Introduction

Tax departments face a perfect storm – rapid regulatory changes, intense seasonal workload, and a growing talent crunch. AI is fast becoming the strategic solution, automating repetitive tasks, elevating audit accuracy, and enabling real-time insights. This comprehensive guide explores where AI is making an impact in tax, and how your organization can harness its power.

What is AI and Why Does It Matter in Tax?

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to the capability of machines to perform tasks that typically require human intelligence, such as learning, reasoning, and decision-making. It leverages technologies like machine learning, which enables systems to improve through data exposure, and natural language processing (NLP), which allows machines to understand and generate human language. Another core component is computer vision, used to interpret visual data from documents or images.

In the tax domain, these technologies streamline and enhance complex processes. Machine learning models detect anomalies in transactions, while NLP tools extract insights from tax codes and filings. Computer vision enables fast, accurate data extraction from invoices, receipts, and tax documents, dramatically reducing manual input and error rates.

The Growing Role of AI in Transforming Tax Industry

AI is reshaping tax departments by automating repetitive, time-consuming tasks that once required significant manual effort. Functions like data entry, reconciliation, and return preparation are now handled by AI tools, allowing tax professionals to redirect their focus toward advisory roles and strategic planning. This shift not only boosts productivity but also improves accuracy and consistency across filings.

Beyond automation, AI is enhancing compliance by continuously monitoring regulatory changes and interpreting new tax legislation. Generative AI models can analyze and summarize tax law updates in real time, helping teams stay ahead of compliance risks. This capability ensures organizations remain responsive to evolving regulations without the lag of manual research.

AI is also elevating decision-making in tax strategy through predictive analytics and scenario modeling. These tools assess historical data and external factors to simulate outcomes, optimizing tax planning and reducing liabilities. As a result, tax teams can proactively design structures and transactions that align with both compliance and financial goals.

Key Statistics and Trends Highlighting AI Adoption in Tax

AI adoption in the tax sector has surged recently, with The 2024 Tax Firm Technology Report highlights that 93% of large tax and accounting firms are either using, exploring, or considering AI technologies. Over the past 18 months, AI implementation rose nearly 70% among accounting firms and corporate tax departments, significantly reshaping traditional workflows. According to a 2025 survey, 21% of firms have implemented generative AI (GenAI) – up from just 8% in 2024 – and 79% expect significant GenAI integration by 2027, underscoring rapid industry momentum.

Industry sentiment supports that trend: 84% of tax and accounting professionals consider AI a “force for good,” and 77% believe it will have a transformational impact within five years. Clients are also increasingly vocal, with 59% of tax-firm clients expecting their advisors to use GenAI tools. Firm investment reflects this shift – 92% of global executives plan to increase AI spending over the next three years, reinforcing the tax industry’s strong commitment to scaling AI initiatives.

