The Generative AI revolution is transforming the Banking, Financial Services, and Insurance (BFSI) sector across the Gulf Cooperation Council (GCC) countries at an unprecedented pace. As financial institutions in the UAE, Saudi Arabia, Qatar, Bahrain, Kuwait, and Oman race to adopt cutting-edge AI technologies, the region has emerged as one of the most dynamic markets for artificial intelligence innovation globally.

The global generative AI in BFSI market was valued at USD 1.90 billion in 2025 and is projected to reach USD 18.52 billion by 2034, representing a remarkable compound annual growth rate (CAGR) of 27.70%. Within the GCC specifically, the overall AI market is forecast to grow from USD 12.3 billion in 2025 to USD 26.0 billion by 2032, reflecting the region’s strong commitment to digital transformation.

More significantly, AI has the potential to contribute up to USD 320 billion to the Middle East economy by 2030, with banking alone capable of adding 13.6% to GCC GDP. These figures underscore not only the economic opportunity but also the strategic imperative for financial institutions to embrace generative AI technologies.

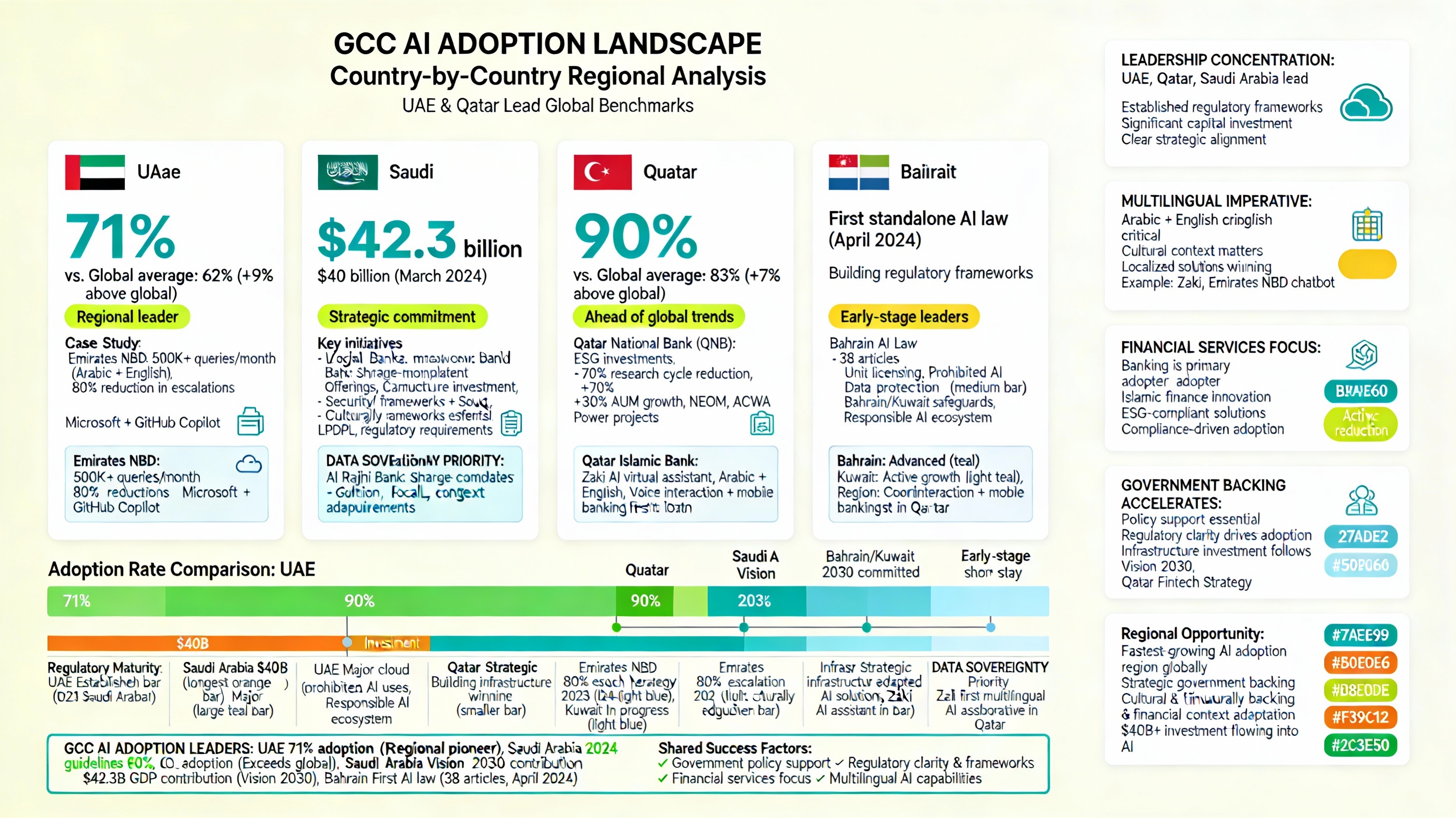

Regional Adoption Landscape: Country-by-Country Analysis

United Arab Emirates: The AI Pioneer

The United Arab Emirates has established itself as the clear regional leader with an AI adoption rate of 71%—significantly higher than the global average of 62%. This success stems from a powerful combination of supportive government policies, advanced digital infrastructure, and a culture that actively encourages innovation and experimentation.

