Digital transformation spending in fintech is projected to reach $1,009.8 billion by 2025, yet most AI projects fail because teams pick the wrong orchestration framework. Your framework choice doesn’t just affect development speed—it directly impacts transaction processing rates, compliance audit trails, and monthly infrastructure costs.

This analysis reveals performance insights from real fintech deployments, comparing LangChain and LlamaIndex across critical production metrics. We tested both frameworks in environments handling everything from fraud detection workflows to regulatory document processing.

You’ll discover which framework excels at complex financial workflows, achieves better retrieval accuracy for compliance documents, and can reduce operational costs in document-heavy scenarios according to SmartDev’s deployment data.

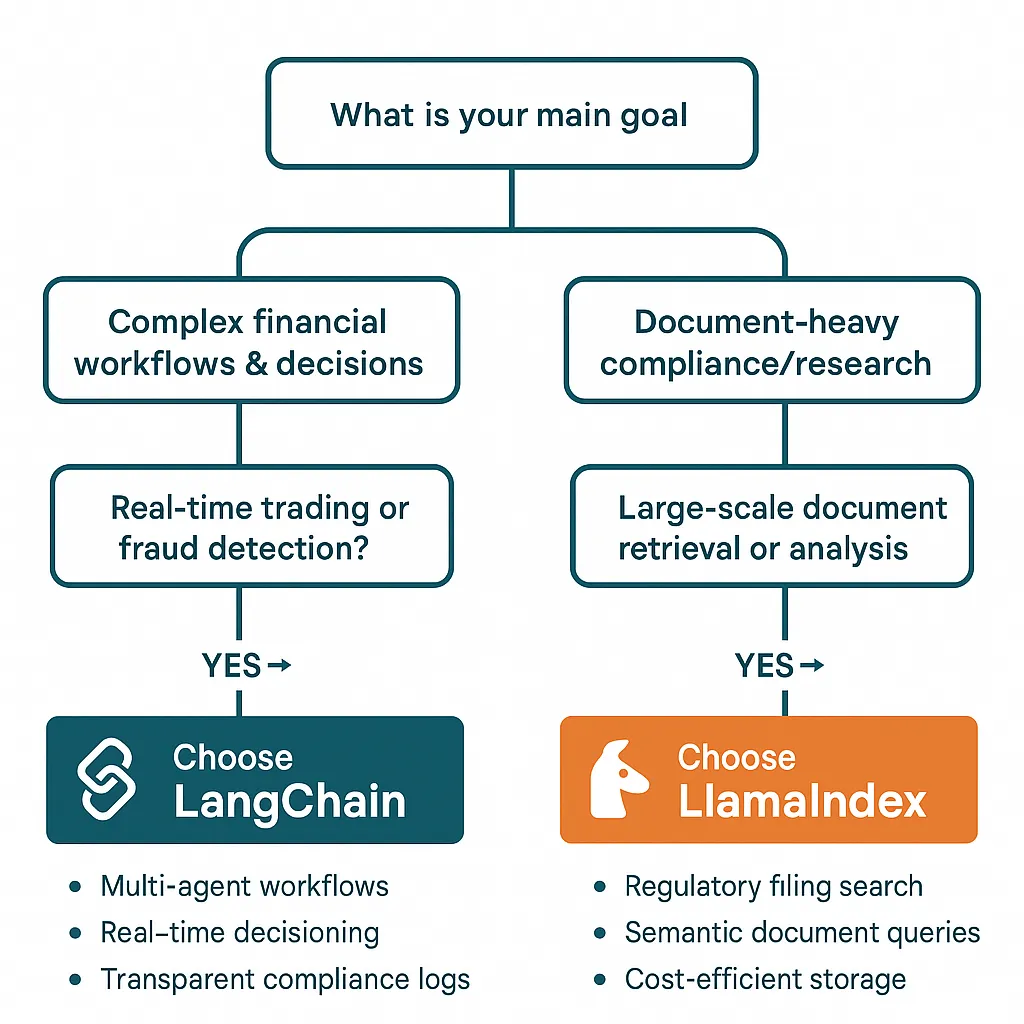

Quick Decision Guide: Which Framework Fits Your Fintech Needs

Choose LangChain when you need:

