The landscape of Banking, Financial Services, and Insurance (BFSI) is undergoing a profound transformation driven by generative AI in BFSI market trends that are reshaping everything from customer engagement to risk management. As we navigate through 2025, CTOs face both unprecedented opportunities and complex challenges in harnessing this technology’s potential.

Market Overview: The Generative AI Inflection Point in Banking

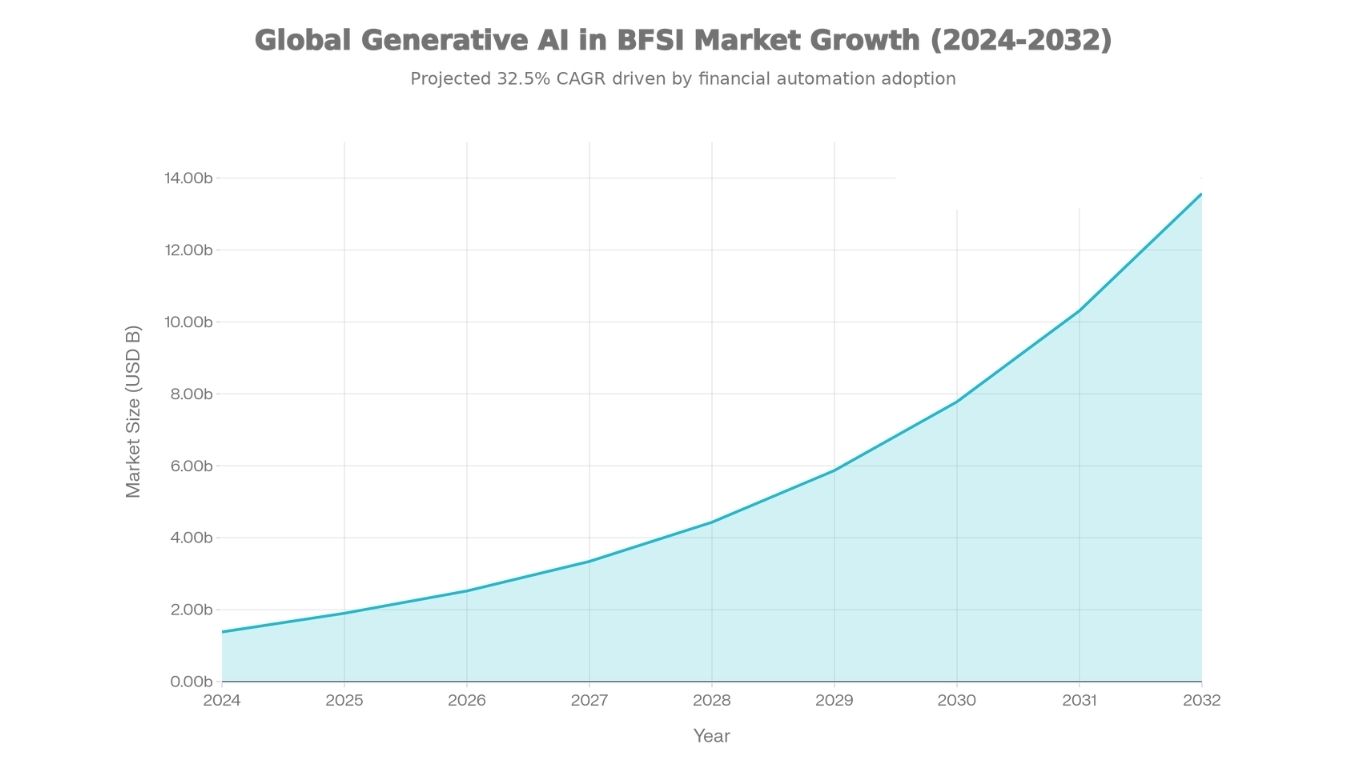

2025 marks a critical inflection point for generative AI adoption in BFSI. The global market has reached USD 1.38 billion in 2024 and is projected to grow to USD 1.90 billion in 2025, with an impressive compound annual growth rate (CAGR) of 32.5% through 2032. This exponential growth reflects the technology’s transition from experimental pilots to strategic, enterprise-wide deployment across financial institutions worldwide.

According to McKinsey’s comprehensive research on AI in banking, generative AI has the potential to create between $200 billion and $340 billion in annual value for the banking industry, equivalent to 9-15% of operating profits. For CTOs, this isn’t just another technology trend, it’s a strategic imperative that will determine competitive positioning for the next decade.

From Experimentation to Production: Understanding Current Adoption Patterns

The generative AI in BFSI market trends reveal a significant maturation in how financial institutions approach AI implementation. Recent data shows that 52% of financial services organizations are actively using generative AI in 2024, up from 40% in 2023. However, a critical gap exists: only 8% of banks are developing generative AI strategically at the enterprise level as of late 2024.

This disparity represents both a challenge and an opportunity. While 78% of banks are now adopting generative AI tactically in 2024—a dramatic increase from previous years—the transition from tactical deployment to strategic transformation remains the key differentiator between market leaders and followers.

A comprehensive Deloitte survey on generative AI financial services pioneers reveals that organizations rating themselves as having high or very high generative AI expertise are seeing substantially greater returns. Nearly half (47%) of pioneers report that ROI from their advanced generative AI initiatives exceeds expectations, compared to only 17% of followers.

For CTOs looking to move from tactical to strategic AI implementation, SmartDev’s AI transformation roadmap provides a proven framework for enterprise-scale deployment.

Fraud Detection: Leading Application with 50% Improvement Potential

Fraud detection has emerged as the largest segment in generative AI in BFSI market trends, driven by the technology’s ability to process real-time data, identify subtle patterns, and continuously adapt to evolving fraud techniques.

Impact metrics:

-

50% projected reduction in fraud rates by 2025

-

56% of executives report GenAI proficiency in fraud detection

-

40-60% reduction in false positives through advanced pattern recognition

-

Capability to simulate rare fraud scenarios using synthetic datasets

According to research on AI in banking, Generative Adversarial Networks (GANs) are particularly effective at identifying anomalous transactions by training on both real and synthetic fraud patterns. This approach is especially valuable when fraudulent activities represent only 0.1-2% of total transactions.

For detailed guidance, explore SmartDev’s AI use cases in digital banking.

Customer Experience Enhancement: The Primary Business Driver

Customer experience enhancement is the primary reason 64% of financial institutions deploy generative AI. OCBC Bank achieved a 50% efficiency gain after a 6-month AI chatbot trial, optimizing document translation, report summarization, and call transcription.

