Introduction

Mortgage lenders today face rising pressure to streamline operations, reduce loan cycle times, and deliver seamless borrower experiences, all while meeting strict regulatory demands. Artificial Intelligence (AI) is emerging as a strategic lever, automating key processes, enhancing decision-making, and driving down operational inefficiencies.

This comprehensive guide examines how AI is transforming the mortgage industry, from underwriting and fraud detection to customer service and predictive loan servicing, delivering measurable value and tackling practical adoption challenges.

What is AI and Why Does It Matter in Mortgage Industry?

Definition of AI and Its Core Technologies

AI refers to technologies that replicate human cognitive functions such as learning, reasoning, and decision-making. Core AI capabilities such as machine learning (ML), natural language processing (NLP), and computer vision allow systems to process vast amounts of mortgage data, identify patterns, and generate actionable insights.

In mortgage lending, these technologies power tools like intelligent document readers, dynamic credit risk models, and conversational chatbots. This helps lenders accelerate loan processing, improve underwriting precision, and support compliance through deeper data analysis.

The Growing Role of AI in Transforming Mortgage Industry

AI is accelerating a long-overdue shift from manual, document-heavy processes to streamlined, automated mortgage workflows. Technologies like Optical Character Recognition (OCR) and NLP can scan and extract structured data from documents such as pay stubs and W-2s within seconds. This automation not only reduces the risk of human error but also shortens loan origination cycles, enabling lenders to process higher volumes without increasing headcount.

Credit risk evaluation is becoming more nuanced through the use of machine learning models trained on non-traditional data sources. These models incorporate variables like rental payment history, bank transaction flows, and freelance income to assess borrower profiles that traditional scoring overlooks.

AI is also reshaping how lenders engage with borrowers during and after the loan process. Intelligent virtual assistants handle frequent borrower inquiries with 24/7 availability. Meanwhile, predictive analytics tools monitor account behavior and payment trends to identify early warning signs of financial distress, enabling loan servicers to intervene before delinquency occurs.

Key Statistics and Trends Highlighting AI Adoption in Mortgage Industry

In 2024, AI usage among mortgage lenders grew significantly, 38% of institutions reported using AI or machine learning tools, up from just 15% in 2023. This more than twofold increase demonstrates a sharp shift from cautious experimentation to active integration, especially in document processing and borrower support. Additionally, 48% of lenders adopted Robotic Process Automation (RPA) to handle repetitive tasks like ordering appraisals and retrieving credit scores, indicating a broader embrace of automation across workflows

A survey by Fannie Mae reveals that 55% of mortgage lenders plan to pilot or expand AI implementations in 2025, with many targeting improvements in operational efficiency and fraud detection. This points to a shift from tactical, tool-specific deployments toward enterprise-level AI strategies.

However, deeper adoption is still emerging. According to Fannie Mae’s 2023 study, 65% of lenders are familiar with AI/ML, but only 7% have fully deployed these tools, and 22% remain in testing phases. Interestingly, 73% cited operational efficiency as the main driver behind AI investment, signaling that internal transformation is currently prioritized over front-end innovation

Business Benefits of AI in Mortgage Industry

AI is unlocking real operational value for mortgage lenders by eliminating friction points in underwriting, fraud detection, and servicing. These benefits directly address some of the most expensive and inefficient elements of the loan lifecycle.

1. Accelerated Document Processing

1. Accelerated Document Processing

Mortgage applications often include hundreds of pages of documents that need to be sorted, verified, and interpreted. AI systems can process these documents in seconds, extracting relevant fields, categorizing forms, and even flagging missing or inconsistent data. This eliminates much of the manual back-and-forth between processors and borrowers, cutting days or even weeks from the underwriting timeline.

Faster document turnaround also means loans move through the pipeline more predictably, improving lock efficiency and funding reliability. In high-volume lending environments, this speed translates directly into increased throughput without requiring proportional increases in staffing. Most importantly, reduced manual input lowers the risk of human error, improving compliance and reducing repurchase risk.

2. Enhanced Fraud Detection and Risk Management

AI excels at pattern recognition – an essential capability in fraud detection. By analyzing thousands of historical transactions and borrower profiles, machine learning models can flag subtle inconsistencies or anomalies that human underwriters often miss.

This shift from rule-based to data-driven risk assessment helps lenders stay ahead of increasingly sophisticated fraud schemes. In addition, real-time alerts generated by AI systems allow teams to act faster and prevent fraudulent loans from closing. This not only protects the lender’s balance sheet but also supports long-term portfolio health.

3. Improved Borrower Experience Through AI Assistants

Digital-first borrowers expect immediate answers, especially when navigating complex processes like home financing. AI-powered chatbots and voice assistants offer 24/7 support, instantly responding to questions about loan status, required documents, and next steps. These tools are not only faster than call centers, but they also eliminate long wait times and support engagement outside business hours.