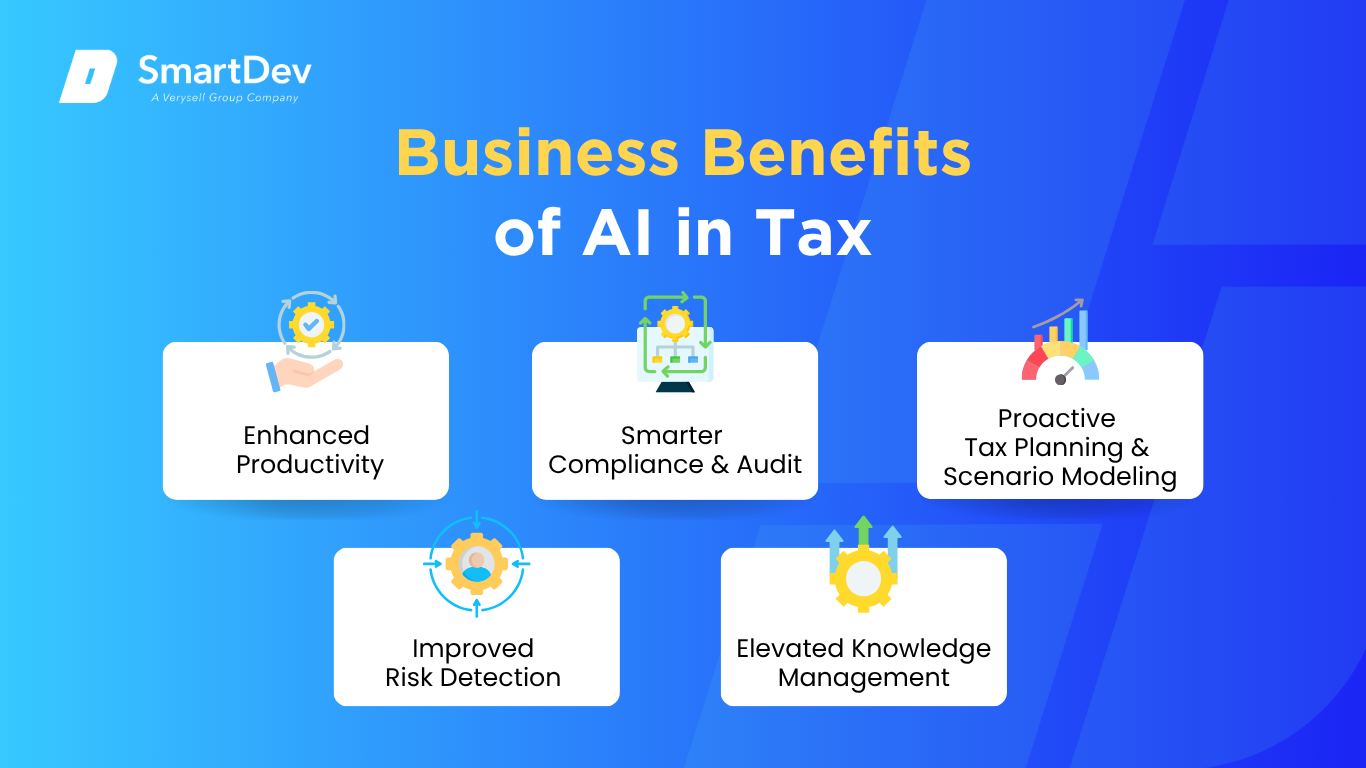

Business Benefits of AI in Tax

AI is transforming tax departments by automating manual tasks, improving accuracy, and enabling faster, data-driven decisions. These capabilities not only boost efficiency but also elevate the strategic role of tax within the organization.

1. Enhanced Productivity

AI significantly reduces the manual workload in tax functions by automating tasks such as data entry, document classification, and return preparation. These capabilities allow tax professionals to focus on higher-value strategic tasks instead of spending hours reconciling data or reviewing spreadsheets. This shift not only streamlines workflows but also helps organizations better manage peak filing seasons with fewer resources.

Automation also improves the consistency and reliability of outputs, minimizing human error in data processing. Tools powered by machine learning can operate continuously without fatigue, ensuring around-the-clock tax operations during critical periods. As a result, firms gain greater operational efficiency and responsiveness across global tax jurisdictions.

See how SmartDev helped automate tax workflows with a scalable web-based solution in this real-world case study.

2. Smarter Compliance & Audit

AI enhances compliance by continuously monitoring regulatory databases and alerting tax teams to new rules, deadlines, or changes. With natural language processing (NLP), AI can interpret complex legal texts, generate summaries, and propose actionable steps all in real time. This real-time capability drastically reduces the risk of missed compliance updates or misinterpreted regulations.

In audit scenarios, AI tools excel at identifying anomalies or discrepancies within massive transaction datasets. These tools flag potential issues early, providing auditors and compliance teams with a proactive approach to investigation and resolution. By minimizing the need for manual reviews, AI accelerates audits and improves their accuracy.

3. Proactive Tax Planning & Scenario Modeling

AI helps tax professionals make informed, forward-looking decisions by analyzing historical data and simulating various tax outcomes. Through scenario modeling, AI can predict the impact of business decisions, such as mergers, expansions, or jurisdictional shifts, on overall tax obligations. This empowers teams to optimize tax strategies and avoid last-minute surprises.

Advanced planning tools can incorporate real-time economic indicators and policy changes into forecasting models. As a result, organizations can respond swiftly to new opportunities or threats, gaining a competitive advantage. By aligning tax planning with business strategy, AI transforms the tax function into a value-generating unit.

4. Improved Risk Detection & Dispute Management

AI’s pattern recognition capabilities are particularly effective in detecting potentially fraudulent or non-compliant activities. These systems scan transactions, vendor relationships, and historical filings to uncover outliers and risks that may trigger audits or penalties. Early detection enables organizations to correct errors or justify positions before they escalate into costly disputes.

During disputes or tax authority reviews, AI can compile and analyze supporting documentation rapidly. It can predict likely outcomes based on past rulings and suggest optimal approaches to negotiation or defense. This speeds up resolution times and enhances an organization’s preparedness during contentious proceedings.

For more on how AI can proactively uncover tax risks and irregularities, read our insights on AI-driven fraud detection and its real-world applications.

5. Elevated Knowledge Management

Tax departments manage vast amounts of legal texts, past rulings, and jurisdictional guidance, much of it unstructured. AI, especially through large language models (LLMs), can ingest this content, extract relevant insights, and surface information contextually when needed. This capability ensures that professionals can access accurate, timely answers without extensive manual research.

By institutionalizing knowledge, AI reduces dependency on individual expertise and mitigates turnover risk. Tools can capture learnings from past decisions and embed them into ongoing processes. Over time, this creates a centralized intelligence layer, boosting collaboration and long-term consistency in decision-making.

