The global offshore software development market is projected to reach $850 billion by 2030, with Southeast Asia emerging as a dominant player in this transformation. For businesses seeking the optimal balance between cost efficiency and technical excellence, understanding which countries and companies deliver the best value has never been more critical.

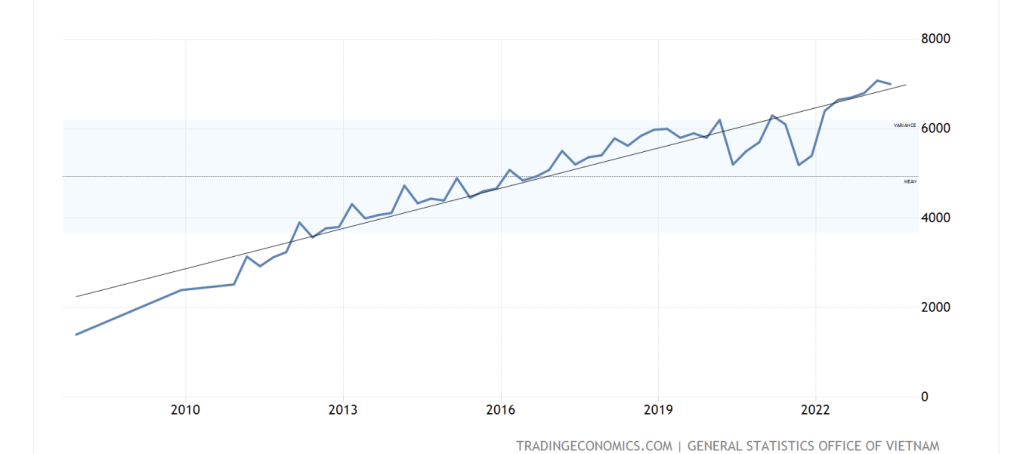

Southeast Asia’s software development sector offers 50-70% cost savings compared to Western markets while maintaining international quality standards. Vietnam alone has recorded a 16.38% annual growth rate in IT outsourcing—significantly outpacing the global average. With over 1 million IT professionals across the region and increasingly sophisticated technical capabilities, Southeast Asia has evolved from a cost-saving destination to a strategic innovation partner.

This comprehensive guide evaluates the best offshore software development companies and best offshore software development countries in Southeast Asia for 2025, providing a data-driven framework to help you make informed vendor selection decisions.