More than just answering FAQs, advanced conversational AI can guide borrowers through full applications or even prequalification. This improves borrower satisfaction while reducing abandonment during the application process. Ultimately, better experiences translate to stronger brand loyalty and higher conversion rates.

4. Smarter Underwriting and Credit Decisioning

Traditional underwriting models often rely on static credit scores and rigid DTI ratios, which can overlook low-risk borrowers who fall outside conventional norms. AI brings dynamic risk modeling into the picture, evaluating real-time cash flow, expense trends, and employment variability. This allows for more inclusive lending without increasing default risk.

By expanding the data universe, AI enables lenders to serve segments like gig workers, recent immigrants, or thin-credit-file applicants. These borrowers often represent untapped opportunities, especially in underserved markets. AI-enhanced underwriting can help lenders grow responsibly while aligning with fair lending principles.

5. Predictive Analytics for Loan Servicing

Loan servicing is traditionally reactive, responding only after a borrower misses payments. Predictive analytics flips this model by using behavioral data, payment history, and economic indicators to flag borrowers at risk of delinquency. This enables servicers to proactively offer support options such as forbearance or loan restructuring.

This shift improves both borrower outcomes and lender profitability. Early interventions help avoid costly defaults and reduce loss severity. It also improves regulatory compliance, as proactive outreach can be tied to consumer protection requirements under servicing guidelines.

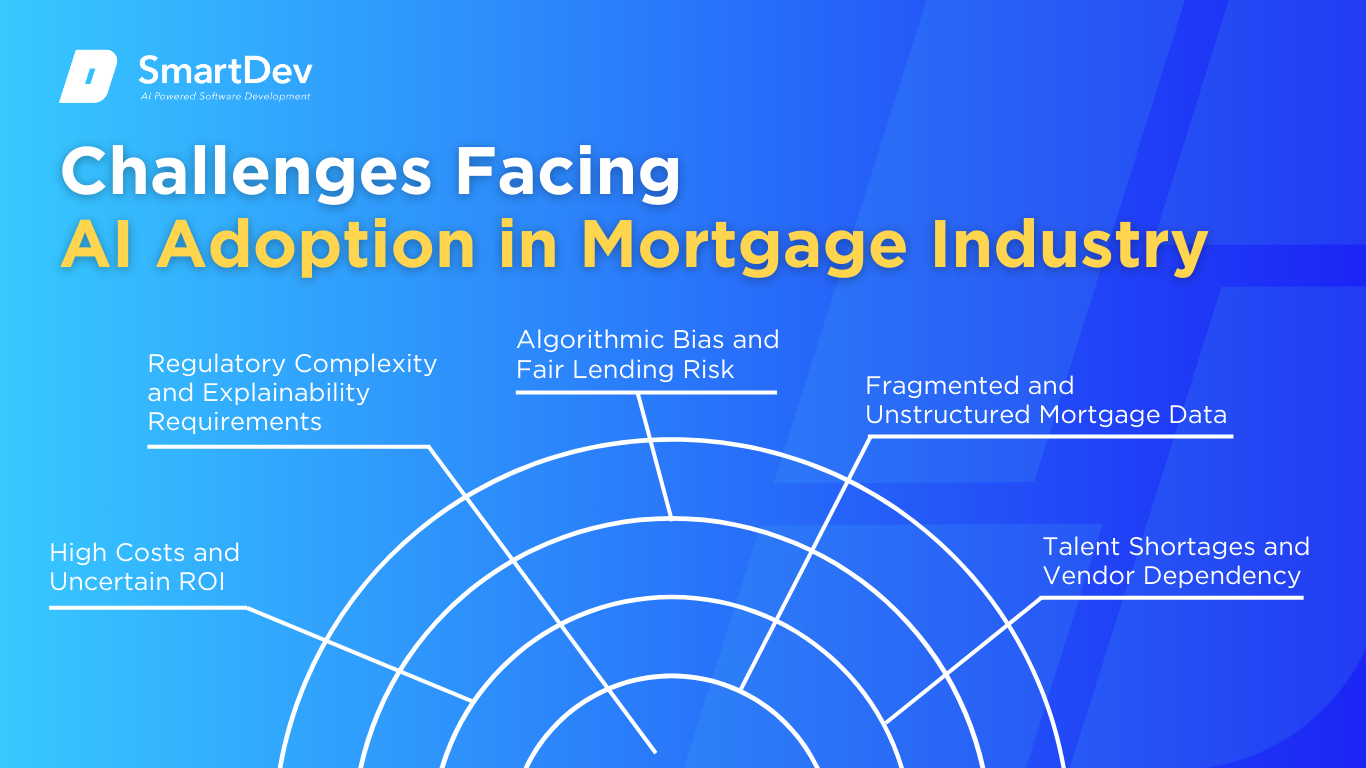

Challenges Facing AI Adoption in Mortgage Industry

While AI offers powerful advantages, implementing it within mortgage operations is far from straightforward. From regulatory complexity to data fragmentation, several barriers slow adoption and limit scale. Understanding these challenges is essential for building realistic, responsible AI strategies in the industry.

