Financial institutions today face a critical challenge: the AI technologies that promise competitive advantage also introduce unprecedented regulatory and operational risks. While AI adoption in financial services now reaches 85% among leading institutions, traditional AI implementation frameworks fall short in highly regulated sectors like banking and insurance.

The stakes couldn’t be higher. Digital transformation spending is projected to reach $2.8 trillion by 2025 across all industries, with financial services as a leading contributor to this investment surge. Yet fewer than one in five banks rate their AI approach as fully ‘compliance-ready’ for advanced initiatives.

This guide provides a practical framework for building AI transformation roadmaps that balance innovation with regulatory compliance. You’ll discover how to navigate complex regulatory requirements, prioritize high-impact use cases, and create sustainable competitive advantages while maintaining the trust of regulators and customers alike.

Key Takeaways for Executive Teams

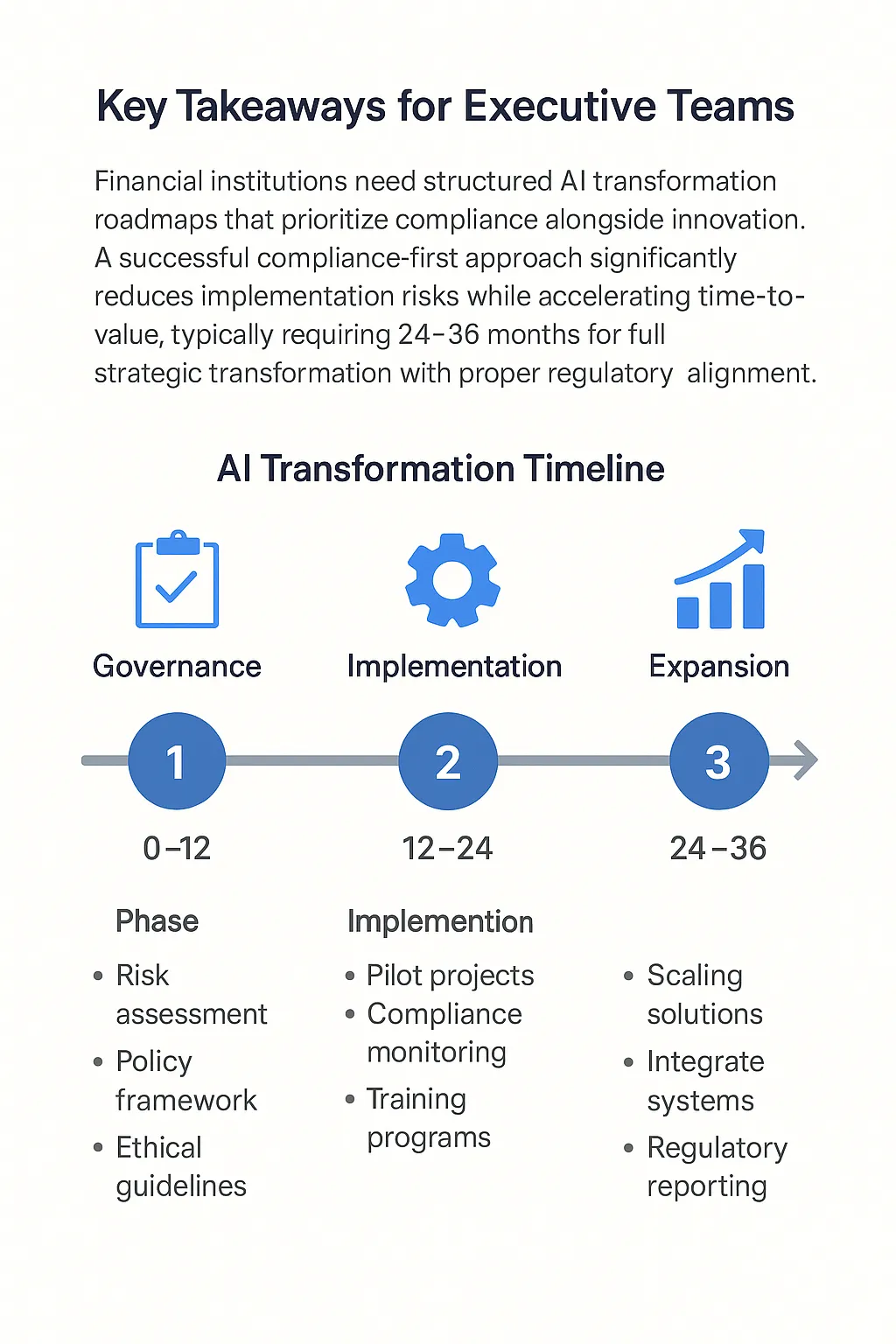

Financial institutions need structured AI transformation roadmaps that prioritize compliance alongside innovation. A successful compliance-first approach significantly reduces implementation risks while accelerating time-to-value, typically requiring 24-36 months for full strategic transformation with proper regulatory alignment.

Fig1, Transformation Timeline showing 3 phases with key milestones

Why Generic AI Frameworks Fail in Financial Services

Building an AI transformation roadmap for financial institutions isn’t just about deploying smart algorithms. It’s about creating a comprehensive strategy that addresses regulatory complexity, risk amplification, and stakeholder alignment in ways that generic AI frameworks simply can’t handle.

Generic digital transformation strategies often fall short in highly regulated sectors, with McKinsey research showing 70% of digital banking transformations exceed budgets or fail because they don’t account for the intricate web of compliance requirements that define financial services.

When major US banks implement compliance-first AI roadmaps—embedding risk and compliance management at the strategy development phase rather than as an afterthought—they report significant reductions in deployment risks and accelerated project timelines. This proactive approach addresses bias, transparency, and data privacy requirements from day one, building trust and accountability that are critical for successful AI adoption in banking while avoiding the regulatory failures that derail generic transformation efforts.

