BFSI security automation has become mission critical as cyber threats targeting banking, financial services, and insurance grow in volume and sophistication. Financial institutions face constant risks from fraud, ransomware, and data breaches driven by digital banking, cloud adoption, and third-party integrations. Traditional, manual security approaches struggle to detect and respond to threats at the required speed, creating gaps that attackers can exploit.

At the same time, increasing regulatory and compliance requirements add operational complexity. AI-driven automation enables BFSI organizations to scale security operations through continuous monitoring, faster incident response, and automated compliance checks. By reducing human dependency and improving accuracy, BFSI security automation strengthens protection while supporting business growth and regulatory alignment.

What BFSI security automation really means today

In the context of modern banking, financial services, and insurance, BFSI security automation refers to the use of advanced tools and intelligent systems to automate not just repetitive tasks but complex security functions at scale. This goes beyond traditional workflow tools by combining machine intelligence with cybersecurity processes to proactively detect, assess, and respond to threats in real time. Intelligent automation in financial services improves risk mitigation, enhances compliance, and elevates operational efficiency by orchestrating end-to-end security actions that once required manual oversight.

Key differences between traditional security tools and AI-powered automation

Traditional security solutions in BFSI typically rely on predefined rules and human intervention to identify threats, manage alerts, and enforce policies. In contrast, AI-powered automation integrates artificial intelligence and machine learning (ML) to analyze massive volumes of data, identify patterns, and make predictive assessments without explicit programming for every scenario. AI systems can adapt to evolving threat patterns, reduce false positives, and accelerate response times, whereas legacy tools often struggle with scalability and contextual decision-making under dynamic conditions.

Core technologies enabling security automation in BFSI

Several interlinked technologies form the backbone of AI-driven security automation:

- Artificial intelligence and machine learning: AI and ML enable systems to learn from historical and real-time data, detect anomalies, and predict potential security incidents with far greater accuracy than manual rule-based systems. These capabilities allow financial institutions to automate complex analyses and reduce the burden on human analysts.

- Robotic process automation and intelligent workflows: Robotic Process Automation (RPA) uses software bots to automate repetitive rule-driven security processes, such as log aggregation, compliance checks, or simple incident handling. When integrated with AI, RPA evolves into intelligent automation that can manage exception handling and facilitate decision-based tasks beyond rote execution.

- Agentic and autonomous security systems: Agentic automation represents the next frontier in BFSI security, where intelligent agents can perceive context, set goals, and autonomously execute and adjust workflows without constant human input. These systems blend reasoning, decision-making, and action to address dynamic security needs, essentially moving from reactive automation to proactive, self-directed protection strategies.

Together, these technologies enable BFSI organizations to scale security operations, automate threat detection and response, and maintain regulatory resilience in an increasingly complex digital environment.

Key Security Challenges Facing BFSI Organizations

BFSI organizations operate in one of the most complex and high-risk security environments. The following challenges explain why traditional security models are no longer sufficient.

1. Rising frequency and sophistication of cyberattacks

Cyberattacks against BFSI organizations are increasing in both frequency and complexity as financial services move online. Threat actors take advantage of always-on systems and high transaction volumes, making manual security monitoring ineffective.

- Automated ransomware and fraud attacks exploit real-time payment systems

- Phishing and account takeover target digital banking users

- Large-scale transaction data overwhelms manual detection processes

2. Data privacy risks and compliance obligations

BFSI organizations manage highly sensitive personal and financial data, which places them under strict regulatory oversight. As systems become more distributed, maintaining consistent compliance becomes harder without automation.

- Regulations require continuous data protection and audit readiness

- Cloud services and third-party vendors increase data exposure

- Manual compliance checks struggle to scale across environments

3. Legacy infrastructure and fragmented security systems

Many financial institutions still depend on legacy core systems that limit visibility and agility. This results in fragmented security operations that slow down response times.

- Legacy platforms lack real-time monitoring capabilities

- Security tools operate in silos across networks and applications

- Teams must manually correlate alerts from multiple systems

4. Skills shortages in cybersecurity operations

Security teams in BFSI are under pressure due to limited human resources and growing workloads. Without automation, this gap directly impacts response speed and accuracy.

