Introduction

Payroll functions today are under growing pressure – complex global regulations, shrinking processing windows, and rising expectations for speed and precision. Artificial Intelligence (AI) is no longer futuristic hype; it’s rapidly transforming payroll into an intelligent, agile operation. This article unpacks how AI modernizes payroll workflows, enhances compliance, and empowers professionals to drive strategic value.

What is AI and Why Does It Matter in Payroll?

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to the capability of machines to perform tasks that typically require human intelligence, such as reasoning, learning, and problem-solving. At its core, AI uses technologies like machine learning, natural language processing (NLP), and computer vision to analyze data, detect patterns, and make decisions. These technologies allow systems to continuously improve based on new information without explicit reprogramming.

In payroll, AI applies these capabilities to automate complex and time-sensitive tasks such as wage calculations, tax deductions, and compliance checks. By leveraging AI, payroll systems can operate with higher speed and accuracy while reducing the need for manual intervention. This shift transforms payroll from a reactive administrative function into a proactive, data-driven process.

The Growing Role of AI in Transforming Payroll

AI is transforming payroll by automating core processes like calculations, deductions, and regulatory updates, reducing manual workloads and human error. As a result, payroll teams can refocus on strategic activities, such as financial forecasting and compliance oversight. AI also enables intelligent self-service portals for employees, improving transparency and trust.

Organizations are witnessing tangible impacts: faster payroll completion, fewer discrepancies, and more adaptability to global regulatory demands. This transformation not only boosts operational efficiency but also elevates payroll as a strategic pillar within HR and finance functions.

Discover AI-powered solutions in our guide to boosting efficiency in finance and accounting.

Key Statistics and Trends Highlighting AI Adoption in Payroll

AI adoption in payroll is accelerating, with 73% of payroll professionals expecting it to significantly impact their operations within the next year, according to MHR’s 2025 report. Despite this, many payroll teams still rely heavily on manual tools – 63% use spreadsheets, and 50% manually enter data, highlighting the urgent need for automation.

On the industry side, Paycom, a major payroll provider, has elevated its 2025 revenue forecast to $2.05–$2.06 billion, attributing the boost to strong demand for its AI-infused “smart” payroll capabilities. These capabilities include automating job description creation and identifying at-risk employees – demonstrating how AI is delivering tangible business value in payroll and workforce management.

Looking ahead, global projections estimate that AI-powered payroll adoption could reach 50% by 2025, helping organizations cut processing times by 25–50% and improve accuracy by 30–40%. Such efficiency and precision gains underscore the strategic opportunity AI offers in evolving payroll from a manual, reactive process into a streamlined, data-driven function.

Business Benefits of AI in Payroll

AI is delivering measurable value across payroll operations by solving long-standing inefficiencies and risk factors. From automating manual tasks to enhancing compliance and employee transparency, these benefits are transforming payroll into a more strategic and responsive function.

1. Improved Accuracy

AI improves payroll accuracy by identifying anomalies in data before payments are processed. It flags inconsistencies such as duplicate entries, incorrect hours, or misclassified deductions – issues that typically go unnoticed in manual systems. This significantly reduces costly payroll errors and post-processing corrections.

The ability to detect discrepancies in real time also protects organizations from compliance violations. Automated checks help avoid underpayments or overpayments that can damage trust and lead to legal penalties. This proactive approach transforms payroll into a more reliable and audit-ready function.

2. Smarter Compliance

Payroll regulations vary by country, state, and even employee classification. AI tools can track legislative changes in real time and update rules across systems without human intervention. This ensures payroll teams remain compliant even in complex, multi-jurisdictional environments.

Incorporating AI for compliance minimizes risk exposure and reduces the reliance on external audits or legal consultations. It also streamlines tax filings and benefits management by keeping calculations aligned with the latest regulations. This adds confidence and agility to payroll operations.

3. Real-Time Insights

AI enables real-time analysis of gross-to-net pay breakdowns, making it easier for employees and managers to understand each component of a paycheck. This includes bonuses, deductions, benefits, and currency adjustments in multinational payrolls. The added visibility fosters employee trust and reduces payroll-related queries.

