The banking industry has undergone remarkable changes in recent years, driven by rapid digital advancements and evolving customer expectations. In 2025, delivering outstanding Customer Experience (CX) is no longer just a competitive advantage—it’s a necessity for financial institutions looking to attract and retain loyal customers.

This guide explores the core pillars of CX in banking, compares traditional vs. digital banking experiences, and highlights the latest innovations shaping the industry. You’ll gain actionable insights on overcoming key CX challenges, adopting best practices, and leveraging technology to enhance customer satisfaction.

By the end, you’ll have a clear roadmap to transform your bank’s customer experience and drive long-term loyalty.

Let’s dive in!

The Growing Importance of Customer Experience in Banking

In today’s fast-evolving banking landscape, customer experience (CX) is no longer just a differentiator—it’s a necessity. As digital innovation reshapes customer expectations, banks must adapt to stay competitive.

This section explores why CX is at the heart of modern banking, the key trends driving its evolution, and how it directly impacts customer retention and business growth. Keep reading to discover how financial institutions can leverage CX to build stronger relationships and gain a lasting edge in the industry.

Why customer experience (CX) is the cornerstone of modern banking

Customer experience (CX) has become the cornerstone of modern banking, driving loyalty, retention, and competitive differentiation in an increasingly digital and customer-centric world. Customers today demand convenience, personalization, and seamless interactions.

Customer experience (CX) has become the cornerstone of modern banking, driving loyalty, retention, and competitive differentiation in an increasingly digital and customer-centric world. Customers today demand convenience, personalization, and seamless interactions.

According to a survey by PwC, 73% of customers consider CX as a key factor in their purchasing decisions, and this is especially true in the banking sector where trust and reliability are paramount. A well-executed CX strategy can lead to increased customer satisfaction, loyalty, and retention, ultimately driving revenue growth.

Research by Accenture shows that banks with superior CX see a 50% higher customer retention rate and a 20% increase in cross-sell opportunities. Furthermore, as digital transformation reshapes the industry, CX ensures that technology serves as a tool to deliver efficient, human-centric interactions, making it essential for sustaining growth and delivering long-term value.

Trends Shaping Customer Experience (CX) in Banking (Traditional and Digital)

Personalization at Scale: Banks are leveraging AI and data analytics to deliver highly tailored experiences, from personalized financial advice to customized product recommendations, ensuring customers feel valued and understood.

Personalization at Scale: Banks are leveraging AI and data analytics to deliver highly tailored experiences, from personalized financial advice to customized product recommendations, ensuring customers feel valued and understood.

Seamless Omnichannel Integration: Customers expect consistent experiences across traditional branches, mobile apps, websites, and call centers. The integration of these channels ensures smooth transitions and unified interactions, enhancing satisfaction.

Enhanced Security and Trust: With increasing cybersecurity concerns, banks are focusing on secure and transparent interactions, using biometric authentication and advanced encryption to build customer trust.

AI-Powered Chatbots and Virtual Assistants: AI-driven tools are revolutionizing customer service by offering instant support, resolving queries efficiently, and providing 24/7 accessibility, bridging the gap between traditional and digital banking.

Branch Transformation: Traditional bank branches are evolving into advisory and experience centers, focusing on high-value services like financial planning while routine transactions shift to digital platforms.

Digital-First Services: From mobile wallets to peer-to-peer payment platforms, digital banking services are becoming the primary mode of interaction, driven by customer demand for convenience and speed.

Sustainability and Ethical Banking: Customers are increasingly favoring banks that align with their values, driving institutions to adopt green initiatives, ethical investments, and transparent practices as part of their CX strategy.

Proactive Engagement: Banks are shifting from reactive problem-solving to proactive customer engagement, using predictive analytics to anticipate needs and address issues before they arise.

Importance of CX for customer retention and competitive edge

Customer experience (CX) plays a pivotal role in customer retention and establishing a competitive edge in the banking industry. In a market where products and services are increasingly commoditized, exceptional CX serves as a key differentiator, fostering trust and loyalty among customers. A positive experience not only strengthens emotional connections but also increases the likelihood of repeat business and long-term relationships, significantly reducing customer churn.

