Introduction

Real estate is evolving rapidly, driven by shifting buyer expectations, tighter margins, and the growing complexity of property data. AI is stepping in to address these challenges head-on: automating valuations, personalizing marketing, streamlining operations, and enhancing decision-making with predictive insights.

This guide explores how AI is transforming real estate into a smarter, more agile industry and how your business can capitalize on it.

What is AI and Why Does It Matter in Real Estate?

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to computer systems designed to perform tasks that typically require human intelligence, including learning, reasoning, problem-solving, and decision-making. According to IBM, AI encompasses various technologies that enable machines to sense, comprehend, act, and learn with human-like intelligence.

In real estate, AI encompasses technologies like machine learning, natural language processing (NLP), and computer vision to automate and enhance tasks such as property valuation, market analysis, customer interactions, and facility management.

The Growing Role of AI in Transforming Real Estate

AI is reshaping real estate operations by enabling more accurate property valuations and market forecasts. By analyzing vast datasets, AI tools can identify trends and predict property values with greater precision than traditional methods.

In property management, AI streamlines operations through predictive maintenance and energy optimization. Smart building systems use AI to monitor equipment performance, anticipate failures, and reduce energy consumption, leading to cost savings and improved tenant satisfaction.

AI also enhances customer engagement by providing personalized property recommendations and virtual tours. Chatbots and AI-driven platforms can interact with clients 24/7, answering queries and guiding them through the property selection process.

Key Statistics and Trends Highlighting AI Adoption in Real Estate

The integration of AI in real estate is becoming foundational. The global AI in real estate market is forecasted to jump from $222.65 billion in 2024 to $303.06 billion in 2025, a staggering 36.1% compound annual growth rate, according to Forbes. This surge is being fueled by advances in predictive analytics, smart property management, and customer-facing automation tools that improve both operational efficiency and client engagement.

AI adoption across the real estate sector is widespread and impactful. According to a 2024 industry survey, 82% of real estate agents now use AI tools daily, primarily to automate listing descriptions, while 75% of top brokerages have integrated AI into their tech stack. These technologies are enhancing how agents and firms attract leads, manage portfolios, and deliver personalized property experiences.

The value of AI is also measurable in terms of operational performance. Firms using AI report a 7.3% rise in productivity, 6.9% improvement in customer engagement, and a 5.6% boost in operational efficiency. These gains show that AI is a strategic investment. Real estate companies that adopt AI now are better positioned to thrive in a highly competitive, data-driven future.