- Multi-step financial workflows with complex decision logic

- Credit scoring or fraud detection systems

- Real-time trading platforms requiring millisecond responses

- Transparent audit trails for regulatory compliance

Choose LlamaIndex when you need:

- Document-heavy compliance monitoring

- Regulatory filing analysis and search

- Cost-optimized retrieval for large document collections

- Faster semantic search across financial research

Performance reality check: LangChain excels at complex multi-agent financial workflows, while LlamaIndex dominates document retrieval scenarios. SmartDev’s production deployments show framework choice can impact performance significantly and save thousands monthly in infrastructure costs.

Fig1. Framework selection decision tree based on primary use case

Framework Performance Analysis: Where Each Excels in Production

Both LangChain and LlamaIndex handle fintech workloads well, but their performance differs dramatically based on your specific use case. Production benchmarks reveal significant gaps that directly affect your bottom line.

Critical Performance Differences

LangChain processes complex financial workflows more efficiently than LlamaIndex when handling multi-step operations like credit scoring or fraud detection, according to SmartDev’s internal benchmarks. However, LlamaIndex achieves superior retrieval accuracy for regulatory document processing—a crucial advantage for compliance-heavy applications.

Memory consumption patterns also differ substantially. LlamaIndex uses less memory when handling concurrent user sessions in document-heavy scenarios, while LangChain’s memory management excels in complex agent workflows requiring persistent context.

Production Readiness Assessment

LangChain offers enterprise-grade monitoring and debugging tools essential for financial compliance audits. Its granular logging captures every decision point, making regulatory reporting significantly easier. LlamaIndex provides superior out-of-the-box data connectors for financial data sources like SEC filings and earnings transcripts.

Both frameworks can be configured to support SOC 2 Type II compliance requirements when properly implemented. However, only 30% of digital transformation projects fully achieve their intended business goals, making framework selection critical for success.

