Artificial Intelligence (AI) is increasingly transforming the BFSI (Banking, Financial Services, and Insurance) sector by improving efficiency, customer experience, and decision-making. With AI technologies like machine learning, natural language processing, and robotic process automation, financial institutions are able to streamline operations, detect fraud more effectively, and offer personalized services.

AI’s ability to analyze large volumes of data quickly and accurately allows businesses to gain valuable insights, optimize risk management, and stay competitive in a rapidly changing market. These advancements not only enhance the way financial services are delivered but also help organizations improve profitability while meeting regulatory requirements.

The adoption of AI in BFSI is driven by a few key factors: the need to reduce operational costs, enhance customer experience, and improve overall efficiency. As consumer demands for faster, more personalized financial services grow, AI enables institutions to deliver real-time solutions tailored to individual needs. AI also plays a crucial role in fraud prevention and security by identifying irregular patterns and potential threats with greater accuracy.

![]()

Understanding the Technologies Behind AI in BFSI

Artificial Intelligence (AI) is rapidly transforming the BFSI (Banking, Financial Services, and Insurance) sector, bringing about significant improvements in efficiency, security, and customer service. The core AI technologies that drive these changes are Machine Learning, Predictive Analytics, Natural Language Processing (NLP), Robotic Process Automation (RPA), and Generative AI. These technologies enable financial institutions to optimize operations, offer personalized services, and manage risks more effectively.

Machine Learning and Predictive Analytics

Machine Learning (ML) is a subset of AI that allows systems to learn from data and improve over time without being explicitly programmed. In BFSI, ML is particularly useful for analyzing large volumes of structured and unstructured data. By identifying patterns in historical data, ML algorithms can predict future outcomes with high accuracy. Predictive analytics, which falls under the umbrella of ML, provides insights into future trends, customer behaviors, and potential risks.

Applications in BFSI

- Fraud detection: ML models are trained to recognize unusual transaction patterns, helping to identify fraudulent activities in real-time before they cause significant damage.

- Credit risk assessment: Financial institutions use predictive models to determine the likelihood that a borrower will default on a loan, helping them make more informed lending decisions.

- Customer segmentation: ML helps banks and insurance companies understand customer preferences and behaviors, allowing them to create personalized financial products and marketing strategies that better meet the needs of different segments.

- Market forecasting: Predictive analytics can forecast market trends, such as fluctuations in stock prices or commodity values, allowing investors and institutions to make more informed decisions.

Natural Language Processing (NLP)

Natural Language Processing (NLP) is the technology that enables machines to understand, interpret, and generate human language. NLP is increasingly being used in BFSI to enhance customer interactions and automate data analysis. One of the most prominent applications of NLP in financial services is the use of chatbots and virtual assistants, which can handle customer inquiries 24/7. NLP also plays a key role in analyzing unstructured data, such as customer feedback, call center logs, and social media posts.

Applications in BFSI

- Customer support: NLP-powered chatbots and virtual assistants are capable of understanding customer inquiries, providing instant responses, and guiding customers through transactions or troubleshooting. This significantly improves customer service and reduces the need for human agents.

- Sentiment analysis: By analyzing social media, customer reviews, and survey data, NLP helps financial institutions gauge customer sentiment. This information can be used to refine products, services, and marketing campaigns.

- Document processing: NLP can automatically extract relevant information from legal and financial documents, reducing the time and effort required for manual review and enhancing compliance and decision-making.

Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is a technology that uses software robots or “bots” to automate repetitive, rule-based tasks. In the BFSI sector, RPA is particularly effective for automating back-office functions, such as data entry, account reconciliation, and compliance reporting. RPA helps eliminate human error, speeds up processes, and reduces operational costs, allowing employees to focus on more strategic tasks.

Applications in BFSI

- Transaction processing: RPA can automate the process of handling customer transactions, such as transferring funds, updating account details, or generating transaction reports, ensuring faster and more accurate execution.

- Compliance reporting: Financial institutions face rigorous regulatory requirements. RPA helps automate the collection, verification, and submission of compliance data, reducing the risk of non-compliance and minimizing the administrative burden.

- Account reconciliation: RPA can handle the tedious process of reconciling financial statements by automatically comparing transactions, detecting discrepancies, and flagging issues for further investigation.

