk & Insurance indicates that 90% of insurance professionals are optimistic about AI’s role in the industry, with 68% strongly in favor of its adoption. This enthusiasm reflects the industry’s recognition of AI’s potential to enhance efficiency and competitiveness.

Despite the optimism, the implementation of AI varies across organizations. A report by Wolters Kluwer reveals that while some insurers have fully integrated AI tools, others are still exploring pilot projects or in the early stages of adoption. This disparity underscores the need for strategic planning and investment in AI technologies.

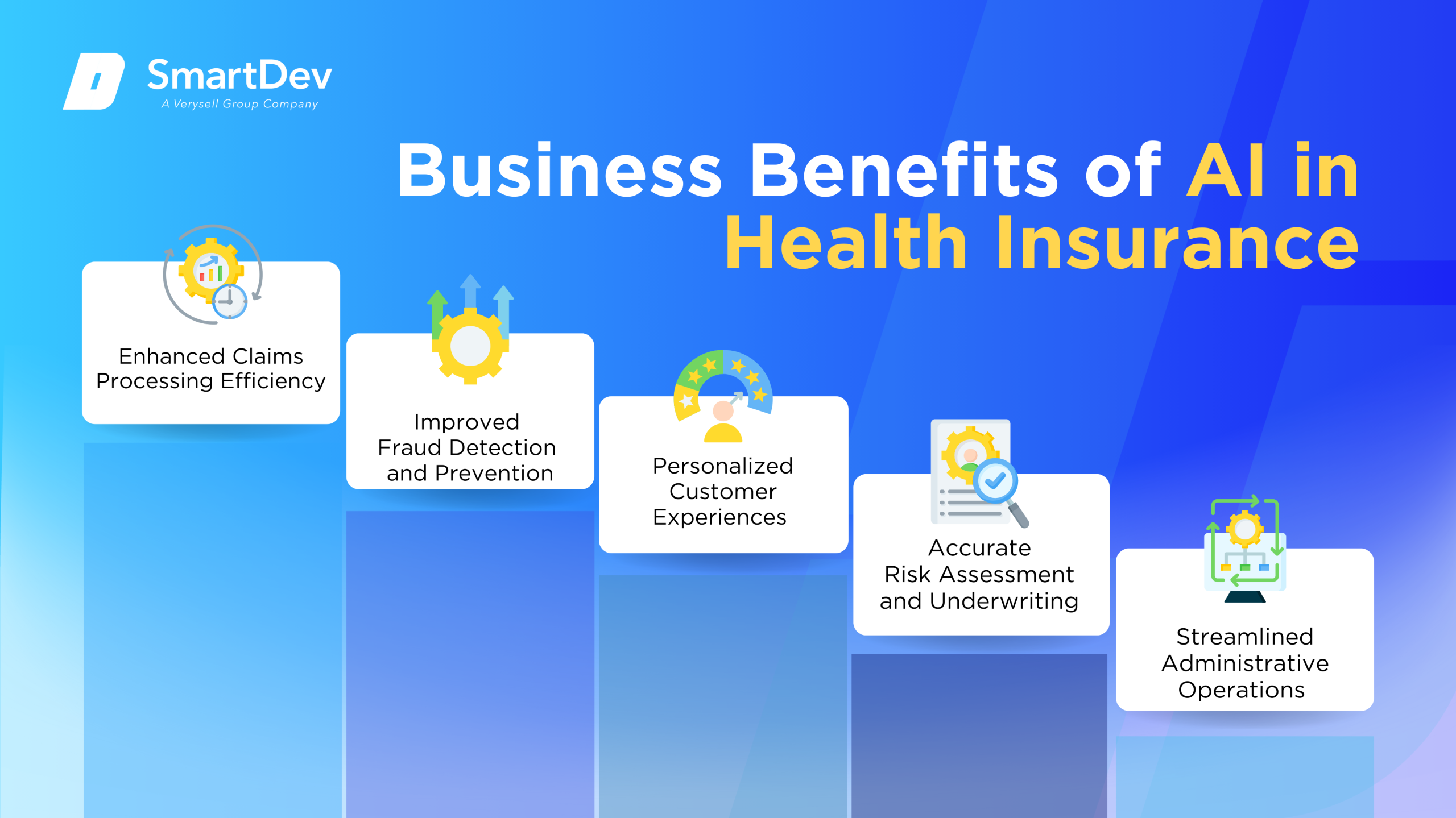

Business Benefits of AI in Health Insurance

AI is unlocking real, measurable value in health insurance by tackling persistent challenges like inefficient workflows, fraud detection gaps, and lackluster customer engagement. These advancements are reshaping core operations and elevating the insurer–member relationship.

