Introduction

Finance leaders are navigating increasingly volatile markets, tighter margins, and mounting pressure for faster, more insightful decision‑making. Artificial Intelligence (AI) is poised to elevate Financial Planning & Analysis (FP&A) from backward‑looking reporting to proactive strategy: improving forecasting accuracy, automating manual processes, and enabling real‑time scenario analysis.

What is AI and Why Does It Matter in FP&A?

Definition of AI and Its Core Technologies

Artificial Intelligence refers to computer systems that can perform tasks typically requiring human intelligence, such as analyzing data, recognizing patterns, and making decisions. These systems are powered by technologies like machine learning, which identifies trends from historical data, and natural language processing, which interprets human language.

In FP&A (Financial Planning and Analysis), AI brings precision and speed to complex processes that once relied heavily on manual effort. It helps teams forecast more accurately, automate routine reporting, and uncover insights hidden in vast amounts of structured and unstructured data. By embedding AI into everyday workflows, finance professionals gain faster access to decision-ready information, supporting more agile and informed planning.

The Growing Role of AI in Transforming FP&A

AI is reshaping FP&A by turning static forecasts into dynamic, data-driven models. Machine learning improves accuracy by identifying trends in historical and external data. This helps finance teams respond faster to market changes.

Natural language tools simplify reporting by automatically generating clear, written insights from dashboards. Teams spend less time explaining numbers and more time acting on them. This boosts communication across departments.

AI also strengthens control by flagging anomalies in real time. Irregular transactions or budget deviations are identified instantly. Finance teams can take corrective action before issues escalate.

Key Statistics and Trends Highlighting AI Adoption in FP&A

Gartner reports that 58% of finance teams are now using AI tools, up from 37% in 2023, reflecting rapid adoption across the function. However, only 23% of FP&A professionals currently apply AI in daily work, though 40% are piloting it for near-term scaling.

A Bain survey shows 94% of CFOs expect generative AI to benefit at least one finance area by 2025, with 79% planning to increase AI budgets. Despite this, 71% have yet to use generative AI in finance, signaling a lag between strategy and execution.

In terms of focus, 76% of finance teams have automated reporting, but only 40% have automated forecasting, indicating a major opportunity for AI to close that gap. Forecast automation remains a top priority for forward-looking FP&A teams aiming to improve accuracy and responsiveness.

