Introduction

Generative AI refers to a class of artificial intelligence models designed to create new content, such as text, images, or data, based on patterns learned from existing information. Unlike traditional AI, which primarily focuses on analyzing and predicting outcomes from data, generative AI has the ability to generate entirely new content. In the BFSI (Banking, Financial Services, and Insurance) sector, this technology is transforming how organizations interact with data, enhance customer experiences, and make decisions. By leveraging generative AI, businesses can automate tasks, predict trends, and improve operational efficiency, all while ensuring a more personalized approach to financial services.

In the rapidly evolving BFSI landscape, AI is no longer a luxury but a necessity. Financial institutions are increasingly adopting AI technologies to stay competitive, reduce costs, and meet the growing demand for faster and more personalized services. Generative AI, in particular, is helping firms enhance risk management, streamline regulatory compliance, detect fraud, and provide tailored solutions to customers. As the sector faces an ever-expanding volume of data and complex financial challenges, generative AI offers the tools needed to drive innovation, improve decision-making, and provide more accurate, efficient services.

What is Generative AI?

Generative AI refers to a type of artificial intelligence that can create new content, such as text, images, or data, by learning patterns and structures from existing data. Unlike traditional AI, which primarily focuses on analyzing and making predictions based on input data, generative AI has the capability to generate entirely new, previously unseen data. It works by leveraging advanced machine learning models, such as neural networks and deep learning algorithms, which are trained on large datasets to understand underlying patterns and structures.

In the BFSI sector, generative AI is being used to automate and optimize a variety of tasks. These include fraud detection, risk management, customer personalization, and document generation. The ability of generative AI to learn from vast amounts of financial data, generate insights, and provide accurate predictions or recommendations is a powerful tool for financial institutions looking to stay competitive in an increasingly data-driven world. As the technology advances, the applications of generative AI in BFSI are expected to grow, enabling financial services to be more efficient, personalized, and secure.

The Rise of Generative AI in BFSI

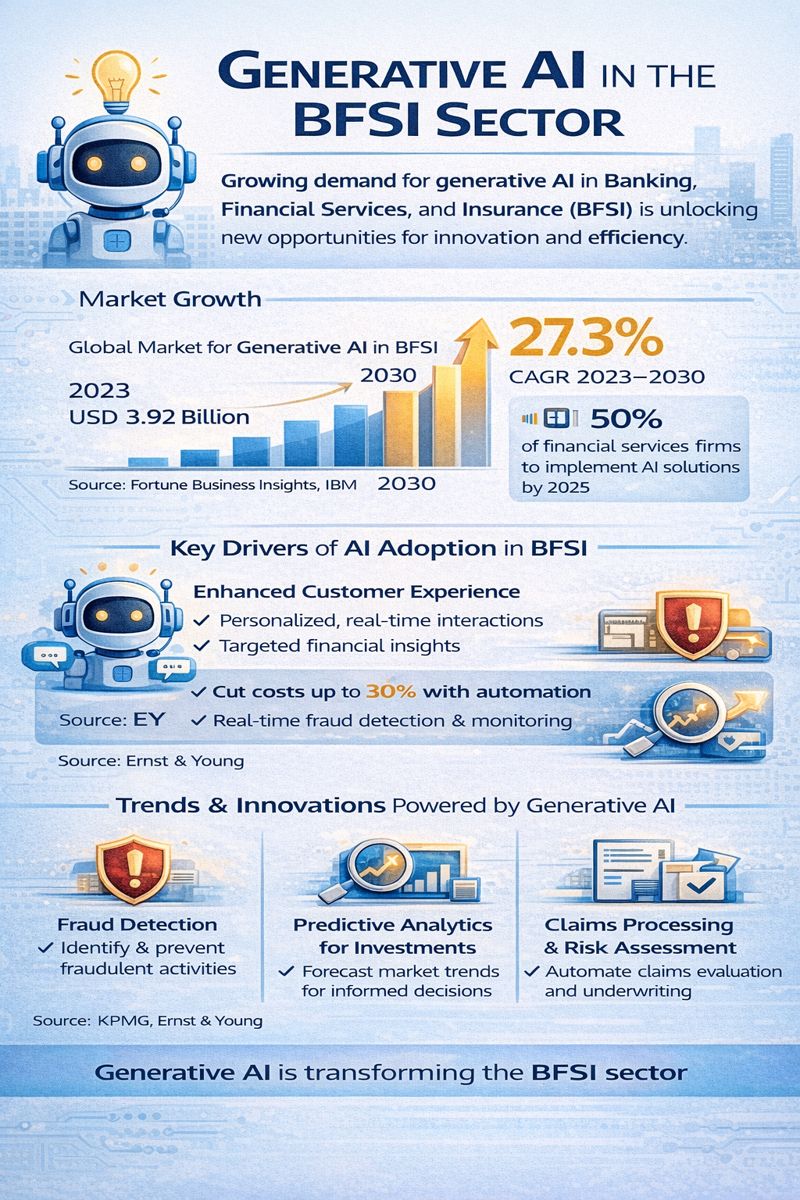

The adoption of generative AI within the Banking, Financial Services, and Insurance (BFSI) sector has witnessed rapid growth in recent years, as organizations seek innovative solutions to improve operational efficiency, enhance customer experience, and ensure security. According to a report by Fortune Business Insights, the global market for generative AI in BFSI is expected to grow from USD 3.92 billion in 2023 to USD 22.82 billion by 2030, reflecting a compound annual growth rate (CAGR) of 27.3% from 2023 to 2030. This surge in demand highlights how generative AI is transforming financial institutions, driving new opportunities for innovation and differentiation.

