Quick Introduction

Retail banking is under immense pressure—rising customer expectations, fintech disruption, and heightened regulatory scrutiny are reshaping the industry. Artificial Intelligence (AI) is emerging as a critical differentiator, enabling banks to reduce costs, improve decision-making, and deliver hyper-personalized services at scale. This guide explores the most impactful AI use cases in retail banking, the business benefits they deliver, and the challenges institutions must navigate to adopt them successfully.

What is AI and Why Does It Matter in Retail Banking?

Definition of AI and Its Core Technologies

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to computer systems capable of performing tasks that typically require human intelligence—such as learning, reasoning, and decision-making. Core technologies include machine learning, natural language processing, and computer vision.

In retail banking, AI means applying these technologies to automate operations, detect fraud, enhance customer experiences, and generate actionable insights from massive datasets. From credit risk scoring to AI-powered chatbots, banks are using AI to boost efficiency, reduce risks, and provide more tailored financial products.

Want to explore how AI can transform your sector? Discover real-world strategies for deploying smart technologies in your systems. Visit How to Integrate AI into Your Business in 2025 to get started today and unlock the full potential of AI for your business!

The Growing Role of AI in Transforming Retail Banking

AI is redefining how retail banks manage risk. By analyzing transaction histories, spending behaviors, and external economic data, banks can develop more accurate credit scoring models, minimizing default rates while extending financial access to underserved customers.

Customer engagement is another area undergoing radical transformation. AI-powered virtual assistants and chatbots now resolve routine queries instantly, allowing human agents to focus on complex cases. Personalized product recommendations—such as savings plans or loan offers—are driven by predictive analytics, ensuring customers receive relevant financial guidance.

Operational efficiency is also being reshaped. From automating anti-money laundering (AML) checks to streamlining loan origination processes, AI reduces manual workload, accelerates compliance, and improves decision-making speed. This operational agility enables banks to compete with fintechs while keeping costs under control.

Key Statistics or Trends in AI Adoption

AI adoption in retail banking is accelerating. According to a World Economic Forum report, over 80% of banks have already implemented AI solutions in at least one business area, with customer service and fraud detection being the most common.

The impact is measurable: McKinsey estimates that AI technologies could add up to $1 trillion annually in value across global banking, largely through improved productivity and personalization.

Market growth is also significant. The global AI in banking market is projected to grow from $5.6 billion in 2023 to over $64 billion by 2033, reflecting a CAGR above 28%. Banks investing today are positioning themselves to lead in innovation, trust, and customer loyalty.

