Introduction

Digital banking is facing new pressures, from rising customer expectations for real-time service to intensifying regulatory demands and growing security threats. Traditional systems are no longer enough to deliver personalized, secure, and scalable experiences.

Artificial Intelligence (AI) has become a strategic imperative, enabling banks to offer proactive fraud prevention, hyper-personalized services, and smarter decision-making. In this guide, we explore how AI is transforming digital banking through concrete applications that deliver measurable business value.

What is AI and Why Does It Matter in Digital Banking?

Definition of AI and Its Core Technologies

AI refers to computer systems that can simulate human intelligence, including learning from data, understanding language, recognizing patterns, and making decisions. Core technologies relevant to digital banking include machine learning, natural language processing (NLP), and computer vision. These enable systems to analyze vast amounts of data, detect anomalies, and interact with conversations.

In digital banking, AI is used to streamline operations, identify fraud in real time, and tailor financial products to individual customer needs. Whether analyzing transactions for risk or powering intelligent chatbots, AI allows banks to scale services, reduce human error, and deliver smarter, faster experiences.

The Growing Role of AI in Transforming Digital Banking

AI is rapidly transforming digital banking from static, reactive systems into intelligent, adaptive platforms. For fraud detection, AI models can assess thousands of data points in milliseconds, stopping suspicious transactions before they cause harm. This real-time capability is reshaping risk management strategies across the industry.

Customer service is also evolving with AI-powered virtual assistants that handle common banking inquiries 24/7, from account updates to dispute resolution. These tools not only lower call center volumes but also improve service accessibility and satisfaction, particularly on mobile-first platforms.

In the back office, AI enables intelligent document processing, automating compliance reviews, credit approvals, and Know Your Customer (KYC) checks. This reduces operational costs and ensures consistency, allowing banks to meet complex regulatory requirements with greater speed and accuracy.

Key Statistics and Trends in AI Adoption in Digital Banking

AI adoption in digital banking is accelerating as institutions prioritize efficiency, agility, and personalization. According to the 2025 AI Index by Stanford University, 78% of organizations across industries reported using AI in 2024, up from 55% in 2023, with banking leading in areas like fraud detection and customer service. The Evident AI Index highlights that 50 of the world’s largest banks are advancing AI maturity, focusing on talent, innovation, and transparency.

Financial institutions are increasingly leveraging generative AI for customer engagement and operational efficiency. For example, JPMorgan Chase has deployed over 300 AI use cases, including generative AI tools like LLM Suite for 140,000 employees, enhancing fraud detection, document processing, and risk management.

The global market for AI in banking was valued at $19.87 billion in 2023 and is projected to reach $143.56 billion by 2030, growing at a CAGR of 31.8%, according to Grand View Research. This growth is fueled by demand for intelligent automation, personalized digital experiences, and enhanced regulatory compliance.