The hyper-personalization trend:

Current generative AI in BFSI market trends show decisive movement toward hyper-personalization—AI systems analyzing individual customer behaviors to deliver tailored experiences. According to research on hyper-personalization in banking, leading institutions are implementing:

- Real-time behavioral analysis driving personalized product recommendations

- Predictive financial advisory based on individual circumstances

- 68% year-over-year increase in customer engagement (Ma French Bank)

SmartDev’s generative AI development services specialize in customer engagement solutions that balance personalization with privacy protection.

Credit Assessment and Compliance: 25% Time Reduction

Generative AI transforms credit assessment by incorporating behavioral data and alternative information sources that traditional scoring models cannot process.

Measurable outcomes:

- 25% reduction in loan approval time

- 15-20% reduction in default rates through accurate assessment

- 60% reduction in manual document analysis time

- $27 billion annual industry savings in compliance costs through AI automation

Citigroup deployed generative AI to analyze 1,089 pages of new US capital rules, enabling compliance teams to efficiently understand complex regulatory documents across jurisdictions.

For comprehensive insights, read SmartDev’s AI transformation roadmap for financial institutions.

Algorithmic Trading: 40% Productivity Gains

Algorithmic trading represents the fastest-growing generative AI in BFSI market trends segment. According to McKinsey analysis, AI optimization delivers up to 40% productivity gains in core corporate and investment banking operations.

Critical Implementation Challenges in Current Generative AI BFSI Market Trends

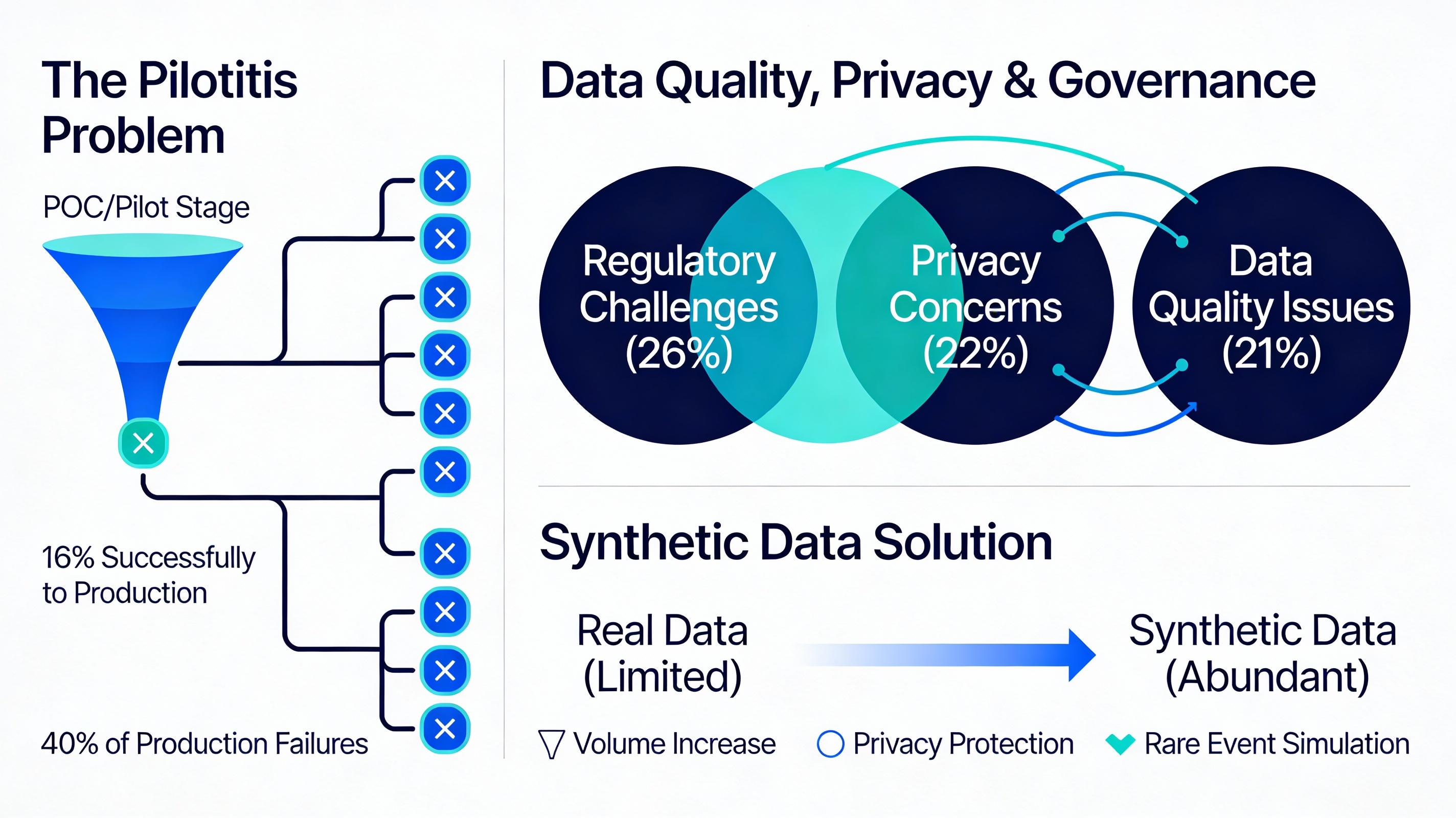

1. The “Pilotitis” Phenomenon: Moving from Proof-of-Concept to Production Scale

One of the most significant generative AI in BFSI market trends is the widespread challenge of “pilotitis”—the difficulty transitioning AI initiatives from small-scale pilots to fully operational, enterprise-grade systems. Current data reveals a sobering reality: only 16% of AI pilots successfully move to production implementation, and among those, 40% fail to achieve planned business outcomes.

Root causes of pilot-to-production failures:

- Lack of clear scalability architecture from pilot inception

- Disconnect between pilot objectives and strategic business imperatives

- Underestimation of data quality and integration requirements at scale

- Insufficient governance frameworks for enterprise deployment

- Legacy system integration complexity underestimated during pilot phase

Strategic solutions from industry leaders:

McKinsey’s research on extracting value from AI in banking emphasizes that successful organizations take a “rewiring” approach—fundamentally restructuring how work gets done rather than simply automating existing processes. This requires:

- Business-first pilot selection: Only pursue pilots tied directly to strategic business problems worth enterprise-scale investment

- Production-ready architecture: Design pilots with production scalability, security, and governance from day one

- Cross-functional teams: Include business, technology, risk, and compliance stakeholders throughout the pilot lifecycle

- Clear success metrics: Define quantifiable business outcomes beyond technical performance metrics

SmartDev’s AI implementation framework addresses pilotitis by incorporating production-readiness requirements into every pilot from inception.

