Introduction: The Future of Insurance Underwriting with AI

What Is an Insurance Underwriter?

Insurance underwriters are professionals who evaluate and analyze the risks involved in insuring people and assets. Insurance underwriters establish pricing for accepted insurable risks. The term underwriting means receiving remuneration for the willingness to pay a potential risk.

Underwriters use specialized software and actuarial data to determine the likelihood and magnitude of a risk. According to a study by the National Association of Insurance Commissioners (NAIC), underwriting accuracy has been a critical factor in maintaining financial stability in the insurance industry, with improved risk assessment models leading to a reduction in losses by up to 15%.

Introduction to Artificial Intelligence in Insurance

Artificial Intelligence (AI) is reshaping the insurance industry by enabling faster and more precise risk assessment, automating data analysis, and improving decision-making processes. By leveraging advanced AI technologies such as machine learning (ML), natural language processing (NLP), and predictive analytics, insurers can process massive datasets, detect fraud, and tailor policies to individual customers with unprecedented accuracy and efficiency.

The adoption of AI in insurance underwriting has grown exponentially, with global investment in AI-driven insurance solutions expected to surpass $6 billion by 2025, as reported by McKinsey & Company.

Why AI is Transforming the Insurance Industry

Artificial Intelligence is transforming the landscape of insurance underwriting by dramatically enhancing the speed, precision, and scalability of risk assessments. Insurers are now empowered to leverage a wealth of real-time data sourced from wearable devices, Internet of Things (IoT) sensors, and even social media platforms. This innovative approach allows for the refinement of risk profiles, facilitating not only dynamic pricing models but also the creation of highly personalized insurance policies tailored to individual needs.

Moreover, AI-fueled fraud detection mechanisms play a crucial role in the industry by significantly curbing fraudulent claims, which ultimately saves insurers billions of dollars each year. This proactive measure also ensures that honest policyholders are rewarded with fair pricing.

In the United States alone, the rampant issue of insurance fraud imposes a staggering annual cost of over $40 billion on the industry. However, with the implementation of AI-driven fraud detection tools, major insurance companies have successfully reduced fraudulent claims by a remarkable 30%, underscoring the profound impact of artificial intelligence on ensuring integrity within the insurance sector.

Understanding AI in Insurance Underwriting

What is AI-Driven Underwriting?

AI-driven underwriting automates and enhances traditional risk assessment processes using data science, automation, and deep learning models. Unlike conventional underwriting methods that rely on static historical data and human judgment, AI-driven systems dynamically adjust risk evaluations based on real-time insights, improving accuracy and efficiency.

AI-driven underwriting automates and enhances traditional risk assessment processes using data science, automation, and deep learning models. Unlike conventional underwriting methods that rely on static historical data and human judgment, AI-driven systems dynamically adjust risk evaluations based on real-time insights, improving accuracy and efficiency.

Research by Deloitte indicates that AI-driven underwriting can reduce policy issuance times by up to 80%, allowing insurers to serve more customers with higher efficiency.

Key Technologies Behind AI in Underwriting

- Machine Learning (ML): ML algorithms continuously analyze past claim patterns and adjust risk models based on emerging trends. Studies show that ML models have improved risk prediction accuracy by 25% compared to traditional actuarial models.

- Natural Language Processing (NLP): AI-driven NLP extracts valuable insights from unstructured text sources, including medical reports, legal documents, and social media activity, reducing document processing times by up to 70%.

- Computer Vision: Advanced image recognition and AI-powered analysis of property damage, vehicle conditions, and medical scans enable faster and more precise underwriting decisions, cutting claim assessment times by half.

- Internet of Things (IoT) & Telematics: Real-time data from connected devices, including wearables, smart homes, and telematics in vehicles, provide granular insights into policyholder behaviors and risk profiles. Insurers using IoT data have seen a 20% reduction in claim losses.