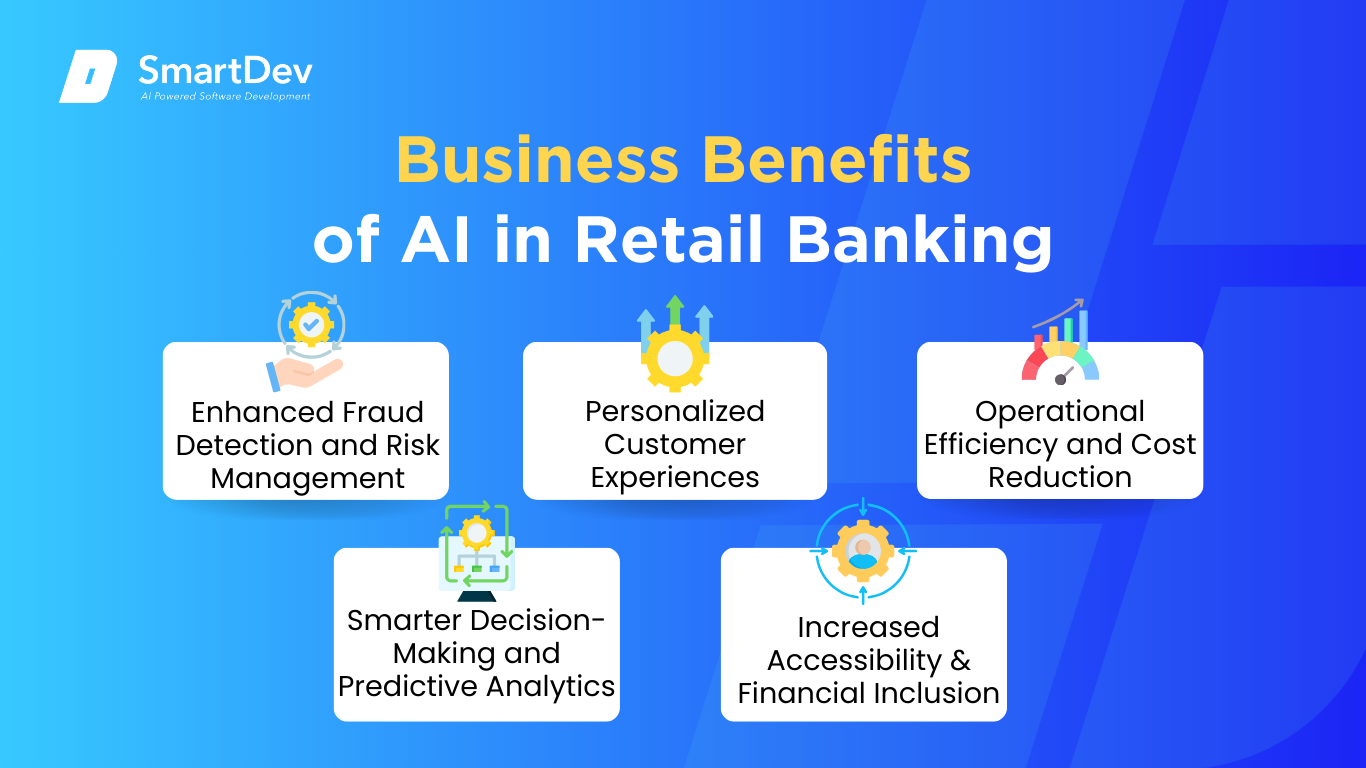

Business Benefits of AI in Retail Banking

AI is solving longstanding pain points in retail banking—from inefficiencies in operations to poor fraud controls. Below are five key business benefits and how they directly address real-world challenges.

1. Enhanced Fraud Detection and Risk Management

1. Enhanced Fraud Detection and Risk Management

Retail banks face growing threats from cybercrime and fraudulent transactions. AI systems analyze real-time transaction data, detecting anomalies that deviate from customer spending patterns. This allows banks to flag suspicious activities instantly, reducing financial losses.

Beyond fraud prevention, AI strengthens credit risk management. By incorporating non-traditional data sources such as utility payments or online behavior, AI models deliver more inclusive and accurate credit scoring, enabling banks to expand lending responsibly.

2. Personalized Customer Experiences

Today’s customers expect financial services tailored to their unique needs. AI leverages behavioral and transactional data to recommend customized financial products—such as mortgages, credit cards, or investment plans. This personalization not only drives customer loyalty but also increases product uptake.

AI-powered virtual assistants provide instant, human-like support. Banks like Bank of America with “Erica” have demonstrated how digital assistants can handle millions of customer requests monthly, reducing call center volumes while improving satisfaction.

3. Operational Efficiency and Cost Reduction

Manual banking processes—loan underwriting, compliance checks, and document verification—are resource-intensive. AI automates these workflows, drastically cutting processing times and reducing costs. For example, robotic process automation (RPA) combined with AI can handle routine back-office tasks at scale.

Compliance, once a major bottleneck, also benefits. AI enhances know-your-customer (KYC) and AML monitoring, enabling real-time flagging of suspicious transactions. This minimizes regulatory fines and ensures smoother audits.

4. Smarter Decision-Making and Predictive Analytics

Retail banks generate enormous amounts of data, yet much of it remains underutilized. AI-powered predictive analytics enables banks to anticipate customer needs—such as predicting who may need a loan or who is at risk of default.

These insights support proactive engagement. For instance, banks can identify customers likely to churn and intervene with targeted retention offers, boosting lifetime value and reducing attrition rates.

5. Increased Accessibility and Financial Inclusion

Millions remain underserved by traditional banking systems due to lack of credit history or geographic barriers. AI-driven alternative credit scoring models, using behavioral or mobile data, provide fairer access to credit for these populations.

Chatbots and multilingual AI interfaces also help expand access, offering financial guidance to customers who may face literacy or language barriers. This positions retail banks as inclusive, socially responsible institutions while opening new growth markets.

