PCI DSS-Compliant Custom GPT Development: What Fintech Companies Actually Pay

Introduction

You’re looking at custom GPT development costs between $150,000-$800,000 for fintech companies needing PCI DSS compliance. If you’re a fintech CTO wrestling with AI budget planning right now, I’ll break down the real numbers, hidden costs, and ROI factors you need.

Global digital transformation spending hit $1.85 trillion in 2022 and is projected to double by 2027, making AI adoption crucial for competitive positioning. But here’s what most vendors won’t tell you upfront: compliance requirements add 25-40% to your base development costs.

Quick Cost Summary

- Base development: $150,000-$800,000 for enterprise fintech solutions

- PCI DSS compliance add-on: 25-40% of base costs

- Customer service automation: 40-50% operational cost reduction within 12 months

- Fraud detection ROI: 2-5x initial investment annually

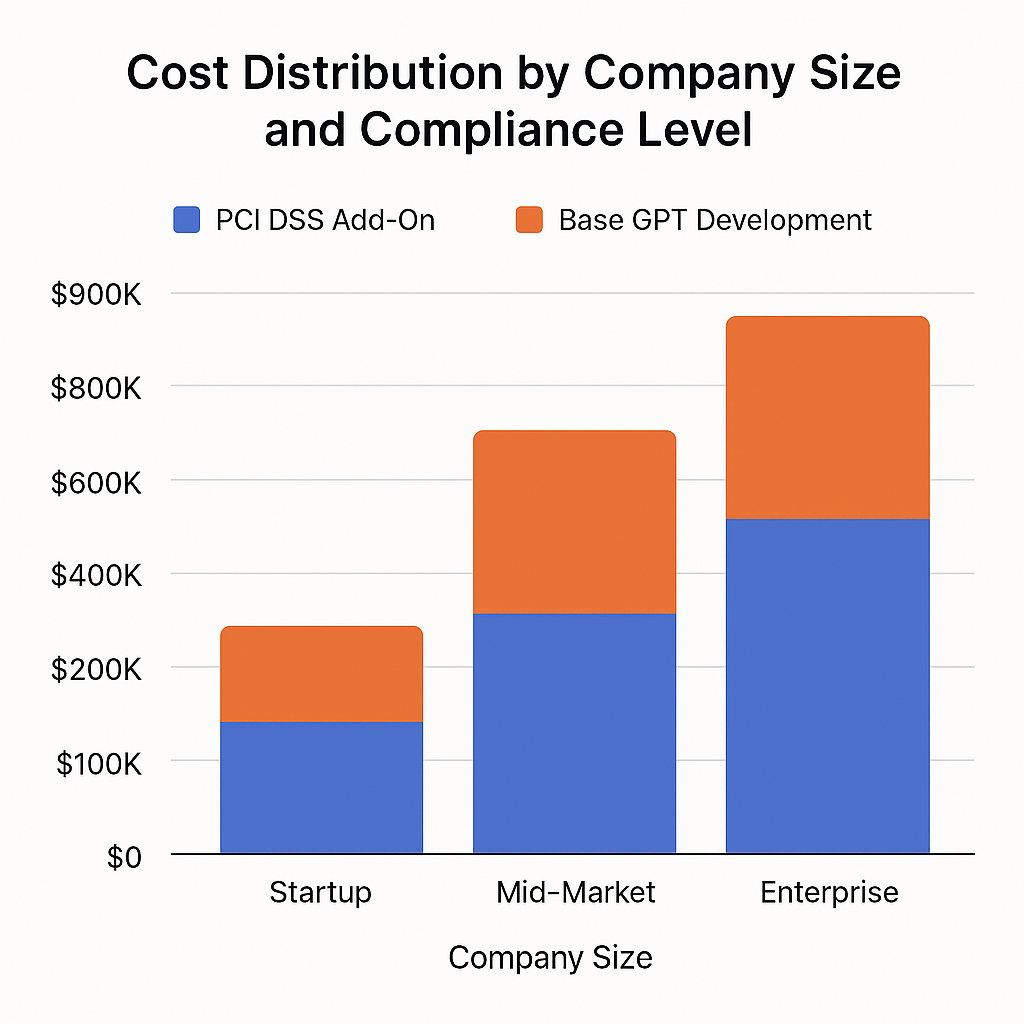

Figure 1: Cost distribution by company size and compliance level

Base GPT Development Costs Start at $120,000-$600,000

Custom GPT development for enterprise fintech ranges from $120,000 to $600,000 before you add compliance requirements. This baseline covers core AI model customization, training, and integration work.