Emirates NBD, one of the region’s leading banks, has deployed an AI chatbot that handles over 500,000 queries monthly in both Arabic and English, reducing escalations to human support staff by 80%. The bank has also entered into a strategic partnership with Microsoft to integrate GitHub Copilot, Microsoft 365 Copilot, and ChatGPT into its operations, marking a major leap forward in comprehensive GenAI application.

The UAE’s Personal Data Protection Law (PDPL) requires banks to store all customer transaction data domestically, creating significant infrastructure requirements but also ensuring data sovereignty and information security. This regulatory framework has spurred investment in local cloud infrastructure and positioned the UAE as a hub for secure financial technology solutions.

Saudi Arabia: Vision 2030 and Strategic AI Investment

Saudi Arabia is aggressively pursuing AI adoption as part of its Vision 2030 initiative, with GenAI expected to contribute approximately USD 42.3 billion to the national GDP. The government announced a USD 40 billion investment fund dedicated exclusively to AI in March 2024, demonstrating unwavering commitment to this technology.

Saudi National Bank is leveraging AI to develop innovative financial products tailored to Saudi Arabia’s unique market characteristics, including Sharia-compliant financial offerings. The Saudi Data and Artificial Intelligence Authority (SDAIA) issued AI Ethics Principles and GenAI guidelines in 2024, creating a clear framework for responsible AI deployment.

Al Rajhi Bank, one of the world’s largest Islamic banks, uses GenAI to analyze spending patterns at local markets like the camel market and Souq Al Haraj, enabling culturally relevant personalized offers. This demonstrates how AI in financial services can be adapted to local contexts and cultural nuances.

Qatar: Accelerating Beyond Global Benchmarks

Qatar has impressed with 90% of CEOs adopting GenAI in the past year—significantly higher than the 83% global average, positioning Qatar ahead of global trends. The Qatar Fintech Strategy 2023 supports innovation in financial services through four pillars: advanced infrastructure, fintech growth prioritization, business empowerment, and cashless transaction support.

Qatar National Bank (QNB) established an AI Research Hub to identify ESG-compliant investment opportunities by analyzing regional developments such as NEOM’s hydrogen targets and ACWA Power’s project portfolio. This approach has shortened research cycles by 70% and increased assets under management from institutional Kuwaiti clients by 30%.

Qatar Islamic Bank launched Zaki, Qatar’s first AI virtual assistant supporting both English and Arabic, with plans to expand voice interaction capabilities and full mobile banking support. This reflects the critical importance of multilingual capabilities in GCC markets.

Bahrain and Kuwait: Active Participants in AI Transformation

Bahrain enacted the region’s first standalone AI law in April 2024, featuring 38 articles covering AI development and use. The law establishes an AI Unit to license AI activities and enforce regulations, including prohibitions on certain AI uses and data privacy safeguards.

Kuwait and other GCC countries are also actively building AI regulatory frameworks and investing in AI infrastructure, though at earlier stages compared to the UAE, Saudi Arabia, and Qatar. The region as a whole is demonstrating strong governmental support for digital transformation in banking.

