Over 300 Fortune 500 companies have quietly shifted their software development operations to Vietnam, and the math speaks for itself. While most Western companies still debate India versus Eastern Europe for outsourcing, smart organizations already discovered Vietnam’s advantage: world-class developers delivering 60-70% cost savings with quality that matches (often exceeds) premium alternatives.

The gap is widening. Most companies pay inflated rates for average talent while their competitors gain massive advantages through Vietnamese tech partnerships. This isn’t just about cutting costs (though that’s nice) – it’s about accessing a talent pool that consistently ranks in the top 10 globally for algorithmic problem-solving.

I’ll show you exactly why Vietnam became the offshore development destination of choice, from hard numbers on savings to real case studies of companies achieving 175% revenue growth after establishing Vietnamese operations. You’ll understand how to evaluate partners and avoid the pitfalls that trap first-time outsourcers.

TL;DR: Vietnam’s Development Advantage in Numbers

- Cost savings: 60-70% reduction compared to US rates without quality compromise

- Talent pool: 500,000+ skilled IT professionals with 55,000-60,000 annual graduates

- Quality metrics: Top 10 global ranking for algorithmic skills, 90%+ client retention rates

- Business benefits: 25% faster delivery times with optimal time zone overlap for US/EU companies

[Insert infographic showing Vietnam’s key metrics vs. other outsourcing destinations]

Vietnam’s Tech Hub Status: The Numbers Don’t Lie

Vietnam ranks 7th globally as the most attractive IT outsourcing destination, according to Kearney’s Global Services Location Index—and frankly, it should be even higher. The country’s IT services sector reached $2-3 billion in revenue for 2024, with the broader digital economy projected to hit $43-45 billion by 2025.

The workforce statistics are impressive: over 500,000 skilled IT professionals work across Vietnamese tech hubs, with major companies like Samsung employing 100,000+ people and generating $62.5 billion in annual exports from their Vietnamese operations.

What makes Vietnam particularly attractive is the combination of technical skill and business-friendly policies. Vietnamese IT professionals demonstrate strong English capabilities, with up to 70% using English daily for work, while the country maintains ISO 27001 and SOC 2 Type II certification standards that match Western security requirements.

“Vietnam has matured into a major tech hub for global companies, using advanced developer skillsets and cost efficiencies while maintaining Western business standards,” explains Alistair Copeland, CEO of SmartDev, a Swiss technology company that’s witnessed Vietnam’s transformation firsthand.

The government actively supports this growth through favorable policies. Foreign investors can fully own software/IT services companies in Vietnam (with limited sector restrictions), plus attractive tax incentives that make establishing operations straightforward for international businesses.

Four Major Vietnamese Tech Cities: Your Options Breakdown

Ho Chi Minh City: Vietnam’s Silicon Valley

Ho Chi Minh City hosts 40% of Vietnam’s total IT workforce with 200,000+ developers, making it the undisputed tech capital.

Major players including Samsung, Intel, and Microsoft operate development centers here, attracted by the massive talent pool specializing in fintech and enterprise software.

Best for: Enterprise-grade development, fintech applications, established infrastructure needs

Advantages:

- Largest talent pool in Vietnam

- Direct flights to major global hubs

- Mature tech ecosystem with international business presence

Hanoi: Government and Enterprise Software Hub

Hanoi specializes in government technology solutions and large-scale enterprise applications, handling significant portions of Vietnam’s software export revenue.

The city maintains direct flights to Singapore, Tokyo, and London, making it ideal for companies requiring frequent face-to-face collaboration.

Best for: Regulated industries, banking systems, compliance-heavy applications

Advantages:

- Deep domain expertise in complex, regulated sectors

- Government technology specialization

- Strong connectivity to Asian business hubs

Da Nang: The Fast-Growing Coastal Alternative

Da Nang has established itself as Vietnam’s fastest-growing tech hub, with 57,000 ICT professionals and an expected 10-12% annual growth through 2030, according to official city statistics.

The city offers 20-30% lower operational costs compared to Ho Chi Minh City and Hanoi while maintaining comparable quality.