For finance and HR leaders, these insights support more accurate forecasting and workforce planning. Instead of waiting for post-payroll reports, decision-makers can access instant summaries and trends. This agility enhances strategic planning and financial oversight.

4. Task Automation

AI can handle repetitive payroll tasks such as timesheet validation, payroll run scheduling, and benefits updates. This reduces dependency on manual input and minimizes human error during high-pressure payroll cycles. Automation accelerates processing times and ensures data consistency across systems.

By freeing up time previously spent on routine duties, payroll professionals can shift focus to strategic responsibilities. These include optimizing pay structures, analyzing labor costs, or contributing to workforce policy. The result is a more engaged, future-ready payroll team.

5. Self-Service Support

AI chatbots answer employee payroll questions instantly and accurately. This reduces ticket volume and eliminates wait times for basic inquiries. It improves employee satisfaction with faster support.

Self-service tools also let employees update details or access documents without HR involvement. This lowers administrative overhead and empowers users. Over time, it builds a more efficient and user-friendly payroll experience.

Discover practical insights in our guide to selecting the right AI solution: chatbots vs. virtual assistants.

Challenges Facing AI Adoption in Payroll

Despite its potential, AI adoption in payroll comes with technical, regulatory, and organizational hurdles. Understanding these challenges is key to implementing AI effectively and avoiding disruption or compliance risk.

1. Data Fragmentation

AI needs clean, structured data to function accurately, but payroll data is often scattered across HR, finance, and time-tracking systems. This fragmentation leads to inconsistent inputs, which compromise AI models’ reliability. As a result, insights generated by AI can be incomplete or misleading.

Integrating these systems requires more than just software, it demands organizational alignment. Departments must agree on data ownership, formats, and maintenance protocols. Without this foundation, AI tools struggle to deliver dependable results.

To learn how unstructured data can be effectively leveraged in AI applications, check out our detailed guide on how AI unlocks the power of unstructured data.

2. Regulatory Complexity

Payroll laws differ by country, state, and worker classification, creating a high-stakes compliance environment. AI tools may struggle to keep pace with legal nuances, especially when interpretation is required. Mistakes in classification or tax handling can lead to costly penalties.

Even with automated updates, oversight is still needed to validate decisions in complex cases. Governments also change reporting formats and exceptions frequently. AI must be continuously monitored to ensure regulatory alignment.

3. Low Trust and Adoption

Many employees and some payroll professionals are hesitant to rely on AI for sensitive financial matters. According to Payroll.org, only 52% of employees are comfortable with AI tools in payroll, compared to 62% of business leaders. This gap in trust slows adoption and reduces tool utilization.

Building trust requires transparency and communication about how AI decisions are made. Employees need assurance that their data is secure and that errors will be addressed quickly. Without buy-in, even the best systems may go underused.

4. Complex Implementation

AI tools are not plug-and-play solutions, they require thoughtful integration with legacy payroll systems. This often involves custom development, API configurations, and cross-department collaboration. Without proper planning, projects stall or fail to scale.

Implementation also demands training, testing, and long-term support. Organizations must allocate time and resources not just for the launch, but for continuous improvement. Without this commitment, AI adoption can lead to more frustration than efficiency.

5. Limited Human Oversight

While AI excels at automation, it still lacks the judgment needed for sensitive payroll decisions. Gray areas, like handling disputes, retroactive pay adjustments, or manual overrides, still require human intervention. Relying entirely on AI in these cases can create compliance and ethical risks.

A balanced model is essential, where AI handles volume and humans handle context. This hybrid approach ensures quality control and preserves employee trust. Skipping this step risks alienating users and increasing error rates.

Specific Applications of AI in Payroll

1. Anomaly Detection & Accuracy Enhancement

AI-powered systems dramatically boost payroll accuracy by spotting irregularities, such as duplicate entries, missing hours, or incorrect pay codes, before finalizing payroll. Machine learning models, leveraging historical patterns, flag deviations using statistical thresholds and cluster-based outlier detection. These systems integrate with time, HRIS, and pay policy data to catch errors proactively and reliably.