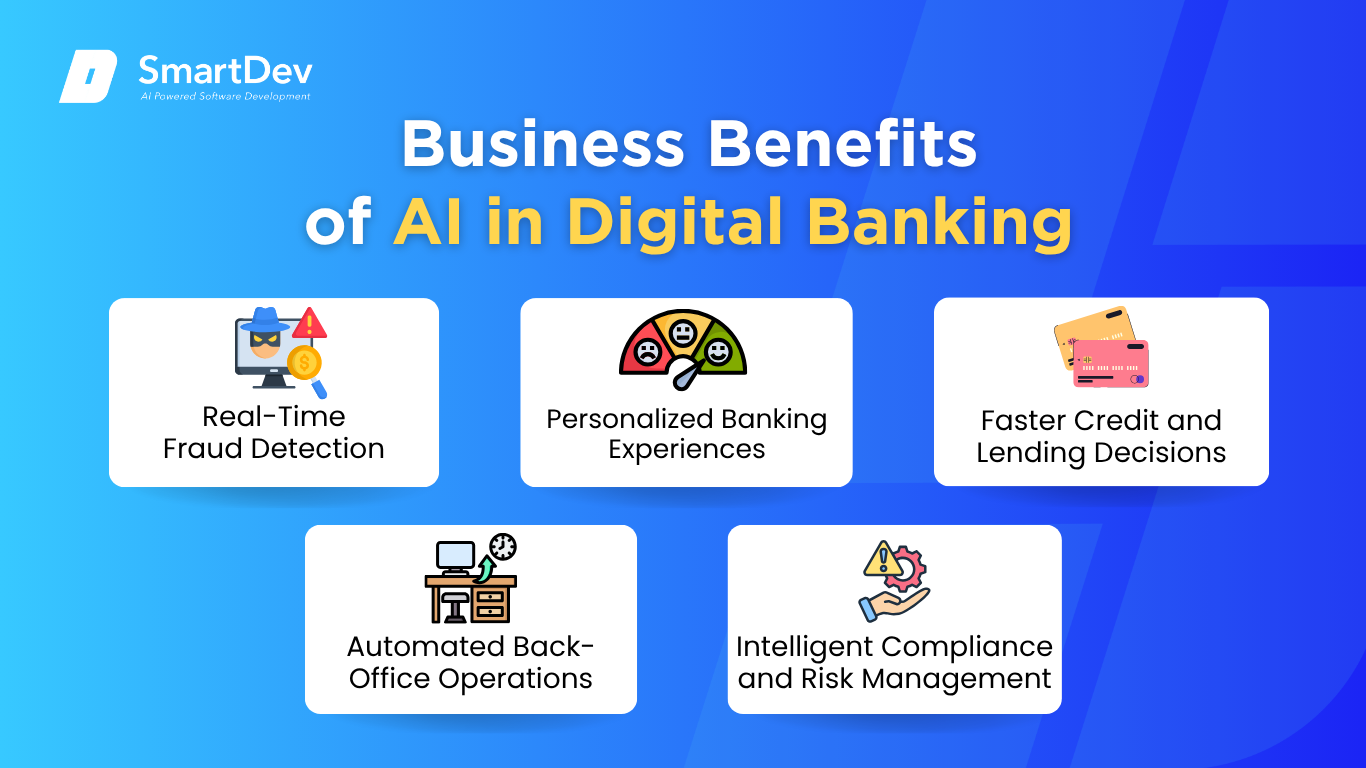

Business Benefits of AI in Digital Banking

AI is creating meaningful improvements in how digital banks operate, engage customers, and manage risks. Below are five strategic benefits, each addressing a critical painpoint in banking.

1. Real-Time Fraud Detection

AI models detect fraud by analyzing behavioral anomalies, location data, device usage, and transaction patterns in real time. This enables banks to proactively block suspicious activity before financial loss occurs, significantly improving fraud response times. As threats evolve, AI systems update their risk logic dynamically—unlike traditional rules-based systems, which must be manually maintained.

Real-time detection also reduces false positives, meaning fewer legitimate transactions are mistakenly flagged. This minimizes customer frustration and enhances trust in digital banking platforms. In highly regulated environments, AI’s precision also helps meet compliance requirements more reliably.

2. Personalized Banking Experiences

AI analyzes customer behavior, preferences, and financial goals to deliver hyper-personalized experiences across mobile apps, web portals, and chat interfaces. These include timely product recommendations, budgeting insights, and contextual nudges that reflect each customer’s life stage or spending habits. This level of personalization makes customers feel understood, increasing satisfaction and digital engagement.

Unlike segmentation-based marketing, AI enables true one-to-one experiences at a scale. Customers are more likely to adopt services when interactions are relevant and well-timed. This leads to higher retention and stronger lifetime value per user.

3. Faster Credit and Lending Decisions

AI models go beyond credit scores to assess alternative signals such as cash flow, employment volatility, and repayment behavior. This allows banks to evaluate risk more accurately, particularly for thin-file or underbanked customers. As a result, loan approval processes become faster, fairer, and more inclusive.

Automated decisioning also reduces time-to-funding, which is crucial for consumers and small businesses needing quick access to credit. AI ensures consistent evaluation criteria across all applicants, improving transparency and reducing human bias. This strengthens risk governance while expanding credit accessibility.

4. Automated Back-Office Operations

Back-office functions like KYC checks, document verification, and data entry are typically time-consuming and error-prone. AI-powered automation handles these tasks with speed and accuracy, reducing operational load on human staff. This results in faster turnaround times and lower operational costs.

AI also supports intelligent exception handling, flagging only truly ambiguous cases for manual review. That frees analysts to focus on complex cases, boosting throughput without compromising quality. Over time, these efficiencies compound, enabling banks to scale without increasing their headcount.

5. Intelligent Compliance and Risk Management

Regulatory compliance often involves massive volumes of data and manual processes. AI streamlines this by continuously monitoring transactions and communications to flag irregularities aligned with AML, KYC, and fraud rules. This reduces the risk of oversight and speeds up reporting cycles.

AI also supports explainable models that trace how risky decisions are made, aiding auditability and regulatory trust. By automating checks and balances, banks can proactively identify issues before they escalate. The result is stronger internal control and lower exposure to fines and reputational damage.