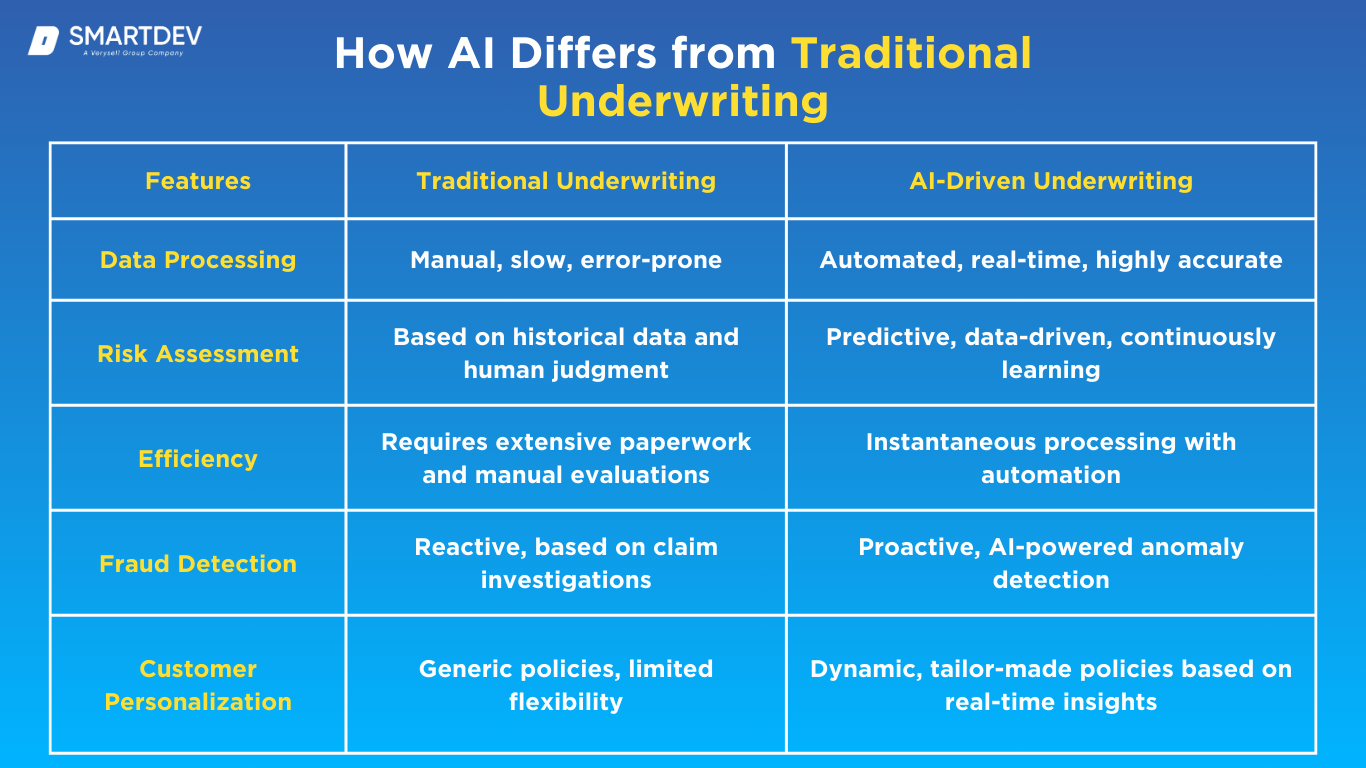

How AI Differs from Traditional Underwriting

Applications of AI in Insurance Underwriting

Applications of AI in Insurance Underwriting

Automating Risk Assessments

AI-driven models are revolutionizing risk assessment in the insurance industry by enabling automated analysis of vast and complex datasets. These models are designed to identify intricate patterns in customer information, historical claims, and external factors to predict potential risks.

By eliminating the need for manual intervention in these assessments, AI streamlines underwriting processes, making them faster and more accurate. As a result, insurers are able to process applications in a fraction of the time it would take with traditional methods, significantly improving operational efficiency and reducing overhead costs.

Enhancing Data Collection and Analysis

With the integration of Internet of Things (IoT) devices, telematics, and advanced data analytics, insurers can gather real-time information on policyholders. This could include anything from vehicle driving behaviors to health metrics.

By leveraging this wealth of data, AI systems can offer more precise insights into an individual’s risk profile. Such advanced data analysis provides a clearer picture of risk and supports the development of behavior-based pricing models, allowing insurers to adjust premiums according to real-time behaviors and conditions. This shift leads to a more dynamic and individualized approach to underwriting.

Fraud Detection in Underwriting

AI’s role in fraud detection has become increasingly important as fraudulent claims and applications continue to pose challenges in the insurance industry. Machine learning algorithms, specifically deep learning techniques, are employed to scrutinize large volumes of data from insurance applications and claims.

By identifying irregularities and patterns that might indicate fraudulent activities, AI systems can flag potential risks early in the underwriting process. This proactive approach allows insurers to take preventative measures before fraud can impact the business, thereby safeguarding financial resources and maintaining policyholder trust.

Real-Time Decision Making: Faster Policy Issuance

One of the most transformative benefits of AI in underwriting is its ability to enable real-time decision-making. By automating complex risk assessments and integrating predictive models, AI significantly reduces the time it takes to process insurance applications.

Where once insurers needed weeks to assess and approve policies, AI-driven systems can approve policies in just minutes. This reduction in approval times not only improves operational efficiency but also enhances customer satisfaction by providing faster responses and reducing the overall waiting period for potential policyholders.

Personalizing Insurance Policies for Customers

AI empowers insurers to go beyond the one-size-fits-all policy approach and deliver hyper-personalized offerings. By analyzing a wide range of data—from individual behaviors and lifestyle choices to specific financial circumstances—AI allows insurers to craft policies that are tailored to the unique needs of each customer.

This level of personalization leads to more relevant coverage options, offering policyholders a better fit for their situations. In turn, this approach fosters greater customer loyalty, as individuals feel their specific needs are being met, which can significantly enhance retention rates.

Benefits of AI in Insurance Underwriting

Improved Accuracy in Risk Assessment

AI-powered underwriting models bring a new level of precision to risk evaluation by minimizing human error and leveraging vast amounts of structured and unstructured data.

Traditional underwriting relies on historical data and human judgment, which can sometimes result in inconsistencies or overlooked risk factors. AI, on the other hand, uses predictive analytics and machine learning algorithms to assess risks more comprehensively.

These advanced models identify hidden correlations, detect subtle patterns, and continuously refine their assessments based on new information. As a result, insurers benefit from more accurate risk evaluations, leading to better pricing strategies, reduced claim losses, and more sustainable business practices.

Cost and Time Efficiency

AI-driven automation streamlines underwriting tasks, significantly reducing the time and resources required to assess applications and approve policies. Unlike conventional underwriting processes, which involve manual data entry, document verification, and risk evaluation by human underwriters, AI can process vast amounts of information in seconds. This efficiency lowers operational costs, allowing insurers to allocate resources more effectively.

By handling repetitive tasks with minimal human intervention, AI frees up underwriters to focus on complex cases that require nuanced decision-making. The acceleration of decision-making processes also translates into faster policy approvals, leading to increased productivity and improved customer satisfaction.

Enhanced Customer Experience and Faster Claims Processing

Customer expectations in the digital age demand speed, transparency, and convenience, all of which AI enhances within the insurance underwriting process. AI-powered systems enable insurers to provide real-time policy approvals, instant premium calculations, and faster claims settlements. This results in a seamless customer journey, where policyholders no longer experience lengthy waiting periods or excessive paperwork.

AI chatbots and virtual assistants further enhance customer engagement by providing instant responses to queries and guiding users through the insurance process. By improving response times and service delivery, insurers can foster stronger customer relationships, leading to higher retention rates and a more competitive position in the market.

Reduction of Human Bias in Underwriting Decisions

Human bias, whether conscious or unconscious, has historically been a challenge in underwriting, potentially leading to unfair pricing or discriminatory policy decisions. AI mitigates this issue by making objective data-driven evaluations.

Machine learning models analyze risk factors solely based on statistical evidence, eliminating subjectivity in decision-making. Additionally, AI systems can be programmed to identify and correct biased patterns in historical data, ensuring that underwriting decisions are fairer and more inclusive.

By leveraging AI for risk assessments, insurers can build greater trust with consumers and regulators while promoting ethical underwriting practices that align with industry compliance standards.

Improved Profitability and Competitive Edge for Insurers

The integration of AI in underwriting enhances insurers’ ability to manage risks effectively, reduce claim losses, and improve profitability. AI-driven insights enable insurers to optimize their pricing models, leading to better alignment between premiums and actual risk exposure.