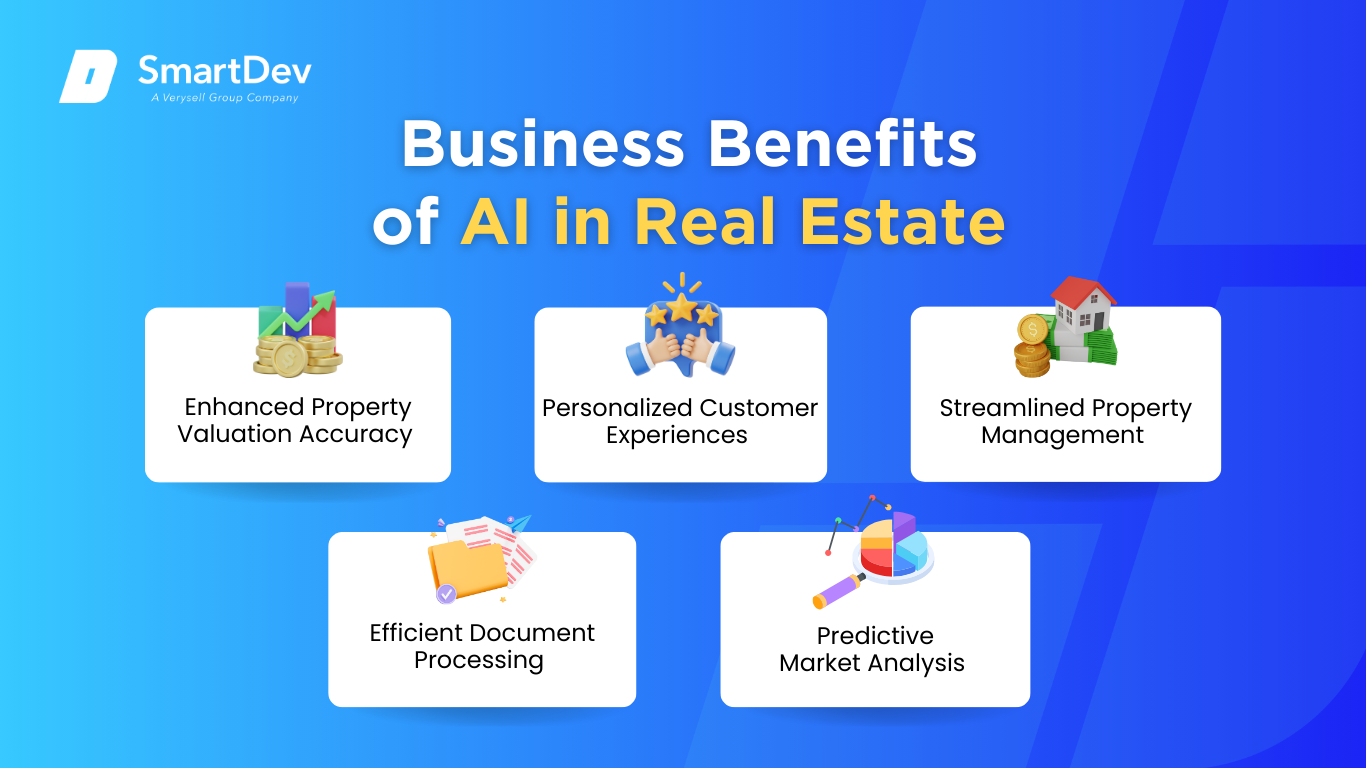

Business Benefits of AI in Real Estate

AI is delivering tangible value in real estate by addressing key challenges such as inefficiencies, high costs, and decision-making gaps.

1. Enhanced Property Valuation Accuracy

Conventional valuation methods often rely heavily on human appraisals and comparable sales, which can be inconsistent and influenced by bias or incomplete data. AI, on the other hand, ingests thousands of variables, from economic indicators and zoning changes to satellite imagery, to generate dynamic, context-specific pricing models.

For example, platforms using machine learning can incorporate non-obvious factors like walkability scores, access to public transport, or even noise levels into their valuation algorithms. This multidimensional analysis allows investors and developers to price assets with greater confidence, reducing over- or under-valuations that can affect deal viability.

2. Personalized Customer Experiences

Homebuyers and renters today expect digital experiences that are as tailored as those from e-commerce platforms. AI meets this demand by learning from user behavior, such as click patterns, saved listings, and price sensitivity, to generate highly relevant property recommendations.

Beyond matching criteria like location and price, AI can predict preferences for architectural style, neighborhood character, or even potential appreciation. This nuanced personalization shortens the buyer journey and increases conversion rates without additional human intervention.

3. Streamlined Property Management

Operational inefficiencies often plague property portfolios, especially as scale increases. AI-powered platforms integrate with building management systems to monitor everything from HVAC performance to water usage, flagging anomalies before they escalate into costly repairs.

In tenant management, AI automates recurring workflows like rent reminders, repair ticket routing, and lease renewals. This frees up property managers to focus on higher-value activities like tenant retention strategies and capital improvement planning.

4. Efficient Document Processing

Contract and lease processing is one of the most labor-intensive aspects of real estate operations. AI technologies such as optical character recognition (OCR) and NLP extract key data points like payment terms, renewal clauses, and liability language from scanned documents and PDFs.

This structured data is then cross-checked for inconsistencies or compliance gaps, significantly reducing legal risk and administrative bottlenecks. The automation also improves audit readiness and facilitates quicker deal closures.

5. Predictive Market Analysis

Market timing can make or break a real estate investment. AI excels in identifying early signals, such as shifting demographics, urban development patterns, or migration trends that typically precede market upswings or downturns.

By aggregating diverse data sources and applying forecasting models, AI tools offer more precise insights into when and where to invest. This allows stakeholders to allocate capital more strategically, balancing risk with opportunity in increasingly volatile markets.

