Introduction

Life insurers face rising regulatory scrutiny, increasingly complex risk profiles, and growing demand for faster, more personalized service. Artificial Intelligence (AI) is stepping up as a powerful ally, enhancing underwriting, improving customer engagement, and streamlining operations. This guide explores how AI is already transforming life insurance and where it’s headed next.

What is AI and Why Does It Matter in Life Insurance?

Definition of AI and Its Core Technologies

AI refers to computer systems that can perform tasks typically requiring human intelligence, such as learning, reasoning, and decision-making. These systems are powered by technologies like machine learning, natural language processing (NLP), and predictive analytics. AI is increasingly used across industries to automate processes and enhance decision-making.

In life insurance, AI is applied to streamline underwriting, refine risk assessment, and detect data anomalies. It enables insurers to automate routine tasks while delivering more personalized and timely services to policyholders. This results in improved efficiency, better customer experiences, and more accurate pricing models.

The Growing Role of AI in Transforming Life Insurance

AI is revolutionizing core processes in life insurance, from underwriting to claims. Leading insurers use machine learning models to analyze health records, behavioral data, and third-party sources to make faster and more accurate risk assessments. This allows companies to issue policies in minutes, dramatically reducing turnaround times and improving customer satisfaction.

AI also drives more precise and personalized policy offerings. By analyzing lifestyle, financial behavior, and demographic data, insurers can tailor products and pricing to match individual customer profiles. Companies like John Hancock and Haven Life are using these tools to shift from one-size-fits-all coverage to dynamic, real-time underwriting models.

Operational efficiency is another major gain. AI-powered tools automate routine tasks such as document review, policy generation, and customer queries—freeing up human staff for high-impact activities. Virtual agents and intelligent chatbots now handle thousands of service requests, ensuring consistent, 24/7 support without increasing operational costs.

Key Statistics and Trends in AI Adoption in Life Insurance

AI adoption in life insurance surged in 2025, with implementation rates climbing to 48%—up sharply from 29% just a year earlier. At the same time, the share of insurers still in the consideration phase dropped from 51% in 2021 to 42% in 2025, signaling a clear shift from exploration to execution. This momentum reflects growing pressure to improve underwriting speed, enhance risk accuracy, and deliver more personalized policy experiences.

Generative AI is also reshaping how insurers operate. Over 50% of carriers are now piloting or deploying generative tools to support agent workflows, automate content generation, and tailor customer communications. As insurers integrate these technologies into their daily operations, they’re improving engagement while reducing manual workloads across underwriting and claims.

The National Association of Insurance Commissioners (NAIC) issued a Model Bulletin in 2023, urging insurers to prioritize fairness, transparency, and oversight in AI systems. Meanwhile, a McKinsey report shows that top-performing insurers using AI at scale are seeing up to 6.1× higher returns, 10–15% premium growth, and onboarding cost reductions of up to 40% – clear proof that enterprise-wide AI integration drives real business impact.

Business Benefits of AI in Life Insurance

AI addresses long-standing inefficiencies in life insurance, such as slow underwriting, limited personalization, and high operational costs. Below are five essential business benefits that AI delivers to insurers seeking competitive advantage:

1. Faster, More Accurate Underwriting

AI processes applicant data, including medical history, lifestyle factors, and external records, far faster than manual review. This leads to quicker decisions and reduces the likelihood of human error. Consistent rule application also ensures greater underwriting reliability across cases.

These models can be continuously updated with new data, improving risk assessment over time. As a result, insurers can maintain speed without compromising accuracy. This balance is critical to both customer satisfaction and portfolio performance.

2. Personalized Policy Recommendations

AI enables insurers to analyze customer data in real time and match products to individual needs. This allows for more relevant policy offerings based on factors like behavior, demographics, and financial goals. Personalization increases the likelihood of policy acceptance and customer satisfaction.