Additionally, AI enhances fraud detection capabilities, preventing fraudulent claims that could otherwise result in financial losses. The increased efficiency and accuracy provided by AI not only reduce costs but also allow insurers to offer more competitive pricing, attracting a broader customer base.

As AI technology continues to evolve, early adopters gain a strategic advantage, positioning themselves as industry leaders in innovation and operational excellence.

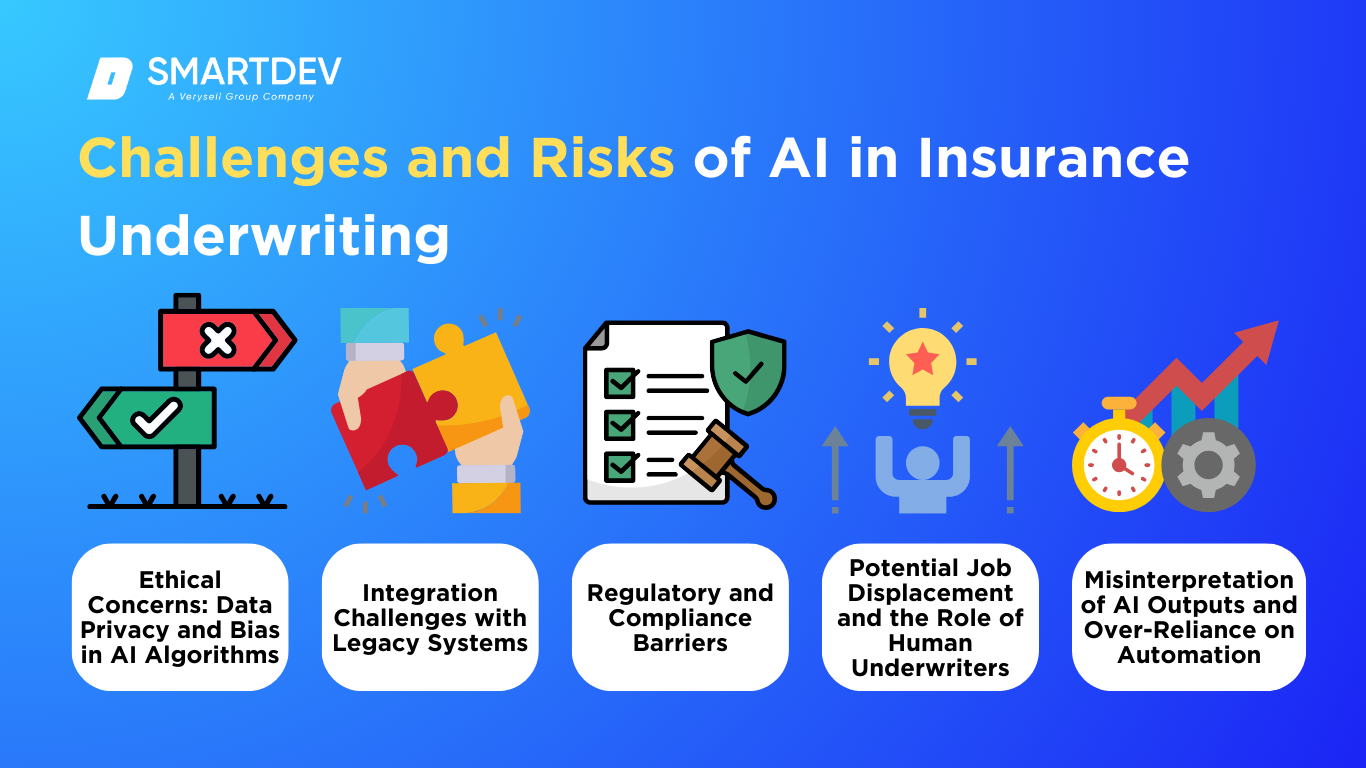

Challenges and Risks of AI in Insurance Underwriting

Ethical Concerns: Data Privacy and Bias in AI Algorithms

As AI becomes increasingly embedded in insurance underwriting, concerns over data privacy and algorithmic bias continue to emerge. AI systems rely on vast amounts of personal and financial data to make risk assessments, raising concerns about how this data is collected, stored, and used.

Bias in AI algorithms can also be a significant issue, as models trained on historical data may inadvertently reinforce existing disparities in underwriting decisions. For example, studies have shown that certain demographic groups may be disproportionately impacted by AI-based underwriting models if the data used to train them reflects past discrimination. Addressing these ethical concerns requires ongoing monitoring, transparent AI development, and the adoption of fairness-focused AI governance frameworks.

Integration Challenges with Legacy Systems

Many insurance companies still operate on legacy IT systems that were not designed to accommodate AI-driven underwriting. Integrating AI into these outdated systems presents several challenges, including data incompatibility, security risks, and high implementation costs.

According to a report by PwC, nearly 65% of insurance firms cite legacy system constraints as a primary barrier to digital transformation. Overcoming these challenges requires a strategic approach, such as adopting modular AI solutions that can integrate seamlessly with existing infrastructure and implementing cloud-based AI platforms to enhance data interoperability.

Read more: The Rise of AI Infrastructure Investment

Regulatory and Compliance Barriers

AI-powered underwriting must comply with a complex web of insurance regulations and data protection laws. Governments and regulatory bodies are increasingly scrutinizing AI applications in insurance to ensure fairness, transparency, and consumer protection.

In regions such as the European Union, the General Data Protection Regulation (GDPR) mandates strict guidelines on AI-driven decision-making, requiring insurers to provide explanations for automated underwriting decisions. Navigating these regulatory challenges requires insurers to work closely with legal experts and regulators to ensure AI models align with evolving compliance requirements.

Potential Job Displacement and the Role of Human Underwriters

The increasing automation of underwriting tasks has raised concerns about job displacement within the insurance industry. While AI enhances efficiency by automating repetitive tasks, human expertise remains crucial in complex underwriting cases that require nuanced judgment and contextual understanding.

According to McKinsey, AI-driven automation could displace up to 25% of current underwriting jobs by 2030, but it is also expected to create new roles that focus on AI model oversight, ethical AI governance, and customer engagement. To address this shift, insurers must invest in reskilling programs that equip underwriters with the necessary skills to work alongside AI.

Misinterpretation of AI Outputs and Over-Reliance on Automation

Despite its advantages, AI is not infallible. Underwriters and insurance firms must be cautious about over-relying on AI-driven recommendations without human validation. AI models can sometimes misinterpret data, leading to incorrect risk assessments and unfair policy decisions.