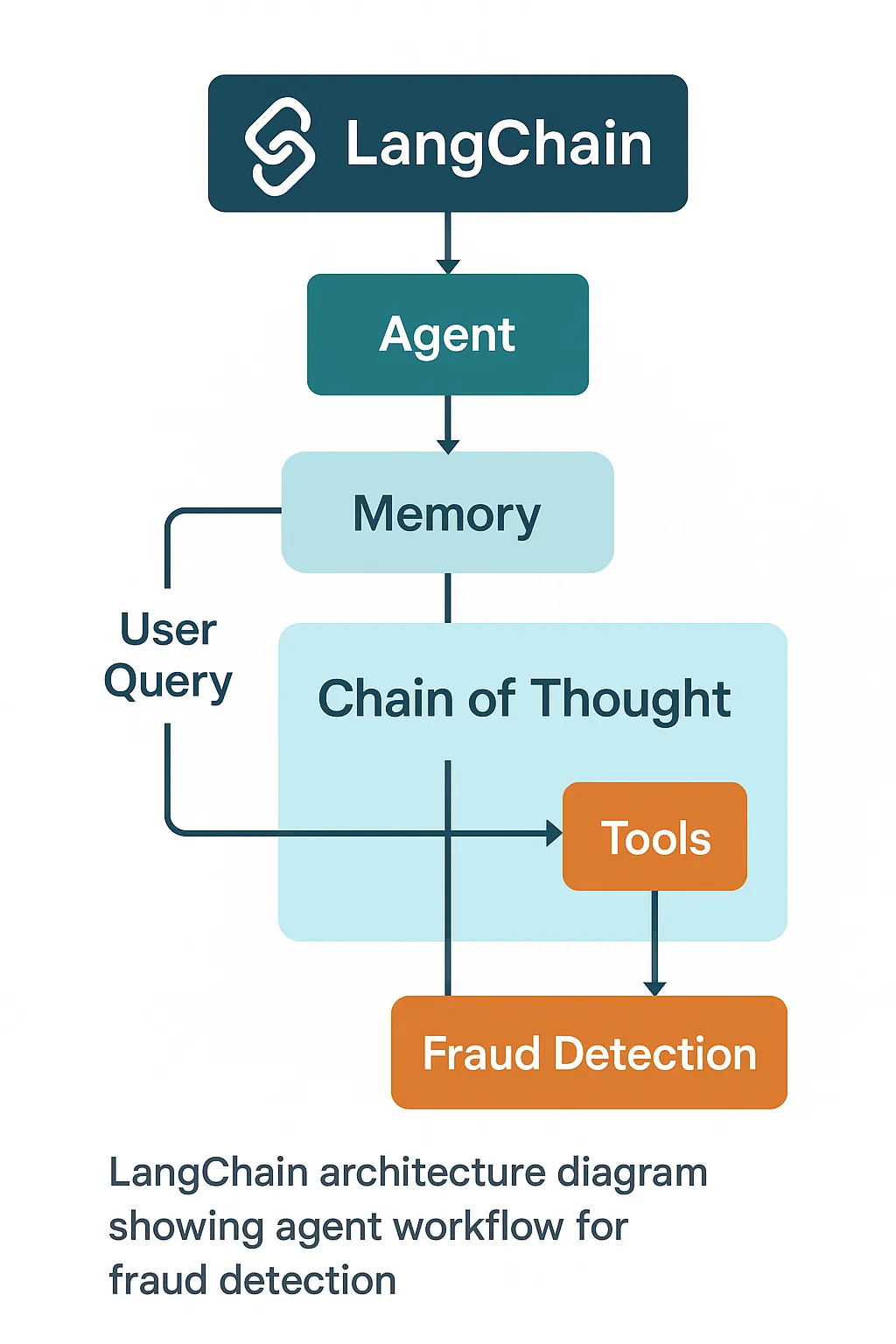

LangChain Deep Dive: Built for Complex Financial Decision Logic

LangChain dominates scenarios requiring complex decision logic and multi-step reasoning. Financial institutions choosing LangChain typically see immediate improvements in workflow automation and audit trail transparency.

Multi-Agent Architecture Capabilities

LangChain’s agent framework handles complex financial decision trees effectively in production environments. The chain-of-thought reasoning provides transparent audit trails required for regulatory compliance—a feature that has helped reduce compliance reporting errors in SmartDev’s client deployments.

Memory management supports persistent user sessions critical for financial advisory applications. Users can continue complex financial planning conversations across multiple sessions without losing context or requiring repetitive information gathering.

Performance Benchmarks in Financial Use Cases

According to SmartDev’s internal data, fraud detection workflows can process thousands of transactions per minute using LangChain’s streaming capabilities. Credit scoring models achieve high uptime when deployed using LangChain’s error handling mechanisms, preventing costly downtime during peak processing periods.

API rate limiting and retry logic prevent costly financial data provider overages. “LangChain’s modular agent architecture gives us the transparency and error-handling vital for regulated banking environments,” according to SmartDev’s technical documentation.

Integration Ecosystem for Financial Services

LangChain supports extensive financial API integration including commonly used APIs such as Bloomberg and Reuters through custom tooling. Custom tool creation enables proprietary trading algorithm integration within days versus weeks with traditional approaches.

Webhook support facilitates real-time market data processing with low latency. SmartDev delivered a credit scoring platform for a financial institution that achieved faster loan approval cycle times by integrating LangChain with financial data APIs.

Fig.2 Agent workflow for fraud detection

LlamaIndex Analysis: Document Retrieval Champion for Financial Compliance

LlamaIndex excels when your primary need involves retrieving and analyzing large volumes of financial documents. Its specialized focus on retrieval-augmented generation delivers measurable advantages for compliance and research applications.