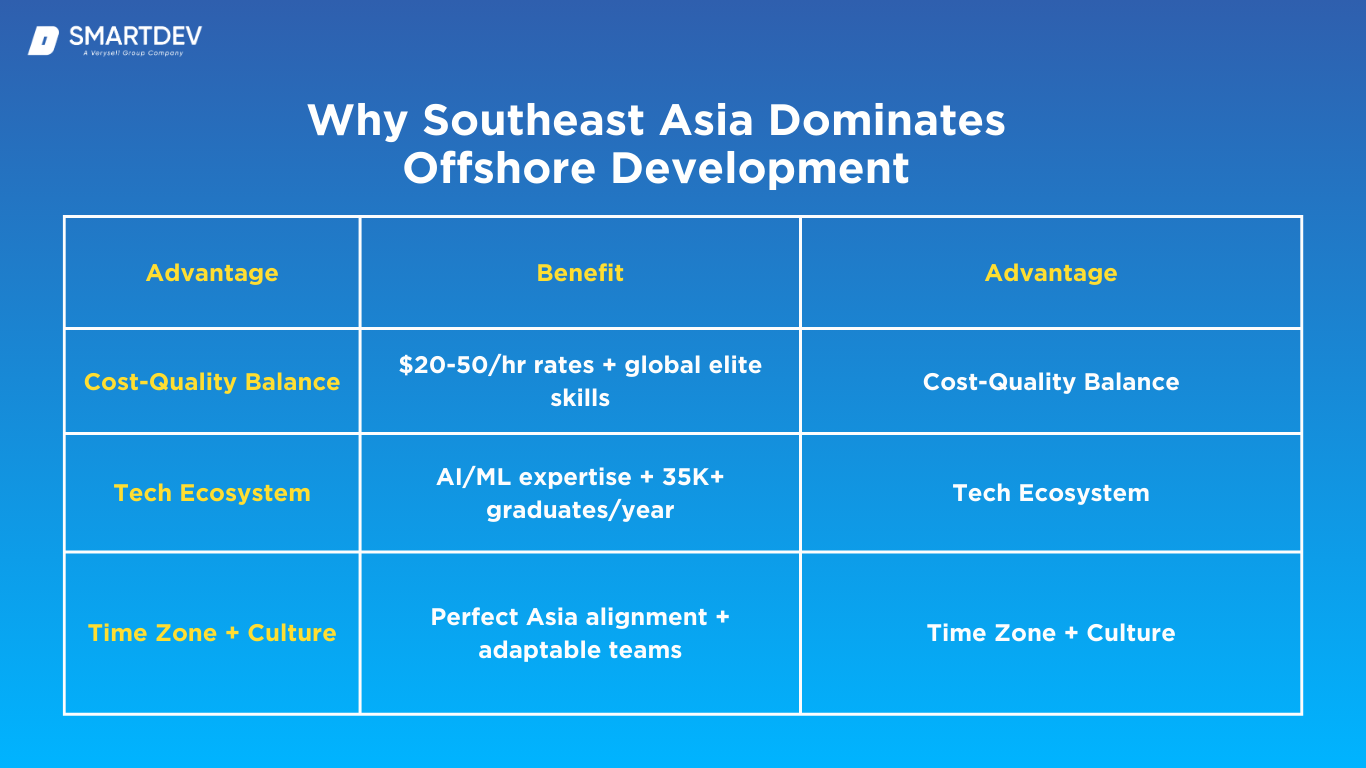

Why Southeast Asia Dominates the Offshore Development Landscape

Southeast Asia’s rise as a premier offshore development destination stems from several converging factors that create exceptional value for international clients.

The Cost-Quality Trifecta

The region’s most compelling advantage lies in its unique cost-quality balance. Vietnamese developers charge $20-50 per hour for mid-to-senior level expertise—representing 70-90% savings compared to US rates of $100-200 per hour. Philippine developers offer similar competitive rates at $25-35 per hour, while maintaining 92% English proficiency and strong cultural alignment with Western business practices.

Unlike traditional low-cost destinations where savings come at the expense of quality, Southeast Asian developers consistently rank among global elites in algorithmic skills and technical proficiency. Vietnam, for instance, ranks 7th in the Global Services Location Index (GSLI) with particularly strong scores in financial attractiveness and people skills availability.

Rapidly Maturing Tech Ecosystems

Government-backed initiatives have accelerated infrastructure development across the region. Vietnam provides tax breaks and R&D incentives for technology companies, while the Philippines offers special economic zones through the Philippine Economic Zone Authority (PEZA). These policies have attracted major tech investments from IBM, Microsoft, Intel, and other global giants.

The talent pipeline continues strengthening year after year. The Philippines produces approximately 35,000 computer science graduates annually, while Vietnam’s universities emphasize strong mathematical foundations and algorithmic thinking—creating developers particularly well-suited for complex problem-solving and AI/ML applications.

Time Zone and Cultural Advantages

For companies in Asia-Pacific markets, Southeast Asia offers near-perfect time zone alignment. Vietnam sits just 1-2 hours behind Japan and shares business hours with Singapore, Hong Kong, and Australia. Even for US-based companies, the time difference enables productive follow-the-sun development models.

Cultural compatibility has become equally important. Filipino developers are known for their strong work ethic, adaptability, and open communication style—traits that minimize friction in cross-cultural collaboration. Vietnamese teams demonstrate dedication to technical excellence and increasing proficiency with Agile methodologies.

Best Offshore Software Development Countries: A Comparative Analysis

Selecting the right country for your offshore development needs requires understanding each location’s distinctive strengths, cost structures, and technical specializations.

Vietnam: The Rising Star of Technical Excellence

Vietnam has emerged as Southeast Asia’s most compelling offshore destination, combining exceptional cost-effectiveness with rapidly advancing technical capabilities. The country’s software development market is projected to reach $50 billion within the next five years, driven by both domestic consumption and international outsourcing.

Cost Structure Analysis

Vietnamese developer rates vary by experience level, creating options for different project requirements:

-

Junior developers (0-2 years): $20-30/hour

-

Mid-level developers (3-5 years): $30-40/hour

-

Senior developers (5-8 years): $40-50/hour

-

Specialized roles (AI/ML, blockchain): $50-65/hour

These rates deliver 60-70% savings compared to hiring equivalent talent in the United States or Western Europe, without compromising on technical quality or delivery standards.

Technical Specializations

Vietnam excels in several high-demand technology domains. 40% of development teams are certified in major AI frameworks, positioning the country as Southeast Asia’s emerging AI development hub. Vietnamese developers have also demonstrated particular strength in:

-

Fintech applications with international regulatory compliance expertise

-

Blockchain development leading Southeast Asia in cryptocurrency solutions

-

Enterprise software with complex system integration capabilities

-

Mobile development across iOS, Android, and React Native platforms

Key Cities and Tech Hubs

Development talent concentrates in three major hubs. Ho Chi Minh City offers the largest talent pool with over 200,000 IT professionals and the most mature startup ecosystem. Hanoi provides access to graduates from Vietnam National University and other top-tier institutions, with slightly lower costs than Ho Chi Minh City. Da Nang has emerged as an attractive mid-sized hub, offering 15-20% lower operational costs while maintaining access to quality talent from local universities.

Philippines: The English Proficiency Champion

The Philippines holds a unique position in Southeast Asia’s offshore landscape, distinguished by its exceptional English language capabilities and cultural affinity with Western business practices.