For example, AI-based health insurance underwriting might flag certain pre-existing conditions as high-risk without considering medical advancements that mitigate the condition’s impact. Ensuring a balanced approach between AI automation and human judgment is key to maintaining underwriting accuracy and fairness.

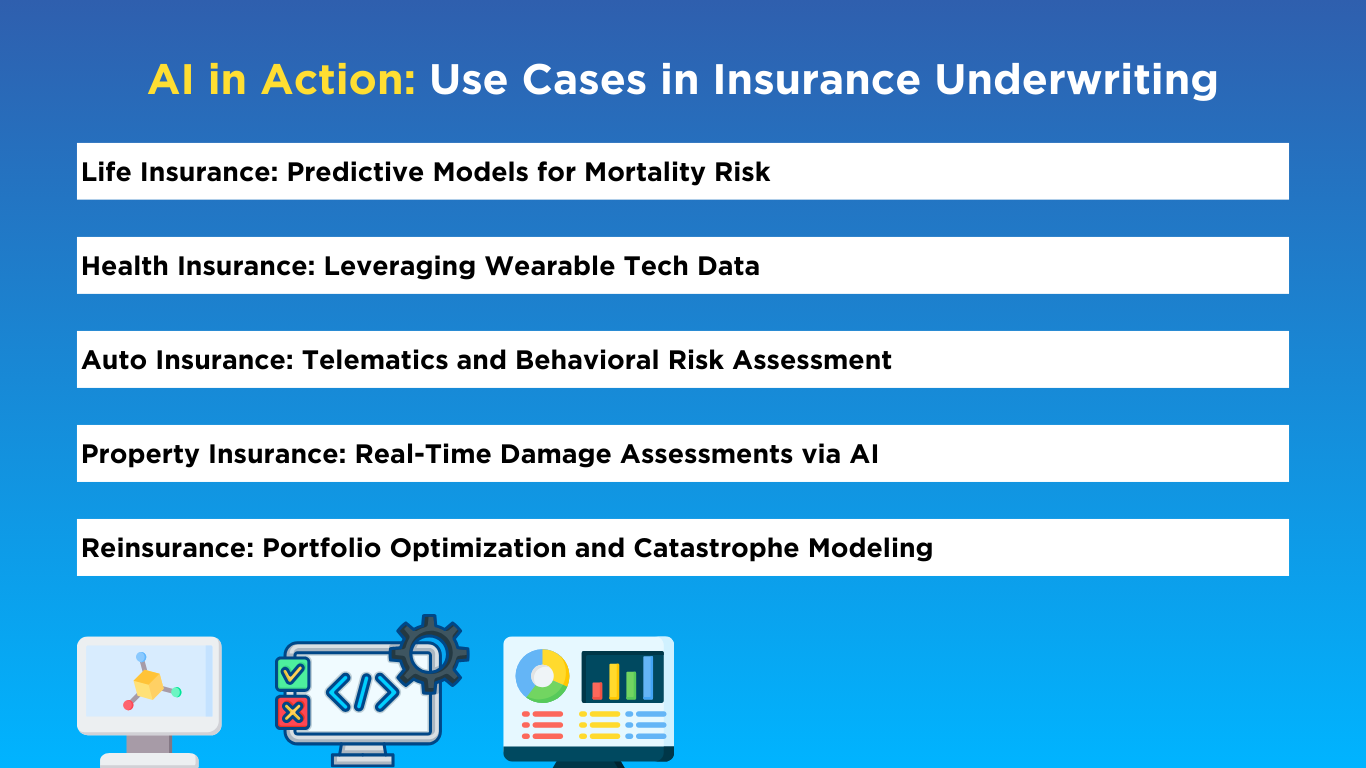

AI in Action: Use Cases in Insurance Underwriting

Life Insurance: Predictive Models for Mortality Risk

AI-powered predictive models analyze vast datasets, including genetic predispositions, lifestyle choices, and medical histories, to assess an individual’s mortality risk with high precision. Insurers using AI in life insurance underwriting can offer more accurate premium pricing and identify previously undetectable risk factors.

Research has shown that AI-driven mortality models improve underwriting accuracy by up to 30% compared to traditional actuarial methods.

Health Insurance: Leveraging Wearable Tech Data

The rise of wearable technology has transformed health insurance underwriting by providing real-time health data. Devices such as smartwatches and fitness trackers collect biometric data, including heart rate, physical activity, and sleep patterns, allowing insurers to adjust premiums dynamically.

A recent study found that policyholders who engage in regular physical activity, as tracked by wearable devices, can receive discounts of up to 15% on their health insurance premiums.

Auto Insurance: Telematics and Behavioral Risk Assessment

Telematics and AI-powered analytics are reshaping auto insurance underwriting by monitoring driver behavior in real time. GPS-enabled devices and mobile applications track factors such as speed, braking patterns, and driving frequency, allowing insurers to offer personalized premiums based on driving habits.

According to industry reports, insurers using telematics-based AI underwriting have reduced claims costs by 20% due to better risk segmentation.

Property Insurance: Real-Time Damage Assessments via AI

AI-driven computer vision technology is revolutionizing property insurance by enabling real-time damage assessments. Drones and satellite imagery analyze structural damages following natural disasters, allowing insurers to process claims faster and with greater accuracy.

Some insurers have successfully reduced claim processing times from weeks to just a few days using AI-powered property assessments.

Reinsurance: Portfolio Optimization and Catastrophe Modeling

Reinsurers are leveraging AI to optimize risk portfolios and enhance catastrophe modeling. By analyzing global climate patterns, historical loss data, and real-time weather forecasts, AI-driven models provide more accurate risk predictions for natural disasters such as hurricanes and wildfires.

A study by Swiss Re found that AI-enhanced catastrophe models improved loss estimation accuracy by 40%, helping reinsurers make more informed decisions.

Tools and Platforms for AI-Driven Underwriting

Top AI Solutions Providers for Insurance

As AI continues to transform the insurance underwriting landscape, several technology firms are at the forefront of developing AI-driven platforms tailored specifically for insurers. Companies such as GradientAI, Appian, and Zesty.ai are pioneering solutions that leverage machine learning, deep learning, and predictive analytics to refine risk assessments and streamline underwriting workflows. These AI-driven platforms enhance efficiency by automating routine underwriting tasks, improving decision-making accuracy, and identifying emerging risk trends.