1. Regulatory Complexity and Explainability Requirements

1. Regulatory Complexity and Explainability Requirements

Mortgage lending is heavily regulated, particularly when it comes to credit decisions, borrower disclosures, and fair lending compliance. AI models, especially deep learning systems, are often viewed as “black boxes,” making it difficult to explain why a specific borrower was denied or approved.

To comply, lenders must ensure that AI-driven decisions are explainable and auditable. This has led to growing interest in explainable AI frameworks that prioritize model interpretability. Without these controls, even high-performing AI models can’t be safely deployed in underwriting or credit decisioning.

2. Fragmented and Unstructured Mortgage Data

AI models require clean, structured, and integrated data sets to deliver reliable outputs. Yet mortgage data is often scattered across multiple systems such as LOS platforms, CRMs, servicing databases, and PDF forms, each with different formats and quality levels. This fragmentation makes it difficult to train consistent models or derive trustworthy insights.

Furthermore, unstructured data like scanned documents or emails still makes up a large portion of operational workflows. Converting that data into usable formats demands upfront investment in intelligent data pipelines and cleansing processes. Until that foundation is in place, AI systems risk generating incomplete or biased outputs.

3. Algorithmic Bias and Fair Lending Risk

AI systems trained on historical mortgage data may inadvertently learn and replicate the biases embedded in past decisions. This poses a major risk in lending, where fairness and equal access are mandated by law. If unchecked, algorithmic bias can lead to discriminatory outcomes, regulatory penalties, and reputational damage.

To mitigate this, lenders must proactively test AI models for disparate impact and bias before deployment. Bias correction techniques, model audits, and demographic analysis should be built into the model lifecycle. Achieving fairness is essential to building borrower trust and long-term brand equity.

4. Talent Shortages and Vendor Dependency

AI implementation requires a blend of skills across data science, machine learning, compliance, and mortgage operations – a combination that many lenders currently lack. This skills gap often leads to over-reliance on third-party vendors for AI tools and model development. While outsourcing can accelerate time-to-market, it introduces risks around integration, data security, and long-term scalability.

Organizations may also struggle to vet AI vendors effectively due to limited internal expertise. Without strong technical oversight, lenders may deploy systems they don’t fully understand or control. Building internal AI literacy across business and IT teams is crucial to achieving sustainable adoption.

5. High Costs and Uncertain ROI

Deploying AI solutions at scale involves significant upfront investment in infrastructure, data preparation, model training, and compliance oversight. For smaller lenders and credit unions, these costs can be prohibitive, especially if early-stage pilots fail to demonstrate clear ROI. The business case for AI often requires long-term vision and patience, which can be hard to justify in volatile lending environments.

To manage this, organizations should start with focused pilots targeting high-impact use cases like document automation or fraud alerts. These quick wins help build internal momentum and support broader rollouts. Ultimately, AI adoption is most successful when aligned to strategic goals—not just technology trends.

Specific Applications of AI in Mortgage Industry

1. Automated Underwriting & Risk Assessment

1. Automated Underwriting & Risk Assessment

AI-powered underwriting is transforming the mortgage industry by automating risk evaluation and eligibility checks. Traditional underwriting requires extensive manual review of income, employment, and credit history, often taking days to complete. By contrast, AI-driven systems streamline this process, delivering faster and more consistent loan decisions.

These systems use machine learning models trained on historical loan performance, repayment patterns, and borrower attributes. Data such as credit scores, tax returns, and banking transactions are processed through predictive algorithms that identify correlations with default risk. The technology integrates seamlessly with loan origination systems, allowing underwriters to focus on complex exceptions instead of repetitive tasks.

For example, Blend, a leading mortgage technology provider, leverages AI to automate underwriting workflows. According to the company, lenders using Blend have reduced loan processing time by up to 30%, while improving accuracy and borrower satisfaction. This demonstrates the tangible efficiency and customer experience gains that AI brings to mortgage underwriting.

2. Intelligent Document Processing & OCR

Mortgage applications involve hundreds of pages of supporting documents, from pay stubs to tax returns, that traditionally require manual review. This process is slow, error-prone, and costly for lenders who must ensure data accuracy before approving loans. AI-driven document processing solves this bottleneck by automating classification and extraction of information.