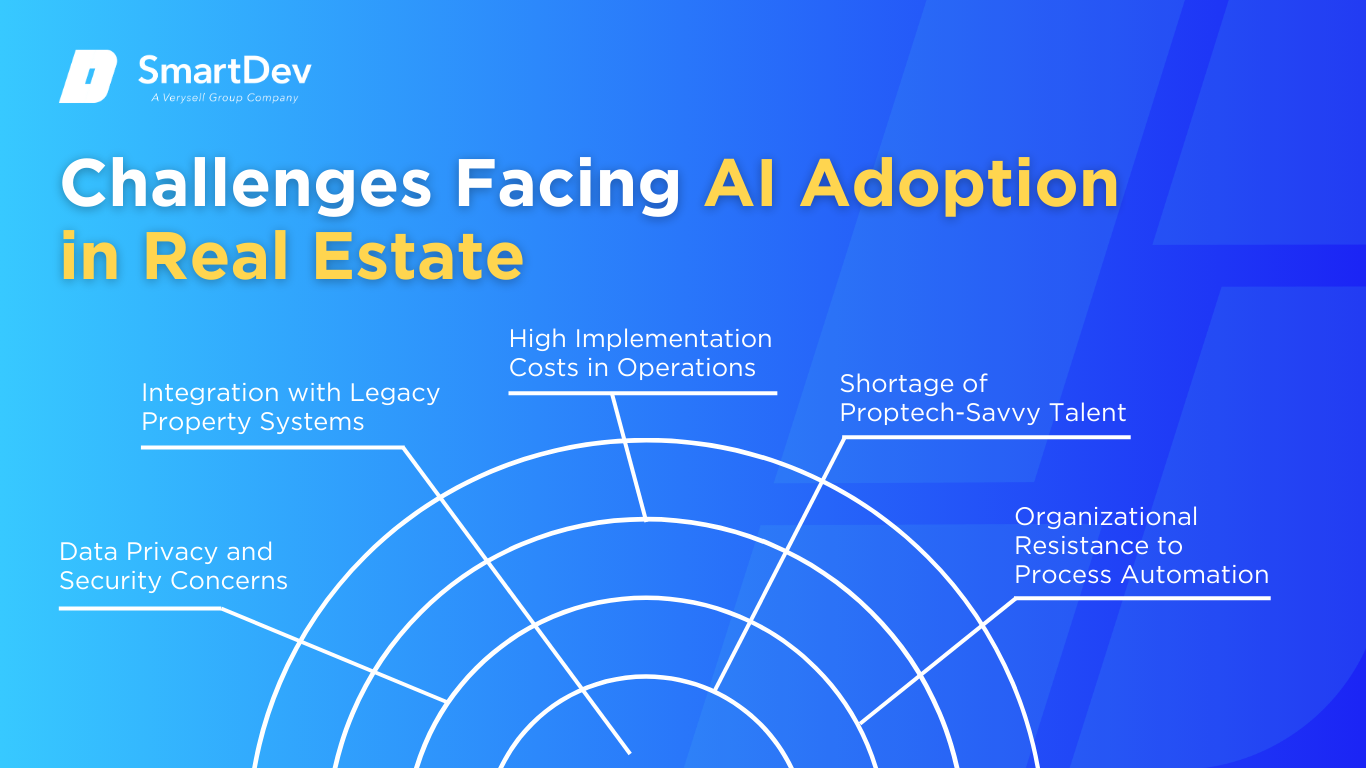

Challenges Facing AI Adoption in Real Estate

While AI offers significant benefits, several challenges can hinder its adoption in the real estate industry.

1. Data Privacy and Security Concerns

Real estate transactions involve the exchange of highly sensitive information like bank details, personal IDs, and legal contracts often across multiple third parties including brokers, tenants, and lawyers. As AI systems process and store more of this data, firms face elevated exposure to cyberattacks and data misuse.

Moreover, real estate firms are often unfamiliar with stringent data protection regulations like GDPR or local privacy laws. Ensuring AI systems are compliant requires not just technical safeguards, but also legal oversight and cross-departmental coordination – an operational challenge for companies not traditionally built around data.

2. Integration with Legacy Property Systems

Property firms commonly rely on fragmented legacy systems: old-school CRMs, Excel-based property databases, or siloed lease management tools. These systems were not designed for interoperability or large-scale automation, which makes integrating AI solutions difficult.

For instance, an AI model predicting rental price trends can’t function well if it’s fed inconsistent lease data from unstructured spreadsheets. Without investing in core system modernization or data unification, the full potential of AI like real-time valuation or dynamic pricing remains out of reach.

3. High Implementation Costs in Asset-Heavy Operations

Unlike tech-native sectors, real estate is asset-heavy and capex-intensive, leaving limited budgets for experimental technologies. Implementing AI tools, such as smart building automation or AI-driven underwriting requires upfront investments in IoT sensors, cloud infrastructure, and integration consultants.

This financial burden is especially hard on smaller firms or developers operating on thin margins. Many are forced to prioritize short-term ROI over long-term tech transformation, slowing AI adoption at scale.

4. Shortage of Proptech-Savvy Talent

The real estate sector traditionally lacks in-house expertise in data science, machine learning, or AI deployment. Hiring professionals who understand both real estate workflows and AI tools is challenging, as this hybrid talent pool remains limited and in high demand.

As a result, even when firms invest in AI platforms, they often struggle to operationalize them or extract actionable insights. Bridging this gap requires not only hiring but also reskilling asset managers, brokers, and analysts in data literacy.

5. Organizational Resistance to Process Automation

Real estate is deeply relationship-driven, and many stakeholders value intuition and personal networks over algorithmic decision-making. From veteran brokers to asset managers, there’s often skepticism about handing critical decisions like pricing, leasing, or acquisitions to AI systems.

Overcoming this resistance requires more than just training; it demands a cultural shift. AI tools must be framed as augmenting, not replacing, human expertise and firms need success stories and tangible ROI to build internal trust.

