Introduction

Generative AI chatbots are rapidly transforming customer service in banking. Unlike rule-based bots, they use natural language processing (NLP) and machine learning to deliver human-like interactions at scale. For banks, this means shorter wait times, personalized assistance, and 24/7 support—all while reducing operational costs.

But what does it actually cost to develop generative AI chatbots for customer service in banking? The answer is complex. Costs depend on the level of customization, security requirements, integration needs, and the scale of deployment. Some banks can launch a pilot with $50,000, while enterprise-grade implementations may exceed $1 million when factoring compliance, hosting, and ongoing optimization.

This guide breaks down everything you need to know—from cost factors and case studies to budgeting strategies and future trends—so banking leaders can make informed decisions.

Understanding Generative AI Chatbots for Customer Service in Banking

Definition of the generative AI chatbots?

Generative AI chatbots go beyond scripted responses, delivering real-time, contextually relevant answers for banking customers.

Generative AI chatbots represent the next stage of conversational AI evolution. Rather than relying on pre-written scripts or decision trees, these systems generate responses in real time, drawing on natural language processing and machine learning to craft contextually relevant answers.

For banking customer service, this capability is particularly important. A customer inquiring about a mortgage payment, for example, may phrase their question in dozens of different ways. A generative chatbot can recognize intent, pull the right information from integrated systems, and respond in a way that feels natural to the customer.

This adaptability stands in stark contrast to traditional bots, which often frustrate users by failing to recognize variations in phrasing. Learn how enterprises are building smarter, faster, and more secure solutions in our detailed guide on Generative AI Development Services

Key differences from traditional chatbots

When comparing generative AI chatbots with their traditional predecessors, the differences are stark. Traditional chatbots are essentially rule-based systems. They are only as smart as the scripts written for them, and when faced with unexpected inputs, they quickly reach their limits.

Generative AI, on the other hand, continuously learns and improves through exposure to new data, retraining, and feedback. This makes them capable of handling complex multi-step conversations, such as walking a customer through loan eligibility or resolving disputes. For banks striving to build digital trust and provide superior customer service, the move toward generative AI is less about a competitive edge and more about long-term survival in a rapidly shifting industry.

Benefits of generative AI chatbots in customer service in banking

1. 24/7 Availability for Banking Customers

One of the most immediate advantages of generative AI chatbots in banking is the ability to provide uninterrupted service. Unlike human agents, who are bound by working hours, AI-powered assistants are available around the clock. This means customers can get answers to their queries whether it’s a weekday afternoon or a late-night weekend. For an industry that thrives on trust and responsiveness, being able to serve clients at any hour builds stronger relationships and reduces frustration.

Banks that deploy 24/7 chatbots also notice a significant reduction in abandoned requests. When a customer doesn’t have to wait until the next business day for a response, their likelihood of completing transactions—whether that’s checking account details, paying bills, or even starting a loan application—rises dramatically. The result is not just improved customer experience but also increased opportunities for revenue.

2. Cost Savings through Automation

Generative AI chatbots can substantially reduce the financial burden associated with customer service in banking. Traditionally, call centers represent one of the largest recurring costs for financial institutions, as they require staffing, training, and infrastructure. With AI handling a significant portion of routine inquiries, banks can reduce workloads for human agents by as much as 30 to 50 percent. This translates into millions of dollars in annual savings for larger institutions and measurable efficiency gains even for smaller community banks.

The savings extend beyond staffing. Automating repetitive interactions minimizes error rates, shortens handling times, and allows institutions to allocate human expertise toward more complex, revenue-generating activities. Over time, the compounding effect of these efficiencies strengthens a bank’s operating margin, making generative AI not only a customer experience tool but also a driver of financial performance.

Explore real-world strategies to streamline processes and boost productivity in our guide on Unlocking Operational Efficiency with AI

3. Personalization at Scale

Another transformative benefit of generative AI chatbots is their ability to deliver personalized interactions. Unlike traditional systems that rely on static responses, generative models can adapt based on a customer’s profile, transaction history, and prior interactions. For example, instead of offering a generic message about loan options, a chatbot can recommend products aligned with the customer’s financial behavior or suggest savings tips tailored to their spending patterns.

This level of personalization was once the exclusive domain of in-branch advisors, but AI now makes it possible to extend the same experience across digital channels. The impact is significant: customers feel understood and valued, which strengthens trust and loyalty. In a competitive landscape where digital-first challenger banks are rapidly gaining ground, personalization at scale gives traditional banks a critical edge.