Over time, AI refines these recommendations as customer profiles evolve. This ensures that coverage remains aligned with life changes and risk levels. A dynamic approach to product matching supports both retention and cross-selling strategies.

3. Operational Efficiency and Cost Reduction

AI automates routine tasks such as data entry, claims triage, and communication workflows. This significantly reduces processing time and operational expenses. Teams can shift focus from administrative tasks to higher-value strategic work.

These efficiencies lead to faster turnaround times and reduced resource strain. Automation also enhances scalability, allowing firms to handle more volume without proportional increases in staffing. This cost leverage is key to sustainable growth.

4. Smarter Risk and Fraud Detection

AI models identify inconsistencies and anomalies that may indicate fraudulent behavior or misrepresented data. These insights support early intervention and reduce exposure to loss. Detecting risk patterns proactively also strengthens compliance and governance frameworks.

In addition to fraud detection, AI refines overall risk scoring by incorporating broader data inputs. This enables more precise pricing and reduces the impact of adverse selection. A sharper view of risk leads to healthier portfolios and more stable margins.

5. Stronger Customer Engagement and Retention

AI enhances customer communication by providing timely, relevant responses across digital channels. This helps build trust and improves user experience without overburdening support teams. Customers are more likely to engage with insurers that respond quickly and accurately.

Personalized, data-driven communication nurtures long-term relationships. Retention increases when customers feel understood and supported throughout the policy lifecycle. These experiences also increase the likelihood of product renewal and additional coverage uptake.

Challenges Facing AI Adoption in Life Insurance

While AI offers significant advantages, implementing it within life insurance ecosystems presents a range of practical and strategic obstacles. Below are five critical challenges insurers must address to adopt AI effectively:

1. Legacy Systems and Data Fragmentation

Many life insurers operate on outdated technology stacks that limit data accessibility and system integration. These fragmented systems make it difficult to consolidate the clean, structured data that AI requires. Inconsistent data formats across departments also hinder the reliability of AI outputs.

Migrating to more modern infrastructure is often costly and time-consuming. It requires strong leadership commitment and cross-functional coordination. Without foundational upgrades, AI projects risk failure due to unreliable or incomplete inputs.

2. Algorithmic Bias and Data Ethics

AI models trained on historical data can unintentionally replicate existing biases, especially in underwriting and pricing. This can lead to unfair outcomes for certain demographic groups and pose reputational and legal risks. Ethical use of AI demands transparency in how decisions are made.

Implementing bias mitigation requires rigorous data governance and continuous model auditing. Insurers must establish clear policies on acceptable data use and fairness standards. Failure to address these concerns may result in regulatory scrutiny or customer mistrust.

3. Regulatory Uncertainty and Compliance

AI regulation in insurance is still evolving, with differing expectations across jurisdictions. This creates ambiguity around what constitutes acceptable use of automated decision-making. Insurers must navigate a complex and shifting compliance landscape to avoid penalties.

Ensuring auditability, explainability, and human oversight in AI systems is essential. Compliance frameworks must be integrated into every stage of the AI lifecycle. The lack of standardized regulation increases the risk of implementation delays and legal exposure.

4. Talent Gaps and Cultural Resistance

Building effective AI systems requires specialized skills in data science, machine learning, and insurance domain knowledge. Many insurers lack the in-house talent needed to develop, manage, and scale AI initiatives. Hiring or reskilling can be slow and expensive.

Beyond skills, cultural resistance often arises from uncertainty about AI’s role in decision-making. Employees may fear job displacement or struggle to trust automated systems. Without clear communication and change management, adoption efforts can stall.

5. Reliability and Model Accuracy

AI outputs are only as good as the data and logic behind them. Inaccurate predictions or flawed recommendations can undermine trust and lead to poor business outcomes. Errors in underwriting or claims processing can be particularly costly in life insurance.