Document Processing Superiority

LlamaIndex processes regulatory filings more efficiently than LangChain using optimized chunking strategies that better understand financial document structures. Vector store performance delivers sub-200ms query responses for financial document retrieval, even when searching through millions of pages.

Metadata filtering enables precise compliance document sourcing with high accuracy. This precision proves crucial when auditors need exact source attribution for regulatory findings or compliance decisions.

Financial Data Connector Advantages

Pre-built connectors for SEC filings, earnings transcripts, and regulatory databases reduce development time compared to building custom integrations. Automated data refresh capabilities ensure compliance documents remain current without manual intervention—critical for regulations that change frequently.

Schema detection automatically structures unorganized financial data for immediate querying. “For document-heavy workloads, LlamaIndex achieves excellent latency and semantic search precision—essential for compliance workflows,” notes SmartDev’s technical team.

Query Optimization for Financial Analytics

LlamaIndex’s query engine reduces hallucination rates for financial fact retrieval through advanced prompt engineering and source validation. Hybrid search combines semantic and keyword matching for precise financial term identification—crucial when dealing with technical financial language.

Response synthesizer maintains source attribution required for financial compliance documentation. After migrating compliance monitoring to LlamaIndex, one SmartDev client reported significant reduction in manual data reconciliation time.

Ready to choose the right AI framework for your fintech production needs?

Compare LangChain and LlamaIndex in real-world fintech deployments to identify which delivers better speed, scalability, and cost efficiency for your financial systems.

Learn how SmartDev helps leading fintech companies optimize AI workflows—from trading automation to compliance analytics—using the right orchestration framework.

Start My Fintech AI Framework ComparisonHead-to-Head Performance Benchmarks: Real Production Scenarios