4. Scalability During High-Demand Periods

Banking demand is rarely static. Seasonal events such as tax season, year-end reconciliations, or even sudden economic shifts can lead to massive spikes in customer inquiries. Traditionally, banks have had to staff up call centers in anticipation of these surges, an expensive and inefficient process. Generative AI chatbots change this dynamic by offering instant scalability. They can handle thousands of simultaneous conversations without any degradation in service quality.

This scalability ensures customers aren’t left waiting during critical moments, which is vital for maintaining trust in financial services. At the same time, it allows banks to avoid overinvesting in temporary staff who may only be needed for a few weeks each year. By matching resources with demand more efficiently, generative AI offers both cost stability and enhanced customer experience.

5. Continuous Learning and Improvement

Unlike static rule-based systems, generative AI chatbots are designed to learn from interactions and improve over time. Every customer conversation contributes to refining the model, enhancing its ability to interpret intent, detect sentiment, and provide accurate responses. This means the chatbot becomes more valuable with continued use, delivering better experiences month after month.

For banks, this continuous improvement is not just about efficiency—it also reduces long-term costs. Instead of requiring extensive manual updates to scripts, the system evolves organically, needing only periodic fine-tuning and retraining. Over the years, this adaptability ensures the chatbot stays aligned with changing customer expectations, regulatory requirements, and product offerings. In essence, it future-proofs the investment, ensuring that the value delivered keeps growing while the marginal cost of improvement declines.

Challenges of Implementing Generative AI Chatbots in Banking Customer Service

1. Data Privacy and Security Risks

Perhaps the most pressing challenge banks face when deploying generative AI chatbots is data privacy and security. Customer interactions often involve highly sensitive information—account balances, transaction histories, loan details, and personally identifiable data. Any mishandling of this information could lead to severe reputational damage, regulatory penalties, and loss of customer trust. While generative AI models can be trained to follow strict protocols, they also increase the attack surface for cybercriminals looking to exploit vulnerabilities.

Banks must therefore invest heavily in encryption, secure hosting environments, and continuous monitoring. Beyond technology, they also need to align with global regulations such as GDPR in Europe and PCI-DSS for payment data. Compliance adds additional cost and complexity, which must be factored into both initial budgets and ongoing maintenance.

Siloed systems and scattered data can cripple decision-making and slow growth. Discover how AI is helping organizations unify, clean, and unlock value from their data faster and smarter. Explore the full article to see how AI transforms data chaos into clarity.

2. Integration with Legacy Systems

A second major challenge is integration. Many banks still operate on decades-old core banking systems that were never designed to communicate with AI-driven applications. Building secure, reliable bridges between generative chatbots and these legacy systems is technically demanding and often expensive. Without seamless integration, the chatbot risks being little more than a glorified FAQ system, unable to access real-time account data or execute transactions.

This integration hurdle is not only about technology but also about organizational readiness. IT teams may be stretched thin maintaining critical infrastructure, and layering AI on top adds another set of requirements. The result is often longer timelines, higher costs, and greater risk of project delays compared to industries with more modern digital backbones.

3. Bias and Accuracy of AI Responses

Generative AI chatbots rely on the quality of the data used to train them. If that data contains biases or inaccuracies, the chatbot may produce flawed or unfair responses. In banking, where customer trust hinges on impartiality and precision, this risk cannot be overlooked. A biased loan recommendation or an inaccurate fraud alert could have real-world financial consequences for customers and trigger regulatory scrutiny.

Ensuring accuracy requires continuous monitoring and retraining of the chatbot on up-to-date, representative datasets. This is resource-intensive, demanding not only technical expertise but also governance frameworks that include ethics reviews and bias audits. For many institutions, managing these risks is as challenging as the technical development itself.

4. High Development and Maintenance Costs

While the long-term cost savings of generative AI chatbots can be significant, the upfront and ongoing investments are substantial. Initial development may require hundreds of thousands of dollars, and maintenance—including model retraining, compliance updates, and infrastructure costs—can quickly accumulate. For smaller banks with limited IT budgets, these expenses can be prohibitive, leaving them reliant on off-the-shelf solutions that may not fully meet their needs.

Even for large institutions, the financial challenge lies in justifying the investment against competing priorities. Every dollar allocated to chatbot development is a dollar not spent on other digital initiatives, such as mobile banking apps or fraud prevention systems. Decision-makers must weigh these trade-offs carefully to ensure the investment in AI aligns with long-term business strategy.