- High alert volumes lead to fatigue and delayed responses

- Shortage of skilled professionals increases operational risk

- AI-assisted solutions can reduce manual effort and testing time by 50 percent, helping teams scale effectively

How AI Transforms Security Automation Across BFSI Operations

Automated threat detection and real-time risk analysis

AI fundamentally changes how BFSI organizations detect threats by shifting security from reactive to proactive. Instead of relying on static rules, AI models continuously analyze transaction data, user behavior, network traffic, and system logs to identify anomalies in real time. This approach is critical in BFSI environments where millions of transactions occur daily and threats evolve rapidly.

- Machine learning models detect abnormal patterns that indicate fraud or intrusion attempts

- Behavioral analytics help identify insider threats and compromised accounts

- Real-time risk scoring enables faster decision-making during high-risk transactions

SmartDev highlights that AI-driven security analytics significantly improve detection accuracy while reducing false positives, allowing security teams to focus on real threats instead of noise.

AI-driven incident response and remediation

Beyond detection, AI enables automated and intelligent incident response across BFSI operations. When a threat is identified, AI-powered systems can trigger predefined or adaptive response actions without waiting for manual intervention. This reduces response time, which is critical for minimizing financial and reputational damage.

- Automated containment of compromised accounts or endpoints

- Intelligent prioritization of incidents based on risk impact

- Self-learning systems improve response strategies over time

BizTech Magazine notes that cybersecurity automation helps financial institutions significantly reduce mean time to detect and respond to incidents by eliminating manual bottlenecks .

Security monitoring at scale using intelligent automation

As BFSI organizations expand digital services, security monitoring must scale without a proportional increase in staff. Intelligent automation allows continuous monitoring across cloud, on-premise, and hybrid environments while maintaining consistency and accuracy.

- Automated log analysis across applications, networks, and endpoints

- Continuous monitoring of transactions, APIs, and user activity

- Reduction of alert fatigue through intelligent correlation and filtering

SmartDev reports that AI-assisted quality assurance and security testing can reduce manual effort and testing time by 50 percent, demonstrating how automation directly improves scalability and operational efficiency.

Integrating AI with existing SOC and SIEM platforms

AI does not replace existing Security Operations Centers (SOC) or SIEM platforms. Instead, it enhances them by adding intelligence, automation, and contextual awareness. Integration allows BFSI organizations to modernize security operations without disrupting core infrastructure.

- AI enriches SIEM data with contextual and predictive insights

- Automated workflows streamline SOC alert triage and investigation

- Integration supports legacy systems while enabling gradual modernization

SmartDev emphasizes that successful AI adoption in BFSI depends on seamless integration with existing systems to maintain compliance and operational continuity.

Overall, AI transforms BFSI security automation by enabling faster detection, smarter response, and scalable monitoring across complex environments. By embedding intelligence into SOC and SIEM workflows, BFSI organizations can strengthen resilience, reduce operational strain, and maintain continuous compliance in an increasingly hostile threat landscape.