Using a combination of optical character recognition (OCR), NLP and machine learning, these systems can read unstructured documents and convert them into structured data. The extracted information is validated against business rules and automatically integrated into loan origination systems. This accelerates document handling, reduces human errors, and lowers operational costs.

For example, Hyland’s Intelligent Document Processing solution has been adopted by financial institutions to speed up mortgage workflows. Lenders using this tool report up to 40% faster processing of loan documents and significant reductions in back-office workload. The result is quicker loan decisions and improved borrower experience.

3. AI-Driven Property Valuation & Appraisals

Determining accurate property values is essential in the mortgage industry, but traditional appraisals are slow and inconsistent. Manual methods often delay loan approvals and create discrepancies due to subjective human judgment. AI-driven property valuation provides a faster and more reliable approach.

Automated Valuation Models (AVMs) leverage large datasets including sales history, property characteristics, neighborhood trends, and even satellite imagery. Machine learning algorithms process these inputs to generate precise valuation estimates in seconds. These models help lenders pre-screen collateral, reduce costs, and minimize appraisal delays.

A well-known example is Zillow’s Zestimate, which uses AI to predict property values across millions of homes. The tool achieves a median error rate as low as 1.9% for listed homes, providing lenders with dependable early valuation insights. By incorporating such models, mortgage companies can shorten appraisal timelines and enhance decision confidence.

4. Borrower Chatbots & Virtual Assistants

Customer engagement is a critical part of the mortgage process, yet call centers are often overwhelmed with repetitive borrower questions. Long wait times and inconsistent responses can frustrate customers and strain lender resources. AI-powered chatbots and virtual assistants offer a scalable solution to this challenge.

These conversational agents use natural language processing to answer FAQs, guide applicants through document submission, and provide real-time loan status updates. Integrated into websites or mobile apps, they operate 24/7, delivering consistent and efficient borrower interactions. At the same time, they reduce call center volume and improve overall service quality.

For instance, Capacity has developed AI virtual assistants tailored for lenders. One credit union reported that the chatbot could resolve over 90% of customer inquiries instantly, cutting support calls by 20%. This not only improved borrower satisfaction but also freed staff to focus on more complex service requests.

5. Predictive Analytics for Credit Risk & Default Modeling

Accurately predicting borrower default risk has long been a challenge in the mortgage industry. Traditional credit scoring models rely heavily on static factors like FICO scores, which may not capture nuanced risk signals. Predictive analytics powered by AI offers lenders a deeper and more dynamic view of borrower behavior.

Machine learning models analyze payment histories, spending patterns, and macroeconomic indicators to identify early signs of default. These models continuously learn from new data, adapting to changing conditions and improving risk prediction accuracy. By deploying such tools, lenders can take proactive measures like loan restructuring or targeted borrower outreach.

A regional U.S. bank implemented AI-based risk models to forecast mortgage defaults. The system improved prediction accuracy by more than 15% compared to traditional methods. This enabled the bank to reduce delinquency rates and strengthen its overall loan portfolio performance.

6. Fraud Detection & Compliance Monitoring

Mortgage fraud remains a serious concern, with fraudulent applications leading to significant financial losses. Manual fraud detection is often reactive, identifying issues only after loans are processed. AI-based fraud detection systems provide a proactive defense by analyzing large volumes of data in real time.

These platforms monitor application data, identity documents, behavioral signals, and device information to flag suspicious patterns. Advanced algorithms compare applicant data against known fraud networks and anomalies, significantly increasing detection accuracy. In addition, they support compliance by maintaining auditable records of flagged cases.

A major initiative is Fannie Mae’s partnership with Palantir to deploy AI for fraud detection. Their system can process millions of records to uncover fraudulent activity at scale. This collaboration is expected to save millions in potential fraud losses while reinforcing trust in the mortgage market.

Examples of AI in Mortgage Industry

Real-World Case Studies

1. Fannie Mae: AI-Powered Fraud Detection

Fannie Mae launched an AI-driven Crime Detection Unit in partnership with Palantir to combat the growing threat of mortgage fraud. The system analyzes millions of data points from borrower records, property transactions, and third-party datasets to identify anomalies that suggest fraudulent behavior. This proactive approach marked a shift from manual, after-the-fact fraud checks to real-time monitoring and prevention.

The collaboration allows Fannie Mae to flag suspicious activity with higher precision and speed than traditional systems. Machine learning algorithms detect hidden correlations and patterns that human investigators might miss. By automating detection, the system not only enhances security but also reduces the workload of compliance teams.

Early reports highlight the system’s potential to save millions of dollars in fraud-related losses annually. It also reinforces trust among lenders, regulators, and borrowers by showing that AI can safeguard mortgage transactions. This case illustrates how advanced AI analytics are becoming essential in maintaining integrity within the mortgage market.