Challenges Facing AI Adoption in Retail Banking

While the benefits are significant, adopting AI in retail banking is not without obstacles. Below are five critical challenges banks must address.

1. Data Privacy and Regulatory Compliance

1. Data Privacy and Regulatory Compliance

Banks handle highly sensitive financial data, making compliance with privacy laws such as GDPR and local banking regulations paramount. Misuse or mishandling of customer data could lead to fines and reputational damage.

AI models often require massive datasets for training. Balancing the need for data with strict compliance standards requires strong governance frameworks and secure data architectures.

Siloed systems and scattered data can cripple decision-making and slow growth. Discover how AI is helping organizations unify, clean, and unlock value from their data faster and smarter. Explore the full article to see how AI transforms data chaos into clarity.

2. Legacy Infrastructure and System Integration

Many retail banks still rely on decades-old core banking systems. Integrating modern AI solutions with these legacy infrastructures is costly and complex, often leading to delays in implementation.

Upgrading or replacing outdated systems demands significant investment. Without modernization, banks risk limiting the scalability and effectiveness of AI initiatives.

For those navigating these complex waters, a business-oriented guide to responsible AI and ethics offers practical insights on deploying AI responsibly and transparently, especially when public trust is at stake.

3. Bias and Fairness in AI Models

AI systems can unintentionally replicate biases present in training data, leading to discriminatory lending or risk assessments. For example, historical credit data may underrepresent minority groups, creating unfair outcomes.

Banks must implement fairness audits and ethical AI frameworks to ensure models produce unbiased results. Transparent explainability of AI decisions is increasingly required by regulators.

4. Talent and Skills Gap

Building and maintaining AI systems requires specialized expertise in data science, machine learning, and financial modeling. However, the talent pool for these roles remains limited, making recruitment and retention challenging.

Partnerships with fintechs or technology providers can help bridge this gap, but internal capability building remains essential for long-term competitiveness.

5. Customer Trust and Adoption

While AI can enhance services, some customers remain skeptical about interacting with machines for financial advice or decision-making. A lack of transparency in how AI models work further fuels distrust.

Banks must prioritize clear communication, ensuring customers understand when and how AI is being used. Blending AI tools with human oversight can foster confidence and smoother adoption.

Specific Applications of AI in Retail Banking

Retail banking is evolving fast as customers expect instant, personalized, and secure services. The most impactful AI use cases in retail banking now deliver measurable gains in fraud prevention, service quality, underwriting accuracy, and operational speed.

Use case 1: Real-Time Fraud Detection and Transaction Monitoring

Use case 1: Real-Time Fraud Detection and Transaction Monitoring

AI-driven fraud detection targets a persistent banking problem: sophisticated scams that slip past static rules while overwhelming teams with false positives. Modern platforms fuse anomaly detection, graph analytics, and behavioral profiling to spot deviations in spend, device, and network patterns as they happen. Deployed in the authorization stream and contact centers, these models shrink loss windows and reduce customer friction by allowing legitimate transactions to pass with fewer unnecessary challenges.

Under the hood, supervised models learn from labeled fraud cases while unsupervised methods flag new typologies by clustering unusual behavior across accounts and merchants. Graph techniques connect devices, IPs, and beneficiaries to expose mule networks that individual-transaction systems miss. The models require historical transactions, device IDs, merchant risk signals, chargeback outcomes, and case-management feedback, and they integrate via decision engines that orchestrate step-up authentication only when risk crosses a threshold.

Strategically, banks gain lower fraud losses, fewer manual reviews, and better customer experience thanks to precise step-ups. Operationally, teams work higher-value alerts as false positives fall and true positives rise, driving faster case closure and lower operating costs. Governance improvements follow as explainability modules log reasons and thresholds used for each decision to support audits and regulator reviews.

Real-World Example. Danske Bank moved from rules to deep learning for card-payment monitoring, cutting false positives by up to 60% while increasing true-fraud catches by 50%. The bank’s program shows deep learning outperforming earlier machine-learning baselines and the legacy rules engine. This illustrates how graph-aware and anomaly-detection models materially improve both precision and recall in live retail payments.