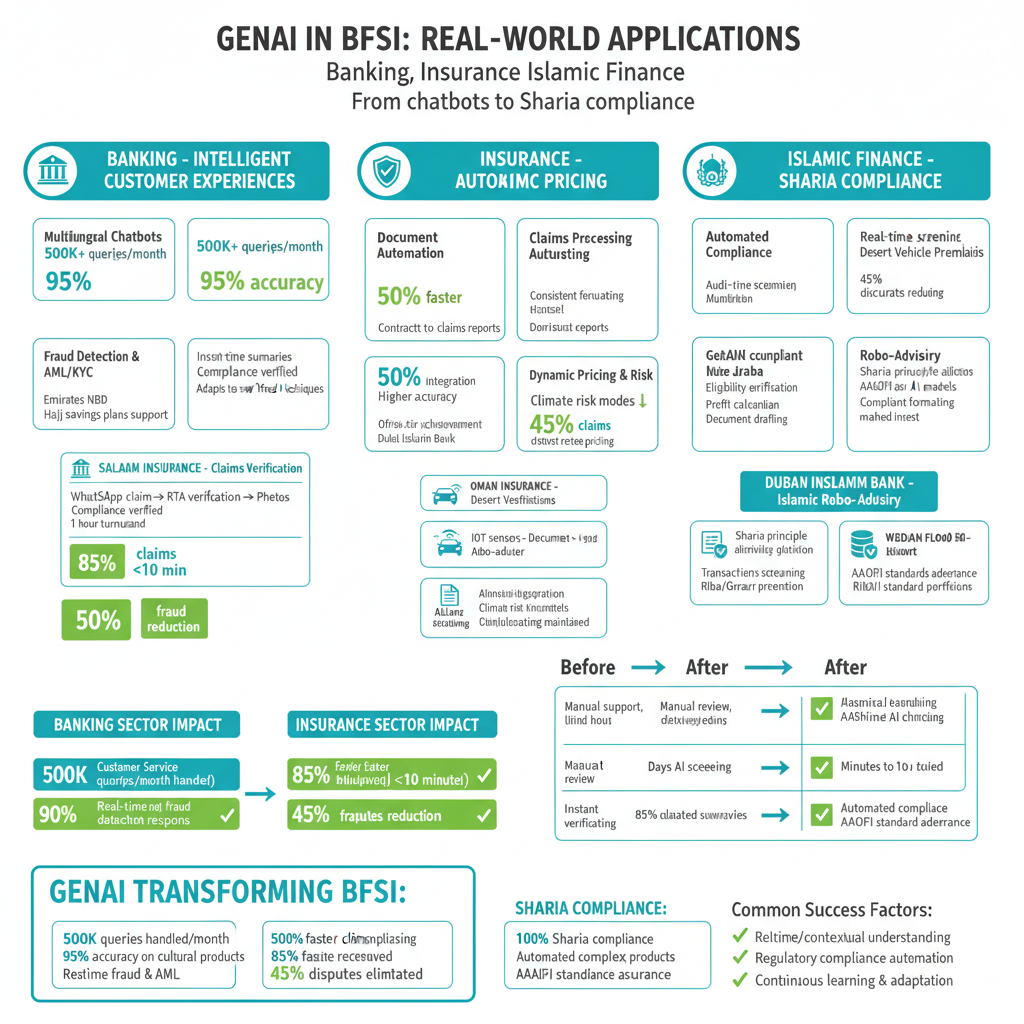

Transformative GenAI Applications in BFSI: From Theory to Practice

Banking: Intelligent and Personalized Customer Experiences

Multilingual Chatbots and Virtual Assistants

GenAI is revolutionizing banking customer service through intelligent chatbots supporting both Arabic (including local dialects) and English. These systems don’t just answer questions—they can execute transactions, provide financial advice, and maintain conversational context across multiple channels.

Emirates NBD has demonstrated the power of this approach with its ability to handle 500,000+ monthly queries, achieving 95% accuracy in resolving questions about Hajj savings plans—a highly culturally specific financial product. This level of conversational AI requires deep understanding of both language and cultural context.

Fraud Detection and AML/KYC Compliance

GenAI provides superior fraud detection capabilities by processing and analyzing data in real-time, instantly identifying and responding to suspicious activities. Generative models can continuously learn and adapt from new data, improving detection capabilities over time and staying ahead of evolving fraud techniques.

Salama Insurance used AI to validate car insurance claims by cross-referencing traffic authority databases and repair invoices submitted via WhatsApp. When a Dubai customer reported a collision, AI verified details by analyzing data from RTA’s Hayyak app and timestamped vehicle damage photos within one hour. This AI-driven approach led to 85% of claims being settled in under 10 minutes and a 50% reduction in fraud rates in Sharjah.

Credit Decisioning and Loan Approval

GenAI helps organize income information, credit history, and risk checks, creating clear summaries for credit teams. Systems can:

- Gather VAT records, POS data, salary transfers, and bank statements

- Analyze cash flow patterns and seasonality

- Prepare risk notes and decision summaries for credit teams

- Verify compliance with KSA and UAE lending regulations

- Support Sharia-compliant products by checking contract rules and profit structures

This aligns perfectly with SmartDev’s expertise in fintech solutions that streamline complex financial processes.

Insurance: Automation and Dynamic Pricing

Automated Document Processing and Claims

Insurance companies manage thousands of documents, from contracts to claims reports. GenAI generates these documents automatically while maintaining consistent tone, structure, and compliant formatting. Document generation automation not only improves processing time but also ensures higher accuracy in customer-facing and regulatory documents.