Ensuring reliability requires rigorous model validation and ongoing performance monitoring. Human review remains necessary, especially for complex or high-risk cases. Overreliance on automation without safeguards may compromise both customer experience and financial results.

Specific Applications of AI in Life Insurance

From underwriting automation to personalized customer engagement, AI is transforming how life insurance companies operate, evaluate risk, and serve policyholders. These technologies are enabling faster decisions, smarter pricing, and more efficient claims—all while enhancing the customer experience:

1. Automated Underwriting and Risk Assessment

AI-powered automated underwriting is revolutionizing how life insurance providers assess risk and approve policies. Traditional underwriting involves manual review of medical records, interviews, and questionnaires – a process that’s often slow, inconsistent, and prone to human bias. AI solves this challenge by streamlining underwriting with machine learning models that evaluate applicant data quickly, objectively, and at scale.

These systems utilize algorithms trained on millions of historical policyholder records, incorporating factors such as health history, prescription data, and lifestyle indicators. Using methods like gradient boosting and neural networks, they classify applicants into risk tiers and recommend pricing or policy decisions in real time. Integrated with digital onboarding tools and insurer CRMs, AI-enabled underwriting reduces processing time from weeks to minutes, cuts administrative costs, and improves consistency across applications.

One strong example comes from Ethos Life, a leading digital life insurance platform, which uses AI to fully automate underwriting for many applicants. The platform integrates medical databases, public records, and predictive analytics to determine eligibility without requiring a medical exam. This innovation has drastically reduced approval times while expanding access to life insurance for underserved demographics.

2. Policy Lapse Prediction and Retention

AI-driven lapse prediction models help insurers anticipate when customers are likely to let their policies lapse due to inactivity or non-payment. Lapse rates have long challenged insurers by impacting profitability and long-term revenue predictability. With AI, insurers can proactively intervene and improve retention outcomes with data-informed outreach.

These solutions use behavioral data such as payment history, support queries, digital activity, and demographic variables to train predictive models. Algorithms like XGBoost and logistic regression flag customers at high risk of lapse, triggering alerts for human agents or automated retention actions. Integrated with CRM and marketing tools, this helps insurers target messaging and offers to retain at-risk policyholders more effectively.

Zurich Insurance has successfully implemented such AI-powered lapse detection to reduce customer churn. The system analyzes ongoing customer behaviors and provides retention teams with timely alerts, enabling proactive engagement before lapse occurs. As a result, Zurich has improved policyholder retention and reduced costly churn across its portfolio.

3. Claims Fraud Detection and Prevention

Insurance fraud costs the life insurance industry billions annually, with claim manipulation and identity fraud being major culprits. AI is reshaping fraud detection by scanning vast datasets to identify suspicious patterns in real time. These systems allow insurers to flag and investigate anomalies before fraudulent claims are paid out.

Machine learning and anomaly detection algorithms analyze data across applications, claims, death certificates, and financial transactions. Techniques such as random forests and unsupervised clustering compare new claims to known fraudulent patterns, surfacing outliers and inconsistencies. This reduces investigation time, cuts false positives, and enables fraud teams to focus on the most likely cases.

A noteworthy example is from a multinational insurer deploying an AI-based fraud detection platform that flagged over 200 high-risk claims within weeks. By analyzing behavioral anomalies and document inconsistencies, the system helped investigators identify fraudulent claims much faster. The initiative led to significant reductions in fraud payouts and recovered millions in prevented losses.

4. Personalized Customer Engagement

AI is helping life insurers shift from reactive service to proactive, personalized customer engagement. Traditional call centers and generic outreach often fail to build loyalty or deepen relationships. AI-driven personalization engines use behavioral and demographic data to tailor interactions and recommend relevant products or actions.

NLP and recommender systems analyze support transcripts, website behavior, and policyholder profiles. This information is used to send personalized emails, offer policy updates, or trigger service reminders—enhancing the customer journey at each touchpoint. Integrated across web, mobile, and agent portals, this elevates customer satisfaction and cross-sell potential.