Generative AI and its Applications in BFSI

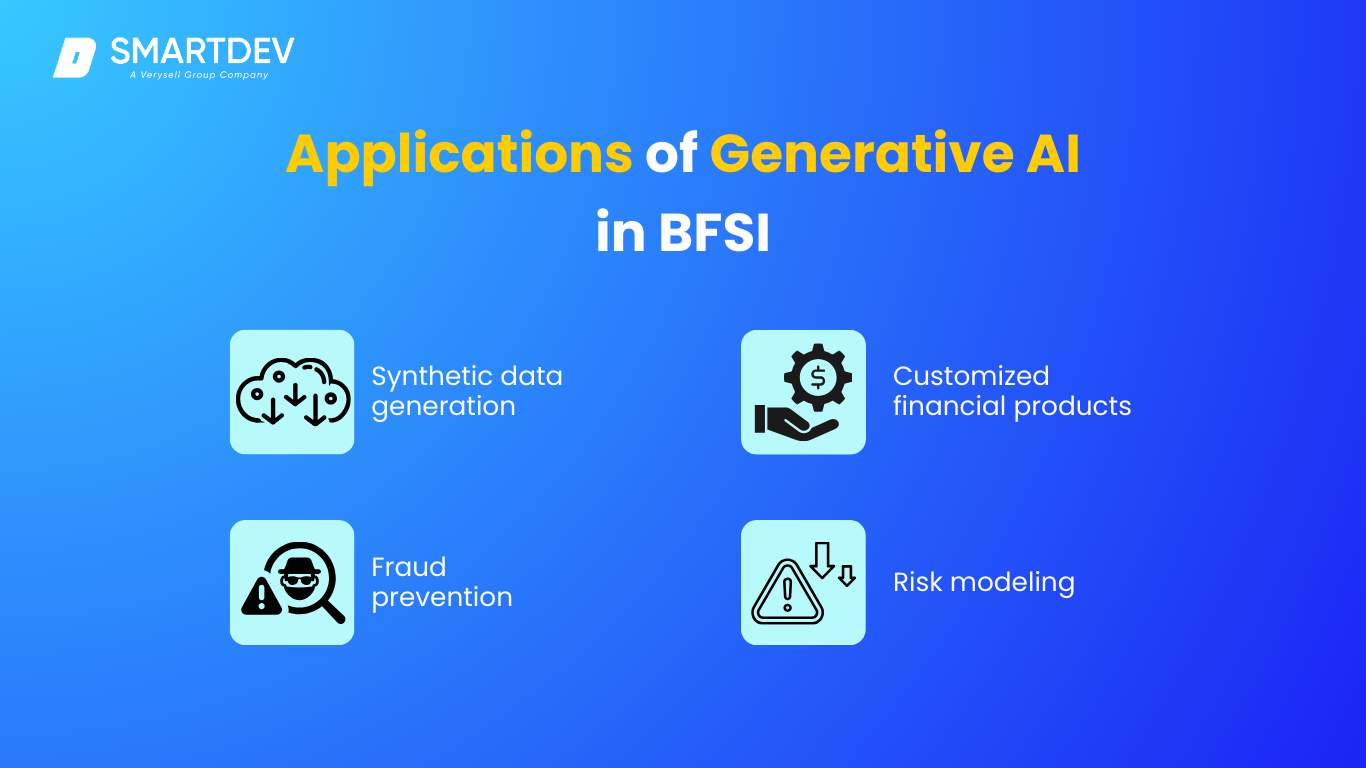

Generative AI, which includes technologies like Generative Adversarial Networks (GANs), is a more advanced AI technology that can create new content based on patterns it learns from existing data. In BFSI, generative models are increasingly used for generating synthetic data, improving fraud detection, and creating customized financial products. This technology can simulate various financial scenarios, helping institutions make more accurate predictions and decisions.

Applications in BFSI

- Synthetic data generation: Generative AI can create synthetic data that mirrors real customer data, allowing institutions to test new financial models or develop products without compromising privacy. This is particularly useful in training machine learning models without risking exposure to sensitive customer information.

- Customized financial products: By analyzing individual risk profiles, generative AI can help design tailored insurance policies, loans, or investment products that best suit each customer’s unique needs. This level of personalization enhances customer satisfaction and loyalty.

- Fraud prevention: Generative AI can simulate new types of fraudulent activities by learning from past data. This enables financial institutions to anticipate and prevent emerging fraud patterns, improving the robustness of security systems.

- Risk modeling: Generative AI can simulate various economic scenarios to assess how different factors (e.g., market crashes, regulatory changes) would impact a financial institution’s operations. This helps organizations improve their risk management strategies.

Together, these AI technologies are revolutionizing the BFSI sector, providing institutions with the tools they need to streamline operations, enhance customer experiences, and stay competitive in an increasingly data-driven world. Each technology complements the others, creating a holistic approach to digital transformation in financial services.