5. Customer Adoption and Trust

Finally, no matter how advanced a generative AI chatbot may be, its success ultimately depends on whether customers are willing to use it. Some customers, particularly older demographics, may be hesitant to trust an AI with sensitive financial inquiries. Others may prefer the reassurance of human interaction when dealing with complex or high-stakes issues. This creates a barrier to adoption that cannot be solved purely through technology.

Banks must invest in customer education, user-friendly design, and hybrid service models where human agents remain available for escalation. Building trust takes time, and in the interim, banks may find that their expensive new chatbot handles fewer queries than anticipated. Balancing AI automation with human reassurance is key to overcoming this challenge and ensuring widespread adoption.

For those navigating these complex waters, a business-oriented guide to responsible AI and ethics offers practical insights on deploying AI responsibly and transparently, especially when public trust is at stake.

Factors Affecting the Cost of Generative AI Chatbots Development

Complexity of generative AI chatbots features

When it comes to determining the cost of building generative AI chatbots for customer service in banking, the first element that decision-makers must assess is the complexity of features required. A bank that only needs a simple chatbot capable of answering FAQs about account balances or branch locations will face a very different investment compared to an institution looking to deploy a sophisticated assistant capable of handling transactions, providing financial advice, and integrating with fraud detection systems.

The level of sophistication directly impacts not only development time but also the expertise required, which in turn shapes the final budget. Banks that pursue advanced features such as sentiment analysis, multilingual capabilities, or voice-enabled interactions should expect costs to escalate significantly, often reaching into six- or seven-figure territory.

Integration requirements for banking customer service

Integration requirements represent another critical factor influencing cost. Unlike many industries, banking relies on a web of legacy systems, core banking platforms, customer relationship management tools, and third-party services. Ensuring that a generative AI chatbot can securely and efficiently interact with these systems is not a minor task. Each integration point requires custom APIs, rigorous testing, and in many cases, specialized compliance checks.

A relatively straightforward integration with a modern CRM system might be manageable within a modest budget, but connecting to decades-old mainframes or adapting to fragmented infrastructure can increase costs dramatically. This is one of the reasons why smaller banks with simpler systems often achieve chatbot implementation more cost-effectively than global institutions with sprawling IT ecosystems.

Security and compliance considerations

Security and compliance considerations add another layer of complexity—and cost. In the financial sector, trust is paramount, and any chatbot solution must be compliant with strict regulations such as PCI-DSS for payment data, GDPR for privacy in European markets, and additional frameworks in other jurisdictions. Ensuring compliance involves not only technical safeguards like encryption and secure data storage but also ongoing monitoring, audits, and certifications.

These measures are non-negotiable for banks, and they typically add both upfront and recurring expenses to the project. Finally, the way banks approach training data and model customization also has a significant impact on cost. Using pre-trained models offers a more affordable starting point, but the results may lack industry-specific nuance. Custom training on proprietary datasets, though more expensive, often delivers the accuracy and contextual understanding required for high-stakes customer service in banking.