The regulatory landscape alone presents unique challenges. Financial AI projects must simultaneously satisfy SEC oversight, GDPR requirements, PCI DSS standards, and emerging AI governance frameworks. This multi-jurisdictional complexity creates implementation barriers that don’t exist in other industries.

Risk amplification is another critical factor. In financial services, AI systems can exponentially amplify operational, credit, and market risks if not properly governed from day one. A single biased algorithm in lending could trigger fair lending violations, while inadequate fraud detection could expose institutions to massive losses.

Successful financial AI transformation also requires unprecedented stakeholder alignment. You need buy-in from risk management teams focused on avoiding losses, compliance officers worried about regulatory violations, IT security professionals concerned about data protection, and business units eager for competitive advantages. Each group has conflicting priorities that must be balanced carefully.

Foundation Assessment: Where to Start Your AI Journey

Before launching any AI initiative, financial institutions must conduct a comprehensive readiness assessment that goes far beyond typical technology evaluations. Organizations that invest properly in AI talent, data governance, and legacy integration see substantially higher project success rates compared to those rushing into implementation.

Technical Infrastructure Evaluation

Your AI maturity assessment should evaluate three critical dimensions. First, assess your current data infrastructure and technical capabilities using a standardized financial services AI maturity model. This isn’t just about having modern technology – it’s about ensuring your systems can support the transparency, auditability, and monitoring requirements that regulators demand.

Data quality deserves special attention in financial AI deployments. High data accuracy (often above 95% in compliance use cases) is critical for regulatory-compliant applications, yet surveys show just over half of institutions routinely achieve this level consistently. Your assessment must identify data quality gaps and create remediation plans before proceeding with AI implementation.

Regulatory Readiness Audit

Regulatory inventory is equally important. Document all applicable regulations, existing compliance frameworks, and audit requirements that will impact your AI implementation. This includes not just current regulations but emerging requirements like the EU AI Act, which only 9% of global financial firms report feeling prepared for, underscoring a widespread readiness gap according to 2025 research.

With AI-specific regulation still evolving around transparency, bias, and explainability requirements, many institutions have yet to map these obligations to their existing AI models and risk management frameworks—creating significant compliance exposure as EU AI Act provisions roll out through August 2027.

Organizational Change Capacity

Stakeholder readiness assessment is where many institutions stumble. While business leaders view digital transformation investment as essential, successful financial AI transformation requires something more nuanced: clear understanding that meaningful ROI typically takes 18-36 months and demands sustained executive commitment.

A European insurer that conducted a comprehensive AI maturity and regulatory readiness assessment in 2023 uncovered 17 previously unaddressed regulatory gaps. More importantly, addressing these gaps upfront reduced their approval cycles by 70% once implementation began.

Mapping Regulatory Requirements for AI Implementation

Navigating the regulatory landscape for financial AI requires a systematic approach to mapping existing and emerging requirements. Deloitte’s enterprise AI survey identifies regulatory compliance worries as the top global barrier (36%), ahead of talent gaps and risk management challenges, while financial institutions cite regulatory complexity and multi-jurisdictional compliance as major barriers—navigating EU AI Act, SEC guidance, and FCA requirements simultaneously.

With penalties reaching up to 6% of global annual turnover for non-compliance, banks face the challenge of ensuring AI systems meet transparency, explainability, and risk mitigation standards across multiple regulatory jurisdictions, each with distinct and sometimes conflicting requirements for high-risk applications like credit scoring and trading algorithms.