Communication Excellence

With 92% English proficiency—the highest in Asia—Filipino developers minimize the communication barriers that plague many offshore relationships. This linguistic strength extends beyond basic conversation to include technical documentation, requirements analysis, and stakeholder presentations. The cultural compatibility with US and Australian business practices creates seamless collaboration that feels more like nearshoring than traditional offshoring.

Cost and Value Proposition

Philippine developer rates range from $25-35/hour for mid-level talent, translating to $5,962-8,030 annual salaries compared to $105,253 in the United States. This creates up to 70% employment cost savings without sacrificing quality or communication effectiveness.

Operational Advantages

Filipino developers demonstrate remarkable time zone flexibility, routinely accommodating 4-5 hour daily overlaps with US schedules—far exceeding what’s possible with Indian or Eastern European teams. The Philippines also maintains exceptionally low turnover rates of 12-15% compared to India’s 20-30%, preserving institutional knowledge and team stability.

Technical Capabilities

While not as specialized in emerging technologies as Vietnam, Philippine developers excel in:

-

Full-stack web development using modern JavaScript frameworks

-

Mobile application development for consumer-facing products

-

E-commerce platforms and customer relationship management systems

-

Quality assurance and testing with strong attention to detail

![How Many People in The Philippines Speak English? [2025 Data]](https://www.thehistoryofenglish.com/wp-content/uploads/2024/03/philippines-english-proficiency-index.png)

Thailand and Malaysia: Specialized Regional Players

While Vietnam and the Philippines lead Southeast Asia’s offshore development sector, Thailand and Malaysia serve specific niches effectively.

Thailand’s Niche Positioning

Thailand has carved expertise in digital transformation for traditional industries and IoT applications. Bangkok’s tech scene attracts projects requiring regional market knowledge for Southeast Asian product launches. However, Thai developers command slightly higher rates ($35-50/hour) due to higher living costs, making the country less competitive for pure cost-arbitrage plays.

Malaysia’s Enterprise Focus

Malaysia positions itself at the premium end of Southeast Asia’s offshore market, with strong capabilities in enterprise software and financial services applications. The country’s multicultural workforce provides unique advantages for projects requiring Chinese, Malay, and English language support. Rates typically range $40-60/hour—competitive with Eastern Europe but with better time zone alignment for Asia-Pacific clients.

Comprehensive Vendor Evaluation Framework

Selecting among the best offshore software development companies requires systematic evaluation across multiple dimensions. This framework provides an objective methodology for comparing vendors and identifying the optimal partner for your specific needs.

Technical Expertise and Domain Knowledge

Begin by assessing whether potential vendors demonstrate deep expertise in your required technology stack and industry domain.

Technology Stack Proficiency

Request specific evidence of team capabilities in your core technologies. Look for:

-

GitHub profiles or code samples demonstrating actual technical work

-

Certifications from major technology vendors (AWS, Microsoft Azure, Google Cloud)

-

Framework-specific expertise in React, Angular, Node.js, Python, or other relevant technologies

-

Emerging technology capabilities in AI/ML, blockchain, or other specialized domains

Leading vendors like SmartDev maintain 100% English-proficient engineering teams with certifications across multiple technology domains, ensuring seamless communication alongside technical excellence.

Industry-Specific Experience

Generic software development capabilities differ significantly from domain expertise. Evaluate whether vendors understand your industry’s unique challenges:

-

Regulatory compliance knowledge for fintech, healthcare, or other regulated industries

-

Security requirements specific to your sector

-

Integration patterns common in your industry ecosystem

-

User experience conventions that your customers expect

Top-tier providers demonstrate this expertise through case studies, client testimonials, and verifiable project histories in your specific domain.

Security and Compliance Certifications

In an era of increasing cybersecurity threats and stringent data protection regulations, security certifications provide essential vendor validation.

Essential Certifications

Prioritize vendors holding internationally recognized security standards:

-

ISO 27001 certification demonstrates systematic information security management

-

SOC 2 Type 2 compliance validates operational security over extended time periods

-

GDPR compliance for projects involving European customer data

-

Industry-specific certifications such as HIPAA for healthcare or PCI-DSS for payment processing

SmartDev’s dual ISO 27001 and SOC 2 Type 2 certifications represent the gold standard for offshore security, providing enterprises the assurance needed for mission-critical projects. These certifications require rigorous audits of security practices, data handling procedures, and operational controls—filtering out vendors with inadequate security postures.

Track Record and Industry Recognition

A vendor’s reputation provides valuable insight into their reliability and service quality.

Awards and Industry Recognition

Prestigious industry awards indicate peer and expert validation. For Southeast Asian vendors, key recognitions include:

-

Sao Khue Awards (Vietnam’s most prestigious IT recognition)

-

Clutch Top Developers rankings based on client reviews

-

SME100 Fast Moving Companies for demonstrated growth

-

Global Services Location Index rankings for national ecosystems

SmartDev’s three consecutive years of Sao Khue Awards (2024, 2025, and 2026) demonstrate sustained excellence rather than one-time achievement. The company’s recognition in multiple categories—including Best IT Outsourcing Services and Best AI Consulting and Solution Development—validates broad-based capabilities across traditional and emerging technologies.