Best for: Cost-conscious projects, long-term team retention, work-life balance priorities

“Da Nang offers exceptional work-life balance with beachfront offices and modern infrastructure, creating an environment where developers want to stay long-term,” notes Nguyen Le, COO of SmartDev.

Can Tho: The Emerging Mekong Delta Hub

Can Tho specializes in agricultural technology and IoT solutions development, serving as an ideal location for startups and SME development projects.

The city offers the most competitive salary rates while maintaining professional output quality.

Best for: AgTech, IoT projects, budget-conscious startups, emerging technology focus

Ready to build a high-performance Offshore Development Center in Vietnam—while cutting up to 60% of engineering costs?

Discover why 300+ global companies choose Vietnam for their ODC setup, leveraging world-class tech talent, scalable delivery models, and cost-efficient operations.

Compare ODC setup models, operational frameworks, compliance readiness, and real cost-to-value advantages to determine whether Vietnam is the right location for your long-term engineering expansion.

Explore the Vietnam ODC Evaluation GuideReal Cost Analysis: Vietnam vs. Global Alternatives

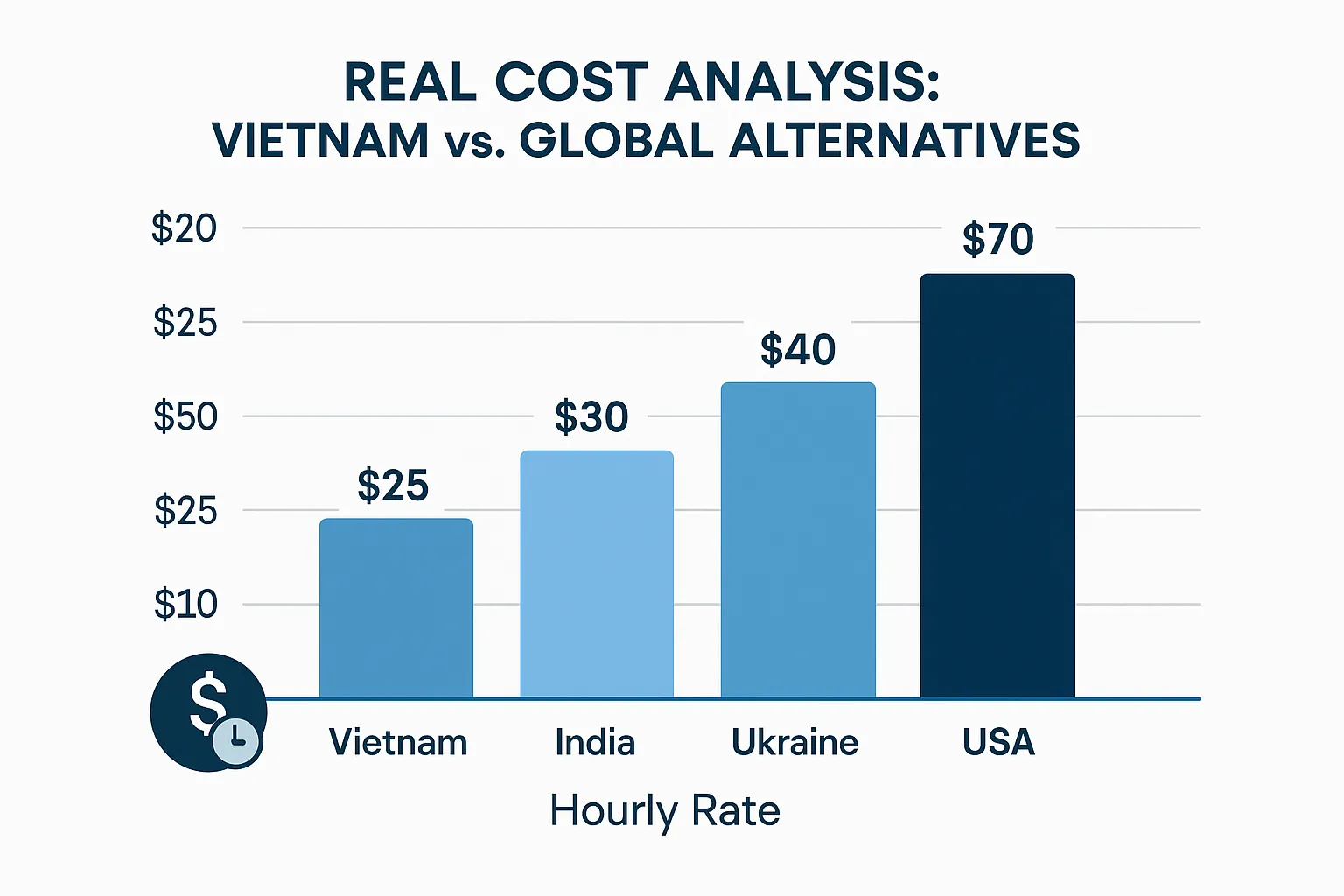

The financial advantages are substantial. Senior software developers in Vietnam typically earn around $18,000–30,000 per year compared with roughly $80,000–120,000 for similar roles in the US, delivering a 60–70% cost advantage without compromising on engineering quality.

Here’s where it gets interesting: Vietnam delivers better cost-quality alignment than India, with developer rates 15-30% lower than India overall and superior infrastructure—making it an increasingly attractive choice for businesses seeking reliability and innovation alongside affordability.

Ukrainian developer rates are 30% higher than Vietnamese equivalents, and that’s before considering current geopolitical risks.

Fig2. Hourly rates across major outsourcing destinations

Hidden cost advantages extend beyond salaries:

- Stable political environment with 6-7% GDP growth averaged over the past decade

- Government incentives including 10% corporate tax rate for technology companies

- 50% less management overhead due to cultural alignment with Western business practices

- 25% faster delivery times through dedicated team structures

“Vietnam delivers cost premiums of up to 70% for Western companies without sacrificing quality,” explains Ha Nguyen Ngoc, Marketing Director at SmartDev.