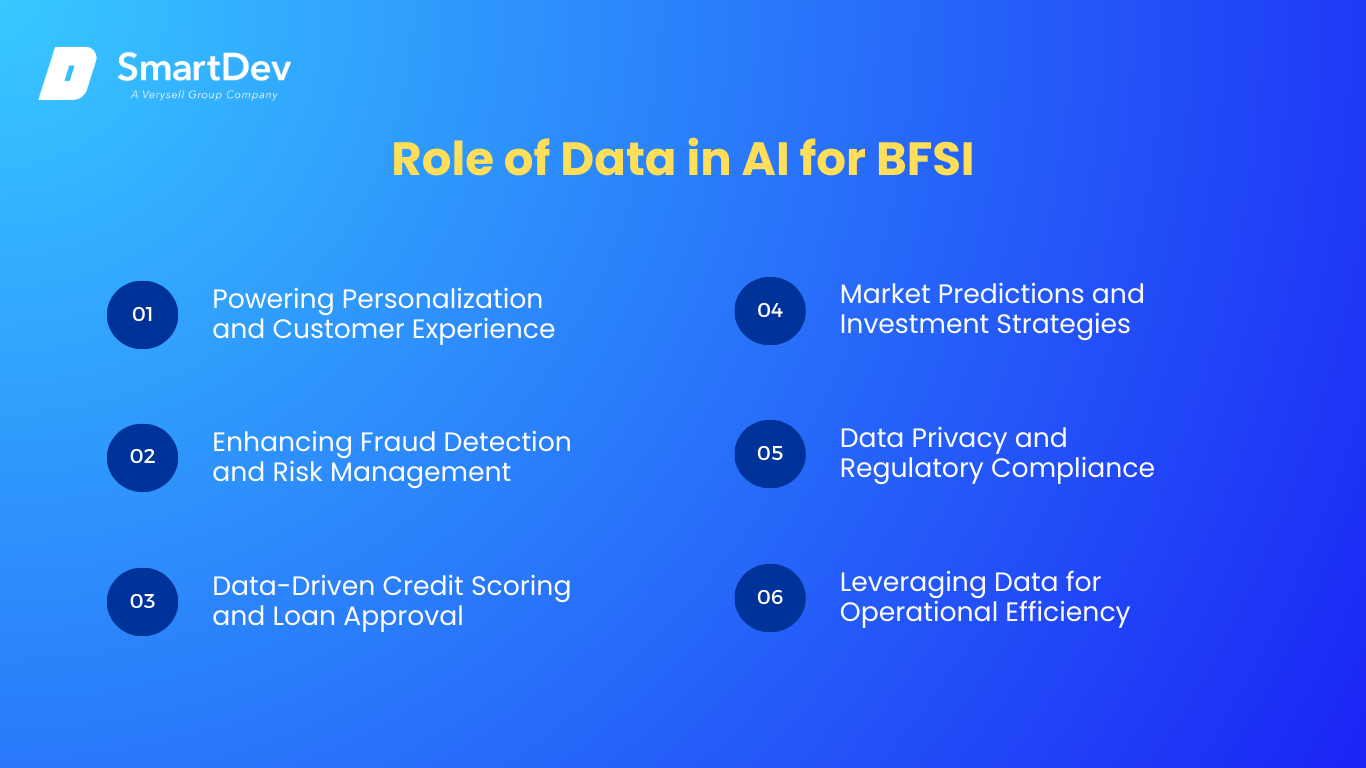

The Role of Data in AI for BFSI

Data is not just a component of AI; it is the foundation upon which AI-driven transformations in the BFSI (Banking, Financial Services, and Insurance) sector are built. The importance of data in AI adoption cannot be overstated—financial institutions use massive volumes of both structured and unstructured data to train AI models that power everything from fraud detection to customer personalization and market analysis.

1. Powering Personalization and Customer Experience

One of the most prominent roles of data in AI for BFSI is in personalizing customer interactions. AI algorithms rely heavily on vast datasets to understand individual customer needs, preferences, and behaviors. These insights allow financial institutions to offer tailored products and services, increasing customer satisfaction and engagement.

For example, according to Salesforce, 80% of consumers are more likely to engage with a business that offers personalized experiences. In banking, this translates to AI-driven solutions that suggest the right financial products based on transaction history, spending patterns, and even lifestyle choices. This data-driven personalization not only improves customer relationships but also increases revenue opportunities for financial institutions.

2. Enhancing Fraud Detection and Risk Management

Another critical role of data in AI for BFSI is fraud prevention. AI models are particularly powerful in analyzing real-time transaction data to detect anomalies, identifying fraudulent activities, and preventing financial crimes before they escalate. Machine learning (ML) algorithms are trained on large datasets of transaction histories to pinpoint unusual patterns, such as rapid withdrawals or inconsistent spending behavior, which could indicate fraud.

PwC reports that AI has helped reduce the time to detect fraud by over 50%, making it much more effective than traditional methods. AI systems can flag potentially fraudulent activities instantly, allowing financial institutions to take action much faster, minimizing losses. With AI’s ability to process vast amounts of data in real time, fraud detection is becoming more accurate and efficient.

3. Data-Driven Credit Scoring and Loan Approval

AI is also reshaping the way banks and financial institutions assess credit risk and approve loans. Traditional credit scoring models rely heavily on limited financial data (like credit history and income). However, AI-enabled credit scoring models use a broader range of data, such as spending habits, social media activity, and even employment history, to assess an individual’s creditworthiness.