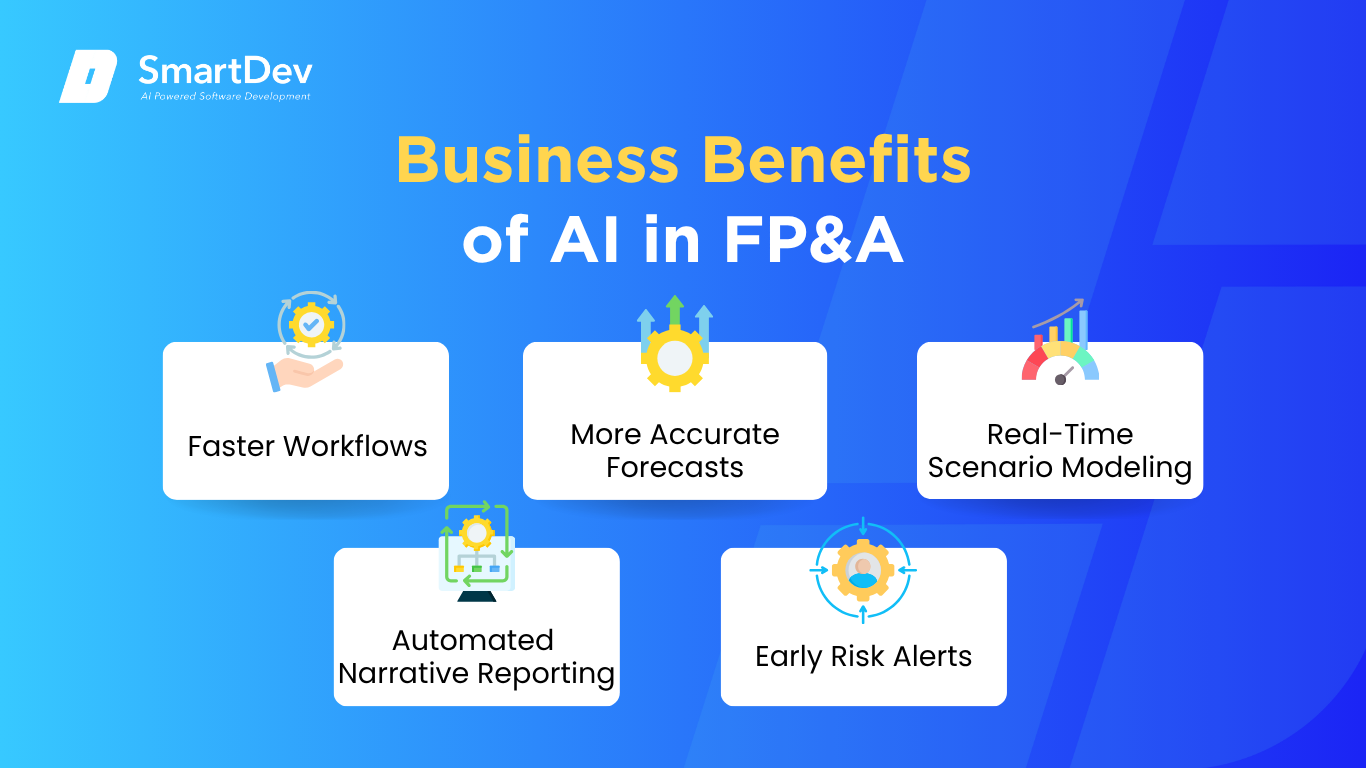

Business Benefits of AI in FP&A

AI is driving tangible improvements across FP&A by streamlining operations, boosting accuracy, and enabling faster decision-making. These benefits are helping finance teams move from reactive reporting to strategic leadership.

1. Faster Workflows

Manual consolidation of spreadsheets and financial reports consumes valuable analyst time. AI streamlines this process by automatically gathering, mapping, and validating data from multiple systems. As a result, teams spend less time preparing data and more time analyzing it.

Automated workflows also reduce human error and shorten planning cycles. Tasks that once took days – like monthly close or variance analysis – can now be completed in hours. This shift frees finance teams to focus on strategic initiatives that add real business value.

2. More Accurate Forecasts

Traditional forecasting methods rely heavily on historical data and static assumptions. AI enhances this by incorporating real-time data and external variables such as market trends and customer behavior. This leads to more accurate and adaptable projections.

With improved forecast precision, organizations can anticipate financial risks and opportunities earlier. AI enables rolling forecasts that adjust dynamically as new data becomes available. This agility supports better capital allocation and strategic decision-making.

3. Real-Time Scenario Modeling

What-if analysis is often slow and manual, limiting agility in a fast-changing market. AI enables real-time scenario modeling that instantly recalculates financial impacts based on changing assumptions. This empowers decision-makers with immediate insights to respond to uncertainty.

Executives can simulate different market conditions, pricing models, or cost structures with just a few inputs. These capabilities enhance planning flexibility across budgeting, cash flow management, and resource allocation. As a result, finance becomes a more proactive strategic advisor.

4. Automated Narrative Reporting

Finance teams often spend hours crafting executive summaries and management commentary. AI tools with natural language generation can automatically translate charts and data into narrative insights. This not only speeds up reporting but ensures consistency across reports.

Automated narratives also make financial data more accessible to non-financial stakeholders. Business leaders receive clear, context-rich explanations without needing to interpret spreadsheets. This improves collaboration and speeds up decision-making across departments.

5. Early Risk Alerts

AI can monitor transactions and financial patterns in real-time to detect anomalies. Irregular expenses, duplicate payments, or fraud indicators are flagged immediately for investigation. This early detection reduces financial leakage and strengthens internal controls.

AI also learns from past patterns to improve detection over time. It adapts to your organization’s unique risk profile, enhancing accuracy and relevance. This proactive risk management allows FP&A teams to shift from reactive to preventive strategies.