Allianz achieved a 50% reduction in claims processing time thanks to simpler information structuring through GenAI solutions. Similar document processing capabilities are available through SmartDev’s insurance automation services.

Dynamic Pricing and Risk Assessment

Oman Insurance integrates IoT data from desert vehicle sensors with AI to dynamically adjust premiums based on off-road driving patterns. Additionally, AI-driven climate models, such as those developed by King Abdullah University, are used to predict flood risks for properties in Jeddah, leading to a 45% reduction in claims disputes.

Islamic Finance: Sharia-Compliant GenAI

Automated Compliance Checking

AI is revolutionizing Islamic finance by automating compliance checks, reducing manual workload, and increasing audit accuracy. Dubai Islamic Bank has deployed AI-powered compliance solutions to screen transactions according to Sharia principles, ensuring financial activities are free from Riba (interest), Gharar (excessive uncertainty), and haram investments.

Complex Islamic Financial Product Processing

AI supports complex Islamic financial products including:

- Murabaha, Ijara, and Mudaraba applications

- Eligibility verification according to Sharia Board guidelines

- Profit calculation with precise formulas

- Verification that contract steps follow the correct sequence

- Drafting standardized Sharia-compliant documents

Wahed Invest, an Islamic fintech company, leverages machine learning algorithms to provide Sharia-compliant robo-advisory services, optimizing investment portfolios while adhering to AAOIFI standards. This demonstrates the growing intersection of AI development services and Islamic finance.