Companies typically achieve 300-400% ROI within 18 months of establishing Vietnamese development centers, with client retention rates exceeding 90% after the first year.

Technical Talent Quality: Why Vietnam Stands Out

Vietnam graduates 55,000-60,000 IT professionals annually from 150+ technology universities, with 85% holding bachelor’s degrees or higher in computer science. More importantly, Vietnamese developers rank in the top 10 globally for algorithmic problem-solving according to HackerRank.

The English proficiency numbers are solid: Vietnam ranks 64th out of 123 countries with “moderate” English proficiency according to the 2025 EF English Proficiency Index, with IT professionals demonstrating above-average English skills and working regularly in English-speaking environments. Vietnamese teams operate effectively in US/EU time zones with 6-12 hour overlap windows.

Specialized expertise areas where Vietnam excels:

- AI/ML development: 40% of teams certified in major AI frameworks

- Blockchain development: Leading Southeast Asia in cryptocurrency solutions

- Fintech applications: Regulatory compliance expertise for international markets

- Enterprise software: Complex system integration and scalable architecture

“Vietnamese developers rank among the global elite in core algorithmic and AI skills, ready for enterprise-grade delivery,” confirms the Chief Technology Officer at SmartDev.

Business and Cultural Advantages: Why Teams Actually Work

Vietnam’s time zone (UTC+7) provides optimal overlap with Australian business hours (9-hour difference), while European companies benefit from a 6-hour difference allowing same-day collaboration. US West Coast teams achieve a 14-hour difference, creating true 24/7 development cycles.

The cultural compatibility factor often surprises Western companies. Vietnamese business culture focuses on long-term partnerships and relationship building, following Agile and DevOps methodologies adopted from Silicon Valley best practices. Vietnamese teams demonstrate high loyalty with above-average employee retention compared to regional competitors.

Infrastructure supporting seamless collaboration:

- 85.3% household fiber-optic penetration with median fixed broadband speeds of 154 Mbps—placing Vietnam among the world’s top 10.

- Government invested $2.8 billion in digital infrastructure development (2020-2023)

- Major cloud providers (AWS, Google Cloud, Microsoft Azure) expanding Vietnamese data center operations

“Vietnamese teams excel in Agile and DevOps, building lasting partnerships based on transparency and Western-aligned business values,” notes Luan Nguyen, General Director at SmartDev.