2. Data Quality, Privacy, and Governance: The Foundation Challenge

Among generative AI in BFSI market trends, data-related challenges consistently emerge as the greatest barrier to successful implementation. Current research shows 26% of organizations cite regulatory and compliance data challenges, 22% report data privacy concerns, and 21% struggle with limited access to high-quality training data.

The triple challenge:

- Volume: Generative AI models require massive datasets—often billions of data points—for effective training

- Quality: Training data must be clean, labeled, and representative to avoid biased or inaccurate outputs

- Privacy: Financial data is highly sensitive and subject to strict regulatory requirements (GDPR, CCPA, GLBA, etc.)

Emerging solution: Synthetic Data Generation

One of the most promising generative AI in BFSI market trends is the use of generative AI itself to address data scarcity challenges through synthetic data generation. Gartner research predicts that by 2026, 75% of enterprises will use generative AI to create synthetic customer data for model training, up from less than 5% in 2023.

Benefits of synthetic data in financial services:

- Generate statistically representative data without exposing real customer information

- Simulate rare events (fraud, default, market crashes) using sparse real-world examples

- Balance skewed datasets to improve model performance on minority classes

- Accelerate model development when real data access is constrained by privacy regulations

JPMorgan Chase uses generative models to produce synthetic examples of fraudulent transactions, balancing heavily skewed datasets and dramatically improving fraud detection model performance. Similarly, HSBC has implemented synthetic data for stress testing and scenario analysis, generating market conditions too rare to occur frequently in historical data.

For financial institutions navigating data challenges, SmartDev’s AI and machine learning services include synthetic data generation capabilities that maintain statistical properties while ensuring privacy compliance.

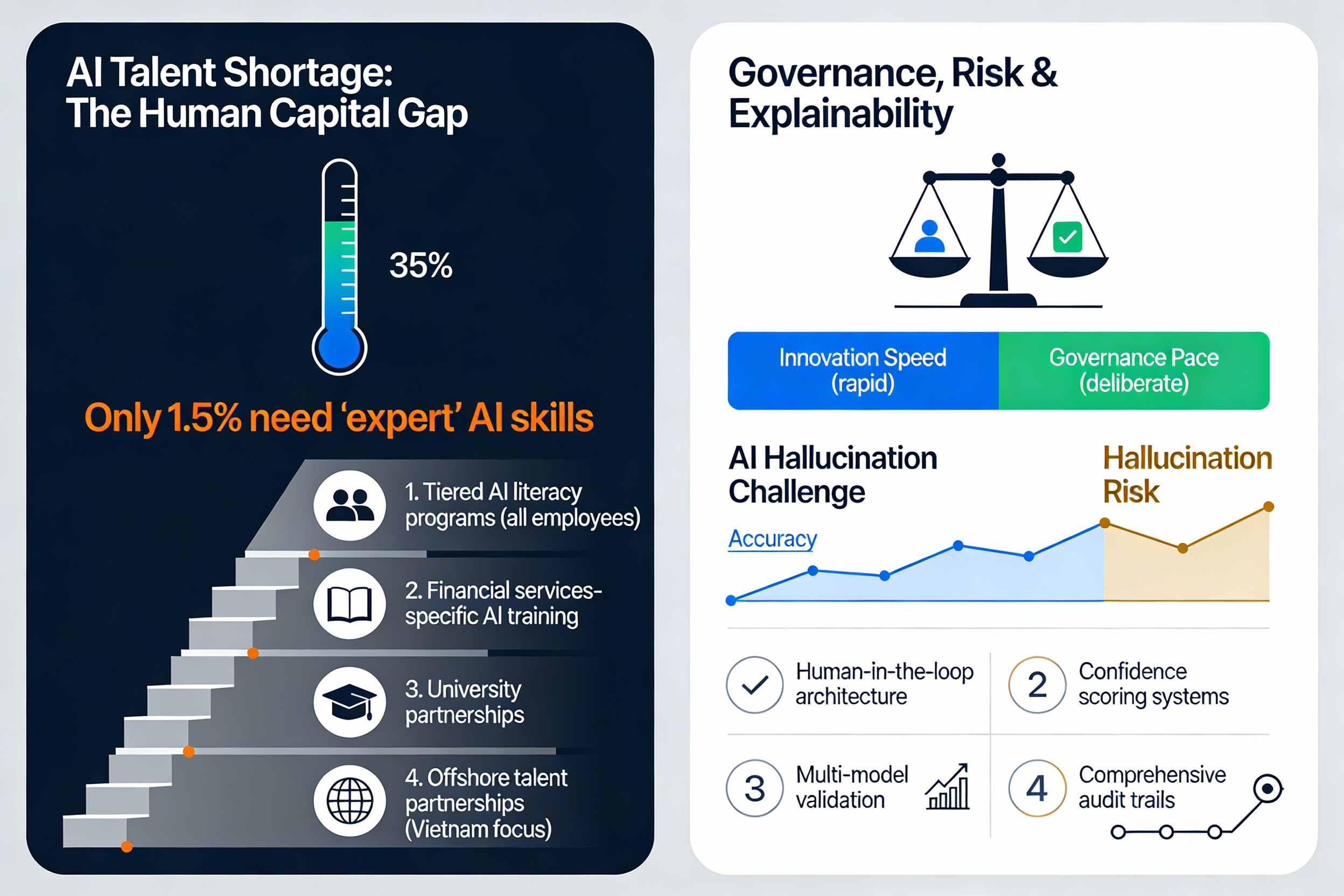

3. AI Talent Shortage: The Human Capital Gap

The AI skills gap represents one of the most critical generative AI in BFSI market trends impacting implementation timelines and success rates. Current research reveals a stark 35 percentage point gap between AI-related skills demand and talent availability in financial services.

The surprising skills insight:

Counter-intuitively, only 1.5% of the financial services workforce requires ‘expert’ AI skills. The greater challenge lies in developing broad AI literacy across the organization and identifying professionals who can bridge technical capabilities with domain expertise.

According to the Financial Services Skills Commission report, demand for relationship management, critical thinking, and ethical judgment skills actually outweighs the need for advanced technical AI skills. This finding suggests that AI development will place increasingly higher value on uniquely human qualities—empathy, contextual understanding, and ethical reasoning—rather than complete replacement of human judgment.