Cost Breakdown: Developing Generative AI Chatbots for Banking

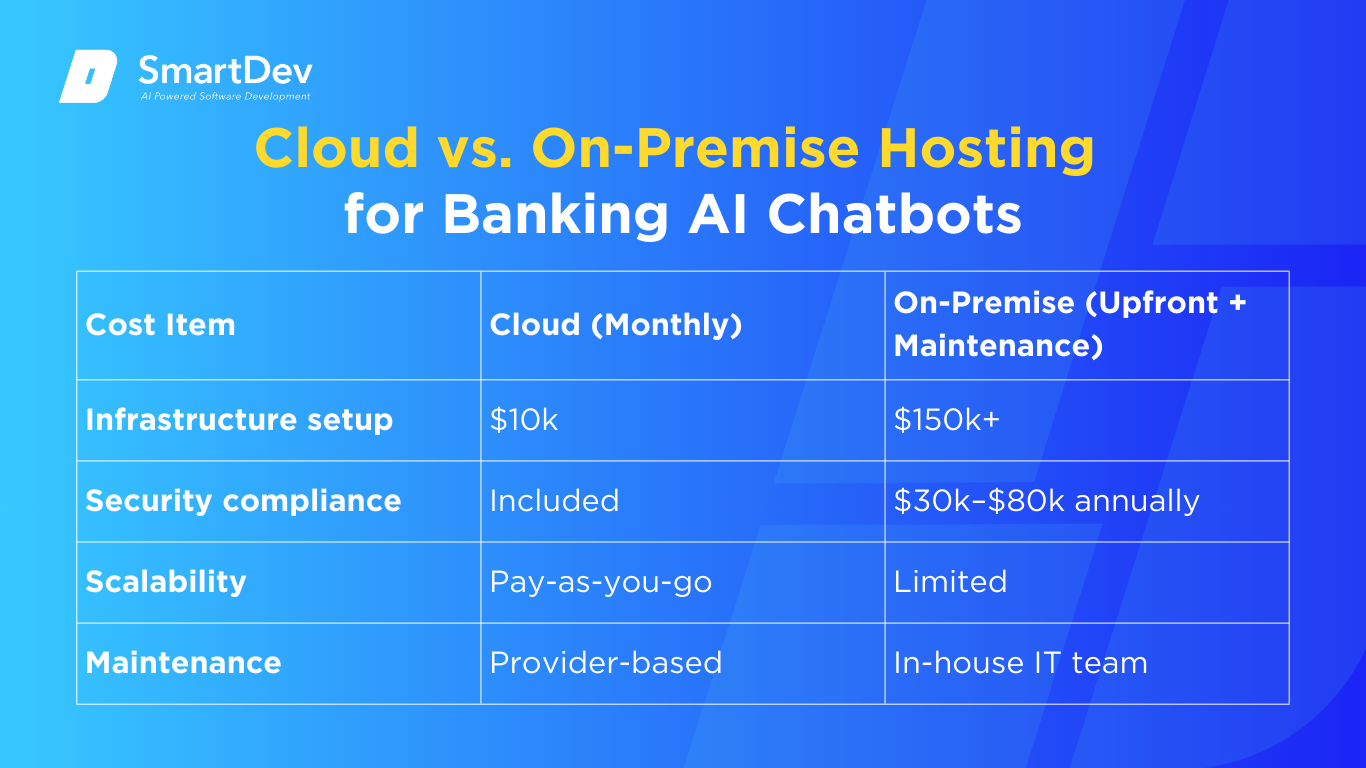

Banks must weigh the pros and cons of cloud versus on-premise hosting when deploying generative AI chatbots.

Initial development costs for customer service in banking solutions

The first phase of any generative AI chatbot project is initial development, which lays the foundation for long-term success. This typically begins with discovery and design, where banks work with technology partners to define user journeys, identify core use cases, and create prototypes. Costs in this stage usually range between $20,000 and $40,000, reflecting the workshops, research, and design iterations needed to ensure the chatbot aligns with both customer expectations and regulatory requirements. A strong discovery process often determines whether the final chatbot feels intuitive or clumsy, so underinvesting here can create expensive problems down the line.

Once the design phase is complete, attention shifts to model development, which is typically the costliest component. Building and fine-tuning a generative AI model for banking use cases requires not only technical expertise in natural language processing but also access to relevant training data. Depending on the desired level of sophistication, this stage can range from $50,000 for a relatively simple chatbot to over $200,000 for advanced systems capable of multilingual support, sentiment analysis, or proactive financial advice. Integration and API development represent the final piece of the puzzle in the initial phase. Here, banks must connect the chatbot to core systems such as CRMs, transaction databases, and fraud detection tools. Costs usually fall between $30,000 and $100,000, though legacy systems often push expenses higher. Taken together, these development costs set the stage for how well the chatbot will serve customers once deployed.

Ongoing maintenance and improvement expenses

Generative AI chatbots are not “set it and forget it” tools. Once a system is live, banks must budget for ongoing maintenance to keep the technology reliable, compliant, and aligned with customer needs. One of the most important aspects of this maintenance is model retraining. As customers interact with the chatbot, their behaviors and expectations evolve. Regular retraining ensures the chatbot can handle new query patterns, adapt to regulatory updates, and maintain high accuracy. Depending on the complexity of the model, retraining cycles can cost between $5,000 and $20,000, and most banks schedule them several times per year.

In addition to retraining, banks should expect regular updates and bug fixes to address emerging issues, security vulnerabilities, and feature enhancements. These updates typically require ongoing investment of $2,000 to $10,000 per month, depending on whether the system is managed in-house or through a vendor. Continuous compliance checks represent another ongoing expense that cannot be overlooked. Financial regulators are increasingly scrutinizing the use of AI in customer interactions, and ensuring that the chatbot meets requirements such as GDPR or PCI-DSS often involves periodic audits, testing, and reporting. While these costs may seem incremental compared to development, they are essential to sustaining customer trust and avoiding penalties.