Specific Applications of AI in Real Estate

1. Predictive Property Valuation

AI-driven property valuation addresses the challenge of accurately pricing properties by analyzing vast datasets, including historical sales, market trends, and property features. Traditional valuation methods often rely on limited data and subjective assessments, leading to inconsistencies. AI models can process diverse data points to provide more objective and precise valuations.

These models utilize machine learning algorithms to assess factors such as location, amenities, and economic indicators. By integrating with real estate platforms, AI can offer real-time valuations that adjust to market fluctuations. This integration enhances decision-making for buyers, sellers, and investors.

For example, Daffodil Software developed an AI-based property valuation system for a UK-based company, achieving 93% accuracy on training data. The system provided estate agents with insights into market performance and enabled lenders to analyze price trends, facilitating informed financial decisions.

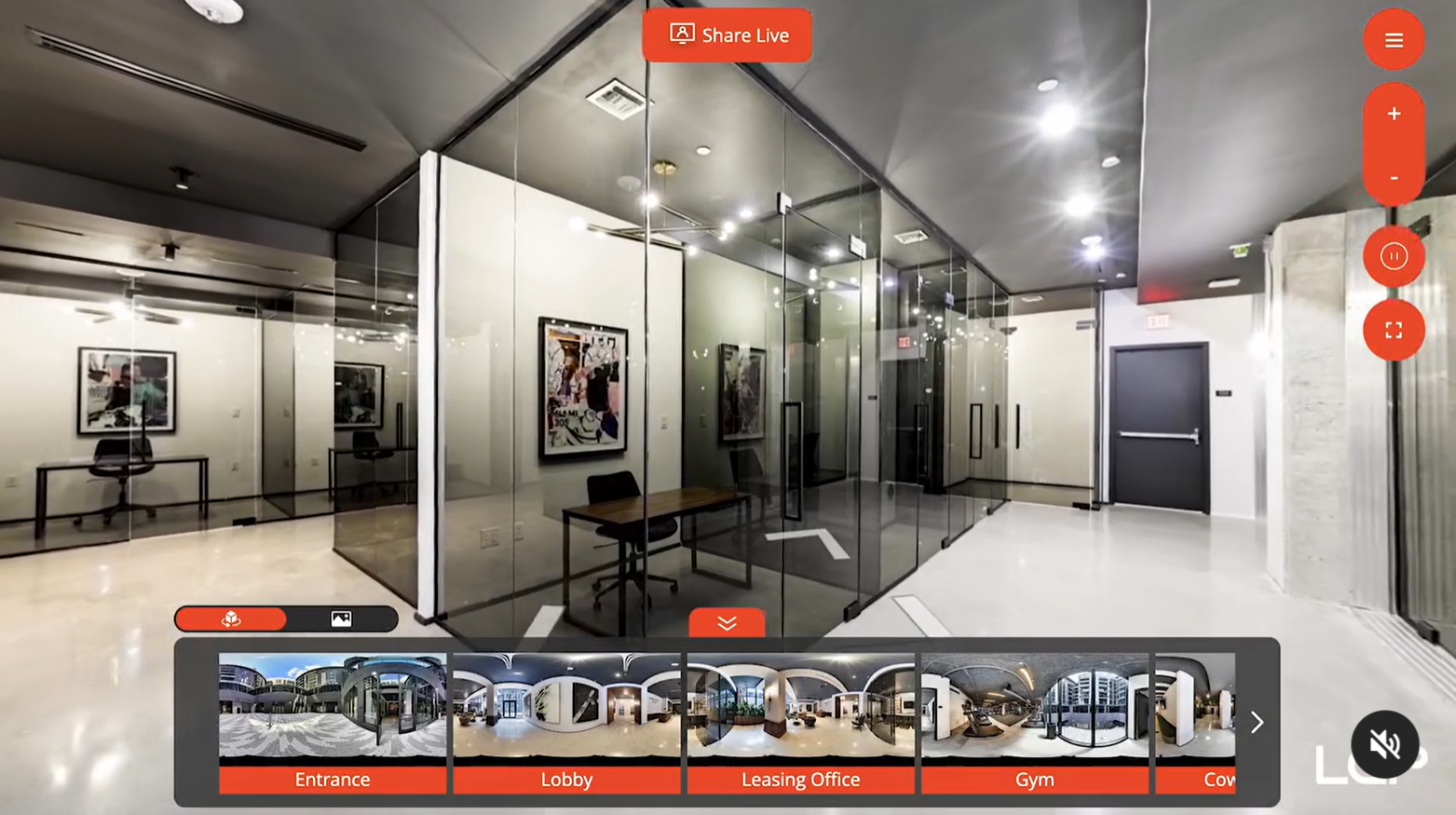

2. Virtual Property Tours and Staging

AI-powered virtual tours revolutionize property viewing by enabling potential buyers to explore homes remotely. This technology addresses limitations of traditional in-person visits, offering convenience and broader reach. Virtual staging further enhances this experience by digitally furnishing spaces, helping buyers visualize the property’s potential.