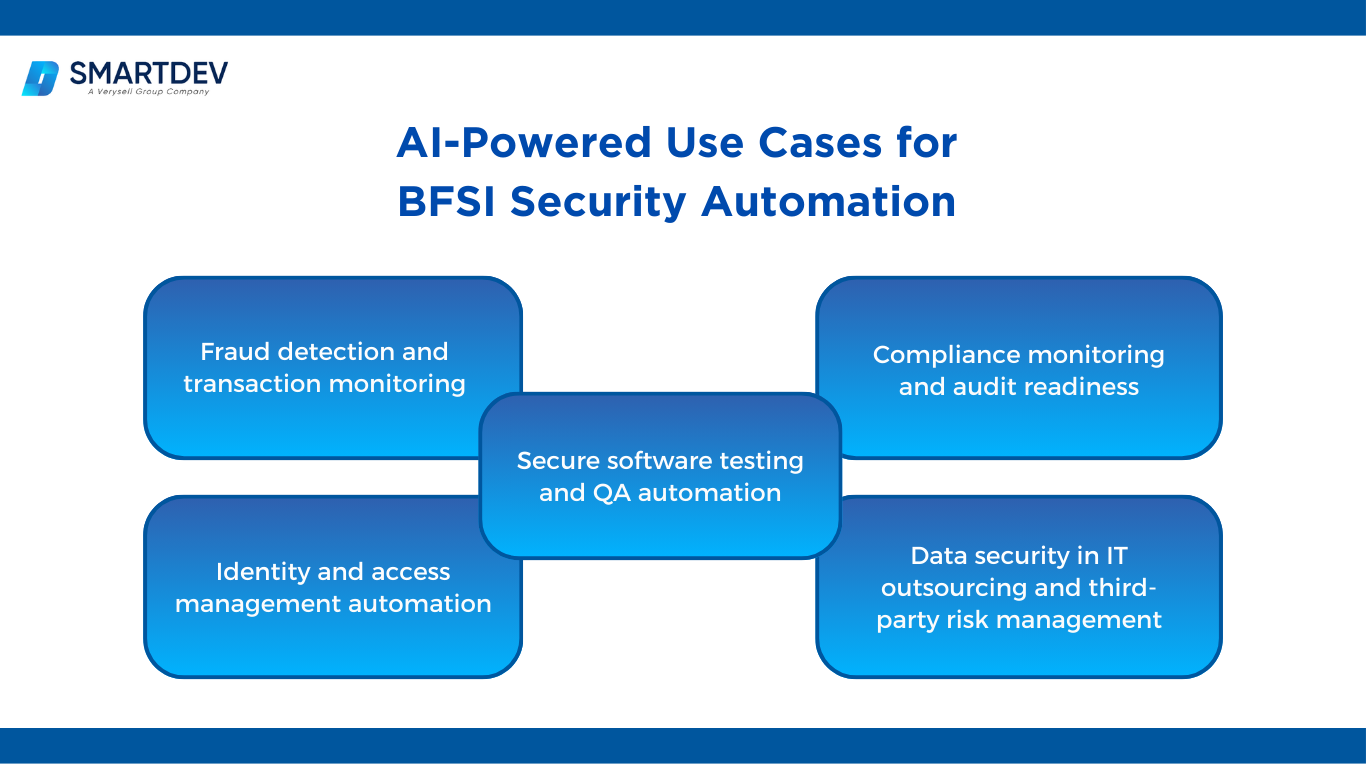

AI-Powered Use Cases for BFSI Security Automation

AI-powered security automation plays a central role in helping BFSI organizations protect digital operations while scaling services securely. Across banking, financial services, and insurance, AI is being applied to high-impact security use cases where speed, accuracy, and consistency are critical.

1. Fraud detection and transaction monitoring

1. Fraud detection and transaction monitoring

Fraud detection remains the most visible application of AI in BFSI security automation due to the sheer volume and velocity of financial transactions. AI models analyze transactional behavior in real time to identify anomalies that rule-based systems often miss. These models continuously learn from new data, allowing them to adapt as fraud patterns evolve.

- Real-time monitoring of payments, transfers, and card transactions

- Behavioral analysis to detect deviations from normal customer activity

- Automated risk scoring to approve, flag, or block transactions instantly

SmartDev highlights that AI-driven analytics significantly improve fraud detection accuracy while reducing false positives, helping institutions balance security with customer experience.

2. Identity and access management automation

Identity and access management is a critical security layer in BFSI, where unauthorized access can lead to severe financial and regulatory consequences. AI enhances IAM by continuously assessing user behavior rather than relying solely on static credentials.

- Continuous authentication based on behavior, device, and context

- Automated detection of abnormal access patterns and privilege misuse

- Faster, more secure onboarding and offboarding of users

According to BizTech Magazine, security automation improves identity governance by reducing manual access reviews and strengthening controls across financial environments.

3. Secure software testing and QA automation

As BFSI organizations accelerate digital transformation, secure software development becomes essential. AI-powered QA and security testing automate vulnerability detection earlier in the development lifecycle, reducing risk before applications go live.

- Automated security testing embedded in CI/CD pipelines

- Early identification of vulnerabilities in code, APIs, and integrations

- Faster release cycles without weakening security controls

SmartDev reports that AI-assisted QA reduces testing time by 50 percent, allowing financial institutions to deliver secure applications faster with fewer resources.

4. Compliance monitoring and audit readiness

Maintaining regulatory compliance requires continuous oversight rather than periodic checks. AI-powered security automation enables BFSI organizations to monitor compliance in real time and remain audit-ready.