- GradientAI specializes in AI-powered underwriting models that help insurers evaluate policy applications with enhanced precision, reducing claim risks and optimizing pricing strategies.

- Appian focuses on low-code AI solutions that integrate seamlessly into existing underwriting workflows, enabling insurers to enhance operational efficiency without overhauling their infrastructure.

- Zesty.ai, on the other hand, utilizes geospatial data and climate modeling to assess property risks more accurately, making it particularly valuable for home and commercial property insurance underwriting.

These AI platforms integrate with insurers’ existing systems, providing real-time insights, automating data collection, and facilitating seamless collaboration between AI models and human underwriters. By adopting AI-driven underwriting tools, insurers can reduce manual workload, accelerate policy issuance, and improve the overall accuracy of risk evaluations, positioning themselves for sustained competitive advantage in the evolving insurance market.

How Insurers Can Select the Right AI Vendor

Selecting an AI vendor is a crucial step in successfully implementing AI in underwriting, as the right solution can greatly enhance efficiency, compliance, and long-term scalability. To make an informed decision, insurers must carefully evaluate potential AI vendors based on several key factors:

- Model Transparency and Explainability – Insurers should prioritize AI solutions that offer clear insights into how risk assessments and policy decisions are made. Explainable AI (XAI) ensures that underwriters and regulators can understand and validate AI-driven decisions, mitigating concerns around black-box algorithms.

- Regulatory Compliance – Compliance with data protection laws (e.g., GDPR, CCPA) and industry-specific regulations is essential. Vendors must provide AI models that align with evolving legal frameworks to prevent regulatory penalties and ensure ethical underwriting practices.

- Scalability and Integration – The selected AI platform should be capable of scaling with the insurer’s growth while integrating seamlessly with existing underwriting, claims management, and customer relationship management (CRM) systems. Flexible APIs and cloud-based deployments can simplify integration.

- Data Security and Privacy – As insurers handle sensitive customer information, AI vendors must prioritize robust cybersecurity measures, including encryption, secure data sharing, and AI-driven fraud detection mechanisms.

- Performance and Accuracy Benchmarking – Conducting pilot projects and benchmarking AI models against traditional underwriting methods allows insurers to assess real-world performance, ensuring that AI enhances risk assessments without introducing unintended biases or inefficiencies.

By carefully evaluating vendors against these criteria, insurers can select an AI solution that aligns with their operational goals, enhances underwriting efficiency, and ensures compliance with industry standards.

Emerging Technologies Shaping AI in Underwriting

The future of AI-driven underwriting is being shaped by groundbreaking technologies that promise to make the process more ethical, secure, and efficient. As insurers continue to refine their AI strategies, several emerging innovations are poised to redefine the landscape:

- Explainable AI (XAI) – As AI adoption in underwriting increases, the demand for greater transparency has led to the development of explainable AI models. These systems provide clear justifications for underwriting decisions, allowing insurers to enhance accountability, build customer trust, and meet regulatory requirements. XAI ensures that underwriters can audit and understand how AI models arrive at risk assessments, eliminating the opacity often associated with black-box algorithms.

- Blockchain for Secure Data Sharing – Blockchain technology is revolutionizing how insurers store, share, and verify underwriting data. By leveraging decentralized and tamper-proof ledgers, insurers can ensure the integrity of customer information while reducing fraud risks. Blockchain-based smart contracts can also automate policy approvals and claims processing, enhancing efficiency and reducing administrative overhead.

- Federated Learning for Privacy-Preserving AI – Privacy concerns around AI training data have led to the rise of federated learning, a technique that allows AI models to be trained across multiple insurers’ datasets without exposing sensitive information. By enabling collaborative AI model development without direct data sharing, federated learning enhances underwriting accuracy while maintaining strict privacy and data protection standards.

- Advanced Telematics and IoT Integration – Insurers are increasingly utilizing Internet of Things (IoT) devices, such as connected vehicles and wearable health monitors, to gather real-time data for underwriting. AI analyzes these dynamic data streams to refine risk assessments, allowing for behavior-based pricing models in auto, health, and life insurance.

As these emerging technologies mature, they will enable insurers to build more ethical, transparent, and customer-centric AI-driven underwriting models. The continued evolution of AI in underwriting will not only improve risk prediction and decision-making but also reshape the way insurers engage with policyholders in an increasingly digital world.

Human & AI Collaboration in Insurance Underwriting

The Role of Human Expertise in Augmenting AI Decision Making

AI has significantly improved the efficiency and accuracy of insurance underwriting, but human expertise remains essential. While AI can analyze vast datasets quickly and make data-driven recommendations, human underwriters provide critical oversight, ensuring that decisions align with ethical considerations and business objectives.

Experts contribute contextual awareness, industry experience, and the ability to handle complex cases where AI may struggle with nuances. By working together, human professionals and AI models enhance risk assessment accuracy and customer trust.

Hybrid Models: Balancing Automation and Human Judgment

A hybrid underwriting model leverages the strengths of both AI and human decision-making. In this model, AI handles routine underwriting tasks, such as data extraction and initial risk scoring, while human underwriters step in for complex or high-risk cases.

Research suggests that hybrid underwriting can improve efficiency by 40% and reduce errors by eliminating human biases while ensuring AI-driven recommendations are contextually appropriate. Successful implementation of hybrid models requires clear policies, transparent AI models, and a seamless workflow between AI systems and human professionals.

Training Insurance Professionals for AI-Enhanced Roles

As AI adoption grows, insurance professionals must develop new skills to work effectively alongside AI-driven systems. Training programs should focus on AI literacy, data interpretation, and ethical considerations.

Insurers can introduce AI training modules, workshops, and certification programs to equip their workforce with the skills needed to oversee AI outputs, manage exceptions, and ensure regulatory compliance. Investing in upskilling initiatives ensures a smooth transition into AI-enhanced underwriting roles while maintaining a balance between automation and human oversight.

Future Trends in AI and Insurance Underwriting

The Role of Generative AI in Insurance

Generative AI is revolutionizing the insurance industry by automating core underwriting tasks such as policy generation, claims processing, and customer interactions. Unlike traditional automation, which follows predefined rules, generative AI uses advanced deep learning models to create tailored insurance policies based on customer data, regulatory requirements, and risk assessments.