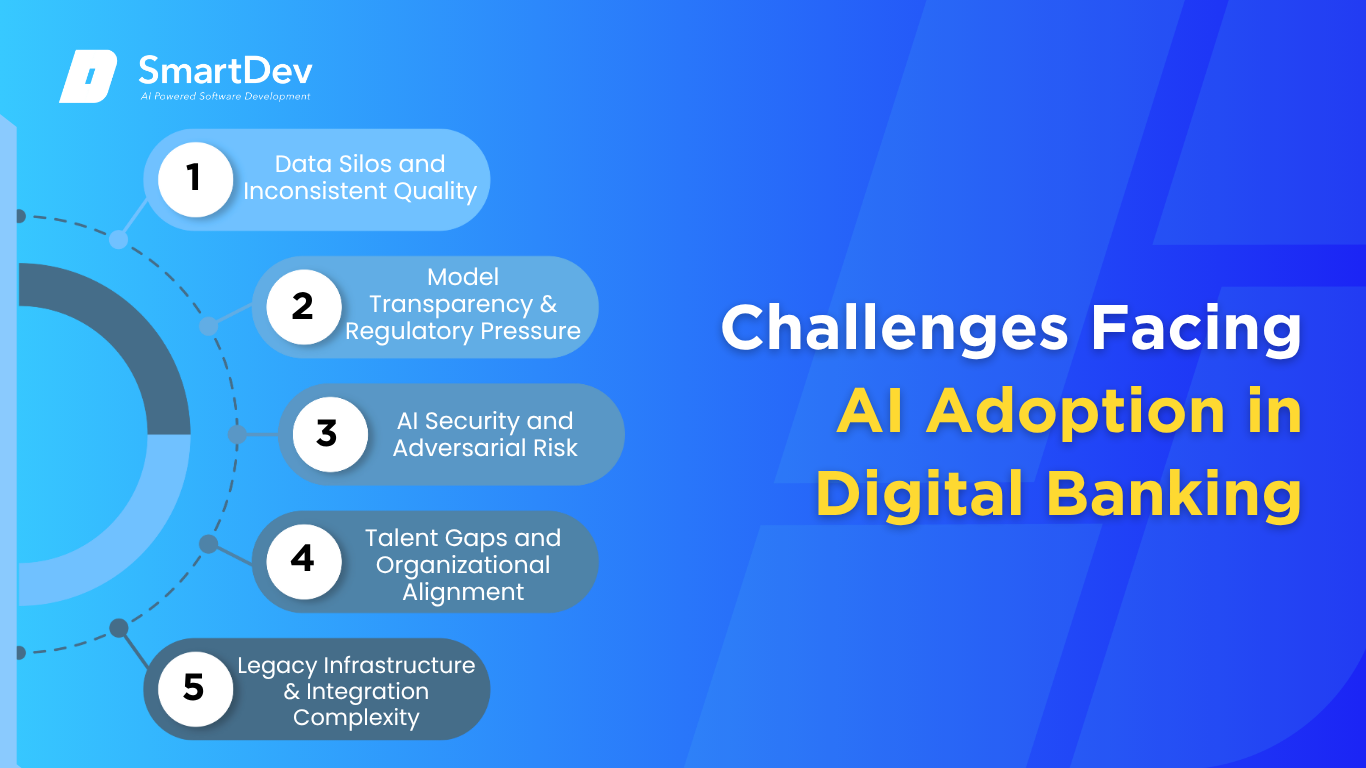

Challenges Facing AI Adoption in Digital Banking

While the value of AI is clear, implementation comes with structural, technical, and regulatory challenges. Below are five barriers that banks must navigate to scale AI effectively.

1. Data Silos and Inconsistent Quality

AI relies on high-quality, integrated data, but many banks operate with fragmented systems and legacy infrastructure. Customer, transactional, and risk data are often stored in separate silos, limiting AI’s ability to generate accurate insights. Without unified pipelines and governance, model performance suffers.

Data standardization and integration are not just technical tasks; they require cross-functional alignment. Teams must agree on taxonomies, access controls, and update protocols. Banks that overlook data infrastructure often fail to realize full AI value.

2. Model Transparency and Regulatory Pressure

AI models, particularly in credit and risk, must be explainable to meet regulatory standards. Complex neural networks or black-box systems can make it difficult to trace decisions, posing compliance risks. Regulators increasingly demand auditability, fairness, and human oversight in automated systems.

Banks need to balance performance with transparency, developing models that deliver results and can be interpreted by legal and compliance teams. This often requires dedicated tooling and cross-functional review processes. Without explainability, even high-performing models may be unusable in critical functions.

3. AI Security and Adversarial Risk

AI systems can be manipulated through adversarial inputs, where attackers deliberately craft data to mislead models. For example, fraudsters might simulate legitimate behavior by bypassing detection algorithms. These threats introduce new vectors for financial and reputational harm.

To mitigate this, banks must adopt AI-specific security practices such as adversarial testing, model hardening, and anomaly detection at the input layer. Traditional cybersecurity measures are not enough. AI must be protected across the data, model, and output pipelines.

4. Talent Gaps and Organizational Alignment

AI requires specialized skills from data science to MLOps to domain-specific regulatory knowledge. Yet banks often face shortages in technical talent and lack structured programs to build these capabilities internally. This slows development, deployment, and long-term innovation.

Organizationally, many banks are still structured around siloed business units, making cross-functional AI teams hard to establish. Success requires cultural change, not just hiring. Institutions that treat AI as a business-wide capability, not just a tech function, see better outcomes.

5. Legacy Infrastructure and Integration Complexity

Most traditional banks still operate on outdated core systems not designed for real-time data ingestion or dynamic AI workloads. Integrating modern AI solutions with these platforms often introduces latency, complexity, and security concerns. This limits scalability and agility.

Modernization requires more than APIs. It often involves re-platforming core functions, migrating to cloud-native architectures, and adopting open standards. These efforts are capital-intensive but necessary. Without them, AI remains isolated in pilots rather than powering enterprise-wide transformation.

Specific Applications of AI in Digital Banking

1. AI‑Powered Virtual Assistants

AI-powered virtual assistants solve a critical customer service challenge in digital banking: delivering instant, accurate support without overwhelming human agents. These assistants simulate human-like conversation through natural language processing (NLP), answering common banking questions such as balance inquiries, password resets, or fraud alerts. Their always-on availability boosts responsiveness, improves customer satisfaction, and reduces wait times in digital channels.