1. Enhanced Claims Processing Efficiency

AI automates the claims processing workflow, reducing manual errors and speeding up settlements. Machine learning algorithms can assess claims for completeness and compliance, ensuring faster turnaround times.

This efficiency not only improves customer satisfaction but also reduces operational costs. For example, AI can identify duplicate claims or flag inconsistencies, allowing for prompt resolution and resource optimization.

2. Improved Fraud Detection and Prevention

AI systems analyze vast datasets to detect anomalies and patterns indicative of fraudulent activities. By continuously learning from new data, these systems become more adept at identifying sophisticated fraud schemes.

Early detection of fraud not only saves money but also protects the insurer’s reputation. Implementing AI-driven fraud detection mechanisms ensures a more secure and trustworthy insurance environment.

3. Personalized Customer Experiences

AI enables insurers to offer personalized services by analyzing customer data to understand preferences and behaviors. This insight allows for tailored policy recommendations, targeted communications, and customized wellness programs.

Personalization enhances customer engagement and loyalty. For instance, AI can suggest preventive health measures or policy adjustments based on individual health data, fostering a proactive approach to customer care.

4. Accurate Risk Assessment and Underwriting

AI enhances underwriting accuracy by evaluating a broader range of data points, including medical history, lifestyle factors, and social determinants of health. This comprehensive analysis leads to more precise risk assessments.

Accurate underwriting ensures fair pricing and reduces the likelihood of adverse selection. AI-driven models can adapt to emerging trends, maintaining relevance in a dynamic healthcare landscape.

5. Streamlined Administrative Operations

AI automates administrative tasks such as policy renewals, billing, and customer inquiries. This automation reduces the administrative burden on staff, allowing them to focus on strategic initiatives.

Streamlining operations leads to cost savings and improved service delivery. For example, AI-powered virtual assistants can handle routine customer interactions, ensuring consistent and efficient communication.