Infrastructure and hosting costs

Finally, infrastructure and hosting costs represent a critical, recurring component of a generative AI chatbot’s total cost of ownership. Many banks today prefer cloud-based deployments through providers such as AWS, Microsoft Azure, or Google Cloud. These platforms offer scalability, reliability, and built-in security features, making them attractive for institutions that expect fluctuating demand or rapid growth. Depending on usage volumes, cloud hosting typically costs between $5,000 and $30,000 per month, with pricing models based on consumption of compute power and storage. This pay-as-you-go model makes cloud hosting predictable for budget planning, but costs can rise quickly if customer adoption accelerates faster than anticipated.

On-premise hosting offers an alternative for banks seeking greater control over data and infrastructure. While the upfront investment is significantly higher—often $150,000 or more—it can provide long-term cost stability by reducing reliance on third-party providers. For highly regulated institutions, on-premise hosting can also address compliance concerns by keeping sensitive financial data within the bank’s own environment. However, on-premise setups come with their own challenges, including the need for internal IT expertise and limited scalability compared to the cloud. As a result, many banks are adopting hybrid approaches that balance the flexibility of the cloud with the control of on-premise systems.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherReal-World Examples

Leading banks like ABN AMRO, ING, and DNB are already using generative AI chatbots to scale conversations and boost efficiency.

ING: Banking on Innovation with Generative AI

ING, one of Europe’s leading financial institutions, embarked on a project to redesign its customer service chatbot using generative AI. The bank’s goal was to move beyond scripted responses and provide tailored support that felt closer to human interaction. By focusing first on user experience design and risk control frameworks, ING built a chatbot pipeline capable of retrieving information from multiple knowledge bases, ranking potential answers, and generating responses that aligned with customer intent.

The outcome was a system that delivered faster, more accurate assistance while maintaining strict compliance safeguards. While ING has not disclosed exact costs, the project illustrates how global banks can reduce long-term expenses by investing heavily in upfront design and governance. For ING, this investment translated into measurable improvements in customer satisfaction and service efficiency, setting the stage for broader generative AI adoption.

ABN AMRO: Scaling Customer Conversations with AI Agents

ABN AMRO, a major Dutch bank, replaced its earlier chatbot systems with new AI-powered agents called “Anna” for customer-facing interactions and “Abby” for employee support. These agents were built to handle both text and voice conversations, with natural language understanding enhanced through advanced intent recognition. Today, Anna manages more than two million text-based conversations each year, while also supporting around 1.5 million customer phone calls.

The shift to AI-driven agents allowed ABN AMRO to process a broader range of requests, from unlocking debit cards to adjusting ATM withdrawal limits. The impact was twofold: customers received faster, more accurate responses, and the bank reduced operational strain on human service teams. Although exact budget figures remain undisclosed, the scale of conversations handled shows that the investment quickly delivered value in both cost savings and customer experience.

DNB: Aino and the Chat-First Strategy

Norway’s largest financial group, DNB, adopted a “chat-first” customer service strategy powered by a virtual assistant named Aino. Unlike traditional chatbots that focused only on FAQs, Aino was trained to resolve a much wider set of inquiries, from transaction questions to digital banking support. Within the first year of deployment, Aino was automatically resolving 50 to 60 percent of all chat interactions. Even more impressively, about 22 percent of the bank’s total customer service traffic—across chat, phone, and email—was successfully handled by the AI.

This approach significantly reduced pressure on call centers and improved overall customer satisfaction scores. DNB’s case demonstrates that a phased, AI-first strategy can yield strong returns without requiring an immediate multi-million-dollar overhaul. By prioritizing chat as the primary service channel and continuously refining the model based on customer feedback, DNB proved that generative AI can drive both efficiency and loyalty at scale.

Cost-Effective Strategies for Banking Institutions

Build vs. Buy Decisions for Generative AI Chatbots

One of the most fundamental strategic choices banks face when considering generative AI chatbots is whether to build the solution in-house or purchase it from a vendor. Building internally provides full control over the technology stack, allowing banks to customize features to meet specific customer needs and regulatory requirements. This approach also ensures that sensitive financial data remains entirely within the institution’s infrastructure, reducing reliance on third-party providers. However, the trade-off is cost and complexity. Developing in-house often requires investments ranging from $300,000 to more than $1 million, not to mention the ongoing burden of maintaining AI talent and infrastructure. For global banks with deep technical resources, this investment may be worthwhile, but for smaller institutions, it can quickly become prohibitive.