Such systems ease human workload: instead of manual reconciliation, payroll teams receive precise alerts for outlier review. Error rates that once hovered between 1–8% in manual systems are reduced substantially through AI automation. This enhances compliance, builds employee trust, and enables scalable, high-quality payroll operations.

Implementation challenges include ensuring model transparency to avoid biased flagging, maintaining data privacy, and configuring thresholds to minimize false positives. Ongoing human oversight remains vital to assess flagged anomalies within context. Overall, AI transforms payroll from reactive correction to proactive prevention.

Real‑World Example:

Deloitte reported that a large multinational client using AI-based anomaly detection reduced payroll errors by 42% and shortened payroll processing time by 33%. These improvements were achieved by integrating machine learning models into the payroll validation pipeline.

2. Processing Speed & Workflow Optimization

AI enhances payroll speed by automating task flows like calculations, approvals, and batch processing, minimizing manual handoffs. Intelligent process automation (IPA) orchestrates each workflow step using event triggers and rule-based routing. This leads to significantly shorter processing cycles and fewer bottlenecks.

AI also optimizes sequencing, reducing downtime caused by dependencies or delays in timesheet validation or tax adjustments. These systems learn from historical bottlenecks and reroute flows dynamically to increase throughput. Payroll departments benefit from reduced overtime and faster processing with fewer resources.

Legacy systems integration and change management are common implementation challenges. Careful orchestration is required to ensure regulatory compliance and auditability are maintained. When executed well, AI transforms payroll operations into a streamlined, real-time system.

Real‑World Example:

Ignite HCM reports that companies using AI-enhanced payroll workflows experience up to 65% faster payroll runs and a 30% reduction in process costs. Their systems optimize routing of approvals and exception handling.

3. AI Chatbots for Employee Self-Service

AI chatbots enable employees to resolve payroll queries, like deductions, benefits, and payment dates, without waiting for HR responses. Using NLP, these bots understand context and retrieve answers from payroll databases or knowledge repositories. This self-service model reduces HR workload and improves response time.

Advanced bots can handle jurisdiction-specific queries, personalize responses, and escalate complex issues to humans when necessary. Integration with HRIS and payroll software ensures real-time data access and up-to-date answers. Employees benefit from a consistent, always-available support experience.

Privacy, accuracy, and escalation mechanisms are crucial for successful deployment. Bots must be trained regularly to align with changing policies or regulations. When executed correctly, chatbot systems reduce helpdesk tickets and increase satisfaction.

Real‑World Example:

EY and Microsoft developed a payroll AI chatbot to automate employee queries in multinational environments, delivering consistent responses across compliance regions. The chatbot reduced HR inquiries by up to 40% and accelerated issue resolution.

4. Agentic AI for Autonomous Payroll Workflows

Agentic AI platforms enable intelligent agents to perform payroll tasks autonomously within policy constraints. These agents can validate data, execute payments, enforce thresholds, and trigger alerts without human initiation. They integrate with multiple enterprise systems, such as HRMS and finance tools.

Workflows that previously required manual triggers, like tax recalculations or benefits updates, are now handled automatically by agentic systems. Human oversight remains in place to approve escalations or exceptions flagged by the agents. This ensures both speed and control in payroll governance.

Governance, traceability, and audit logs are necessary to keep autonomous operations compliant. Ethical use of agentic AI requires policies to define what agents can and cannot do. When implemented responsibly, agentic AI elevates productivity while maintaining corporate accountability.

Real‑World Example:

Workday’s Illuminate platform launched in 2024, includes AI agents that autonomously handle payroll workflows such as compliance verification and document creation. The company reported a 52% improvement in accounts payable processing and 49% boost in HR task automation.

5. Predictive Analytics for Payroll Forecasting

AI models analyze historical payroll data to forecast future salary costs, taxes, and labor expenses with high accuracy. Time series models and regression analysis identify seasonality, hiring trends, and overtime spikes. This enables better cash flow planning and financial decision-making.

With predictive insights, finance leaders can plan for labor budget increases, bonus cycles, or overtime surges before they occur. These forecasts can be customized by department, location, or pay structure. It transforms payroll from a cost center to a strategic lever.

Accuracy depends on clean input data and model tuning, especially for organizations with complex workforce dynamics. Validation cycles are critical to avoid over- or underestimating costs. When done right, predictive analytics empowers proactive financial leadership.