These systems rely on large language models (LLMs) like GPT or Claude, trained on transaction history, support logs, and policy documents. They integrate into mobile apps, websites, and contact centers, with fallback mechanisms to escalate complex queries to human agents. Operationally, they reduce call center costs, shorten resolution times, and increase self-service adoption.

Commonwealth Bank uses an AI-based virtual assistant to handle up to 50,000 customer inquiries daily through its mobile banking app. This assistant is powered by Microsoft Azure and integrated into CommBank’s support platform. It has significantly improved response efficiency and reduced strain on live agents.

2. Smart Document Processing

Smart document processing tackles a major operational challenge in digital banking: manually reviewing and verifying customer-submitted documents. These AI systems use natural language understanding and optical character recognition (OCR) to analyze identity proofs, loan agreements, and compliance forms. By automating data extraction and validation, banks can dramatically accelerate onboarding and reduce errors.

The core technology combines OCR for digitizing scanned files with transformer-based models that identify key information such as names, dates, and financial figures. Integrated with core banking systems, these tools auto-populate forms, trigger approval workflows, and flag discrepancies in real-time. This improves processing speed, reduces labor costs, and ensures compliance with KYC/AML regulations.

Generative AI tools deployed by leading banks now summarize and verify loan documents up to 70% faster than manual review. These tools are often built on platforms like AWS Textract or Google Document AI. Banks report substantial gains in processing time and customer onboarding satisfaction.

3. Predictive Fraud Detection

AI-driven fraud detection addresses a crucial pain point in digital banking: catching fraudulent transactions before they occur. These systems continuously monitor transaction patterns and flag anomalies that could indicate identity theft, account takeover, or payment fraud. Their predictive capabilities allow banks to prevent losses rather than respond to the facts.

Using machine learning algorithms trained on historical fraud data, these models evaluate every transaction in real time based on risk scores. Inputs may include location, device ID, transaction value, and user behavior. They are embedded into transaction processing pipelines and escalate suspicious activity for manual review or customer verification.

PwC reports that AI-enabled fraud systems can reduce fraud-related losses by up to 50% compared to rule-based systems. Many banks integrate these models’ using platforms like Feedzai, Darktrace, or SAS. This leads to faster response times and fewer false positives, improving both security and user experience.

4. AI‑Based Credit Scoring and Risk Analysis

AI-based credit scoring helps digital banks overcome the limitations of traditional credit bureaus and static scoring models. It uses broader datasets, including spending behavior, income flow, and mobile usage to assess borrower’s risk more accurately. This improves credit access for underbanked populations and increases loan portfolio quality.

These systems use supervised machine learning models such as logistic regression, random forests, or neural networks. They analyze structured and unstructured data to calculate default probabilities and recommend approval decisions. Integrated with digital loan origination platforms, they enable instant decisions and dynamic credit limit adjustments.

Machine learning credit scoring models deployed by neobanks have achieved accuracy rates of over 85% on loan repayment predictions. One bank reported reducing default rates by 30% after replacing its legacy scoring system with an AI-powered alternative. This translated into stronger credit growth and lower write-offs.

5. Automated Compliance and Regulatory Reporting

AI streamlines compliance in digital banking by automating report generation, policy matching, and anomaly detection. These tools solve the rising cost and complexity of keeping up with changing regulations such as GDPR, PSD2, and AML directives. They help compliance teams respond faster and with fewer manual errors.

Using NLP and generative AI, these platforms extract obligations from regulatory texts, match them to internal controls, and draft required reports. Integration with audit logs and transaction data enables full traceability and reduces audit risks. Benefits include lower compliance costs, faster report turnaround, and reduced human error.

Several global banks have deployed AI systems that automatically map internal controls to policies and generate audit-ready reports. For example, tools built with IBM Watson or WorkFusion have reduced compliance preparation time by over 60%. This shift enables compliance teams to focus on oversight rather than paperwork.

6. Hyper‑Personalized Financial Insights

AI enables hyper-personalization in digital banking by delivering real-time financial advice tailored to each customer’s behavior, goals, and preferences. These insights help users save more, manage debt, and discover relevant products. This improves engagement and loyalty in an increasingly competitive market.

Behavioral AI systems analyze transaction history, income patterns, and life events to surface nudges like “save more this month” or “you’re overspending on food delivery.” Integrated into banking apps, they trigger timely messages or offers based on user behavior. This increases product uptake, drives cross-sells, and builds long-term customer relationships.

Fintechs and digital banks using these personalization engines report higher product conversion rates and improved Net Promoter Scores (NPS). For example, one neobank saw a 25% increase in customer retention after launching personalized savings recommendations based on user behavior. These systems are often built using AI platforms like Personetics or Flybits.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Digital Banking

AI is already delivering measurable value across leading digital banks. These real-world examples highlight how institutions are using AI to improve operations, enhance customer experience, and reduce risk.

Real-World Case Studies

1. Commonwealth Bank of Australia: AI‑Driven Customer Support & Fraud Detection

Commonwealth Bank of Australia (CBA) has implemented one of the most advanced AI ecosystems in global banking. With over 2,000 AI models deployed, the bank processes 157 billion data points and delivers 55 million real-time decisions daily. These models span customer service, fraud detection, personalization, and operational optimization.