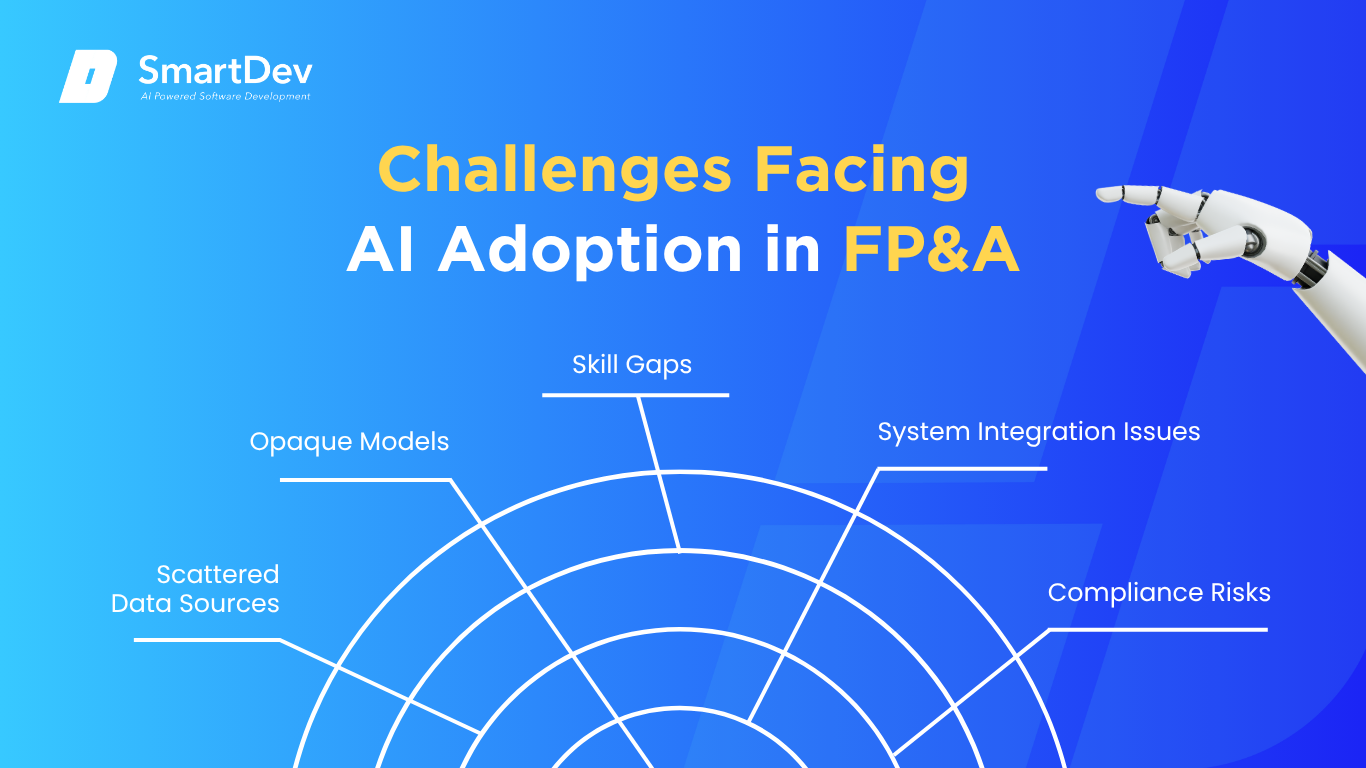

Challenges Facing AI Adoption in FP&A

Despite its potential, implementing AI in FP&A comes with real hurdles: technical, organizational, and regulatory. Addressing these challenges early is critical to unlocking long-term value.

1. Scattered Data Sources

FP&A data often lives across disconnected systems like ERP, CRM, and spreadsheets. This fragmentation makes it difficult to feed AI tools with clean, consistent inputs. Poor data quality directly limits the accuracy of forecasts and models.

Centralizing and cleaning data requires cross-functional alignment and significant IT support. It’s not just a technical task, it demands governance and ownership across teams. Without this foundation, AI initiatives stall before they start.

Discover how AI unlocks financial insights from unstructured data in our article on unstructured AI applications.

2. Opaque Models

Many AI models operate like black boxes, offering little visibility into how results are calculated. This makes finance leaders wary of trusting critical forecasts or insights. In regulated industries, lack of explainability can be a dealbreaker.

Teams need tools that offer clear logic and traceable outputs. Explainable AI features and back-testing methods help validate models. Building trust is essential for adoption at scale.

3. Skill Gaps

Most finance professionals aren’t trained in data science or AI. This limits their ability to evaluate tools, build models, or interpret outputs. Without the right skills, even powerful tools can go unused.

Upskilling programs are needed to bridge finance and analytics. Training in data fluency and AI literacy should be embedded into FP&A roles. Partnerships with IT or external vendors can also fill gaps temporarily.

4. System Integration Issues

AI tools must connect with core systems like ERP, BI platforms, and data warehouses. Legacy architecture often lacks the flexibility to support smooth integration. This creates bottlenecks and slows deployment.

API-based tools and modular platforms help ease the transition. Still, organizations need a clear integration roadmap. Without it, AI solutions remain siloed and underutilized.

Discover how API-driven infrastructure is streamlining integration across financial ecosystems in our article on Banking-as-a-Service (BaaS).

5. Compliance Risks

Finance operates under strict regulatory standards like SOX, IFRS, and GAAP. AI-generated outputs must be auditable and compliant with these frameworks. If not, organizations face legal and reputational risk.

Maintaining compliance requires model documentation, audit trails, and review processes. Collaboration with legal and internal audit is key. Governance must evolve alongside innovation to ensure safe AI use.

Learn how responsible AI design ensures trust, transparency, and security in our data privacy guide.