The Growing Demand for Generative AI in BFSI

The demand for generative AI in BFSI can be attributed to several factors. Financial institutions are increasingly focusing on automation to streamline operations, reduce costs, and enhance efficiency. For example, AI-powered systems can automate customer support through chatbots, generate reports, or assist in fraud detection. According to IBM, 50% of financial services firms are expected to implement AI-driven solutions by 2025, making it a core technology for future operations. As firms face growing pressure to meet customer expectations for personalized, quick, and secure services, generative AI becomes a critical tool for meeting these demands.

Key Drivers of AI Adoption in Financial Institutions

Key Drivers of AI Adoption in Financial Institutions

Several key drivers are accelerating the adoption of generative AI in the BFSI industry. One major factor is the need for enhanced customer experience. Customers expect personalized, real-time interactions with their banks and insurance providers, and generative AI can help meet these expectations by automating and tailoring responses. Additionally, AI’s ability to process large volumes of data enables financial institutions to offer better insights for investment strategies, credit assessments, and risk management.

Another key driver is cost reduction. AI helps firms automate repetitive tasks, reducing the need for manual intervention and human error. According to Ernst & Young (EY), AI’s automation capabilities have the potential to cut costs for financial institutions by up to 30% by streamlining processes such as compliance, reporting, and transaction monitoring.

Industry Trends and Innovations in BFSI with AI

The BFSI sector has seen several innovations driven by AI. One of the most notable trends is the use of AI in fraud detection. Generative AI models can analyze transaction data in real-time to detect unusual patterns and flag potential fraudulent activity. Another area of innovation is predictive analytics for investment management, where AI generates forecasts based on historical market data. In insurance, AI is being used for claims processing and risk assessment, helping companies automate claim evaluation and underwriting processes. This trend is reflected in a study by KPMG, which found that 70% of financial services leaders see AI as a game-changer for driving innovation.

With these trends and innovations, generative AI is quickly becoming indispensable to the future of BFSI, enabling firms to remain competitive in an increasingly digital landscape.

Core Applications of Generative AI in BFSI

Generative AI is transforming the Banking, Financial Services, and Insurance (BFSI) sector by providing innovative solutions to enhance customer service, streamline operations, improve security, and optimize decision-making. Below are the key applications of generative AI across various domains in BFSI:

Generative AI is transforming the Banking, Financial Services, and Insurance (BFSI) sector by providing innovative solutions to enhance customer service, streamline operations, improve security, and optimize decision-making. Below are the key applications of generative AI across various domains in BFSI:

Personalized Customer Service & Virtual Assistants

AI-powered chatbots and virtual assistants are revolutionizing how financial institutions interact with their customers. These intelligent systems leverage natural language processing (NLP) to understand and respond to customer queries in real time, providing personalized services and reducing the burden on human agents. According to a report by IBM, nearly 60% of financial institutions have integrated AI-powered chatbots for customer service, improving response time and customer satisfaction (IBM, 2023).

By using machine learning algorithms, these virtual assistants can offer tailored financial advice, recommend products based on individual preferences, and assist with routine transactions like balance inquiries, fund transfers, and account management. As customer expectations evolve towards faster and more personalized interactions, generative AI systems ensure that BFSI firms can meet these needs efficiently, enhancing both user experience and operational efficiency.

Fraud Detection and Risk Management

Fraud prevention is a critical challenge in the BFSI industry, and generative AI plays a crucial role in identifying and mitigating fraudulent activities. By analyzing large volumes of transactional data in real time, AI systems can detect suspicious patterns, flag potentially fraudulent activities, and even predict future fraud attempts. Generative AI can create synthetic data to train fraud detection models, allowing them to improve accuracy and reduce false positives over time.

AI-powered fraud detection models use anomaly detection techniques to identify deviations from normal transaction behaviors, thus preventing fraud before it occurs. This has become particularly important in combating digital fraud, as cybercriminals increasingly target online banking and payment systems. Research from Fortune Business Insights predicts that generative AI’s role in fraud detection will continue to grow, with AI solutions for cybersecurity in BFSI expected to be valued at over USD 12.5 billion by 2026 (Fortune Business Insights, 2023).