CBA’s AI-powered virtual assistant handles up to 50,000 inquiries daily across digital channels, including the mobile app and website. The assistant is integrated with backend systems and Microsoft Azure, providing contextual responses and seamless escalation to human agents. This has reduced wait times and offloaded a significant portion of volume from call centers.

On the fraud detection front, the bank uses machine learning to proactively identify suspicious activity and protect customer accounts. Models analyze patterns across accounts, devices, and transaction types to flag anomalies in real time. The result is enhanced fraud prevention, lower losses, and a more secure banking environment.

2. Bank of America: Erica Virtual Assistant

Bank of America launched Erica, a conversational AI assistant, to help customers manage finances more efficiently via mobile and online platforms. Erica is powered by advanced NLP models and continuously learns from billions of user interactions. Since its launch, Erica has handled more than 2.5 billion transactions and support inquiries.

The assistant offers a wide range of services, from balance checks and payment reminders to budgeting tips and subscription tracking. It is fully embedded within the bank’s mobile app, making it easily accessible to millions of users. Erica’s ability to deliver contextual, personalized financial guidance has made it a standout feature of the digital banking experience.

Internally, Erica has helped reduce the workload on customer service teams by automating routine inquiries. This has led to significant savings in support costs and improvements in operational efficiency. In customer surveys, Bank of America reported higher satisfaction scores among users who regularly engage with Erica.

3. Citigroup & Ant International: AI‑Powered FX Hedging

Citigroup partnered with Ant International to develop an AI-powered FX hedging tool aimed at helping corporate clients manage currency risk. The solution is built on Ant’s Falcon AI engine, a transformer-based system trained on macroeconomic data and market signals. The platform provides real-time hedging recommendations tailored to a client’s portfolio and exposure profile.

One of the first clients, a major Asian airline, used the platform to cut foreign exchange hedging costs by 30%. The AI system identifies optimal hedging strategies by analyzing currency trends, market volatility, and historical patterns. This represents a major advancement in how corporate treasury departments can automate and optimize financial decisions.

For Citigroup, the partnership demonstrates the growing importance of intelligent, data-driven tools in investment and capital markets. The solution aligns with the bank’s push toward offering AI-enhanced digital services to global clients. It also reinforces the potential of AI to transform complex, high-stakes domains such as risk management and trading.

Innovative AI Solutions

One major innovation is the rise of agentic AI systems, where multiple autonomous agents collaborate across tasks like fraud detection, compliance, and customer engagement. These agents operate independently but share information, improving speed and resilience of decision-making. They enable banks to scale operations while maintaining accuracy and flexibility.

Another frontier is multimodal AI, which processes text, speech, images, and structured data simultaneously to improve user experiences. This technology powers features features like voice-enabled banking, document verification, and video-based onboarding. It helps banks deliver more intuitive, inclusive, and seamless interactions across devices and channels.

A third innovation is federated learning, which allows banks to train AI models on decentralized data without sharing sensitive information. This is particularly valuable for anti-fraud collaboration or joint analytics across institutions. It preserves privacy and security while unlocking powerful insights from distributed datasets.