Use case 2: AI-Powered Virtual Assistants and Conversational Banking

Virtual assistants now solve a concrete service gap: long waits and limited branch hours when customers need answers or help completing tasks. AI chat and voice bots handle balance queries, card controls, bill payments, dispute triage, and money movement with natural language understanding and secure back-end hooks. These assistants escalate seamlessly to human agents with full conversation context, reducing repeat effort for both customers and colleagues.

Technically, intent classification and entity extraction route requests, while retrieval engines fetch policy and account-specific details to answer with bank-approved language. Dialogue management ensures the assistant asks clarifying questions, validates payees, and triggers two-factor authentication for sensitive actions. Training draws on historical chat logs, IVR transcripts, product FAQs, and compliance text, and the bot integrates with core banking, CRM, and case systems via APIs.

The operational upside is substantial: automation of high-volume intents, shorter handle times, and consistent answers across channels. Strategically, assistants produce structured data on customer needs that feed journey redesign and proactive outreach, increasing digital engagement and product adoption. With controls around safety testing and audit trails, banks can scale conversational AI while meeting supervisory expectations.

Real-World Example. Bank of America’s “Erica” has surpassed billions of client interactions, with more than 20 million users leveraging the assistant for everyday banking and investing tasks. Erica now handles a significant share of client interactions in digital channels, reflecting deep customer uptake. These volumes translate to deflected calls and faster self-service resolution at scale.

Use case 3: Next-Best Action Personalization and Financial Coaching

Personalization engines solve the scatter-shot cross-sell problem by recommending the right action for each customer in real time. AI computes propensities for savings nudges, fee-avoidance tips, card offers, and protection products based on life events and cash-flow patterns. Integrated into the mobile app and contact-center scripts, next-best action guides each interaction toward a helpful, compliant outcome.

These systems unify transactional history, merchant categories, pay cycles, product tenure, and service interactions in a customer-state store. Models rank actions against eligibility and fairness rules, and a policy layer suppresses offers after declines or during hardship flags. Continuous testing tunes uplift and ensures the model learns from outcomes like clicks, acceptance, activation, and long-term value.

The results are higher engagement and lift in conversion without spamming customers, plus measurable reductions in complaints from irrelevant offers. Strategic value grows as the same platform powers proactive risk outreach—such as overdraft prevention tips before payday or credit-utilization coaching to protect scores. With strong governance, personalization can be both value-creating and trust-building.

Real-World Example. Commonwealth Bank of Australia leverages its Customer Engagement Engine to deliver real-time, personalized prompts through its app. Millions of users log in monthly, engaging with tailored nudges and insights. The program demonstrates how personalization improves both adoption and satisfaction.

Use case 4: Credit Risk and Inclusive Underwriting with Alternative Data

Traditional credit scores miss thin-file and no-file consumers, constraining inclusion and growth. AI underwriting augments bureau data with cash-flow histories, verified income patterns, and stability signals to predict ability and willingness to repay. The outcome is more approvals at similar or lower risk, with dynamic pricing tied to predicted loss.

Technically, models use machine learning on features like income volatility, expense obligations, deposit regularity, and debt-service coverage inferred from transactions. Feature governance enforces fair-lending constraints, removes prohibited attributes, and monitors for drift in outcomes. Integration with origination, KYC, and fraud signals yields end-to-end decisions, while reason codes and challenger models support audits.

Strategically, lenders expand addressable markets and compress time to decision, while lowering acquisition costs through higher first-pass approvals. Risk teams benefit from sharper early-warning signals and scenario analysis that captures macro shifts in employment or rates. Properly governed, AI underwriting advances both growth and fairness goals.

Real-World Example. Upstart demonstrated that AI underwriting could approve more applicants at lower average APRs compared to traditional models. Tests showed higher inclusivity and reduced bias across demographic groups. This case illustrates how alternative-data models can expand safe access to credit when paired with fairness testing.

Use case 5: Intelligent Document Processing for Loan Origination and Servicing

Document-heavy processes slow mortgage and consumer lending, creating costly rework and long cycle times. AI-powered intelligent document processing classifies packages, extracts fields from pay stubs and bank statements, and validates consistency against core and bureau data. By removing manual keying and checklist chasing, banks accelerate time-to-decision and reduce downstream exceptions.

These pipelines combine optical character recognition with layout-aware models to read semi-structured forms and unstructured letters accurately. Confidence scores trigger human review only when needed, while metadata records each field’s source for audit. Training sets include diverse templates and languages, and models are retrained as lenders update forms and regulators refine requirements.

