AI and advanced machine learning in BFSI market are driving a major digital transformation across the global Banking, Financial Services, and Insurance sector. AI has become a core technology in BFSI, reshaping how financial institutions deliver products, manage risk, and improve customer experience.

In 2023, financial firms invested around USD 35 billion in AI, reflecting its growing role in revenue growth and operational efficiency. This report provides a top-of-funnel overview of AI and advanced ML in BFSI, combining market data with educational insights to highlight key technologies, use cases, opportunities, and challenges across banking, insurance, and fintech.

Market Overview: Rapid Growth of AI in BFSI

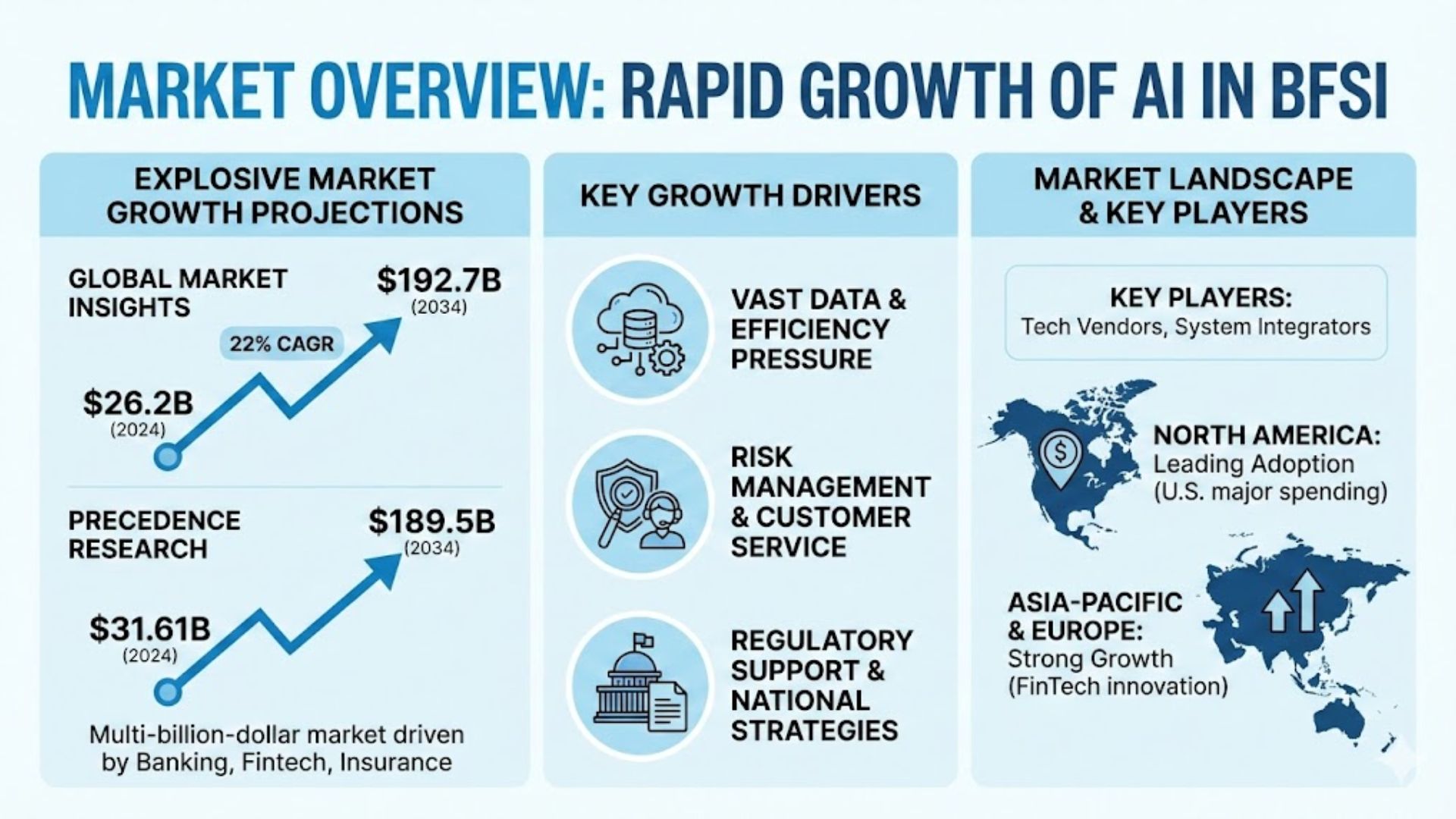

Industry analysts forecast explosive growth in the AI and machine learning market for BFSI. For example, Global Market Insights estimates the global AI in BFSI market at about $26.2 billion in 2024 with a 22% CAGR through the next decade. One report predicts the market will reach roughly $192.7 billion by 2034. Similarly, Precedence Research projects growth from $31.61 billion in 2024 to about $189.5 billion by 2034. These forecasts align on a multi-billion-dollar market driven by banking, fintech, and insurance adoption worldwide.

Several factors fuel this expansion: BFSI firms are sitting on vast amounts of data and are under pressure to improve efficiency, customer service, and risk management simultaneously. AI provides tools to process large data volumes in real time and extract insights (for example, spotting fraud patterns or predicting loan default) to run operations more efficiently. Governments and regulators have also spurred interest. For instance, U.S. Treasury and international bodies have issued guidance on managing AI-related risks, while national AI strategies (e.g. India’s National AI strategy) encourage adoption in finance.

Key players in this market include both technology vendors (cloud and software providers) and system integrators serving BFSI clients. Regional markets differ: North America leads in adoption, with the U.S. alone accounting for several billion dollars of AI spending in BFSI. Globally, Asia-Pacific and Europe also show strong growth, aided by innovations in FinTech and pro-technology regulations.