AI-Driven Innovations Transforming Digital Banking

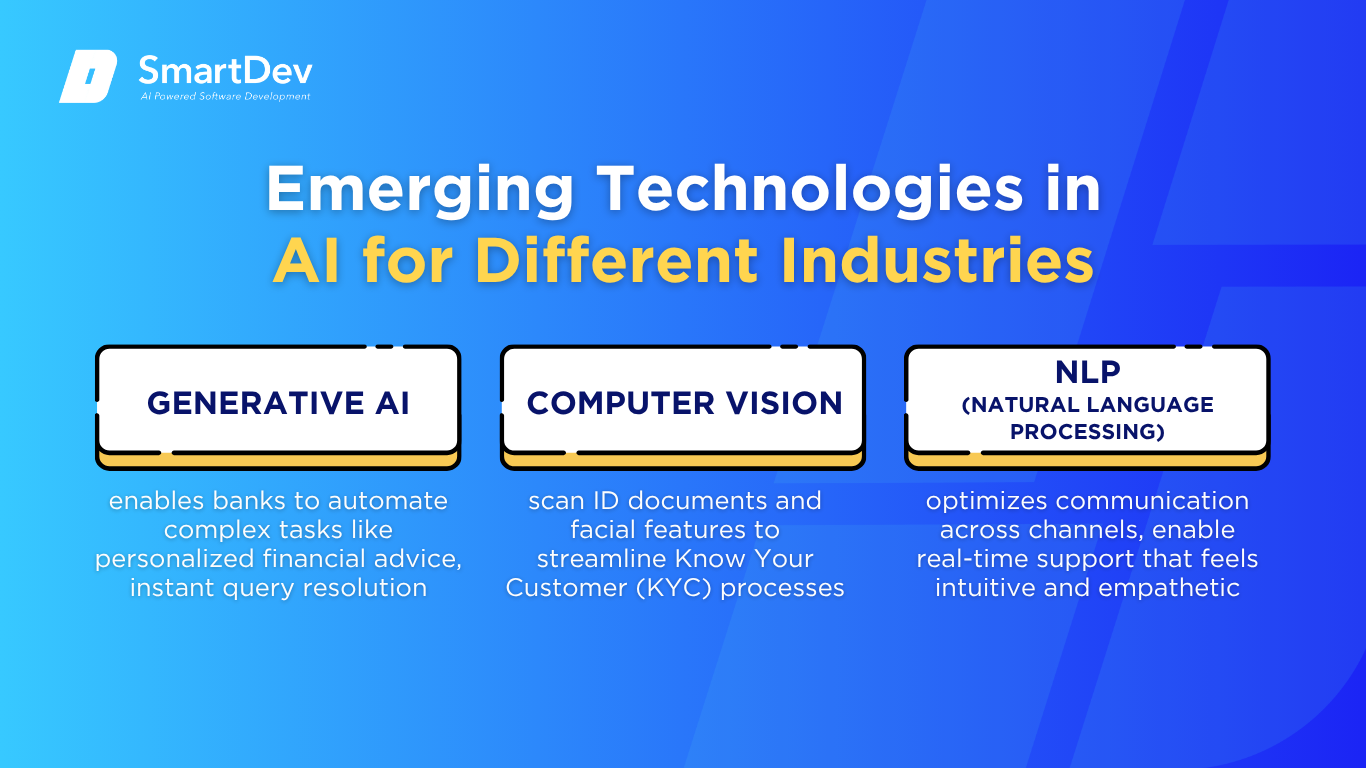

Emerging Technologies in AI for Digital Banking

AI is revolutionizing digital banking by introducing intelligent technologies that drive hyper-personalized, secure, and efficient experiences. Generative AI, in particular, enables banks to automate complex tasks like personalized financial advice, instant query resolution, and customized content creation. Solutions like Bank of America’s “Erica” and UBS’s internal advisory assistants use generative models to deliver contextual insights to both customers and employees, reducing response times and improving decision-making.

Computer Vision is another game-changing innovation, especially for remote onboarding and fraud prevention. Banks now use biometric verification tools that scan ID documents and facial features to streamline Know Your Customer (KYC) processes. These tools not only speed up authentication but also reduce human error and regulatory risk. Additionally, some branches deploy vision-based monitoring systems for ATM usage, enhancing security and operational oversight.

Natural Language Processing (NLP) is optimizing how banks communicate across channels, whether through chatbots, mobile apps, or voice assistants. By analyzing customer sentiment, intent, and transaction history, NLP-powered tools enable real-time support that feels intuitive and empathetic. This leads to more engaging conversations, higher customer satisfaction, and significant reductions in call-center volume, freeing agents for more value-added tasks.

AI’s Role in Sustainability Efforts

AI is also playing a crucial role in advancing sustainability in digital banking. Predictive analytics allow financial institutions to forecast customer demand, optimize staffing, and reduce unnecessary infrastructure usage. For example, AI models can analyze transaction patterns to recommend consolidating underused ATMs or branch services, significantly cutting energy and maintenance costs.

Smart systems powered by AI are being implemented in bank buildings and data centers to monitor energy consumption and suggest adjustments in real time. These tools help banks comply with environmental regulations and reduce their carbon footprint, all while lowering operational costs. Furthermore, the digitization of paperwork and onboarding through AI-powered document processing reduces reliance on physical resources, aligning digital banking operations with broader ESG goals.