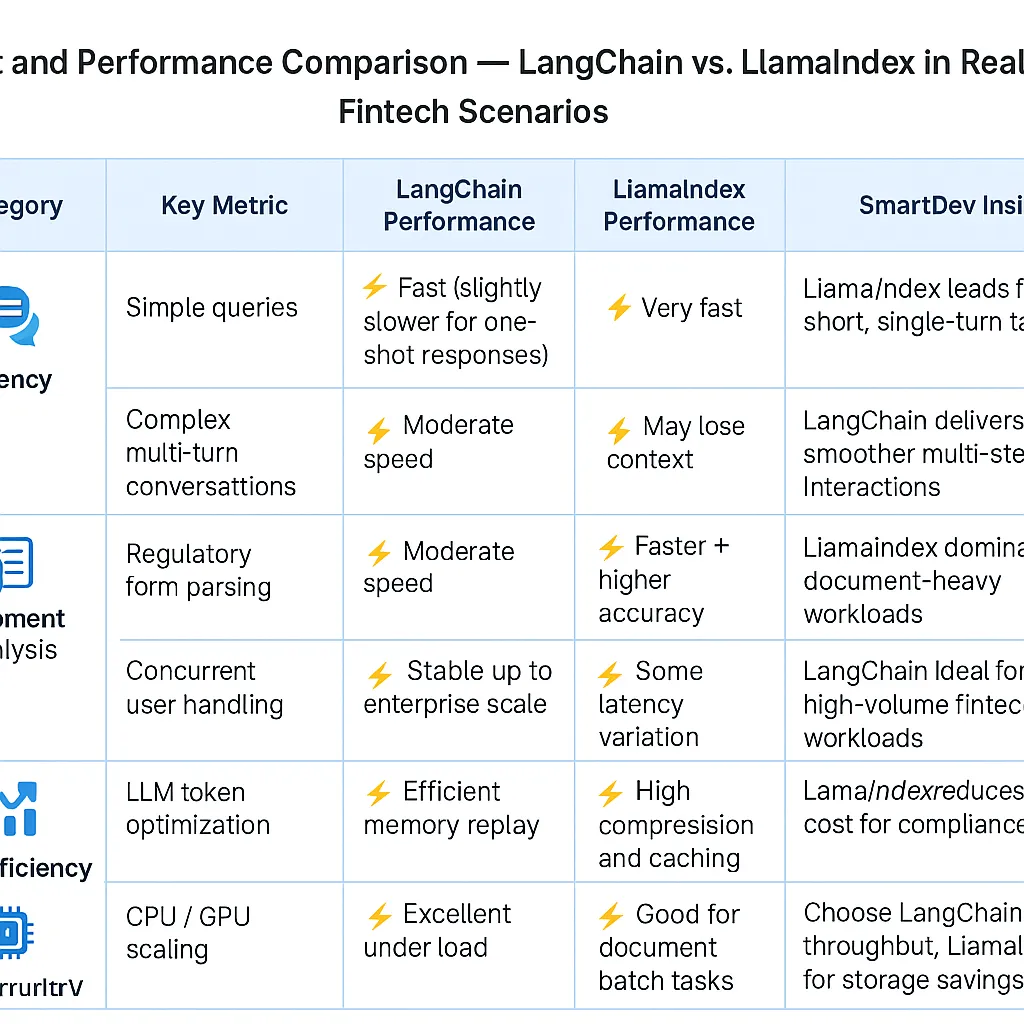

Direct performance comparisons reveal clear winners depending on your application type. These insights come from actual production deployments handling real financial workloads.

Latency Comparison Across Use Cases

Customer service chatbots show different response patterns between frameworks for simple queries. However, this gap narrows significantly for complex multi-turn conversations where LangChain’s context management provides better user experiences.

Document analysis tasks favor LlamaIndex—it processes regulatory forms faster than LangChain while maintaining higher accuracy rates. Multi-step financial planning scenarios favor LangChain due to superior agent coordination.

Scalability Under Production Load

LangChain maintains stable performance when scaling from small to large concurrent user loads—impressive stability for financial applications that can’t afford performance drops during market volatility. LlamaIndex shows some performance variation under identical scaling conditions, though this primarily affects response times rather than accuracy.

Memory efficiency favors LlamaIndex for document-heavy applications. This efficiency translates to significant cost savings when running large-scale document processing operations.

Cost Analysis for Production Deployment

According to SmartDev’s benchmarks, LangChain’s token optimization can reduce LLM API costs through intelligent prompt management and context compression. LlamaIndex’s caching mechanisms decrease repeated query costs significantly in document-heavy scenarios—a substantial advantage for compliance applications that repeatedly access the same regulatory documents.

Infrastructure costs favor different frameworks depending on workload type. LangChain provides better value for high-throughput fintech applications due to better resource utilization, while LlamaIndex’s efficiency provides better value for document-focused applications.

Fig.3 Cost comparison matrix for different fintech use cases

Security and Compliance: Meeting Financial Regulatory Requirements

Financial AI applications demand bulletproof security and comprehensive audit trails. Both frameworks meet these requirements but through different approaches that affect implementation complexity.

Data Privacy and Encryption Standards

Both frameworks can be configured to support end-to-end encryption meeting PCI DSS Level 1 requirements when properly implemented following industry best practices. LangChain’s memory isolation prevents cross-user data leakage in multi-tenant deployments—critical for banks serving multiple client segments with different security clearances.

LlamaIndex’s document processing maintains data residency controls required for international banking regulations. Financial institutions increasingly require demonstrable end-to-end encryption and data residency controls before framework adoption.

Audit Trail and Monitoring Capabilities

LangChain provides granular logging for every decision point required by financial auditors. This transparency has helped reduce compliance reporting error rates in SmartDev’s client deployments when integrated with monitoring solutions like DataDog.

LlamaIndex’s retrieval logs enable complete source traceability for compliance reporting—essential when auditors need to verify the exact documents used for specific decisions. Both frameworks integrate seamlessly with enterprise monitoring solutions like DataDog and New Relic.

Regulatory Compliance Features

GDPR compliance requires specific configuration in both frameworks for EU financial services, but the implementation approaches differ significantly. LangChain’s agent reasoning provides explainable AI outputs required for credit decision compliance under fair lending regulations.