The development process involves fine-tuning large language models for specific use cases:

- Customer service automation

- Fraud detection algorithms

- Regulatory reporting systems

- Risk assessment tools

Development timelines span 4-12 months, with PCI DSS compliance extending this by 2-4 months. Key technical components driving these costs include:

Data Processing and Security Requirements

Financial data preprocessing requires specialized expertise since you’re dealing with sensitive information requiring careful anonymization. Model architecture selection significantly impacts both performance and compliance costs – larger models provide better accuracy but need more robust security infrastructure.

API development and secure integration typically represent 20-30% of total project costs in fintech environments. You’ll need secure API endpoints with PCI DSS compliance, which requires additional encryption, monitoring, and access control implementations beyond standard development practices.

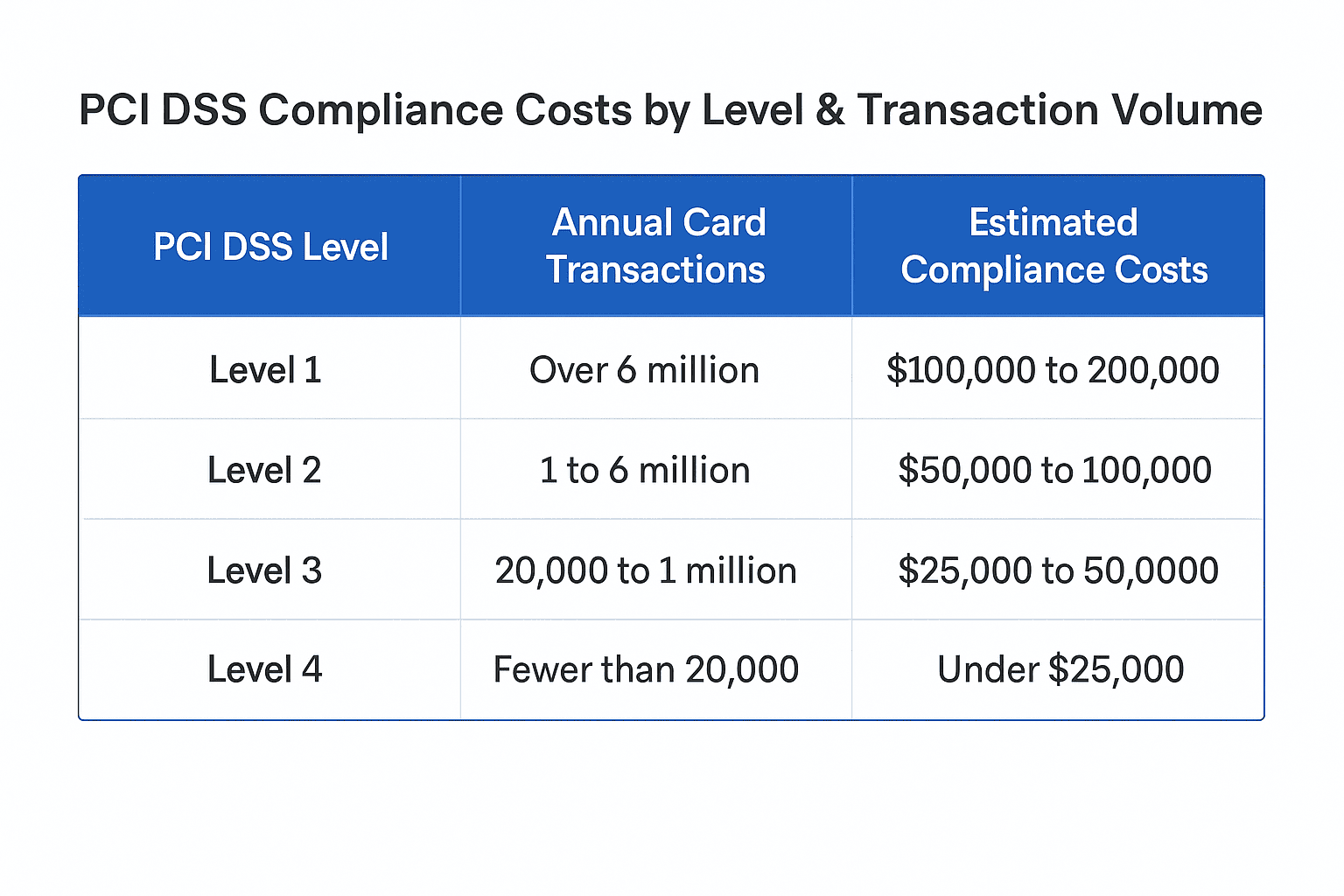

PCI DSS Compliance Adds $50,000-$200,000 to Your Project

PCI DSS compliance adds $50,000-$200,000 to custom AI project costs for security implementation, monitoring systems, and documentation. Annual compliance maintenance runs $20,000-$80,000.

PCI DSS Level 1 Requirements Drive the Highest Costs

Companies processing over 6 million card transactions annually face the most stringent security measures. You’ll need comprehensive security frameworks affecting every development aspect:

- Data encryption standards

- Network segmentation requirements

- Access control implementations

- Continuous monitoring systems

End-to-end encryption and secure development lifecycle increase project duration by 15-25% and QA costs by 30-50%. All data transmission, storage, and processing must meet PCI DSS encryption standards.

Network segmentation and monitoring infrastructure requires $25,000-$100,000 in additional setup costs for:

- Isolated network environments

- Intrusion detection systems

- Continuous monitoring tools

Figure 2: PCI DSS compliance costs by level and transaction volume

Project Phase Breakdown: Where Your Money Goes

Discovery and Planning Phase (10-15% of total cost)

Requirements gathering and compliance assessment costs $15,000-$60,000. This phase includes:

- Regulatory review and analysis

- Technical feasibility studies

- Detailed project scoping with compliance considerations

- Architecture design and security framework planning

The phase requires 4-8 weeks since PCI DSS-compliant system architecture needs security architects with specific fintech compliance experience.

Development and Training Phase (60-70% of total cost)