These virtual experiences are created using computer vision and 3D modeling, allowing for immersive and interactive property walkthroughs. AI algorithms can also personalize tours based on user preferences, highlighting features of interest. This personalization increases engagement and aids in faster decision-making.

Greystar, a global leader in rental housing, implemented virtual tours to enhance leasing performance. The adoption of this technology led to reduced vacancy rates and increased rent revenues, demonstrating the effectiveness of AI-driven virtual property tours in real estate marketing.

3. Predictive Maintenance in Property Management

AI enhances property management by predicting maintenance needs before issues arise, reducing downtime and repair costs. Traditional maintenance approaches are often reactive, leading to unexpected failures and higher expenses. Predictive maintenance leverages AI to shift from reactive to proactive strategies.

By analyzing data from sensors and equipment, AI models can identify patterns indicating potential failures. This analysis enables timely interventions, optimizing maintenance schedules and extending the lifespan of assets. Integration with property management systems ensures seamless implementation of maintenance activities.

DoorLoop, a property management software, adopted predictive maintenance, resulting in a 45% reduction in emergency maintenance requests within four months. This strategic approach improved operational efficiency and tenant satisfaction.

4. Investment Analysis and Risk Assessment

AI transforms real estate investment by providing comprehensive analysis and risk assessment. Investors face challenges in evaluating numerous variables that impact property performance. AI addresses this by processing vast datasets to uncover insights and predict outcomes.

Machine learning algorithms analyze factors such as market trends, economic indicators, and property-specific data. This analysis aids in identifying lucrative investment opportunities and assessing potential risks. AI tools can simulate various scenarios, helping investors make informed decisions.

DataRobot showcased the power of AI in investment management by improving the quality of potential investment forecasts. Their AI models enhanced the accuracy of predicting future performance, enabling better investment strategies in the real estate sector.

5. Personalized Marketing Strategies

AI enables personalized marketing in real estate by analyzing customer behavior and preferences. Traditional marketing approaches often lack customization, leading to lower engagement. AI addresses this by delivering tailored content to potential buyers.

Through data analysis, AI models identify patterns in user interactions, search history, and demographic information. This information is used to create targeted marketing campaigns, recommend properties, and personalize communication. Such strategies increase the likelihood of conversion and enhance customer experience.

Netguru highlighted the impact of generative AI in achieving hyper-personalization in real estate marketing. By leveraging AI-powered tools, companies can deliver customized experiences, improving engagement and driving sales.

Examples of AI in Real Estate

Real-World Case Studies

1. Zillow: Enhancing Property Valuations with AI

Zillow faced a core challenge shared by most digital real estate marketplaces—providing trustworthy, consistent, and up-to-date home valuation data at scale. Buyers and sellers relied on outdated or inconsistent estimates, creating friction in pricing negotiations and slowing transaction velocity. As Zillow expanded, the need to automate and improve the accuracy of their Zestimate algorithm became urgent to maintain platform trust and relevance in a competitive space.

To address this, Zillow turned to machine learning, revamping its Zestimate tool using neural networks and scalable AI infrastructure on AWS. The model draws from hundreds of millions of data points including historical transactions, public records, and geographic variables. AI enables Zestimate to update home values in near real-time, reflecting ongoing market shifts and integrating user-corrected information to self-improve.

The updated AI-driven Zestimate now covers over 104 million U.S. homes with median error rates for on-market properties reduced to 2.4%. This shift has reinforced Zillow’s market leadership, providing consumers with dependable price insights and enabling smoother buyer-seller engagement.

2. Rexera: Automating Real Estate Document Processing

Rexera’s challenge was rooted in the overwhelming scale of legal and transactional documentation in institutional real estate operations. Manual processing of lease agreements, disclosures, and compliance documentation caused severe operational drag. For a firm facilitating thousands of monthly transactions, every delay in document review created bottlenecks across sales, legal, and compliance workflows.

To eliminate this inefficiency, Rexera integrated Amazon Bedrock and foundation models from Anthropic to build AI agents capable of classifying, extracting, and verifying information across vast document sets. These agents are deployed across their pipeline to read, understand, and flag issues within contracts and paperwork—enabling continuous quality control and automated decision-making.

As a result, Rexera automated the review of over 5 million pages monthly and reduced manual workload by 99%. This transformation not only accelerated transaction closures but also ensured higher compliance accuracy, empowering their legal team to redirect focus toward exceptions rather than routine verification.

3. JLL: Streamlining Commercial Real Estate Marketing

JLL, one of the world’s largest commercial real estate firms, struggled with the labor-intensive nature of marketing processes such as writing offering memorandums. These complex documents often took 4–6 weeks to compile, due to data aggregation, stakeholder input, and detailed financial modeling. The delay directly affected how quickly deals could be brought to market, limiting responsiveness in fast-paced commercial negotiations.