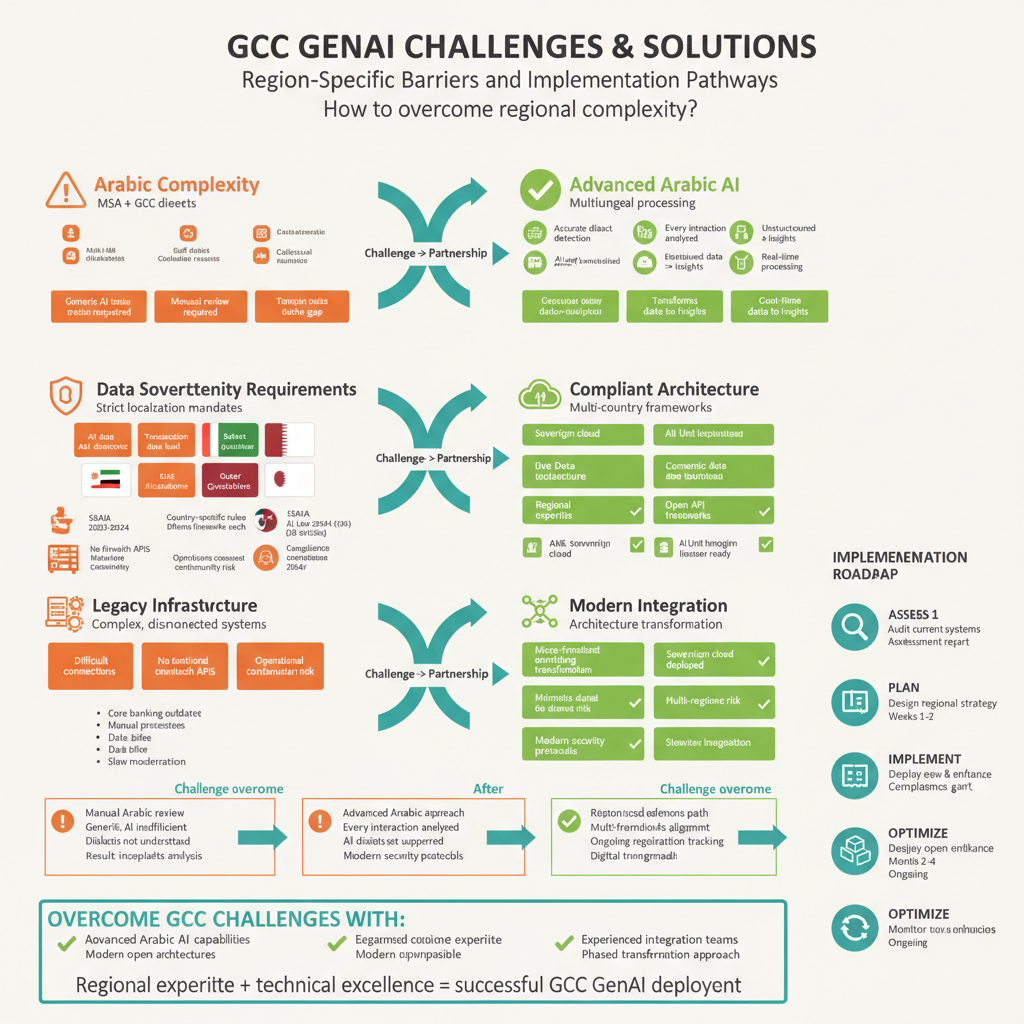

Region-Specific Challenges and Implementation Solutions

Language Requirements: Complex Arabic Processing

One of the biggest challenges in deploying GenAI in the GCC is the ability to process Arabic—not just Modern Standard Arabic (MSA) but also diverse GCC dialects. Conventional AI systems often struggle with the complexity of Arabic dialects, and financial institutions frequently must rely on manually reviewing a small fraction of customer calls.

Visa partnered with intella to deliver advanced Arabic conversational AI to MENA banks, helping close the critical “intelligence gap” that generic AI tools often fail to address. These solutions enable banks to accurately analyze every customer interaction, transforming unstructured call data into actionable insights.

For organizations looking to implement Arabic-capable AI solutions, partnering with experienced providers who understand regional linguistic nuances is essential.

Data Sovereignty and Regulatory Compliance

Domestic Data Storage Requirements

GCC countries have enacted strict data sovereignty requirements:

- Saudi Arabia: Requires all personal data to remain within the Kingdom. Banks, healthcare providers, and government contractors face the strictest scrutiny

- UAE: Banks must store all customer transaction data domestically. The government has partnered with AWS to create a “sovereign cloud” that keeps government data within national borders while leveraging global cloud capabilities

- Bahrain: The 2018 Personal Data Protection Law (PDPL) and “Cloud Law” prioritize data localization for government data

AI Regulatory Frameworks

Each GCC country is developing distinct AI regulatory frameworks:

- Saudi Arabia: SDAIA issued AI Ethics Principles (2023), GenAI Guidelines (January 2024), and AI Adoption Framework (September 2024)

- Bahrain: Region’s first AI law (April 2024) with 38 articles establishing an AI Unit to license AI activities

- Qatar: Central Bank AI Guidelines for licensed financial institutions (September 2024)

- UAE: UAE AI Charter and Abu Dhabi Data Enablement Program demonstrate the region’s commitment to ethical AI use

Organizations implementing AI in the GCC must ensure compliance with these evolving frameworks, making regulatory expertise a critical component of any AI strategy.

Legacy System Integration

Many GCC banks still operate on complex legacy systems that don’t easily connect with modern fintech APIs. Bridging this technology gap requires both parties to invest in open architectures and secure data-sharing protocols.

Successful banks are adopting micro-frontend architectures, core banking transformation, and cloud integration to modernize infrastructure while maintaining operational continuity. SmartDev’s custom software development services specialize in exactly these types of complex integration challenges.

Partnership Ecosystem: Banks, Fintechs, and Technology Providers

Strategic Collaboration Models

Rather than competing, banks and fintechs in the GCC are increasingly partnering to leverage each other’s strengths. The result is a new hybrid ecosystem delivering faster, smarter, and more personalized financial services.

Why Collaboration Has Become a Strategic Necessity:

- Accelerating Digital Transformation: For established financial institutions, partnering with fintech companies provides a shortcut to digital readiness. Instead of spending years building new technology in-house, they can integrate proven fintech solutions and transform customer experiences in months

- Expanding Reach and Inclusion: Fintechs often design solutions targeting underbanked populations and small businesses. Through partnerships, banks can access new customer segments

- Enhancing Regulatory Compliance and Security: Through partnerships, banks ensure their digital services align with national compliance standards, while fintechs gain guidance and structure from organizations with decades of regulatory experience

Real-World Collaboration Examples

- Qatar: Local banks partner with fintech startups to streamline digital KYC and introduce smart wealth management solutions

- UAE: The UAE Central Bank has launched initiatives encouraging banks and fintechs to co-develop blockchain-based payment systems and AI-powered fraud detection tools

- Saudi Arabia: Through Fintech Saudi, financial institutions collaborate with tech startups to pilot and scale innovative solutions under a regulated sandbox environment

- Bahrain: Fintech Forward 2025 signed 38 industry-shaping partnerships, including successful trials of Google Cloud’s new payments infrastructure

Ecosystem Investment and Funding

The MENA region has become a global technology investment hub, with fintech and AI accounting for over 60% of venture capital flows. In H1 2025, MENA fintechs raised USD 598 million across 93 deals, processing over USD 240 billion in transactions.