Lemonade exemplifies this strategy with its AI chatbot “Maya,” which interacts with customers from quote to claim. Maya leverages real-time data to answer questions, guide users, and complete policy setups without human involvement. This approach has enabled Lemonade to deliver a seamless digital experience and scale its customer base efficiently.

5. Synthetic Data for Model Training

One of the barriers to AI adoption in life insurance is limited access to large, diverse, and high-quality datasets due to privacy constraints. Generative AI now enables the creation of synthetic datasets that mirror real-world policyholder and claim data without compromising privacy. This accelerates AI model development and testing across risk modeling and fraud detection.

Synthetic data is generated by AI models like GANs (Generative Adversarial Networks) trained on real datasets to simulate realistic but fictitious records. These synthetic datasets retain statistical properties of the originals and are used to improve model generalization and robustness. This innovation allows insurers to train, validate, and deploy AI models faster while maintaining data security and compliance.

McKinsey reports that insurers are increasingly turning to synthetic data to overcome data scarcity and bias in model training. Life insurance firms are using synthetic claim histories and underwriting cases to improve AI systems’ accuracy while protecting personal data. This method is accelerating innovation without compromising on data governance or regulatory standards.

6. Dynamic Pricing and Real-Time Risk Adjustment

AI is enabling life insurers to move beyond static pricing toward dynamic, real-time premium adjustments based on individual behavior and health indicators. This model introduces fairness, competitiveness, and personalized policy offerings that better match risk to price. It represents a fundamental shift from traditional actuarial tables to responsive pricing algorithms.

These systems leverage IoT data, wearable device feeds, and real-time lifestyle metrics like heart rate or exercise levels. Machine learning algorithms assess changing risk profiles and recalibrate premiums or benefits accordingly. For insurers, this not only improves margin control but also incentivizes healthy behaviors among policyholders.

Leading AI platforms, like Akur8 and Earnix, are being adopted by insurers to implement scalable dynamic pricing strategies. These tools allow insurers to rapidly deploy transparent, auditable pricing models and adjust them in near real time. One insurer using Earnix’s dynamic pricing engine saw a 15% increase in quote-to-bind conversion rates thanks to more competitive and responsive pricing

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Life Insurance

AI’s transformative potential in life insurance becomes most evident through real-world implementations. The following case studies showcase how forward-thinking insurers are applying AI to optimize underwriting, reduce fraud, and enhance customer experience at scale.

Real-World Case Studies

1. Lemonade: Fully Automated Claims Processing

Lemonade faced the industry-wide challenge of slow, expensive, and manual claims processes—especially for life and term insurance products. Traditional methods involved long wait times, paperwork, and human adjusters, leading to poor user experience and high overhead. Lemonade sought a digital-first solution to modernize claims without increasing operational headcount.

They implemented AI-powered chatbots and NLP systems to fully automate claims submission, fraud detection, and approvals in real time. Their AI assistant “Maya” handles customer onboarding, while backend bots process and review claims using machine learning models. This has resulted in claims being approved in as little as 3 seconds, with minimal human oversight and reduced fraud risk.

The results are compelling: Lemonade reported a significant reduction in claims processing costs and enhanced customer satisfaction, particularly among digital-native policyholders. The company scaled its platform to cover term life insurance while maintaining low operational costs. This AI-first model has set a new benchmark for the future of digital insurance servicing.

2. Prudential: Predictive Retention Modeling

Prudential struggled with rising lapse rates among term policyholders, especially in younger segments who often disengaged after purchase. Traditional outreach methods weren’t timely or targeted enough to retain customers on the verge of cancellation. The company needed a predictive approach to proactively intervene before customers lapsed.

Prudential launched a machine learning-driven lapse prediction engine trained on behavioral, transactional, and communication data. The system identified high-risk accounts and fed insights into the CRM for automated messaging and agent interventions. AI models continuously updated based on policyholder behavior, improving their accuracy and targeting over time.