To solve this, JLL launched JLL GPT, a proprietary generative AI platform trained on internal and industry-specific data. It is designed to produce high-quality first drafts of marketing materials within minutes, using natural language generation tuned to real estate vernacular. Analysts now simply input property data and receive editable memorandums that can be refined and published rapidly.

This initiative cut memorandum creation time down to under five hours, delivering a 90% reduction in production cycle. By significantly accelerating time to market, JLL improved its competitive positioning and demonstrated the strategic value of domain-specific AI deployment.

4. Greystar: Boosting Leasing Performance with Virtual Tours

Greystar, managing hundreds of multifamily residential properties globally, grappled with the logistical and economic challenges of on-site tours. During the COVID-19 pandemic and continuing into the remote-first shift, in-person viewings sharply declined, and properties faced extended vacancy periods. Greystar needed a way to digitize its leasing funnel without compromising the visual quality and personalized nature of tours.

They partnered with LCP Media to deploy AI-enhanced virtual tours, integrating 3D visuals, navigation, and property-specific staging through automated rendering. These tours are embedded on leasing websites and allow users to explore both unit-level and common area visuals, often personalized by region or amenity preferences based on user data.

Post-implementation, Greystar saw leasing cycles shrink by five days per property and achieved annual vacancy cost savings of $37,895 per location. The digital shift improved not only operational efficiency but also enhanced user experience, establishing virtual touring as a core component of its leasing strategy.

Innovative AI Solutions

AI innovations are accelerating digital transformation across the real estate value chain. Generative AI now powers dynamic listing creation by generating rich, customized property descriptions directly from photos or floor plans. This not only accelerates time-to-market for listings but also ensures that agents and platforms maintain a consistent, engaging brand voice, boosting lead conversion on portals and CRM systems alike.

In investment management, AI enables real estate firms and REITs to analyze portfolio performance across markets with unparalleled granularity. Platforms like Skyline AI ingest tenant data, lease structures, and market comparables to recommend asset repositioning, pricing adjustments, or capital deployment strategies. This analytical edge helps firms optimize portfolio returns and mitigate investment risks with real-time insights.

AI-driven building automation is also becoming essential in commercial and multifamily real estate. Solutions such as BrainBox AI apply predictive algorithms to HVAC and energy systems, automatically adjusting operations based on occupancy and weather forecasts. Property managers benefit from reduced utility costs, minimized equipment downtime, and improved tenant satisfaction.

AI-Driven Innovations Transforming Real Estate

Emerging Technologies in AI for Real Estate

AI innovations are accelerating digital transformation across the real estate value chain. Generative AI now powers dynamic listing creation by generating rich, customized property descriptions directly from photos or floor plans. This not only accelerates time-to-market for listings but also ensures that agents and platforms maintain a consistent, engaging brand voice, boosting lead conversion on portals and CRM systems alike.

In investment management, AI enables real estate firms and REITs to analyze portfolio performance across markets with unparalleled granularity. Platforms like Skyline AI ingest tenant data, lease structures, and market comparables to recommend asset repositioning, pricing adjustments, or capital deployment strategies. This analytical edge helps firms optimize portfolio returns and mitigate investment risks with real-time insights.

AI-driven building automation is also becoming essential in commercial and multifamily real estate. Solutions such as BrainBox AI apply predictive algorithms to HVAC and energy systems, automatically adjusting operations based on occupancy and weather forecasts. Property managers benefit from reduced utility costs, minimized equipment downtime, and improved tenant satisfaction.

AI’s Role in Sustainability Efforts

AI is playing a pivotal role in promoting sustainability within the real estate sector. Predictive analytics, powered by AI, are being used to forecast energy consumption patterns, allowing for the implementation of energy-saving measures. Smart systems, integrated with AI, optimize heating, ventilation, and air conditioning (HVAC) operations, leading to significant reductions in energy usage and costs.

Moreover, AI aids in waste reduction by analyzing construction processes and identifying areas where materials can be conserved. This not only minimizes environmental impact but also results in cost savings. The integration of AI in building management systems ensures continuous monitoring and adjustment of energy consumption, aligning with green building standards and sustainability goals.