AI-Driven Risk Assessment Models

AI is also significantly enhancing risk management practices in the BFSI industry. Generative AI models analyze diverse datasets, including financial reports, market trends, and macroeconomic indicators, to assess risks associated with investments, loans, and insurance policies. These AI-driven models can generate predictive insights on credit risk, market volatility, and the likelihood of loan defaults, helping firms make more informed decisions.

By incorporating AI into risk assessments, financial institutions can create more accurate risk models that adapt to market fluctuations and emerging trends. This, in turn, allows firms to optimize their portfolios, better allocate resources, and minimize exposure to high-risk ventures.

Automated Content Generation and Compliance

One of the most time-consuming tasks in the BFSI sector is generating regulatory reports and legal documents. Generative AI can automate this process by quickly drafting and assembling required documentation based on predefined templates and data inputs. This not only saves time but also minimizes human error and ensures that firms remain compliant with regulatory requirements.

Generative AI can create reports related to risk management, transactions, financial statements, and more. By analyzing internal data, AI systems can automatically fill out sections of regulatory reports and ensure all required information is included, significantly reducing compliance costs. According to EY, generative AI has the potential to reduce compliance costs by as much as 30% (EY, 2023).

AI’s Role in Compliance and Legal Document Generation

Compliance with laws and regulations is a significant concern for financial institutions. Generative AI can help automate the creation of legal documents, such as contracts, policy statements, and other compliance-related materials. These systems can scan legal frameworks and regulations to generate documents that comply with the latest rules, reducing the need for manual drafting and review.

Moreover, AI tools can continuously monitor regulatory changes, allowing firms to adjust their documentation practices in real time. This is particularly useful for organizations with a global presence, where they must comply with various local and international regulations. AI can not only improve compliance but also speed up the process of legal review and document generation.

Wealth Management and Investment Insights

Generative AI is making wealth management more personalized and accessible. AI-driven advisory services can analyze a client’s financial history, risk appetite, and investment goals to generate tailored investment strategies. By creating custom portfolios and continuously adjusting them based on market conditions, AI helps clients achieve better returns while mitigating risks.

These systems also provide personalized recommendations for savings, investment opportunities, tax optimization, and retirement planning, enhancing the client’s financial planning experience. As generative AI models evolve, they will become more adept at predicting market movements and adjusting investment strategies in real-time, ensuring that clients’ portfolios remain optimal in the face of market volatility.

Generative AI in Portfolio Optimization

Generative AI plays a pivotal role in portfolio optimization by generating models that balance risk and return according to individual investor preferences. AI systems use historical market data, asset correlations, and predictive algorithms to suggest the optimal mix of investments. As a result, financial advisors can offer more precise advice, and investors can make more informed decisions.

This use of AI in portfolio management allows firms to increase their operational efficiency and better meet the needs of high-net-worth clients by offering data-driven insights and proactive adjustments.

AI in Lending & Credit Scoring

Generative AI is transforming the credit decision-making process by enabling financial institutions to evaluate loan applicants more accurately. AI models can analyze a vast range of data points—from financial history to behavioral data—allowing lenders to generate credit scores and make lending decisions more efficiently.

These AI-driven models also help reduce biases in credit scoring by incorporating more comprehensive data, ensuring that lending decisions are based on a broader, more equitable assessment of an applicant’s financial health.

Predictive Analytics for Better Risk Profiling

Generative AI’s ability to process large datasets enables the creation of more accurate predictive models for risk profiling in lending. AI can generate credit risk scores based on various financial and personal attributes, providing lenders with a more holistic view of an applicant’s creditworthiness. This improves risk management by allowing institutions to predict potential defaults or payment delays, reducing exposure to bad debt.

By leveraging predictive analytics, financial institutions can make more informed decisions, set better interest rates, and offer customized lending solutions to a wider range of customers.

Benefits and Challenges of Generative AI for BFSI Firms

Generative AI offers significant advantages to firms in the Banking, Financial Services, and Insurance (BFSI) sector, while also presenting a range of challenges that need to be carefully managed. Below are the key benefits and challenges of adopting generative AI in BFSI.