- Continuous validation of controls against regulatory requirements

- Automated audit logs and evidence collection

- Faster detection and remediation of compliance gaps

SmartDev emphasizes that automation significantly reduces compliance overhead by standardizing controls and minimizing manual documentation efforts.

5. Data security in IT outsourcing and third-party risk management

IT outsourcing and third-party partnerships are common in BFSI but introduce additional security and compliance risks. AI enhances visibility and governance across external environments.

- Continuous monitoring of vendor access to sensitive data

- Automated risk assessment and scoring of third-party systems

- Early detection of policy violations and abnormal data usage

SmartDev notes that AI-driven security automation improves third-party risk management by enabling consistent enforcement of data protection policies across outsourced operations.

Together, these use cases demonstrate how BFSI security automation powered by AI delivers practical, measurable improvements. By embedding intelligence across fraud prevention, identity management, software security, compliance, and third-party oversight, BFSI organizations can scale securely while meeting rising regulatory and customer expectations.

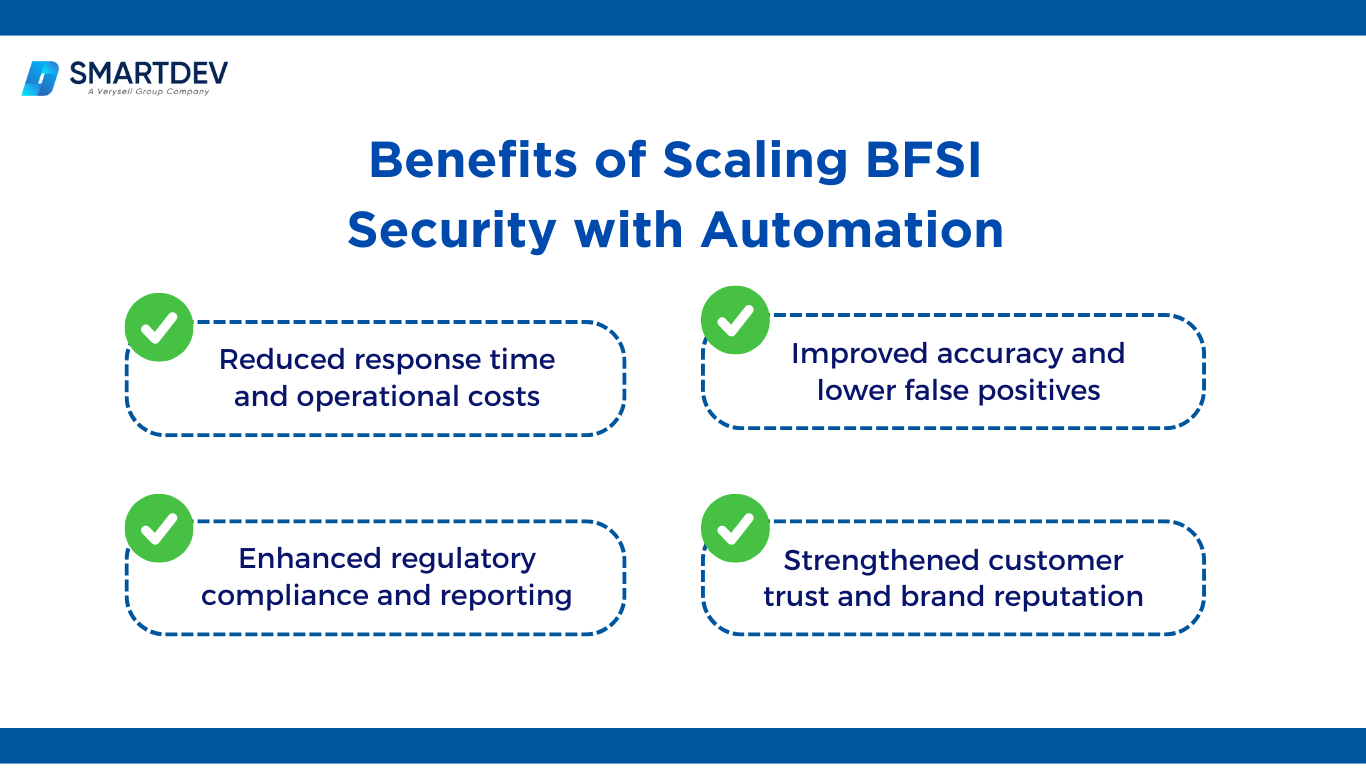

Business Benefits of Scaling BFSI Security with Automation

Scaling BFSI security automation delivers clear business value beyond technical protection. When security operations become intelligent and automated, financial institutions gain measurable improvements in cost efficiency, accuracy, compliance, and customer trust.