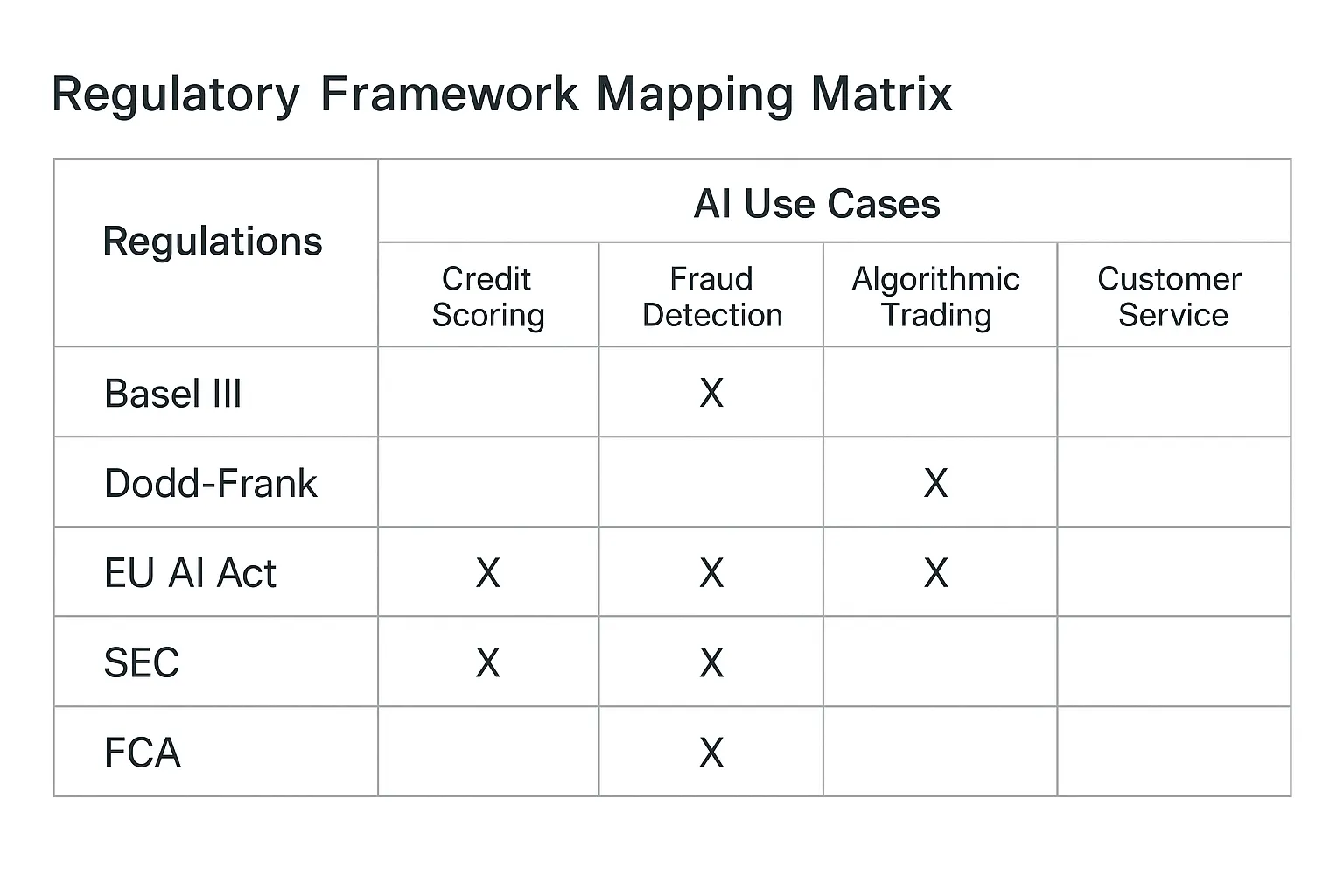

Current Financial Regulation Mapping

Understanding your regulatory environment starts with mapping current financial regulations to specific AI use cases. Basel III capital requirements affect how you deploy AI in risk assessment. Dodd-Frank stress testing rules influence AI model validation procedures. MiFID II transaction reporting impacts how you implement AI in trading systems. Each regulation creates specific compliance requirements that must be built into your AI architecture from the ground up.

Emerging AI Governance Frameworks

Emerging AI governance frameworks add another layer of complexity. The EU AI Act introduces risk-based classifications that directly impact how you can deploy AI systems. The NIST AI Risk Management Framework provides guidelines that many regulators are adopting as baseline standards. Central banks worldwide are developing AI-specific guidance that will shape future compliance requirements.

Building Compliance-by-Design

Building compliance-by-design principles is essential for sustainable AI transformation. As Deloitte emphasizes in their 2025 Agentic AI in Banking research, “embedding compliance at the core of agentic AI shouldn’t be an afterthought”. Banks should proactively embed compliance considerations directly within AI operational logic, workflows, and oversight mechanisms—establishing built-in compliance guardrails, automated risk assessments, and continuous monitoring from the design phase.

This requires close collaboration between compliance teams and AI development groups throughout both design and deployment, resulting in more transparent, explainable, and accountable AI systems that operate securely within regulatory frameworks rather than retrofitting compliance after development.

Explainable AI becomes particularly crucial in financial services. Regulators increasingly require clear, auditable explanations for AI-driven decisions, especially in lending, trading, and risk assessment. ING Real Estate Finance‘s implementation of explainable AI credit risk models demonstrates how meeting explainability requirements can actually accelerate model approval—they automated 80% of credit reviews and 50% of loan extensions while satisfying audit traceability requirements.

The Expert-based Learning model explains its outcomes through dashboards, logs every decision with contributing parameters, and was rigorously validated by ING’s Model Risk Management department—proving that transparency and efficiency are complementary rather than competing objectives when compliance is embedded from design.

Fig2. Regulatory Framework Mapping Matrix showing regulations vs AI use cases

Strategic Use Case Prioritization Framework

Successfully prioritizing AI use cases in financial services requires balancing business impact with regulatory risk and implementation complexity. Banks adopting structured, phased AI use case prioritization report significantly improved ROI from their transformation efforts.

Quick Wins: Foundation Building Applications

High-impact, low-risk applications should form the foundation of your AI transformation roadmap. Process automation delivers immediate value while building organizational AI capabilities.

McKinsey research shows agentic AI promises cost reductions of 30-50% in document processing workflows, with leading banks achieving zero-touch operations where AI agents independently manage onboarding, document verification, and loan processing—delivering substantial efficiency gains in regulatory reporting while building the foundation for more advanced AI applications across the enterprise.

Fraud detection enhancement represents another compelling quick win. AI-enhanced fraud detection solutions improve detection rates by 40-60% while substantially reducing false positives. These improvements come with relatively low regulatory risk since they enhance rather than replace existing compliance frameworks.

Fraud detection enhancement represents another compelling quick win. AI-enhanced fraud detection solutions deliver 40-60% improvements across multiple dimensions according to Feedzai’s 2025 global survey of 562 financial institutions: 39% of FIs saw 40-60% reduction in fraud losses, 43% saw 40-60% efficiency improvements, and 34% saw 40-60% reduction in false positives. These improvements come with relatively low regulatory risk since AI fraud detection enhances rather than replaces existing compliance frameworks, with 90% of financial institutions worldwide now using AI to fight fraud—fighting fire with fire as 60% of fraudsters themselves use GenAI for scams.

Medium-Term Strategic Applications

Risk analytics applications offer substantial value for institutions ready to tackle medium-complexity implementations. AI-powered portfolio monitoring, stress testing, and regulatory capital calculations can enhance existing frameworks without requiring complete system overhauls. JPMorgan Chase’s expansion of its AI-powered credit risk engine (developed with DataRobot on AWS) improved loan default prediction accuracy by 22% and reduced loan loss provisions by 18% while maintaining full regulatory compliance across 60+ countries. The implementation includes explainable AI frameworks compliant with Basel IV and OCC guidelines, automated audit trails for accountability, and dynamic stress testing that helps maintain optimal capital buffers—demonstrating how AI enhances rather than replaces existing risk frameworks while satisfying regulatory requirements.