The impact was immediate: policy lapse rates dropped by 35% in affected segments, and customer re-engagement increased through timely, personalized outreach. The initiative also helped reduce customer acquisition costs by preserving existing relationships. Prudential now uses the same framework to inform retention strategy across other product lines.

3. ZhongAn: AI-Powered Dynamic Pricing & Risk Assessment

ZhongAn, China’s first fully digital insurer, was challenged by the need to rapidly scale personalized life and health insurance while ensuring accurate pricing and efficient risk management in a highly competitive market. Traditional actuarial methods struggled to adapt to real-time customer behavior and emerging risk patterns. ZhongAn needed a solution that could dynamically price policies and assess risk with agility.

To tackle this, ZhongAn developed AI-driven models that continuously analyze transactional data, customer behavior, and broader environmental factors. Real-time analytics platforms feed these models to adjust pricing dynamically and detect anomalies. By leveraging scalable AI infrastructure, ZhongAn ensures its offerings remain competitive while mitigating emerging risks with speed and precision.

The outcome has been substantial: ZhongAn now processes millions of insurance applications daily with millisecond-level pricing decisions. Dynamic AI pricing has improved profitability by fine-tuning risk–reward trade-offs, while speed and scalability have enhanced customer experience and market responsiveness.

Innovative AI Solutions

AI-Driven Innovations Transforming Life Insurance

Emerging Technologies in AI for Life Insurance

Generative AI is reshaping the underwriting and policy management process in life insurance. Carriers can now automate document processing, generate personalized policy recommendations, and simulate risk scenarios using synthetic datasets. This capability accelerates decision-making for underwriters while enhancing customer experience through faster, more tailored responses.

Computer vision is gaining traction in digital claims and identity verification. AI can now process video evidence from medical assessments, detect inconsistencies in submitted documents, and even verify facial recognition during onboarding. This reduces fraud, streamlines claims processing, and minimizes the need for in-person appointments—offering both operational savings and improved policyholder convenience.

AI-powered virtual assistants are transforming how life insurers interact with customers and agents. From guiding applicants through policy selection to helping agents retrieve key client data in real time, NLP-driven bots offer 24/7 service with human-like comprehension. AI makes policy servicing intuitive, data-rich, and frictionless, empowering agents to focus more on relationship-building than administrative tasks.

AI’s Role in Sustainability Efforts

AI is helping life insurers build more sustainable, resource-efficient operations by predicting policy lapse risks, optimizing pricing, and minimizing manual data entry. Machine learning algorithms identify patterns that flag at-risk customers, allowing insurers to intervene early with personalized offers or outreach. This reduces customer churn, which not only preserves revenue but also cuts down on repetitive processing and administrative waste.

Firms are also using AI to clean and maintain vast datasets, ensuring more accurate records, better segmentation, and less duplication. SulAmérica’s initiative to remove over 20% of duplicate entries from a 21 million-record database is a clear example of how AI supports data sustainability. Additionally, predictive analytics is guiding smarter investments and actuarial decisions, helping insurers align long-term business growth with ESG and compliance goals.