Buying from vendors, on the other hand, offers a faster and more predictable path to deployment. Many technology providers now offer subscription-based chatbot platforms that cost between $5,000 and $30,000 per month. These solutions come pre-built with banking features, compliance frameworks, and integration options, enabling banks to get up and running within weeks rather than months. While they may offer less flexibility than custom-built solutions, vendor platforms reduce risk, lower upfront capital expenditure, and allow institutions to benefit from the vendor’s ongoing innovation. For mid-sized banks looking to modernize quickly without taking on technical debt, buying is often the more cost-effective option.

Phased Implementation Approaches

Another cost-effective strategy is to roll out generative AI chatbots in phases rather than attempting a full-scale launch from day one. Many successful banks start small by piloting chatbots in narrow use cases such as balance inquiries or branch information requests. These pilots allow institutions to gather customer feedback, validate adoption, and measure ROI before committing additional funds. Importantly, they also reduce the risk of large-scale project failures, which are not uncommon in the complex world of financial IT.

Once the pilot proves effective, banks can gradually expand the chatbot’s capabilities to cover more complex tasks such as loan servicing, credit card dispute resolution, or even fraud alerts. Each phase adds incremental value while spreading costs over time, making it easier to manage budgets and secure executive buy-in. Phased implementation also gives IT and compliance teams more time to adapt, ensuring the solution scales without overwhelming internal processes. For banks of all sizes, this approach combines agility with fiscal discipline, allowing them to reap the benefits of AI without exposing themselves to excessive financial or operational risk.

Optimizing Customer Service in Banking Budgets

The third strategy involves making smarter use of available resources to optimize chatbot investments. One way to do this is by leveraging pre-trained large language models (LLMs), which provide a strong foundation without requiring banks to start from scratch. While fine-tuning may still be necessary for banking-specific contexts, using pre-trained models can cut initial costs dramatically. Another optimization tactic is to share infrastructure across multiple service lines. Instead of building separate AI systems for retail banking, wealth management, and corporate clients, banks can develop a unified platform that serves multiple functions, driving economies of scale.

Prioritization is also key. Instead of chasing every advanced feature, banks should focus on ROI-driven capabilities that deliver immediate impact. Automating high-volume interactions—such as password resets, transaction queries, and account verifications—often produces quick cost savings while laying the groundwork for more advanced services. This disciplined approach ensures that every dollar spent moves the bank closer to measurable outcomes, whether that is reducing call center volume, improving customer satisfaction, or boosting cross-sell opportunities. In short, optimizing budgets is about balancing ambition with pragmatism, ensuring chatbot investments are both financially viable and strategically impactful.