Client Portfolio and Case Studies

Evaluate the caliber of a vendor’s existing client base. Working with 300+ global clients across BFSI, healthcare, e-commerce, and other sectors—as SmartDev does—indicates an ability to meet diverse enterprise requirements. Request detailed case studies showing:

-

Project scale and complexity comparable to your needs

-

Technologies implemented matching your requirements

-

Measurable business outcomes delivered for clients

-

Long-term client relationships indicating satisfaction and trust

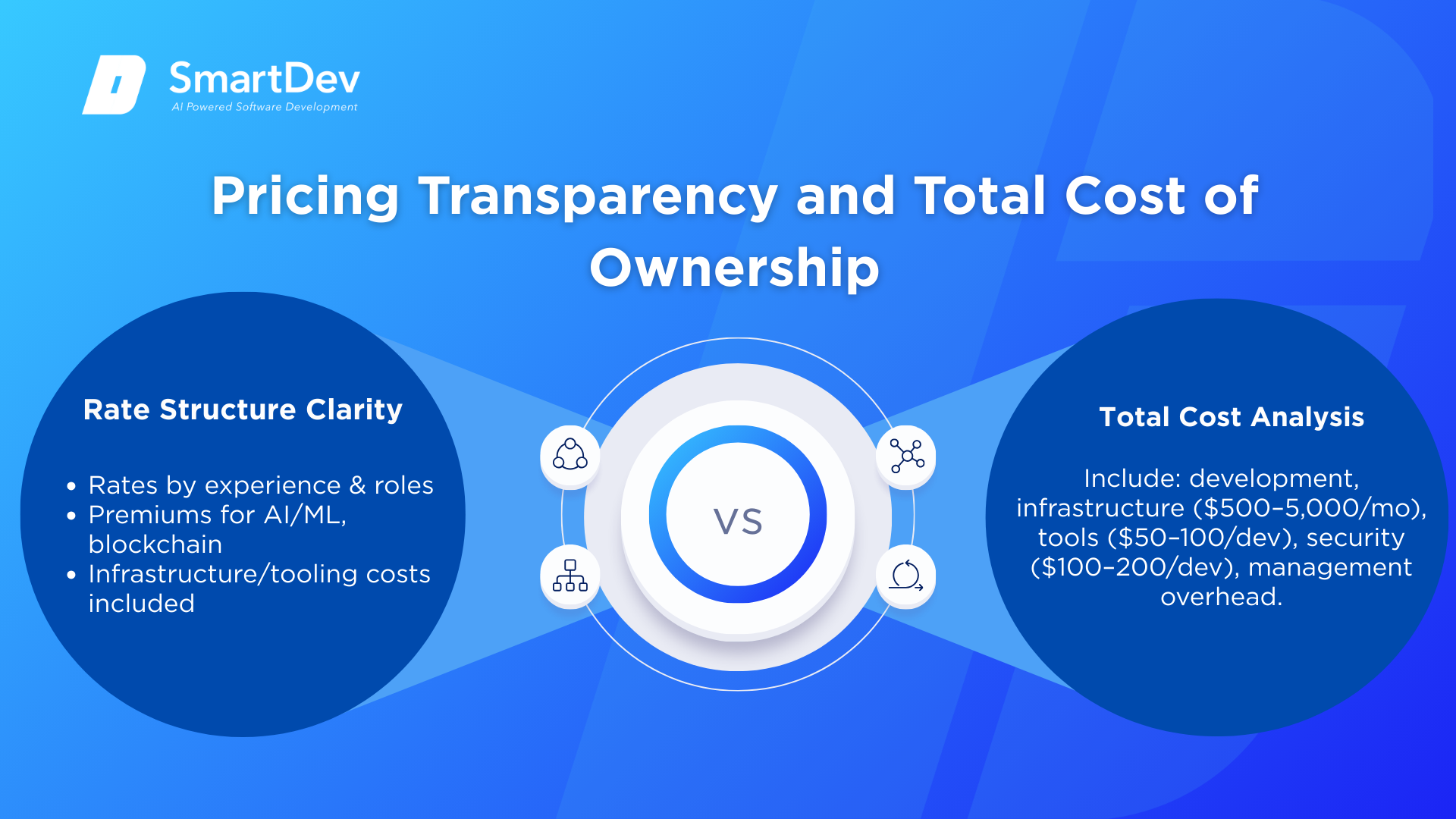

Pricing Transparency and Total Cost of Ownership

Misleading pricing structures create hidden costs that undermine offshore development ROI. Demand complete transparency in cost breakdowns.