Strategic talent development approaches:

- Tiered AI literacy programs: Basic AI understanding for all employees, intermediate skills for managers, advanced capabilities for technical teams

- Financial services-specific AI training: Focus on BFSI applications, regulatory requirements, and domain-specific challenges

- University partnerships: Collaborate with institutions developing AI curricula tailored to financial services

- Offshore talent partnerships: Leverage emerging AI development hubs like Vietnam to access cost-effective, high-quality AI talent

- SmartDev’s position in Vietnam’s emerging AI ecosystem provides clients access to a rapidly expanding pool of AI specialists trained specifically in financial services applications.

4. Governance, Risk, and Explainability: Balancing Innovation with Control

A critical tension in current generative AI in BFSI market trends is the mismatch between traditional banking governance’s deliberate pace and AI development’s rapid, iterative nature. Organizations that develop agile, risk-proportionate governance frameworks will succeed; those that apply traditional waterfall governance to AI initiatives will fall behind.

The AI Hallucination Challenge:

One of the most significant risks in generative AI in BFSI market trends is the potential for “AI hallucinations”—instances where generative models produce plausible-sounding but factually incorrect outputs. In financial services, where accuracy in credit decisions, investment advice, and compliance reporting is paramount, hallucinations pose serious risks.

Current best practices for risk mitigation:

- Human-in-the-loop architecture: Use generative AI as a powerful assistant, but maintain human oversight for critical decisions

- Confidence scoring: Implement systems that flag low-confidence outputs for additional review

- Multi-model validation: Cross-check critical outputs across multiple AI models to identify inconsistencies

- Comprehensive audit trails: Maintain detailed logging of AI decision factors for regulatory review

5. Explainable AI (XAI): From Best Practice to Regulatory Requirement

Among evolving generative AI in BFSI market trends, the shift from opaque “black box” AI to explainable AI systems represents both a regulatory mandate and a competitive advantage. With regulations like GDPR’s “right to explanation” and the EU AI Act, XAI is transitioning from optional to mandatory.

Regulatory drivers for XAI adoption:

- GDPR Article 22: Rights regarding automated decision-making and profiling

- EU AI Act: Transparency obligations for high-risk AI systems, including credit scoring and insurance underwriting

- US Fair Lending Laws: Requirements to explain credit decisions and identify potential discrimination

- Model Risk Management (SR 11-7): Federal Reserve guidance requiring model validation and governance

XAI applications in financial services:

- Loan approvals: Explain specific factors (credit history, income, debt-to-income ratio) and their weights in credit decisions

- Fraud detection: Detail why specific transactions trigger alerts, not just flagging them as suspicious

- AML compliance: Justify AI-generated suspicious activity reports with specific risk factors

- Investment recommendations: Explain the reasoning behind AI-generated investment advice

According to CFA Institute research on explainable AI in finance, SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations) methods are becoming industry standards for explaining AI decisions in credit scoring and fraud detection.

For more on implementing explainable AI in financial services, explore SmartDev’s approach to AI governance.

Ready to cut defect costs by $1.25M annually with computer vision?

Most manufacturers overshoot budgets by 40-60% on first deployment. SmartDev helps you evaluate real CV system pricing, compare costs, and calculate accurate ROI before implementation. Understand hardware ($50K-$150K), software ($30K-$300K), integration complexity, and hidden costs. Build a pilot strategy that delivers 12-18 month payback.

Get transparent pricing, vendor comparison, and ROI analysis tailored to your production line.

Schedule Your Manufacturing AI Cost Analysis TodayEmerging Generative AI in BFSI Market Trends 2025-2026

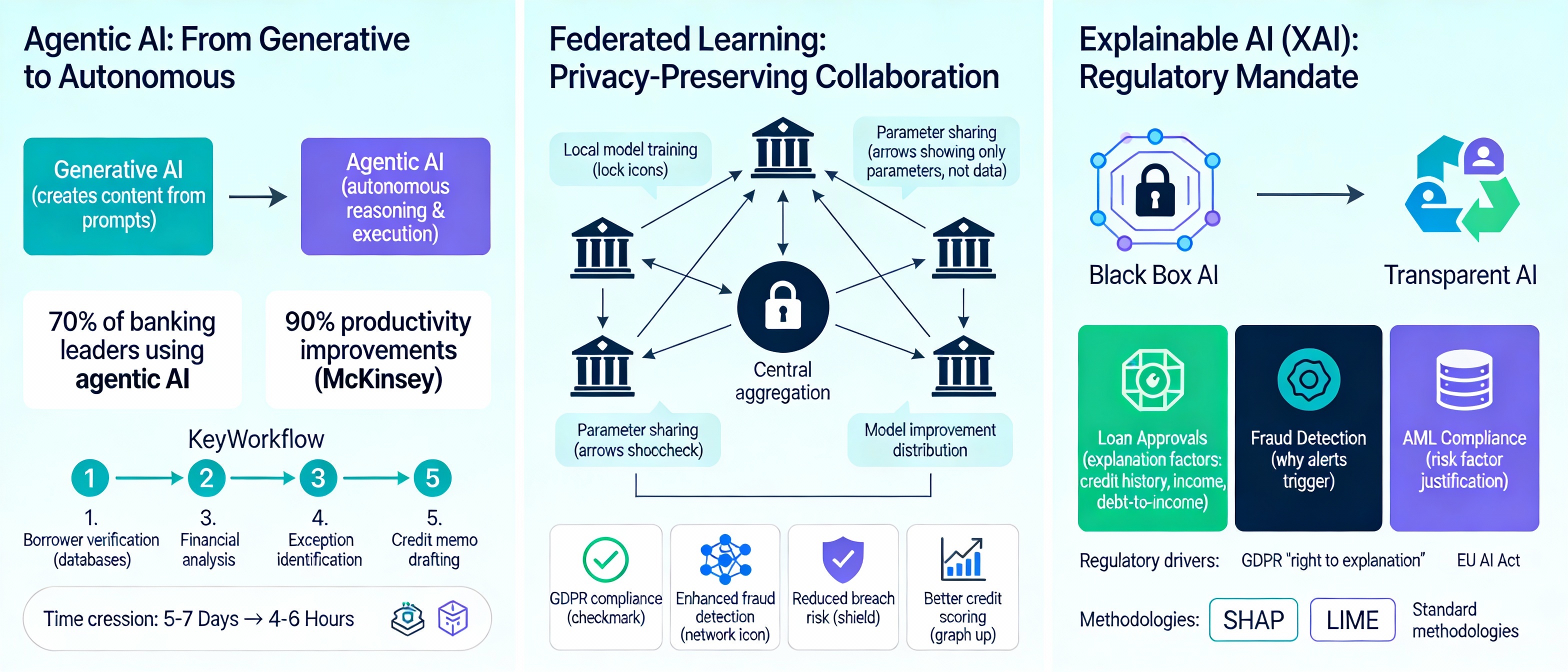

Agentic AI: From Generative to Autonomous

The most transformative among generative AI in BFSI market trends is agentic AI—systems capable of independent reasoning, goal-setting, and complex task execution. Unlike generative AI that creates content based on prompts, agentic AI autonomously pursues objectives.