AI-powered language models, such as GPT-based systems, can draft detailed policy documents, ensuring compliance with legal frameworks while optimizing coverage terms for individual policyholders. These models can also streamline customer support by answering complex insurance-related queries through intelligent virtual assistants.

Furthermore, generative AI aids in claims processing by analyzing claim submissions, detecting inconsistencies, and suggesting resolution strategies. This level of automation enhances efficiency, reduces administrative workload, and improves customer experience by delivering faster and more accurate policy responses.

How Blockchain and AI Will Revolutionize Underwriting

The combination of Blockchain and AI is set to reshape underwriting by introducing greater transparency, security, and efficiency into insurance processes. Blockchain’s decentralized ledger ensures tamper-proof data storage, while AI enhances real-time risk assessments and fraud detection.

One of the most promising applications of AI-blockchain integration is smart contracts—self-executing contracts that automate policy issuance and claims verification. When an insured event occurs, AI-driven analysis can verify policyholder claims against blockchain-stored data, instantly determining eligibility for payouts. This eliminates manual processing, reduces disputes, and speeds up claims settlements.

Moreover, blockchain enhances data security by ensuring sensitive customer information is encrypted and immutable, preventing fraudulent activities such as identity theft or document forgery. AI-powered fraud detection models analyze claim patterns, identifying suspicious transactions and flagging potential fraudulent activities before they escalate. The synergy between AI and blockchain will redefine underwriting by making it more reliable, secure, and cost-effective.

Predictive Analytics: The Next Frontier in Risk Assessment

Predictive analytics is rapidly emerging as a game-changer in risk assessment, enabling insurers to anticipate future claim probabilities and optimize policy pricing. Unlike traditional underwriting, which relies on historical data and actuarial models, AI-powered predictive analytics continuously learns from vast data sources, identifying subtle risk factors that may go unnoticed by human analysts.

By analyzing customer demographics, financial behavior, health records, and even environmental conditions, AI can pinpoint potential risks with greater precision. For instance, auto insurers leverage telematics data to assess driving behavior, allowing them to offer usage-based insurance (UBI) policies with dynamically adjusted premiums. Similarly, health insurers use predictive analytics to identify high-risk individuals, allowing for early interventions and better risk management.

With insurers gaining deeper insights into emerging risks, predictive analytics not only optimizes pricing models but also enhances claims management, reducing loss ratios and improving underwriting profitability.

Ethical AI: Ensuring Fairness and Transparency in AI Algorithms

As AI becomes increasingly embedded in underwriting, ensuring fairness, transparency, and ethical decision-making is paramount. Ethical AI frameworks aim to prevent biased underwriting decisions that could unfairly disadvantage certain groups based on gender, ethnicity, or socioeconomic status.

To address these concerns, insurers are implementing bias audits to identify and correct discriminatory patterns in AI-driven risk assessments. Additionally, explainable AI (XAI) ensures that AI models provide clear and interpretable reasoning for underwriting decisions, allowing human underwriters and regulators to validate their fairness.

Another key component of ethical AI is dataset diversity—AI systems must be trained on representative data to prevent skewed decision-making. By prioritizing transparency and fairness, insurers can build customer trust, comply with regulatory requirements, and create AI-driven underwriting models that are both effective and socially responsible.

AI-Powered Ecosystems: Collaboration Between Insurers, Tech Companies, and Regulators

The future of AI-driven underwriting lies in a collaborative ecosystem where insurers, technology providers, and regulatory agencies work together to refine AI solutions while ensuring compliance and innovation.

InsurTech startups and AI vendors are developing cutting-edge underwriting solutions, leveraging advancements in machine learning, big data, and automation to improve risk assessments. However, to ensure responsible AI adoption, regulatory bodies are implementing guidelines to monitor AI’s impact on underwriting fairness and consumer protection.

Collaborations between insurers and tech firms enable seamless integration of AI tools, while partnerships with regulators ensure AI models align with ethical and legal standards. As AI-powered underwriting evolves, these multi-stakeholder ecosystems will be instrumental in