Credit decision support systems that augment rather than replace human underwriters can improve accuracy while maintaining compliance with fair lending regulations. Trading and investment applications need careful regulatory oversight but can deliver significant performance improvements.

Customer experience applications like personalized financial recommendations and robo-advisory services require careful attention to fiduciary duty requirements but can drive substantial customer satisfaction and retention improvements.

Advanced Competitive Differentiators

Advanced AI applications should be reserved for institutions with mature AI capabilities and robust governance frameworks.

Regulatory change management systems that use AI to monitor regulatory developments and assess impact can provide significant operational advantages. Dynamic risk pricing models that respond to real-time market conditions while maintaining regulatory capital requirements represent the cutting edge of financial AI.

As KPMG emphasizes in their 2025 Intelligent Banking report, “Building trust into the transformation roadmap is critical—AI in banking introduces unique risks that can undermine trust, meaning proactive risk management is critical from the outset”, with banks needing to align AI deployments with strategic goals like fraud detection and underwriting that offer clear regulatory pathways. This systematic approach to prioritization—starting with low-risk, high-impact use cases that enhance rather than replace existing compliance frameworks—ensures you build capabilities progressively while managing risk appropriately, establishing the data governance, model validation, and explainability foundations needed before advancing to more complex, higher-risk AI applications.

Three-Phase Implementation Roadmap

Creating an effective implementation timeline for financial AI transformation requires a structured approach that balances speed with regulatory compliance. Successful banking AI implementations require a phased 18-36 month roadmap progressing from governance foundations to controlled deployment and competitive differentiation, with conservative financial models assuming 24-36 month payback periods accounting for implementation complexity, validated by IDC research showing average enterprise break-even at 1.2-3 years.

Most institutions split execution into three distinct phases—learning (months 1-12), break-even adaptation (months 13-24), and ROI acceleration (months 25-36)—to manage complexity and risk while building organizational capabilities progressively.

Phase 1: Foundation Building (Months 1-6)

Your foundation phase focuses on establishing the infrastructure, governance, and capabilities needed for sustainable AI transformation. This isn’t about deploying AI systems yet – it’s about creating the conditions for successful deployment.

Infrastructure development priorities:

- AI-ready data platforms with comprehensive lineage tracking

- Security frameworks designed for AI workloads

- Compliance monitoring systems with real-time alerting

- Model governance and validation procedures

Team development requirements:

- Recruiting AI talent with financial services experience

- Training existing staff on AI governance and ethics

- Establishing cross-functional AI committees

- Creating clear escalation procedures

Pilot project selection criteria:

- Low regulatory risk with clear compliance pathways

- High visibility to demonstrate organizational value

- Measurable business impact within 90 days

- Technology requirements that fit existing infrastructure

Document processing automation, basic fraud detection enhancements, and customer service chatbots often work well as initial pilots.

Phase 2: Capability Expansion (Months 7-18)

The expansion phase focuses on scaling successful pilots to production while implementing medium-risk AI applications in core business functions. Santander‘s phased AI implementation during 2024 generated over €200 million in cost savings through AI deployments across operational functions while maintaining full regulatory compliance, according to Ricardo Martín Manjón, Chief Data & AI Officer. The bank’s phased expansion approach—scaling from 15,000 to 30,000 employees by year-end—ensures AI tools are robustly integrated, minimizing disruptions while maximizing efficiency gains, with AI copilots handling 40% of contact center interactions and speech analytics freeing 100,000 staff hours annually, all while adhering to GDPR guidelines and rigorous ethical standards.

Production deployment requirements:

- Comprehensive governance frameworks operational

- Real-time monitoring systems validated

- Regulatory approval processes proven

- Audit trail capabilities confirmed

Advanced use case implementation:

- Credit decision support systems

- Advanced risk analytics platforms

- Trading algorithm enhancements

- Regulatory reporting automation

Ecosystem integration:

- Centralized governance with distributed innovation

- Clear policies for business unit AI initiatives

- Standardized evaluation and approval processes

- Performance monitoring across all deployments

Phase 3: Strategic Transformation (Months 19-36)

The final phase focuses on deploying advanced AI applications that create sustainable competitive advantages while maintaining regulatory leadership. KPMG research examining leading practice identifies that banks can increase capability and value across three phases of AI transformation—Enable (building foundations), Embed (integrating into workflows), and Evolve (transforming business models and ecosystems), a structured framework increasingly common among top-tier banks and recommended by leading consultancies.

The Evolve phase leverages AI with frontier technologies like quantum computing and blockchain to solve sector-wide challenges while orchestrating seamless value across enterprises and partners, emphasizing ethics, trust, and real-time security that creates sustainable differentiation.

Competitive differentiation through AI:

- Dynamic pricing algorithms

- Predictive compliance systems

- Autonomous trading capabilities

- Real-time risk adjustment models

Innovation culture development:

- Continuous identification of new AI opportunities

- Regular evaluation of emerging technologies

- Systematic approach to regulatory engagement

- Knowledge sharing across the organization

Industry leadership positioning:

- Thought leadership in AI governance

- Active participation in regulatory working groups

- Best practice sharing with industry peers

- Influence on emerging standards and regulations

Deloitte emphasizes that “effective risk management can play a pivotal role in enabling regulated firms to harness the power of AI and innovate with confidence”, with successful institutions treating AI transformation as a multi-phase journey requiring careful development of an AI Risk Management Framework. This measured approach—providing effective challenge and oversight at each stage rather than rushing deployment—reduces risk while building sustainable capabilities, ensuring organizations understand the implications for existing risk management practices within the broader regulatory context before scaling.