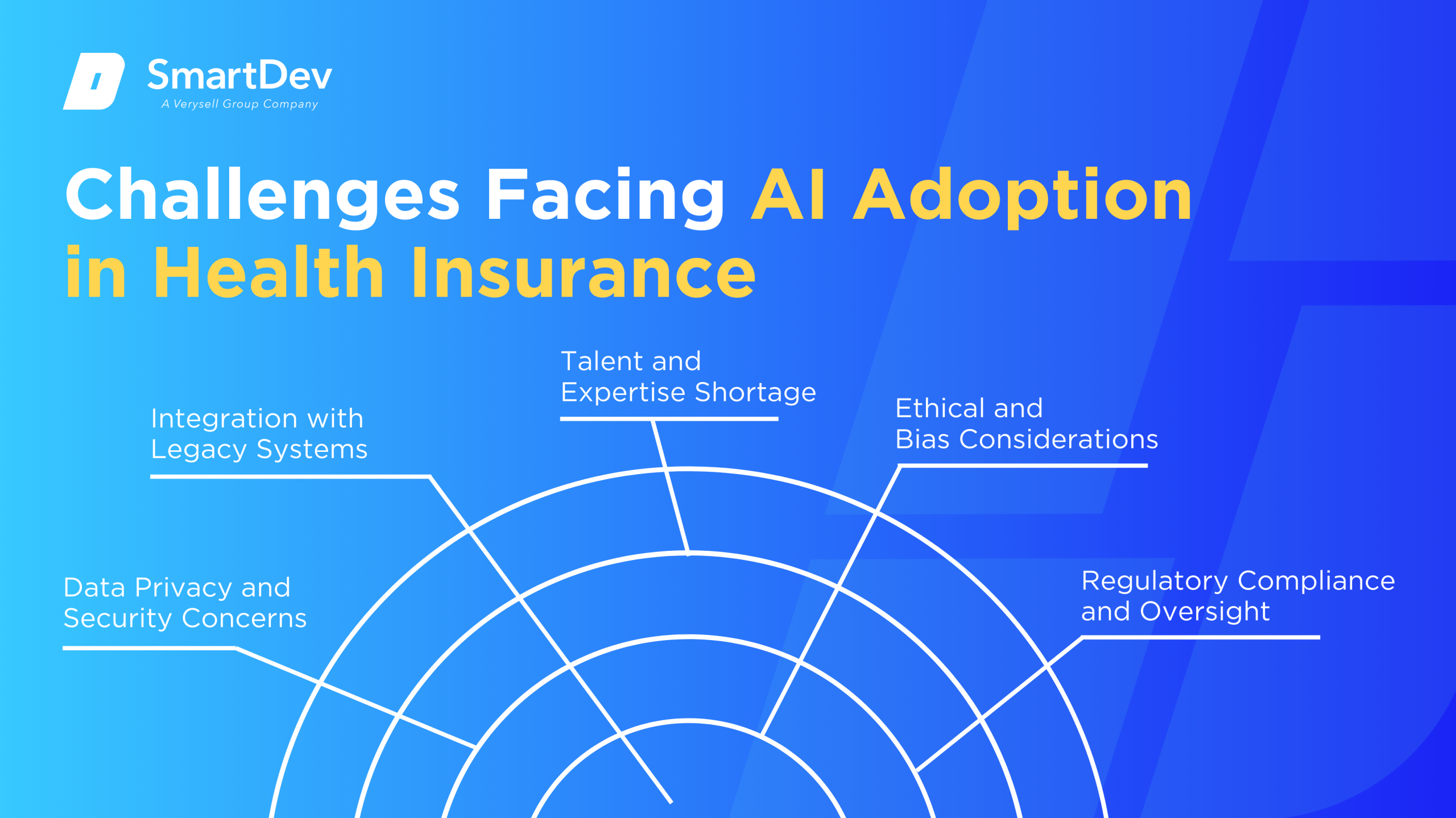

Challenges Facing AI Adoption in Health Insurance

Despite its promise, adopting AI in health insurance comes with complex challenges, from data security risks to integration hurdles that insurers must navigate to realize its full potential.

1. Data Privacy and Security Concerns

Handling sensitive health data requires stringent privacy and security measures. Ensuring compliance with regulations like HIPAA is critical to maintaining customer trust.

Insurers must invest in robust cybersecurity frameworks to protect against data breaches and unauthorized access. Failure to do so can result in legal penalties and reputational damage.

2. Integration with Legacy Systems

Many insurers operate on outdated legacy systems that are incompatible with modern AI technologies. Integrating AI requires significant investment in infrastructure upgrades and system overhauls.

This integration process can be complex and time-consuming, potentially disrupting ongoing operations. Strategic planning and phased implementation are essential to mitigate these challenges.

3. Talent and Expertise Shortage

The successful deployment of AI requires specialized skills in data science, machine learning, and AI ethics. There is a shortage of professionals with this expertise in the insurance industry.

Insurers must invest in training and development programs or partner with external experts to build the necessary capabilities. Attracting and retaining AI talent is crucial for sustained innovation.

4. Ethical and Bias Considerations

AI systems can inadvertently perpetuate biases present in training data, leading to unfair outcomes. Ensuring ethical AI involves rigorous testing and validation to detect and mitigate biases.

Transparency in AI decision-making processes is essential to maintain fairness and accountability. Insurers must establish ethical guidelines and oversight mechanisms to govern AI use.

5. Regulatory Compliance and Oversight

The regulatory landscape for AI in health insurance is still evolving. Insurers must navigate a complex web of laws and guidelines to ensure compliance.

Proactive engagement with regulators and participation in policy development can help shape favorable regulatory environments. Staying informed about regulatory changes is vital to avoid compliance issues.