2. Wells Fargo: AI-Enhanced Customer Support

Wells Fargo integrated AI-powered chatbots into its mortgage division to improve borrower engagement and reduce call center congestion. The virtual assistants guide applicants through the loan process, answer common questions, and provide status updates in real time. This ensured that customers could access support instantly without waiting for human agents.

The chatbot system relies on natural language processing to understand borrower queries and provide contextually relevant answers. It connects with backend mortgage systems to deliver accurate information on payments, applications, and approvals. By doing so, Wells Fargo reduced repetitive tasks for staff and allowed human agents to focus on complex cases.

Since deploying the technology, Wells Fargo reported a 20% reduction in call center volume and higher borrower satisfaction scores. Customers praised the convenience of 24/7 access, while the bank benefited from significant operational cost savings. The success of this initiative demonstrates how AI can balance efficiency with improved customer experience in mortgage lending.

3. JPMorgan Chase: AI for Risk Prediction

JPMorgan Chase has invested heavily in predictive analytics to forecast mortgage default risks more accurately. The bank uses AI models trained on borrower data, market trends, and macroeconomic indicators to identify potential delinquencies earlier. This approach helps the institution proactively mitigate losses and strengthen portfolio resilience.

The AI system analyzes both structured financial data and unstructured signals like spending behavior or employment volatility. By continuously retraining the models, JPMorgan ensures adaptability to shifting economic conditions. This provides underwriters and risk managers with actionable insights that were not possible with traditional scoring models.

As a result, JPMorgan Chase reduced mortgage delinquency rates by more than 10% in pilot programs. The system also improved risk-adjusted returns by enabling more informed loan pricing. This case highlights the value of predictive analytics in balancing profitability and borrower protection in the mortgage industry.

Innovative AI Solutions

Emerging AI innovations are reshaping the mortgage industry by addressing challenges that traditional models could not solve. Generative AI is being adopted to summarize lengthy mortgage documents, simplify compliance disclosures, and support conversational interfaces that guide borrowers. These capabilities reduce complexity and make the lending process more transparent for both customers and regulators.

Another frontier is explainable AI, which ensures that automated underwriting and risk models remain interpretable. By revealing how decisions are made, lenders can comply with fair lending regulations while maintaining customer trust. This innovation positions AI not just as a tool for efficiency, but as a driver of ethical and sustainable mortgage lending.