Technology Architecture and Vendor Selection Strategy

Selecting the right technology architecture and vendor partners is crucial for successful financial AI transformation. 91% of financial institutions worldwide now use cloud services, with 91% specifically leveraging cloud to develop AI capabilities and support AI and machine learning initiatives according to LSEG’s financial services survey. Hybrid cloud penetration has reached 68% of financial firms utilizing a mix of public and private clouds to optimize costs and compliance, with AI and machine learning representing the top use case for cloud adoption over the next three years as institutions recognize that cloud-hosted AI models deliver 62% higher fraud detection rates compared to traditional on-premise systems.

AI-Ready Infrastructure Requirements

Your cloud strategy must balance AI scalability with financial services security and compliance requirements. Hybrid cloud architectures allow you to maintain sensitive data on-premises while leveraging cloud resources for AI processing. This approach satisfies regulatory requirements while providing the computational power needed for advanced AI applications.

Data architecture becomes particularly important for AI workloads. Modern data platforms must support real-time processing, maintain comprehensive data lineage, and provide the governance controls required in financial services. Market analysts estimate the cost of an AI-ready data platform deployment at several million dollars over three years, with substantial costs attributed to compliance measures.

Security frameworks for AI require specialized capabilities including model protection, adversarial attack prevention, and privacy-preserving machine learning techniques. Traditional cybersecurity approaches may not adequately protect AI systems and the data they process.

Vendor Evaluation Framework

Vendor selection in financial services requires particular attention to regulatory compliance and integration capabilities. As FinTech practitioners emphasize, “partners with ISO 27001, PCI DSS, and SOC 2 certifications are non-negotiable—not just claims, but verified credentials” for regulated entities deploying AI at scale. One compliance failure can cost millions in fines and destroy years of reputation building, requiring vendors whose developers understand how GDPR affects database design, how PCI DSS impacts payment flows, and how regulatory requirements shape AI architecture decisions from day one, not as afterthoughts.

Financial services expertise evaluation criteria:

- Proven track record in banking and insurance

- Understanding of regulatory landscape complexity

- Existing integrations with core banking systems

- Experience with regulatory reporting requirements

Regulatory support capabilities assessment:

- Compliance documentation as standard service

- Audit support and expert testimony availability

- Ongoing regulatory guidance and updates

- Change management for regulatory evolution

Integration capabilities evaluation:

- APIs designed for financial services environments

- Pre-built connectors for common platforms

- Support for real-time and batch processing

- Scalability to handle peak transaction volumes

A top-10 APAC bank reduced third-party risk incidents substantially after implementing a comprehensive vendor evaluation framework focused on AI capabilities, compliance support, and integration readiness. Banks that factor compliance support and integration into vendor selection report fewer project delays than their peers.

A top-10 APAC bank reduced third-party risk incidents substantially after implementing a comprehensive vendor evaluation framework focused on AI capabilities, compliance support, and integration readiness. Banking leaders emphasize that the wrong vendor choice leads to costly integrations, project delays, and long-term friction, with projects stalling in UAT, SIT, or integration phases when vendors don’t account for execution risk, while vendors who underdeliver on integration support cause projects to face delays, errors, and rising internal costs when messages can’t flow smoothly across risk, treasury, and customer systems. Strong partners who are transparent on technical feasibility, provide proven integration support, and offer more than checkbox compliance with market-specific variations reduce implementation friction and accelerate time-to-value.

Build vs. Buy Decision Framework

The build vs. buy decision in financial AI requires careful consideration of competitive advantage, regulatory requirements, and total cost of ownership. Build AI capabilities that directly support competitive differentiation, but buy commodity AI services that meet regulatory requirements without providing strategic advantage.

Custom development considerations:

- Greater control over compliance and risk management

- Extensive validation and ongoing maintenance requirements

- Substantial regulatory burden for customer-facing applications

- Higher total cost including ongoing compliance costs

Vendor solution benefits:

- Proven compliance capabilities and documentation

- Shared regulatory burden with experienced providers

- Faster time to market for non-differentiating capabilities

- Access to specialized expertise and ongoing support

When evaluating AI development services, look for partners that combine technical expertise with deep financial services knowledge and proven compliance capabilities.

Discover how financial institutions can build a compliance-first AI transformation roadmap—balancing innovation, security, and regulatory alignment while accelerating digital modernization.

SmartDev’s financial AI specialists outline a structured roadmap for banks and fintechs to integrate AI responsibly—ensuring transparency, auditability, and adherence to evolving regulatory frameworks.

Learn how leading financial organizations accelerate digital transformation securely through phased AI adoption—combining governance frameworks with performance-driven deployment strategies.

Start My Compliance-First AI RoadmapGovernance, Risk Management, and Compliance Framework