Rate Structure Clarity

Ensure vendors provide detailed hourly or monthly rates segmented by:

-

Developer experience levels (junior, mid, senior, architect)

-

Specialized roles (DevOps, QA, project management, business analysts)

-

Technology premiums for high-demand skills like AI/ML or blockchain

-

Infrastructure and tools costs including cloud services, development tools, and project management platforms

Beware of vendors offering suspiciously low rates. These often hide costs through:

-

Bait-and-switch tactics where quoted junior developers are actually used

-

Unbundled services charging separately for QA, project management, or DevOps

-

Infrastructure fees not included in hourly rates

-

Knowledge transfer charges for project handoffs or documentation

Total Cost Analysis

Calculate comprehensive project costs including:

-

Direct development costs based on team size and duration

-

Infrastructure expenses typically $500-5,000 monthly depending on project complexity

-

Communication and collaboration tools around $50-100 per developer monthly

-

Security infrastructure approximately $100-200 per developer monthly

-

Management overhead for coordination and oversight

Hidden costs typically add 15-20% to headline hourly rates, making transparency essential for accurate budgeting.

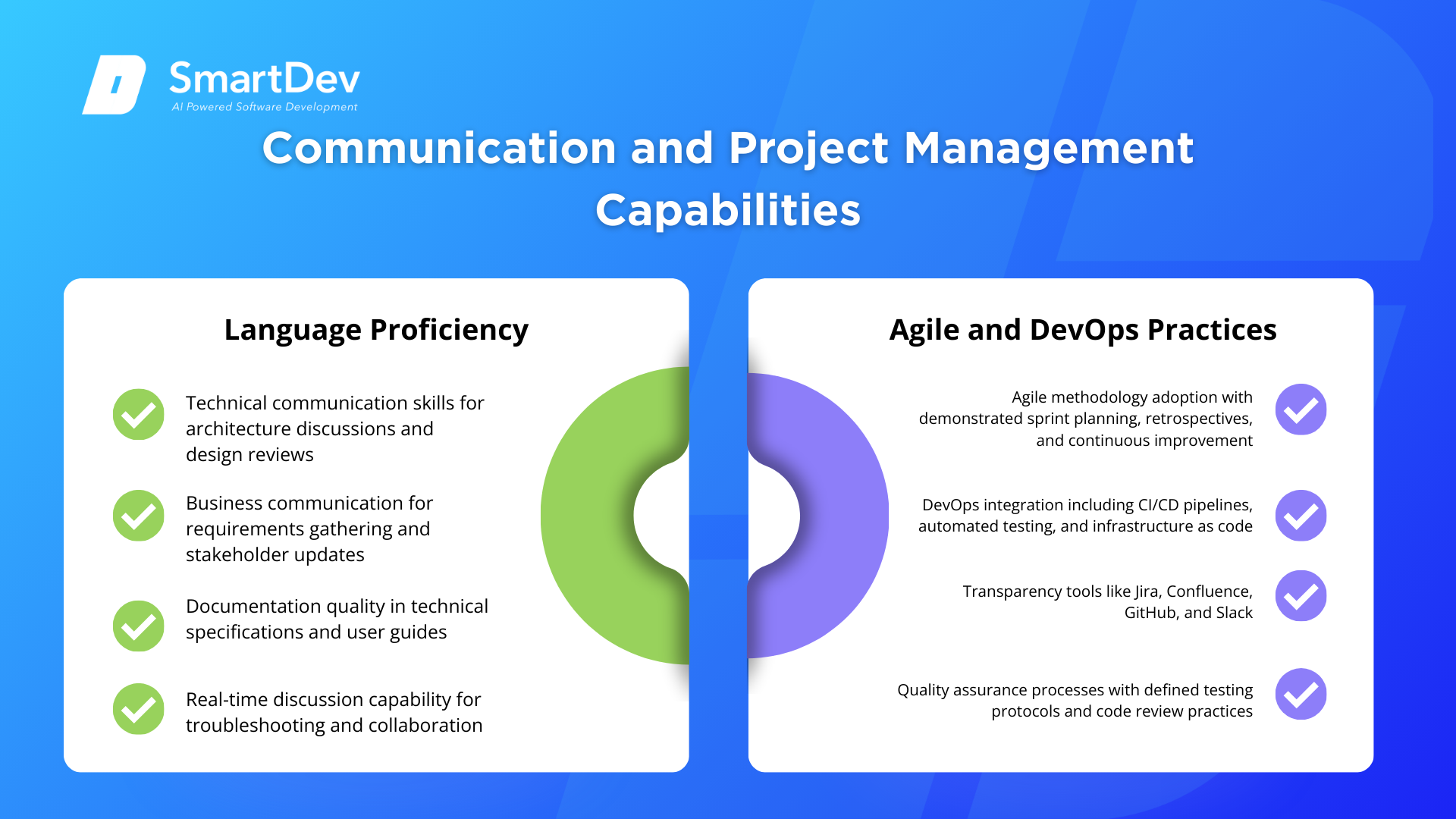

Communication and Project Management Capabilities

Technical skills matter little if communication breakdowns derail projects. Evaluate vendors’ communication infrastructure and project management maturity.