Core GPT model customization and training costs $80,000-$350,000. This includes:

- Compute resources for model training

- Specialized talent and expertise

- Iterative model refinement over 8-16 weeks

Compliance-specific feature development adds $30,000-$150,000 for:

- Audit logging capabilities

- Data masking implementations

- Access controls and permissions

- Compliance reporting features

Security testing and penetration testing requires $20,000-$80,000 for thorough assessment by certified professionals.

Integration and Deployment Phase (15-20% of total cost)

Production environment setup with PCI DSS compliance costs $25,000-$100,000. This covers:

- Secure infrastructure configuration

- Monitoring systems implementation

- Compliance tools integration

User acceptance testing and compliance validation requires 3-6 weeks of dedicated effort for end-to-end testing with real financial data.

Company Size Determines Your Cost Range

Enterprise fintech companies (>$1B assets) face 40-60% higher costs; regional banks invest $150,000-$400,000; startups spend $120,000-$250,000 for PCI DSS-compliant GPT solutions.

Enterprise vs. Mid-Market vs. Startup Costs

Enterprise fintech companies with over $1 billion in assets face 40-60% higher development costs due to:

- More complex integrations across business units

- Higher security standards and audit requirements

- Extensive testing across multiple systems

Regional banks and credit unions typically invest $150,000-$400,000, balancing functionality requirements with budget constraints through phased implementation approaches.

Fintech startups can expect entry-level solutions starting at $120,000-$250,000 by opting for simplified compliance requirements and focused use case implementations.

Geographic Cost Variations

North American and European projects cost 20-30% more due to regulatory overhead; offshore development delivers 30-50% savings. GDPR, SOX compliance, and regional banking regulations add complexity layers beyond basic PCI DSS requirements.

Multi-jurisdiction deployments increase costs by 25-40% per additional region, as each new market requires:

- Separate compliance assessments

- Local regulation reviews

- Potentially modified implementations

Technology Stack Complexity Factors

Legacy system integration adds $50,000-$200,000 to modern GPT implementations. Older core banking systems require extensive middleware development and custom API creation.

Real-time processing requirements increase infrastructure costs by 30-50% for low-latency applications supporting fraud detection or trading systems.

Multi-language and multi-currency support adds $20,000-$80,000 per additional language/currency pair for global fintech applications.