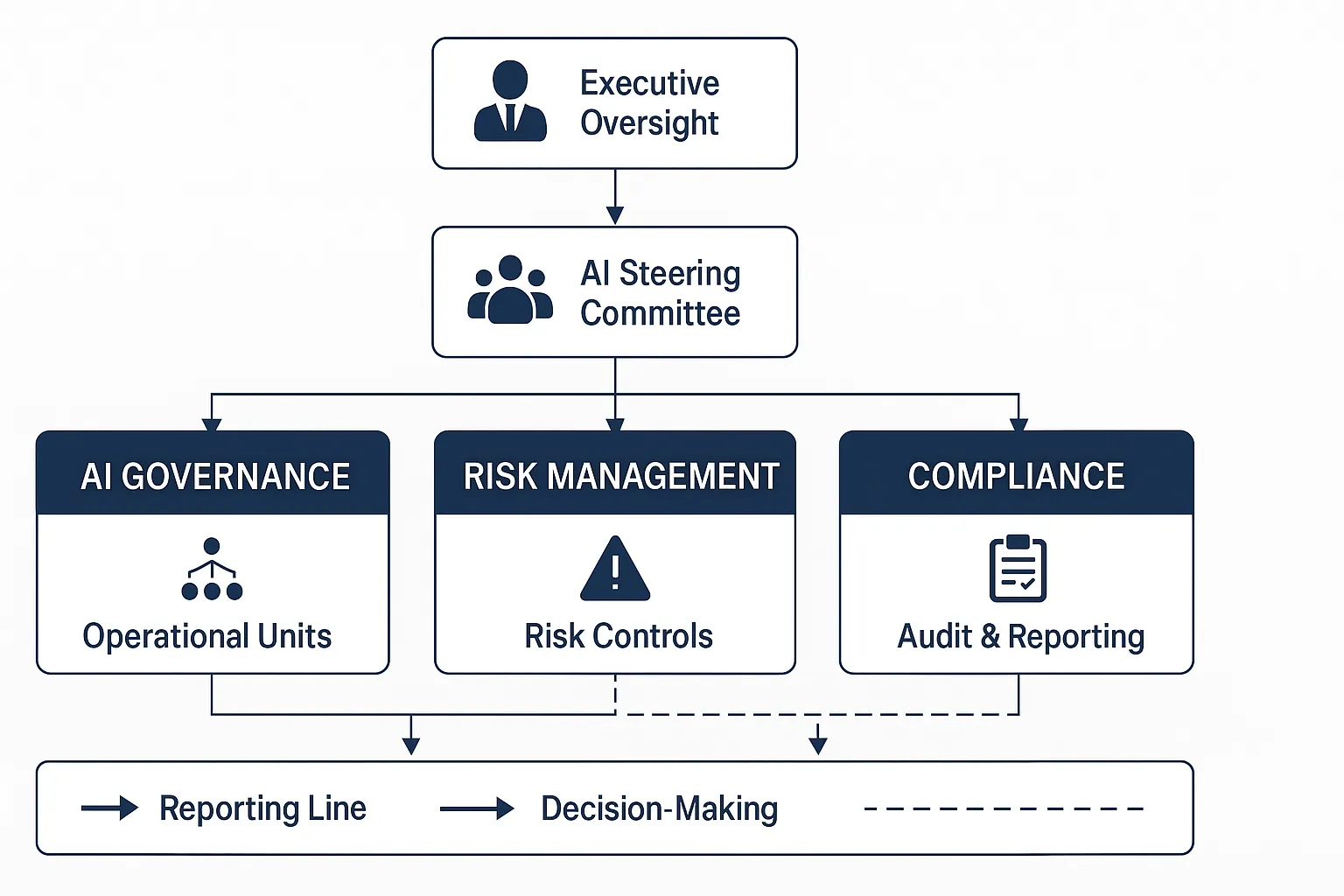

Establishing robust governance frameworks is essential for sustainable financial AI transformation. While AI adoption continues growing rapidly, many global banks still lack formalized AI governance structures despite regulatory expectations for comprehensive oversight of AI systems.

AI Governance Structure Design

Executive oversight requirements:

- AI steering committees with C-level representation

- Strategic alignment with business objectives

- Adequate resource allocation for multi-year transformation

- Clear accountability for AI outcomes and compliance

Operational governance framework:

- Cross-functional teams including risk, compliance, and IT security

- Business unit representatives for operational input

- Translation of strategic direction into operational policies

- Regular review and update of governance procedures

Model governance integration:

- AI-specific requirements within existing model risk management

- Quarterly AI validation procedures

- Annual independent compliance reviews

- Documentation standards for regulatory examination

Risk Management Framework Implementation

AI risk taxonomy for financial services must address unique risk categories including model risk, operational risk, compliance risk, and reputational risk. Each category requires specific assessment procedures, monitoring controls, and mitigation strategies.

Risk assessment procedures:

- Integration with existing enterprise risk management

- AI-specific considerations including algorithmic bias

- Data drift detection and response protocols

- Explainability requirements for regulatory compliance

Monitoring and controls:

- Real-time performance tracking systems

- Automated bias detection and alerting

- Compliance verification procedures

- Incident response and escalation protocols

Compliance Management Systems

Regulatory reporting for AI systems is becoming increasingly complex. Financial institutions must prepare for requirements that include model documentation, performance metrics, bias testing results, and audit trails for all AI-driven decisions.

Audit readiness components:

- Comprehensive documentation of AI system development

- Validation records and ongoing operation logs

- Change management procedures with version control

- Testing procedures and rollback capabilities

BBVA‘s implementation of cross-functional AI governance in 2023 reduced regulatory incident rates substantially while expediting model approval cycles, demonstrating the value of structured governance approaches.

Diego Lopez from BBVA emphasizes that “A well-structured governance system is the backbone of responsible AI in financial services.” Institutions with dedicated AI risk and compliance committees consistently achieve higher audit pass rates than those without formal governance structures.

BBVA emphasizes that a well-structured governance system is the backbone of responsible AI in financial services. ACA Group’s 2024 AI Benchmarking Survey of 200+ financial services compliance leaders found that only 32% have established an AI committee or governance group, and just 12% have adopted an AI risk management framework—exposing the 68% without formal structures to significantly higher regulatory scrutiny and operational risk.

Institutions with dedicated AI risk and compliance committees consistently achieve higher audit pass rates than those without formal governance structures, with structured AI compliance frameworks enabling 83% reductions in regulatory penalties, 99.3% accuracy in high-risk customer identification, and 91% faster regulatory filing preparation compared to institutions lacking systematic governance protocols.

Resource Planning and Implementation Timeline

Successful financial AI transformation requires careful resource planning and realistic timeline expectations. Budgets should allocate the majority of transformation spending to infrastructure, governance, and compliance rather than pure technology deployment.