Language Proficiency

While basic English competence suffices for coding, complex projects require nuanced communication. Assess:

-

Technical communication skills for architecture discussions and design reviews

-

Business communication for requirements gathering and stakeholder updates

-

Documentation quality in technical specifications and user guides

-

Real-time discussion capability for troubleshooting and collaboration

Vietnamese and Filipino developers generally offer the strongest English proficiency in Southeast Asia, with Filipino teams providing native-level fluency and Vietnamese teams achieving business-level competence through dedicated training programs.

Agile and DevOps Practices

Modern software development requires sophisticated project management approaches. Evaluate:

-

Agile methodology adoption with demonstrated sprint planning, retrospectives, and continuous improvement

-

DevOps integration including CI/CD pipelines, automated testing, and infrastructure as code

-

Transparency tools like Jira, Confluence, GitHub, and Slack

-

Quality assurance processes with defined testing protocols and code review practices

Leading vendors like SmartDev employ flexible Agile models with close collaboration involving European and American technology experts, ensuring international development standards rather than rigid, offshore-adapted approximations.

Scalability and Long-Term Partnership Potential

Short-term project success differs from long-term strategic partnership viability. Assess vendors’ capacity for growing alongside your needs.

Team Scaling Capabilities

Evaluate whether vendors can:

-

Rapidly expand teams when project requirements increase

-

Maintain quality during scaling without diluting expertise as teams grow

-

Access specialized skills for new technology requirements

-

Support multiple concurrent projects as your relationship matures

Vendors with 400+ employees across multiple development centers—like SmartDev’s Da Nang and Hanoi operations—demonstrate the organizational depth required for enterprise-scale engagements.

Geographic and Legal Flexibility

International operations provide important advantages:

-

Multiple legal entities (Switzerland, Singapore, Vietnam) enable flexible contracting options

-

Geographic redundancy mitigates risks from local disruptions

-

Time zone coverage for follow-the-sun development models

-

Market access through local presence in key regions

Financial Stability and Growth

Partner with vendors demonstrating sustainable growth rather than unstable startups or stagnant incumbents. Positive indicators include:

-

Year-over-year revenue growth indicating market success

-

Strategic investments in emerging technologies and training

-

Professional development programs for employee retention

-

Parent company backing providing financial stability

SmartDev’s 44% revenue growth in 2024—far exceeding Vietnam’s industry average—combined with Verysell Group ownership provides the financial foundation for long-term strategic partnerships.

Cut offshore development costs by 30-60% while maintaining enterprise quality?

Let's evaluate which Southeast Asian destination and engagement model delivers the best ROI for your needs.

SmartDev helps enterprises benchmark costs, compare vendors, and design scalable offshore partnerships that reduce expenses without compromising security or timelines.

Schedule Your Free Offshore Strategy ConsultationTop Offshore Software Development Companies in Southeast Asia

Based on our comprehensive evaluation framework, these companies represent the strongest offshore development partners across Southeast Asian countries.

Tier 1: Vietnamese Leaders

SmartDev – The Swiss-Managed Excellence Standard

Founded in 2014 and acquired by Verysell Group (Switzerland) in 2019, SmartDev exemplifies Swiss precision combined with Vietnamese efficiency. The company’s unique positioning as a Swiss-managed Vietnamese development center provides clients with European management standards at Southeast Asian costs.

![HN] Công Ty SMARTDEV Tuyển Dụng Nhân Viên Mobile Marketer Full-time 2022 - YBOX](https://static.ybox.vn/2022/8/4/1659589019792-smartdev-logo.png)

Key Differentiators:

-

Dual ISO 27001 and SOC 2 Type 2 certifications provide enterprise-grade security assurance rarely found among offshore vendors

-

Three consecutive years of Sao Khue Awards validate sustained service excellence and industry leadership

-

450+ professionals across Da Nang and Hanoi provide scalability and redundancy

-

300+ global clients across demanding sectors including fintech, healthcare, and enterprise software

-

100% English-proficient teams eliminate communication barriers common with offshore development

-

Dedicated AI/ML capabilities with 40% of teams certified in major frameworks

-

Strategic partnership with Verysell AI providing cutting-edge artificial intelligence expertise

Cost-Value Analysis:

SmartDev delivers 60% cost savings compared to US development while maintaining Swiss quality standards. The company’s transparent pricing model includes all infrastructure costs, avoiding the hidden fees that inflate competitor pricing.

Ideal For:

Mid-sized to enterprise companies requiring secure, scalable offshore development with minimal communication friction. Particularly strong fit for fintech, healthcare, and AI/ML-intensive projects where security certifications and domain expertise create differentiated value.

Learn more: Visit SmartDev

FPT Software – Enterprise Scale Leader

As Vietnam’s largest IT services company, FPT Software handles massive enterprise engagements with 30,000+ employees globally. The company excels at large-scale system integration, digital transformation, and managed services for Fortune 500 clients.

Kyanon Digital – AI and Digital Transformation Specialist

Kyanon focuses on AI/ML solutions and digital transformation consulting. Their ISO certifications and deep technical expertise make them strong contenders for emerging technology projects requiring specialized knowledge.

