The term digital asset once belonged to crypto enthusiasts and early adopters. Today, it’s at the heart of financial transformation. From tokenized securities to blockchain-based infrastructure, digital assets are changing how organizations store, transfer, and grow value.

This article explores what digital assets are, why they matter, and how technology and institutions are converging around them. It also features insights from the Ctrl Shifter Podcast, where Wave Chan Wei Jie shared his personal journey: a story that perfectly illustrates how attitudes toward digital assets have evolved in less than a decade.

What Is a Digital Asset?

A digital asset is any item of value that exists in a digital form and carries verifiable ownership. Unlike a typical file or record, it is secured through cryptographic methods and often lives on decentralized networks.

Examples include:

- Cryptocurrencies such as Bitcoin or Ethereum

- Stablecoins pegged to fiat currencies

- Non-fungible tokens (NFTs)

- Tokenized real-world assets such as real estate or equities

- Digital securities issued on blockchain platforms

The defining feature of a digital asset is trust through technology. Ownership and authenticity are verified by code, not by a central intermediary.

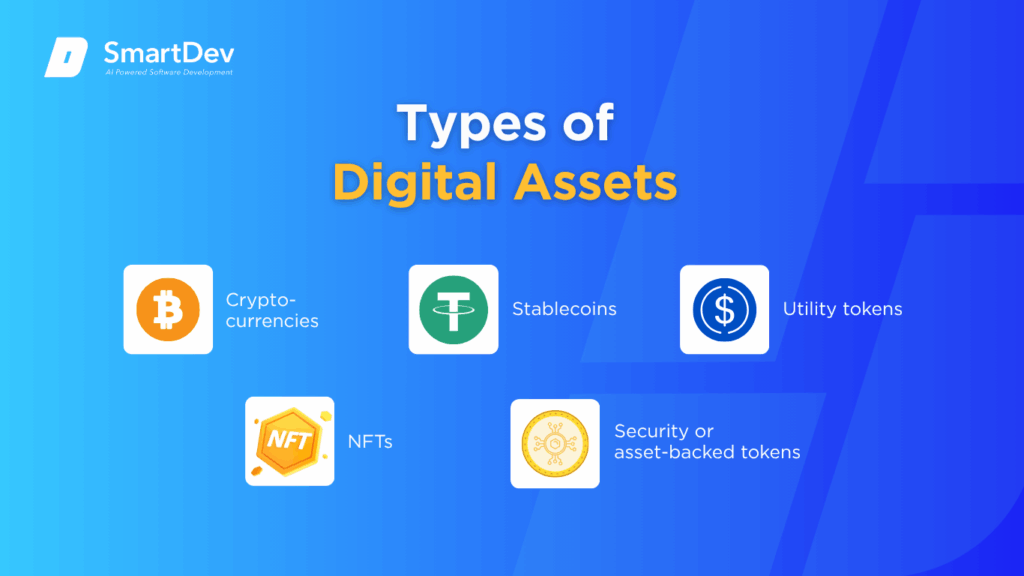

Types of Digital Assets

Digital assets now span multiple categories, each serving different purposes in today’s economy:

- Cryptocurrencies: Digital currencies designed for peer-to-peer transactions.

- Stablecoins: Pegged to stable assets to reduce volatility.

- Utility tokens: Used within a network to access products or services.

- Security or asset-backed tokens: Represent fractional ownership in regulated assets.

- NFTs: Unique tokens used for art, identity, and intellectual property.

This diversity shows how digital assets are expanding far beyond speculative trading into infrastructure for new digital economies.

Why Digital Assets Matter Today

Digital assets represent more than a financial innovation — they’re a shift in how value is created and transferred.

Im Ctrl Shifter Podcast, Wave Chan Wei Jie shared a story that captures this transformation. Years ago, during a dinner with trading friends, he dismissed Bitcoin as a passing trend. Fast-forward eight years, and he now leads digital-asset initiatives for financial institutions.

“Back in the day, banks wouldn’t even open accounts for crypto guys,” Wave recalled. “Now they’re redesigning their onboarding and due-diligence frameworks to make sure they’re not missing out on new wealth.”

This change is not isolated. Major banks like JPMorgan are developing crypto-backed loans and blockchain-secured systems. The shift marks a generational change in finance, where digital assets move from skepticism to strategic adoption.