Specific Applications of AI in Health Insurance

1. AI-Driven Claims Processing

Claims processing involves reviewing and approving insurance claims submitted by policyholders. AI automates this by using natural language processing (NLP) to extract key data from unstructured documents and machine learning to validate claims against policy rules, significantly reducing manual effort. This accelerates processing times, increases accuracy, and minimizes errors.

AI systems continuously learn from vast historical claims data, refining their decision-making to improve outcomes and reduce false rejections. They can instantly flag inconsistencies and anomalies for human review, ensuring that only questionable claims require manual intervention. This capability helps insurers manage high claim volumes efficiently without compromising quality.

The strategic value of AI in claims processing lies in scalability and customer satisfaction, as quicker settlements improve client trust and retention. It also reduces operational costs by cutting down labor-intensive tasks and decreasing the chance of costly errors. Overall, AI transforms claims departments into agile, data-driven operations.

Real-World Example:

A Nordic insurer implemented EY’s AI-driven claims processing solution to automate document handling and validation. The system reduced claims processing time and improved service levels, enhancing operational efficiency and customer experience.

2. Fraud Detection

Fraud detection targets the identification of false claims or suspicious billing activities that cost insurers billions annually. AI leverages machine learning and anomaly detection algorithms to analyze massive datasets, spotting subtle irregularities and complex fraud patterns undetectable by traditional methods. These models continuously adapt to emerging fraud tactics, keeping detection methods current.

Real-time flagging allows fraud investigators to prioritize high-risk claims, increasing the efficiency and effectiveness of investigations. Over time, AI reduces false positives, decreasing unnecessary claim rejections that could harm customer relationships. This precision in fraud detection protects both insurers’ finances and legitimate policyholders.

AI’s major advantage is processing scale and accuracy, enabling continuous, comprehensive surveillance that manual reviews cannot match. It leads to significant savings by reducing fraudulent payouts and streamlining investigative workflows. The technology also enhances trust in the insurance ecosystem.

Real-World Example:

LexisNexis Risk Solutions helped a health plan enhance its fraud detection using AI tools. The system flagged suspicious billing patterns, improving detection speed and effectiveness while saving millions.

3. Underwriting

Underwriting determines eligibility and pricing for insurance applicants. AI enhances underwriting by analyzing complex data such as electronic health records, lifestyle data, and genetic indicators. This improves the speed and accuracy of risk assessments.

These AI tools continuously learn from historical underwriting decisions, improving risk assessments and enabling personalized insurance products. This approach accelerates underwriting decisions and reduces human bias, promoting fairness and consistency. It also helps insurers optimize their portfolios by selecting the right risks.

Strategically, AI-driven underwriting reduces operational costs and improves customer satisfaction through faster policy issuance and tailored coverage. It allows insurers to remain competitive in a complex market by balancing risk and reward effectively. The technology fosters innovation in product development.

Real-World Example:

A global reinsurer partnered with Cognizant to build an AI-powered underwriting tool. The solution streamlined assessments and improved risk evaluation, significantly accelerating the underwriting process.

4. Prior Authorization

Prior authorization requires insurers to verify that prescribed treatments are medically necessary before approval, often causing administrative delays. AI automates this by using NLP and rule-based engines to quickly review claims against clinical guidelines and insurance policies. This streamlines approvals, reducing provider workload and accelerating patient access to care.

AI systems improve over time by learning from past authorizations to minimize unnecessary denials and identify edge cases needing manual review. This helps balance efficiency with fairness, ensuring patients receive timely, appropriate care. However, regulatory oversight remains crucial to prevent automation from causing inappropriate denials.

The key benefit of AI in prior authorization is increased processing speed and consistency, reducing costly administrative bottlenecks. It improves collaboration between insurers and healthcare providers, enhancing overall care delivery. Yet, transparency in AI decision-making is essential to maintain trust.

Real-World Example:

UnitedHealthcare integrated AI to automate prior authorization requests. This reduced approval times but also prompted regulatory concerns due to a reported increase in care denials.

5. Predictive Analytics

Predictive analytics uses AI to analyze historical health and claims data to forecast individuals’ risk of chronic diseases or high-cost claims. This allows insurers to identify at-risk members early and offer personalized interventions, improving health outcomes. Machine learning models detect complex patterns that traditional analytics might miss.