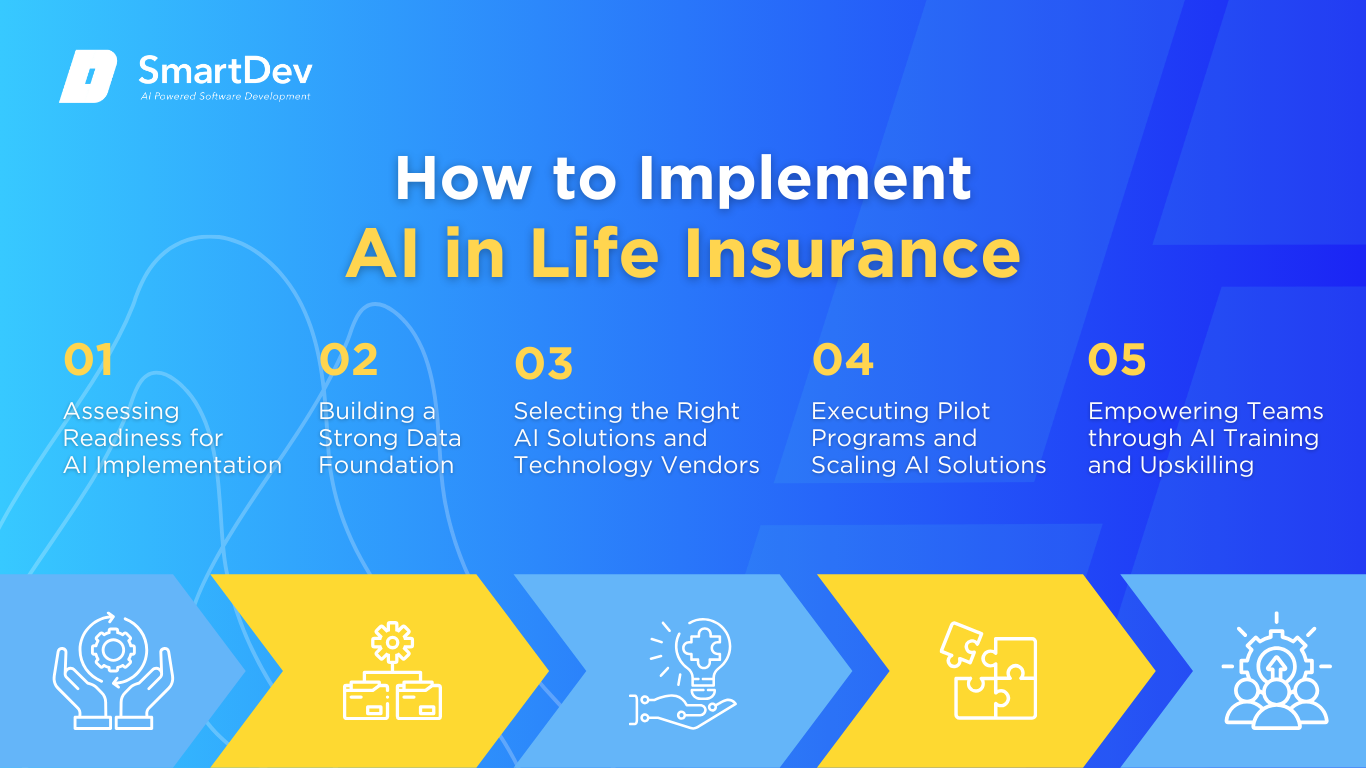

How to Implement AI in Life Insurance

A step-by-step guide for adopting AI in life insurance: assessing readiness, preparing data, choosing vendors, piloting, and training.

Step 1: Assessing Readiness for AI Adoption

Before jumping into AI implementation, life insurance leaders need to pinpoint where AI can make the biggest difference. Common entry points include underwriting automation, policy lapse prediction, fraud detection, and enhancing agent support. If your teams are buried in manual reviews, battling high policy churn, or struggling to detect fraud efficiently, these are red flags AI can address immediately.

It’s also essential to evaluate your tech and cultural readiness. Are your legacy systems flexible enough to integrate with AI APIs or cloud platforms? Do your teams have the analytical maturity to trust AI-generated decisions? Assessing both system capability and organizational mindset sets the foundation for AI to be more than a trend; it becomes a transformative business asset.

Step 2: Building a Strong Data Foundation

AI in life insurance is only as strong as the data it learns from. That means building a centralized data architecture that captures policyholder demographics, medical records, behavioral insights, and historical claims. The more connected and normalized this data is, the more powerful your models become.