Building a PCI DSS-Compliant GPT Solution? Let’s Do It Right.

Partner with SmartDev’s AI and compliance experts to design and deploy GPT solutions that meet PCI DSS standards: secure, scalable, and tailored for fintech.

From planning to audit readiness, we help you achieve compliance without slowing innovation.

Get My Compliance EstimateExpected ROI: Customer Service Cuts Costs 40-50%

Customer service automation reduces operational costs by 40-50% within 12 months; compliance automation streamlines audit processes by 25-45%. Custom AI for fraud detection often returns 2-5x the development investment annually.

Quantifiable Benefits You Can Expect

Customer Support Automation

- GPT-powered support handles 70-80% of routine inquiries

- Significantly reduces human agent requirements

- Improved response times and 24/7 availability

Fraud Detection Improvements

- Enhanced pattern recognition capabilities

- Real-time analysis and threat identification

- Often identifies threats traditional systems miss

Regulatory Reporting Automation

- 30-50% reduction in compliance costs per reporting cycle

- Automated data gathering, analysis, and report generation

- Reduced manual effort and error rates

Long-term Value Considerations

Custom GPT solutions provide 3-5 year competitive advantages through proprietary AI capabilities. Domain-specific model training creates unique intellectual property that’s difficult for competitors to replicate quickly.

Scalability benefits allow 200-500% transaction volume increases without proportional cost increases. Well-architected GPT solutions handle massive scale increases with minimal additional infrastructure investment.

Industry data suggests best-performing fintech AI implementations typically achieve payback periods of 18-36 months for operational AI automation.

Figure 3: Our customer testimonial about SmartDev’s ROI achievement timeframe

Cost Optimization Strategies That Actually Work

PCI DSS certified partners add 15-25% to hourly rates but reduce long-term compliance risks and prevent costly overruns. Fixed-price contracts with compliance guarantees are becoming industry standard.

Choosing the Right Development Partner

Certified PCI DSS development partners typically charge premium rates but reduce overall project risk by:

- Preventing costly compliance mistakes

- Ensuring first-time audit success

- Understanding regulatory requirement nuances

Experienced compliance teams can navigate complex implementation challenges efficiently, often saving more in avoided mistakes than their premium costs.

Phased Implementation Approaches

Spreading costs over 12-24 months while delivering early value makes large investments more manageable:

- Phase 1: High-impact use cases (customer service automation)

- Phase 2: Risk management and fraud detection

- Phase 3: Advanced analytics and reporting

Starting with high-impact use cases provides ROI to fund subsequent development phases.

Technology Cost Optimization

Companies with established PCI DSS environments can focus investment on AI development rather than compliance foundation, reducing incremental costs by 20-30%.

Open-source foundation models typically reduce licensing costs by $50,000-$200,000 versus proprietary models with minimal impact on compliance performance. Commercial fine-tuning of open models often provides better cost-performance ratios than building from scratch.

Future Cost Trends: Plan for 2025-2030

AI regulatory compliance expected to increase development costs 10-20% by 2026; quantum-resistant encryption upgrades by 2030 likely to add $25,000-$100,000 to fintech solution rebuilds.

Emerging Cost Factors

AI Regulation Compliance will add 10-20% to development costs by 2025-2026 as emerging frameworks require:

- Additional documentation and testing

- Enhanced audit capabilities

- Real-time explainability features ($30,000-$120,000 additional cost)

Quantum-Resistant Encryption requirements may necessitate security upgrades costing $25,000-$100,000 by 2030 for long-term compliance maintenance.

Cost Reduction Opportunities

Industry adoption of standardized compliance frameworks projected to cut custom implementation needs by 20-30% in the next 3-5 years. Industry-standard compliance templates and tools will streamline implementation processes.

Continuous improvement in AI development platforms is reducing development timelines by 30-40%, which should lower costs for innovative fintechs by 2026.

Shared compliance infrastructure models may cut per-firm costs by 40-50% for mid-size fintechs by 2027 through industry consortiums and shared service providers.

The trajectory favors early adopters who can establish competitive advantages before costs rise due to increased regulation. Smart fintech leaders are making these investments now to secure market position and operational efficiency benefits.

Ready to explore custom GPT development for your fintech company? Contact SmartDev’s AI experts for a detailed cost assessment and implementation roadmap tailored to your PCI DSS compliance requirements.