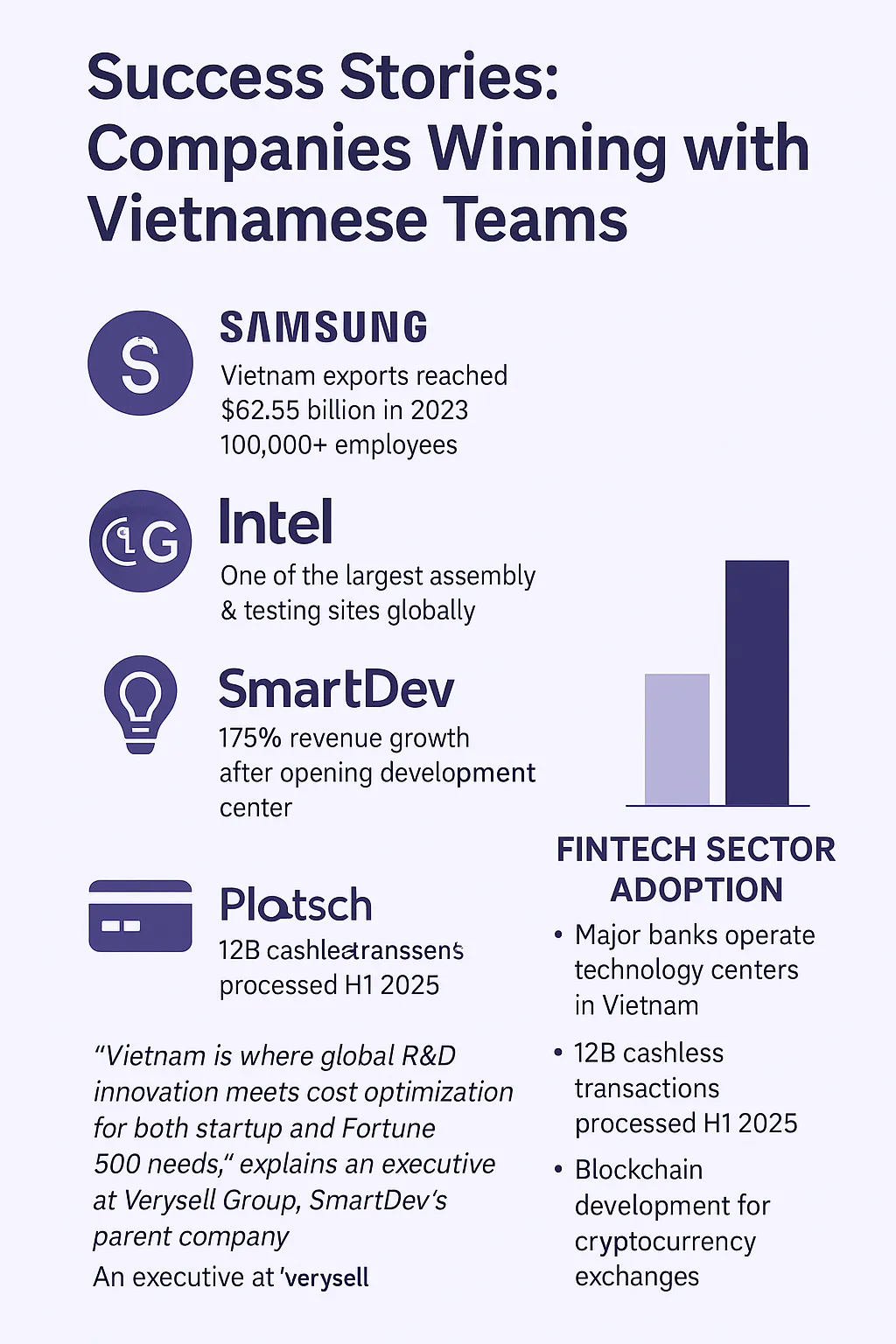

Success Stories: Companies Winning with Vietnamese Teams

The enterprise adoption speaks volumes. Samsung Vietnam’s exports reached $62.55 billion in 2023, employing over 100,000 staff. Intel Vietnam operates as one of the company’s largest assembly and testing sites globally, while LG Electronics runs its largest smartphone manufacturing facility in Haiphong.