Benefits of Generative AI for BFSI Firms

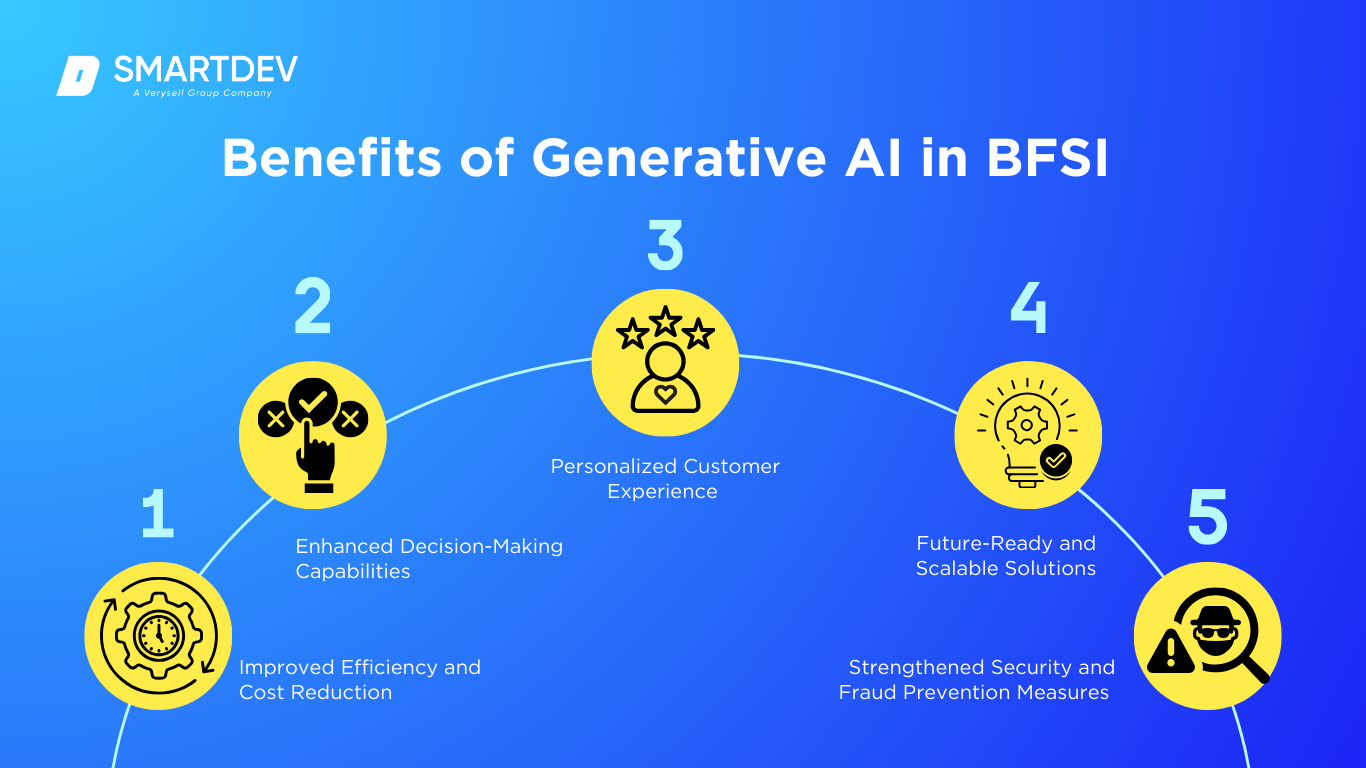

1. Improved Efficiency and Cost Reduction

1. Improved Efficiency and Cost Reduction

Generative AI helps BFSI firms automate various time-consuming processes, such as customer service, document generation, fraud detection, and regulatory reporting. This automation not only accelerates operations but also reduces operational costs by minimizing human intervention. By automating tasks that traditionally required manual effort, financial institutions can significantly cut costs while improving overall efficiency.

2. Enhanced Decision-Making Capabilities

Generative AI enhances decision-making by providing data-driven insights derived from large volumes of financial data. AI systems can analyze market trends, customer behavior, and risk factors in real time to support more informed, timely decisions. For example, AI can assist in predicting market shifts, identifying credit risk, or optimizing investment portfolios, thus enabling better strategic decisions that drive growth.

3. Personalized Customer Experience

Generative AI empowers BFSI firms to offer highly personalized services to their customers. AI-driven systems can analyze customer data to deliver tailored recommendations, customized financial advice, and targeted product offerings. By enhancing personalization, AI improves customer satisfaction and loyalty, leading to increased retention rates. Customers benefit from more relevant products, services, and interactions, which ultimately boost the customer experience.

4. Future-Ready and Scalable Solutions

Generative AI offers future-proof solutions that can scale as financial institutions grow. As firms collect more data and expand their operations, AI models can be easily adapted and scaled to handle increased workloads. Whether it’s processing more transactions, analyzing larger data sets, or adding new features, AI systems can evolve without requiring significant infrastructure changes, making them ideal for long-term growth.

5. Strengthened Security and Fraud Prevention Measures

Generative AI plays a crucial role in enhancing security within the BFSI sector. With its ability to detect anomalies and identify fraudulent activities in real time, AI systems can help prevent fraud and safeguard sensitive customer data. AI-driven fraud detection models continuously learn from historical data, improving their ability to spot fraud attempts before they cause significant damage. This added layer of security helps BFSI firms protect their assets, maintain regulatory compliance, and build customer trust.

Challenges in Adopting Generative AI in BFSI

1. Data Privacy and Security Concerns

1. Data Privacy and Security Concerns

While generative AI can significantly improve security and efficiency, it also raises concerns about data privacy. Financial institutions deal with vast amounts of sensitive customer data, and AI systems require access to this data for training and operation. Ensuring that AI models adhere to strict data privacy regulations (such as GDPR or CCPA) is critical to prevent data breaches and safeguard customer trust. Striking the right balance between utilizing data for AI applications and protecting customer privacy is an ongoing challenge for BFSI firms.