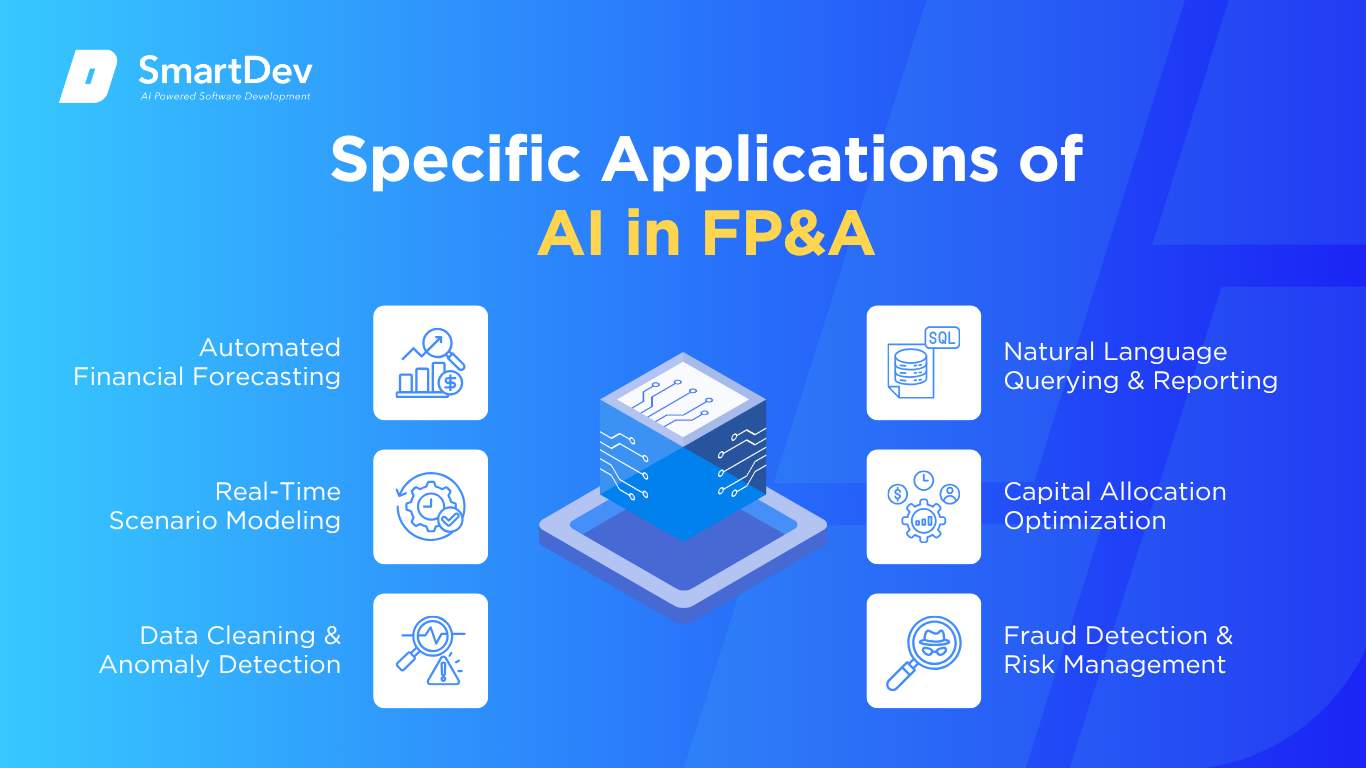

Specific Applications of AI in FP&A

1. Automated Financial Forecasting

AI-driven forecasting addresses the complexity and inefficiency of traditional spreadsheet-based financial models. It uses machine learning and time-series algorithms (like ARIMA or neural nets) to ingest historical financials, driver data, and external inputs. This enables continuous scenario updates and real-time “what‑if” planning, translating into faster, more resilient decision‑making.

These tools enhance strategic outcomes by reducing forecast latency and enhancing accuracy, allowing FP&A teams to anticipate risks and opportunities quickly. AI solutions can detect subtle patterns missed by human analysts, leading to more nuanced and reliable projections. However, the black-box nature of some models can hinder audit transparency, and reliable forecasts require high data quality and strong governance.

Strategically, automated forecasting saves significant time and reduces reliance on error-prone manual inputs. It offers predictive insights that align finance with strategic priorities, like demand planning or investment allocation. Yet teams must continuously validate models and maintain interpretability to retain trust in AI outcomes.

Real-world example:

Microsoft implemented Copilot for Finance within its M365 suite to automate forecasting and analysis in Excel. The tool helped streamline forecasting workflows, reduce close cycles, and enhance scenario planning across large enterprises. Companies using Copilot reported higher productivity and more agile financial responses.

For a closer look at how AI boosts forecasting accuracy and reduces manual workload, explore our article on AI Use Cases in Finance and Accounting.

2. Real-Time Scenario Modeling

Traditional scenario modeling is slow; AI revolutionizes it by enabling dynamic, instantaneous analysis. Agentic AI agents or ChatGPT-style tools can generate and compare multiple budget/forecast iterations on-demand, based on prompt inputs. This capability transforms static models into responsive, adaptive planning systems.

Real-time agility empowers CFOs to swiftly evaluate market changes, optimize inventory or spend, and manage cash proactively. Machine learning dynamically updates scenarios using real-time data streams, such as sales pipelines or commodity prices. Finance leaders can proactively reallocate resources based on high-probability shifts.