Notable investment funds include:

- Presight-Shorooq Fund I: USD 100 million targeting AI ventures from early to growth stage

- Saudi Vision 2030 AI Fund: USD 40 billion dedicated to AI investment

- PayPal: Committed USD 100 million investment in the Middle East and Africa

For technology providers like SmartDev targeting GCC market expansion, understanding this ecosystem is crucial for successful market entry.

Ready to cut defect costs by $1.25M annually with computer vision?

Most manufacturers overshoot budgets by 40-60% on first deployment. SmartDev helps you evaluate real CV system pricing, compare costs, and calculate accurate ROI before implementation. Understand hardware ($50K-$150K), software ($30K-$300K), integration complexity, and hidden costs. Build a pilot strategy that delivers 12-18 month payback.

Get transparent pricing, vendor comparison, and ROI analysis tailored to your production line.

Schedule Your Manufacturing AI Cost Analysis TodayWhy SmartDev Is the Ideal Partner for GCC Market Expansion

Deep BFSI and AI Expertise

SmartDev has established itself as a trusted technology partner for the BFSI sector through extensive experience developing AI and machine learning solutions. With a team of over 250 Vietnamese technology experts at development centers in Da Nang and Hanoi, SmartDev delivers a unique combination of high-end technical expertise and cost efficiency.

SmartDev’s Applied AI Lab specializes in developing custom AI solutions for multiple industries, from banking and finance to telecommunications, manufacturing, and retail. The comprehensive, future-oriented approach aims to leverage AI’s transformative power to optimize operations, dramatically enhance efficiency, and significantly improve customer experiences.

Comprehensive Technology Solutions

SmartDev offers a comprehensive suite of technology solutions specifically suited to GCC BFSI market requirements:

Blockchain and Decentralized Finance (DeFi)

- Secure and efficient blockchain systems for recording transactions and managing assets

- Explorer-Chain for real-time transaction tracking and verification

- Cloud Exchange Network (CEN) for secure cloud-based transactions

- DeFi wallets for secure digital asset storage and management

- Decentralized applications (DApps) on blockchain

eKYC and Compliance

- Electronic Know Your Customer (eKYC) solutions to streamline identity verification

- Improved security and compliance in digital transactions

- Automated KYC/AML processes from initial alert to case closure

API and Integration Services

- API Portal services enabling easy blockchain technology integration and interaction

- Average API response time of 300ms (reduced from 2.1 seconds)

- Support for up to 2,500 concurrent credit check requests (increased from 800)

- These capabilities align perfectly with GCC banking sector needs for modern, scalable technology infrastructure.

Proven Track Record of Success

Case Study 1: Malaysian Credit Agency

SmartDev deployed 7 Senior Backend Engineers and 2 Front-End Developers specializing in Next.js to comprehensively transform the platform for Malaysia’s leading credit agency.

Achieved Results:

- API response time for credit report queries averaged 300ms (reduced from 2.1 seconds)

- Platform now supports up to 2,500 concurrent credit check requests without performance degradation (previously limited to 800)

- User satisfaction score reached 90% based on post-deployment surveys

- Achieved ISO 27001 certification for information security management

- Zero security incidents throughout the 18-month transformation period

- This case study demonstrates SmartDev’s ability to deliver enterprise-grade solutions for financial institutions, similar to what GCC banks require.

Case Study 2: BFSI Data Structure and Reporting Optimization

SmartDev worked with a leading financial services company to enhance reporting capabilities through AI-driven data structure improvements. The client’s existing data management system was cumbersome and inefficient, making it difficult to extract valuable insights in a timely manner.

SmartDev implemented an intelligent data structuring system enabling better organization and faster retrieval of financial data. Using advanced machine learning algorithms, the new system could process large datasets, identify patterns, and automatically generate real-time reports. This transformation helped the client significantly reduce reporting time and improve insight quality.

Case Study 3: Insurance Document Processing Improvement

SmartDev helped an insurance company automate claims document processing using AI technology, significantly improving both accuracy and processing speed while reducing manual data entry and assessment needs.

These real-world examples showcase SmartDev’s generative AI development capabilities that directly address GCC BFSI challenges.

Vietnam’s Competitive Advantages in the GCC Market

Superior Cost Efficiency

Offshore software development in Vietnam is renowned as the most cost-effective outsourcing choice. According to CIO Magazine, outsourcing software development in Vietnam is approximately 90% cheaper than hiring American staff, saves 50% compared to China, and 30% compared to India. Vietnam also ranks among “Top 10 Countries to Outsource Software Development in 2020” by Product Coalition.