1. Reduced response time and operational costs

1. Reduced response time and operational costs

Automation significantly shortens the time required to detect, investigate, and respond to security incidents. AI-powered systems analyze alerts in real time and trigger predefined responses without waiting for manual approval. This reduces downtime, limits financial losses, and lowers the operational burden on security teams.

From a cost perspective, automation minimizes reliance on large security teams for repetitive tasks such as alert triage, log analysis, and incident documentation. SmartDev reports that AI-assisted security and testing automation can reduce manual effort and testing time by 50 percent, directly lowering operational costs while maintaining security quality.

2. Improved accuracy and lower false positives

One of the biggest challenges in BFSI security operations is alert fatigue. Traditional rule-based systems generate high volumes of false positives, which distract teams from real threats. AI-driven security automation improves accuracy by learning normal behavior patterns and detecting meaningful anomalies.

By filtering out noise and prioritizing high-risk events, automation allows security teams to focus on incidents that matter most. BizTech Magazine highlights that cybersecurity automation improves threat detection accuracy while reducing unnecessary alerts, leading to faster and more confident decision-making.

3. Enhanced regulatory compliance and reporting

Regulatory compliance in BFSI requires continuous monitoring, evidence collection, and audit readiness. Automation transforms compliance from a reactive, manual process into a continuous, system-driven capability.

AI-powered security automation:

- Continuously validates controls against regulatory requirements

- Automatically generates audit logs and compliance reports

- Detects compliance gaps early, before they become violations

SmartDev emphasizes that automated compliance monitoring reduces human error and ensures consistent enforcement of security policies across complex environments, including outsourced and cloud-based systems.

4. Strengthened customer trust and brand reputation

Security incidents directly impact customer confidence in financial institutions. Faster threat detection, reduced fraud, and consistent data protection improve customer experience and trust. When customers feel their data and transactions are secure, loyalty and brand reputation increase.

By preventing breaches and minimizing service disruption, BFSI security automation protects not only systems but also long-term brand value. Reliable security operations become a competitive advantage in an increasingly digital financial market.

Overall, scaling BFSI security with automation delivers strategic benefits that extend beyond cybersecurity. Reduced costs, higher accuracy, stronger compliance, and improved customer trust position financial institutions for sustainable and secure growth.

Explore how SmartDev partners with BFSI teams through a focused AI sprint to validate use cases, align stakeholders, and define a clear path forward before AI development begins.

SmartDev helps BFSI organizations clarify AI use cases and assess feasibility, enabling confident decisions and reducing risks before committing to AI development.

Learn how SmartDev accelerates AI initiatives, ensuring rapid deployment and reduced time to market.