The World Economic Forum reveals that AI-driven credit scoring models have made it possible for 45% of individuals who were previously underserved by traditional scoring methods to gain access to credit. This broader approach to data enables financial institutions to make more inclusive lending decisions and reduces the risk of defaults by providing a more accurate picture of a customer’s financial behavior.

4. The Role of Data in Market Predictions and Investment Strategies

Data is also critical for market predictions and investment decision-making. AI systems use historical market data, global trends, and real-time financial data to predict stock movements, commodity prices, and economic indicators. By analyzing these large datasets, AI models can offer investment insights that would be too complex for humans to identify on their own.

For instance, PwC highlights that 77% of financial firms believe AI can significantly improve their ability to predict market trends and make data-driven investment decisions. By leveraging AI to analyze market data, institutions can reduce risks and increase the likelihood of profitable outcomes.

5. Data Privacy and Regulatory Compliance

While data powers AI, the use of customer data also brings challenges, especially concerning privacy and compliance. Financial institutions must ensure that they follow strict regulations, such as GDPR in the EU, to protect sensitive customer information. As the World Economic Forum reports, 90% of BFSI executives say that maintaining compliance with data privacy laws is a significant barrier to AI adoption. However, with appropriate safeguards, AI can still be deployed effectively, helping institutions meet regulatory requirements while utilizing data for operational improvements.

6. Leveraging Data for Operational Efficiency

AI not only improves customer-facing functions but also drives operational efficiency within financial institutions. By using data to automate routine tasks such as data entry, reconciliation, and compliance checks, financial services organizations can streamline back-office operations. AI models can learn from historical data and optimize workflows, reducing operational costs and increasing productivity.

Salesforce reports that 60% of financial institutions using AI have already seen improvements in operational efficiency. By harnessing data to automate mundane tasks, these organizations are able to allocate human resources to more strategic activities, improving overall performance.