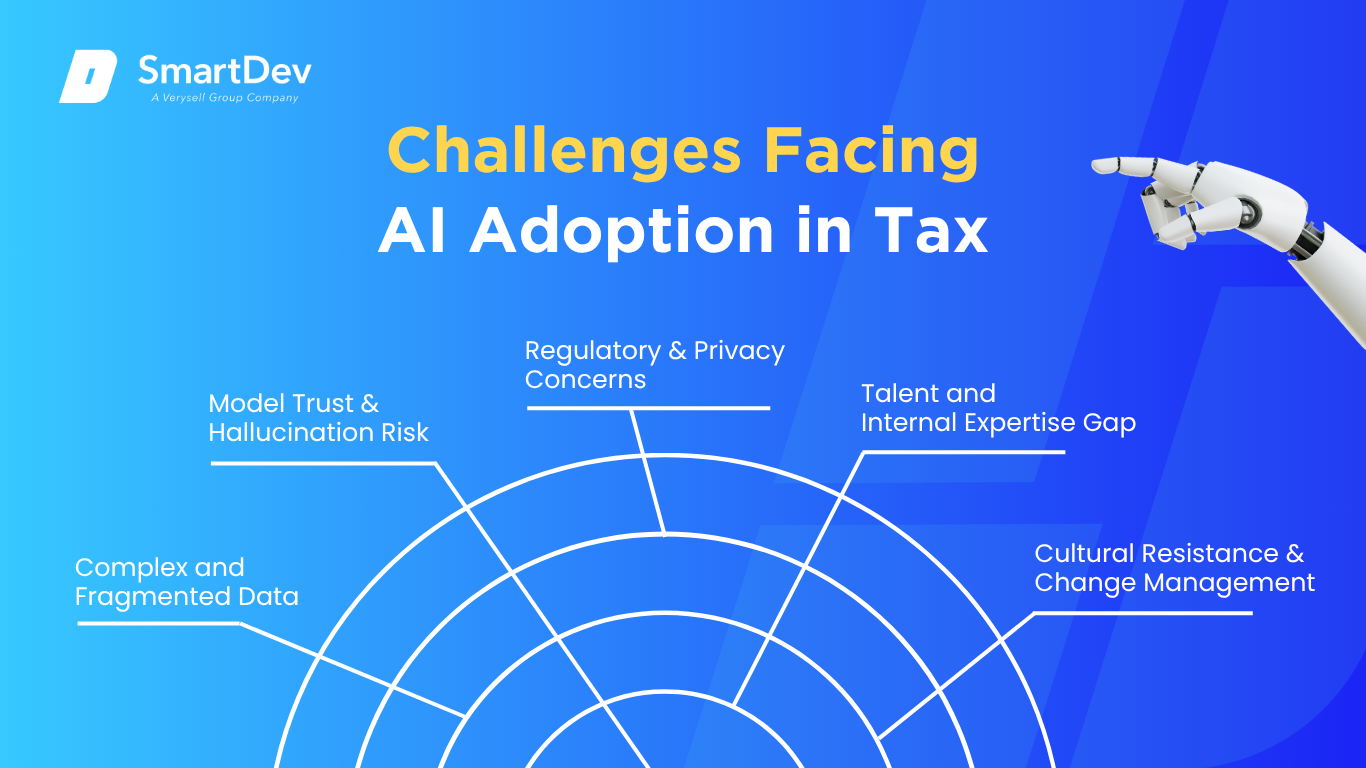

Challenges Facing AI Adoption in Tax

While AI offers significant advantages, adoption in tax is often hindered by data quality issues, regulatory constraints, and internal resistance. Addressing these challenges is critical to ensuring AI delivers reliable and compliant value at scale.

1. Complex and Fragmented Data

Tax data often originates from multiple systems – ERP platforms, spreadsheets, and email threads – leading to inconsistencies and gaps. AI tools require structured, high-quality data to generate accurate results, but fragmented inputs can distort outcomes or cause automation to fail. Cleaning and unifying tax data demands significant cross-departmental effort, including IT, finance, and legal teams.

This challenge is compounded by legacy systems that lack integration capabilities, making real-time data access difficult. Without a centralized data repository, AI cannot provide cohesive insights across jurisdictions or reporting requirements. Organizations must prioritize data governance and interoperability to enable scalable AI deployments in tax.

To understand why strong data infrastructure is foundational to effective AI adoption, explore our article on data management’s role in business success.

2. Model Trust & Hallucination Risk

AI tools, especially those using generative models, can sometimes produce confident but factually incorrect outputs, a phenomenon known as “hallucination.” In tax, even minor inaccuracies can lead to regulatory penalties, disputes, or reputational damage. This makes unchecked automation risky, particularly in advisory or legal interpretation contexts.

To build trust, companies must implement human-in-the-loop systems where AI outputs are reviewed and verified by experts before submission. Transparent audit trails and explainable AI features are essential to ensure compliance and accountability. These safeguards help maintain professional standards while still benefiting from AI efficiency.

3. Regulatory & Privacy Concerns

Tax data includes sensitive personal and financial information, making privacy compliance a major concern. Regulations like GDPR and CCPA impose strict rules on data storage, usage, and cross-border transmission, directly affecting AI implementation. Non-compliance could result in significant fines or regulatory scrutiny.

Additionally, tax authorities themselves are evolving in how they audit AI-driven processes. Firms must ensure that AI models are explainable and that decision-making logic can be documented and shared with regulators. Developing robust AI governance frameworks is essential to manage this growing layer of regulatory complexity.

For a deeper look at how to manage privacy risks while deploying AI, explore our guide on balancing innovation with data security.