Strategic benefits include improved responsiveness, better capital deployment, and faster course corrections during volatility. AI-driven “what-if” analysis aligns financial planning with external factors and emerging opportunities. However, teams must build frameworks for prompt governance and human review of AI scenarios.

Real-world example:

Acterys integrated GPT-based scenario modeling into its platform to enable real-time forecast simulations. CFOs used it to dynamically adjust plans in response to market fluctuations, reducing turnaround time for planning updates. The platform helped improve planning accuracy and flexibility.

3. Data Cleaning & Anomaly Detection

FP&A requires reliable data; AI automates cleansing by flagging inconsistent entries and structural anomalies. ML models actively detect and correct outliers based on historical patterns. These systems scan thousands of line items, improving speed and reliability.

Anomaly detection tools reduce the time spent verifying financial inputs, freeing analysts to focus on strategic work. By applying unsupervised learning or autoencoder models, AI systems identify unusual trends or entries in real-time. These insights also help improve audit and compliance reviews.

This ensures data integrity across forecasting, budgeting, and reporting cycles. Strategic implications include lower reporting lag, improved accuracy, and early detection of fraudulent or erroneous data. However, organizations must set guardrails to avoid over-correcting legitimate anomalies.

Real-world example:

Microsoft Copilot for Finance flags anomalies in financial data directly within Excel workflows. Users reported a 50% reduction in manual reconciliation efforts, boosting data reliability. The result was faster reporting and fewer downstream corrections.

4. Natural Language Querying & Reporting

Natural‑language-processing (NLP) AI allows finance teams to ask questions in plain English and generate narratives. NLP reads intelligent insights from spreadsheets and databases, producing explanatory summaries automatically. This capability reduces complexity and increases transparency in financial storytelling.

NLP-enabled chatbots and dashboards allow cross-functional teams to extract insights without needing technical expertise. These systems use transformers and large language models (LLMs) to interpret user intent and provide context-aware financial explanations. This speeds decision-making while improving cross-team collaboration.

Strategically, natural language AI enhances usability of FP&A platforms and democratizes access to insights. It minimizes dependence on analysts for basic queries, allowing finance teams to scale support. Yet, model accuracy and narrative integrity must be continuously validated.

Real-world example:

TAL, a major Australian life insurer, implemented Microsoft Copilot to support financial analysis with plain-language summaries and queries. Staff saved up to six hours per week, increasing time available for strategic planning. The adoption of NLP features improved accessibility and accelerated team workflows.

5. Capital Allocation Optimization

AI systems analyze spend patterns and ROI to identify inefficiencies and suggest reallocations. By processing multi-year expense data with predictive insights, AI highlights cost-saving opportunities. These tools guide FP&A teams toward more profitable investment decisions.

Machine learning identifies spending anomalies, underperforming business units, or ineffective campaigns. Prescriptive analytics suggests budget reallocations based on KPIs and real-time performance metrics. This improves both operational efficiency and long-term financial health.

Strategically, this allows finance to move beyond backward-looking cost control to proactive capital deployment. AI transforms FP&A from policing budgets to enabling strategic growth. Organizations must balance these recommendations with leadership priorities and organizational goals.

Real-world example:

Citi and Ant International used Falcon, an AI model, to help a major Asian airline cut FX hedging costs by 30%. This freed up capital for investment while maintaining currency risk management. The case illustrates AI’s impact on financial optimization in treasury-linked FP&A.

6. Fraud Detection & Risk Management

AI-powered continuous auditing uses transaction-level data to spot anomalies, flagging high-risk activity in near real-time. Deep learning models review supplier invoices, contracts, and general ledger entries for irregularities. This increases transparency and reduces the time needed for manual audits.

Natural language understanding and pattern recognition flag duplicate payments, vendor fraud, or expense manipulation. Risk scoring tools highlight suspicious behavior before it escalates. This proactive capability protects enterprise value and strengthens internal control systems.

Strategically, these systems transform fraud prevention from reactive to real-time. This also improves compliance and speeds external audit timelines. However, organizations must guard against false positives and maintain ethical oversight.

Real-world example:

Amazon is piloting generative AI tools in finance to detect fraud and improve compliance checks. The tools enhanced audit accuracy and reduced document review time in early testing. These gains allow finance teams to focus on strategic oversight and planning.

Learn how AI strengthens fraud detection and internal controls in our article on AI-driven fraud detection reshaping financial security.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in FP&A

Real-world applications of AI in FP&A showcase how advanced technologies drive measurable improvements in forecasting, planning, and financial operations. The following case studies highlight leading companies leveraging AI to transform their finance functions.

Real-World Case Studies

1. Microsoft: Copilot-Driven FP&A Automation

Microsoft launched Copilot for Finance to embed AI into Excel and Outlook, automating tasks like variance analysis and reconciliation. This allowed finance teams to speed up forecasting and reduce manual workload across key planning functions.