Consistency is non-negotiable. Data must be labeled, structured, and free from duplication. Companies like SulAmérica have invested in large-scale data hygiene initiatives, cleaning millions of records to create a single customer view. This clean foundation fuels machine learning models with clarity, powering everything from accurate risk scoring to real-time policy personalization.

Step 3: Choosing the Right Tools and Vendors

Choosing AI tools for life insurance is about solving real business problems. Whether you’re looking at predictive underwriting software, generative customer service assistants, or fraud detection engines, choose platforms that are built specifically for insurance or financial services.

You’ll also want partners with proven regulatory and compliance experience. This industry isn’t just about innovation; it’s about trust. Evaluate vendors for transparency, explainability of AI outputs, and integration ease with core systems. Top-tier insurers now benchmark AI maturity with indices like Evident’s AI Insurance Index to ensure vendor choices support long-term scalability and responsible AI governance.

Step 4: Pilot Testing and Scaling Up

Start small to think big. Test AI tools in controlled environments—like applying automated underwriting to a subset of straightforward policies or trialing an AI chatbot for policy FAQs. These controlled pilots help you measure performance, customer experience, and integration complexity without disrupting your existing workflows.

When pilot programs show measurable value, like faster processing times, improved fraud detection, or reduced policy lapses, then it’s time to scale. Expand incrementally across departments, regions, or product lines. This phased approach not only reduces risk but also enables your internal teams to adapt gradually, learn from each stage, and fine-tune deployments before going enterprise-wide.

Step 5: Training Teams for Successful Implementation

Even the smartest AI system can’t replace the judgment of a seasoned underwriter or agent. Training your teams to work alongside AI is critical to making technology stick. Focus on teaching how AI models work, where they shine, where human oversight is still needed, and how to evaluate AI output for accuracy and bias.

Cross-functional collaboration drives long-term success. Encourage dialogue between actuarial teams, IT, compliance, and customer service. When employees see AI as a tool to enhance their expertise, they’re far more likely to engage. Organizations that frame AI as an intelligent co-pilot, rather than an autopilot, are building more resilient, data-driven, and future-ready insurance teams.

Measuring the ROI of AI in Life Insurance

Key Metrics to Track Success

Measuring the return on investment for AI in life insurance starts with operational impact. One of the clearest metrics is underwriting speed. AI-driven underwriting platforms have been shown to reduce decision times from weeks to less than a day. This reduction not only increases throughput but allows insurers to close policies faster—directly accelerating revenue generation.

Cost savings is equally measurable. By automating tasks like document review, risk scoring, and claims triage, insurers lower administrative overhead and free up teams for higher-value activities. AI-powered fraud detection has improved false positive rates and reduced financial leakage by flagging questionable claims early.

Case Studies Demonstrating ROI

Zurich Insurance offers one of the clearest examples of AI-driven ROI in action. Their implementation of a Spotify-style CRM with AI recommendation engines allowed agents to surface relevant products in real time, leading to faster consultations and more conversions. In four pilot countries, they achieved a 70%+ reduction in customer service time—translating directly to cost savings and improved sales performance.

SulAmérica, a Brazilian insurer, tackled data fragmentation by cleaning more than 20% of duplicate entries from a 21 million-record dataset. With more accurate and accessible customer data, they improved segmentation, reduced compliance risk, and enhanced campaign targeting—ultimately boosting revenue per policyholder.

Common Pitfalls and How to Avoid Them

Despite the upside, there are critical pitfalls that can erode AI’s ROI in life insurance. One of the most common is poor data quality. Insurers often operate with outdated, siloed, or inconsistent customer data. When fed into AI models, this leads to inaccurate predictions and ineffective automation. To avoid this, insurers must invest early in robust data governance and master data management systems.

Another challenge is over-reliance on black-box models without human oversight. AI’s opacity can undermine trust, especially when underwriting or claim decisions are not explainable. Google’s own AI assistant for insurance-related queries was found to be wrong 57% of the time—highlighting the need for human validation at every stage. Firms that blindly deploy AI without interpretability or compliance safeguards expose themselves to legal and reputational risks.