These systems recommend targeted prevention programs and care management plans, reducing costly hospitalizations and claims over time. They continuously update predictions as new data arrives, ensuring adaptive and proactive healthcare strategies. This shift from reactive to preventive care benefits insurers and policyholders alike.

The strategic advantage of AI-driven predictive analytics is reduced long-term costs and enhanced member health through timely interventions. It also supports value-based care models by aligning incentives toward wellness. Predictive insights help insurers allocate resources more effectively.

Real-World Example:

RGA used predictive analytics to help insurers offer better care plans for high-risk individuals. This approach led to improved member health and reduced claims payouts.

6. AI-Powered Customer Engagement

Customer engagement involves responding to inquiries, guiding policy selection, and assisting with claims. AI-powered chatbots and virtual assistants use NLP to understand and respond instantly to customer questions, providing 24/7 support. This reduces wait times and improves accessibility.

These AI systems learn from each interaction to enhance response quality and expand their capabilities. By automating routine tasks, they reduce call volumes, freeing human agents to focus on complex issues. This improves operational efficiency and service quality.

AI-enhanced engagement leads to higher customer satisfaction by delivering consistent, personalized assistance quickly. It also lowers operational costs by optimizing workforce allocation. The technology supports scalable, seamless customer experiences.

Real-World Example:

NIB launched Nibby, an AI assistant that automated over 60% of service inquiries. This cut agent call volumes by 15% and saved the company over $22 million.

7. Pricing and Risk Modeling

Pricing and risk modeling determine premium rates based on individual risk profiles. AI leverages machine learning to analyze health data, lifestyle habits, and environmental factors, enabling highly granular risk assessments. This enhances accuracy compared to traditional actuarial models.

AI models dynamically update pricing in real time as new data becomes available, allowing insurers to adjust premiums to current risk conditions. This personalization improves market competitiveness and customer fairness by aligning prices with actual risk.

The value of AI in pricing lies in improved profitability and customer retention through fair, data-driven premiums. It also helps insurers manage portfolio risk more effectively. This leads to sustainable growth and innovation in product offerings.

Real-World Example:

Oscar Health uses AI to refine risk scoring and dynamic pricing. Their data-driven pricing approach supports cost control and competitive product offerings.

To see how these AI capabilities come together in a real-world solution, check out how SmartDev built a seamless end-to-end health insurance platform that streamlined operations and improved customer outcomes.

Examples of AI in Health Insurance

Real-World Case Studies

AI’s integration into health insurance is not just theoretical; numerous organizations have successfully implemented AI solutions, yielding tangible benefits.

1. Baltimore Life: Enhancing Underwriting and Claims Processing

Baltimore Life Insurance Company implemented DigitalOwl’s AI platform to optimize their underwriting and claims review processes. The system automates the extraction and structuring of information from complex medical records, which historically required time-intensive manual work by underwriters and claims adjusters.

As a result, Baltimore Life experienced significantly faster turnaround times in policy underwriting and claims decisions. The AI integration led to improved accuracy, reduced manual errors, and streamlined workflows, allowing staff to focus on higher-value tasks and ultimately improving customer satisfaction.

2. NIB: AI-Driven Customer Service

NIB, a prominent Australian health insurer, deployed an AI-powered chatbot named Nibby to manage a wide range of customer service interactions. These virtual assistant addresses inquiries related to coverage, billing, and claims, substantially easing the burden on human support agents.

Since launch, Nibby has automated over 60% of service inquiries and reduced agent call volumes by 15%, translating into an estimated $22 million in operational savings. This demonstrates how AI not only cuts costs but also improves the scalability and responsiveness of customer engagement strategies.

3. Dutch Insurer: Automating Claims Processing

A major Dutch health insurer adopted a customized AI solution to automate decisions on motor insurance claims. This solution managed to automate 91% of claim decisions within this segment, vastly accelerating claims resolution time and reducing the manual review burden.