AI-Driven Innovations Transforming Mortgage Industry

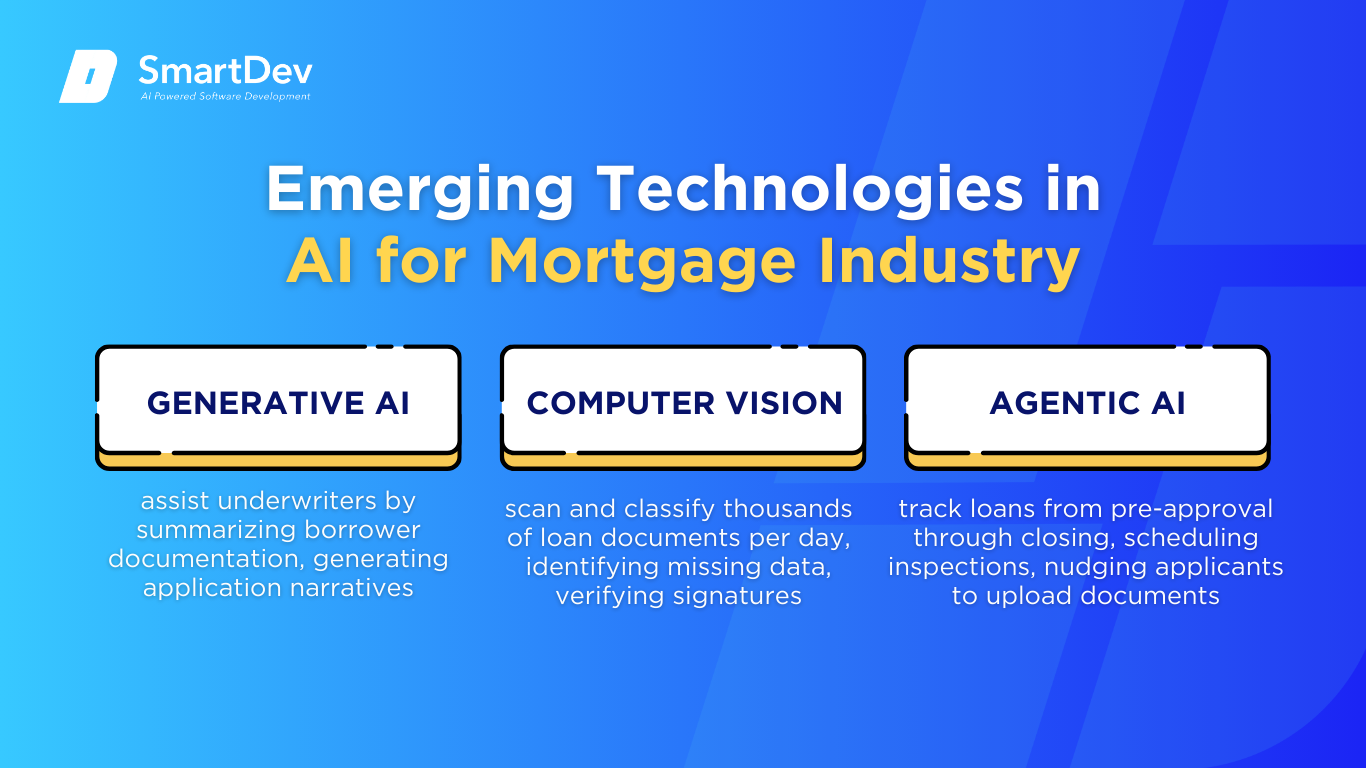

Emerging Technologies in AI for Mortgage Industry

Generative AI models now can assist underwriters by summarizing borrower documentation, generating application narratives, and even drafting borrower communications, shaving hours off processing times. Instead of toggling between PDFs, spreadsheets, and databases, your team can rely on AI to surface key insights and risk indicators in real time.

Computer vision is also making waves, especially when it comes to document intake and property evaluations. AI-powered OCR systems can scan and classify thousands of loan documents per day, identifying missing data, verifying signatures, and flagging anomalies instantly. On the valuation side, computer vision is being used to analyze photos, satellite images, and 3D scans of properties, automating condition assessments and cross-referencing against MLS data for accurate appraisals.

Agentic AI is emerging in mortgage ecosystems to support workflow orchestration. Imagine an AI agent that tracks a loan from pre-approval through closing, automatically scheduling inspections, nudging applicants to upload documents, and escalating issues to human staff only when needed.

AI’s Role in Sustainability Efforts

Predictive analytics models can forecast everything from borrower defaults to equipment maintenance at branch offices, reducing waste and minimizing costly rework. For lenders with physical infrastructure, AI also helps optimize delivery routes for in-person appraisals and mobile notaries, cutting fuel use and emissions.

As regulatory and investor pressure grows around ESG reporting, AI will become central to tracking and optimizing sustainability KPIs. Whether you’re reducing paper usage through eClosings, improving the efficiency of your appraisal logistics, or financing eco-friendly homes, AI can turn sustainability from a buzzword into a strategic advantage.