Resource Requirements and Team Structure

Core team composition requirements:

- AI specialists with financial services experience

- Compliance professionals who understand AI implications

- Project managers experienced in regulatory environments

- Business analysts familiar with financial operations

Budget allocation guidelines:

- Infrastructure, governance, and compliance: 60-70% of total budget

- Technology implementation and integration: 20-25%

- Training and change management: 15-20%

- Contingency for regulatory changes: 5-10%

Training investment priorities:

- Ongoing staff training in AI governance and ethics

- Regulatory compliance for AI practitioners

- Leadership development for AI-enabled organizations

- Technical skills development for implementation teams

Milestone-Based Implementation Timeline

Quick wins (0-90 days):

- Process automation pilot deployments

- Basic analytics and reporting enhancements

- Simple chatbot implementations

- Proof of concept demonstrations

Foundation completion (12 months):

- Full AI infrastructure deployment

- Governance framework implementation

- Regulatory compliance for initial use cases

- Team training and capability development

Strategic transformation (24-36 months):

- Advanced AI application deployment

- Competitive advantage realization

- Industry leadership positioning

- Sustainable innovation culture establishment

Institutions that align transformation timelines around quick wins, foundational buildout, and strategic expansion show substantially higher project success rates than those attempting faster implementation schedules.

Michael Tang from Deloitte observes, “You can achieve visible value in 90 days, but lasting transformation for compliance and competitive advantage takes 24-36 months and sustained investment.”

As Deloitte emphasizes, you can achieve visible value in 90 days through specific, high-yield workflows proving value quickly in compliance functions like SAR narrative generation or case summarization, but [lasting transformation for compliance and competitive advantage takes 24-36 months with conservative financial models accounting for implementation complexity and sustained investment in phased roadmaps.

While 65% of financial institutions experience implementation delays averaging 14 months, institutions that define specific use cases with measurable impact can demonstrate quick wins while simultaneously building systematic capabilities through pre-integrated platforms that balance speed with control—avoiding the 70% CIO failure rate for rushed custom AI applications that lack governance readiness and workforce enablement.

Success Metrics and KPIs

Business impact measurement:

- Revenue enhancement from AI-driven improvements

- Cost reduction through automation and efficiency

- Risk mitigation and compliance cost avoidance

- Customer satisfaction and retention improvements

Compliance metrics tracking:

- Regulatory examination results and findings

- Audit success rates and compliance incidents

- Time to regulatory approval for new models

- Documentation quality and completeness scores

Operational performance indicators:

- System uptime and reliability metrics

- User adoption rates across business units

- Processing speed and accuracy improvements

- Integration success and maintenance costs

A major UK insurer that completed foundational AI compliance and governance within established timelines reported substantial ROI within two years of launch, demonstrating the value of proper planning and execution.

Change Management and Organizational Readiness

Organizational change management is often the most challenging aspect of financial AI transformation. Culture represents the biggest barrier to AI adoption for over 70% of organizations, making change management a critical success factor.

Cultural Transformation Strategies

Executive leadership requirements:

- Sustained commitment through resource allocation

- Personal involvement in transformation initiatives

- Consistent messaging about AI’s strategic importance

- Visible support for change management efforts

Banks with executive-led AI change programs achieve significantly higher adoption rates than those relying only on technical leadership.

Employee engagement approaches:

- Address AI-related job displacement concerns transparently

- Provide retraining programs and clear role redefinition

- Focus on human-AI collaboration rather than replacement

- Create opportunities for career advancement in AI-enabled roles

Success communication strategies:

- Regular updates on AI achievements and lessons learned

- Progress reporting toward strategic objectives

- Recognition of early adopters and change champions

- Transparent discussion of challenges and setbacks

Training and Development Programs

Technical training components:

- AI literacy for all staff members

- Advanced AI skills for technical teams

- Financial services applications focus

- Regulatory considerations and compliance requirements

Compliance training elements:

- Regulatory requirements for AI practitioners

- Ethics considerations and bias prevention

- Governance procedures and approval processes

- Incident reporting and escalation protocols

Leadership development focus:

- AI governance and risk management

- Strategic decision-making in AI-enabled organizations

- Change leadership and communication skills

- Performance management for hybrid human-AI teams

Rita Sallam from Gartner notes that “AI transformation succeeds when leaders set the tone for change and continually reinforce the value of human-AI collaboration.”

Rita Sallam from Gartner notes that AI transformation succeeds when leaders proactively manage change, helping users understand how AI will change their work rather than just throwing out tools without thinking through their impact on people, with Gartner’s 2025 Data & Analytics Summit emphasizing that “the human factor remains key”—the biggest blockers to AI adoption are cultural, not technical, with successful organizations focusing on comprehensive AI literacy programs and organizational readiness.

Leaders must set the tone for change and continually reinforce the value of human-AI collaboration, as companies leading the AI transformation have reimagined workflows from the ground up, enabling users to experience AI as a genuine productivity enhancer rather than just another tool to learn—reporting significantly higher adoption rates and ROI than those with reactive implementation approaches.

Stakeholder Communication and Buy-in

Board engagement strategies:

- Regular transformation progress updates

- Regulatory compliance status reporting

- Strategic impact measurement and communication

- Risk management and mitigation updates

Regulatory communication approach:

- Proactive rather than reactive engagement

- Demonstration of AI governance maturity

- Guidance seeking on emerging requirements

- Collaborative approach to standards development

Customer communication planning:

- Transparent disclosure of AI use in services

- Privacy and security assurance programs

- Trust building through responsible AI practices

- Regulatory disclosure requirement compliance

DBS Bank‘s comprehensive upskilling program resulted in substantial growth in staff AI literacy and reduced project resistance, demonstrating the power of comprehensive change management approaches.

Measuring Success and Continuous Improvement

Measuring AI transformation success requires balanced scorecards that address business impact, regulatory compliance, and operational performance. When measured properly across appropriate timeframes, digital transformation ROI often exceeds executive expectations.

ROI Measurement Framework

Financial metrics tracking:

- Direct cost savings from AI implementation

- Revenue enhancement through improved capabilities

- Risk reduction and compliance cost avoidance

- Total cost of ownership optimization

Measuring ROI in financial services requires longer timeframes than other industries due to regulatory validation requirements and the time needed to demonstrate compliance effectiveness.