The impact was profound – claims processing time dropped by 46% and customer satisfaction rose by 9%. These results illustrate how AI can simultaneously enhance operational efficiency and customer experience by streamlining decision-making in core insurance functions.

Innovative AI Solutions

AI is streamlining prior authorization processes by automating approval workflows, reducing paperwork and delays. However, concerns over increased care denials have prompted regulatory scrutiny to ensure fairness and accountability.

In predictive analytics, insurers use AI to identify high-risk individuals and intervene early with targeted care plans. This proactive approach improves health outcomes and reduces long-term treatment costs.

Customer engagement is also being transformed through AI-powered chatbots and virtual assistants. These tools offer instant support, guide users through policies, and simplify claims, enhancing satisfaction and operational efficiency.

AI-Driven Innovations Transforming Health Insurance

Emerging Technologies in AI for Health Insurance

Artificial Intelligence (AI) is revolutionizing the health insurance industry by introducing innovative technologies that enhance efficiency, accuracy, and customer satisfaction. One significant advancement is the use of AI-powered chatbots and virtual assistants. These tools provide 24/7 customer support, handling inquiries ranging from policy details to claim statuses, thereby reducing wait times and operational costs.

Another emerging technology is predictive analytics, which leverages machine learning algorithms to assess risk profiles and predict future healthcare needs. This enables insurers to design personalized insurance plans and proactive health management programs. For instance, AI models can analyze a policyholder’s medical history, lifestyle, and genetic information to predict the likelihood of chronic diseases, allowing for early interventions and tailored coverage options.

AI’s Role in Sustainability Efforts

AI contributes to sustainability in health insurance by optimizing resource allocation and reducing waste. Predictive analytics can forecast healthcare utilization patterns, enabling insurers to manage resources more effectively and minimize unnecessary medical procedures. This not only lowers costs but also reduces the environmental impact associated with excessive medical interventions.

Moreover, AI-driven fraud detection systems play a crucial role in sustainability by identifying and preventing fraudulent claims. By analyzing patterns and anomalies in claim data, these systems can detect suspicious activities, ensuring that resources are allocated to genuine cases. This enhances the integrity of the insurance system and promotes trust among policyholders.