Real‑World Example:

Companies using OpenLedger’s AI payroll forecasting tools saw a 15–20% improvement in labor cost forecasting accuracy across Q4 2024. This enabled better strategic alignment between HR and finance.

6. Global Compliance & Payslip Transparency

AI automates compliance monitoring across multiple regions by continuously updating tax rules, labor laws, and jurisdiction-specific policies. These systems ensure accurate tax withholding, benefits administration, and country-specific reporting. AI also generates self-explaining payslips, making deductions and benefits clear to employees.

Cross-border payroll becomes more manageable as AI tracks legal updates and adapts payroll logic in real time. Employees gain transparency, which improves trust and reduces support queries. It simplifies global payroll at scale.

Localization, legal validation, and language accuracy are key implementation factors. AI systems must also align with GDPR and other privacy laws when operating internationally. With proper governance, global payroll compliance becomes scalable and efficient.

Real‑World Example:

Neeyamo’s global payroll platform uses AI to automate compliance and generate localized payslips for employees in 150+ countries. Clients reported faster payroll cycles and reduced legal exposure in 2024.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Payroll

After exploring the core applications of AI in payroll, it’s crucial to examine how these technologies perform in real business environments. The following case studies highlight successful, data-backed implementations of AI in payroll across diverse organizational settings.

Real-World Case Studies

1. Deloitte: AI for Wage Anomaly Detection in Higher Education

Deloitte deployed an AI-powered system at a large Australian university to audit over 3.2 million timesheets and payslips. The platform analyzed handwritten and scanned documents to identify wage underpayments across more than 15,000 casual employees. This replaced months of manual effort with a faster, scalable, and more accurate process.

The AI system flagged inconsistencies using pattern recognition and cross-validation against historical wage data. It allowed the university to detect errors quickly and launch appropriate remediation. The initiative reinforced payroll transparency and reduced legal and reputational risk.

2. EY–Microsoft: AI Chatbot for Global Payroll Self-Service

EY partnered with Microsoft to launch an AI chatbot using Azure OpenAI for handling global payroll inquiries. The chatbot achieved a 93% first-response accuracy rate and now addresses over 50% of employee payroll questions. It integrates with HR systems to provide real-time, personalized answers.

The AI assistant reduced the burden on HR teams by automating frequently asked questions. It also delivered consistent payroll support across various regions and languages. This resulted in faster resolutions and improved employee satisfaction.

3. Workday: Illuminate Agentic AI in Payroll and Finance

Workday introduced Illuminate AI Agents, supported by a centralized Agent System of Record (ASR), to manage tasks across payroll, finance, and HR. These agents autonomously executed processes like compliance checks and document generation. Organizations saw a 49% increase in financial planning efficiency and 52% faster accounts payable processing.

The system maintained strong oversight, ensuring all agent actions were auditable and policy-aligned. By offloading routine tasks to AI, human teams focused on exceptions and strategy. This showcased how agentic AI can scale productivity while preserving governance.

Innovative AI Solutions

AI is transforming payroll through hyperautomation, combining intelligent document processing (IDP), generative AI, and intelligent agents. One study found that integrating generative AI with IDP reduced paper receipt processing time by over 80% while improving accuracy and compliance. This illustrates how AI can manage complex workflows with minimal human input.

Workday’s Illuminate AI Agents, governed by an Agent System of Record (ASR), represent a major step in enterprise-grade agentic AI. These agents handle tasks like payroll validation and compliance while maintaining full oversight and auditability. The approach delivers automation at scale without compromising governance.

Explore how AI streamlines workflows and drives performance improvements in our guide to unlocking operational efficiency with AI.

AI-Driven Innovations Transforming Payroll

Emerging Technologies in AI for Payroll

Emerging technologies in AI are revolutionizing payroll by enhancing accuracy, efficiency, and compliance. Machine learning algorithms can detect anomalies, automate tax calculations, and predict future payroll expenses based on historical data. These technologies are capable of processing complex datasets rapidly, reducing the risk of human error and ensuring timely payroll delivery.