2. Regulatory and Ethical Implications of AI

The rapid adoption of AI in BFSI presents several regulatory and ethical challenges. As AI systems become more integrated into decision-making processes, regulators need to ensure that these systems comply with financial laws and regulations. For example, algorithms used for credit scoring must be transparent and free from biases to avoid discriminatory practices. Financial institutions must navigate the regulatory landscape carefully to ensure their AI models are ethical, transparent, and compliant with the law.

3. Integrating AI Solutions with Legacy Systems

Many BFSI organizations still rely on legacy systems that are not built to support advanced AI technologies. Integrating generative AI into these existing infrastructures can be complex and costly. Legacy systems often lack the flexibility required to scale or adapt to the needs of modern AI tools, which can create friction in adoption. Financial institutions must invest in system upgrades or redesigns to effectively implement AI solutions while ensuring minimal disruption to day-to-day operations.

4. Skill Gap and Workforce Transformation

The successful adoption of generative AI in BFSI requires skilled professionals who understand both AI technologies and the financial services industry. However, there is a significant skill gap in AI expertise, making it difficult for many firms to fully leverage AI’s potential. Additionally, AI adoption may require workforce transformation, with employees needing to adapt to new roles as automation takes over certain tasks. Organizations must invest in upskilling and reskilling their workforce to ensure a smooth transition and maximize the benefits of AI.

Explore how SmartDev partners with teams through a focused AI sprint to validate chatbot use cases, align stakeholders, and define a clear path forward before chatbot development begins in Southeast Asia.

SmartDev helps organizations clarify AI chatbot use cases and assess feasibility for Southeast Asian markets, enabling confident decisions and reducing risks before committing to chatbot development.

Learn how companies accelerate AI chatbot initiatives in Southeast Asia with SmartDev’s AI sprint, ensuring rapid deployment and reduced time to market.

Build Your AI Chatbot With UsSteps to Integrate AI in BFSI Firms

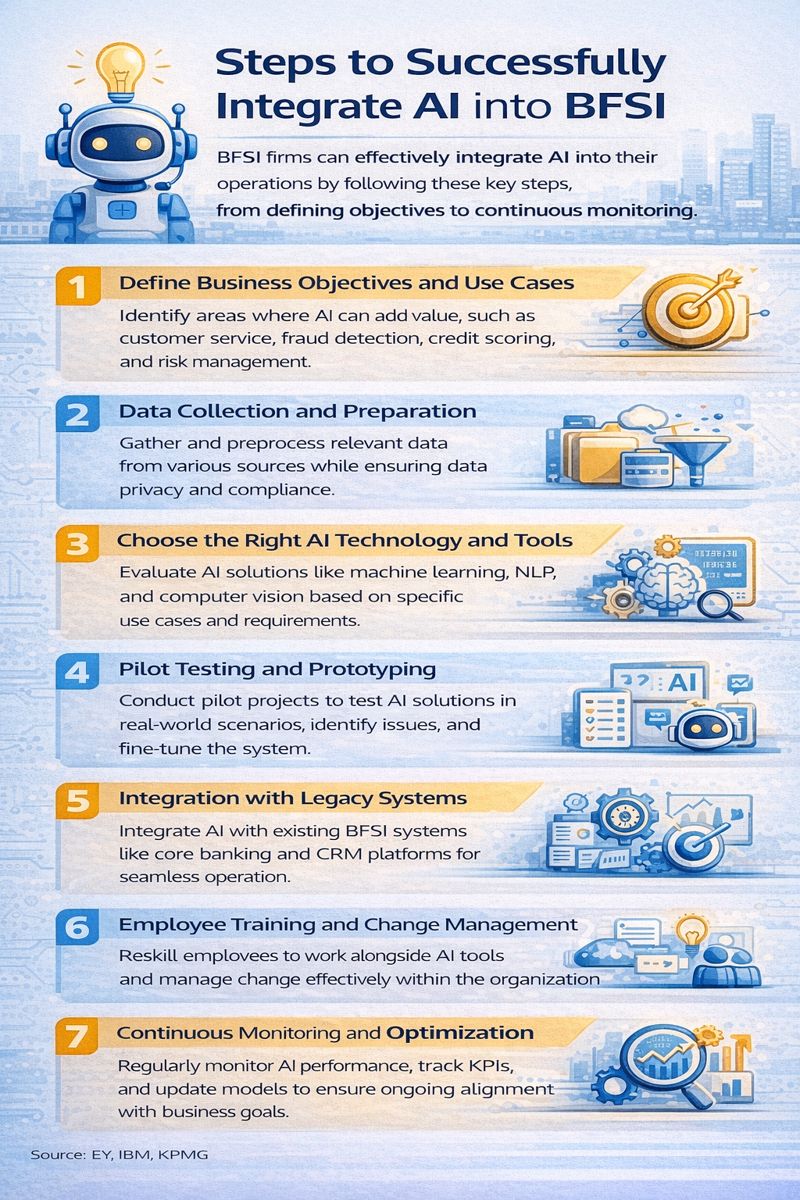

Integrating AI into BFSI firms is a strategic process that requires careful planning, investment, and alignment with business objectives. The following steps can help financial institutions successfully adopt and implement AI solutions:

Step 1: Define Business Objectives and Use Cases

The first step in integrating AI is to clearly define the business goals and identify the areas where AI can add the most value. This could include enhancing customer service through chatbots, automating fraud detection, improving credit scoring, or optimizing risk management. By identifying specific use cases, firms can tailor AI solutions to meet their unique needs and challenges.

Step 2: Data Collection and Preparation

AI systems rely heavily on high-quality data to function effectively. BFSI firms must gather relevant data from various sources, including customer interactions, transaction histories, and market trends. Data cleaning and preprocessing are essential to ensure that the data is accurate, consistent, and ready for training AI models. Financial institutions should also focus on ensuring data privacy and compliance with regulations during this phase.

Step 3: Choose the Right AI Technology and Tools

Selecting the right AI tools and platforms is critical for successful integration. BFSI firms should evaluate different AI solutions, such as machine learning algorithms, natural language processing (NLP), and computer vision, based on their use cases and technical requirements. Firms can either build in-house AI capabilities or collaborate with AI service providers and technology partners to implement customized solutions.

Step 4: Pilot Testing and Prototyping

Before full-scale implementation, it is important to test the AI solution in a controlled environment. Firms should conduct pilot projects to assess how the AI system performs in real-world scenarios, identify potential issues, and fine-tune the solution. This step also helps in measuring the AI model’s effectiveness and understanding how it impacts business processes.

Step 5: Integration with Legacy Systems

Many BFSI firms rely on legacy infrastructure that may not be designed to support modern AI technologies. Therefore, AI solutions must be carefully integrated with existing systems, such as core banking platforms, customer relationship management (CRM) tools, and risk management software. This step may involve system upgrades or data migration to ensure seamless interoperability between AI solutions and legacy systems.

Step 6: Employee Training and Change Management

As AI transforms workflows and automates tasks, it is important to train employees to work alongside AI systems. Firms should invest in reskilling their workforce to adapt to new roles and responsibilities, ensuring that employees are comfortable with the AI tools and can leverage them effectively. Change management practices are also essential to address any resistance to AI adoption and to ensure that employees understand the benefits of the new technology.

Step 7: Continuous Monitoring and Optimization

AI systems require ongoing monitoring and fine-tuning to ensure they continue to deliver optimal results. Firms should track key performance indicators (KPIs) and measure the impact of AI solutions on business outcomes. Over time, AI models should be updated and improved based on new data, market trends, and evolving business needs. Regular monitoring helps identify areas for improvement and ensures that AI systems remain aligned with the organization’s goals.

By following these steps, BFSI firms can effectively integrate AI into their operations, driving innovation, improving decision-making, and enhancing customer experiences while ensuring seamless scalability and long-term success.

The Role of SmartDev in Empowering BFSI Firms with Generative AI

The Role of SmartDev in Empowering BFSI Firms with Generative AI

As the demand for generative AI solutions in the Banking, Financial Services, and Insurance (BFSI) sector continues to rise, firms are seeking expert partners who can help them harness the potential of AI technology to drive innovation, efficiency, and growth. SmartDev, with its expertise in AI and machine learning, stands out as a leader in delivering advanced AI-driven solutions that enable BFSI firms to stay ahead of the curve.

High Demand for Generative AI Solutions in BFSI

Generative AI is rapidly transforming the BFSI sector by enabling more efficient operations, enhanced security measures, and personalized customer experiences. As financial institutions look to meet the growing demand for automation, real-time analytics, and AI-driven insights, generative AI is becoming a cornerstone of digital transformation in the industry. In fact, the global BFSI AI market is projected to experience substantial growth, and businesses are increasingly recognizing the potential of AI technologies to improve everything from risk management to customer service (SmartDev, 2023).

With this high demand for generative AI solutions, firms are seeking trusted partners who can deliver cutting-edge AI capabilities tailored to their specific needs. SmartDev has positioned itself as a key player in this space, helping BFSI firms unlock the full potential of generative AI for their operations.

SmartDev’s Expertise in AI and Machine Learning

SmartDev has deep expertise in AI and machine learning, offering a comprehensive range of services designed to empower BFSI firms with state-of-the-art generative AI solutions. With a team of skilled data scientists, AI experts, and engineers, SmartDev is adept at developing AI systems that enhance decision-making, automate processes, and enable better customer experiences. The company’s solutions leverage the latest advancements in machine learning, natural language processing (NLP), and deep learning to create AI models that learn from data and evolve over time, ensuring that BFSI firms stay competitive in a rapidly changing industry (SmartDev, 2023).