Expected impact:

- 70% of banking leaders acknowledge using agentic AI to some extent

- McKinsey projects up to 90% productivity improvements in core operations

- Deloitte research on agentic AI in banking demonstrates dramatic efficiency gains across credit assessment, treasury, and fraud detection

Real-world application: In commercial lending, agentic AI simultaneously:

- Verifies borrower information across multiple databases

- Analyzes financial statements to assess creditworthiness

- Checks compliance requirements automatically

- Identifies policy exceptions requiring human review

- Drafts credit memos with supporting analysis

This parallel processing compresses timelines from 5-7 business days to 4-6 hours while improving accuracy and consistency.

For more insights, read MIT Technology Review’s analysis on agentic AI in banking.

Federated Learning: Privacy-Preserving Collaboration

Among generative AI in BFSI market trends, federated learning represents a breakthrough approach enabling collaboration without centralized data sharing.

How it works:

- Each institution trains models locally on proprietary data

- Shares only model parameters, never raw data

- Central server aggregates updates to improve global models

Benefits:

- GDPR and privacy regulation compliance

- Enhanced fraud detection through inter-organizational collaboration

- Reduced data breach risk no central “honeypot”

- Improved credit scoring through multi-source learning

Lucinity has achieved two patents for federated learning technology, establishing standards for privacy-conscious financial crime prevention.

Explainable AI: Regulatory Mandate Emerging Now

With GDPR’s “right to explanation” and the EU AI Act mandating transparency, explainable AI (XAI) is transitioning from optional to essential.

XAI applications in BFSI:

- Loan approvals: Explain specific factors (credit history, income, debt-to-income ratio) influencing decisions

- Fraud detection: Detail why transactions trigger alerts, not just flagging them

- AML compliance: Justify suspicious activity reports with specific risk factors

CFA Institute research shows SHAP and LIME methods are becoming standards for explaining AI decisions in credit scoring and fraud detection.