Natural language processing enhances how employees interact with payroll systems. AI chat interfaces answer pay-related questions, explain discrepancies, and manage leave requests. This reduces admin burden and improves employee satisfaction.

AI’s Role in Sustainability Efforts

Payroll systems are becoming more sustainable as intelligent technologies streamline operations and reduce waste. With predictive analytics, businesses can forecast labor costs more accurately and optimize staffing levels, helping to avoid costly overtime and over-allocation. This not only controls expenses but also promotes more efficient use of resources.

Digital transformation through automation further supports sustainability goals. Self-service portals and paperless workflows reduce reliance on manual processes, cutting down on printing, storage, and administrative overhead. The result is a faster, cleaner, and more environmentally responsible payroll experience.

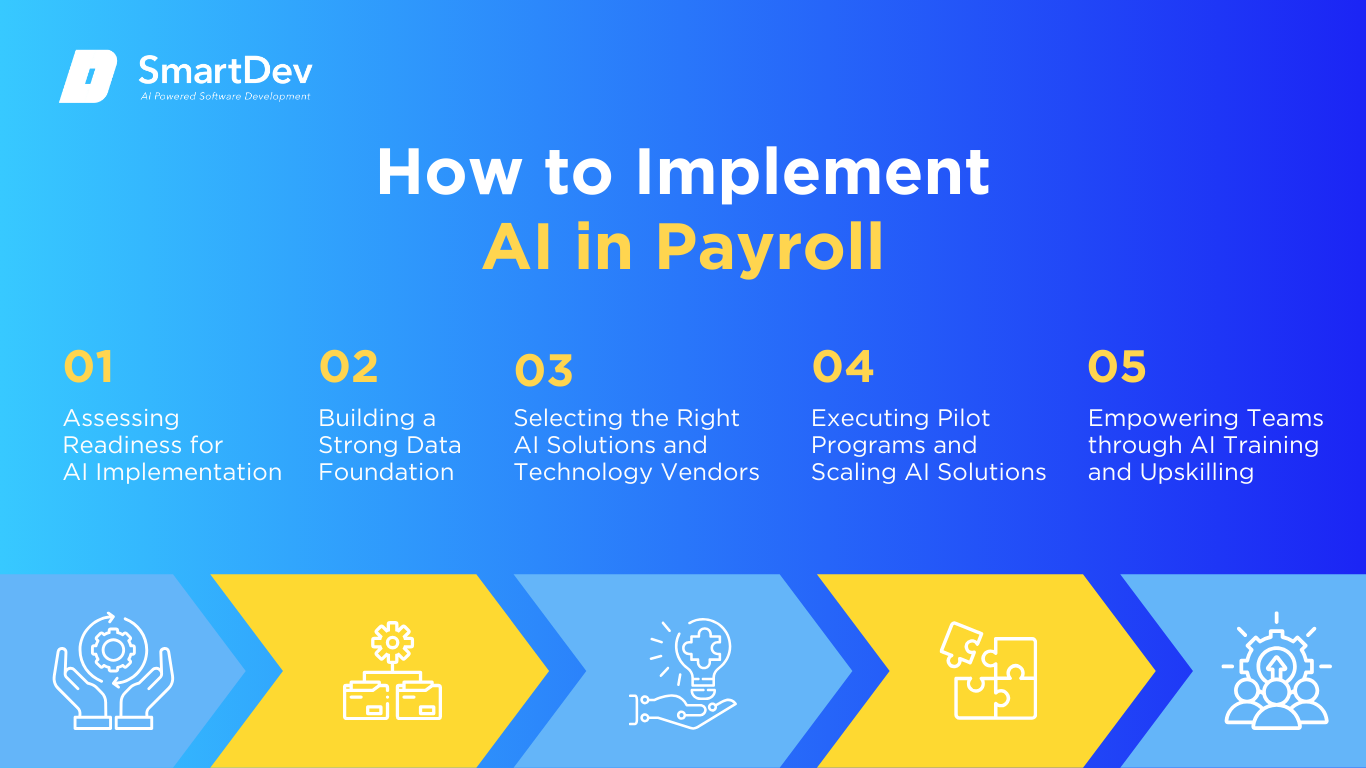

How to Implement AI in Payroll

Implementing AI in payroll isn’t just about adopting new technology, it’s about reshaping how your team works, makes decisions, and delivers value. To ensure success, you’ll need a clear strategy that balances data readiness, tool selection, and employee engagement.