4. Talent and Internal Expertise Gap

Implementing AI in tax requires both technical fluency and domain expertise – skills not commonly found in traditional tax teams. Many organizations lack staff who understand AI architecture, leading to misaligned tools and failed implementations. Even where AI tools are user-friendly, professionals need training to interpret outputs accurately and responsibly.

This skills gap extends to leadership, where strategic understanding of AI capabilities is often limited. Without clear direction, teams struggle to identify high-value use cases or secure the necessary budget for implementation. Building cross-functional teams that blend tax, data science, and IT is critical for sustainable AI adoption.

5. Cultural Resistance & Change Management

AI adoption often clashes with longstanding practices in tax functions, which are typically risk-averse and process-heavy. Staff may be skeptical of automation, fearing job displacement or mistrusting the accuracy of AI-generated insights. This resistance can slow implementation and reduce the impact of even well-designed tools.

Effective change management involves clear communication about AI’s role as a complement, not a replacement, for human judgment. Early pilot programs that demonstrate clear, measurable benefits can help win buy-in across teams. Investing in training and user involvement from the outset is key to fostering a culture that embraces innovation.

Specific Applications of AI in Tax

1. Automated Document Processing & Data Extraction

AI-driven document ingestion combines OCR with NLP to transform tax forms, receipts, and unstructured documents into structured data. The system parses unformatted inputs, identifies relevant tax fields, and routes outputs into tax-preparation software, streamlining excessive manual entry. This reduces errors, accelerates workflows, and allows professionals to focus on advisory work rather than data sorting.

Under the hood, machine learning models are trained on historical tax filings and document formats, while NLP contextualizes field relationships and semantics. Patented text-layer matching in tools like SurePrep’s 1040SCAN enables the system to verify data automatically for about 65% of standard documents. Integration with tax software workflows minimizes manual review and enables scalable processing as document volumes rise.

Operationally, this AI solution boosts accuracy, speeds up preparation cycles, and lets firms redeploy staff from repetitive data tasks. Firms enjoy reduced labor costs, faster client turnaround, and greater capacity during busy seasons. However, they must ensure robust data governance, encryption, and privacy compliance to secure sensitive information.

Real-world example:

SurePrep’s 1040SCAN platform processes four to seven times more documents than standard OCR tools and auto-verifies approximately 65% of standard tax documents, significantly reducing manual review time. The system exports verified data seamlessly into tax software, improving workflow efficiency. Firms report faster filing cycles, enhanced accuracy, and higher profitability per return.

2. Generative AI for Tax Research and Analysis

Generative AI solutions like KPMG’s Digital Gateway GenAI leverage LLMs to analyze tax codes, case law, and regulations and generate summaries, memos, and answers. These tools support professionals with contextual insights and simplified drafting of complex tax guidance. As a result, firms enhance decision-making, accelerate delivery, and reduce research bottlenecks.

Technically, these systems are fine-tuned on tax-specific legal datasets, combining retrieval-augmented generation (RAG) with proprietary firm knowledge. They integrate into workflows via secure cloud platforms; data sovereignty and compliance are embedded through trusted AI frameworks to meet regulatory standards.

Strategically, generative AI shifts tax professionals toward higher-value advisory, improving speed without sacrificing context or quality. However, deployments must incorporate guardrails to prevent hallucinations and maintain human oversight. Security, ethics, and accuracy are crucial given the potential impact of AI-generated advice.

Real-world example:

KPMG launched its multi-agent Workbench platform, which underpins its Digital Gateway for Tax and enables generative AI-driven risk analysis, memo drafting, and insight generation across jurisdictions. Built on Azure AI Foundry, its interoperable agents collaborate to support tax workflows. Early adopters report higher quality deliverables, faster responses, and improved client satisfaction.

3. AI‑Powered Compliance Monitoring & Risk Detection

AI-driven compliance tools proactively scan general ledger and transaction data to identify anomalies, audit triggers, and potential filing errors. These models compare current transactions against historical patterns and industry benchmarks, highlighting discrepancies for review before submission. The result is enhanced filing accuracy, reduced audit exposure, and a more controlled compliance posture.

Technologically, these tools rely on supervised and unsupervised learning algorithms to detect outliers, supplemented by rules-based filters for regulatory alignment. Real-time integration with ERP and tax systems ensures alerts are actionable and timely. Firms must implement strict data governance and privacy controls to protect sensitive client information during analysis.

Strategically, this shifts organizations from reactive compliance to proactive risk management, enabling early remediation of issues and improved regulatory relationships. It reduces the frequency of costly audit interventions and supports a transparent compliance narrative. The main challenges involve maintaining model accuracy and ensuring unbiased anomaly thresholds.

Real-world example:

EY’s AI-enabled tax compliance platform continuously monitors accounting entries and flags anomalies before filing, enabling clients to address errors proactively and reduce audit requests. This system integrates AI-monitored data streams with alerting dashboards, ensuring timely intervention. Clients report fewer audit inquiries and improved tax filing quality since adoption.