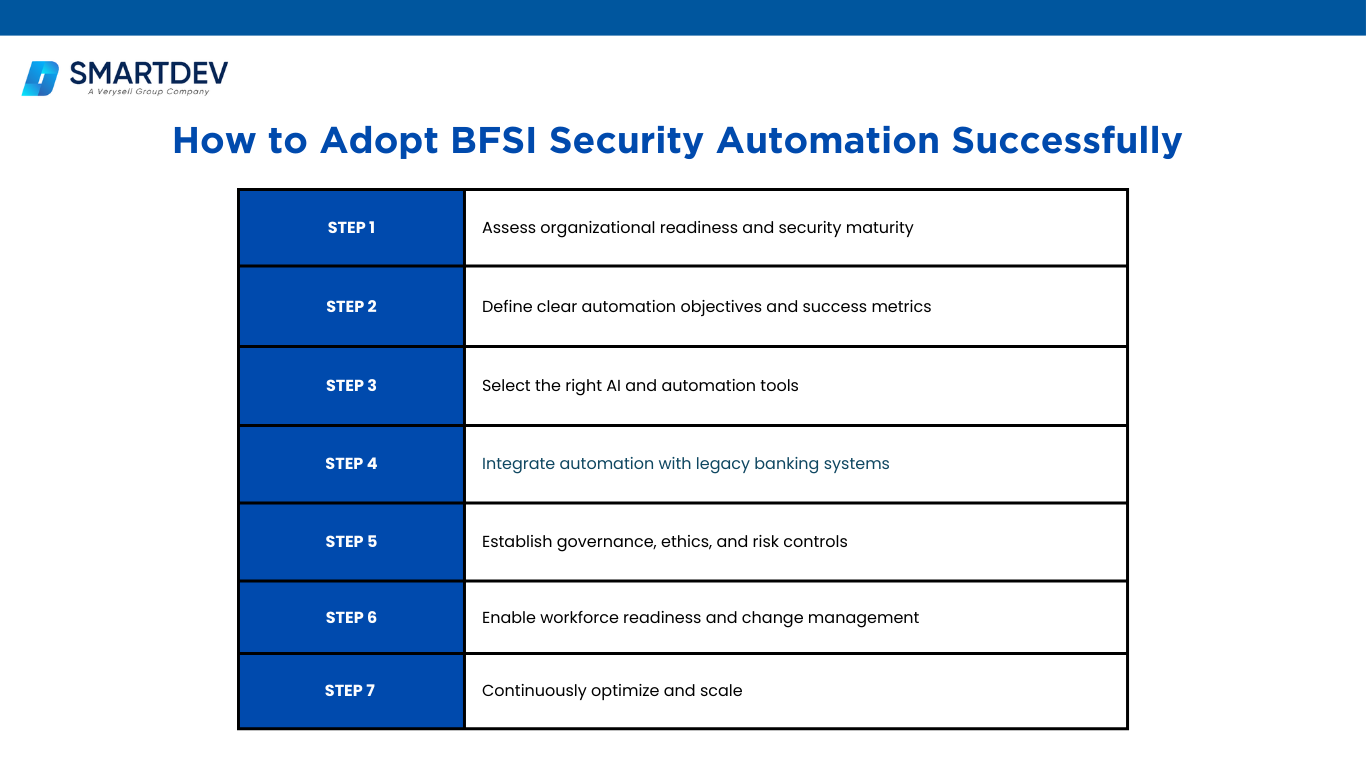

Build Your AI Chatbot With UsImplementation Strategy: How to Adopt BFSI Security Automation Successfully

Successfully implementing BFSI security automation requires more than deploying new tools. It demands a phased strategy that aligns technology, people, and governance while respecting regulatory and operational constraints. The following steps outline a structured approach for BFSI organizations.

Step 1. Assess organizational readiness and security maturity

Step 1. Assess organizational readiness and security maturity

The first step is gaining a clear understanding of the current security environment. BFSI organizations operate across complex ecosystems that include legacy systems, cloud platforms, and third-party integrations. A readiness assessment helps determine where automation will deliver the most value.

This stage should include:

- Reviewing existing security processes, incident response workflows, and compliance practices

- Mapping security tools across infrastructure, applications, and data layers

- Assessing data quality and availability for AI-driven analysis

- Identifying pain points such as alert overload, slow response times, or manual compliance tasks

A maturity assessment prevents unrealistic expectations and ensures automation initiatives are aligned with actual security needs.

Step 2. Define clear automation objectives and success metrics

Once readiness is established, organizations must define clear goals for security automation. These objectives should align with both business priorities and regulatory obligations.

Common objectives include:

- Reducing mean time to detect and respond to incidents

- Lowering operational costs through reduced manual effort

- Improving detection accuracy and reducing false positives

- Enhancing audit readiness and compliance reporting

Each objective should be paired with measurable KPIs, such as response time reduction or compliance audit outcomes, to track progress and demonstrate value.

Step 3. Select the right AI and automation tools

Tool selection is critical in BFSI environments where security, compliance, and reliability are non-negotiable. Organizations should prioritize platforms that are designed for regulated industries and offer explainable AI capabilities.

Key selection criteria include:

- Proven deployment in BFSI use cases such as fraud detection or compliance monitoring

- Strong integration capabilities with existing SOC and SIEM platforms

- Built-in audit logging, access controls, and reporting features

- Vendor transparency regarding AI models and data handling

Choosing interoperable tools reduces implementation risk and accelerates adoption.