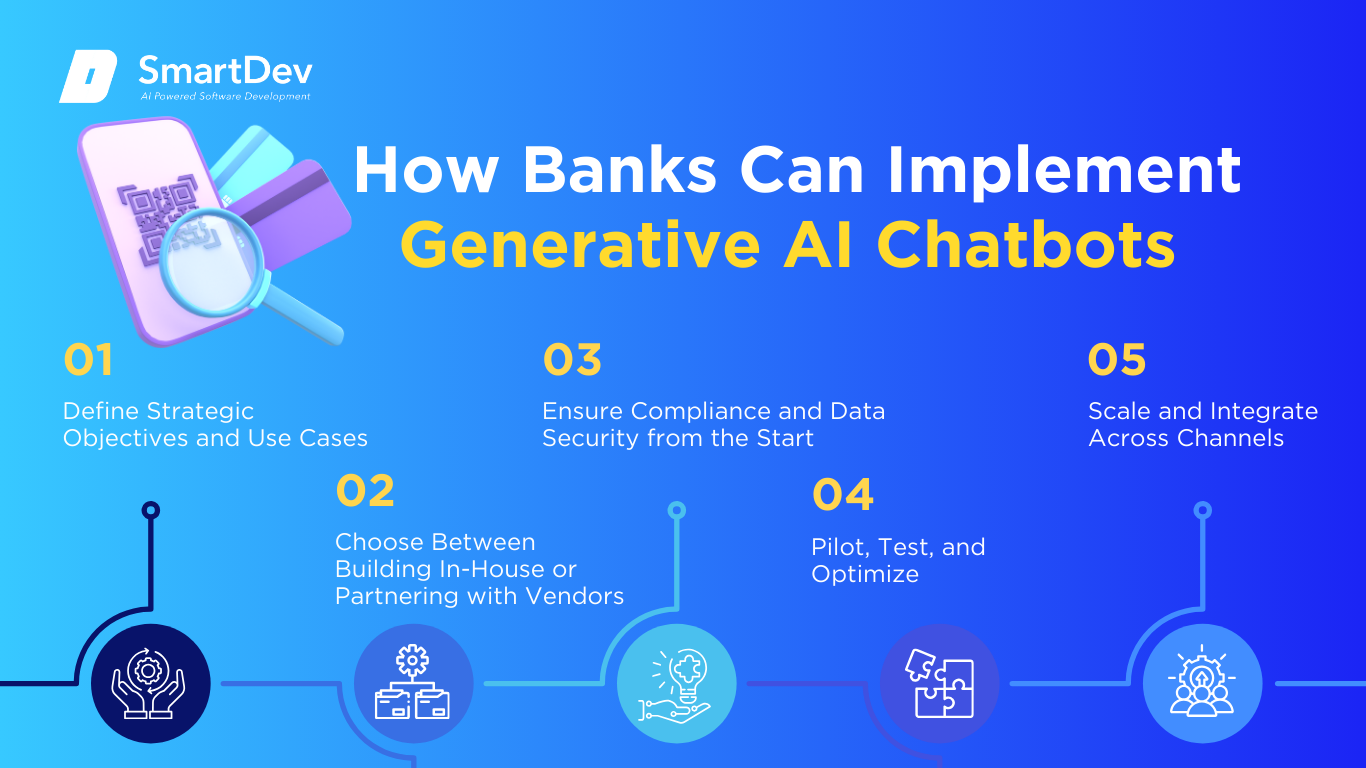

How Banks Can Implement Generative AI Chatbots

From defining use cases to scaling across channels, banks can follow a structured roadmap to implement generative AI chatbots successfully.

Step 1: Define Strategic Objectives and Use Cases

The first step for any bank considering a generative AI chatbot is to define the strategic objectives behind the project. Is the chatbot primarily intended to reduce call center costs, improve customer experience, or create new cross-selling opportunities? Without clarity on objectives, it is easy for projects to spiral into “tech for the sake of tech.” Banks should begin by mapping out high-volume, repetitive interactions—such as balance inquiries or password resets—that are best suited for automation. These initial use cases serve as low-risk entry points that deliver measurable value while laying the groundwork for more advanced applications.

By starting with clearly defined goals, banks can align technology investment with business outcomes. This alignment ensures executive buy-in and helps create a roadmap that avoids wasted resources on features customers may never use.

Step 2: Choose Between Building In-House or Partnering with Vendors

Once objectives are set, the next decision is whether to build the chatbot internally or rely on a technology partner. Building in-house provides greater customization and control but requires substantial investments in AI expertise, infrastructure, and compliance frameworks. For larger banks with strong IT capabilities, this path may offer long-term advantages. Smaller and mid-sized banks, however, often find more value in partnering with established vendors who provide ready-made platforms with built-in banking features.

The choice ultimately comes down to resources, risk appetite, and timeline. Banks that need rapid deployment often lean toward vendors, while those prioritizing proprietary innovation may invest in internal development despite higher upfront costs.

Step 3: Ensure Compliance and Data Security from the Start

No AI project in banking can succeed without rigorous attention to compliance and data protection. From day one, banks must design their chatbot systems with GDPR, PCI-DSS, and local regulatory frameworks in mind. This means building secure data pipelines, encrypting sensitive customer information, and ensuring that audit logs are maintained for every interaction. Waiting until later stages to address compliance often results in costly rework and regulatory delays.

Embedding compliance from the start also builds customer trust. When customers know their financial data is protected, they are far more likely to embrace AI-driven services. This step is not only about risk mitigation—it is also about establishing the credibility needed for long-term adoption.

Step 4: Pilot, Test, and Optimize

After the foundational work is complete, banks should launch a controlled pilot before scaling. A pilot allows them to test the chatbot in real-world conditions, collect user feedback, and identify areas for improvement. This stage should include A/B testing to compare chatbot responses against human agent outcomes, as well as sentiment analysis to measure customer satisfaction.

Optimization is not a one-time task. Banks must monitor the chatbot continuously, fine-tuning the model based on real interactions. Successful pilots often lead to phased rollouts, where new features are added gradually to minimize disruption and manage costs effectively.

Step 5: Scale and Integrate Across Channels

The final step is scaling the chatbot across multiple customer service channels—web, mobile apps, and even voice banking. At this stage, the chatbot moves beyond being a support tool to becoming a central part of the bank’s digital ecosystem. Integration with CRM systems, fraud detection tools, and personalized marketing platforms ensures the chatbot delivers consistent, seamless experiences across every touchpoint.