Moreover, satisfied customers are more inclined to recommend a bank to others, amplifying its reputation and expanding its customer base. In an era of digital transformation, where consumers have numerous alternatives at their fingertips, delivering seamless, personalized, and value-driven interactions becomes essential for staying ahead of competitors. By prioritizing CX, banks not only enhance customer satisfaction but also position themselves as industry leaders in an ever-evolving financial landscape.

What Defines Customer Experience in Banking?

Customer experience (CX) in the banking industry encompasses how customers feel about every interaction with their bank. This covers all stages of their journey, from opening an account and making transactions to seeking customer support or when using various financial services. Each interaction, whether it’s a call to the contact center, a money transfer via a mobile banking app or ATM use, shapes the overall perception of the bank and affects customer retention.

The Pillars of Great Banking CX

Customer experience (CX) in banking hinges on four fundamental pillars: Convenience, Personalization, Trust, and Speed.

Convenience is critical as customers expect seamless access to services, whether through mobile apps, ATMs, or branches, with 89% of consumers citing ease of use as a primary factor in loyalty.

Personalization, driven by advanced data analytics, enables banks to offer tailored financial advice and product recommendations, with research showing 80% of customers are more likely to do business with companies that provide personalized experiences.

Trust remains a cornerstone, as 74% of consumers consider transparency in fees and security crucial to their banking relationships.

Finally, speed is non-negotiable in today’s fast-paced world, with customers expecting instant transactions and quick problem resolution, which are achievable through technologies like AI-powered chatbots and real-time payment systems. Together, these pillars form the foundation of a successful banking CX strategy, ensuring customer satisfaction and loyalty.

Key Touchpoints That Influence the Banking Customer Journey

The customer journey in banking consists of multiple touchpoints, each playing a critical role in shaping perceptions and experiences. Starting with account onboarding, simplicity and efficiency are key, as 63% of customers abandon applications if the process is too complex. Regular interactions, such as using mobile apps or visiting branches, influence satisfaction significantly; studies show that 71% of consumers prefer banking apps for routine transactions.

By optimizing these touchpoints across digital and physical channels, banks can deliver consistent and impactful experiences throughout the customer lifecycle.

Evolution of Customer Expectations in Banking

Customer expectations in banking have evolved dramatically, driven by digital transformation and the rise of tech-savvy consumers. Traditional banking, once defined by face-to-face interactions, has shifted to a digital-first approach where 72% of customers now prefer online or mobile banking.

Expectations for real-time service have grown, with 82% of customers stating they expect immediate responses to inquiries. This evolution underscores the importance of adaptability in meeting these rising expectations, as banks must balance innovation with a customer-first approach to remain competitive.