SmartDev’s AI solutions are tailored to meet the unique challenges and regulatory requirements of the BFSI sector. Whether it’s enhancing fraud detection capabilities, automating regulatory reporting, or providing personalized financial recommendations, SmartDev helps financial institutions implement AI-driven solutions that deliver measurable results.

How SmartDev Helps BFSI Firms Integrate AI Solutions Seamlessly

Integrating AI into existing infrastructure can be a complex challenge for many BFSI firms, particularly those with legacy systems. SmartDev takes a holistic approach to AI implementation, ensuring seamless integration with core banking platforms, CRM systems, and risk management tools. Their expertise in system integration ensures that AI solutions work in harmony with existing workflows, enabling a smooth transition with minimal disruption.

SmartDev also works closely with BFSI firms throughout the implementation process, offering consulting services, data preparation, model training, and post-deployment support. This end-to-end service ensures that AI models are effectively trained, deployed, and continuously optimized for maximum impact. Moreover, SmartDev’s focus on compliance with industry regulations ensures that AI solutions meet the strict legal and ethical standards required in the BFSI sector.

The Benefits of Partnering with SmartDev for BFSI Firms

The Benefits of Partnering with SmartDev for BFSI Firms

Partnering with SmartDev offers numerous benefits for BFSI firms looking to integrate generative AI into their operations:

- Expertise and Experience: SmartDev brings a wealth of knowledge and experience in AI and machine learning, providing BFSI firms with high-quality, tailored solutions that align with their unique business needs.

- Seamless Integration: With SmartDev’s deep understanding of both BFSI processes and AI technologies, firms can enjoy smooth integration of AI solutions into their existing systems, minimizing downtime and ensuring operational continuity.

- Innovative Solutions: SmartDev offers cutting-edge AI solutions that enable BFSI firms to automate tasks, enhance decision-making, and improve customer service, giving them a competitive edge in the industry.

- Scalability and Flexibility: SmartDev’s AI solutions are designed to scale as businesses grow, ensuring that firms can adapt their AI systems to meet changing demands and market conditions.

- Regulatory Compliance: SmartDev prioritizes regulatory compliance, ensuring that all AI solutions meet the legal and ethical requirements of the BFSI sector, helping firms mitigate risk and avoid costly penalties.

By partnering with SmartDev, BFSI firms can unlock the full potential of generative AI, driving innovation, improving efficiency, and providing better services to their customers. SmartDev’s expertise and commitment to delivering high-quality, customized solutions make it the ideal partner for BFSI firms looking to embrace the future of AI technology.

For more information on how SmartDev can help your firm leverage generative AI, visit SmartDev’s AI Solutions for BFSI.

Case Studies: Successful AI Implementations by SmartDev in BFSI

SmartDev has a proven track record of helping BFSI firms enhance their operations through the implementation of AI solutions. Below are a few notable case studies that highlight the impact of SmartDev’s AI-driven innovations across various sectors within BFSI.

1. Reinventing Operations Through Intelligent Data Structure and Reporting

In this project, SmartDev worked with a leading financial services firm to enhance their reporting capabilities through AI-driven data structure improvements. The challenge for the client was that their existing data management system was cumbersome and inefficient, making it difficult to extract valuable insights in a timely manner.

SmartDev implemented an intelligent data structure system that allowed for better organization and faster retrieval of financial data. By utilizing advanced machine learning algorithms, the new system was capable of processing large datasets, identifying patterns, and generating real-time reports automatically. This transformation enabled the client to significantly reduce reporting time and improve the quality of insights, providing decision-makers with the tools they needed to make more informed, data-driven decisions.

Key outcomes of this implementation included:

- Faster reporting cycles: Reducing the time spent on generating reports from days to hours.

- Improved decision-making: With real-time insights and more accurate data, leadership could make quicker and more strategic decisions.

- Scalability: The new data infrastructure could easily scale to accommodate growing datasets as the firm expanded its operations.

This case demonstrates how SmartDev’s AI solutions can transform inefficient data management systems into powerful, automated engines for reporting and decision-making.

Read the full case study here.

2. Improving the Accuracy and Speed of Insurance Document Processing

Insurance companies often deal with large volumes of documents, including policy papers, claims forms, and legal contracts. The manual processing of these documents is not only time-consuming but also prone to human error. SmartDev addressed this challenge for an insurance client by implementing an AI-powered document processing system that leveraged natural language processing (NLP) and machine learning.

The AI solution was designed to automate the extraction of relevant data from insurance documents, such as policy numbers, coverage details, and customer information. This system not only improved the accuracy of data extraction but also sped up the document review process, reducing the need for human intervention and the risk of mistakes.

Key results included:

- Improved accuracy: AI was able to extract key data from documents with far fewer errors than manual processing.