The value shows up in faster clear-to-close, higher capacity per processor, and fewer risks due to missing documents. In servicing, the same stack automates income verification, escrow analysis, and servicing transfers, shrinking backlogs. Compliance teams benefit from full-text search and standardized data for QA and regulator responses.

Real-World Example. HomeTrust Bank used an AI document automation platform to integrate directly with its loan-origination system. The bank reported saving thousands of staff hours and significant processing costs. Loan decisions became faster and more accurate, improving both staff productivity and borrower experience.

Use case 6: KYC / AML Screening and Financial-Crime Analytics

Name-screening and transaction-monitoring queues often swamp teams with false alerts while missing complex networks. AI strengthens KYC and AML by applying entity resolution, fuzzy matching, and network analytics to reduce false positives and identify contextual risk. When paired with case-management and explainable decisions, banks increase effectiveness and satisfy audit expectations.

These systems ingest sanctions lists, PEP databases, adverse media, payments, and customer profiles into a graph that tracks relationships and ownership. Models learn from investigator outcomes, while thresholds adapt to customer typologies and channels. AI orchestration now supports onboarding reviews and periodic refresh, with humans focused on exceptions.

The payoff is faster straight-through processing, fewer false positives, and higher true-positive yield per analyst. Banks also shorten investigation cycle time from weeks to days as alert narratives and evidence bundles are auto-assembled for compliance officers. With logging and model documentation, AML teams gain both scale and trust.

Real-World Example. HSBC deployed AI-enhanced risk assessment systems to detect more financial crime with fewer false positives. The bank also introduced voice biometrics to block telephone-banking fraud. Together, these technologies improved both security and customer experience.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Retail Banking

The impact of AI in retail banking is best seen in production. These case studies show scale, outcomes, and the practices that make value repeatable.

Real-World Case Studies

Bank of America: Conversational Banking with Erica.

Bank of America: Conversational Banking with Erica.

Erica has processed billions of interactions, helping millions of customers complete transfers, manage bills, and get insights instantly. By 2025, Erica accounts for a significant share of client interactions in digital channels. This scale translates to deflected calls, higher satisfaction, and faster resolution.

HSBC: Dynamic Risk Assessment for Financial Crime.

HSBC co-developed an AI system that uses contextual data to detect suspicious activity more accurately. The bank reports detecting far more potential financial crime with fewer false positives. These outcomes translate directly into faster decisions and reduced customer friction.

NatWest Group: Enhancing Cora with Generative AI.

NatWest partnered with AI providers to improve its customer assistant Cora and internal staff copilots. The initiative boosted customer satisfaction and reduced reliance on human advisors. Cora now handles tens of millions of conversations annually.

These examples reflect the value of working with technology partners who understand both the technical and policy implications. If you’re considering a similar digital transformation, don’t hesitate to connect with AI implementation experts to explore what’s possible in your context.

Innovative AI Solutions

Emerging approaches are redefining what’s possible in AI for retail banking. The following trends show where technology is heading next.

Agent-based AI and copilots are moving from pilots to core operations in financial-crime, servicing, and product workbenches. Banks operating AI factories are reporting major productivity gains as humans supervise digital workers and step in for exceptions. This model reduces silos, accelerates reuse, and embeds governance by design.

Privacy-preserving analytics, including federated learning, are becoming the default for sensitive banking data. These methods allow safe collaboration across jurisdictions without centralizing data. Banks adopting these practices gain safer and faster insight sharing.

Regulatory alignment is shaping design choices as new laws classify credit-risk scoring and other applications as high-risk. Retail banks building explainable pipelines and strong audit trails will scale faster and avoid costly rework. Governance also supports smoother regulatory approvals and supervisory dialogues.

AI-Driven Innovations Transforming Retail Banking

Emerging Technologies in AI for Retail Banking

AI in retail banking is evolving from siloed pilots to a fabric that runs across channels, cores, and control functions. For most institutions, the fastest path to value starts with a focused portfolio—fraud detection, conversational banking, document automation, and risk analytics—before scaling into agentic workflows and enterprise copilots. Analysts estimate AI and analytics can create up to a trillion dollars of annual value for global banking, with outsized gains in marketing, risk, and service productivity.