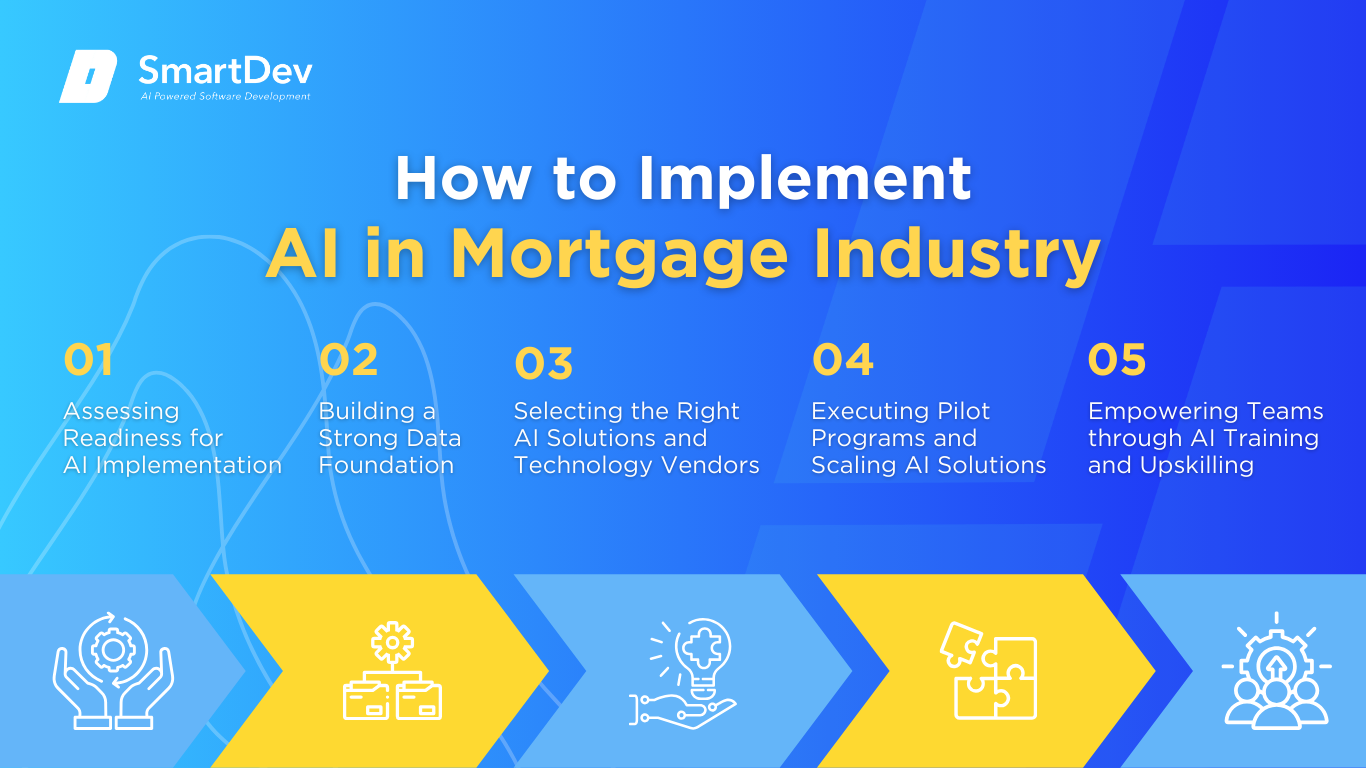

How to Implement AI in Mortgage Industry

Step 1. Assessing Readiness for AI Adoption

Step 1. Assessing Readiness for AI Adoption

Before bringing AI into your mortgage operations, start by identifying where it’s needed most. Look for bottlenecks like manual document reviews, slow underwriting, or inconsistent customer support. These pain points are often the best opportunities for automation and intelligence to make an immediate impact.

It’s also crucial to evaluate your tech stack. AI needs structured data and interoperable systems to perform well. If you’re still operating on legacy platforms, consider upgrading your infrastructure first to lay the groundwork for effective AI integration.

Step 2. Building a Strong Data Foundation

AI is only as good as the data you feed it. In mortgage, that means consolidating inputs from multiple sources such as credit reports, income verification, appraisal data into a unified, well-structured dataset. The cleaner your data, the more accurate your AI predictions and automations will be.

But good data isn’t just technical; it’s also about governance. You’ll need clear access controls, audit trails, and compliance with data privacy laws like GLBA or FCRA. Set up a process to update and validate data regularly so your models always reflect current borrower profiles and market dynamics.

Step 3. Choosing the Right Tools and Vendors

Not every AI platform fits the needs of mortgage lenders. You need tools that address specific pain points such as document classification, borrower chat support, underwriting assistance and can plug directly into your existing LOS or CRM without breaking workflows.

Equally important is choosing the right vendor. Go for partners with domain expertise in mortgage, not just generic AI knowledge. Ask for industry-specific case studies, proof of ROI, and sandbox testing. A solid vendor should offer more than software, they should provide a strategic partnership and a clear roadmap for adoption.

Step 4. Pilot Testing and Scaling Up

Start small. Run pilot projects in areas like document automation or chatbot support where results are easy to measure. Monitor key metrics like processing time, accuracy, user experience, and compliance. Use these pilots to fine-tune models before any major rollout.

Once you’ve validated success, expand gradually. Roll out AI to adjacent functions or more loan products, adjusting processes and training along the way. Scaling AI is not a sprint; it’s a steady, strategic process. With the right feedback loops and benchmarks, you can expand confidently while minimizing risk.

Step 5. Training Teams for Successful Implementation

AI can only thrive when your people are equipped to work with it. Train staff to understand how AI tools function, how to review their outputs, and when to rely on human judgment. This demystifies the technology and builds confidence.

Create ongoing learning opportunities. Offer webinars, internal workshops, and short certification courses to keep your team up to date. Encourage a culture of experimentation and tech adoption. The more familiar your people become with AI, the more value you’ll extract from your investments and the more smoothly your digital transformation will unfold.

Measuring the ROI of AI in Mortgage Industry

Key Metrics to Track Success

Measuring ROI in the mortgage space starts with tracking how AI improves speed, accuracy, and cost-efficiency across the lending lifecycle. AI tools that automate document processing or pre-fill applications significantly cut processing time, reduce human error, and decrease loan defects, directly impacting your bottom line. Faster approvals mean higher throughput and better borrower experience.

Financially, lenders see savings through reduced staffing costs, fewer compliance penalties, and lower rework rates. Predictive models can also flag high-risk borrowers earlier, reducing delinquency rates and improving portfolio performance. Key performance indicators include cycle time per loan, pull-through rate, defect rates, operational cost per file, and customer satisfaction, all of which help quantify AI’s true business impact.

Case Studies Demonstrating ROI

Rocket Mortgage exemplifies AI’s potential with its use of generative AI to process over 1.5 million documents monthly. This tech automatically classifies forms and extracts over 90% of necessary data, accelerating underwriting and reducing human workloads. As a result, Rocket closes loans faster while scaling without linear headcount growth.