Step 4. Integrate automation with legacy banking systems

Legacy systems remain central to many BFSI operations and cannot be replaced overnight. A successful strategy focuses on gradual integration rather than disruptive transformation.

Effective approaches include:

- Using APIs, middleware, or connectors to integrate AI tools with core systems

- Automating specific workflows first, such as alert triage or transaction monitoring

- Running automation in parallel with existing processes during initial phases

This incremental approach ensures business continuity while validating automation benefits.

Step 5. Establish governance, ethics, and risk controls

AI-driven security automation introduces new governance responsibilities. BFSI organizations must ensure automated decisions are transparent, auditable, and aligned with regulatory expectations.

Governance frameworks should define:

- Clear ownership and accountability for automated actions

- Explainability requirements for AI-driven risk assessments

- Regular model validation and performance reviews

- Controls to detect bias, drift, or unintended behavior

Strong governance builds trust with regulators and internal stakeholders.

Step 6. Enable workforce readiness and change management

Automation does not eliminate the need for skilled professionals. Instead, it changes how teams work. BFSI organizations should invest in training and change management to ensure successful adoption.

Key initiatives include:

- Upskilling security teams to manage AI-driven tools

- Redefining roles to focus on analysis and decision-making

- Encouraging collaboration between security, IT, and compliance teams

Step 7. Continuously optimize and scale

Security automation is not a one-time project. Continuous optimization ensures systems remain effective as threats and regulations evolve.

Ongoing activities include:

- Regularly reviewing performance metrics and outcomes

- Updating AI models and automation workflows

- Expanding automation to additional use cases as maturity increases

By following these structured steps, BFSI organizations can adopt security automation in a controlled, compliant, and scalable manner. A disciplined implementation strategy ensures AI strengthens security operations while supporting long-term resilience and digital growth.

Future Outlook: The Next Phase of AI-Driven Security in BFSI

The future of BFSI security automation is moving toward deeper autonomy, stronger prediction capabilities, and tightly governed intelligence. Based on industry outlooks for 2026, AI will no longer function as an isolated security enhancement. Instead, it will become a core operational layer embedded across fraud prevention, risk management, and security operations.

From rule-based automation to agentic intelligence

The first major shift is the transition from rule-based automation to agentic AI. Traditional automation executes predefined instructions, while agentic systems can reason, plan, and take goal-oriented actions across multiple systems. This marks a fundamental change in how security decisions are made in BFSI environments.

According to Retail Banker International, by 2026, BFSI organizations are shifting modernization efforts toward “governed intelligence”, where AI systems are granted higher autonomy but operate within strict regulatory and ethical boundaries. This reflects growing confidence in AI’s reliability while acknowledging the need for oversight.

In security contexts, agentic intelligence enables:

- Automated prioritization of risks across fraud, cyber, and compliance domains

- Context-aware decision-making that adapts to changing threat conditions

- Reduced dependence on static rules that quickly become outdated

This evolution allows BFSI institutions to respond faster and more intelligently to complex, multi-layered threats.

Agentic automation transforming security operations

Agentic automation builds on intelligent decision-making by enabling AI systems to execute end-to-end security workflows autonomously. Instead of generating alerts that require manual follow-up, agentic systems can investigate, validate, and respond to incidents independently.

EBO.ai notes that by 2026, financial institutions adopting agentic AI will focus on systems with memory, reasoning, and execution capabilities, particularly in fraud detection, transaction monitoring, and operational risk management.

In BFSI security operations, this leads to:

- Autonomous investigation of suspicious activity across multiple systems

- Dynamic adjustment of access controls and transaction limits

- Continuous improvement of response strategies based on historical outcomes

Agentic automation reduces operational friction and allows security teams to focus on strategic oversight rather than repetitive tasks.

Predictive security. Anticipating threats before they occur

Predictive security represents another major advancement in AI-driven BFSI protection. Instead of reacting to incidents after they happen, predictive models analyze patterns to forecast risks in advance.

The Economic Times reports that by 2026, AI will play a central role in predicting fraud, credit risk, and operational threats by analyzing transactional, behavioral, and contextual data at scale.