Future Trends of AI in Life Insurance

Predictions for the Next Decade

Over the next decade, AI will become foundational to how life insurers assess risk, serve customers, and design products. One of the biggest shifts will come from real-time, dynamic underwriting. Instead of a one-and-done application process, AI will continuously monitor lifestyle data,from wearable devices, electronic health records, or even social determinants of health,to update policy terms in real time. This means coverage that evolves with the policyholder, creating hyper-personalized and adaptable life insurance experiences.

Generative AI will also reshape how policies are built and sold. Agents will co-create policy documents with large language models, tailoring messaging, benefits, and clauses based on customer profiles in seconds. Advanced conversational AI will act as a digital assistant for both agents and customers, adapting tone, clarifying complex terms, and predicting the next best action. Combined with computer vision, AI may even support remote medical assessments, enabling fully virtual onboarding and claim processing with clinical-level precision.

How Businesses Can Stay Ahead of the Curve

To lead in this future, life insurers must embed AI at the core of their innovation strategies—not just treat it as a bolt-on solution. This starts by investing in scalable, interoperable data infrastructure that connects underwriting, claims, customer service, and risk modeling into a unified AI-ready ecosystem. The winners in this space will be those who can harmonize internal silos and turn fragmented data into actionable intelligence.

Forward-thinking insurers should also create cross-functional AI task forces, bringing together actuaries, data scientists, underwriters, legal, and customer success teams, to test emerging technologies like synthetic risk modeling, bias detection engines, or autonomous agent workflows. Experimentation is key: the insurers that build safe, measurable AI sandboxes today will be best positioned to scale transformational solutions tomorrow. Ultimately, staying ahead means building not just better models, but a culture and capability set that evolves with the pace of AI innovation.

Conclusion

Key Takeaways

AI is fundamentally transforming life insurance—from predictive underwriting and lapse risk mitigation to personalized customer service and smarter fraud detection. With tools like generative AI, computer vision, and advanced machine learning, insurers are reducing operational friction, accelerating policy decisions, and offering more responsive, data-driven customer experiences.

What’s more, AI is making life insurance more sustainable and scalable. By optimizing processes, cleaning massive datasets, and enabling early intervention in at-risk policies, AI enhances both efficiency and impact. Case studies from Zurich, SulAmérica, and Swiss Re clearly demonstrate that AI is driving measurable ROI in speed, accuracy, cost savings, and customer retention today.

Moving Forward: A Strategic Approach to AI in Life Insurance

AI is no longer optional for life insurers; it’s a competitive necessity. To unlock its full value, organizations must prioritize strong data infrastructure, cross-functional collaboration, and continuous employee training. Embedding AI into underwriting, customer engagement, and claims workflows helps insurers stay adaptive, responsive, and resilient in a fast-evolving market.

At SmartDev, we help life insurers deploy intelligent AI solutions, from real-time risk modeling to customer-facing virtual agents and fraud detection engines. Whether you’re just starting your AI journey or scaling enterprise-wide adoption, we partner with you to build secure, ethical, and scalable systems that drive long-term success.

—

References:

- The Future of AI in the Insurance Industry | McKinsey

- Scaling Generative AI in Insurance | Deloitte

- AI Adoption in Insurance Worldwide | Statista

- Artificial Intelligence in Insurance: Major Companies & Case Studies 2025 | CDP Center

- Zurich Insurance Uses Azure OpenAI Service | Microsoft Customer Stories

- Underwriting Explained | Ethos Life

- Lemonade’s Maya AI Chatbot | Rasa Community Showcase

- Prudential plc: AI and Digital Innovation Update | Prudential

- ZhongAn Technology: SaaS & Insurance Data Services | Fintech News Hong Kong