The tool enhanced accuracy and reduced close cycle time, while improving user productivity within familiar interfaces. Though Microsoft hasn’t released detailed metrics, enterprise users reported faster access to insights and improved agility in scenario planning.

2. Citi & Ant International: AI-Enhanced FX Hedging

Citi and Ant International developed Falcon, an AI-driven tool for FX forecasting and risk management. It was piloted with a major Asian airline to help reduce costs on FX hedging for international sales.

While no exact figures were disclosed, Ant confirmed the tool helped “significantly reduce” FX costs. This highlights AI’s growing role in treasury operations and how it supports strategic FP&A outcomes like cost control and cash flow optimization.

3. PwC: AI-Powered Financial Document Review

PwC has integrated AI and machine learning tools to automate document-intensive finance tasks such as invoice matching and contract analysis. Their AI system helps auditors and finance professionals detect anomalies, extract insights, and flag inconsistencies across thousands of documents quickly.

This approach has significantly reduced time spent on manual reviews and improved the accuracy of financial reporting processes. PwC’s adoption of AI illustrates how large-scale financial operations can be enhanced through automation and intelligent data handling.

Innovative AI Solutions

Emerging AI technologies are reshaping FP&A with tools like Copilot, Falcon, and generative assistants integrated into financial systems. Microsoft’s Copilot automates forecasting and reconciliation in Excel and Outlook, improving workflow speed and accuracy. Citi’s Falcon model, developed with Ant Group, applies transformer-based AI to optimize FX risk management for large enterprises.

Amazon is piloting generative AI across its finance division to assist with contract review, fraud detection, and financial forecasting. These tools reduce manual effort and boost compliance efficiency in complex financial environments. While outcomes are still emerging, the shift signals how AI is transforming FP&A into a data-driven, strategic function.

For a practical example of AI’s impact beyond core finance functions, explore our case study on AI-powered solutions for employee financial wellness.

AI-Driven Innovations Transforming FP&A

Emerging Technologies in AI for FP&A

Generative AI and large language models (LLMs) are revolutionising FP&A tasks. Instead of drafting reports line-by-line, finance teams now use tools like Copilot, ChatGPT, and specialized FP&A chatbots to generate narrative analysis automatically. Adobe’s CFO pilot highlighted generative AI’s use in revenue recognition and forecasting: they reported quicker contract reviews, fewer errors, and more sales time engaged with clients.

Computer vision also plays a role – using AI to extract financial data from scanned documents, invoices, or contracts, then feeding this into predictive models. ML algorithms using ARIMA, time‑series modeling, and neural networks detect anomalies, automate journal entry checks, and model cash flows with greater granularity and accuracy than static, rule-based systems.

AI’s Role in Sustainability Efforts

AI in FP&A isn’t just about finance, it’s also a sustainability enabler. Predictive analytics in budgeting helps companies minimize waste and optimize resource planning. For instance, AI can forecast usage of raw materials or energy based on seasonal demand and economic indicators, reducing discrepancies between planned vs. actual and preventing overproduction.

Smart systems powered by AI can dynamically regulate energy consumption across supply chains and offices by analyzing usage patterns in real time. As Vardags’ finance director explained, AI amplifies both human and machine intelligence – unearthing hidden value in existing driver-based models to reduce waste and resource inefficiencies.