Driving Factors and Key Trends Accelerating AI Adoption in the BFSI Market

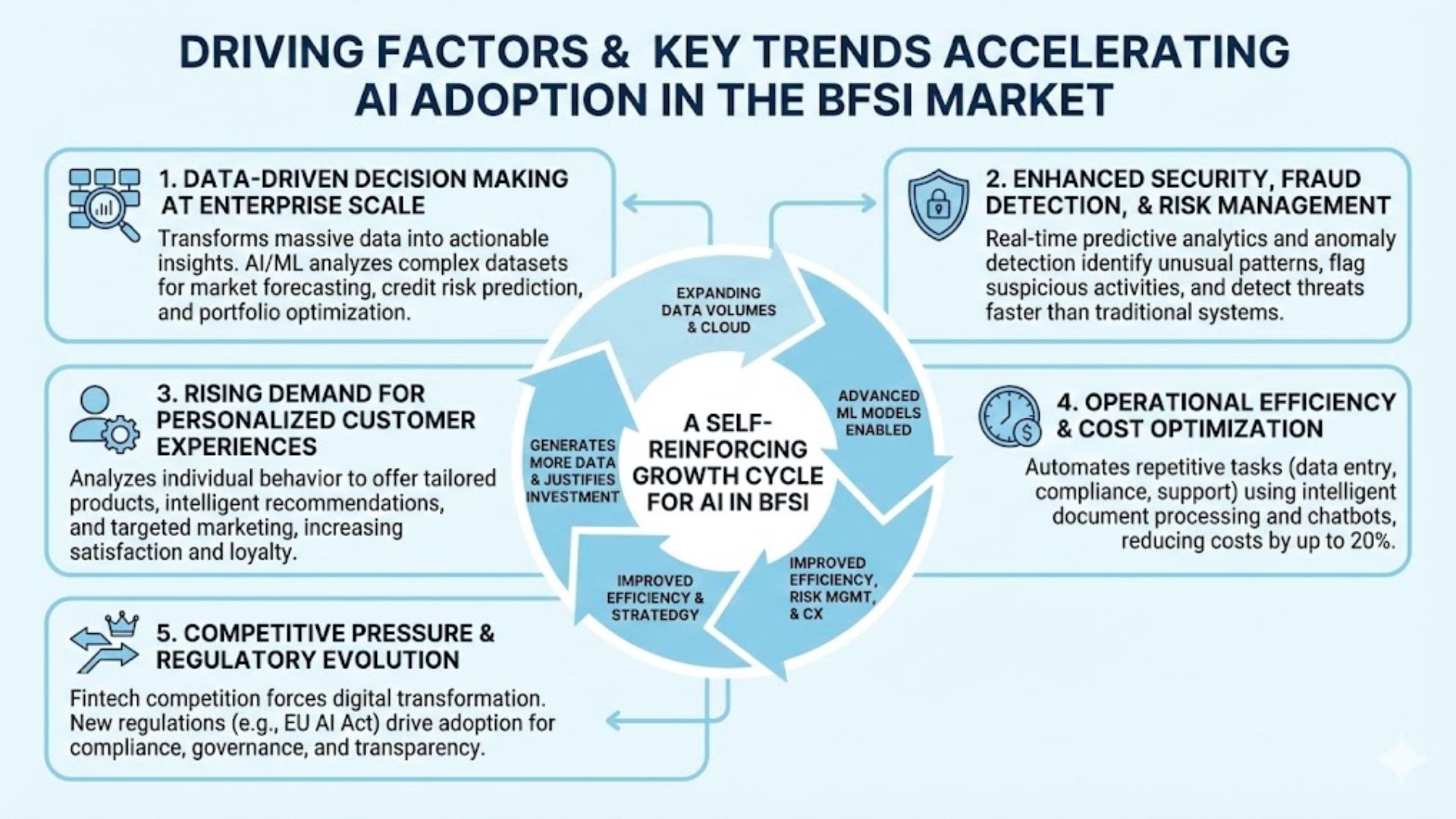

The rapid growth of AI and advanced machine learning in the BFSI market is not driven by a single factor. Instead, it is the result of multiple structural, technological, and market forces converging at the same time. Below are the most critical drivers shaping AI adoption across banking, financial services, and insurance.

1. Data-Driven Decision Making at Enterprise Scale

BFSI organizations generate and manage massive volumes of data every day, including transaction records, customer interactions, credit histories, and market data. However, the real challenge lies not in data availability, but in transforming raw data into actionable insights.

AI and machine learning enable financial institutions to analyze complex datasets at scale, uncover hidden patterns, and support faster, more accurate decision-making. Machine learning models are increasingly used to forecast market trends, predict credit default risks, and optimize portfolio performance. As a result, data-driven strategic decision-making has become one of the most fundamental drivers behind AI adoption in the BFSI sector.

2. Enhanced Security, Fraud Detection, and Risk Management

Fraud, cybercrime, and financial risk represent significant operational and reputational costs for BFSI organizations. Traditional rule-based systems often struggle to keep pace with increasingly sophisticated fraud techniques.

AI-powered predictive analytics and anomaly detection models can continuously monitor transactions and user behavior in real time. These systems identify unusual patterns, flag suspicious activities, and detect potential threats much faster than manual or legacy approaches. By improving accuracy and response time in fraud detection and risk control, AI has become a mission-critical capability for modern financial institutions.

3. Rising Demand for Personalized Customer Experiences

Customer expectations in financial services have evolved rapidly. Today’s consumers expect personalized, seamless, and digital-first experiences across all touchpoints.

AI enables banks and insurers to move beyond basic segmentation by analyzing individual customer behavior, financial profiles, and preferences. Intelligent recommendation engines can suggest relevant products, investment options, or insurance coverage tailored to each customer. AI-driven personalization also powers targeted marketing campaigns and contextual customer engagement, helping BFSI organizations increase customer satisfaction, loyalty, and lifetime value.

4. Operational Efficiency and Cost Optimization

Operational complexity and cost pressure remain major challenges in the BFSI industry. Many institutions still rely on manual processes for tasks such as data entry, document verification, compliance reporting, and customer support.

AI-driven automation significantly improves efficiency by handling repetitive, rule-based tasks at scale. Technologies such as intelligent document processing, chatbots, and workflow automation reduce processing time, minimize human error, and allow employees to focus on higher-value activities. Industry research indicates that effective AI adoption can help banks reduce operating costs by up to 20%, making cost optimization a powerful driver for AI investment.

5. Competitive Pressure and Regulatory Evolution

The competitive landscape in BFSI is becoming increasingly crowded, particularly with the rise of fintech companies and digital-native financial platforms. These players are often more agile and faster at deploying AI-driven solutions, forcing traditional banks and insurers to accelerate their own digital transformation initiatives.

At the same time, regulatory frameworks around AI are beginning to take shape. Regulations such as the EU AI Act classify certain financial AI use cases, including credit scoring, as high-risk applications. As a result, BFSI organizations are adopting AI not only to remain competitive, but also to proactively prepare for future compliance, governance, and transparency requirements.

A Self-Reinforcing Growth Cycle for AI in BFSI

Together, these drivers form a self-reinforcing cycle. Expanding data volumes and cloud computing capabilities enable more advanced machine learning models. These models improve operational efficiency, risk management, and customer experience, which in turn generate more data and justify further AI investment. This dynamic creates a robust and sustainable growth environment for AI solutions across the BFSI market.