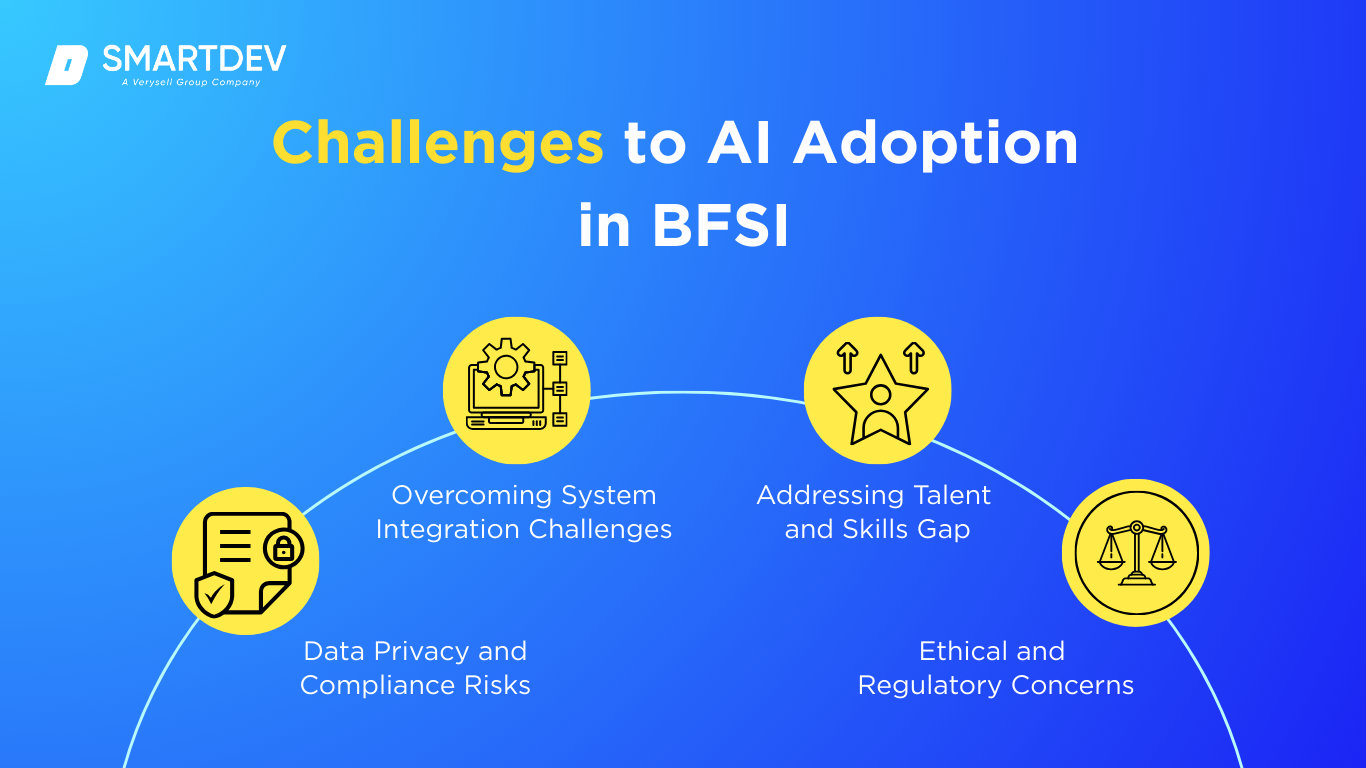

Challenges and Barriers to AI Adoption in BFSI

While AI presents transformative opportunities in the BFSI (Banking, Financial Services, and Insurance) sector, its adoption comes with several challenges and barriers that organizations must address to ensure successful implementation. Here are some of the key hurdles:

1. Data Privacy and Compliance Risks

Data is the foundation of AI, and BFSI institutions deal with sensitive customer information that is governed by strict privacy laws and regulations, such as GDPR, CCPA, and financial industry-specific compliance standards. AI models require access to vast amounts of data to operate effectively, which raises concerns about data privacy and the secure handling of personal information. Financial institutions must ensure that they comply with these regulations while still leveraging data for AI-driven insights. Failure to do so can lead to legal penalties, loss of customer trust, and reputational damage.

2. Overcoming Legacy System Integration Challenges

BFSI organizations often rely on legacy systems that are outdated, fragmented, and not designed to work with modern AI technologies. Integrating AI with these systems can be challenging, as they were not built to handle the scalability, flexibility, and data requirements that AI demands. The cost of upgrading or replacing these legacy systems can be significant, and the integration process may disrupt ongoing operations. Institutions must therefore evaluate whether to overhaul legacy systems or implement hybrid solutions to ensure smooth AI integration.

3. Addressing the Talent and Skills Gap

AI adoption requires highly specialized skills in data science, machine learning, and AI system management. Many BFSI organizations face a talent shortage, as the demand for skilled professionals in AI far outpaces supply. Additionally, there is a lack of professionals who understand both the intricacies of AI and the unique challenges within the financial sector. This skills gap can slow down AI adoption and hinder the ability to fully leverage AI’s potential.

4. Ethical and Regulatory Concerns in AI Deployment

AI raises several ethical issues, such as bias in decision-making, transparency in AI algorithms, and the fairness of AI-driven outcomes. Financial institutions must ensure that AI systems are transparent, accountable, and free from bias to prevent discriminatory practices. Furthermore, regulatory bodies are still catching up with AI technologies, creating uncertainty around the rules governing AI deployment in BFSI. Addressing these concerns is crucial to build trust and ensure responsible AI use.

Explore how SmartDev partners with BFSI teams through a focused AI sprint to validate use cases, align stakeholders, and define a clear path forward before AI development begins.

SmartDev helps BFSI organizations clarify AI use cases and assess feasibility, enabling confident decisions and reducing risks before committing to AI development.

Learn how SmartDev accelerates AI initiatives, ensuring rapid deployment and reduced time to market.

Build Your AI Chatbot With Us5-Step Guide to Implementing AI in BFSI

Implementing AI in the BFSI (Banking, Financial Services, and Insurance) sector can offer numerous advantages, including improving customer experience, enhancing decision-making, increasing operational efficiency, and strengthening risk management. However, the successful adoption of AI requires a systematic approach. Here’s a detailed 5-step guide to help BFSI organizations implement AI effectively:

Step 1: Assessing Business Needs and AI Readiness

Before adopting AI, it’s essential to assess whether AI aligns with your organization’s goals and if your institution is ready for this technological shift.

- Evaluate Business Needs: Start by identifying the specific business challenges you want AI to address. For example, are you aiming to enhance customer service with chatbots, detect fraud more effectively, or streamline loan approval processes? Understanding these challenges will help you determine the type of AI applications that best fit your needs.

- Assess AI Readiness: Consider whether your organization is technologically prepared to implement AI. This includes evaluating your current digital infrastructure, data management practices, and existing AI capabilities. Additionally, assess the readiness of your employees by evaluating their skills and the AI culture within the organization.

- Set Clear Objectives: Having clear, measurable goals is crucial. Whether it’s improving operational efficiency, reducing fraud, or increasing customer satisfaction, make sure that your AI adoption strategy directly aligns with your overall business objectives.

Step 2: Choosing the Right AI Solutions for Your Organization

Once you’ve assessed your business needs and AI readiness, the next step is to choose the AI tools and solutions that best suit your institution.

- Identify Key Use Cases: Focus on AI applications that solve your most pressing challenges. For instance, if customer service is a priority, AI-powered chatbots or virtual assistants might be the right solution. If fraud prevention is a focus, AI-driven transaction monitoring systems would be beneficial. The key is to select the solutions that will provide the greatest return on investment.