High Technical Proficiency and Certifications

Vietnam has a well-trained IT engineering workforce with international certifications:

-

Privacy Mark, ISO 27001, CMMI Level 3 certifications

-

AWS and Microsoft certified engineers

-

Partners with AWS, Microsoft, Odoo, Salesforce, ServiceNow, Adobe Magento

-

Over 250+ BrSEs proficient in multiple languages (English, Japanese, Korean, Chinese)

Tech giants like IBM, Sony, LG, Microsoft, and Samsung have relied on Vietnamese engineers for part of their innovation work, proving the quality of Vietnamese programmers against global standards.

Government Support and Favorable Ecosystem

The Vietnamese government actively supports the IT outsourcing industry through preferential policies, infrastructure investment, and human resource development programs. This creates a favorable business environment for international software development projects.

English Proficiency and Cultural Compatibility

Vietnamese developers have good English proficiency, facilitating effective communication with international clients. Vietnam’s professional, progressive, and dedicated work culture is also highly compatible with international business standards.

This makes Vietnam an ideal location for IT outsourcing for the Middle East market, combining quality, cost-effectiveness, and reliability.

SmartDev’s GCC Market Expansion Strategy

SmartDev is strategically positioned to capture strong growth opportunities in the GCC BFSI market through:

1. Deep Understanding of Regional Requirements

- Sharia compliance in Islamic financial solutions

- Arabic and English language processing support

- Compliance with data sovereignty and privacy regulations (PDPL, SDAIA)

- Integration with core banking systems and Islamic finance engines

2. Scalable and Flexible Solutions

SmartDev’s AI solutions are designed to scale as businesses grow, ensuring companies can adjust their AI systems to meet changing needs and market conditions. Micro-frontend architecture and cloud-based solutions enable seamless scaling.

3. Regulatory Compliance and Security

SmartDev prioritizes regulatory compliance, ensuring all AI solutions meet the legal and ethical requirements of the BFSI sector, helping companies minimize risk and avoid costly penalties. This includes:

- Support for local data storage in UAE, Saudi Arabia, or Qatar cloud regions

- Strong encryption, identity controls, audit logs, and secure API practices

- Proven zero security incidents throughout 18-month transformation periods

4. Long-Term Partnership Model

SmartDev works closely with BFSI companies throughout the deployment process, providing consulting services, data preparation, model training, and post-deployment support. This end-to-end service ensures AI models are trained, deployed, and continuously optimized for maximum impact.

5. Continuous Innovation and Research

SmartDev’s Applied AI Lab continuously researches and develops the latest AI technologies, from natural language processing (NLP) and computer vision to predictive analytics. This ensures SmartDev’s solutions remain at the forefront of AI innovation and meet the evolving requirements of the GCC market.

Implementation Roadmap for Successful GenAI Deployment in BFSI

Phase 1: Assessment and Strategy (Months 1-2)

Current State Assessment

- Audit existing technology infrastructure and legacy systems

- Assess data readiness and quality levels

- Identify operational pain points and improvement opportunities

- Evaluate internal AI skill levels

Business Objectives Definition

- Identify priority use cases (chatbots, fraud detection, KYC, etc.)

- Establish clear KPIs and success metrics

- Estimate ROI and payback period

- Secure support from senior leadership

Regulatory Compliance Assessment

- Review PDPL, SDAIA requirements and local AI regulatory frameworks

- Plan for data sovereignty and local storage requirements

- Establish AI governance and ethics protocols

Phase 2: Pilot Program (Months 3-5)

Pilot Use Case Selection

- Start with high-impact, low-risk projects

- Focus on problems with well-defined scope and measurable success metrics

- Prioritize use cases aligned with strategic business objectives

Data and Infrastructure Preparation

- Clean and structure training data

- Set up secure cloud infrastructure (on-premise, private cloud, or hybrid)

- Implement data pipelines for clean and reliable input

- Ensure integration with core banking systems and CRM

Development and Testing

- Build AI models for pilot use cases

- Conduct thorough testing with representative datasets

- Collect feedback from users and stakeholders

- Iterate and refine based on test results

Phase 3: Scaling and Integration (Months 6-9)

Production Deployment

- Deploy successful pilot AI solutions to production

- Establish continuous monitoring and alerting

- Implement human-in-the-loop mechanisms for high-risk AI systems

- Ensure backup and disaster recovery

System Integration

- Seamlessly integrate with core banking platforms, CRM systems, and risk management tools

- Establish secure APIs for inter-system communication

- Ensure data synchronization and consistency

- Thoroughly test end-to-end integration scenarios

Training and Change Management

- Comprehensive staff training on new tools and processes

- Develop user documentation and guides

- Establish support channels for user adoption

- Manage stakeholder expectations and communicate benefits

Phase 4: Optimization and Expansion (Months 10-12)