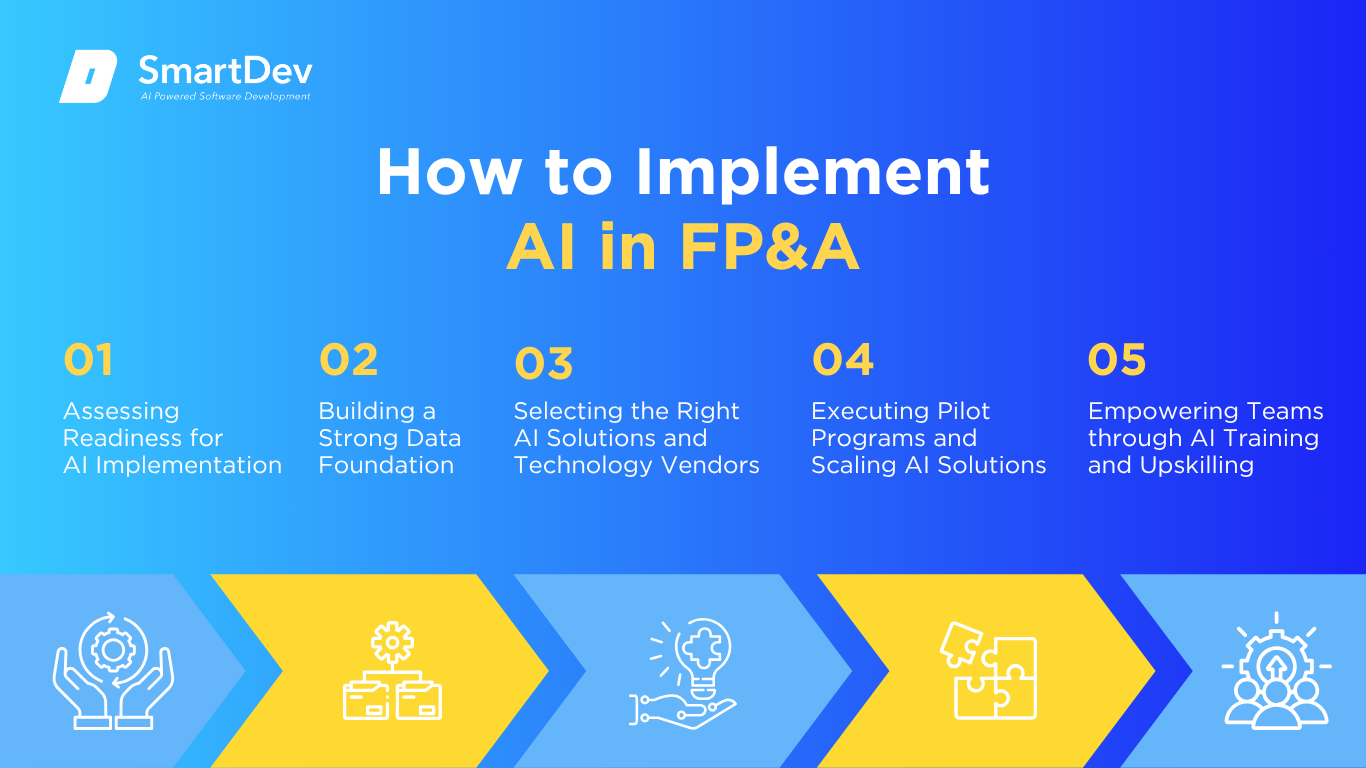

How to Implement AI in FP&A

Implementing AI in FP&A isn’t just about adopting new technology, it’s about transforming how your finance team operates, makes decisions, and adds value. From assessing readiness to scaling successful pilots, here’s a step-by-step guide to help you integrate AI with confidence and impact.

Step 1: Assessing Readiness for AI Adoption

Before adopting AI, you need a clear understanding of which business processes benefit most. Look beyond routine tasks like data consolidation toward areas where insights matter – revenues, expenses, cash forecasting, scenario planning. Align these with strategic goals like accelerating decision cycles or reducing manual drift in forecasts.

Begin by assembling a cross-functional pilot team: an FP&A lead, data scientist, IT specialist, and a business stakeholder. This aligns with FP&A experts’ recommendation to build small, agile teams to test AI before scaling.

Discover why a strong data foundation is essential for FP&A success in our article on data-driven growth strategies for businesses.

Step 2: Building a Strong Data Foundation

AI thrives on structured, clean data. Your first task is standardizing data collection, integrating disparate systems – ERP, CRM, T&E, procurement – and ensuring you have data governance in place. As IBM reminds us, AI is only as good as its input: “garbage in, garbage out” still applies.

Once your data pipeline is robust, design iterative data-cleaning protocols and feedback loops. Teams that train models on high‑quality financial data consistently outperform those relying on siloed or messy systems.

Step 3: Choosing the Right Tools and Vendors

With clarity on your needs and clean data in place, evaluate AI platforms geared for FP&A. Key players like Cube, Datarails, Aleph, and Workday now offer built-in AI modules. Cube, for example, pre-fills forecasts and reports; Datarails integrates live consolidation within Excel; Aleph adds AI‑enabled spreadsheet analysis to cloud workflows.

Your selection should match both technical requirements and cultural compatibility. Look for tools that embed easily in your existing workflows, support collaboration, and offer built‑in explainability and audit trails.

Step 4: Pilot Testing and Scaling Up

Start small: apply AI to one or two high-impact domains – say, rolling cash forecasts or driver-based revenue models. Measure performance in key metrics like forecast accuracy, model speed, error reduction, and stakeholder satisfaction.

A recent generative ERP study (FinRobot) showed generative agents reduced report times by up to 40 % and error rates by 94 %. Use pilots like this to build the case for broader rollout, then progressively expand scope – adding more FP&A functions, data sources, and business units.

Step 5: Training Teams for Successful Implementation

AI won’t stick if your team doesn’t know how to use it. Provide comprehensive training in two areas: technical (data literacy, prompt‑engineering, model evaluation) and strategic (interpreting AI output, turning insights into action). KPMG’s “24 hours of AI” program shows how scalable and effective this can be.

Pair training with change management: maintain human oversight by default, clarify that AI enhances – not replaces – your team, and encourage transparency in the AI workflows.

To get started, check out our detailed guide on how tech leads can assess and drive AI adoption.