Key AI Technologies Powering the BFSI Market

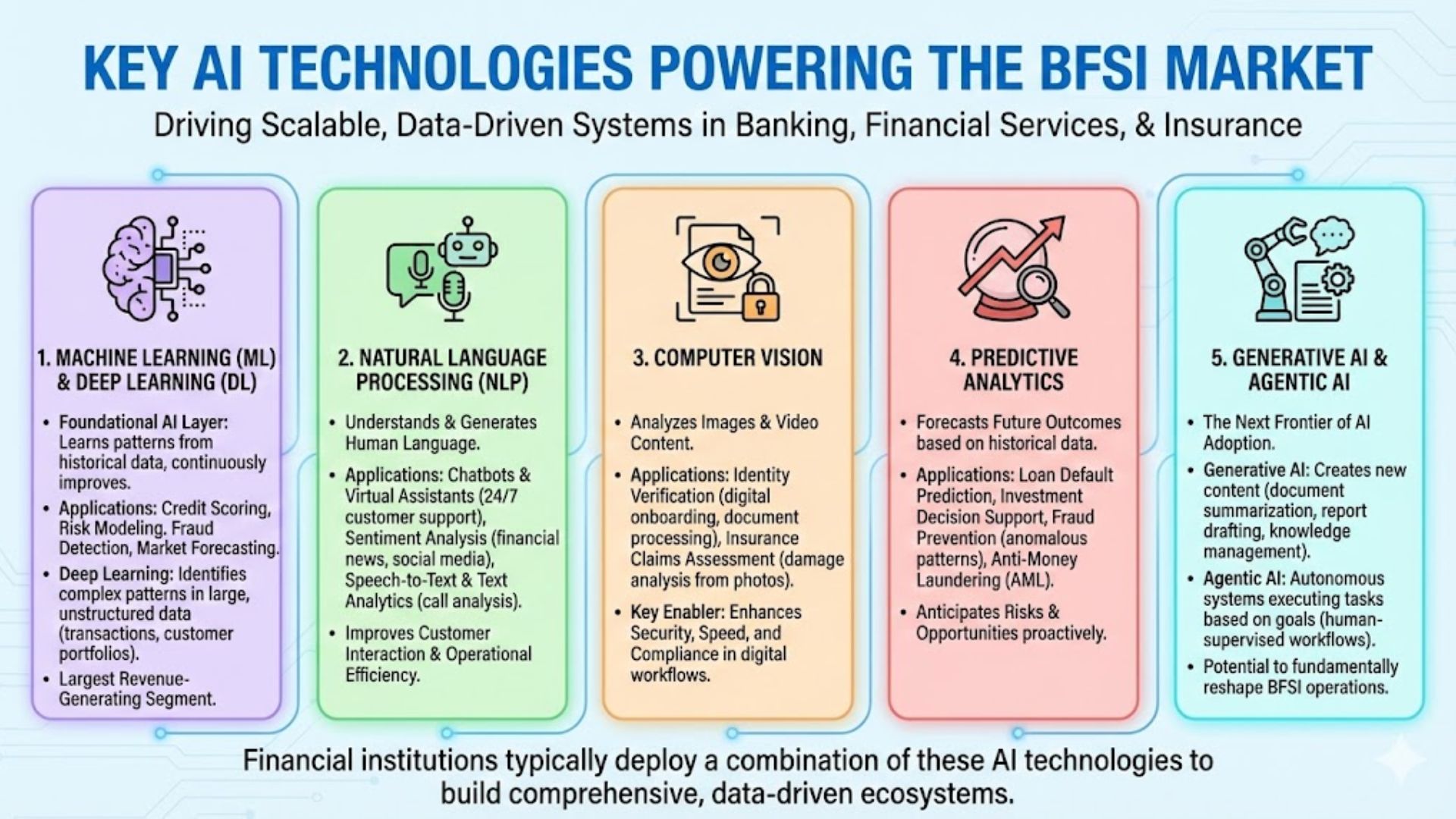

The adoption of AI and advanced machine learning in the BFSI market is driven by a diverse set of technologies, each addressing specific operational, analytical, and customer-facing needs. Financial institutions typically deploy a combination of these AI technologies to build scalable, data-driven systems across banking, financial services, and insurance.

Machine Learning (ML) and Deep Learning (DL)

Machine learning and deep learning form the foundational layer of AI adoption in BFSI. These algorithms learn patterns from historical data and continuously improve their performance over time.

Banks and financial institutions use supervised and unsupervised machine learning models for credit scoring, risk modeling, fraud detection, and market forecasting. Deep learning, powered by neural networks, is particularly effective in identifying complex, non-linear patterns within large and unstructured datasets such as transaction histories, trading data, and customer portfolios.

Industry research consistently highlights machine learning as the largest revenue-generating segment within the BFSI AI market. ML applications span a wide range of functions, including market impact analysis, banking automation, real-time monitoring, and predictive risk assessment, making it a core technology for AI-driven financial transformation.

Natural Language Processing (NLP)

Natural language processing enables machines to understand, interpret, and generate human language. In the BFSI sector, NLP plays a critical role in improving customer interaction, operational efficiency, and market intelligence.

NLP powers chatbots and virtual assistants used in mobile banking apps, websites, and contact centers. These systems handle customer inquiries, provide account information, and support self-service transactions around the clock. Beyond customer service, NLP is also applied to sentiment analysis of financial news, social media, and customer feedback, helping institutions assess market sentiment and reputational risk.

Banks increasingly use speech-to-text and text analytics to analyze recorded calls and chat logs, uncover service issues, and improve customer experience at scale.

Computer Vision

Computer vision enables AI systems to analyze images and video content, making it especially valuable for identity verification and document processing in BFSI workflows.

During digital onboarding, AI-powered image recognition can verify identity documents, extract relevant information, and validate customer credentials in seconds. This significantly reduces onboarding time while enhancing security and compliance. Insurers also leverage computer vision to assess claims, such as analyzing photos of vehicle damage or property loss to estimate repair costs and detect fraud.

As digital-first banking and insurance models continue to grow, computer vision has become a key enabler of seamless and secure customer journeys.

Predictive Analytics

Predictive analytics uses statistical models and machine learning techniques to forecast future outcomes based on historical data. In the BFSI market, predictive models support decision-making across lending, investment, fraud prevention, and compliance.