Fannie Mae, in partnership with Palantir, uses AI to detect fraud patterns across mortgage submissions. By catching anomalies early, they prevent millions in potential losses and protect the integrity of the secondary market. Similarly, Blend Labs helps lenders automate the mortgage application experience, reducing processing time by up to 50% and lifting conversion rates across digital channels.

Common Pitfalls and How to Avoid Them

One major pitfall in mortgage AI deployment is underestimating the importance of clean, standardized data. Models trained on outdated or biased data can yield false positives in underwriting or misclassify risk, leading to regulatory exposure or customer dissatisfaction. Continuous data validation and quality control are essential to avoid costly errors.

Another common misstep is failing to secure internal buy-in. Staff resistance often stems from fear of job displacement or mistrust of opaque AI systems. To avoid this, involve cross-functional teams early, provide transparent training, and emphasize how AI serves as a support. A thoughtful, inclusive approach ensures smoother adoption and long-term success.

Future Trends of AI in Mortgage Industry

Predictions for the Next Decade

Over the next ten years, AI in mortgage lending will become more personalized, proactive, and autonomous. Cloud-native AI platforms will give even small to mid-size lenders access to tools once reserved for large institutions—leveling the playing field with intelligent underwriting, real-time risk assessment, and self-service borrower portals. We’ll see AI agents capable of managing entire loan lifecycles with minimal human intervention, from pre-qualification to post-closing follow-ups.

At the same time, regulation will become more robust. As AI makes more decisions affecting borrower eligibility and pricing, regulators will demand transparency, explainability, and bias mitigation. Lenders will need to prove that their models are fair, compliant, and auditable—making ethical AI governance a competitive necessity, not just a legal checkbox.

How Businesses Can Stay Ahead of the Curve

Staying ahead means more than just buying the latest AI software—it requires cultural and operational agility. Start by building AI literacy across your workforce so everyone from loan officers to compliance teams understands how the tools work and where human judgment fits in. Equip your staff to question outputs, identify bias, and collaborate effectively with AI systems.

Forward-looking lenders will treat AI adoption as a continuous improvement journey, not a one-off upgrade. Foster collaboration between IT, data science, compliance, and lending operations to keep innovation grounded in business reality. The lenders who can scale AI responsibly and strategically will shape the future of mortgage—offering faster, fairer, and more inclusive lending experiences.

Conclusion

Key Takeaways on AI Use Cases in Mortgage Industry

From intelligent document automation and fraud detection to predictive underwriting and AI-powered valuations, the technology brings speed, precision, and scalability to every stage of the mortgage lifecycle. As seen in real-world examples, these innovations translate into measurable gains in productivity, accuracy, cost savings, and borrower satisfaction.

Yet, unlocking the full potential of AI requires more than just installing new tools. Mortgage lenders must build strong data foundations, adopt clear governance practices, and cultivate AI-ready teams. Those who invest early and responsibly in scalable, ethical AI ecosystems will not only boost profitability but also lead the industry into a smarter, more inclusive future.

Moving Forward: A Path to Progress

If you’re leading a mortgage business looking to shorten loan cycles, improve risk analysis, or deliver a more seamless customer journey, now is the time to explore AI. Begin with a targeted pilot—perhaps in document processing or automated pre-approval—and track tangible ROI before scaling across functions. Waiting too long risks losing ground to more agile, AI-driven competitors already redefining the lending experience.

At SmartDev, we partner with mortgage lenders to design and implement AI strategies that align with your business goals and regulatory landscape. Whether you’re starting your first experiment or ready to scale across your enterprise, we bring the technical know-how and industry insight to make AI work—safely, ethically, and profitably.

—

References:

- AI in Lending Market | Market.us

- Lender’s Motivation for AI Adoption | Fannie Mae

- Revolutionizing Finance with Blend: Modern Loan Processing Strategies | Kanbo

- Loan Automation: Streamlining Lending with Technology | Blend Blog

- Financial Services Success Stories | Hyland

- Zillow’s iBuying Home and Zestimate Technology | CNN

- AI in Lending | Capacity Blog

- Fannie Mae Launches AI Fraud Detection Technology in Partnership with Palantir | Fannie Mae Newsroom

- Wells Fargo’s AI Assistant Crosses 245 Million Interactions | VentureBeat

1. Accelerated Document Processing

1. Accelerated Document Processing 1. Regulatory Complexity and Explainability Requirements

1. Regulatory Complexity and Explainability Requirements 1. Automated Underwriting & Risk Assessment

1. Automated Underwriting & Risk Assessment

Step 1. Assessing Readiness for AI Adoption

Step 1. Assessing Readiness for AI Adoption