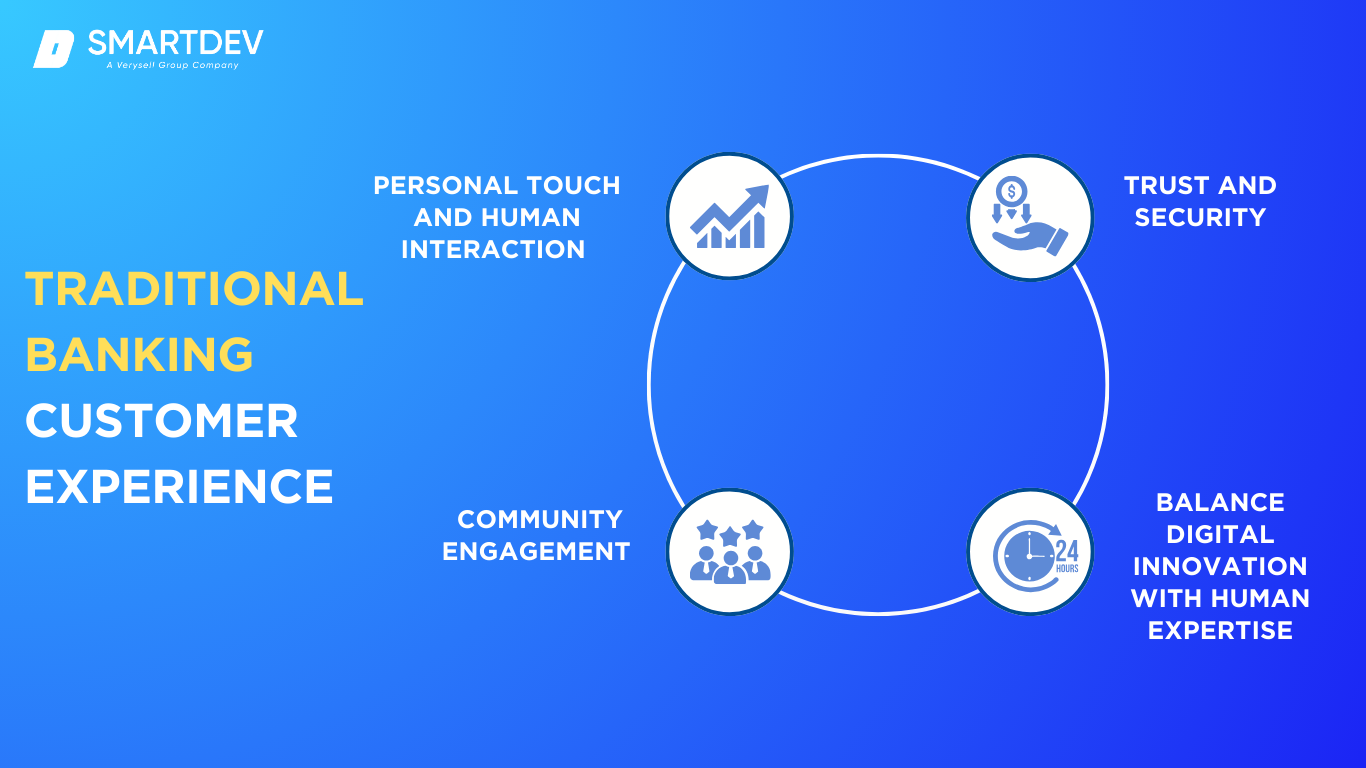

Traditional Banking Customer Experience

Despite the rapid rise of digital-only banks, traditional banks continue to offer unique strengths, particularly in customer experience. A key advantage lies in the personal touch and human interaction they provide, which remains irreplaceable for many customers. Visiting a physical branch allows customers to engage face-to-face with bank tellers and financial advisors, building trust and fostering relationships over time. For individuals who prefer a more hands-on approach or require tailored solutions—such as wealth management or business banking—this personal connection can significantly enhance their experience. Speaking directly with knowledgeable representatives provides reassurance and clarity, especially when navigating complex financial decisions.

Despite the rapid rise of digital-only banks, traditional banks continue to offer unique strengths, particularly in customer experience. A key advantage lies in the personal touch and human interaction they provide, which remains irreplaceable for many customers. Visiting a physical branch allows customers to engage face-to-face with bank tellers and financial advisors, building trust and fostering relationships over time. For individuals who prefer a more hands-on approach or require tailored solutions—such as wealth management or business banking—this personal connection can significantly enhance their experience. Speaking directly with knowledgeable representatives provides reassurance and clarity, especially when navigating complex financial decisions.

Traditional banks also excel in their local presence and community engagement, which allows them to better understand and address the specific needs of the communities they serve. By maintaining physical branches in neighborhoods, they can offer personalized services and develop products tailored to local markets. Their active involvement in community initiatives, charities, and events strengthens their ties with customers, creating a sense of loyalty and belonging that digital-only banks often struggle to replicate.

Another significant advantage is the trust and security that traditional banks provide. With long-standing histories and established reputations, they are often perceived as more stable and reliable than newer digital alternatives. This is particularly appealing to customers who value peace of mind when entrusting their finances to an institution. The physical presence of bank branches enhances this sense of stability, as customers can directly interact with the institution managing their money. Additionally, traditional banks often have robust measures in place to ensure the safety of customer funds, further reinforcing trust.