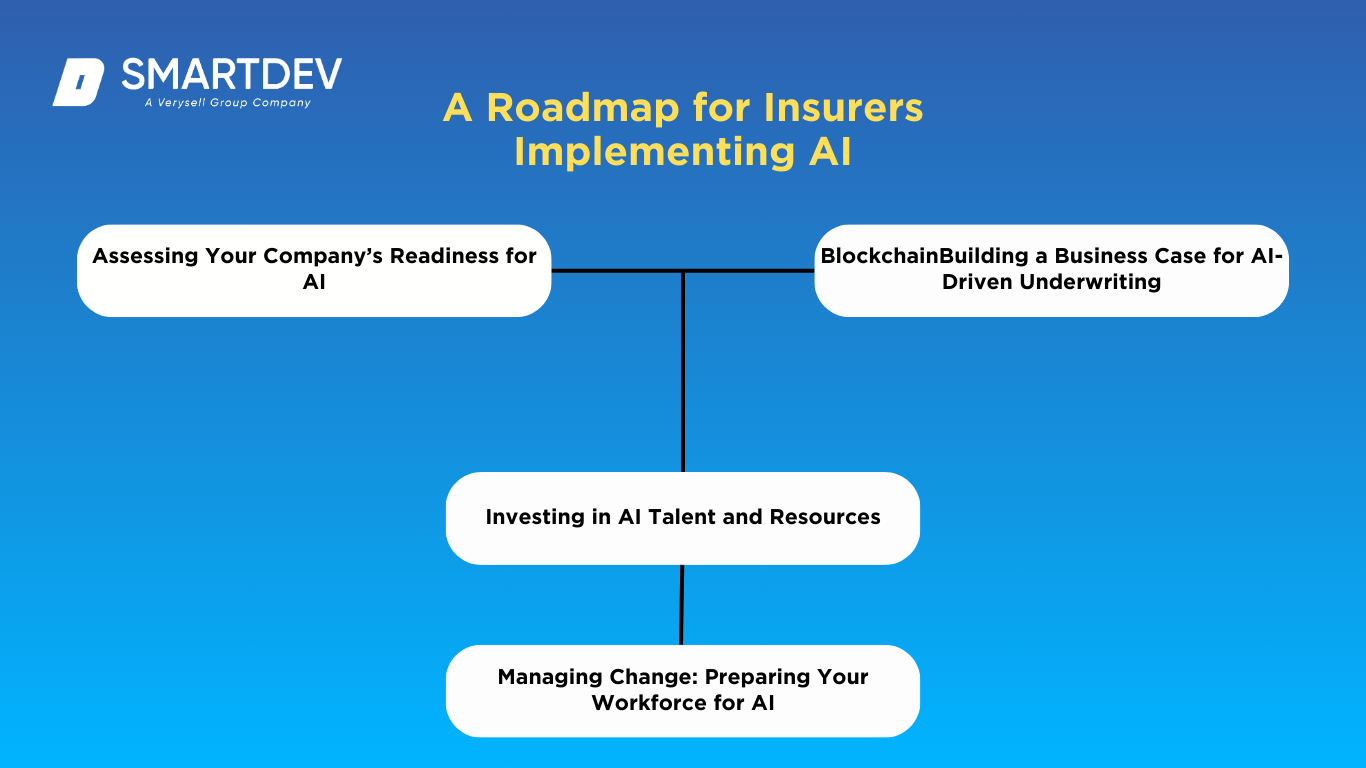

Getting Started: A Roadmap for Insurers Implementing AI

Assessing Your Company’s Readiness for AI

Before integrating AI into underwriting, insurers must conduct a comprehensive readiness assessment to evaluate their technological infrastructure, data quality, and workforce preparedness.

Key considerations include:

- Data Availability – Ensuring access to high-quality, structured, and unstructured data for AI training.

- IT Infrastructure – Upgrading legacy systems to support AI-driven analytics and automation.

- Regulatory Compliance – Understanding AI governance frameworks to ensure adherence to industry regulations.

A readiness assessment helps insurers identify potential gaps and create a strategic implementation plan for AI adoption.

Building a Business Case for AI-Driven Underwriting

To secure executive buy-in for AI investments, insurers must build a compelling business case that highlights AI’s potential in optimizing underwriting efficiency, reducing claim fraud, and enhancing customer satisfaction.

A strong AI business case should include:

- Cost-Benefit Analysis – Comparing AI implementation costs with projected efficiency gains and operational savings.

- Risk Assessments – Identifying potential AI adoption challenges and mitigation strategies.

- Return on Investment (ROI) Forecast – Quantifying AI’s impact on underwriting accuracy, profitability, and customer engagement.

By demonstrating tangible benefits, insurers can justify AI adoption as a strategic priority.

Investing in AI Talent and Resources

A successful AI transformation requires a skilled workforce capable of managing AI-driven underwriting tools. Insurers should:

- Recruit AI Specialists – Data scientists, machine learning engineers, and AI compliance experts.

- Upskill Existing Employees – Providing AI literacy training for underwriters and claims assessors.

- Foster Cross-Disciplinary Collaboration – Encouraging AI specialists and insurance professionals to work together to refine AI models.

Managing Change: Preparing Your Workforce for AI

AI adoption often triggers concerns about job displacement. To ease workforce transitions, insurers should implement change management strategies focused on:

- Encouraging Innovation – Reassuring employees that AI complements human expertise rather than replacing it.

- Defining New Roles – Transitioning underwriters to AI-assisted decision-making and fraud monitoring.

- Providing Continuous Learning Opportunities – Offering AI certification programs to enhance employees’ career development.

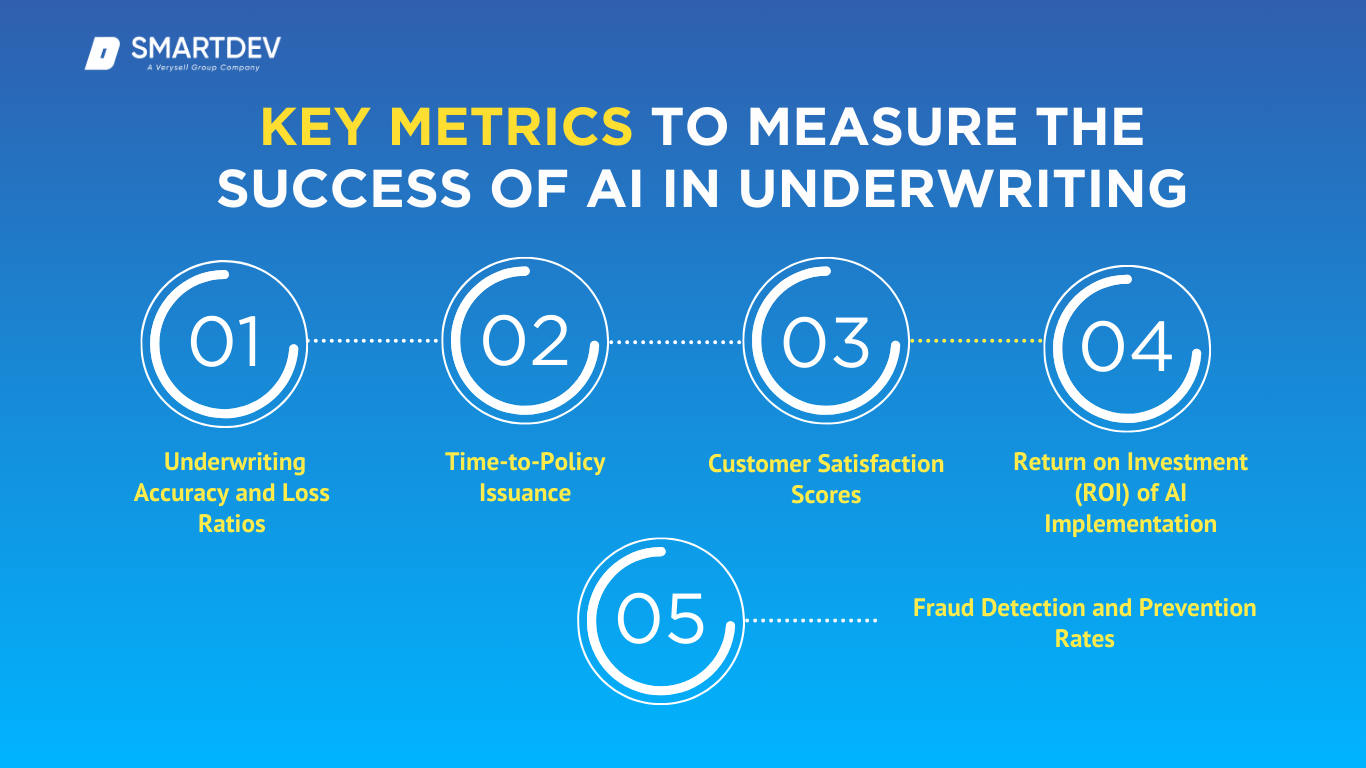

Key Metrics to Measure the Success of AI in Underwriting

Underwriting Accuracy and Loss Ratios

Tracking underwriting accuracy helps insurers assess whether AI improves risk segmentation and reduces claim losses. A lower loss ratio indicates better pricing models and risk prediction.