Generative AI is expanding the frontier. In practical terms, that means drafting compliant messages to customers, summarizing complex policy text for agents, and accelerating software and analytics work through code and data copilots. The economic upside is meaningful: banking is one of the sectors expected to capture a notable share of generative AI’s multi-trillion-dollar impact. The leaders are already building “AI factories” that standardize data, governance, and model deployment across dozens of use cases.

AI’s Role in Sustainability Efforts

Banks don’t typically run energy-hungry factories, but they do operate thousands of branches, data centers, and office sites—each with optimization potential. AI-assisted energy controls can reduce HVAC and cooling loads dramatically. For banks shifting more compute to the cloud or modernizing on-prem facilities, algorithmic control can slash energy costs while supporting net-zero commitments.

Sustainability also shows up in process transformation. Digitizing statements, automating document intake, and enabling remote identity verification reduce paper, transport, and back-office energy footprints while accelerating cycle times. Studies point to AI-enabled building controls and digital processes cutting energy consumption and emissions at double-digit rates over time. The result is a rare win-win: lower operating cost and smaller environmental impact without compromising controls.

How to Implement AI in Retail Banking

Step 1: Assessing Readiness for AI Adoption

Step 1: Assessing Readiness for AI Adoption

Start with business value, not algorithms. Map your top five pain points by impact and feasibility—fraud losses, dispute backlogs, KYC alerts, mortgage cycle time, churn—and quantify the addressable dollars. Your first wave should include AI use cases in retail banking with clear data availability and regulatory footing, so you can prove ROI quickly and build momentum with the board and risk committees. Alongside the use-case map, define “what good looks like” in outcomes, controls, and customer experience.

Then, run a structured readiness assessment across data, talent, tech, and governance. Confirm you can access labeled datasets such as transactions, case outcomes, and call transcripts. Ensure that model risk management can evaluate new model classes, and that you have product owners empowered to make decisions. A lightweight AI steering group should align on success metrics, escalation paths, and model documentation templates before the first lines of code are written.

Step 2: Building a Strong Data Foundation

Modern AI rewards frictionless, well-governed data. Practically, that means an event-driven architecture feeding a governed feature store with lineage and entitlements enforced end-to-end. You’ll also need a clear approach to privacy handling, tokenization, and retention, so data scientists and copilots can safely work with production-grade signals without creating exposure.

Data quality is your hidden ROI lever. Embed automated checks for timeliness, completeness, drift, and bias, and capture investigator or agent outcomes back into the training loop. When data engineering collaborates tightly with model governance, you cut rework, shrink approval timelines, and produce explainable models that pass supervisory scrutiny the first time. Institutions that have industrialized this discipline are the ones reporting durable productivity gains at scale.

Step 3: Choosing the Right Tools and Vendors

Treat tooling as an ecosystem. For fraud and AML, you’ll mix graph analytics, anomaly detection, and case management with rich investigator feedback. For conversational banking, you’ll combine natural language processing with retrieval layers grounded in your policies and knowledge bases, plus secure orchestration into core systems. For lending, you’ll want document AI tuned to financial forms and a decisioning layer that can emit reason codes and satisfy audits.

When evaluating platforms, ask for production evidence: live throughput, reduction in false positives, and time-to-value on migrations. Vendors and partners that can show regulator-ready documentation and references in comparable banks will accelerate approvals. Pair this with a cloud strategy and MLOps stack that’s already proven trustworthy in financial services.

Step 4: Pilot Testing and Scaling Up

Run surgical pilots with explicit control groups and baseline metrics. For example, in fraud, target one high-loss merchant category with a new ensemble and compare authorizations, chargebacks, and customer complaints against control. In servicing, launch a virtual-assistant skill for disputes with guardrails and measure first-contact resolution, handle time, and escalation rates. Pick 8–12 weeks for the pilot, with a go/no-go gate based on predefined ROI and risk thresholds.

Scale with discipline. If a pilot clears the gate, move to phased rollout and lock in the governance artifacts: model inventory entries, stability thresholds, change controls, and challenger models. Build an “AI runbook” per use case that defines playbooks for drift, incident response, and retraining cadence. Executives should see a quarterly scorecard that tracks business value delivered and model health, not just a list of projects in flight.