Finally, traditional banks’ balance digital innovation with human expertise, offering customers the convenience of online services without sacrificing the ability to interact with real people when needed. This hybrid approach makes them well-suited to cater to a broad range of preferences, combining the efficiency of technology with the warmth of personal service.

In a rapidly evolving financial landscape, traditional banks continue to play a vital role by providing a well-rounded customer experience that blends personal interaction, community focus, and reliability with modern convenience.

Digital Banking Customer Experience

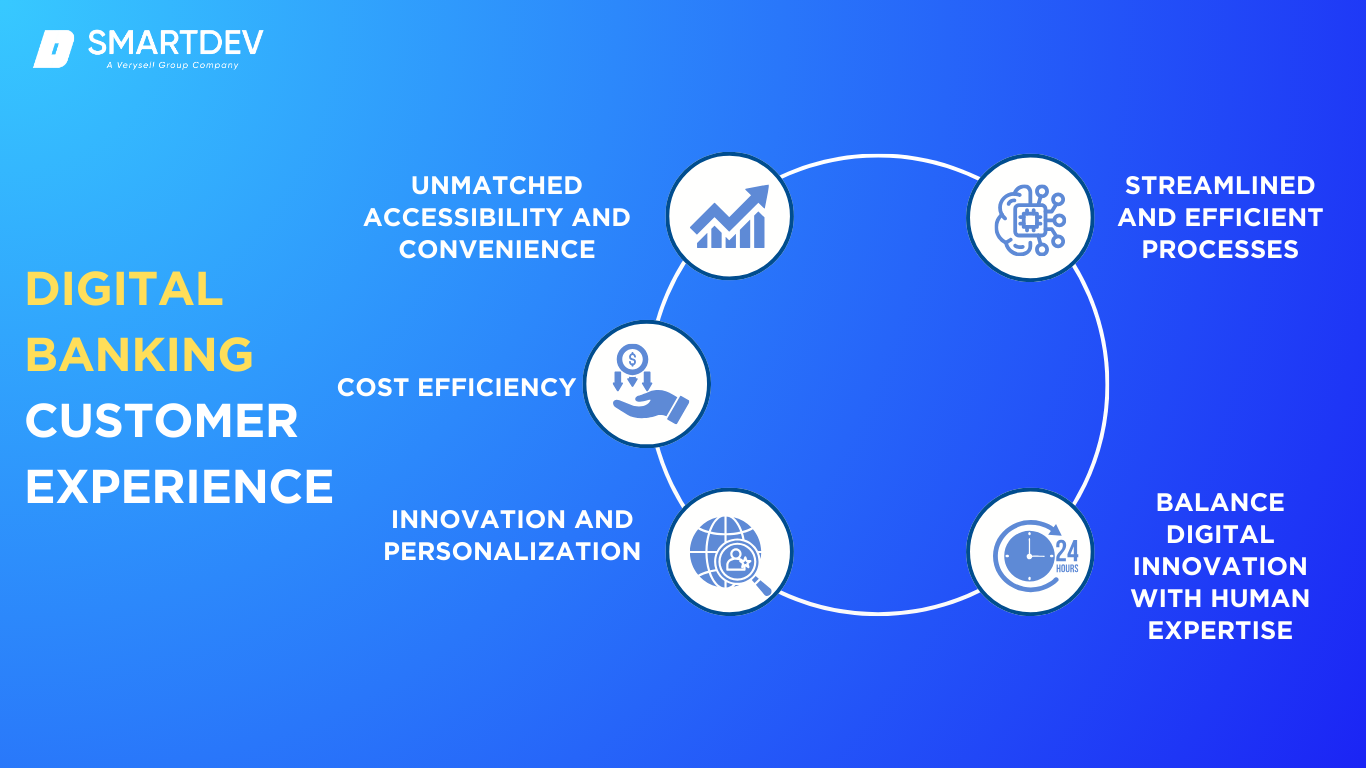

While traditional banks excel in personal connections and community-oriented services, digital-only banks bring a distinct set of advantages to customer experience, primarily centered around convenience, efficiency, and innovation.

While traditional banks excel in personal connections and community-oriented services, digital-only banks bring a distinct set of advantages to customer experience, primarily centered around convenience, efficiency, and innovation.