Orient Software – QA and Testing Excellence

Orient Software has carved a niche in quality assurance and software testing services. Their systematic approach to QA makes them valuable partners for projects where quality verification represents a critical success factor.

Tier 1: Philippine Champions

Accenture Philippines – Global Capabilities, Local Costs

Accenture’s Philippine operations combine global brand credibility with local cost advantages. The company’s massive scale and broad service offerings suit large enterprises seeking comprehensive technology partnerships.

Exist Software Labs – Agile Development Specialists

Exist specializes in agile software development for startups and mid-sized companies. Their cultural alignment with Western startups and strong technical skills create effective partnerships for product development.

Tier 2: Regional Players

Agoda (Thailand) – Travel Technology Pioneer

While primarily a product company, Agoda demonstrates Thailand’s capabilities in building sophisticated, high-scale consumer applications. Thai developers excel in projects requiring regional market knowledge for Southeast Asian launches.

PETRONAS ICT (Malaysia) – Enterprise Systems Expertise

Malaysia’s enterprise software capabilities shine through companies like PETRONAS ICT, which specializes in large-scale enterprise systems for regulated industries including energy and financial services.

Cost Comparison: Southeast Asia vs Alternative Destinations

Understanding relative cost positions helps optimize offshore strategy across geographies.

Southeast Asia vs India

India pioneered offshore software development and maintains the largest developer population globally. However, costs have risen significantly:

Rate Comparison:

-

India: $20-50/hour (rising annually)

-

Vietnam: $20-50/hour (stable to declining)

-

Philippines: $25-35/hour

While rates appear similar, India faces 20-30% annual turnover compared to Southeast Asia’s 12-15%, creating hidden costs from constant knowledge transfer and training. Communication quality also favors Southeast Asia, particularly the Philippines’ native English proficiency.

Time zone considerations strongly favor Southeast Asia for Asia-Pacific clients. Vietnam sits 1-2 hours from major Asian business centers, while India requires 3-4 hour adjustments.

Southeast Asia vs Eastern Europe

Eastern European developers command premium positioning with excellent technical skills:

Rate Comparison:

-

Poland: $35-55/hour

-

Romania: $35-45/hour

-

Ukraine: $25-50/hour

-

Vietnam: $20-50/hour

-

Philippines: $25-35/hour

Eastern Europe offers cultural and time zone alignment with Western Europe, making the region ideal for European clients. However, for US and Asia-Pacific clients, Southeast Asia’s 30-40% cost advantage combined with better time zone positioning creates superior value.

Southeast Asia vs Latin America

Latin America has emerged as a nearshore alternative for US companies:

Rate Comparison:

-

Mexico: $30-60/hour

-

Brazil: $30-55/hour

-

Colombia: $25-45/hour

-

Vietnam: $20-50/hour

-

Philippines: $25-35/hour

Latin America’s primary advantage lies in time zone alignment with the United States. For companies prioritizing real-time collaboration, Latin America’s overlapping business hours justify premium pricing. However, for projects allowing asynchronous communication, Southeast Asia delivers 20-30% cost savings with comparable quality.

Implementation Roadmap: Selecting Your Offshore Partner

Moving from evaluation to engagement requires a structured approach that minimizes risk while accelerating value realization.

Phase 1: Requirements Definition and Shortlisting

Define Project Parameters:

Clearly articulate your technical requirements, timeline constraints, budget parameters, and team size needs. Specify:

-

Technology stack requirements and any existing system dependencies

-

Engagement model preference (dedicated team, project-based, staff augmentation)

-

Security and compliance requirements specific to your industry

-

Communication and reporting expectations including meeting frequency and documentation standards

Shortlist 3-5 Candidates:

Use platforms like Clutch, GoodFirms, and TopDevelopers to identify vendors matching your criteria. Prioritize companies with:

-

Verified client reviews from companies similar to yours

-

Relevant case studies demonstrating comparable project experience

-

Appropriate certifications for your security and compliance requirements

-

Geographic presence in your preferred Southeast Asian country

Phase 2: Detailed Evaluation and Proposals

Request Comprehensive Proposals:

Submit detailed RFPs to shortlisted vendors including:

-

Complete project specifications or high-level requirements

-

Timeline and milestone expectations

-

Budget range to ensure realistic proposals

-

Team structure preferences indicating roles you expect

Conduct Vendor Interviews:

Schedule video conferences with technical leads and account managers. Key questions include:

-

How do you handle communication across time zones?

-

What’s your typical developer retention rate?

-

Can you provide references from similar projects?

-

What’s your approach to intellectual property protection?

-

How do you ensure code quality and security?