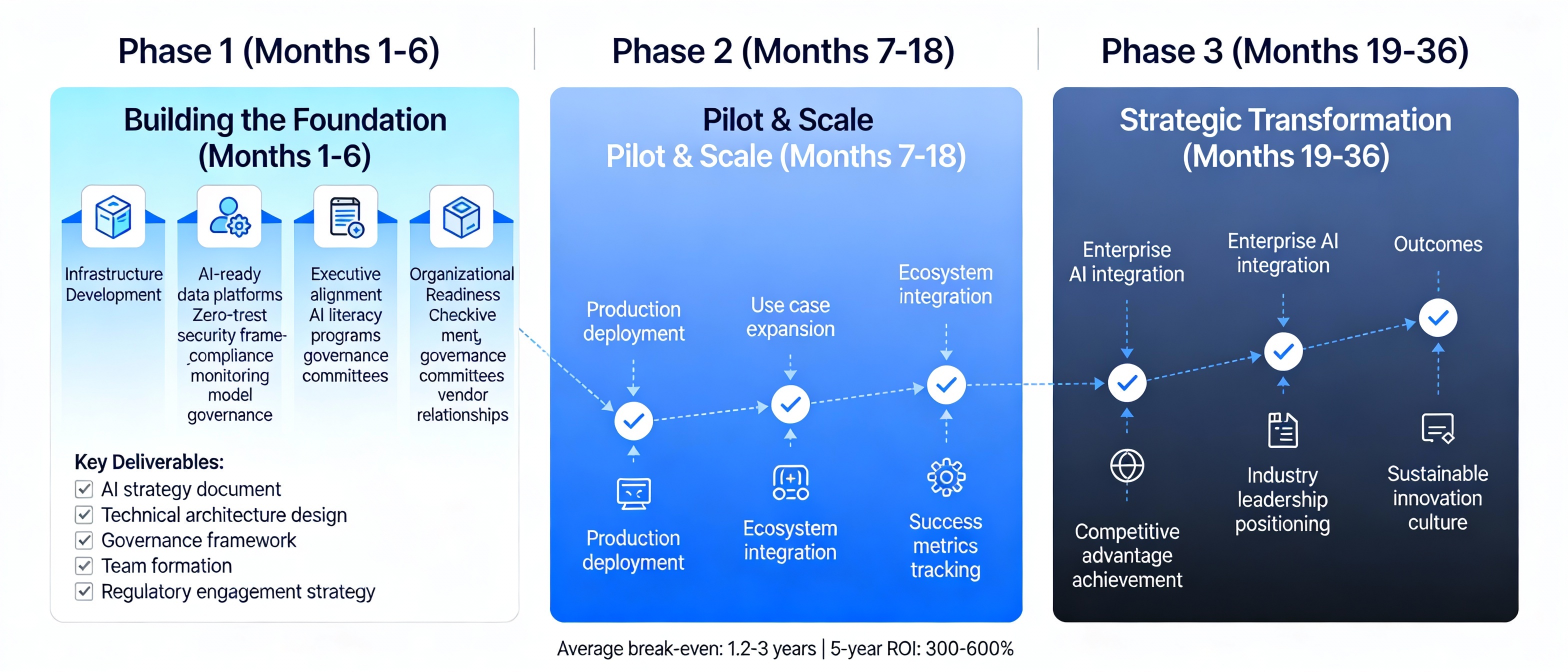

Strategic Implementation Roadmap: From Foundation to Transformation

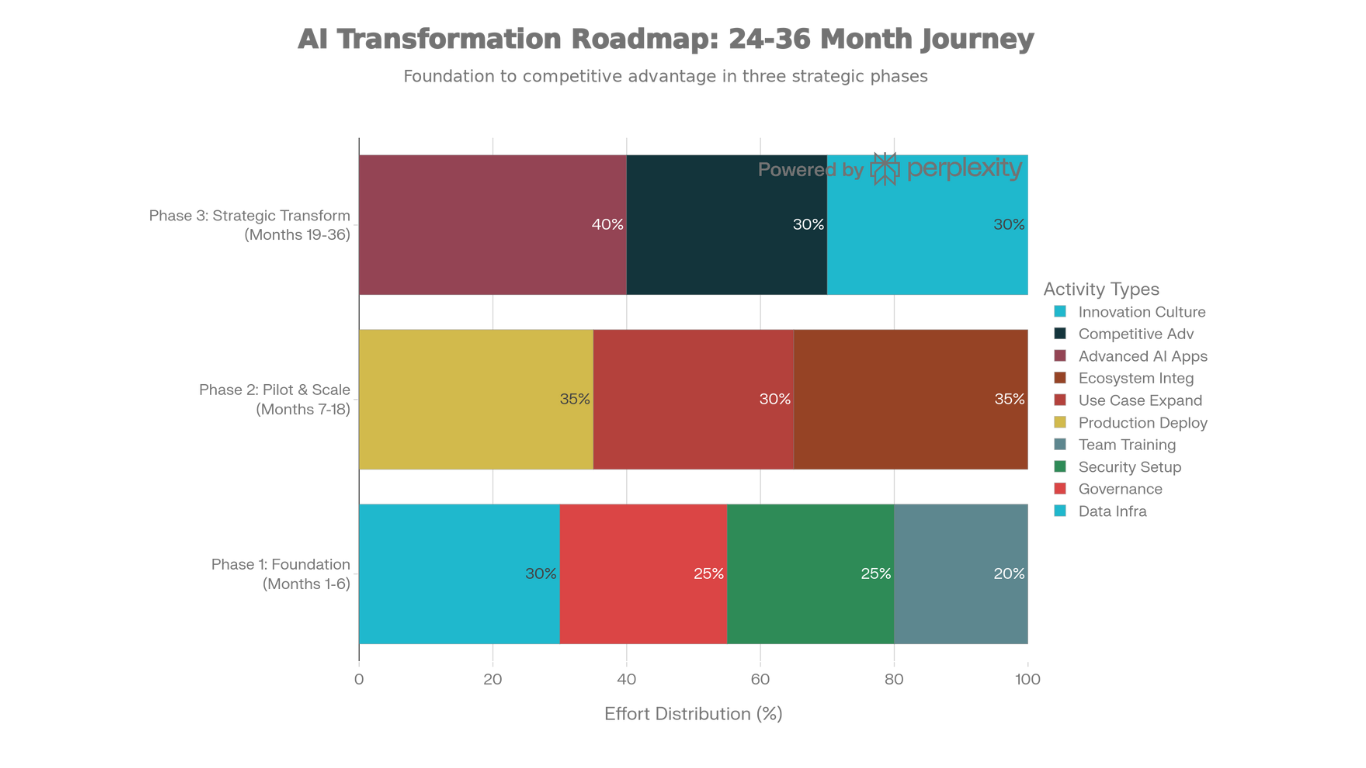

For CTOs navigating generative AI in BFSI market trends, a structured implementation roadmap is essential. Based on SmartDev’s proven framework for financial institution AI transformation, successful deployment follows three distinct phases.

Phase 1: Building the Foundation (Months 1-6)

The foundation phase establishes infrastructure, governance, and organizational capabilities necessary for sustainable AI transformation. This phase focuses on preparation rather than immediate AI deployment—creating conditions for long-term success.

Infrastructure development priorities:

- AI-ready data platforms: Modern data architectures with comprehensive lineage tracking, data quality monitoring, and governance controls

- Security frameworks: Zero-trust architecture, encryption at rest and in transit, and access controls designed specifically for AI workloads

- Compliance monitoring: Real-time alerting systems for regulatory violations, model drift, and data quality degradation

- Model governance: Processes for model validation, performance monitoring, bias testing, and regulatory approval

Organizational readiness:

- Executive alignment: Secure C-suite sponsorship and cross-functional leadership commitment

- AI literacy programs: Tiered training providing appropriate AI understanding for all organizational levels

- Governance committees: Cross-functional teams including business, technology, risk, compliance, and legal representatives

- Vendor relationships: Evaluate and select strategic partners for specialized capabilities

Key deliverables:

- Comprehensive AI strategy document aligned with business objectives

- Technical architecture design approved by architecture review board

- Governance framework with clear escalation paths and decision rights

- Initial team formation and capability assessment

- Regulatory engagement strategy for early regulator dialogue

For detailed guidance on building AI foundations, explore SmartDev’s comprehensive AI development services.