- Increased speed: The AI solution processed documents in minutes, reducing turnaround time from hours to seconds.

- Operational efficiency: The automation of document processing allowed the insurance firm to allocate human resources to higher-value tasks, improving overall productivity.

This implementation highlights how AI can streamline administrative tasks in the insurance industry, freeing up resources while enhancing operational accuracy and speed.

Read the full case study here.

3. Creating a New Digitalized Beginning for Individuals in BFSI Operations

In another project, SmartDev partnered with a prominent financial institution to create a new, digitalized platform that would provide individuals with a seamless experience in managing their finances. The challenge was to build a user-friendly digital interface that could handle complex banking and financial services operations while ensuring high levels of security and compliance.

SmartDev used its expertise in AI and machine learning to design a solution that personalized financial services for each user based on their individual financial goals, transaction history, and preferences. By leveraging data analytics and AI-powered insights, the platform offered personalized financial advice, product recommendations, and real-time updates.

This solution also incorporated robust security measures, utilizing AI-driven fraud detection and identity verification systems to ensure that customers’ financial data remained secure. The end result was a fully digitalized platform that allowed individuals to take control of their financial health with ease.

Key outcomes of this project included:

- Personalized financial experience: AI enabled tailored recommendations and advice, increasing user engagement and satisfaction.

- Enhanced security: AI-powered fraud detection systems helped protect customers’ financial data from potential threats.

- Streamlined operations: The digital platform reduced the need for manual intervention, improving the efficiency of service delivery.

This case study exemplifies how SmartDev can create a fully digitalized ecosystem that caters to the evolving needs of individual customers in the BFSI sector, driving both convenience and security.

Read the full case study here.

Future of Generative AI in BFSI

Generative AI is poised to reshape the future of the Banking, Financial Services, and Insurance (BFSI) sector with emerging trends and groundbreaking innovations. The next decade will see rapid advancements in AI capabilities, driving significant transformations in how financial services are delivered and consumed.

Emerging Trends and Innovations in AI for Financial Services

One of the most prominent trends in BFSI is the increasing adoption of AI-powered personalization. Financial institutions are leveraging generative AI to create tailored financial products, personalized investment strategies, and customer experiences. This trend is fueled by AI’s ability to analyze vast amounts of customer data, enabling firms to offer highly individualized services and anticipate customer needs. Additionally, AI-driven automation will continue to play a key role in streamlining operations, reducing human error, and improving efficiency in tasks such as fraud detection, risk management, and regulatory compliance.

Another exciting development is AI-powered conversational interfaces, like chatbots and virtual assistants, that enable 24/7 customer support, financial advisory, and transaction management, making banking services more accessible and efficient.

The Impact of Quantum Computing on AI in BFSI

Quantum computing promises to amplify the capabilities of AI, especially in the BFSI sector. By processing vast amounts of data in parallel, quantum computing could accelerate AI’s ability to perform complex risk assessments, optimize portfolios, and enhance fraud detection. Quantum AI could solve problems that are currently intractable for classical computers, leading to faster, more accurate predictions and decision-making in areas like credit scoring and market forecasting.

Predictions for the Next Decade of AI in BFSI

Looking ahead, generative AI will become deeply integrated into all aspects of BFSI operations. We can expect AI to significantly reshape customer interactions, automate advanced financial modeling, and streamline compliance processes. Over the next decade, AI’s role in predicting market trends and personalizing financial services will continue to evolve, driving greater innovation and efficiency in the sector. The next phase of AI will bring self-learning models capable of continuously improving without human intervention, enhancing the ability of BFSI firms to adapt in real-time to market changes.

Conclusion

Generative AI is poised to redefine the future of the BFSI sector by enhancing operational efficiency, improving decision-making, and delivering personalized customer experiences. With innovations like AI-powered automation, fraud detection, and predictive analytics, financial institutions can streamline processes, reduce costs, and provide more tailored services to their customers. As AI continues to evolve, it offers BFSI firms a powerful tool to stay competitive in an increasingly digital and data-driven world.

However, the adoption of AI comes with its own set of challenges, including data privacy concerns, regulatory compliance, and the need for skilled talent. To successfully navigate these challenges and unlock the full potential of AI, BFSI firms must partner with experienced AI providers like SmartDev. By embracing generative AI technologies, firms can not only transform their operations but also position themselves for long-term growth and innovation in the rapidly evolving financial landscape.

Key Drivers of AI Adoption in Financial Institutions

Key Drivers of AI Adoption in Financial Institutions

1. Improved Efficiency and Cost Reduction

1. Improved Efficiency and Cost Reduction 1. Data Privacy and Security Concerns

1. Data Privacy and Security Concerns The Role of SmartDev in Empowering BFSI Firms with Generative AI

The Role of SmartDev in Empowering BFSI Firms with Generative AI The Benefits of Partnering with SmartDev for BFSI Firms

The Benefits of Partnering with SmartDev for BFSI Firms