Banks use predictive analytics to estimate loan default probabilities, detect early warning signals of financial distress, and forecast market movements. These models also play a critical role in fraud detection by identifying anomalous transaction patterns and in anti-money laundering (AML) by flagging unusual activity spikes for further investigation.

The ability to anticipate risks and opportunities before they materialize makes predictive analytics one of the most valuable AI capabilities in financial services.

Generative AI and Agentic AI

Generative AI represents the next frontier of AI adoption in BFSI. These models can generate new content, including text, code, and images, based on learned patterns from large datasets.

Financial institutions are beginning to experiment with generative AI for document summarization, report drafting, knowledge management, and internal productivity tools. Industry estimates suggest that generative AI alone could contribute hundreds of billions of dollars in annual value to the global banking sector.

Beyond generative AI, agentic AI introduces autonomous systems capable of executing tasks based on defined goals. In early implementations, organizations are building architectures where a single human supervisor oversees multiple AI agents handling end-to-end workflows, such as transaction processing, compliance checks, or operational monitoring. While still emerging, agentic AI has the potential to fundamentally reshape how financial institutions operate.

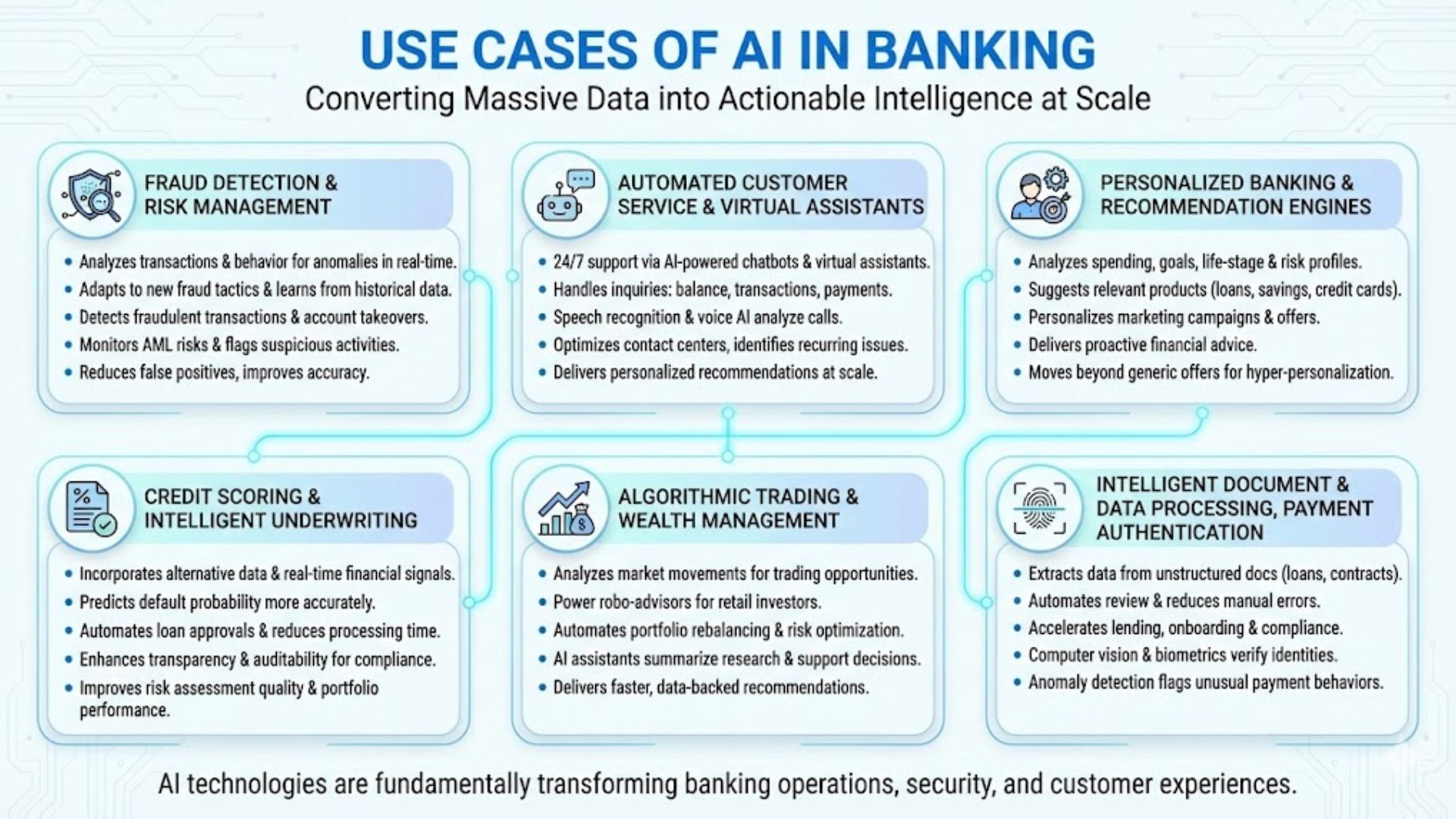

Key Use Cases of AI in Banking

Banks are among the most advanced adopters of AI within the BFSI ecosystem. AI technologies are embedded across front-office, middle-office, and back-office functions to improve efficiency, security, and customer experience.

Fraud Detection and Risk Management

Fraud detection remains one of the most mature and impactful AI use cases in banking. Machine learning models analyze high-volume transaction streams in real time to identify unusual patterns and flag potentially fraudulent activities.

By continuously learning from new data, AI systems adapt to evolving fraud tactics more effectively than traditional rule-based systems. Advanced anomaly detection also supports broader risk management and regulatory compliance, helping banks mitigate financial crime and operational risk.

Automated Customer Service and Virtual Assistants

AI-powered chatbots and virtual assistants are now standard components of digital banking platforms. These systems handle common customer requests such as balance inquiries, transaction history, and card management, providing instant responses and reducing pressure on call centers.

NLP-driven assistants also convert voice calls into structured data for further analysis, enabling banks to improve service quality and operational performance. As AI capabilities mature, virtual assistants are increasingly offering personalized recommendations and proactive support.

Personalized Banking and Recommendation Engines

Personalization is a key differentiator in modern banking. AI-driven recommendation engines analyze customer behavior, financial goals, and transaction patterns to deliver tailored product suggestions and financial advice.

Rather than relying on broad customer segments, banks are using AI to treat customers as individuals. Personalized offers, dynamic pricing, and targeted marketing campaigns improve engagement, increase conversion rates, and strengthen long-term customer relationships.

Credit Scoring and Loan Underwriting

AI-enhanced credit scoring models evaluate a wider range of risk factors than traditional scoring methods, including alternative data sources where permitted by regulation. Automated underwriting systems accelerate loan approval processes while improving accuracy and consistency.