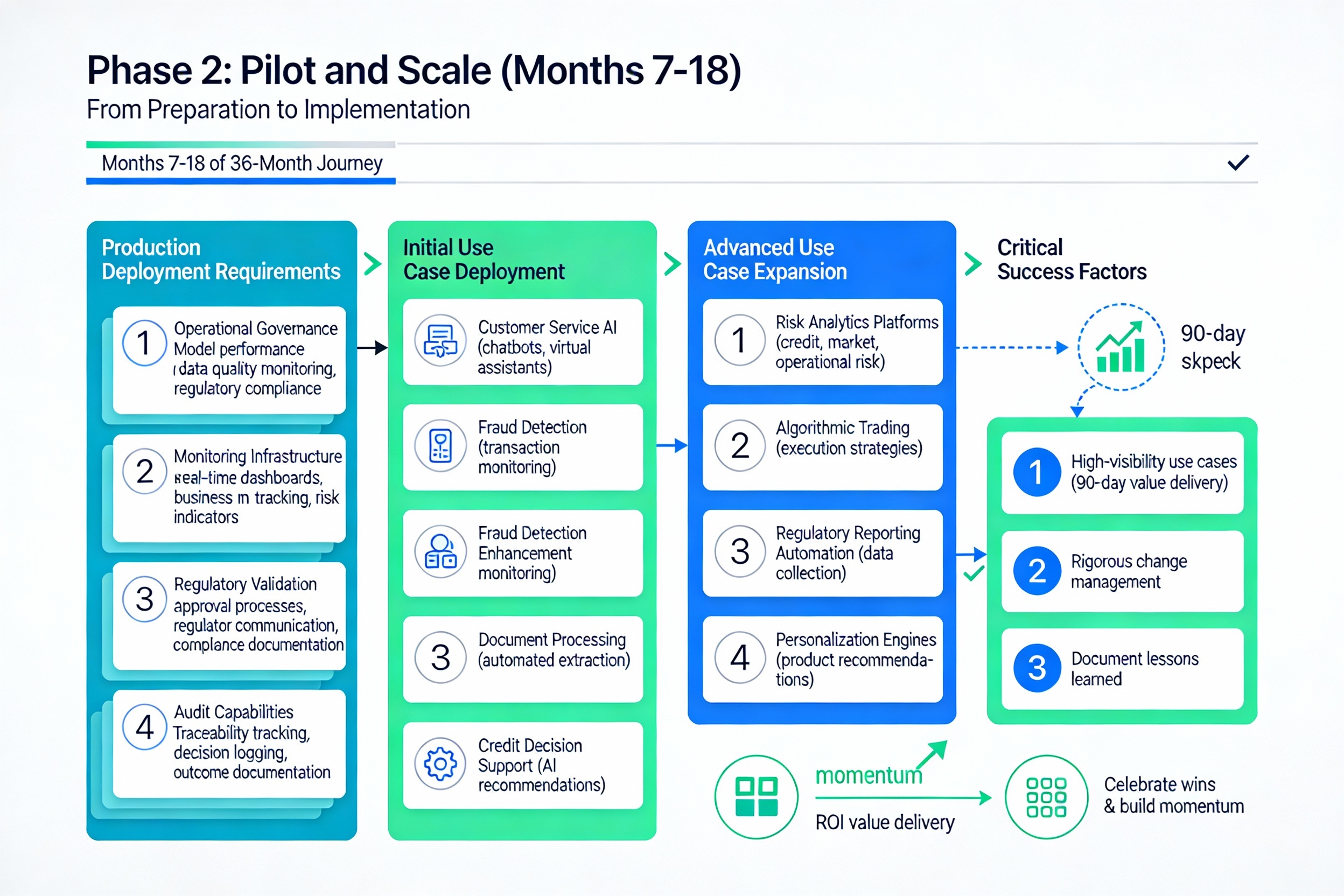

Phase 2: Pilot and Scale (Months 7-18)

This phase transitions from preparation to implementation, deploying initial AI applications in controlled environments with rigorous monitoring and governance oversight.

Production deployment requirements:

- Operational governance: Comprehensive frameworks actively managing model performance, data quality, and regulatory compliance

- Monitoring infrastructure: Real-time dashboards tracking business metrics, technical performance, and risk indicators

- Regulatory validation: Documented approval processes and ongoing regulator communication

- Audit capabilities: Complete traceability from model inputs through decisions to business outcomes

Initial use case deployment:

- Customer service AI: Intelligent chatbots and virtual assistants handling routine inquiries

- Fraud detection enhancement: AI-augmented transaction monitoring with reduced false positives

- Document processing: Automated extraction and analysis of structured and unstructured documents

- Credit decision support: AI-powered analysis providing recommendations to underwriters

Advanced use case expansion:

- Risk analytics platforms: Comprehensive credit, market, and operational risk modeling

- Algorithmic trading enhancements: AI-optimized execution strategies and market making

- Regulatory reporting automation: Automated data collection, validation, and submission

- Personalization engines: Real-time product recommendations and customer journey optimization

Critical success factors:

- Start with high-visibility use cases delivering measurable business value within 90 days

- Maintain rigorous change management to drive organizational adoption

- Document lessons learned to accelerate subsequent deployments

- Celebrate wins to build organizational confidence and momentum

Phase 3: Strategic Transformation (Months 19-36)

The final phase focuses on deploying advanced AI applications that create sustainable competitive advantage while establishing industry leadership in responsible AI deployment.

Enterprise-wide AI integration:

- Core system transformation: AI embedded in critical banking systems (core banking, payment processing, risk management)

- Ecosystem partnerships: AI-enabled collaboration with fintechs, regulators, and industry consortia

- Innovation culture: Sustainable processes for continuous AI experimentation and improvement

- Thought leadership: Industry recognition as an AI leader through publications, conferences, and regulatory engagement

Critical timeline milestones:

- Quick wins (0-90 days): Deploy process automation pilots, deliver immediate value, build organizational confidence

- Foundation completion (12 months): Full AI infrastructure operational, governance frameworks validated, initial use cases in production

- Scaled deployment (24 months): Multiple use cases across business units, measurable business impact, organizational AI literacy established

- Strategic transformation (36 months): AI-native operating model, competitive differentiation, industry leadership positioning

ROI and break-even expectations:

According to IDC research on enterprise AI implementations, successful organizations typically experience three distinct investment phases:

- Learning (months 1-12): Net investment as infrastructure and capabilities are built

- Adaptive break-even (months 13-24): Initial use cases begin generating returns offsetting ongoing investment

- ROI acceleration (months 25-36): Scaled deployment generates substantial returns exceeding total investment

Average break-even for enterprise financial institution AI transformations is 1.2-3 years, with long-term ROI ranging from 300-600% over five years.

Michael Tang, Deloitte’s AI transformation lead for financial services, notes: “You can achieve visible value in 90 days, but long-term transformation for compliance and competitive advantage takes 24-36 months and sustained investment. Organizations that treat AI as a quick fix invariably fail; those that view it as fundamental business transformation succeed”.

2026 Predictions: The Future of Banking is Intelligent, Real-Time, and Human-Centric

As generative AI in BFSI market trends continue evolving, a clear vision for 2026 emerges: banking will be intelligent, connected, and paradoxically more human-focused despite extensive AI deployment. Six defining trends shaping 2026:

1. Real-time data and ISO 20022 ubiquity

The transition to ISO 20022 messaging standards enables rich, structured data flows through open APIs, facilitating real-time decisioning and seamless ecosystem collaboration. Financial institutions will leverage this data richness for AI applications previously constrained by legacy data formats.

2. Agentic AI embedded in core banking infrastructure

Rather than bolt-on applications, agentic AI will be deeply integrated into core banking systems, autonomously fixing transaction errors, reconciling accounts, initiating compliance updates, and managing liquidity in real-time.

3. Tokenized money and programmable finance

Digital assets and tokenized money will enable programmable, conditional payments executed autonomously by AI agents based on predefined business logic, transforming treasury operations, trade finance, and cross-border payments.

4. Zero Trust Architecture as standard

Following regulatory mandates including RBI’s 2025 cybersecurity requirements, Zero Trust Architecture will become standard for financial institutions by H1 2026, with AI playing a critical role in continuous authentication, anomaly detection, and threat response.

5. Self-healing, autonomous banking ecosystems

Financial institutions will transition from reactive incident response to self-guiding, self-healing systems where AI agents detect issues, diagnose root causes, implement fixes, and learn from resolutions autonomously.

6. Competition from AI-native challengers

Next-generation AI-native financial services firms will emerge, built from the ground up around agentic AI capabilities, competing on agility, personalization depth, and operational efficiency that legacy institutions struggle to match.

For comprehensive 2026 predictions, read CGI’s analysis on the future of banking and SAS’s expert predictions for banking in 2026.