Step 5: Training Teams for Successful Implementation

Your people will determine whether AI becomes an engine for advantage or a new layer of complexity. Stand up role-based learning for investigators, agents, product owners, risk officers, and engineers—short, scenario-based modules that teach them to interpret scores, read model narratives, and manage exceptions. The goal is confidence and fluency: when teams trust the system and know how to intervene, outcomes improve immediately.

Talent strategy matters just as much. Blend external experts with internal rotations so domain knowledge is never lost. A pragmatic shift we see in leaders: embed “analytics translators” inside lines of business to connect use cases with data and compliance realities. AI is now second nature across banking in tasks like segmentation and fraud detection—your advantage comes from the people who can operationalize it day to day.

Whether you’re exploring your first pilot or scaling an enterprise-wide solution, our team is here to help. Get in touch with SmartDev and let’s turn your challenges into opportunities.

Measuring the ROI of AI in Retail Banking

Key Metrics to Track Success

ROI lives in your P&L, not your pilot deck. In fraud and financial crime, anchor on fraud-loss avoided, false-positive rate, true-positive yield per analyst, and investigation cycle time. In service, quantify call deflection to digital assistants, first-contact resolution, and customer satisfaction. At scale, digital assistants process billions of interactions, compressing wait times and reducing cost-to-serve.

In lending and operations, track end-to-end cycle times, touches per application, rework rates, and cost per booked loan. Document automation and cash-flow underwriting frequently unlock double-digit time savings and more inclusive approvals at similar or lower loss rates. For personalization, measure incremental product uptake, attrition reduction, and lifetime value. Finally, watch model health—drift, stability, and bias—because unstable models quietly erode ROI.

Case Studies Demonstrating ROI

Bank of America’s Erica has crossed billions of client interactions since launch. The economics are straightforward: billions of automated, policy-grounded answers mean fewer inbound calls, faster resolution, and more consistent service across channels. Erica’s scale underlines a shift in customer behavior toward digital self-service—one that translates into structurally lower cost-to-serve.

HSBC co-developed Dynamic Risk Assessment with a technology partner and reports two to four times more financial crime detected with much greater accuracy. Those gains don’t just reduce operational burden; they reduce loss, improve regulator confidence, and cut customer friction. The program scales to screen over a billion transactions monthly.

The Consumer Financial Protection Bureau documented that an AI underwriting model using alternative data approved significantly more applicants with lower APRs than traditional approaches. For banks expanding unsecured lending responsibly, this demonstrates that cash-flow features and machine learning can increase approvals without compromising fairness. The commercial upside is higher booking rates and lower acquisition cost per booked dollar.

Danske Bank’s shift from static rules to deep learning cut false positives by about 60 percent and boosted true positives by 50 percent. The business consequence is lower fraud write-offs and materially lower investigation cost per case; the customer consequence is fewer declines and smoother checkout. For institutions still dominated by rules, this is a proven path to better performance.

HomeTrust Bank’s mortgage teams reported saving thousands of hours annually and significant processing costs after deploying AI document automation. Loan decisions became faster and more accurate, improving both staff productivity and borrower experience. This is the kind of ROI that accelerates board support for further automation.

Common Pitfalls and How to Avoid Them

The “pilot zoo” is a common trap. Many banks accumulate a dozen disconnected proofs-of-concept, each with a different stack and governance process. The fix is institutional design: a reusable platform for data, features, and deployment; a single model inventory; and clear model-risk controls.

Governance and regulation are another challenge. Credit risk scoring and other retail-bank models fall under high-risk obligations, requiring documented data quality, logging, human oversight, and robustness. Build explainability, audit trails, and monitoring into the pipeline from day one; it’s both faster and safer.

Finally, data without discipline can quietly kill ROI. Poor lineage, inconsistent labels, and missing feedback loops force manual reviews and undermine trust. Invest in feature stores, data contracts, and continuous label capture from investigators and agents. Banks that operationalize these basics are the ones reporting stable models and compounding productivity gains.