These AI-driven models also enhance transparency and auditability by documenting decision variables, supporting regulatory compliance and risk governance requirements.

Algorithmic Trading and Wealth Management

In capital markets and wealth management, AI is widely used for algorithmic trading, portfolio optimization, and robo-advisory services. Machine learning models analyze market data in real time to identify trading opportunities and manage risk.

Investment banks and asset managers also deploy AI assistants to support research, summarize market insights, and generate investment recommendations for advisors and traders.

Document Processing and Data Extraction

Banks process vast volumes of unstructured documents, including loan agreements, compliance filings, and customer records. AI-powered optical character recognition (OCR) and document intelligence systems automate data extraction, classification, and validation.

By transforming unstructured documents into structured data, these systems reduce manual workloads, improve accuracy, and accelerate decision-making across banking operations.

Payment Authentication and Transaction Security

AI plays a critical role in securing digital payments and preventing unauthorized transactions. Computer vision supports identity verification during account setup, while machine learning models monitor payment activity to detect anomalies and suspicious behavior.

These AI-driven security mechanisms help protect customers, reduce fraud losses, and maintain trust in digital financial services.

Ready to cut defect costs by $1.25M annually with computer vision?

Most manufacturers overshoot budgets by 40-60% on first deployment. SmartDev helps you evaluate real CV system pricing, compare costs, and calculate accurate ROI before implementation. Understand hardware ($50K-$150K), software ($30K-$300K), integration complexity, and hidden costs. Build a pilot strategy that delivers 12-18 month payback.

Get transparent pricing, vendor comparison, and ROI analysis tailored to your production line.

Schedule Your Manufacturing AI Cost Analysis TodayUse Cases of AI in Banking

Banks generate massive volumes of structured and unstructured data every day, ranging from transaction records and customer interactions to market feeds and regulatory reports. AI technologies enable banks to convert this data into actionable intelligence at scale.

Fraud Detection and Risk Management

Fraud detection remains one of the earliest and most valuable applications of AI in banking. Machine learning models continuously analyze transaction streams to identify abnormal patterns, suspicious behaviors, and potential financial crime in real time.

Unlike traditional rule-based systems, AI-powered fraud detection systems learn from historical data and adapt to new fraud tactics. Advanced anomaly detection models can uncover subtle correlations across accounts, geographies, and transaction types. Industry research consistently highlights that AI-driven analytics “transform risk management and fraud detection” by uncovering hidden patterns within large, complex datasets.

In practice, banks deploy AI to:

- Detect fraudulent card transactions and account takeovers

- Monitor anti-money laundering (AML) risks

- Flag suspicious activities for regulatory reporting

- Reduce false positives while improving detection accuracy

As digital transactions continue to rise, AI-based fraud prevention has become mission-critical for protecting customers and safeguarding financial institutions.

Automated Customer Service and Virtual Assistants

AI-powered chatbots and virtual assistants have rapidly become standard features in modern banking applications. Using natural language processing (NLP), these systems can understand customer queries and provide instant responses 24/7.

Banks deploy AI assistants to handle:

- Balance inquiries and transaction histories

- Payment and card-related questions

- Account updates and basic troubleshooting

- Beyond text-based chatbots, speech recognition and voice AI convert customer calls into structured data for analysis. This enables banks to optimize contact-center performance, improve service quality, and identify recurring customer issues.

According to industry analyses, retail banks are transforming front-office operations through intelligent CRM systems, automated credit workflows, and AI-powered assistants that deliver personalized recommendations at scale.

Personalized Banking and Recommendation Engines

Personalization is a key competitive differentiator in the AI-driven BFSI market. AI systems analyze customer spending behavior, financial goals, life-stage indicators, and risk profiles to deliver tailored banking experiences.

Machine learning-powered recommendation engines enable banks to:

- Suggest relevant products such as loans, savings plans, or credit cards

- Personalize marketing campaigns and offers

- Deliver proactive financial advice based on customer behavior

Instead of relying on broad customer segmentation, AI allows banks to treat each customer as an individual. Research from leading consulting firms shows that banks are increasingly using AI to move beyond generic offers and deliver hyper-personalized experiences that drive customer satisfaction and long-term loyalty.

Credit Scoring and Intelligent Underwriting

Traditional credit scoring models rely on static rules and limited data sources. AI-enhanced underwriting systems incorporate a wider range of variables, including alternative data, behavioral indicators, and real-time financial signals.

Machine learning models improve credit decisioning by:

- Predicting default probability more accurately

- Automating loan approvals and reducing processing time

- Enhancing transparency and auditability for regulatory compliance

AI-driven credit scoring not only accelerates loan origination but also improves risk assessment quality. Financial institutions benefit from faster decisions, reduced operational costs, and improved portfolio performance.

Algorithmic Trading and Wealth Management

AI plays a central role in capital markets and wealth management. Investment banks, asset managers, and fintech platforms use advanced machine learning to analyze market movements, identify trading opportunities, and optimize portfolio strategies.

Key applications include:

- Algorithmic and high-frequency trading

- AI-powered robo-advisors for retail investors

- Automated portfolio rebalancing and risk optimization

Leading financial institutions have introduced internal AI assistants that summarize research, generate insights, and support investment decision-making. AI-driven advisory tools help financial advisors deliver faster, data-backed recommendations to clients, improving both productivity and service quality.

Intelligent Document and Data Processing

Banks process enormous volumes of documents, including loan applications, compliance filings, contracts, and customer records. AI-powered document processing systems use OCR, NLP, and machine learning to extract and structure data from unstructured sources.

AI enables banks to:

- Automate document review and data extraction

- Reduce manual errors and processing time

- Accelerate lending, onboarding, and compliance workflows

- Document intelligence solutions significantly improve operational efficiency and enable faster decision-making across core banking functions.

Payment Authentication and Transaction Security

AI also plays a critical role in securing digital payments. Computer vision and biometric technologies are used to verify identities during customer onboarding and authentication processes. At the transaction level, anomaly detection models flag unusual payment behaviors across accounts and networks.

These capabilities strengthen trust in digital banking channels while reducing fraud-related losses.