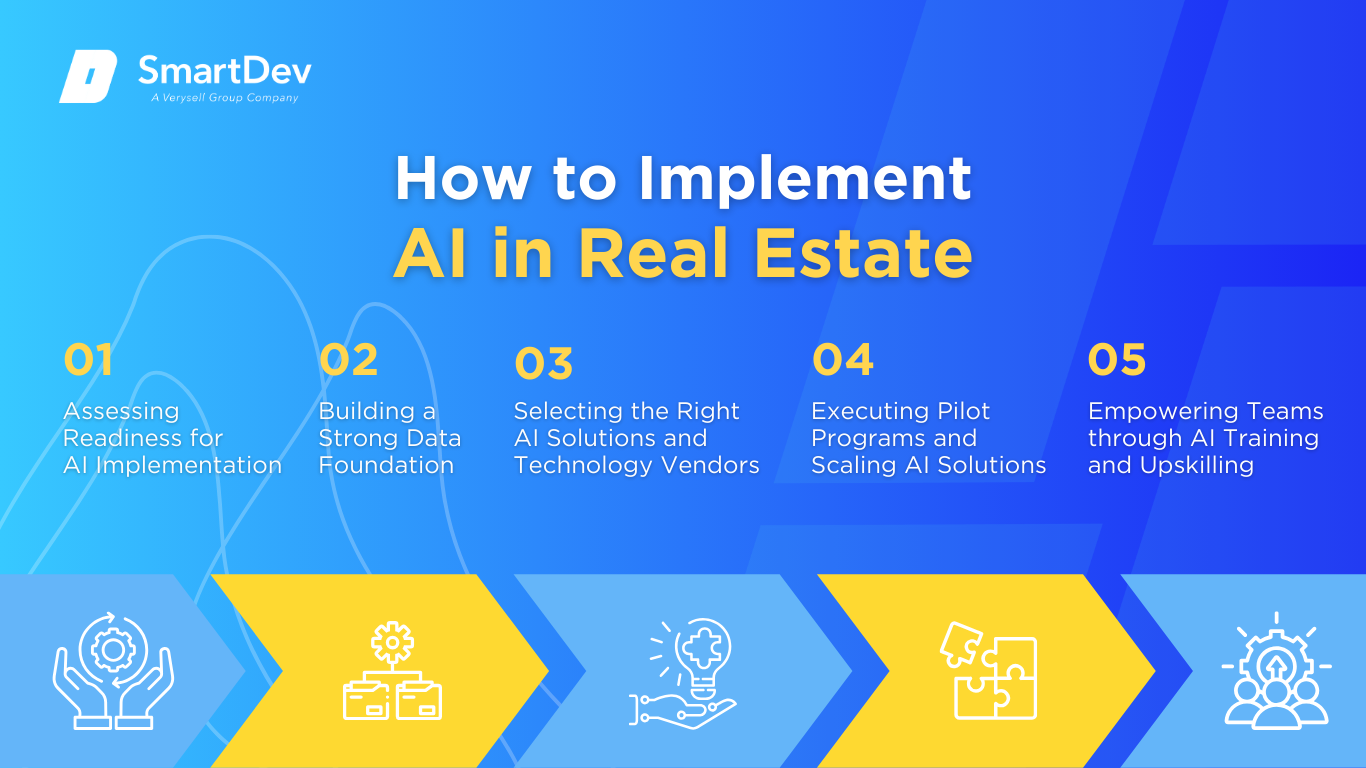

How to Implement AI in Real Estate

Step 1: Assessing Readiness for AI Adoption

Before adopting AI in real estate, you need to evaluate which parts of your operations are primed for intelligent automation. Look for areas where repetitive tasks slow down workflows, like lead generation, customer inquiries, or document management. Assess your organization’s current tech infrastructure and digital maturity and involve key stakeholders to align AI adoption with business goals.

Step 2: Building a Strong Data Foundation

AI thrives on quality data, so laying a strong data foundation is critical. This means consolidating property data, transaction records, client behavior, and market trends into a centralized, clean, and structured database. Accurate, well-maintained data not only trains AI models effectively but also ensures the insights they generate are reliable and actionable.

Step 3: Choosing the Right Tools and Vendors

The right AI tool can make or break your investment. Choose platforms that are purpose-built for real estate, offering scalability, ease of integration, and user-friendly interfaces. Vet vendors for industry experience, support services, and customization capabilities, and prioritize those with proven success in delivering measurable results in real estate contexts.

Step 4: Pilot Testing and Scaling Up

Rather than deploying AI organization-wide from the start, begin with a pilot in one strategic area, such as tenant communication or pricing analytics. Track key metrics like efficiency gains and customer satisfaction to assess effectiveness. Once validated, create a roadmap to scale the solution across other departments with minimal disruption.

Step 5: Training Teams for Successful Implementation

Equipping your team with the skills to work alongside AI is essential. Provide training sessions that not only teach the tools but also help employees understand the benefits of AI in their roles. Encouraging a mindset of collaboration between humans and machines ensures a smoother transition and higher overall adoption rates.

Measuring the ROI of AI in Real Estate

Key Metrics to Track Success

Evaluating the return on investment (ROI) of AI initiatives involves tracking specific metrics that reflect operational improvements and financial gains. Productivity enhancements can be measured by the reduction in time spent on tasks such as data entry, property evaluations, and customer inquiries. For instance, AI-powered chatbots can handle multiple customer interactions simultaneously, freeing up human agents for more complex tasks.