A key strength of digital-only banks is their unmatched accessibility and convenience. Customers can manage their accounts and perform transactions anytime, anywhere, without the need to visit a physical branch. This is particularly appealing to those with busy lifestyles or who travel frequently, as digital banks enable on-the-go banking through intuitive mobile apps and websites. Features like instant account opening, real-time transaction tracking, and secure biometric logins make managing finances effortless and stress-free.

Digital-only banks also stand out for their streamlined and efficient processes, which significantly enhance the customer experience. By leveraging cutting-edge technology, they can complete tasks such as account openings, fund transfers, and bill payments in minutes—tasks that might take much longer with traditional banks. This eliminates the need for lengthy bureaucratic procedures or waiting in queues, providing a seamless and frustration-free experience.

In addition, digital-only banks often lead the way in innovation and personalization, offering tools and features designed to enhance financial management. Customers benefit from advanced budgeting tools, spending insights, and integration with third-party financial apps, all tailored to individual preferences. These personalized features create a more engaging and customized experience, empowering customers to make informed financial decisions effortlessly.

Another notable advantage is the cost efficiency digital-only banks provide, which can translate to direct benefits for customers. Without the overhead costs of maintaining physical branches, these banks often offer higher interest rates on savings accounts, lower fees, and more competitive loan options, adding tangible value to the customer experience.

Lastly, digital-only banks embrace constant evolution, staying ahead of technological advancements to continually improve their offerings. With a focus on innovation, they can rapidly adapt to customer needs, ensuring they remain relevant in an ever-changing financial landscape.

Comparing Traditional Banks vs. Digital Banks: A CX Perspective

The customer experience (CX) offered by traditional and digital banks varies significantly, shaped by differences in services, accessibility, and personalization. Traditional banks have long been valued for their personal touch and in-person services, particularly for complex financial needs like mortgages or wealth management. Customers can build relationships with advisors and benefit from a sense of trust and stability often associated with longstanding institutions. However, traditional banks may fall short in accessibility and speed, as many services require visiting a branch or navigating bureaucratic processes. On the other hand, digital banks excel in convenience and efficiency, allowing customers to access accounts and complete transactions anytime through user-friendly apps and websites. This 24/7 availability, combined with features like real-time notifications, biometric logins, and instant account setups, appeals to tech-savvy consumers and those seeking quick, hassle-free banking solutions.

Personalization is another key differentiator. Traditional banks offer personalized service through face-to-face interactions, particularly for customers seeking tailored advice or niche financial products. However, digital banks leverage data analytics and artificial intelligence to deliver a different kind of personalization—automated insights, budgeting tools, and spending analysis tailored to individual behaviors and preferences. While traditional banks rely on human expertise, digital banks use technology to provide hyper-personalized services at scale, often with greater speed and accuracy.

Customer demographics also play a significant role in shaping preferences. Younger, tech-savvy generations often gravitate toward digital banks due to their ease of use, innovative features, and lower costs. Conversely, older customers or those with more complex financial needs may prefer traditional banks, valuing in-person consultations and the trust associated with established institutions. Businesses, too, often lean toward traditional banks for more specialized corporate banking services, although digital banks are increasingly developing competitive offerings.

Hybrid banking models are emerging as a solution to bridge the gap between these two approaches, combining the best of both worlds. By integrating digital technologies with traditional strengths, such as personalized in-branch services, hybrid banking provides a seamless customer experience. For instance, traditional banks are increasingly offering advanced mobile apps and online services, while digital banks explore physical touchpoints through partnerships or flagship branches. This strategy ensures that banks cater to a broader customer base, meeting diverse needs and preferences while maintaining competitive relevance in an evolving financial landscape.

Innovations Transforming Customer Experience in Banking

The banking industry is undergoing a transformation driven by technological innovations that are redefining customer experience (CX). At the forefront are AI-powered tools, chatbots, and mobile banking apps, which enhance convenience and efficiency. AI enables banks to provide intelligent automation, such as virtual assistants that offer 24/7 customer support, resolve queries instantly, and even recommend financial products based on customer needs. Mobile banking apps have become essential, offering real-time access to accounts, instant transactions, and biometric security features, ensuring customers can manage their finances seamlessly anytime, anywhere.