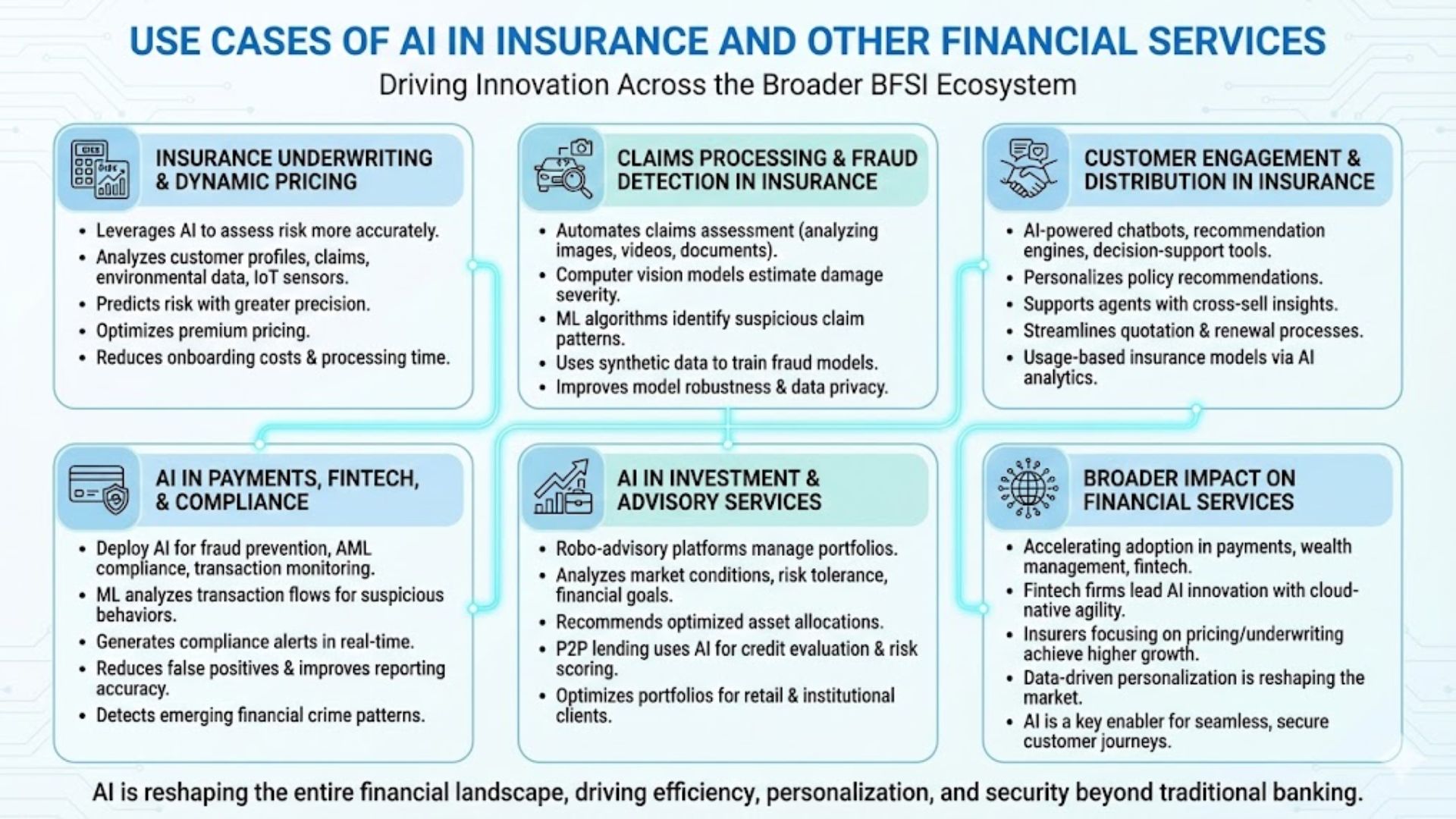

Use Cases of AI in Insurance and Other Financial Services

Beyond banking, AI adoption across the broader BFSI ecosystem is accelerating, particularly in insurance, payments, wealth management, and fintech platforms.

Insurance Underwriting and Dynamic Pricing

Insurance companies leverage AI to assess risk more accurately and price policies dynamically. Machine learning models analyze customer profiles, claims history, environmental data, and even IoT sensor inputs to improve underwriting decisions.

AI-driven underwriting enables insurers to:

- Predict risk with greater precision

- Optimize premium pricing

- Reduce onboarding costs and processing time

Research indicates that insurers focusing AI investments on pricing and underwriting achieve higher premium growth and significantly lower customer acquisition costs.

Claims Processing and Fraud Detection in Insurance

AI automates claims assessment by analyzing images, videos, and documents submitted by policyholders. Computer vision models estimate damage severity, while machine learning algorithms identify suspicious claim patterns.

Some financial institutions also use synthetic data generated by AI to train fraud detection models when real-world examples are limited. This approach improves model robustness while maintaining data privacy and regulatory compliance.

Customer Engagement and Distribution in Insurance

AI-powered chatbots, recommendation engines, and decision-support tools enhance customer engagement throughout the insurance lifecycle. Insurers use AI to personalize policy recommendations, support agents with cross-sell insights, and streamline quotation and renewal processes.

Usage-based insurance models, powered by AI analytics, further illustrate how data-driven personalization is reshaping the insurance market.

AI in Payments, FinTech, and Compliance

Payment networks and fintech platforms deploy AI extensively for fraud prevention, AML compliance, and transaction monitoring. Machine learning models analyze transaction flows to identify suspicious behaviors and generate compliance alerts in real time.

AI-driven compliance systems help organizations:

- Reduce false positives

- Improve regulatory reporting accuracy

- Detect emerging financial crime patterns

Fintech firms, in particular, lead AI innovation due to their agility and cloud-native architectures. Industry data suggests that fintech companies account for a disproportionately high share of AI initiatives in financial services.

AI in Investment and Advisory Services

Robo-advisory platforms use AI to manage investment portfolios for retail and institutional clients. These systems analyze market conditions, risk tolerance, and financial goals to recommend optimized asset allocations.

Peer-to-peer lending and alternative investment platforms also rely heavily on AI for credit evaluation, risk scoring, and portfolio optimization.