Predictive security enables BFSI organizations to:

- Identify high-risk transactions or users before fraud occurs

- Detect early warning signals of system compromise or misuse

- Proactively apply controls rather than reacting to losses

This shift significantly reduces financial exposure and improves resilience in fast-moving digital environments.

The emergence of self-healing security systems

Self-healing security systems extend predictive capabilities by automatically remediating issues when risks are detected. These systems act without waiting for human intervention, which is critical in high-volume BFSI environments.

Self-healing actions may include:

- Automatically isolating compromised accounts or services

- Resetting credentials or revoking access when anomalies appear

- Triggering compliance remediation workflows in real time

As threat volumes grow, self-healing security reduces response times and limits the operational impact of incidents, making large-scale protection more sustainable.

Preparing BFSI organizations for autonomous security operations

Adopting autonomous security requires organizational readiness beyond technology. BFSI institutions must prepare governance models, data foundations, and workforce structures to support higher AI autonomy.

Key preparation areas include:

- High-quality, well-governed data to ensure reliable AI decisions

- Clear accountability for AI-driven actions and outcomes

- Human-on-the-loop models where experts supervise and validate AI behavior

EBO.ai emphasizes that institutions combining autonomy with explainability and regulatory alignment will be better positioned to scale AI safely and competitively by 2026.

Overall, the next phase of AI-driven security in BFSI will be defined by agentic automation, predictive intelligence, and self-healing systems operating within strong governance frameworks. Organizations that prepare early will gain a decisive advantage in resilience, compliance, and long-term digital trust.

Why BFSI Organizations Should Choose SmartDev for Security Automation

For BFSI organizations aiming to scale security through automation, SmartDev stands out for three clear and practical reasons. Each reason reflects real operational needs in regulated financial environments.

1. Automation-first DNA across security and quality

1. Automation-first DNA across security and quality

SmartDev approaches security and software quality with an automation-first mindset. Instead of relying on manual testing and reactive controls, SmartDev embeds automation throughout development and delivery pipelines. This allows BFSI organizations to scale secure systems efficiently while reducing human error and operational overhead.

What this means for BFSI teams:

- Consistent security and quality at scale

- Faster release cycles without increased risk

- Reduced dependence on manual security processes

2. Strong AI-powered development capabilities

SmartDev goes beyond basic automation by applying AI to software development and security workflows. These capabilities support intelligent decision-making, predictive analysis, and adaptive automation. As BFSI threats evolve, AI-powered systems help institutions move from reactive defense to proactive risk management.

Key advantages:

- Support for intelligent fraud and anomaly detection

- Predictive risk assessment and automation workflows

- Scalable architectures ready for future AI-driven security

3. Proven fit for regulated BFSI environments

Security automation in BFSI must meet strict regulatory, compliance, and data protection requirements. SmartDev designs solutions with governance, transparency, and auditability in mind, ensuring automation strengthens compliance rather than creating new risks.

Why this matters:

- Automation aligned with regulatory expectations

- Secure handling of sensitive financial data

- Long-term security maturity, not short-term fixes

Together, these three strengths make SmartDev a trusted partner for BFSI organizations seeking to scale security through intelligent, compliant, and future-ready automation.

Conclusion

BFSI security automation is no longer optional as financial institutions face escalating cyber risks, regulatory pressure, and operational complexity. AI-driven automation allows organizations to scale protection efficiently by improving threat detection, accelerating response, and maintaining continuous compliance. By embedding intelligence across security workflows, BFSI organizations can reduce manual effort, improve accuracy, and build resilient defenses that support ongoing digital transformation.

As the industry moves toward predictive, agentic, and autonomous security models, early adoption will be a key differentiator. Now is the time for BFSI leaders to evaluate their security maturity and invest in automation-first strategies that deliver long-term value.

If you are looking to accelerate BFSI security automation with proven AI and automation expertise, connect with SmartDev to explore how intelligent automation can strengthen your security operations and prepare your organization for the future.

1. Fraud detection and transaction monitoring

1. Fraud detection and transaction monitoring 1. Reduced response time and operational costs

1. Reduced response time and operational costs Step 1. Assess organizational readiness and security maturity

Step 1. Assess organizational readiness and security maturity

1. Automation-first DNA across security and quality

1. Automation-first DNA across security and quality