Measuring the ROI of AI in FP&A

Key Metrics to Track Success

Evaluating AI’s ROI in FP&A begins with tracking improvements in forecast accuracy and cycle efficiency. AI-powered models often outperform traditional methods by analyzing real-time data and external indicators, leading to up to 30% more accurate forecasts. This translates into better budget alignment and reduced variance.

Another key metric is the time saved across planning and reporting cycles. AI cuts budgeting and forecasting time from weeks to days, allowing finance teams to focus on strategic insights. Alongside speed, automation improves data integrity, reduces manual errors, and enhances the reliability of financial reports, adding long-term value beyond short-term gains.

For more on how AI-driven models accelerate planning and improve decision-making, check out our detailed article on AI-powered financial modeling.

Case Studies Demonstrating ROI

Coca-Cola HBC used machine learning to improve demand forecasting, integrating real-time sales and event data to replace manual models. This boosted forecast accuracy, cut inventory costs, and freed up capital, allowing finance teams to focus more on strategy than data prep.

Chevron adopted MindBridge AI to detect anomalies across ledgers, payroll, and vendor systems. The shift from manual sampling to continuous monitoring improved risk detection and audit efficiency, strengthening compliance while saving time and resources.

Common Pitfalls and How to Avoid Them

One of the biggest missteps in AI implementation is neglecting data quality. Inconsistent or incomplete data can undermine the effectiveness of even the best tools. Equally problematic is viewing AI solely as a cost-cutter instead of a driver of strategic insight.

Siloed teams and unclear ownership often stall progress. Avoid these issues by aligning AI initiatives with business goals, involving finance, IT, and analytics teams from the start, and rolling out projects in phases. With the right planning and cross-functional collaboration, AI becomes a lasting asset in FP&A strategy.

Future Trends of AI in FP&A

Predictions for the Next Decade

AI in FP&A is moving toward fully autonomous planning, with multi-agent systems handling tasks like variance analysis and scenario modeling in real time. Generative AI is also streamlining reporting by creating forecasts and board-ready narratives with minimal input, shifting finance from periodic cycles to continuous strategy.

Sustainability is becoming a key focus, with AI helping teams model ESG impacts alongside financial metrics. As ESG reporting becomes integral to planning, early adopters will gain an edge in compliance, transparency, and long-term value creation.

How Businesses Can Stay Ahead of the Curve

To stay competitive, finance teams must treat AI as a core capability, not just a tool. This means embedding AI into everyday workflows – from forecasting to variance analysis – and continuously refining models with updated data and feedback. Leading organizations also prioritize platforms that integrate easily across systems, ensuring scalability and agility.

Equally important is investing in talent and collaboration. Upskilling finance professionals to work alongside AI tools, while fostering strong partnerships with IT and data teams, ensures AI is both usable and trustworthy. Staying ahead isn’t just about adopting new tech, it’s about building a culture that’s ready to evolve with it.

Conclusion

Key Takeaways

AI is fundamentally reshaping the FP&A landscape, turning manual, time-consuming processes into agile, data-driven workflows. From improving forecast accuracy and shortening planning cycles to enhancing risk detection and ESG modeling, AI enables finance teams to deliver deeper insights and faster decisions.

The organizations seeing the most value are those that start with clear goals, build strong data foundations, and take a phased approach to implementation. By combining the right tools with cross-functional collaboration and ongoing training, FP&A teams can unlock both immediate efficiencies and long-term strategic gains.

Moving Forward: A Strategic Approach to AI-Driven Transformation

As AI reshapes the finance function, now is the time to evolve your FP&A strategy to be faster, smarter, and more forward-looking. From boosting forecast accuracy to automating reporting and identifying financial risks in real time, AI is becoming a critical enabler of agile decision-making and long-term growth.

At SmartDev, we help finance teams harness the power of AI through tailored solutions that integrate seamlessly with your existing systems. Whether you’re piloting predictive models, scaling automated workflows, or embedding generative AI into your planning cycles, we guide you every step of the way.

Explore our AI-powered software development services to see how we deliver measurable impact: reducing manual effort, enhancing insight, and driving strategic value.

Contact us today to learn how AI can elevate your finance function and position your business for what’s next.

—

References:

- The future of FP&A with AI | KPMG

- How AI is Transforming FP&A: A Practical Guide to Maturity, Transformation, and Its Evolving Role | EY

- AI in FP&A: The Future of Financial Decision-Making | Acterys

- Only 23% of FP&A practitioners are using AI | CFO.com

- AI and the Office of the CFO in 2025: AI Spend to Increase Across Strategic and Administrative Activities | Bain Capital Ventures

- Citi, Ant International pilot AI-powered FX tool for clients to help cut hedging costs | Reuters

- The Impact of AI in Financial Planning and Analysis (FP&A) | Citrin Cooperman

- 7 Finance Use Cases for Decision Intelligence Tools That Drive ROI | MindBridge

- AI and ML in FP&A – Two Case Studies | FP&A Trends

- How you should calculate the ROI in AI | The Australian