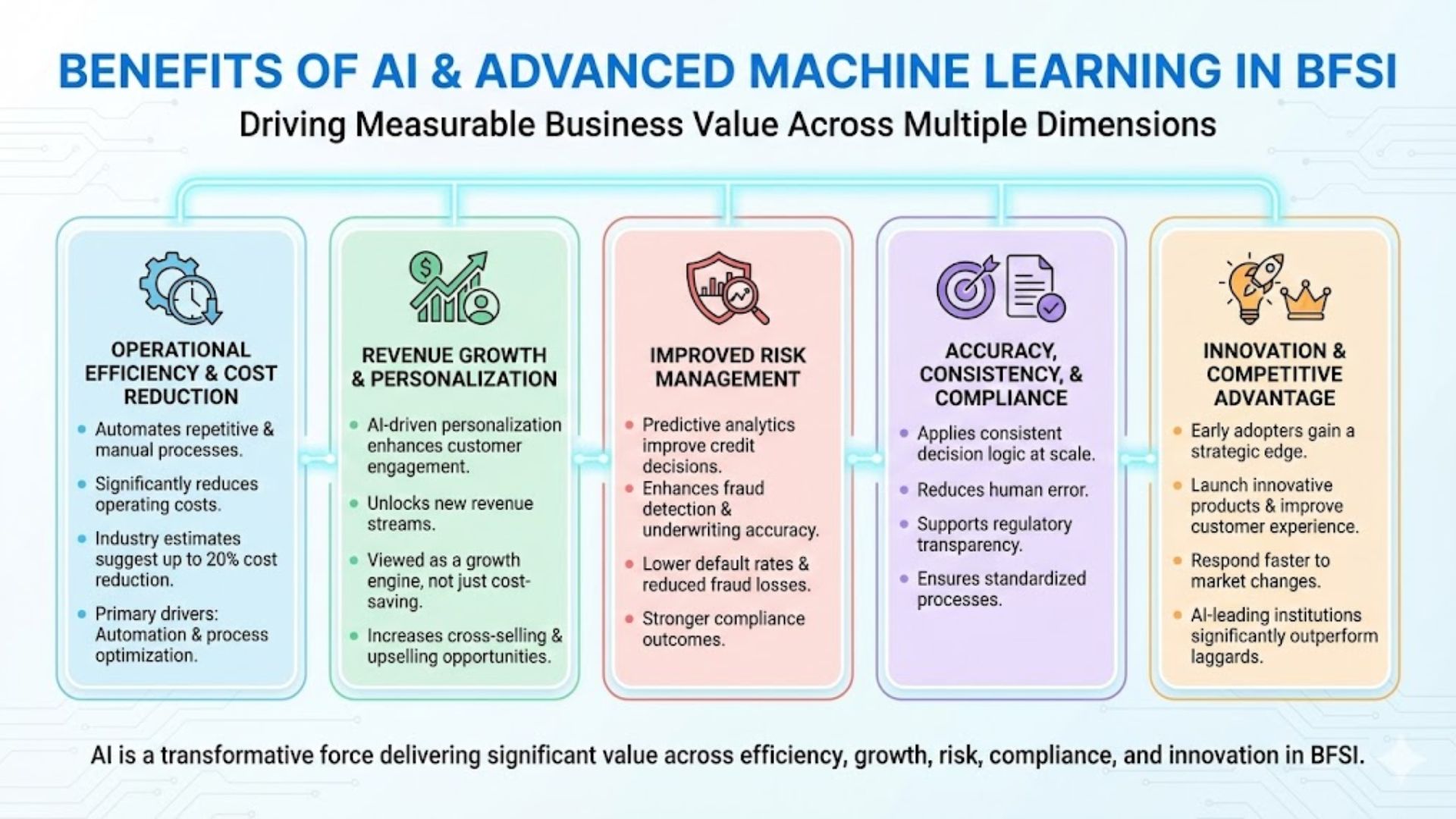

Benefits of AI and Advanced Machine Learning in BFSI

The rapid adoption of AI and advanced machine learning in the BFSI market is driven by measurable business value across multiple dimensions.

Operational Efficiency and Cost Reduction

AI automates repetitive and manual processes, significantly reducing operating costs. Industry estimates suggest AI adoption can reduce banking industry costs by up to 20%, primarily through automation and process optimization.

Revenue Growth and Personalization

AI-driven personalization enhances customer engagement and unlocks new revenue streams. Financial institutions increasingly view AI as a growth engine rather than a cost-saving tool.

Improved Risk Management

Predictive analytics improve credit decisions, fraud detection, and underwriting accuracy. Financial firms benefit from lower default rates, reduced fraud losses, and stronger compliance outcomes.

Accuracy, Consistency, and Compliance

AI systems apply consistent decision logic at scale, reducing human error and supporting regulatory transparency.

Innovation and Competitive Advantage

Early adopters of AI gain a strategic edge by launching innovative products, improving customer experience, and responding faster to market changes. Market data shows that AI-leading financial institutions significantly outperform laggards over time.