Technical Team Assessment:

Request conversations with actual developers who would work on your project. Evaluate their:

-

Technical depth in your required technologies

-

Communication clarity and English proficiency

-

Problem-solving approach through technical discussions

-

Cultural fit with your team’s working style

Phase 3: Pilot Project and Validation

Start with Limited Scope:

Rather than committing to a multi-year relationship immediately, begin with a 2-3 month pilot project covering:

-

Clearly defined deliverables enabling objective quality assessment

-

Full team engagement including developers, QA, and project management

-

Real-time collaboration replicating your intended long-term workflow

-

Knowledge transfer demonstrating their documentation practices

Evaluate Pilot Results:

Assess the pilot against objective criteria:

-

Code quality through independent review of architecture and implementation

-

Communication effectiveness measuring response times and clarity

-

Project management evaluating their planning, tracking, and reporting

-

Business outcomes determining whether deliverables met requirements

Leading vendors like SmartDev confidently support pilot engagements, knowing that their Swiss-managed quality standards withstand objective evaluation.

Phase 4: Long-Term Partnership Structure

Negotiate Service Level Agreements:

Formalize expectations through detailed SLAs covering:

-

Response time commitments for different issue severities

-

Availability requirements including coverage hours and escalation procedures

-

Quality metrics with defined standards for code review, testing, and documentation

-

Performance penalties and remediation procedures for SLA violations

Establish Governance Framework:

Create sustainable collaboration structures:

-

Regular status meetings (daily standups, weekly reviews, monthly retrospectives)

-

Escalation procedures for addressing issues quickly

-

Change management processes for handling scope adjustments

-

Continuous improvement mechanisms for optimizing the partnership over time

Future-Proofing Your Offshore Strategy

The offshore development landscape continues evolving rapidly. Position your partnerships for long-term success by anticipating key trends.

Shift from Cost to Value

The most sophisticated offshore relationships have transcended pure cost arbitrage. Forward-thinking companies now evaluate offshore partners on:

-

Innovation contribution beyond merely executing specifications

-

Domain expertise that improves product strategy and architecture

-

Speed to market through efficient processes and technical excellence

-

Risk mitigation via security practices and quality assurance

This evolution favors premium Southeast Asian vendors like SmartDev that invest heavily in certifications, training, and emerging technology capabilities rather than competing solely on price.

AI and Automation Integration

Artificial intelligence is transforming software development itself. According to Gartner’s research on offshore trends, leading offshore vendors now leverage:

-

AI-assisted coding tools improving developer productivity

-

Automated testing reducing QA cycle times

-

Intelligent project management predicting risks and optimizing workflows

-

Code review automation ensuring consistent quality standards

SmartDev’s strategic partnership with Verysell AI positions the company at the forefront of these developments, providing clients with AI-powered development capabilities that accelerate delivery while improving quality.

Specialized Expertise Premium

As software development commoditizes, specialized expertise commands increasing premiums. Vendors demonstrating deep capabilities in high-demand domains—AI/ML, blockchain, IoT, cloud-native architectures—will capture disproportionate value.

Vietnam’s 40% AI/ML certification rate among development teams positions the country to capitalize on this trend. Companies establishing Vietnamese partnerships now gain first-mover advantage accessing this emerging expertise at reasonable rates before market maturity drives premiums.

Regulatory and Security Intensification

Data protection regulations continue proliferating globally. GDPR, CCPA, and industry-specific requirements create rising compliance burdens. This trend favors:

-

Certified vendors holding ISO 27001, SOC 2, and industry-specific certifications

-

Established legal frameworks through multiple geographic entities enabling flexible compliance

-

Mature security practices with documented processes and regular audits

Vendors lacking these capabilities will face increasing barriers to enterprise accounts where compliance requirements serve as table stakes.

Conclusion: Making the Right Choice for Your Business

Southeast Asia has matured from a low-cost alternative into a strategic technology partner for enterprises worldwide. The region’s combination of 60-70% cost savings, strong technical capabilities, improving English proficiency, and favorable time zones creates compelling value unavailable elsewhere.

Success in offshore partnerships requires moving beyond simplistic cost comparisons to comprehensive evaluation spanning technical expertise, security certifications, communication capabilities, track record, and long-term partnership potential.

Among Southeast Asian countries, Vietnam offers the strongest overall value proposition for most use cases—combining the lowest costs with rapidly advancing technical capabilities and improving English proficiency. The Philippines excels for projects prioritizing communication quality and cultural alignment with Western business practices.

Within Vietnam’s offshore ecosystem, SmartDev represents the gold standard for enterprises seeking Swiss management quality at Vietnamese costs. The company’s dual ISO 27001 and SOC 2 Type 2 certifications, three consecutive years of Sao Khue Awards, 450+ professionals, and strategic AI capabilities create differentiated value justifying premium positioning within the Vietnamese market.

For companies beginning their offshore journey, the path forward is clear:

Start with thorough vendor evaluation using the framework outlined in this guide. Shortlist 3-5 candidates matching your technical requirements and budget parameters. Conduct pilot projects with your top choices before committing to long-term relationships. Establish clear governance and continuous improvement mechanisms for sustainable partnerships.

The offshore development decision represents more than a cost-saving tactic—it determines your capacity to access global talent, accelerate innovation, and scale technical capabilities efficiently. Choose wisely, and Southeast Asia’s exceptional development talent becomes your competitive advantage in an increasingly technology-driven world.