Performance Monitoring

- Track KPIs and business metrics

- Analyze user feedback and satisfaction levels

- Identify areas for improvement and optimization

- Detect and address model drift issues

Continuous Optimization

- Refine AI models based on production data

- Update training datasets with new information

- Improve model accuracy and performance

- Expand to additional use cases and departments

AI Capability Expansion

- Identify new AI opportunities based on initial success

- Build AI center of excellence or dedicated team

- Establish processes for continuous AI experimentation and deployment

- Create culture of AI innovation and experimentation

Phase 5: Enterprise Transformation (Year 2+)

Enterprise-Wide AI Integration

- Embed AI into core business processes

- Develop new AI-based products and services

- Create hyper-personalized customer experiences

- Transform operating model into AI-driven organization

Partnership Ecosystem

- Collaborate with fintech companies and technology providers

- Participate in open banking and embedded finance initiatives

- Share insights and best practices across the industry

- Co-create solutions with customers and partners

Organizations looking to implement this roadmap successfully can partner with experienced providers like SmartDev who specialize in AI-powered software development.

Future Trends: Shaping the GCC BFSI Industry Through 2030

Agentic AI: The Next Generation of Intelligent Automation

Agentic AI – autonomous systems capable of making independent decisions within carefully defined parameters—is emerging as the next trend in the GCC BFSI industry. In the Gulf region, recent findings show 19% of organizations have moved from pilots to Agentic AI deployment.

Early applications include Fatema Digital, an emotionally intelligent customer service chatbot developed by Bank ABC, demonstrating the region’s focus on culturally aware AI. This represents a significant evolution beyond simple chatbot implementations.

Tokenization and Digital Assets

Tokenization—creating digital tokens representing assets on distributed ledgers—is gaining momentum thanks to its ability to enhance liquidity, improve accessibility, and reduce costs. The Arab Monetary Fund estimates the MENA open banking market was worth USD 350-420 million in 2022 and forecasts 25% annual growth to reach USD 1.17 billion by 2027.

The UAE has established itself as a hub for blockchain and cryptocurrency innovation, receiving over USD 30 billion in cryptocurrency transactions and launching the first AED-backed stablecoin in December 2024. This aligns with growing interest in blockchain custom development across the region.

FinAI: The New Generation of Financial Services

As we enter the AI era, new business models, products, services, and partnerships will be necessary in the financial sector. Banks, trusted with vast amounts of data, are uniquely positioned to develop new use cases for emerging AI innovations.

A new generation of AI-native financial services companies—FinAI—are likely to emerge to challenge both banks and Fintechs. Building on this foundation, digital-only banks in the GCC like ila Bank in Bahrain and E20 in the UAE have demonstrated the region’s readiness for financial innovation.

Open Banking and Embedded Finance

2025 marks the deployment of open banking frameworks across GCC markets, following models established in the UK and Europe. The UAE, Saudi Arabia, and Bahrain have announced open finance regulations, with eight major UAE banks deploying open finance systems in 2025.

Open banking enables data sharing between banks and third-party service providers, especially fintechs, who can introduce products to customers. This creates a more competitive environment but also delivers significant benefits to consumers: easier everyday banking, more accessible financial services, and better value for money.

Financial institutions preparing for this shift can benefit from SmartDev’s API integration expertise to ensure seamless connectivity.

Sovereign AI and Sovereign Cloud

Saudi Arabia has introduced proposals designed to encourage foreign investment in data centers, offering other countries and international technology providers the ability to process data they store in KSA according to foreign legal frameworks.

The Global AI Hub law’s main purpose is to position KSA as “a global digital hub and pioneer in advanced technology by promoting an attractive environment for foreign governments and private sector organizations to develop and adopt those technologies for peaceful purposes and use”.

This sovereign AI approach, combined with data sovereignty requirements, creates both challenges and opportunities for technology providers entering the GCC market.

Conclusion: Seizing the GCC Opportunity with the Right Partner

The GCC generative AI in BFSI market represents an exceptional growth opportunity for organizations looking to leverage advanced AI technologies in one of the world’s most dynamic and prosperous regions. With digital banking growth rates around 20.8% annually—more than double the global average of 9.98%, the opportunity is clear.

SmartDev brings the ideal combination of global technical expertise, deep BFSI understanding, and commitment to delivery excellence. With a proven track record deploying complex AI solutions for the financial sector, combined with Vietnam’s cost and quality advantages, SmartDev is uniquely positioned to support GCC BFSI organizations on their AI transformation journey.

As GCC countries continue investing heavily in digital infrastructure, AI, and fintech innovation, organizations partnering with the right technology providers will be best positioned to capture this significant growth opportunity and lead in the new AI-driven financial era.