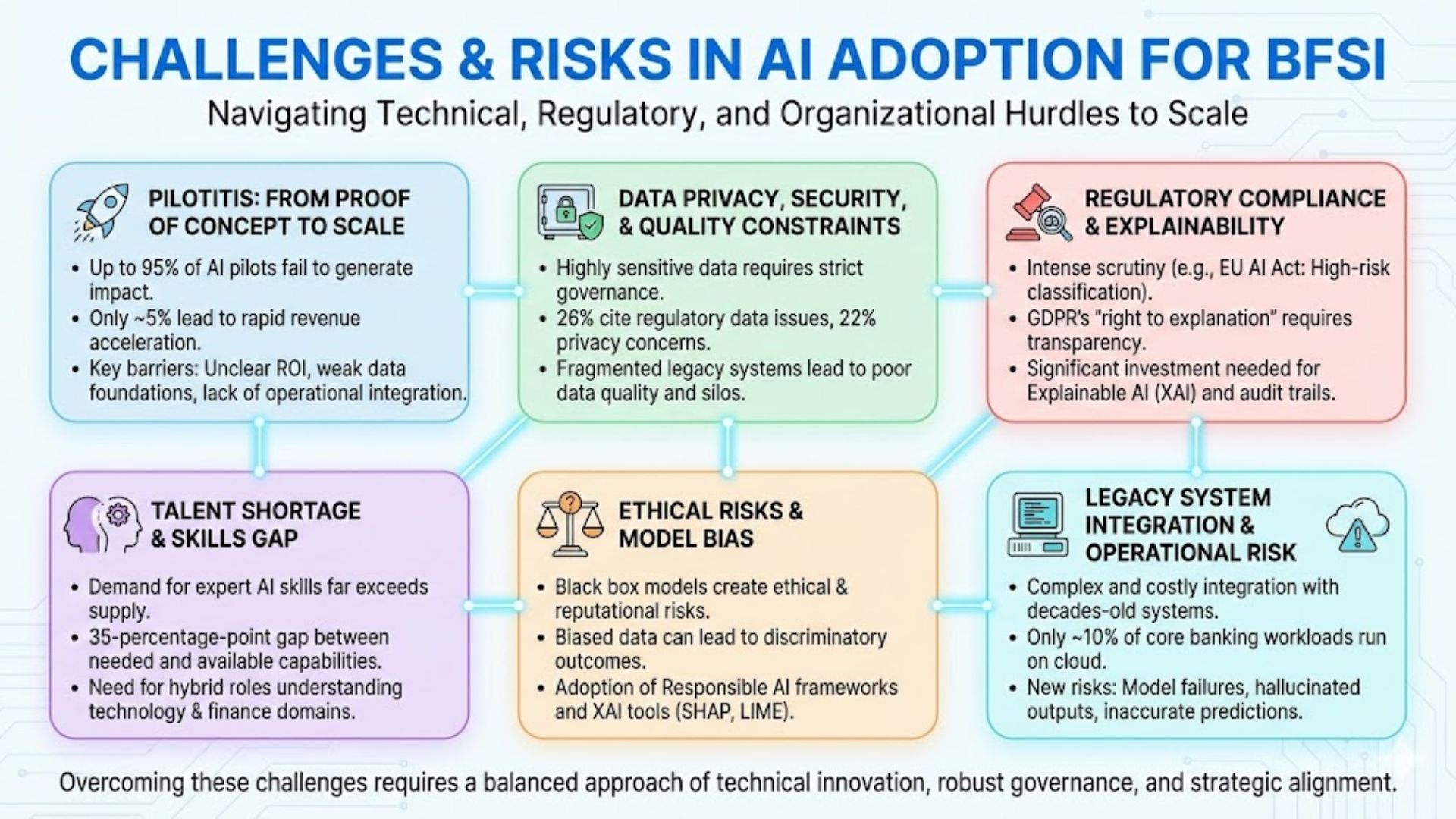

Challenges and Risks in AI Adoption for BFSI

While AI delivers significant value to the BFSI sector, its implementation is far from frictionless. Financial institutions face a combination of technical, regulatory, and organizational challenges when scaling AI initiatives.

Pilotitis: From Proof of Concept to Production at Scale

One of the most persistent challenges in BFSI AI adoption is “pilotitis” — the inability to scale AI pilots into enterprise-wide solutions. Research indicates that up to 95% of AI proof-of-concept projects fail to generate measurable business impact. According to an MIT study, only around 5% of AI pilots lead to rapid revenue acceleration, while the majority stall due to unclear ROI, weak data foundations, or lack of operational integration.

In BFSI, where systems are complex and risk tolerance is low, scaling AI beyond experimentation requires strong alignment between business objectives, data readiness, and technology architecture.

Data Privacy, Security, and Quality Constraints

Financial services rely on highly sensitive data, including personal financial records, transaction histories, and insurance or health-related information. This makes data governance a critical barrier to AI adoption. Industry research shows that 26% of BFSI organizations cite regulatory and compliance data issues, while 22% point to privacy concerns as primary obstacles.

Regulations such as GDPR, GLBA, and sector-specific data protection laws impose strict requirements on how data can be collected, stored, and processed. In addition, fragmented legacy systems often result in poor data quality and silos, limiting model accuracy and reliability.

Regulatory Compliance and Explainability Requirements

AI in financial decision-making operates under intense regulatory scrutiny. The EU AI Act, expected to take effect in 2027, classifies AI-driven credit scoring and underwriting systems as “high-risk”, requiring transparency, explainability, and continuous monitoring.

Similarly, GDPR enshrines the “right to explanation,” meaning customers must be able to understand how automated decisions affect them. As a result, BFSI firms must invest heavily in explainable AI (XAI) methods, documentation, and audit trails—adding cost and operational complexity to AI programs.

Talent Shortage and Skills Gap

Although only 1.5% of financial services roles currently require expert-level AI skills, demand far exceeds supply. Research highlights a 35-percentage-point gap between the AI capabilities BFSI firms need and what is available in the workforce.

This shortage extends beyond data scientists to include ML engineers, AI architects, and product managers who understand both technology and financial domains. Upskilling existing employees through AI literacy programs is essential but time-intensive.

Ethical Risks and Model Bias

AI models, especially deep learning systems, often operate as black boxes. In BFSI, where accountability and fairness are non-negotiable, this creates ethical and reputational risks. Biased data can lead to discriminatory outcomes in lending, insurance pricing, or fraud detection.

To mitigate this, institutions increasingly adopt XAI tools such as SHAP and LIME, which help explain how models arrive at specific decisions. Responsible AI frameworks are becoming standard to ensure fairness, transparency, and trust.

Legacy System Integration and Operational Risk

Many banks still operate on decades-old core systems. Integrating modern AI solutions into these environments is technically complex and costly. While cloud adoption is a key enabler of AI, studies show that only around 10% of core banking workloads currently run on the cloud.

Additionally, AI introduces new forms of operational risk. Model failures, hallucinated outputs, or inaccurate predictions can lead to financial losses. As a result, human-in-the-loop designs, rigorous testing, and continuous validation remain essential.

Why SmartDev: Educational Insights Backed by Market Data

SmartDev’s approach to AI in BFSI focuses on clarity, credibility, and real-world relevance. Our insights combine accessible explanations with rigorous market research, ensuring readers understand not only what is happening, but why it matters.

Key elements of SmartDev’s methodology include:

- Market-Backed Insights: Drawing from McKinsey, Gartner, Accenture, and WEF to ground analysis in credible data.

- Synthetic Data Expertise: Highlighting trends such as Gartner’s projection that 75% of enterprises will use generative AI for synthetic data by 2026, especially relevant for BFSI privacy challenges.

- Governance and Compliance Focus: Addressing real barriers, including regulatory and data governance constraints cited by over 40% of BFSI firms.

- Practical Case Examples: Referencing real deployments such as JPMorgan’s synthetic fraud data, Goldman Sachs’ AI Assistant, and NatWest’s AI-powered customer service initiatives.

By blending educational storytelling with up-to-date market evidence, SmartDev helps BFSI leaders, technologists, and strategists navigate AI adoption with confidence.

Conclusion

AI and advanced machine learning are fundamentally reshaping the BFSI sector. From fraud detection and personalized banking to autonomous agents and generative AI, the transformation is accelerating. With the global AI in BFSI market projected to exceed $100 billion in the coming decade, the opportunity is immense but so are the challenges.

At SmartDev, our mission is to deliver clear, data-driven perspectives that help organizations understand AI trends, evaluate risks, and capture real business value. By connecting technology, regulation, and market dynamics, we empower BFSI stakeholders to move beyond pilots and build scalable, responsible AI solutions.