Step 1: Assessing Readiness for AI Adoption

Before adopting AI in payroll, it’s essential to evaluate your organization’s operational maturity and current pain points. Start by identifying repetitive, time-consuming tasks like manual data entry, compliance tracking, or responding to routine employee queries. These areas are ideal for early AI integration because improvements are immediate, measurable, and low-risk.

Leadership alignment is just as important as process selection. AI adoption often signals a shift in how teams operate, requiring trust in automation and openness to change. Without executive support and team buy-in, even the best tools can struggle to deliver lasting impact.

Explore our data analytics services to see how we help businesses implement AI solutions that scale.

Step 2: Building a Strong Data Foundation

Clean, consistent data is the backbone of successful payroll automation. Ensure your systems can capture and standardize information such as time logs, benefits details, tax rules, and employee classifications. Structured, up-to-date data enables AI models to detect errors, spot trends, and automate calculations reliably.

Centralizing your data across HR, finance, and payroll platforms improves visibility and coordination. Strong data governance is also key – clear rules around access, updates, and validation protect data quality and compliance. A reliable data foundation makes your payroll AI smarter and more scalable.

Explore why clean, well-governed data is the foundation of successful AI adoption in our data management guide.

Step 3: Choosing the Right Tools and Vendors

Choosing AI tools for payroll is more than a technical decision, it’s a strategic one. Look for solutions that align with your operational needs and regulatory environment, offering flexibility to grow with your organization. Compatibility with existing systems will reduce friction and speed up implementation.

Transparency from vendors is equally critical. Understand how your payroll data will be handled, stored, and updated, especially in relation to security and compliance. A trustworthy partner should offer support, training, and clear documentation to ensure long-term success.

Step 4: Pilot Testing and Scaling Up

Start by piloting AI in specific payroll functions where the stakes are manageable and the payoff is visible. Automating compliance checks or trialing predictive analytics for budget planning can deliver early wins and uncover workflow issues before scaling. These small experiments are key to validating the value of AI in real-world conditions.

Use the pilot phase to measure results and gather feedback. If the system improves speed, accuracy, or employee satisfaction, you’ll have a clear case for broader deployment. With proven impact and refined processes, expansion becomes both strategic and seamless.

Step 5: Training Teams for Successful Implementation

Teams need the right knowledge and support to work effectively with AI-enhanced payroll systems. Training should focus on understanding AI outputs, managing exceptions, and trusting automated processes. When people know how and why the system works, adoption becomes smoother and more sustainable.

Foster collaboration between payroll staff and technical experts. AI works best when it complements human oversight, not replaces it. A confident, well-trained team ensures consistent use and helps maximize long-term value from your investment.

To ensure successful AI integration, institutions should start with a clear roadmap. Our guide for tech leads outlines how to assess readiness and align stakeholders from the start.

Measuring the ROI of AI in Payroll

Key Metrics to Track Success

The most immediate sign of ROI is time saved. AI can cut payroll processing by 50–70%, turning multi-day cycles into streamlined same-day operations. That efficiency reduces administrative strain and frees teams for higher-value tasks.

Cost savings also come from fewer errors and better compliance. AI flags anomalies before they become costly mistakes, avoiding fines and manual corrections. These gains add up, making payroll more reliable and predictable over time.

Case Studies Demonstrating ROI

At Communicorp UK, payroll processing time dropped from two days to just one hour per month after adopting an AI-enabled system. This freed up HR to focus on strategic initiatives, showing how automation can drive both efficiency and impact.

SMEs using similar AI tools saw a 52% increase in efficiency and a 65% reduction in paperwork. These gains translated into lower admin costs and improved compliance, proving that even small-scale adoption can deliver strong ROI.

Common Pitfalls and How to Avoid Them

One major barrier to ROI is poor data quality. Incomplete time logs or inconsistent employee records can cause AI systems to misfire, eroding trust and slowing adoption. Clean, well-managed data is critical for accurate outcomes.