- Consider Integration: AI tools need to seamlessly integrate with your existing systems. Ensure that the AI solutions you choose are compatible with your core banking systems, CRM tools, and other platforms. This integration will ensure smooth operations and data flow across all departments.

- Vendor Selection: Work with AI vendors who have expertise in the BFSI sector. These vendors will offer solutions that are customizable, scalable, and secure. Check for vendor support, data privacy compliance, and the ability to scale with your organization’s future needs.

Step 3: Data Collection, Privacy, and Security

AI’s success depends largely on the quality and quantity of data. Proper data collection, privacy protection, and security measures are critical for effective AI implementation.

- Data Collection: AI models rely on data to learn and make predictions. For BFSI organizations, this includes transactional data, customer profiles, market data, and even unstructured data like customer service chat logs. Ensure you collect the right data to train AI models and derive meaningful insights.

- Data Privacy: With sensitive customer information involved, privacy is a critical concern. Adhere to stringent data privacy regulations such as GDPR, CCPA, or other regional regulations. Implement data anonymization and encryption methods to protect customer data and maintain their trust.

- Security Measures: Implement robust security practices to protect your data from cyber threats. Secure data pipelines, access control mechanisms, and regular vulnerability assessments will help mitigate the risks of data breaches and unauthorized access to sensitive information.

Step 4: Integrating AI into Existing Systems and Operations

Integrating AI into your organization’s existing technology infrastructure is often the most complex step but is crucial for ensuring AI’s long-term success.

- System Compatibility: AI tools must work well with your current systems. Whether it’s your core banking platform, CRM, or legacy software, ensuring AI tools integrate smoothly with existing operations is crucial. You may need to update legacy systems or invest in hybrid solutions to ensure smooth compatibility.

- Collaboration Across Teams: Successful AI integration requires collaboration between multiple departments, including IT, operations, and business teams. IT teams need to ensure that the AI solution is technically sound, while business units must provide insights into operational requirements and customer-facing needs.

- Testing and Pilot Projects: Before fully deploying AI solutions, run pilot projects or test environments to validate the performance of AI models. Pilot testing will help identify potential issues early, allowing you to make adjustments and ensure the AI solutions are functioning as expected before a full-scale roll-out.

Step 5: Measuring AI Impact and Continuous Improvement

AI implementation doesn’t end once systems are integrated; it requires continuous monitoring, assessment, and optimization to ensure sustained value.

- Track KPIs and Metrics: Define key performance indicators (KPIs) that align with your business goals. For example, measure improvements in customer service through reduced wait times, enhanced fraud detection accuracy, or faster loan approval processes. Tracking these metrics will help gauge the effectiveness of AI solutions.

- Ongoing Model Updates and Improvements: AI models must continuously evolve based on new data and changing market conditions. Regularly update your AI systems to improve their accuracy and performance. Feeding AI models with fresh data helps them adapt to new trends, customer behavior, and emerging risks.

- Employee Training and Support: As AI tools become more integrated into business processes, ensure your employees are trained to use them effectively. Continuous education and support will help employees make the most of AI-driven systems, fostering a culture of innovation and improving operational efficiencies.

Applications of AI in BFSI

AI is playing an increasingly critical role in transforming various sectors within the BFSI (Banking, Financial Services, and Insurance) industry. From enhancing customer engagement to improving risk management, AI is driving innovation and improving efficiency across the board. Below are some key AI applications in BFSI:

1. AI in Banking: Smarter Transactions and Customer Engagement

AI is revolutionizing banking by improving transaction processes and enhancing customer engagement. With AI-driven chatbots, virtual assistants, and intelligent systems, banks can offer personalized services to customers in real-time. These systems use data to understand customer preferences, answer queries, and automate routine tasks like balance checks, fund transfers, and loan applications. Additionally, AI enhances fraud detection by analyzing transaction patterns and identifying anomalies faster than manual systems.

- Smarter Transactions: AI helps banks process transactions more quickly and accurately. By leveraging machine learning algorithms, banks can detect potential fraudulent activities in real-time, making transactions safer and more efficient.

- Improved Customer Engagement: AI tools like chatbots and virtual assistants provide 24/7 customer service, offering personalized assistance based on individual customer profiles and past interactions.

2. AI in Insurance: Claims Processing and Risk Assessment

In the insurance sector, AI is transforming both claims processing and risk assessment. AI models can process large volumes of data from various sources, such as medical records, accident reports, and customer history, to evaluate claims quickly and accurately. This reduces the time spent on manual claims processing and enhances customer satisfaction.

- Claims Processing: AI automates the claims approval process by extracting relevant information from documents, validating data, and determining the claim’s legitimacy. This leads to faster decision-making and reduced operational costs.