The banking industry is undergoing a transformation driven by technological innovations that are redefining customer experience (CX). At the forefront are AI-powered tools, chatbots, and mobile banking apps, which enhance convenience and efficiency. AI enables banks to provide intelligent automation, such as virtual assistants that offer 24/7 customer support, resolve queries instantly, and even recommend financial products based on customer needs. Mobile banking apps have become essential, offering real-time access to accounts, instant transactions, and biometric security features, ensuring customers can manage their finances seamlessly anytime, anywhere.

Another critical innovation is the use of data analytics to drive personalization. By analyzing customer behavior, spending patterns, and preferences, banks can deliver tailored services and proactive recommendations, such as budgeting advice or customized product offerings. This data-driven approach not only enhances customer satisfaction but also fosters loyalty by making customers feel understood and valued. For example, predictive analytics can identify potential issues or opportunities, enabling banks to offer solutions even before customers recognize a need.

Furthermore, omnichannel strategies are revolutionizing CX by ensuring seamless integration across all customer touchpoints. Whether interacting with a bank through a mobile app, website, call center, or physical branch, customers expect a consistent and cohesive experience. Advanced CRM systems and unified communication platforms enable banks to provide continuity, where customer data and interactions are accessible across channels. This ensures customers can start a transaction on one platform and complete it on another without disruptions.

Challenges in Delivering Exceptional Banking CX

Delivering exceptional customer experience (CX) in banking comes with distinct challenges for both traditional and digital banks. Traditional banks often face hurdles tied to legacy systems and slow adaptation to digital trends. Outdated infrastructure can hinder their ability to innovate and provide seamless, tech-driven services that modern customers demand. Moreover, bureaucratic processes and reliance on physical branches can make it difficult for traditional banks to match the speed and convenience offered by their digital counterparts.

Delivering exceptional customer experience (CX) in banking comes with distinct challenges for both traditional and digital banks. Traditional banks often face hurdles tied to legacy systems and slow adaptation to digital trends. Outdated infrastructure can hinder their ability to innovate and provide seamless, tech-driven services that modern customers demand. Moreover, bureaucratic processes and reliance on physical branches can make it difficult for traditional banks to match the speed and convenience offered by their digital counterparts.

On the other hand, digital banks grapple with building trust and fostering emotional connections with customers. Without physical branches or face-to-face interactions, it can be challenging for digital banks to establish the same level of credibility and personal rapport that traditional banks offer. Customers managing significant financial transactions or seeking complex advisory services may hesitate to rely solely on virtual interactions, favoring the perceived stability of established institutions.

Both traditional and digital banks also contend with regulatory and compliance hurdles that can impact CX. Strict regulations around data privacy, anti-money laundering (AML), and Know Your Customer (KYC) requirements can add layers of complexity to processes, potentially leading to delays or friction in the customer journey. Balancing regulatory compliance with delivering seamless and innovative CX remains a critical challenge for the industry.

Best Practices for Improving Customer Experience in Banking

Traditional Bank

Traditional Bank

For traditional banks, improving customer experience (CX) starts with addressing long-standing infrastructure challenges. Modernizing legacy systems is crucial, enabling banks to adopt advanced technologies like AI, real-time analytics, and cloud computing to streamline operations and enhance service delivery. These updates allow for faster transactions, better personalization, and seamless omnichannel experiences, making traditional banks more competitive in a digital-first world.

Another critical aspect is empowering frontline staff with better tools and training. Equipping employees with modern customer relationship management (CRM) systems and data-driven insights ensures they can provide personalized, efficient, and proactive service. Additionally, enhancing the branch experience through digital integration is essential. Transforming branches into hybrid advisory centers—complete with interactive kiosks, self-service options, and mobile integrations—combines the personal touch of in-person interactions with the convenience of digital tools, creating a well-rounded and engaging customer experience.