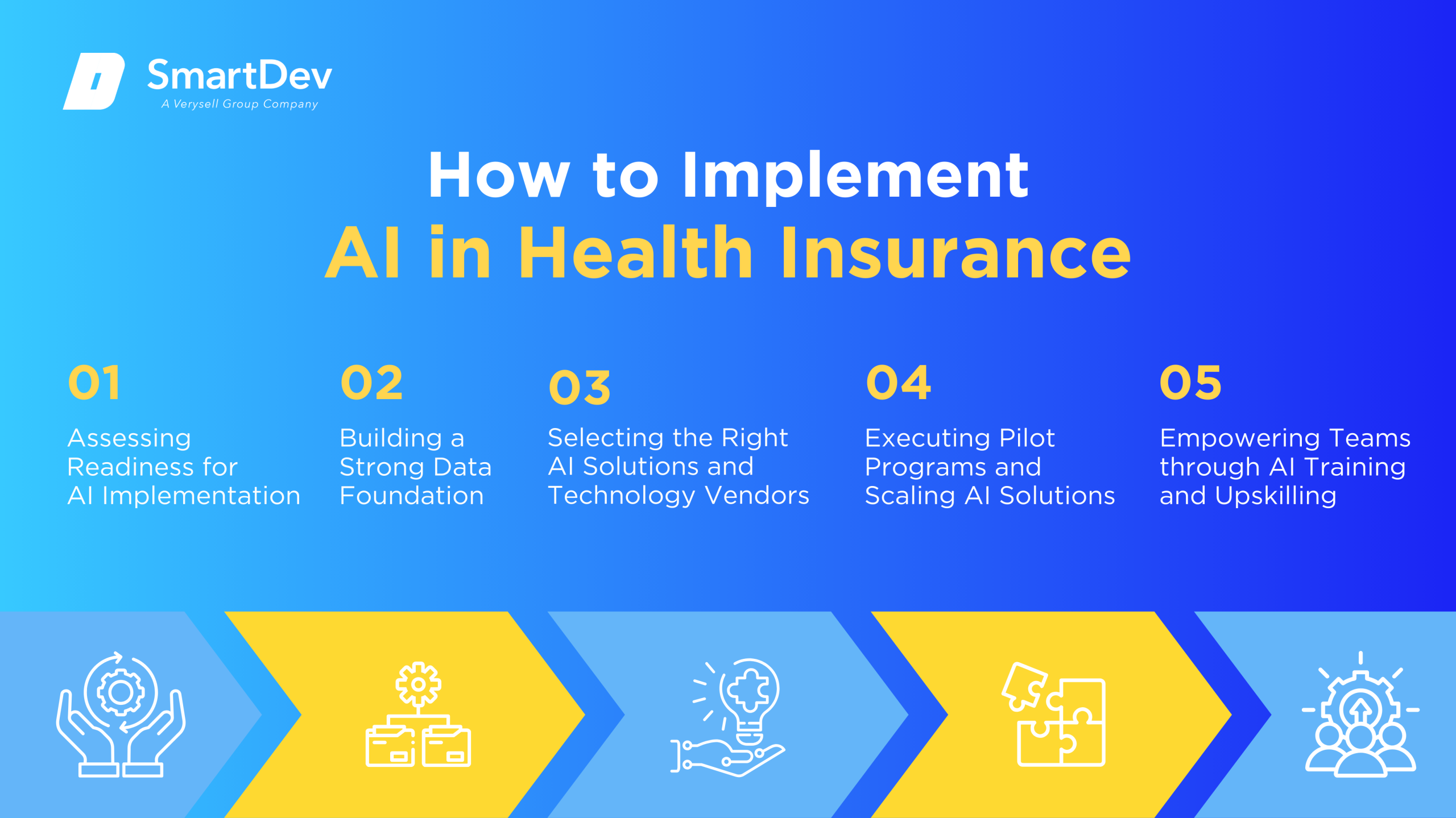

How to Implement AI in Health Insurance

Step 1. Assessing Readiness for AI Adoption

To successfully implement AI in health insurance, you need to evaluate your company’s current infrastructure, data capabilities, and employee readiness. Identify which processes such as claims adjudication, customer service, or risk assessment are best suited for AI integration. Aligning AI initiatives with your broader business strategy and compliance obligations helps ensure lasting impact.

Step 2. Building a Strong Data Foundation

Your company’s AI success begins with establishing a unified and secure data infrastructure that combines claims, health records, and customer interaction data. Ensuring that your data is clean, accurate, and compliant with privacy regulations like HIPAA is essential for building trustworthy AI models. Regular data audits and ongoing quality control will help your systems perform with greater accuracy and fairness.

To explore why data is the backbone of AI in healthcare, our in-depth article on the power of big data will give you the full picture.

Step 3. Choosing the Right Tools and Vendors

Choosing the right AI tools involves assessing their ability to scale, integrate with your systems, and meet your company’s specific needs. Collaborating with vendors who have healthcare expertise ensures the solutions are tailored to your challenges. Testing these tools in your live environment helps you evaluate their effectiveness before making a full investment.

Step 4. Pilot Testing and Scaling Up

You can begin your AI journey by launching focused pilots in key areas such as fraud detection or automated claims processing to evaluate performance and gather feedback. Insights from these pilot projects allow you to adjust your strategy and build confidence for broader deployment. Once proven successful, you can scale these initiatives across your organization to maximize value.

Step 5. Training Teams for Successful Implementation

Empowering your team to work effectively with AI is essential for long-term adoption and success. Offer training that emphasizes how AI supports their roles and enhances productivity rather than replacing human input. Cultivating a mindset of innovation and continuous learning will help your employees adapt quickly and contribute to the success of your AI initiatives.

Measuring the ROI of AI in Health Insurance

Key Metrics to Track Success

Evaluating the return on investment (ROI) of AI initiatives involves tracking specific metrics that reflect operational efficiency, cost savings, and customer satisfaction. For instance, measuring the reduction in claim processing times and administrative costs can indicate improvements in efficiency. Monitoring the accuracy of fraud detection systems and the decrease in fraudulent claims provides insights into cost savings.