Cost savings are another critical metric, achieved through automation of routine processes, predictive maintenance reducing repair expenses, and optimized marketing strategies leading to higher conversion rates. Monitoring these metrics over time will provide a comprehensive view of AI’s impact on your business.

Case Studies Demonstrating ROI

A notable example of AI delivering substantial ROI is the case of a real estate firm that integrated AI-driven chatbots into their customer service operations. The implementation led to a 45% increase in the conversion rate of inquiries to property viewings, significantly boosting sales figures. Additionally, the firm experienced a reduction in response time from several hours to just a few minutes, enhancing customer satisfaction and engagement.

Another case involves a property management company that adopted AI for predictive maintenance. By analyzing data from building systems, the AI solution identified potential issues before they escalated, reducing maintenance costs by 14% and increasing tenant retention due to improved living conditions.

Common Pitfalls and How to Avoid Them

While AI offers numerous benefits, certain pitfalls can hinder its successful implementation. One common issue is the lack of quality data, which can lead to inaccurate predictions and insights. To avoid this, invest in robust data collection and management practices.

Another challenge is resistance to change among staff. Address this by involving employees in the AI adoption process, providing adequate training, and clearly communicating the benefits. Additionally, setting unrealistic expectations can lead to disappointment; it’s essential to understand that AI is a tool to augment human capabilities, not replace them.

Future Trends of AI in Real Estate

Predictions for the Next Decade

Looking ahead, AI is poised to become even more integral to the real estate industry. We can anticipate advancements in AI algorithms leading to more accurate property valuations and market forecasts. The integration of AI with Internet of Things (IoT) devices will enable real-time monitoring of building systems, enhancing energy efficiency and maintenance.

Moreover, AI will play a significant role in urban planning, analyzing vast datasets to inform infrastructure development and zoning decisions. The use of AI in virtual reality (VR) and augmented reality (AR) will also transform property viewing experiences, allowing potential buyers to explore properties remotely with immersive technologies.

How Businesses Can Stay Ahead of the Curve

To remain competitive, real estate businesses must embrace continuous innovation and adaptability. Investing in AI research and development will keep organizations at the forefront of technological advancements. Collaborating with tech startups and participating in industry forums can provide insights into emerging trends and best practices.

Furthermore, fostering a culture that encourages experimentation and agility will enable businesses to quickly adapt to changes and leverage new AI capabilities. Staying informed about regulatory developments and ethical considerations surrounding AI will also be crucial in navigating the evolving landscape.

Conclusion

Key Takeaways

AI is not just a buzzword in real estate. It’s a transformative force that’s already redefining how properties are listed, sold, managed and valued. From generative AI tools that create immersive virtual tours to predictive analytics that forecast market shifts, AI is giving real estate professionals an unprecedented edge in speed, efficiency, and decision-making. Companies that have embraced AI are seeing real improvements in cost savings, client engagement, and operational performance.

The success of AI in real estate depends on more than just technology, it requires the right strategy, data foundation, and team mindset. Businesses must carefully assess where AI fits into their operations, choose trusted vendors, and empower their teams with the right skills. Real-world case studies continue to demonstrate not only high ROI but also faster cycles in lead conversion, maintenance efficiency, and customer support, all of which make a compelling case for adoption.

Moving Forward: A Path to Progress

AI in real estate isn’t just a passing trend, it’s the backbone of the industry’s next chapter. Companies that embrace AI now are seizing a rare opportunity to lead the market with smarter decisions, sharper customer experiences, and leaner operations. If you’re serious about scaling your real estate business and outpacing competitors, AI isn’t optional, it’s the catalyst for your next breakthrough.

At SmartDev, we don’t just offer AI solutions, we engineer tailored, high-impact systems that turn data into deals. From intelligent property valuation and virtual customer agents to predictive maintenance and smart building insights, our AI-powered technologies are built for real estate teams ready to lead the future.

Talk to us today and see how our AI solutions can elevate your real estate operations to the next level. Together, we’ll build a smarter, more agile, and future-ready business that stands out in a rapidly evolving market.

—

References:

- What Is Artificial Intelligence? | IBM Think

- What’s Next for AI in Commercial Real Estate? | Forbes Tech Council

- Real AI Survey Reveals Real Estate’s Heavy Use of AI | WAV Group

- Generative AI: 2nd Edition Infographic | Capgemini Research Institute

- AI-Based Property Valuation System Development | Daffodil Software

- Using AI to Understand the Complexities and Pitfalls of Real Estate Data | Zillow

- Rexera Boosts Data Accuracy and Developer Productivity with Amazon Bedrock | AWS Case Study

- JLL Unveils First GPT Model for Commercial Real Estate | JLL Newsroom

- Greystar Enhances Virtual Tours with LCP Media | LCP Media