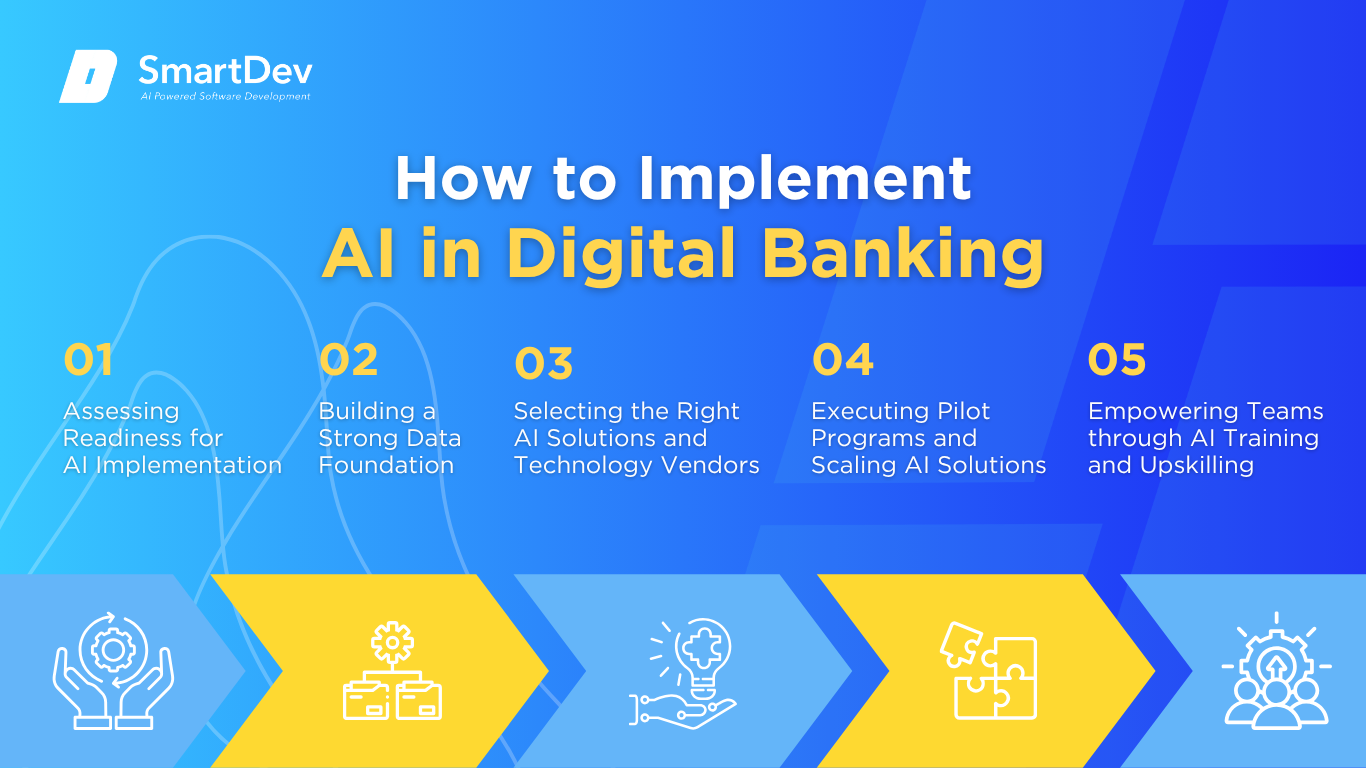

How to Implement AI in Digital Banking

Step 1: Assessing Readiness for AI Adoption

Before implementing AI, banks must thoroughly evaluate their digital maturity and determine which operations would benefit most from AI-driven enhancement. This includes analyzing customer service processes, fraud detection systems, lending workflows, and compliance operations. Understanding the current pain points helps identify where AI can create the most value.

It is equally vital to assess the underlying technical infrastructure. AI models require seamless access to structured data from multiple systems like core banking, CRM, transaction databases, and customer interaction platforms. A modern, cloud-ready architecture and open APIs ensure scalability and integration of AI systems without disrupting daily operations.

Step 2: Building a Strong Data Foundation

For AI to thrive in digital banking, clean, consistent, and secure data is non-negotiable. Banks need to consolidate customer profiles, transaction records, fraud histories, and channel behavior into unified datasets. This holistic data view powers predictive models, from fraud alerts to real-time credit scoring, enhancing accuracy and reliability.

Strong data governance is essential to maintain privacy, regulatory compliance, and trust. This includes clear data ownership, lineage tracking, access controls, and regular audits. Tokenization and anonymization protocols protect sensitive information, while continuous quality checks ensure AI-driven insights remain valid and bias-free over time.

Step 3: Choosing the Right Tools and Vendors

Selecting AI tools aligned with digital banking priorities is crucial for success. Platforms that offer pre-trained banking models, explainable AI, and regulatory support can significantly shorten implementation timelines and enhance reliability.

Choosing the right vendors also means selecting partners with proven financial services expertise. These vendors understand the nuances of banking compliance, security, and legacy system integration. Strategic partnerships enable banks to tailor AI use cases for their specific context, whether it’s reducing loan decision time or boosting digital engagement with virtual assistants.

Step 4: Pilot Testing and Scaling Up

The best approach to deploying AI in banking is to start small via controlled pilots that test a single use case, such as chatbot deployment in mobile apps or transaction anomaly detection for fraud. These pilots help validate technical feasibility, monitor user response, and fine-tune models for optimal performance.

Once a pilot shows clear ROI and system stability, it’s time to expand. Scaling should be phased in, with strong cross-departmental collaboration to ensure consistency and manage risk. This iterative approach not only minimizes disruption but also builds trust among stakeholders, setting the foundation for enterprise-wide AI transformation.

Step 5: Training Teams for Successful Implementation

AI implementation is not just about technology; it’s about people. For AI to deliver real value, banks must train employees at all levels, from call center agents to compliance officers. These teams need to understand how to interpret AI-generated outputs, make decisions based on predictions, and communicate AI insights to clients.

Encouraging collaboration between technical experts and business teams ensures AI systems are grounded in real banking needs. Setting up internal AI task forces, offering hands-on workshops, and creating feedback loops will continuously improve model performance and staff confidence, fostering a culture where AI becomes a trusted advisor in daily banking operations.

Measuring the ROI of AI in Digital Banking

Key Metrics to Track Success

To evaluate the ROI of AI in digital banking, institutions must monitor performance metrics across operational efficiency, fraud reduction, customer engagement, and financial outcomes. Metrics like transaction processing time, fraud detection rates, and customer service response times reveal how AI streamlines core functions. For example, using AI to automate compliance monitoring or payment routing can significantly reduce manual workload and error rates.

Customer experience metrics are equally vital. Digital engagement rates, satisfaction scores (CSAT), and virtual assistant usage offer insights into how AI improves front-end interactions. AI-powered personalization can increase product uptake, click-through rates, and customer lifetime value, showing tangible impact on growth. On the cost side, metrics like call center deflection, loan processing speed, and compliance auditing automation reflect bottom-line savings directly attributable to AI integration.