Scaling also means preparing for growth. As adoption rises, infrastructure must be able to handle increased query volumes without performance issues. Banks that invest in scalable cloud or hybrid solutions at this stage are better positioned to support long-term customer demand. With full integration, the chatbot evolves into a strategic asset that drives both operational efficiency and customer loyalty.

Ready to take the next step? Get in touch with our team to explore how AI can transform your customer service.

Future Trends and Cost Predictions

By 2027, nearly 70% of banking customer service interactions will involve AI automation, reshaping cost structures and service models.

Emerging Technologies Affecting Generative AI Chatbots Costs

The future of generative AI chatbots in banking will be shaped not only by adoption trends but also by the emergence of new technologies. One of the most significant developments is multimodal AI, which enables chatbots to process text, voice, and even visual data simultaneously. In a banking context, this could mean customers submitting an image of an ID card for verification and receiving immediate confirmation through the chatbot. While the possibilities are exciting, the cost of developing and maintaining multimodal systems is higher than for text-only chatbots. Banks will need to budget for more complex data pipelines, larger models, and additional compliance safeguards, especially when handling visual data.

Agentic AI is another technology poised to influence costs. Unlike traditional chatbots that respond reactively, agentic AI can proactively complete tasks and orchestrate multi-step workflows. Imagine a chatbot that not only alerts a customer about unusual activity but also walks them through fraud resolution in real time. This shift promises to reduce operational costs significantly in the long run, but it comes with a steeper upfront investment. Development timelines will be longer, integration requirements more demanding, and governance frameworks more critical. As a result, banks exploring agentic AI will need to balance near-term cost increases against the potential for long-term efficiency gains.

Market Trends in Customer Service in Banking Automation

From a market perspective, the adoption of generative AI chatbots in banking is accelerating at a pace few other technologies can match. According to industry analysts, AI adoption in financial services is projected to grow at more than 20 percent annually through 2030, with chatbots representing one of the most common entry points for institutions. Gartner forecasts that by 2027, nearly 70 percent of all customer service interactions in banking will involve some form of AI automation. As adoption scales, the cost structure will likely evolve. Cloud providers are expected to offer more competitive pricing as demand grows, lowering infrastructure costs for banks entering the market. At the same time, the proliferation of pre-trained models will make it easier and cheaper to launch chatbot pilots, particularly for smaller institutions.

However, these market-level cost reductions will be counterbalanced by rising compliance and governance expenses. Regulators worldwide are paying closer attention to how banks use AI in customer interactions, especially when sensitive data is involved. Meeting these requirements will require banks to invest more in monitoring, auditing, and reporting capabilities. In other words, while the technical side of chatbot development may become cheaper over time, the total cost of ownership is unlikely to fall dramatically. Instead, costs will shift from raw development to oversight and compliance, reflecting the new realities of operating in a highly regulated digital environment.

Conclusion

Summary of Key Takeaways on Generative AI Chatbots for Customer Services in Banking

The question of how much it costs to develop generative AI chatbots for customer service in banking does not have a one-size-fits-all answer. The reality is that costs span a wide spectrum, from modest pilots that can be launched for under $100,000 to enterprise-grade platforms requiring multi-million-dollar budgets. What determines the actual investment is not just technology, but the institution’s strategic goals, integration requirements, compliance obligations, and appetite for innovation.

For some banks, the chatbot will be a straightforward cost-saving tool designed to reduce call center volumes. For others, it will become the centerpiece of a broader digital transformation strategy, reshaping customer experience and opening new avenues for growth.

Moving Forward: A Path to Progress for Businesses Considering Generative AI Chatbots in Banking

What is consistent across all implementations is the shift in mindset that generative AI demands. This is no longer about deploying a chatbot as an auxiliary support channel. It is about embedding intelligence into the very fabric of customer service, creating an environment where interactions are faster, more accurate, and more human than ever before. The banks that succeed will be those that approach chatbot development not as an isolated IT project but as a strategic investment tied directly to customer outcomes and long-term competitiveness.

References

- https://www.mckinsey.com/industries/financial-services/how-we-help-clients/banking-on-innovation-how-ing-uses-generative-ai-to-put-people-first

- https://masterofcode.com/blog/generative-ai-in-banking

- https://verysell.ai/ai-chatbots-in-banking-boost-customer-service/

- https://www.ijournalse.org/index.php/ESJ/article/view/2734

- https://hekate.ai/en/generative-ai-enhances-banking-industry-customer-service/

- https://neontri.com/blog/best-banking-chatbots/