Digital Bank

For digital banks, the focus is on building trust and humanizing virtual interactions. A top priority is ensuring security and transparency, which involves implementing robust measures like biometric authentication, end-to-end encryption, and fraud prevention systems. Clearly communicating data usage policies and fee structures reinforces trust and positions digital banks as credible and secure options. Providing proactive customer support is another best practice, leveraging AI-powered chatbots to deliver instant assistance while offering escalation to human agents for complex issues. Proactively addressing potential concerns, such as fraud alerts or overdraft warnings, demonstrates attentiveness and care for the customer.

Finally, creating humanized digital experiences helps foster emotional connections in a virtual environment. This involves designing intuitive, user-friendly platforms with features like personalized financial insights, budgeting tools, and tailored recommendations. Adding empathetic messaging and easy access to live support ensures that customers feel valued and connected, even in a fully digital setting. Together, these practices enable digital banks to offer seamless, personalized, and customer-centric experiences that rival their traditional counterparts.

Success Stories: Banks Excelling in Customer Experience

Traditional banks are increasingly revolutionizing customer experience (CX) through innovative digital services. For instance, BBVA, a Spanish multinational, has integrated AI and mobile banking features to offer personalized services, such as tailored financial advice, improving customer engagement. Similarly, digital banks like Monzo and N26 are excelling by providing seamless, app-based experiences. Monzo, for example, allows users to manage finances in real-time with instant notifications and a user-friendly interface, while N26 has streamlined account management with minimal physical touchpoints, prioritizing speed and convenience. These transformations show how both traditional and digital banks are enhancing CX through technology-driven approaches.

Traditional banks are increasingly revolutionizing customer experience (CX) through innovative digital services. For instance, BBVA, a Spanish multinational, has integrated AI and mobile banking features to offer personalized services, such as tailored financial advice, improving customer engagement. Similarly, digital banks like Monzo and N26 are excelling by providing seamless, app-based experiences. Monzo, for example, allows users to manage finances in real-time with instant notifications and a user-friendly interface, while N26 has streamlined account management with minimal physical touchpoints, prioritizing speed and convenience. These transformations show how both traditional and digital banks are enhancing CX through technology-driven approaches.

The Future of Customer Experience in Banking

In the next 5-10 years, banking customer experience (CX) will be shaped by emerging technologies such as AI, blockchain, and the metaverse. Banks will increasingly offer hyper-personalized services driven by AI, allowing customers to have tailored financial advice and real-time assistance. Blockchain will enhance security, enabling transparent and faster transactions. The metaverse will introduce immersive banking experiences, allowing customers to engage in virtual branches or attend financial consultations in virtual spaces. Banks must invest in these technologies, adapt to changing customer expectations, and prioritize data security to remain competitive and relevant in the evolving landscape.

SmartDev can help transform your bank’s customer experience by providing tailored AI-driven solutions that enhance personalization, streamline processes, and improve customer interactions. Our expertise in digital transformation ensures that your bank stays ahead of emerging trends, delivering a seamless and innovative CX that fosters customer loyalty and satisfaction.

Transform Your Bank’s Customer Experience with SmartDev

SmartDev can help transform your bank’s customer experience by providing tailored AI-driven solutions that enhance personalization, streamline processes, and improve customer interactions. Our expertise in digital transformation ensures that your bank stays ahead of emerging trends, delivering a seamless and innovative CX that fosters customer loyalty and satisfaction.

SmartDev can help transform your bank’s customer experience by providing tailored AI-driven solutions that enhance personalization, streamline processes, and improve customer interactions. Our expertise in digital transformation ensures that your bank stays ahead of emerging trends, delivering a seamless and innovative CX that fosters customer loyalty and satisfaction.

Ready to elevate your bank’s customer experience? Contact us today to discover how we can transform your banking CX and give you a competitive edge!

Reference

- Monzo mania: deconstructing a fintech success story

- Know-How as a Driver of Digital Transformation in the Case of BBVA

- The Importance of CX in the Banking Industry

- PWC: Experience is everything. Get it right

- Accenture Research: Banking Consumer Study – Reignite human connections

- MKckinsey: Five ways to drive experience-led growth in banking