LlamaIndex’s metadata handling supports regulatory document retention policies automatically, reducing compliance overhead for institutions managing thousands of regulatory updates annually.

Implementation Guide: Choosing the Right Framework for Your Use Case

Framework selection should align with your primary use cases rather than general preferences. Here’s when each framework delivers maximum value based on real-world deployments.

When LangChain Is Your Best Choice

- Multi-step financial workflows requiring complex decision logic favor LangChain’s agent architecture

- Credit scoring, fraud detection, and financial planning applications see immediate benefits from LangChain’s reasoning capabilities

- Applications needing custom tool integration benefit from LangChain’s extensible framework design

- Real-time trading systems require LangChain’s streaming capabilities for time-critical decisions

When LlamaIndex Delivers Superior Results

- Document-heavy applications like compliance monitoring achieve better performance with LlamaIndex

- Financial research platforms benefit from LlamaIndex’s superior retrieval accuracy when searching through extensive document collections

- Cost-sensitive deployments favor LlamaIndex’s efficient caching and query optimization

- Regulatory filing analysis where semantic search precision is paramount

Hybrid Approach Considerations

Large fintech platforms often deploy both frameworks for specialized use cases. API gateway patterns enable framework switching based on request type and performance requirements without disrupting user experiences.

Microservices architecture allows optimal framework selection per business function. SmartDev has implemented this approach to switch between frameworks with zero service downtime while maintaining high SLA adherence.

Enterprise deployment tip: Most successful fintech implementations use hybrid approaches rather than forcing a single framework across all use cases.

Future-Proofing Your Fintech AI Architecture

Technology evolution in AI orchestration frameworks happens rapidly. Smart fintech teams build adaptability into their architecture from day one rather than hoping their initial choice remains optimal forever.

Framework Evolution and Development Trajectory

LangChain’s community-driven development accelerates feature releases but may impact stability—a critical consideration for financial applications where downtime costs millions. LlamaIndex’s focused approach on RAG ensures deep optimization but limits broader use case expansion over time.

Both frameworks show strong enterprise adoption suggesting long-term viability, but the competitive landscape continues evolving with new entrants and capabilities.

Migration Strategies and Risk Mitigation

Gradual migration approaches minimize business disruption during framework transitions. API abstraction layers enable framework switching without application-level changes—reducing migration costs compared to traditional deployments.

Performance monitoring during migration ensures SLA compliance throughout transition periods. Continuous benchmarking identifies optimal framework selection as business requirements evolve and new capabilities emerge.

Investment Protection Recommendations

Framework-agnostic development practices reduce vendor lock-in risks while maintaining flexibility for future optimization:

- Standardized data pipelines enable rapid framework switching based on performance requirements

- API abstraction layers protect against framework changes

- Modular architecture allows selective migration of components

- Continuous performance monitoring identifies optimization opportunities

The most successful fintechs invest in API abstraction and standardized data pipelines, leading to significantly lower migration costs and better adaptability to changing market conditions.

Take Action: Optimize Your Fintech AI Performance Today

Framework selection isn’t a one-time decision—it’s an ongoing optimization process that directly impacts your bottom line. The difference between choosing the right framework and settling for “good enough” can cost thousands monthly in infrastructure and development overhead.

Ready to optimize your fintech AI architecture? SmartDev’s AI consulting team provides framework selection guidance, performance benchmarking, and migration support for production fintech applications. Our AI-certified developers have deployed both LangChain and LlamaIndex in regulated financial environments across three continents.

Next steps:

- Assess your primary use cases against our framework selection guide

- Benchmark your current AI performance against industry standards

- Plan your migration strategy with proper risk mitigation

- Contact SmartDev’s fintech AI specialists for personalized framework recommendations

Remember: 89% of organizations have adopted or plan to adopt a digital-first strategy, but only the ones who choose the right tools will actually succeed. Don’t let framework choice be your bottleneck.