Case Studies Demonstrating ROI

A large international bank used AI to personalize its customer outreach and deliver predictive recommendations for financial products. By analyzing transaction patterns, lifestyle markers, and behavior signals, the bank saw a 736% ROI from its marketing campaigns within the first year. The AI engine identified the optimal product for each customer and timed recommendations based on life events and spending shifts, which led to higher conversion and retention.

Meanwhile, a major U.S. financial institution deployed conversational AI across digital and voice channels to handle tier-one support inquiries. The solution resolved over 60% of queries without human intervention, reducing support costs by millions annually and improving average customer wait times. In parallel, the bank achieved compliance enhancements by implementing NLP tools that audit 100% of calls and flag potential violations in real time – an impossible task with manual review.

Common Pitfalls and How to Avoid Them

One of the most frequent missteps in AI adoption within digital banking is underestimating the importance of data integrity. AI models trained on inconsistent or siloed data often generate inaccurate or biased outputs—particularly dangerous in high-stakes areas like lending or fraud detection. Banks must prioritize data governance from day one, instituting quality audits, lineage tracking, and access protocols.

Another common barrier is resistance from internal stakeholders who view AI as disruptive or threatening. Transparent communication is crucial: emphasize how AI complements human roles, automates repetitive tasks, and allows staff to focus on higher-value work. Offering cross-functional training and involving teams in the design and testing phases can build confidence and ensure smoother integration.

Future Trends of AI in Digital Banking

Predictions for the Next Decade

The next decade will see AI in digital banking shift from augmentation to autonomy. With the emergence of agentic AI, banks will deploy intelligent systems capable of managing complex, end-to-end workflows without constant human oversight. These agentic platforms will coordinate across departments, learning continuously and adapting to new financial regulations or customer behaviors on the fly.

Generative AI will evolve into a core banking interface. Instead of navigating through static mobile menus, customers will engage with conversational interfaces that understand financial context, anticipate needs, and offer proactive suggestions.

On the backend, AI will enable hyper-automation of operations and driving efficiency at scale. Smart contracts and real-time analytics will replace static processes, allowing instant reconciliation, fraud detection, and credit decisions. Coupled with quantum computing advancements, these AI systems will handle far more complex datasets, improving risk modeling accuracy and market responsiveness.

How Businesses Can Stay Ahead of the Curve

To maintain a competitive edge, banks must evolve from AI adopters to AI leaders. This starts with cultivating internal AI fluency, training leaders to understand AI strategy, and equipping teams to manage ethical and technical complexities. AI should be viewed not just as a tool but as a strategic asset, integrated into long-term digital roadmaps and innovation budgets.

Forward-looking institutions should also invest in building adaptable tech stacks. This includes open-data architectures, modular AI platforms, and API-first systems that allow for easy integration of new tools and models. Collaborating with FinTech startups, academic researchers, and global AI labs can give banks early access to emerging innovations.

Proactive engagement with regulators and standard-setting bodies will be vital. As governments roll out AI-specific regulations, banks must ensure their systems meet evolving compliance requirements without stifling innovation. Embracing ethical AI principles will also strengthen trust among stakeholders and customers alike.

Conclusion

Key Takeaways

AI is redefining digital banking by delivering smarter, faster, and more secure operations across the entire customer and operational journey. From generative AI chatbots and biometric onboarding to predictive fraud detection and hyper-personalized financial recommendations, banks are leveraging intelligent automation to boost efficiency, lower costs, and elevate customer experience.

The institutions that succeed are those that treat AI as a strategic imperative—not just a technology upgrade. Building a strong data foundation, piloting purpose-driven use cases, and training employees to work alongside intelligent systems are essential steps. As the regulatory landscape evolves and customer expectations rise, responsible AI adoption and continuous innovation will separate leaders from laggards.

Moving Forward: A Strategic Approach to AI in Digital Banking

If your bank or financial institution is ready to unlock the full potential of AI, now is the time to act decisively. Start by identifying key banking workflows where automation and intelligence can deliver measurable value. Partner with vendors who understand both the complexity of banking and the power of scalable AI technologies.

At SmartDev, we specialize in guiding digital banks and financial institutions through every phase of AI transformation from pilot testing and data governance to full-scale deployment and ROI tracking. Our expertise minimizes risk, accelerates implementation, and ensures your AI investments translate into real business outcomes.

Let’s build the future of digital banking together. Reach out to discover tailored AI solutions that will drive customer trust, operational agility, and long-term growth in an increasingly intelligent financial world.

—

References:

- Commonwealth Bank’s ChatIT Helps Employees Fix IT Issues in Seconds Using Generative AI | Microsoft Source Asia

- Artificial Intelligence in Banking Market Report | Grand View Research

- JPMorgan Chase Digital Transformation: AI and Data Strategy | Constellation Research

- Evident AI Index – October 2024 | Evident Insights

- 2025 AI Index Report | Stanford HAI

- Citi, Ant International Pilot AI-Powered FX Tool to Help Cut Hedging Costs | Reuters

- Bank of America’s Erica Surpasses 2 Billion Interactions | Bank of America Newsroom

- CommBank’s Apate AI: Reducing Fraud Before It Happens | Commonwealth Bank

- The Impact of AI on Fraud and Scams | PwC UK

- Enhancing AWS Intelligent Document Processing with Generative AI | AWS Blog