- Risk Assessment: AI models also help insurers evaluate risks more accurately by analyzing vast amounts of data. Machine learning algorithms assess patterns and predict potential risks, helping insurers to offer more personalized pricing and better underwriting decisions.

3. AI in Wealth Management: Personalized Investment Solutions

In wealth management, AI enables more personalized and data-driven investment solutions. AI systems analyze financial markets, economic indicators, and individual client portfolios to provide personalized investment strategies that align with the client’s goals, risk tolerance, and preferences.

- Personalized Investment Solutions: AI algorithms track market trends, identify investment opportunities, and make portfolio recommendations based on individual preferences and market conditions. This helps wealth managers provide highly personalized investment services to clients at scale.

- Enhanced Decision-Making: AI helps wealth managers improve decision-making by providing data-driven insights and predictions, optimizing the management of client portfolio.

4. AI in Payments: Faster and More Secure Transactions

AI is also enhancing the payments sector by making transactions faster, more secure, and more efficient. Machine learning algorithms can analyze vast amounts of transaction data in real-time to identify fraud, prevent chargebacks, and optimize transaction flows.

- Faster Transactions: AI speeds up payment processing by automating manual tasks, improving transaction verification, and streamlining payment gateways. This enables financial institutions to process a larger volume of transactions more efficiently.

- More Secure Transactions: AI-powered fraud detection systems analyze user behavior patterns and flag unusual activities to prevent fraudulent transactions. These systems are essential for ensuring the security of digital payments.

5. AI in Fraud Prevention and Risk Management

AI is playing a crucial role in enhancing fraud prevention and risk management in BFSI. By analyzing vast amounts of data from transactions, financial records, and customer behavior, AI can detect potential fraud and mitigate risks more effectively.

- Fraud Detection: AI systems use machine learning to detect suspicious activity and flag potentially fraudulent transactions in real-time. These models continuously learn from new data, becoming more accurate over time at identifying fraud.

- Risk Management: AI models help financial institutions assess and manage risks more effectively by predicting future risks based on historical data. These models help optimize lending decisions, detect systemic risks, and enhance regulatory compliance.

Case Studies: AI in Action in BFSI

Here are a few case studies that showcase the real-world impact of AI in BFSI:

1. Creating a New Digitalized Beginning for Individuals in BFSI Operations

A BFSI organization aimed to modernize its operations and offer a seamless, personalized, digital experience for individual customers. By integrating AI, the organization could analyze customer behavior and offer customized financial solutions, including personalized loan recommendations and investment advice.

Challenges

- Outdated legacy systems that couldn’t support modern, scalable digital operations.

- A lack of personalized, data-driven financial services that customers increasingly demand.

- Inconsistent user experience across different digital channels, making customer interaction fragmented.

Solutions

- Implemented AI-powered systems to analyze customer behavior and transaction data in real time.

- AI tools recommended personalized financial products such as tailored loans, investment plans, and insurance options based on each customer’s unique financial profile.

- Integrated AI-driven digital channels, including chatbots and virtual assistants, that offered 24/7 personalized financial advice and customer support.

Outcomes

- The AI implementation resulted in a smoother, more cohesive customer experience across all digital touchpoints, leading to a significant increase in customer engagement.

- Personalized financial advice based on real-time data improved customer decision-making, contributing to higher customer satisfaction and retention rates.

- Operational costs were significantly reduced, as the need for manual intervention in customer interactions decreased, allowing the organization to scale without additional human resource investments.

- The success of this transition to digital enhanced the company’s competitiveness in a fast-evolving financial services market, positioning them as an innovative leader in the sector.

2. Empowering a Belgian Insurance Provider with Seamless Management Tools

A leading Belgian insurance provider was looking to streamline its claims processing and policy management systems. They sought an AI-powered solution to automate workflows, reduce manual handling, and enhance data accuracy.

Challenges

- Inefficient, manual claims processing that led to long processing times and human errors.

- High operational costs resulting from time-consuming administrative tasks and paperwork.

- Lack of real-time data processing, which slowed down decision-making and delayed customer responses.

Solutions

- The company implemented AI-driven automation tools to process claims and manage policy data more efficiently.

- Machine learning algorithms and NLP (Natural Language Processing) were used to extract and validate data from claims forms and insurance policies, automating key parts of the workflow.

- Integrated AI to provide real-time analytics, allowing faster decision-making in claims approval and policy management.

Outcomes

- The AI-powered system reduced claims processing time by more than 50%, significantly speeding up response times and improving customer satisfaction.

- Errors related to manual data entry and document processing were drastically minimized, leading to improved data accuracy and reduced operational overhead.

- The company saw increased operational efficiency, as human employees could focus on more complex and value-added tasks like customer service and personalized policy recommendations.

Overall, the insurer benefited from higher customer retention due to faster and more reliable claims handling, while also lowering costs and scaling operations more effectively without compromising service quality.