For startups and SMEs, the results are equally compelling. The Swiss fintech company SmartDev achieved 175% revenue growth after establishing their Vietnamese development center. Multiple Y Combinator startups use Vietnamese teams for MVP development and scaling operations.

Fintech sector adoption highlights:

- Major banks including HSBC and Standard Chartered operate technology centers in Vietnam

- Vietnamese teams power fintech infrastructure processing 12 billion cashless transactions in H1 2025, positioning Vietnam as the second global digital payment leader

- Cryptocurrency exchanges choose Vietnam for blockchain development due to regulatory clarity

“Vietnam is where global R&D innovation meets cost optimization for both startup and Fortune 500 needs,” explains an executive at Verysell Group, SmartDev’s parent company.

Fig.3 Metrics for a major client implementation

How to Evaluate Vietnamese Development Partners

Quality indicators you should demand:

- ISO 27001, SOC 2 Type II, and CMMI Level 3 certifications as baseline quality markers

- English communication standards verified through technical interviews and trial phases

- Cultural fit assessed through video calls and on-site visits to development facilities

- Transparent project management systems with Western-standard reporting

Red flags to avoid:

- Rates significantly below market average ($14-20/hour for junior developers)

- Providers without transparent communication protocols

- Companies lacking verifiable client testimonials from Western businesses

- Partners without proper legal entity registration and business licenses in Vietnam

“Western clients should insist on international certifications and clear communication protocols for seamless, secure outsourcing,” advises the Chief Operation Officer at SmartDev.

Your due diligence checklist:

- Verify legal entity registration and business licenses in Vietnam

- Request client references from companies in similar industries

- Conduct security audits and data protection compliance reviews

- Test communication and project management capabilities through pilot projects

Setting Up Your Vietnamese Development Center

Foreign companies can establish 100% owned subsidiaries in Vietnam under Investment Law 2020, typically requiring $10,000–$15,000 in charter capital for service and consulting businesses, with capital assessed by the Department of Planning and Investment for business adequacy.

Technology companies qualify for a 10% corporate tax rate for the first two years, though Vietnam requires a local legal entity for employment contracts and office agreements.

Hiring strategy best practices:

- Partner with Vietnamese universities for graduate recruitment and internship programs

- Offer competitive benefits including health insurance, performance bonuses, and training budgets

- Implement retention strategies with career development paths and international assignment opportunities

- Choose office locations in designated IT parks for government incentives and infrastructure benefits

“Direct university partnerships streamline talent pipelines and offer instant access to fresh, motivated graduates,” explains the HR Director at SmartDev.

Infrastructure requirements:

- Establish redundant internet connections and backup power systems for 99.9% uptime

- Implement VPN and security protocols meeting international compliance standards

- Set up development environments compatible with Western time zone collaboration

- Create disaster recovery plans and data backup systems

Future Outlook: Vietnam’s Growing Tech Dominance

The government vision is ambitious and achievable. Vietnam aims for 1 million IT professionals by 2030, with plans for $10 billion investment in AI, IoT, and blockchain infrastructure development. The target shows serious commitment to maintaining competitive advantages.

Vietnamese companies are developing expertise in quantum computing and advanced AI applications. The country positions itself as a regional hub for Industry 4.0 and smart manufacturing solutions, while Vietnam’s gaming industry generates $500 million annually with rapid international growth.

Investment trends supporting this outlook:

- Foreign direct investment in Vietnamese technology sector increased 35% in 2023

- Major cloud providers expanding Vietnamese data center operations

- Vietnam signed comprehensive trade agreements providing preferential access to 50+ countries for technology exports

“Vietnam’s digital transformation vision invests in advanced tech disciplines from quantum computing to AI, positioning the nation as an innovation leader for years ahead,” predicts Alistair Copeland, CEO of SmartDev.

The smart money is already moving. While other companies debate whether to make the switch, early movers are building sustainable competitive advantages through Vietnamese partnerships. The question isn’t whether Vietnam will dominate offshore development – it’s whether you’ll be part of that success story.

Ready to explore how Vietnamese development teams can accelerate your next project? Check out SmartDev’s comprehensive offshore development guide or discover their talent solutions that have helped 300+ global companies achieve measurable results.