Operational efficiency assessment:

- Process automation benefits and time savings

- Decision-making speed and accuracy improvements

- Resource optimization and productivity gains

- Error reduction and quality improvements

Strategic value evaluation:

- Competitive positioning and market differentiation

- Customer satisfaction and retention improvements

- Innovation capability development

- Industry leadership and influence

Continuous Monitoring and Optimization

Model performance tracking requirements:

- Continuous monitoring of AI accuracy and performance

- Bias detection and drift identification

- Performance degradation early warning systems

- Automated alerting and escalation procedures

Top financial institutions review AI models quarterly and conduct annual comprehensive compliance reviews as standard practice to maintain regulatory compliance and operational effectiveness.

Regulatory compliance monitoring:

- Tracking changing requirements and new guidance

- Ongoing compliance status assessment

- Gap analysis and remediation planning

- Audit readiness and documentation maintenance

Morgan Stanley’s 2024 AI transformation deployed observability dashboards that significantly reduced regulatory incidents while exceeding revenue targets, demonstrating the value of comprehensive monitoring approaches.

Technology evolution assessment:

- Regular evaluation of emerging AI capabilities

- Assessment of changing business requirements

- Optimization of transformation roadmaps

- Integration planning for new technologies

Future-Proofing Your AI Strategy

Regulatory adaptability planning:

KPMG observes that “Regulatory adaptability is now a required dimension of ROI measurement in any AI-enabled financial transformation.”

- Architectural flexibility for regulatory changes

- Compliance framework evolution capabilities

- Proactive engagement with regulatory development

- Standards development participation and influence

Technology flexibility maintenance:

- Preservation of existing investment value

- Integration capabilities for emerging technologies

- Scalability for changing business requirements

- Vendor relationship management and evaluation

Industry leadership development:

- Participation in regulatory working groups

- Best practice sharing and thought leadership

- Standards development influence and contribution

- Competitive positioning through innovation

Institutions with formalized continuous monitoring and improvement processes achieve substantially higher sustained ROI over multi-year periods compared to those treating AI transformation as one-time initiatives.

Next Steps for Implementation

Starting your AI transformation journey requires systematic preparation and realistic expectations about timeline and resource requirements. Banks that align executive sponsorship, budgets, and realistic timelines to make data ready for AI are more likely to realize its full potential, with successful implementations setting the vision at the top, backing it with investment, and driving alignment so each AI initiative ladders up to broader strategic objectives, while McKinsey research shows that a CEO’s oversight of AI governance is the element most correlated with higher bottom-line impact, particularly at larger institutions where executive commitment drives workflow redesign.

More than 90% of successful financial AI initiatives attribute their outcomes to executive commitment and regulatory alignment, with leading banks embedding compliance into agents themselves from inception—establishing permissions, auditability, and human checkpoints while orchestrating centralized governance that ensures accountability, trust, and measurable returns.

Implementation Readiness Checklist

Executive commitment verification:

- Adequate budget allocation for 24-36 month journey

- Timeline commitment for full transformation scope

- Resource allocation for governance and compliance

- Change management support and leadership

Half-hearted executive support virtually guarantees transformation failure in the complex financial services environment.

Regulatory preparation requirements:

- Comprehensive framework mapping completion

- Compliance expert relationships establishment

- Regulatory engagement strategy development

- Audit readiness assessment and gap closure

Technical foundation assessment:

- Infrastructure evaluation for AI workload support

- Security and governance control verification

- Integration capability assessment

- Scalability planning and capacity evaluation

First 30 Days Action Plan

Stakeholder assembly priorities:

- AI transformation steering committee formation

- Cross-functional working group establishment

- Executive sponsor identification and engagement

- Regulatory liaison relationship development

Institutions maintaining dedicated steering committees report significantly faster time-to-value and fewer project restarts compared to those without formal governance structures.

Current state assessment execution:

- Technology infrastructure comprehensive evaluation

- Regulatory compliance status baseline establishment

- Organizational change capacity assessment

- Resource availability and capability analysis

Quick win identification process:

- Low-risk AI pilot project selection

- 90-day value demonstration planning

- Organizational confidence building strategy

- Expertise development pathway creation

These early successes are crucial for maintaining momentum throughout the longer transformation journey.

Long-term Success Factors

Sustained investment commitment:

- Multi-year technology and talent investment

- Compliance capability continuous development

- Training and development program maintenance

- Innovation culture establishment and nurturing

Short-term thinking undermines the long-term value creation potential of AI in financial services.

Regulatory leadership development:

- Proactive regulator engagement and relationship building

- Industry working group participation

- Standards development contribution and influence

- Best practice sharing and thought leadership

This proactive approach provides competitive advantages and reduces compliance risk over time.

Continuous evolution planning:

- Technology advancement monitoring and assessment

- Regulatory change anticipation and preparation

- Market opportunity identification and evaluation

- Innovation pipeline development and management

David Hardoon from UnionBank emphasizes that “Transformation is not a one-off event but a continuous journey in adapting to technology evolution and regulatory change.”

UnionBank of the Philippines‘ regulatory-focused transformation council enabled rapid scaling of AI initiatives while minimizing compliance events, demonstrating the value of sustained governance investment.

Ongoing investment and proactive regulatory engagement correlate with higher long-term AI adoption and strategic impact in financial services compared to reactive approaches.

Building a successful AI transformation roadmap for financial institutions requires balancing innovation ambition with regulatory reality. The institutions that succeed combine technical excellence with compliance expertise, sustained executive commitment with realistic timelines, and strategic vision with operational discipline.

Ready to start your AI transformation journey? SmartDev’s AI consulting services combine deep financial services expertise with proven AI development capabilities, helping institutions navigate the complex path from strategy to implementation while maintaining regulatory compliance throughout the transformation process.