4. AI‑Driven Chatbots & Virtual Tax Assistants

Conversational AI assistants, powered by LLMs, guide taxpayers through filing processes and provide answers to common tax questions. These systems use intent detection and contextual memory to maintain conversation flow and escalate complex queries to human experts. This hybrid design delivers round-the-clock support and eases customer friction.

Technically, the chatbots pull from proprietary tax-code datasets and help articles, mapping natural language queries to structured responses, and escalate based on confidence thresholds. Generative AI updates their knowledge continually while guardrails prevent risky outputs. Combining LLM capabilities with verified tax content balances responsiveness with compliance.

Strategically, these assistants reduce support burden, expedite resolution, and enhance user satisfaction, especially during peak tax season. However, accuracy concerns persist, early implementations showed error rates around 50%, leading to cautious rollouts. Continued human oversight is needed to validate AI advice and maintain trust.

Real-world example:

Alongside human review, TurboTax and H&R Block’s AI chatbots now handle over 65% of user interactions, up from about 15%, helping customers with straightforward queries while deferring complex cases. Updated models are more stable, routing complicated questions to live agents or help documentation. Users report decreased wait times and improved stress levels during filing.

5. Predictive Forecasting & Tax Planning Predictive

AI models analyze historical tax data, legislative scenarios, and macroeconomic indicators to forecast future liabilities and cash-flow impacts. These tools generate what-if simulations, allowing tax teams to evaluate the effects of policy changes or structural decisions. The interactive outputs promote proactive tax planning and capital optimization.

Built on machine learning techniques, systems like CCH Tagetik integrate cross-functional data (financial, operational, external) to predict outcomes, explain drivers, and adjust with new inputs. Visualization dashboards help teams compare scenarios and select optimal strategies. Accuracy hinges on data completeness and the diversity of modeled situations.

Strategically, predictive tax planning supports better-managed risk, optimized cash reserves, and informed decision-making. These models help companies stay agile amid shifting fiscal regulations. However, firms must safeguard against overreliance on forecasts and ensure scenario validity.

Real-world example:

Wolters Kluwer’s CCH Tagetik Predictive Intelligence provides instant scenario-based tax forecasts and explanations, helping firms understand liability drivers and optimize tax planning. Early adopters report faster decision cycles and more confident financial projections. The transparency of drivers encourages stakeholder buy-in and adoption across finance teams.

6. Audit & Fraud Detection

AI-based audit tools detect misreporting and fraud by scanning general ledger entries for anomalies and irregular patterns. Unsupervised models like clustering and outlier detection flag unexpected variance, which is then examined by auditors using visual analytics. This enhances detection rates while reducing false positives and audit effort.

Supervised learning algorithms trained on historical audit cases refine the system’s ability to prioritize high-risk entries. Tools like PwC’s GL.ai analyze billions of data points per engagement, enabling risk-focused sampling and deep inspection. Integrations with audit platforms streamline review workflows and documentation.

Strategically, AI empowers auditors to detect fraud more accurately and efficiently, shifting focus from routine checks to meaningful investigation. Audit teams can handle larger data volumes with enhanced scrutiny and reduced time. Organizational trust increases when audit processes are both thorough and transparent.

Real-world example:

PwC’s GL.ai engine scans entire ledgers in milliseconds and identifies suspicious activity for deeper audit scrutiny. The AI-driven prioritization allows auditors to focus on high-risk anomalies rather than random sampling. This results in faster fraud detection, improved assurance quality, and audit cost savings.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Tax

Understanding the practical application of AI in tax provides valuable insight into its strategic benefits. The following case studies showcase how top firms are leveraging AI to enhance efficiency, accuracy, and client service in real-world tax operations.

Real-World Case Studies

1. Blue J Legal: Generative AI for Tax Research

Blue J’s Ask Blue J platform uses generative AI trained on curated tax codes and federal case law to deliver quick, verifiable tax insights. It combines a reputable database with LLM technology to draft memos and answer complex queries, dramatically reducing research time. The tool is designed to be conversational and trustworthy, with professional oversight ensuring reliability.

Regional accounting firms cite adoption metrics showing around 2 hours saved per user weekly, with 63% of new users generating answers within minutes of onboarding. Larson Gross Advisors grew from 25 to 75 users in just three months, reflecting rapid adoption and enhanced productivity. These firms report deeper client engagement and improved strategic advisory capacity thanks to AI-driven efficiency.

2. TurboTax (Intuit): AI‑Powered Chatbot & Autofill

TurboTax and H&R Block have integrated AI chatbots that guide users through tax questions using LLMs trained on tax codes and internal documentation. The tools leverage intent detection and confidence thresholds to route complex issues to live agents, delivering conversational guidance without replacing experts. Although initial versions had accuracy issues, iterations in 2024–2025 have been more reliable for common queries.

TurboTax reports that chatbot usage grew from 15% of user queries in 2023 to 65% in 2025, indicating strong adoption. Meanwhile, Intuit’s “expert platform” utilizes AI to auto-import documents and match users with tax professionals, delivering full-service returns in under two hours. These innovations have enhanced user experience, reduced pressure on support staff, and encouraged faster refunds and higher satisfaction.