3. Improving the Accuracy and Speed of Insurance Document Processing

A prominent insurance company faced significant challenges with the speed and accuracy of processing insurance-related documents, including claims, underwriting forms, and contracts. These documents were often lengthy and complex, which made manual processing slow and prone to errors.

Challenges

- Slow and inefficient manual review of large volumes of documents, leading to backlogs and delays.

- Human errors in extracting critical information, which resulted in inconsistencies and poor decision-making.

- High operational costs due to the need for manual document entry and document handling.

Solutions

- The company integrated AI-powered Natural Language Processing (NLP) systems to automatically extract and process key information from documents.

- The AI models were trained to recognize and extract relevant data such as policy numbers, claim details, and customer information from unstructured documents.

- AI was also used to automatically validate the data, flagging any discrepancies or missing information before sending documents for further review.

Outcomes

- AI automation reduced document processing time by 60%, allowing claims and underwriting to be completed much faster and more efficiently.

- The accuracy of data extraction improved significantly, minimizing human errors and ensuring consistent, reliable data across all processed documents.

- By automating the document review process, the insurer was able to cut operational costs and free up staff to focus on more complex tasks like customer service and policy analysis.

- Customer satisfaction improved as claims and policy processing became faster, leading to higher retention rates and stronger customer loyalty.

With the enhanced AI-driven system, the company was able to scale its operations without increasing costs, driving both efficiency and growth in the highly competitive insurance market.

Why Choose SmartDev for AI in BFSI

SmartDev is a leader in providing cutting-edge AI solutions, with a deep understanding of both technology and the BFSI industry. The company’s AI capabilities span a wide range of technologies, including Machine Learning, Natural Language Processing (NLP), Robotic Process Automation (RPA), and Predictive Analytics. These technologies are used to create tailored solutions that streamline operations, enhance customer experience, and improve decision-making processes within BFSI organizations.

SmartDev’s expertise extends beyond just developing AI models—it involves creating end-to-end solutions that integrate seamlessly into existing systems. Whether it’s enhancing fraud detection systems, automating document processing, or improving risk management, SmartDev’s AI-driven solutions are designed to bring tangible value to financial institutions. The company’s commitment to data privacy and security ensures that all AI applications comply with regulatory standards, offering peace of mind to clients in a highly regulated industry.

Success Stories and Use Cases in BFSI

SmartDev has a proven track record of successful AI implementations across the BFSI sector. For example, a major Belgian insurance provider partnered with SmartDev to streamline their claims processing and policy management. By integrating AI tools for data extraction and validation, the provider was able to reduce claims processing time by more than 50% while improving accuracy. This allowed the insurer to enhance customer satisfaction and reduce operational costs.

Another success story comes from a global bank that turned to SmartDev to implement AI-powered fraud detection systems. Through machine learning models that analyzed transaction data in real-time, the bank significantly reduced its exposure to fraudulent activities and enhanced its ability to detect suspicious patterns earlier. This proactive approach not only saved the bank millions of dollars but also improved customer trust and security.

How SmartDev Supports BFSI Organizations in AI Transformation

SmartDev’s approach to AI transformation is centered around collaboration, customization, and continuous improvement. The company works closely with BFSI organizations to understand their unique challenges and goals, ensuring that AI solutions are tailored to their specific needs. From initial consultation and strategy development to implementation and ongoing support, SmartDev ensures that clients fully realize the benefits of AI.

Key areas where SmartDev supports BFSI organizations include:

- Integration with Legacy Systems: SmartDev helps BFSI companies modernize their systems by integrating AI solutions into existing infrastructures, ensuring minimal disruption and maximum scalability.

- Data Management and Security: With AI dependent on high-quality, secure data, SmartDev ensures that data governance and privacy requirements are met, enabling organizations to make the most of their data while complying with industry regulations.

- Ongoing AI Optimization: AI solutions need to evolve as business environments change. SmartDev provides ongoing optimization and model training to ensure that AI systems stay relevant and effective.

By partnering with SmartDev, BFSI organizations can not only enhance their operational efficiency but also improve customer satisfaction, reduce risks, and stay ahead of the competition in an increasingly digital world.

Conclusion

In an increasingly competitive and digital-first world, AI is no longer a luxury but a necessity for BFSI organizations looking to stay ahead. SmartDev stands out as a trusted partner in this AI transformation journey, offering deep industry knowledge, innovative solutions, and a proven track record of success.

With SmartDev’s expertise in machine learning, natural language processing, robotic process automation, and predictive analytics, BFSI institutions can seamlessly integrate AI into their operations to drive efficiency, enhance customer experiences, and ensure compliance with evolving regulatory standards.

By partnering with SmartDev, BFSI organizations not only unlock the power of AI but also gain a partner who understands the complexities of the industry and is dedicated to driving long-term success.