Customer satisfaction scores, such as Net Promoter Scores (NPS), can assess the impact of AI on customer experiences. Additionally, tracking employee productivity and engagement levels helps evaluate how AI tools enhance workforce performance.

Case Studies Demonstrating ROI

Several health insurance companies have reported significant ROI from AI implementations. For example, a Nordic insurance company automated its claims processing using AI, resulting in increased operational efficiency and improved customer experience. By automating unstructured data, the insurer streamlined its claims handling process, reducing processing times and enhancing accuracy.

Another case involves a large health insurance company that utilized UiPath’s AI Center to streamline clinical outcomes. The implementation led to the identification of high-risk pregnancies more quickly, saving the payer $11 million and improving patient care.

Common Pitfalls and How to Avoid Them

While AI offers numerous benefits, insurers must be cautious of potential pitfalls. One common issue is the reliance on biased or incomplete data, which can lead to inaccurate predictions and unfair outcomes. To mitigate this, insurers should implement robust data governance practices and regularly audit AI models for bias.

Another challenge is the lack of transparency in AI decision-making processes, which can erode trust among stakeholders. Employing explainable AI techniques ensures that decisions are understandable and justifiable. Additionally, involving cross-functional teams in AI development promotes diverse perspectives and ethical considerations.

Future Trends of AI in Health Insurance

Predictions for the Next Decade

Over the next decade, AI is expected to become deeply integrated into health insurance operations. Predictive analytics will enable more personalized insurance plans, while real-time data processing will facilitate dynamic pricing models. AI-driven virtual health assistants may become commonplace, providing policyholders with instant support and health guidance.

Advancements in natural language processing and machine learning will enhance the accuracy and efficiency of claims processing and fraud detection. Moreover, the integration of AI with wearable devices and health monitoring tools will allow insurers to offer proactive health management services.

How Businesses Can Stay Ahead of the Curve

To remain competitive, health insurers should invest in continuous innovation and adaptability. Establishing partnerships with technology providers and startups can provide access to cutting-edge AI solutions. Emphasizing a customer-centric approach ensures that AI implementations align with policyholders’ needs and preferences.

Staying informed about regulatory developments and ethical considerations is crucial for responsible AI adoption. Engaging in industry forums and collaborative initiatives can facilitate knowledge sharing and the establishment of best practices.

Conclusion

Key Takeaways

AI is transforming health insurance by enhancing operational efficiency, reducing costs, and improving customer experiences. From automating claims processing to detecting fraud and personalizing insurance plans, AI applications offer substantial benefits. Successful implementation requires a strong data foundation, careful tool selection, employee training, and continuous evaluation of ROI.

Moving Forward: A Path to Progress

As AI continues to transform the health insurance landscape, your success will depend on how proactively and strategically you adopt these innovations. Prioritizing a strong data foundation, selecting AI solutions that align with your goals, and investing in team readiness are all critical components. With AI at the core of your operations, your company can enhance claims accuracy, detect fraud faster, and deliver more personalized, customer-centric services.

At SmartDev, we provide advanced AI solutions designed specifically for the health insurance industry. Our team of experts partners with insurers to implement intelligent automation, predictive analytics, and machine learning systems that drive operational efficiency and improve customer outcomes.

Contact us today to explore how AI can elevate your health insurance operations. Together, we’ll build a smarter, more agile future that reduces costs, strengthens trust, and delivers lasting value.

—

References:

- An AI opportunity for health insurers | McKinsey & Company

- Insurance Industry Accelerates AI Technology Adoption | Risk & Insurance

- 2025 insurance tech trends: AI, big data and cautious adoption | Wolters Kluwer

- Revolutionizing healthcare: the role of artificial intelligence in clinical practice | BMC Medical Education

- Artificial Intelligence in Health Insurance: How AI Changes Analytics | Clarity

- Detecting Insurance Fraud using AI: A Case Study of Claims Processing | ResearchGate

- 30 Practical Generative AI Use Cases in Healthcare With Real-World Projects | Medium

- The AI Revolution In Medical Claims Processing | Forbes

- How a Nordic insurance company automated claims processing | EY