3. SurePrep 1040SCAN: Automated Document Ingestion

SurePrep’s 1040SCAN employs AI-powered OCR and text-layer matching to extract and verify data from tax documents, reducing manual input. It automatically verifies approximately 65% of standard forms, allows 4–7× document volume processing compared to older tools, and indexes work papers for efficient review. Integration with platforms like TaxCaddy streamlines document flows while maintaining data security standards.

Adopting firms report significant efficiency gains, faster completion of filings and reduced labor requirements, especially during peak seasons. Sorge CPA and others using 1040SCAN and SPbinder have noted more standardized workflows and reduced reviewer burden. The result is measurable time savings, smoother team collaboration, and improved overall accuracy.

Innovative AI Solutions

Innovative AI applications are advancing beyond routine automation to handle complex, end-to-end tax processes. These emerging systems use intelligent agents and large language models to independently manage tasks such as data extraction, classification, compliance monitoring, and report generation. By simulating professional workflows, they reduce the need for manual oversight and accelerate the entire tax lifecycle.

In addition, AI is becoming deeply embedded within core business systems, allowing real-time tax calculation, regulatory updates, and scenario-based forecasting. These integrated solutions provide dynamic insights, enabling tax teams to make faster, data-driven decisions and adjust strategies proactively. As AI capabilities evolve, tax departments are shifting from reactive compliance units to strategic advisory functions.

AI-Driven Innovations Transforming Tax

Emerging Technologies in AI for Tax

Generative AI is rapidly becoming a key asset in tax operations, especially for tasks like drafting technical memos, researching legislation, and summarizing IRS rulings. These systems are now integrated into leading tax platforms, accelerating compliance review cycles and reducing reliance on manual interpretation. Firms are embedding AI into internal chatbots and research tools to streamline advisory services and support complex decision-making.

Computer vision and NLP automate data extraction from K-1s, invoices, and tax returns, reducing the need for manual entry across thousands of documents. These tools are enabling faster turnaround during busy seasons by accurately pulling details from unstructured sources like scanned PDFs and client emails. With integrated AI pipelines, tax teams can shift focus from low-value tasks to high-impact planning and analysis.

Explore how we helped a client streamline financial operations through AI-powered e-invoicing in this digital transformation case study.

AI’s Role in Sustainability Efforts

AI is supporting sustainability in tax departments by minimizing paper use and manual processing through digital automation. Predictive systems reduce rework and late filings by flagging errors and inconsistencies early in the workflow. Companies adopting these AI-driven tools have cut down on printing, courier costs, and staff overtime associated with peak compliance periods.

Smarter tax provisioning models also enable more accurate forecasts, helping to manage cash flow and avoid overpaying estimated taxes. AI streamlines reporting for ESG-linked tax credits and environmental levies, ensuring timely filings and proper utilization of incentives. As global standards evolve, AI helps organizations stay compliant while minimizing their operational carbon footprint.