Time-to-Policy Issuance

Measuring policy issuance speed evaluates AI’s efficiency in expediting underwriting decisions and reducing processing delays.

Customer Satisfaction Scores

Analyzing customer feedback provides insights into AI’s impact on policyholder experiences, particularly in policy approvals and claims settlements.

Return on Investment (ROI) of AI Implementation

Quantifying cost reductions, revenue growth, and efficiency improvements determines AI’s financial impact on underwriting operations.

Fraud Detection and Prevention Rates

Monitoring AI-driven fraud detection efficiency ensures AI effectively identifies and mitigates fraudulent claims, enhancing underwriting integrity.

Conclusion: Embracing the AI Revolution in Insurance

Summary of Key Takeaways

AI in insurance underwriting is reshaping how insurers assess risk, price policies, and process claims. Key benefits include:

- Increased Efficiency: AI automates data collection, risk analysis, and policy issuance, speeding up underwriting processes.

- Improved Accuracy: AI reduces human error by analyzing large datasets for more precise risk assessments.

- Cost Savings: Automation cuts operational costs by reducing manual tasks.

- Enhanced Customer Experience: AI leads to faster policy issuance and more personalized offerings.

- Better Fraud Prevention: AI identifies suspicious patterns and prevents fraudulent claims.

- Ethical Practices: AI frameworks promote fairness and transparency in underwriting decisions.

AI is not just a technological upgrade—it represents a fundamental shift in the insurance industry, offering insurers a competitive edge through improved efficiency, cost-effectiveness, and customer satisfaction.

The Future of AI in Underwriting: Opportunities and Challenges

AI in underwriting offers vast opportunities, but also poses challenges:

Opportunities:

- Hyper-Personalization: AI enables insurers to offer highly customized policies based on individual behaviors and data.

- Predictive Models: AI can predict future risks and reduce losses by proactively addressing emerging threats.

- Global Scalability: AI allows insurers to expand efficiently into new markets by analyzing regional dynamics.

Challenges:

- Regulatory Compliance: Navigating evolving regulatory frameworks to ensure transparency and fairness in AI models.

- Data Privacy: Securing vast amounts of sensitive customer data against breaches and misuse.

- Bias in AI: Ensuring AI models are free from biases that could result in discriminatory pricing or decision-making.

While AI presents immense opportunities, insurers must carefully navigate regulatory, privacy, and ethical challenges to maximize its potential.

Why Insurers Must Act Now

The time for insurers to act is now. Those who delay AI adoption risk falling behind in a market demanding speed, personalization, and efficiency.

- Competitive Advantage: Early adopters will streamline operations, reduce costs, and offer innovative products that meet evolving customer expectations.

- Regulatory Preparedness: Early adoption helps insurers align with future regulatory requirements, ensuring smoother compliance.

- Customer Expectations: AI enables faster, more personalized services that modern customers expect.

- Long-Term Sustainability: AI improves risk management and provides insights that help insurers stay profitable and resilient to changes in the market.

AI-driven underwriting is revolutionizing the insurance industry by enhancing efficiency, accuracy, and customer satisfaction. It offers benefits such as faster processing times, improved risk assessment, personalized policies, and better fraud detection. However, the adoption of AI also presents challenges, such as data privacy concerns, the need for upskilling employees, and the potential for algorithmic bias. Insurers that embrace AI early on can gain a significant competitive advantage, streamline operations, and foster long-term growth.

To navigate this transformation effectively, consider leveraging SmartDev’s AI solutions for underwriting. Their expertise can help insurers integrate cutting-edge technology seamlessly, ensuring enhanced decision-making and a future-proof business model.

Contact SmartDev today to learn how AI can drive your underwriting processes forward!

—

References:

- National Association of Insurance Commissioners (NAIC) – https://content.naic.org/

- PwC Insurance Industry Report 2023 – https://www.pwc.com/gx/en/industries/financial-services/insurance.html

- General Data Protection Regulation (GDPR) Compliance Guide – https://gdpr.eu/

- McKinsey & Company – The Future of Work and AI – https://www.mckinsey.com/featured-insights/future-of-work

- Harvard AI Ethics Initiative – https://aiethics.harvard.edu/

- Swiss Re Institute – AI in Insurance Risk Assessment – https://www.swissre.com/institute/

- Deloitte Insights – AI in Health Insurance – https://www2.deloitte.com/us/en/pages/life-sciences-and-health-care/articles/ai-in-health-care.html

- Allianz Telematics and Auto Insurance Report – https://www.allianz.com/en/press/news/studies/

- IBM AI in Insurance Solutions – https://www.ibm.com/industries/insurance

- Swiss Re Climate and Catastrophe Modeling – https://www.swissre.com/institute/research.html

- European Union’s AI Act Overview – https://digital-strategy.ec.europa.eu/en/policies/regulation-artificial-intelligence

- Explainable AI (XAI) Research Papers and Use Cases – https://arxiv.org/abs/2012.09969

- World Economic Forum Report on AI-Powered InsurTech – https://www.weforum.org/reports/the-future-of-insurance

- Accenture Study on AI-Driven Underwriting Efficiency – https://www.accenture.com/us-en/insights/insurance/artificial-intelligence

- RegTech for AI Compliance in Insurance – https://www2.deloitte.com/insights/us/en/industry/financial-services/regtech-insurance.html

- Insurance Fraud Prevention with AI – Industry Reports – https://www.iii.org/article/insurance-fraud

- MIT AI Governance and Ethical AI Frameworks – https://cbmm.mit.edu/research/papers

Applications of AI in Insurance Underwriting

Applications of AI in Insurance Underwriting