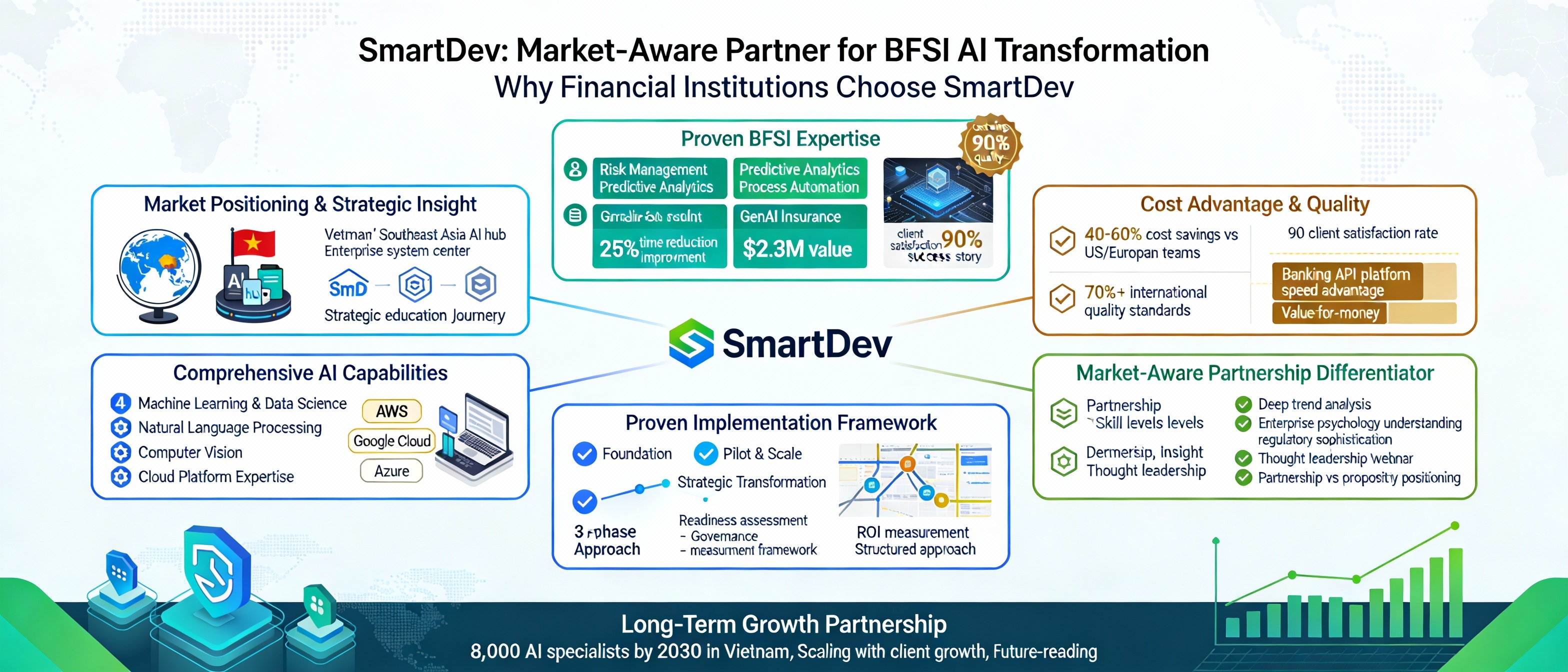

SmartDev: Your Market-Aware Partner for BFSI AI Transformation

In navigating rapidly evolving generative AI in BFSI market trends, selecting the right technology partner is critical for success. SmartDev positions itself not as a commodity vendor, but as a strategic partner with deep understanding of both market dynamics and implementation realities.

Why SmartDev Stands Out

1. Market positioning and strategic insight

SmartDev’s position in Vietnam’s emerging AI ecosystem provides unique advantages. As enterprises educate themselves about Vietnam’s AI talent and offshore opportunities, they simultaneously develop sophistication about offshore engagement models precisely SmartDev’s positioning.

2. Proven BFSI expertise delivering measurable outcomes

SmartDev provides customized generative AI solutions for BFSI including:

- Risk Management AI: Advanced fraud detection and credit risk assessment

- Predictive Analytics: Financial forecasting, credit scoring, portfolio optimization

- Process Automation: Claims processing, document intelligence, KYC automation

- GenAI for Insurance: Risk assessment automation, personalized recommendations

Case study: A SmartDev BFSI client reduced loan approval time by 25% while improving portfolio quality by 15%, achieving $2.3M annual value. Read the full case study: How AI is Shaping the Future of Employee Finance.

3. Cost advantage with international quality standards

SmartDev combines:

- 40-60% cost savings compared to US/European teams

- 90% client satisfaction for completed projects

- 70%+ of deliverables meeting international quality standards

- One of the fastest banking API integration platforms in the industry

4. Comprehensive AI capabilities across key domains

SmartDev maintains deep expertise across BFSI-critical areas:

- Machine Learning & Data Science: Model development, feature engineering, production deployment

- Natural Language Processing: Chatbots, document processing, sentiment analysis

- Computer Vision: Document verification, fraud detection, image analysis

- Cloud Platform Expertise: AWS, Google Cloud, Azure certifications

5. Proven implementation framework

SmartDev’s AI transformation roadmap specifically addresses financial institution requirements, including:

- 3-phase structured approach (Foundation, Pilot & Scale, Strategic Transformation)

- Comprehensive readiness assessment

- Governance frameworks aligned with regulatory requirements

- Continuous ROI measurement and optimization

Unique Value: Market-Aware Partnership

SmartDev differentiates through genuine market awareness:

- Deep trend analysis: Educating clients on emerging generative AI in BFSI market trends rather than merely responding to requests

- Enterprise psychology: Transparently addressing offshore partnership concerns and risk mitigation

- Regulatory sophistication: Understanding financial services complexity and governance requirements

- Thought leadership: Contributing industry insights through webinars on AI and BFSI synergies

Long-Term Growth Partnership

With Vietnam graduating 8,000 AI specialists annually by 2030, SmartDev is positioned to scale alongside ecosystem growth, ensuring clients benefit from expanding talent with specialized financial services AI expertise.

Conclusion: Strategic Imperatives for CTOs in the Generative AI Era

As generative AI in BFSI market trends accelerate, CTOs face a defining moment: lead the transformation or risk competitive displacement. With the market projected to reach $13.57 billion by 2032 and 80% of banks believing non-AI-adopters will fall behind, the strategic imperative is clear.

SmartDev exemplifies this strategic partner profile, combining deep BFSI domain expertise, comprehensive AI capabilities, cost-effective delivery, and genuine market-aware partnership approach.

Ready to accelerate your AI transformation?

Visit smartdev.com to explore how our market-aware partnership approach can help you navigate generative AI in BFSI market trends and achieve measurable business outcomes.

Contact SmartDev today to schedule a consultation and discover how we can help you implement scalable, secure AI solutions that drive competitive advantage.