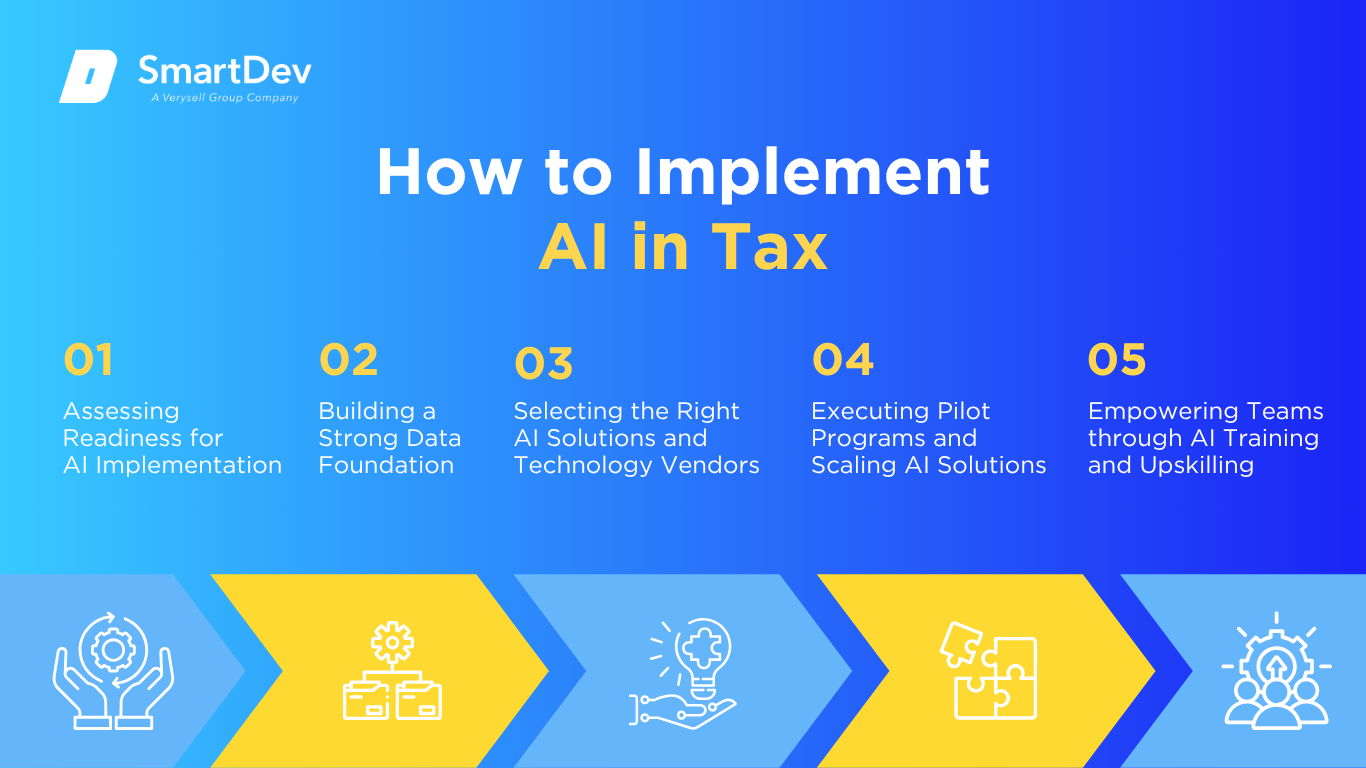

How to Implement AI in Tax

Successfully implementing AI in tax operations requires strategic planning, clean data, and team alignment. From identifying automation opportunities to building scalable pilots, each phase builds the foundation for long-term transformation.

Step 1: Assessing Readiness for AI Adoption

Start by pinpointing where your tax function is overloaded areas like document review, form intake, or indirect tax calculation are strong candidates. Conduct a readiness review that covers data accessibility, software compatibility, and regulatory implications. Focus initial AI efforts on quick wins, like automating entity classification or matching financial records for reconciliation.

Clear workflow mapping ensures buy-in from leadership and execution teams alike. Set goals early, whether that’s reducing filing errors or shortening close cycles, to guide performance evaluation. Internal champions can help ease resistance and maintain momentum during deployment.

Step 2: Building a Strong Data Foundation

Clean, structured data is the backbone of any successful AI initiative. Begin by aggregating information from ERP systems, tax software, and spreadsheets into a central, governed environment. Prioritize the removal of duplicates, inconsistencies, and legacy formatting issues that could confuse AI models.

Establish strong data governance policies that ensure accuracy, traceability, and compliance with tax authority standards. Building secure, query-ready tax data lakes will support scalable automation and deeper analytics. A well-maintained data pipeline sets the stage for long-term success and model refinement.

Learn how our data analytics services can help you build a scalable, high-quality data foundation to power AI testing and insights.

Step 3: Choosing the Right Tools and Vendors

Choose AI platforms designed with tax use cases in mind, capabilities like OCR, NLP, and multi-entity workflows are essential. Solutions from providers like Thomson Reuters, KPMG, or newer entrants like K1x offer tools tailored for tax lifecycle management. Look for vendors that support seamless integration with existing finance systems and provide transparency in model behavior.

Customization is often necessary, so prioritize platforms that allow for modular deployment and user-specific controls. Vendors track record and support offerings will play a big role in adoption speed and ongoing optimization. Selecting partners who understand tax complexity ensures smoother implementation.

Step 4: Pilot Testing and Scaling Up

Start with a focused pilot that measures a specific KPI, like reducing time to prepare K-1 forms or increasing data extraction accuracy from invoices. Rollouts should be designed to validate impact, highlight gaps, and generate internal case studies for broader buy-in. Keep pilots small and agile so changes can be made quickly before committing to a larger investment.

Use performance data to guide where to scale next, whether by region, entity, or tax process. Layering in additional functionality, such as provision calculation or risk scoring, helps build a robust AI ecosystem. Always include feedback loops for human review and model retraining as scope expands.

Step 5: Training Teams for Successful Implementation

AI success depends on user trust and fluency. Tax professionals need to understand when and how AI is making decisions, and where their own judgment still matters. Training should focus on interpreting results, validating outputs, and adjusting workflows to incorporate automation.

Create a culture of shared ownership where team members collaborate with AI tools rather than compete with them. Designate AI ambassadors to provide peer coaching and facilitate adoption. Regular updates, Q&A sessions, and clear escalation paths make implementation smoother and build lasting confidence.

Measuring the ROI of AI in Tax

Key Metrics to Track Success

To evaluate the success of AI in tax operations, start by measuring time savings in routine processes like data entry, document classification, and tax return preparation. These efficiency gains are often the most tangible indicator of value, when workflows that once took hours can be completed in minutes, productivity scales fast. Cost savings are equally critical, particularly reductions in overtime, outsourced processing, and penalties from missed filings or compliance errors.

Another key metric is accuracy, tracking how often AI correctly extracts, classifies, or predicts outcomes in tax filings. Improved precision means fewer downstream corrections and audits, and more trust from stakeholders. Additionally, consider measuring how AI frees up staff for higher-value work, like advisory or strategic tax planning, which can result in long-term revenue growth.