Cultural resistance is another challenge. Teams may resist AI if they fear job loss or don’t understand the system. Training, transparency, and early involvement help ease concerns and ensure successful adoption.

Learn how to evaluate AI model effectiveness and ROI with our practical guide on AI performance metrics.

Future Trends of AI in Payroll

Predictions for the Next Decade

AI in payroll is expected to evolve from task automation to intelligent decision-making. Over the next decade, we’ll see systems that not only process payments but proactively adjust for tax changes, recommend budget allocations, and flag potential compliance risks before they occur. These tools will become more adaptive, using continuous learning to fine-tune payroll operations in real time.

Natural language interfaces and multi-agent AI systems will likely become standard, allowing employees to interact with payroll in human-like conversations. We’ll also see deeper integration with finance and HR platforms, enabling unified insights across workforce costs, productivity, and engagement. As regulations grow more complex, AI will be key to staying compliant while keeping operations lean.

How Businesses Can Stay Ahead of the Curve

Staying competitive in the future of payroll means embracing AI as a long-term strategy, not just a quick fix. Companies should invest in scalable, modular systems that allow for gradual AI adoption while maintaining strong data integrity. Building a flexible infrastructure today makes it easier to integrate emerging technologies tomorrow.

Ongoing training and change management will be just as important as the tools themselves. By fostering a culture of innovation and preparing teams to work alongside AI, businesses can adapt faster and more confidently. Those who combine smart technology with empowered people will be best positioned to lead in the next era of payroll.

To see which emerging technologies are shaping AI adoption in the next decade, our IT landscape trends recap and guide for business to intergrating AI in 2025 breaks down the must-watch shifts for business leaders.

Conclusion

Key Takeaways

AI is transforming payroll by automating tasks, reducing errors, and improving compliance. It enables faster processing, predictive insights, and more strategic use of HR resources. The result is a smarter, more efficient payroll function that directly supports business goals.

Success relies on clean data, the right tools, and team readiness. Real-world examples like Communicorp UK show how AI delivers measurable gains today, not just in cost savings, but in time and impact. Staying adaptive will be key as payroll technology continues to evolve.

Moving Forward: A Strategic Approach to AI-Driven Transformation

As payroll becomes increasingly complex and fast-paced, AI offers a powerful way to simplify operations, ensure compliance, and create space for strategic HR initiatives. From automating calculations to detecting anomalies and improving employee experience, AI is no longer a luxury, it’s a competitive necessity for modern payroll management.

At SmartDev, we help organizations implement AI-powered payroll solutions that are secure, scalable, and built for real-world impact. Whether you’re streamlining processing, enhancing accuracy, or enabling smarter decision-making, our team delivers solutions that align with your business goals.

Explore our AI-powered software development services to see how we create custom payroll solutions for automated processing, predictive labor cost analytics, and real-time compliance monitoring.

Contact us today to start transforming your payroll operations with intelligent automation that delivers measurable value from day one.

—

References:

- Paycom raises 2025 revenue and profit forecasts on AI-driven demand | Reuters

- AI Payroll in 2025: The Future of Automated Compensation Systems | Open Ledger

- AI set to transform payroll as nearly three-quarters of professionals brace for change, yet manual data processing on the rise | Onrec

- The impact of artificial intelligence (AI) on payroll management | RSM Global

- AI in Payroll: Improving Accuracy, Compliance, and Efficiency in Pay Processing | Ignite HCM

- “We’re in the business of work” – Workday’s Illuminate looks to bring a holistic approach to Agentic AI | TechRadar

- Payroll Forecasting AI: Transforming Financial Planning in 2025 | Open Ledger

- AI in Global Payroll: If You’re Still Thinking in 2023 Terms, You’re Already Behind | NeeyamoNeeyamo

- AI Technologies as a Solution to Wage Underpayment in Australia | Deloitte

- How ecosystems can help navigate complex international payroll operations | EY

- E2E Process Automation Leveraging Generative AI and IDP-Based Automation Agent: A Case Study on Corporate Expense Processing | arXiv

- AI Report on Payroll Processing Issued by PayrollOrg | PayrollOrg