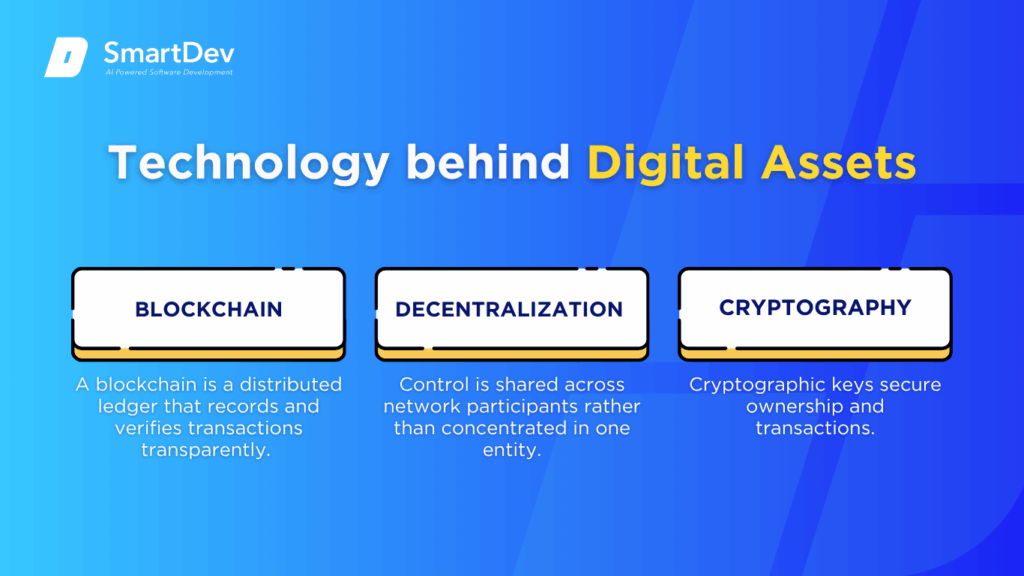

The Technology Behind Digital Assets

Three technological foundations enable the digital-asset ecosystem: blockchain, decentralization, Und cryptography.

Blockchain

A blockchain is a distributed ledger that records and verifies transactions transparently. It removes the need for central authorities and ensures data integrity.

Dezentralisierung

Control is shared across network participants rather than concentrated in one entity. This structure improves resilience and security but raises new regulatory questions.

Cryptography

Cryptographic keys secure ownership and transactions. They verify identity, prevent tampering, and ensure that digital assets remain unique and authentic.

Together, these technologies create an open financial architecture capable of running securely at a global scale.

Digital Assets as Investments

Digital assets have evolved into a legitimate asset class, drawing both retail and institutional investors. Their appeal lies in diversification, liquidity, and accessibility. Blockchain technology allows fractional ownership and 24/7 markets, removing many barriers of traditional finance.

Yet, investors must understand what they’re truly buying:

- Cryptocurrencies may serve as stores of value or speculative assets.

- Tokenized assets represent ownership in tangible instruments, such as equities or property.

- Decentralized finance (DeFi) products offer yield or lending opportunities outside traditional banking systems.

While the potential returns can be significant, digital asset investments demand careful analysis. The lack of mature regulation and the pace of innovation make it essential for investors to balance ambition with prudence.

Key Investment Risks to Consider

Like any emerging asset class, digital assets carry real risks that investors and institutions must manage carefully.

- Regulatory uncertainty: Laws and compliance requirements continue to evolve. Sudden changes in jurisdictional rules can impact asset value and legality.

- Market volatility: Prices are highly sensitive to sentiment, technology updates, and macroeconomic events.

- Security vulnerabilities: Despite advances in cybersecurity, hacks and fraud remain threats — particularly in unregulated or newer exchanges.

- Liquidity risk: Some digital assets lack active markets, making them difficult to trade at fair value when needed.

Prudent investors mitigate these risks through diversification, partnering with regulated custodians, and maintaining strong compliance frameworks.

Institutional Adoption: A Generational Shift

One of the clearest takeaways from the Ctrl Shifter Podcast is how dramatically institutional attitudes have changed.

Not long ago, traditional banks distanced themselves from anything related to crypto. Today, they are re-engineering systems to participate in blockchain-based markets. This evolution mirrors what happened with cloud computing and artificial intelligence — once doubted, now indispensable.

As Wave Chan Wei Jie noted, organizations that resist technological shifts risk obsolescence. Those that adapt, however, position themselves at the forefront of innovation and new revenue models.

Abschließende Gedanken

The journey of digital assets — from fringe experiment to institutional priority — marks one of the most rapid transformations in modern finance. It’s no longer just about cryptocurrency; it’s about the digitalization of value itself.

As the Ctrl + Shifter podcast conversation revealed, this shift is both technological and cultural. Professionals once skeptical of Bitcoin now drive adoption strategies for global banks. That evolution signals a broader truth: the future of finance belongs to those who can bridge the old and the new.

Digital assets aren’t replacing traditional finance; they’re redefining it. The real question for leaders today is not whether to engage with digital assets — but how soon.