Case Studies Demonstrating ROI

MHA, a UK accounting firm, implemented a robotic tax assistant that automatically extracted and processed data from personal tax return documents. Within its first year, the AI handled over 5,000 returns, saving up to three hours per return and totaling more than 45,000 hours reclaimed for advisory work. The firm reported a 4× return on investment by reducing seasonal workloads and minimizing human error.

Similarly, Deloitte launched an ML-powered solution for accounts processing that reduced a 5-hour manual workflow to just 6 minutes. The project delivered a staggering 50× improvement in speed and was deployed in just six months – eight times faster than typical enterprise automation timelines. These results underscore how targeted pilots, when scaled, deliver measurable and repeatable financial impact.

Common Pitfalls and How to Avoid Them

One of the biggest pitfalls in AI adoption is expecting fully autonomous systems too soon, most tax AI still requires human oversight, particularly in edge cases. Overreliance can lead to missed nuances in regulatory interpretation, increasing compliance risk. To mitigate this, maintain a clear division of responsibilities between AI tools and experienced tax professionals.

Another common issue is neglecting change management. Teams may resist new tools unless they’re given training, context, and support. Organizations that embed AI ambassadors and prioritize transparency in how models work tend to see smoother adoption and more consistent performance over time.

Future Trends of AI in Tax

Predictions for the Next Decade

Over the next ten years, AI in tax will become more embedded, predictive, and autonomous. Tax processes that once relied on manual intervention, like compliance monitoring, provision calculations, and global filings, will increasingly run in real time within enterprise systems. AI agents will not only process data but also recommend actions, detect anomalies, and adapt to evolving regulations with minimal oversight.

As tax authorities modernize their own systems, businesses will need to keep pace with AI-driven audits, real-time reporting, and digital tax exchanges. Advanced analytics will play a greater role in strategic planning, helping CFOs anticipate tax implications of major business decisions. The focus will shift from reactive compliance to proactive, insight-driven tax leadership.

How Businesses Can Stay Ahead of the Curve

To stay ahead, companies must treat AI as a long-term investment, not a quick fix. This means building adaptable infrastructures, fostering cross-functional collaboration, and aligning AI use with broader tax strategy goals. Leaders should promote experimentation through pilot programs while maintaining strong oversight to ensure responsible implementation.

Upskilling teams will also be crucial – today’s tax professionals need fluency in both regulation and technology. By nurturing internal expertise and partnering with trusted vendors, businesses can evolve alongside the technology rather than being disrupted by it. Staying curious, agile, and data-driven will be key to thriving in the next wave of AI transformation.

Conclusion

Key Takeaways

AI is transforming tax operations by automating routine tasks, enhancing data accuracy, and streamlining compliance processes. Technologies like generative AI and natural language processing are simplifying research and reporting, while tools powered by computer vision extract data from unstructured documents with ease. This shift enables tax professionals to focus on advisory roles and strategic decision-making.

Adopting AI also supports greater agility and responsiveness in a complex regulatory environment. With the right implementation strategy, starting from data readiness to team training, businesses can integrate AI seamlessly into their tax workflows. As AI capabilities continue to evolve, staying proactive ensures organizations remain competitive and compliant in the digital age.

Moving Forward: A Strategic Approach to AI-Driven Transformation

As AI continues to redefine tax functions across industries, businesses have a prime opportunity to streamline compliance, reduce operational burdens, and unlock deeper financial insights. From automating repetitive filings to enhancing strategic forecasting and risk management, AI is no longer optional, it’s essential for staying agile in a fast-evolving regulatory environment.

At SmartDev, we build AI-driven tax solutions that simplify data workflows, accelerate processing, and ensure scalable, audit-ready accuracy. Whether you’re piloting document automation, leveraging AI for tax provision modeling, or exploring intelligent analytics, we partner with you to align technology with your tax and finance strategies.

Explore our AI-powered software development services to see how we build intelligent, compliance-ready solutions tailored to tax operations, from automating document workflows to enabling predictive tax planning and audit analytics.

Contact us today to explore how AI can elevate your tax operations and help future-proof your organization in the age of intelligent automation.

—

References:

- AI: Reshaping the Future of Tax | Deloitte

- How GenAI is reshaping the future of tax talent | EY

- How Is AI Used in Tax and Accounting? | Bloomberg Tax

- KPMG Survey: AI Adoption Across US Finance Functions Reaches Highest Levels, with ROI Exceeding Expectations | KPMG

- How artificial intelligence will empower the tax function | EY

- AI in the workplace: A report for 2025 | McKinsey & Company

- Maximize efficiency and automate tax work paper preparation with 1040SCAN | Thomson Reuters

- AI in Tax Smarter. Faster. Ready for the future. Generative AI for powerful tax productivity | KPMG

- KPMG launches KPMG Workbench: a multi-agent AI platform, transforming client delivery and ways of working across the global organization | KPMG

- How an AI application can help auditors detect fraud | EY

- 10 Ways Generative AI Can Be Used in the Taxation Sector [2025] | DigitalDefynd

- Q&A: Expert discusses how AI is impacting the tax industry | Phys.org