Understanding ROI is possibly a challenge to many businesses and institutions as different in background, cost. So, if you need to dig deep about this problem, you can read AI Return on Investment (ROI): Unlocking the True Value of Artificial Intelligence for Your Business

Future Trends of AI in Retail Banking

Predictions for the Next Decade

Predictions for the Next Decade

First, agentic AI will move from copilots to autonomous digital workers supervised by humans. You’ll see end-to-end orchestration across onboarding, disputes, and AML refresh, where agents gather evidence, draft narratives, and route exceptions—collapsing cycle times while preserving accountability. Second, personalization will deepen as real-time state stores and policy engines deliver the next best action with guardrails for fairness and suitability. Third, model-risk management will modernize; supervisors will expect continuous assurance with telemetry, versioned datasets, and stress tests on par with credit models.

At the macro level, the banks that win will be those that industrialize AI—treating it as a core capability, not a set of tools. Expect more cross-industry patterns to land in finance, like AI-controlled energy savings in data centers and buildings, tightening the link between digital transformation and sustainability. And as digital engagement keeps compounding, the bar for low-effort, always-on service will keep rising.

How Businesses Can Stay Ahead of the Curve

You don’t need 100 use cases; you need ten that matter and a platform that lets you ship the next ten faster. Put fraud, AML/KYC, document automation, conversational service, cash-flow underwriting, and personalization on your first-wave roadmap because they hit revenue, risk, and cost simultaneously. Build the muscle for model lifecycle management—inventory, controls, monitoring—and set quarterly business reviews that focus on value delivered, not just model performance.

Partnerships will accelerate your journey, but don’t outsource your brain. Select vendors who can show production outcomes and regulator-ready documentation, and pair that with a build team that understands your data and customers. Finally, invest in people: role-based training, analytics translators in the business, and clear change-management. When your teams trust the systems and know how to intervene, AI becomes an amplifier of human judgment rather than a black box.

Conclusion

Summary of Key Takeaways on AI Use Cases in Retail Banking

Across fraud, AML, lending, service, and personalization, AI use cases in retail banking are delivering hard-dollar outcomes today. The evidence is robust: billions of assistant interactions deflect calls and lift satisfaction; inclusive underwriting approves more customers at lower APRs; deep-learning fraud models catch more real cases with far fewer false alarms; and document automation returns thousands of hours to frontline teams. The institutions that benefit most align value with governance—treating data quality, explainability, and fairness as enablers of scale rather than hurdles.

Moving Forward: A Path to Progress for Businesses Considering AI Adoption

If you’re serious about results in the next two quarters, pick three use cases with clean data and a clear regulatory path, set an aggressive but controlled pilot plan, and hold teams accountable to P&L-linked metrics. Stand up the platform and governance once, then reuse it relentlessly. AI can unlock trillion-dollar value pools for banking—your job is to capture your slice by moving from experiments to industrialized delivery.

References

- https://www.mckinsey.com/industries/financial-services/our-insights/extracting-value-from-ai-in-banking-rewiring-the-enterprise

- https://cloud.google.com/discover/ai-in-banking

- https://www.mckinsey.com/industries/financial-services/our-insights/the-state-of-retail-banking-profitability-and-growth-in-the-era-of-digital-and-ai

- https://neontri.com/blog/ai-retail-banking/

- https://trustingsocial.com/blog/trusting-social-sees-the-future-of-retail-banking-in-ai-presented-in-a-co-hosted-seminar-with-the-vietnam-banks-association

- https://www.hkma.gov.hk/media/eng/doc/key-functions/finanical-infrastructure/Artificial_Intelligence_(AI)_in_Retail_Banking.pdf

- https://www.ey.com/content/dam/ey-unified-site/ey-com/en-gl/insights/banking-capital-markets/documents/ey-generative-ai-in-retail-and-commercial-banking.pdf

Definition of AI and Its Core Technologies

Definition of AI and Its Core Technologies 1. Enhanced Fraud Detection and Risk Management

1. Enhanced Fraud Detection and Risk Management 1. Data Privacy and Regulatory Compliance

1. Data Privacy and Regulatory Compliance Use case 1: Real-Time Fraud Detection and Transaction Monitoring

Use case 1: Real-Time Fraud Detection and Transaction Monitoring Bank of America: Conversational Banking with Erica.

Bank of America: Conversational Banking with Erica.  Step 1: Assessing Readiness for AI Adoption

Step 1: Assessing Readiness for AI Adoption Predictions for the Next Decade

Predictions for the Next Decade