In an age where convenience and speed dictate consumer preferences, businesses are constantly seeking innovative ways to enhance the shopping experience. Imagine walking into your favorite coffee shop, effortlessly ordering your drink, and paying without ever reaching for your wallet. This is the power of closed-loop payment systems, a transformative approach that not only simplifies transactions but also builds lasting customer loyalty.

Starbucks stands out as a prime example of how effective a closed-loop payment system can be. By leveraging its mobile app and rewards program, Starbucks has created a seamless ecosystem that encourages repeat visits and deepens customer engagement. This success story serves as an inspiring case study for businesses looking to harness the potential of closed-loop payments in today’s competitive marketplace.

What is a Closed-Loop Payment System?

A closed-loop payment system allows customers to make transactions exclusively within a specific merchant’s ecosystem. This system is typically tied to a proprietary app, card, or account, ensuring that payments and benefits remain within the brand’s network.

For example, Starbucks’ app enables customers to load money, make purchases, and earn rewards, all without involving third-party payment processors.

In contrast, open-loop systems, such as Visa or Mastercard, allow customers to make payments across various merchants. While open-loop systems offer convenience and universality, they lack the level of control and data access that closed-loop systems provide.

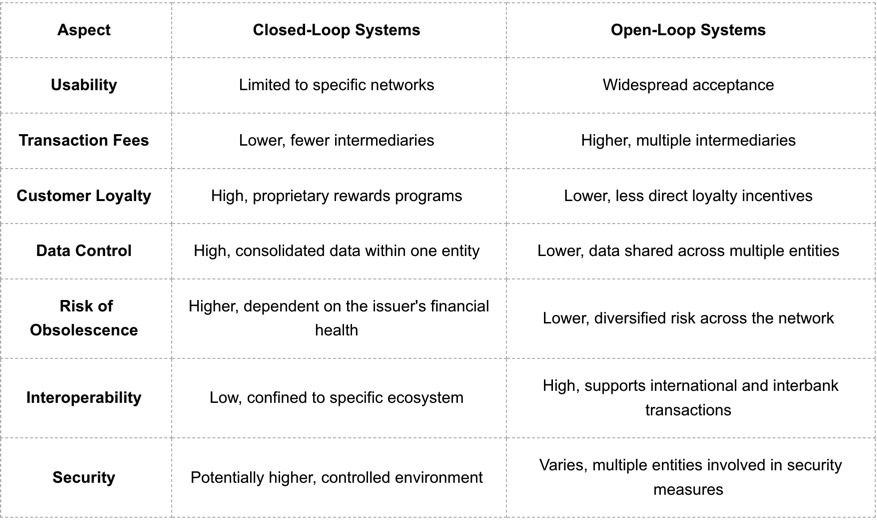

Comparison Table: Open-Loop vs. Closed-Loop Payment Systems

The Evolution of Payment Systems

The evolution of payment systems has been nothing short of revolutionary. From the days of cash and checks to the rise of credit cards and digital wallets, the landscape has transformed dramatically. This evolution has been fueled by technological advancements and an increasing demand for efficiency in financial transactions.

Startups and innovators are continually pushing the boundaries of what’s possible in the payment ecosystem, paving the way for closed-loop systems that offer businesses enhanced control and improved customer experiences.

Historically, consumers relied heavily on cash for everyday purchases. However, as credit cards gained traction in the late 20th century, the landscape began to shift dramatically.

The explosion of e-commerce in the 2000s further accelerated this transformation, leading to the development of digital wallets and mobile payment solutions designed to meet consumer demands for speed and convenience.

Key Benefits of Closed-Loop Payment Systems

1. Enhanced Customer Loyalty and Engagement

One of the most significant advantages of closed-loop payment systems is their ability to foster customer loyalty. By integrating rewards programs, these systems incentivize repeat purchases and long-term engagement.

For instance, Starbucks Rewards allows customers to earn points with every transaction, redeemable for free drinks or food items. This not only encourages frequent visits but also creates a sense of exclusivity and belonging.

2. Increased Data Insights and Strategic Growth

Closed-loop systems generate a wealth of data, offering businesses unparalleled insights into customer behavior. By analyzing transaction data, companies can identify spending patterns, preferences, and trends. Starbucks, for example, uses its app data to tailor promotions and optimize inventory.

These insights empower businesses to make informed decisions, refine marketing strategies, and improve product offerings.

3. Cost Efficiency

Compared to open-loop systems, closed-loop payment solutions are more cost-effective. By eliminating the need for third-party payment processors, businesses can reduce transaction fees, leading to significant savings.

These savings can be reinvested into improving the customer experience, such as offering discounts or enhancing app features.

Best Uses for Closed-Loop Payment Systems

1. Retail

Closed-loop payment systems have become a powerful tool for retailers aiming to create exclusive and engaging experiences for their customers. Major retail chains implement proprietary payment cards or apps that allow customers to access special deals, cashback offers, or early product releases.

For instance, retailers can offer loyalty points that accumulate with each purchase, incentivizing repeat visits and fostering a deeper connection between the brand and its customers.

This approach not only boosts customer loyalty but also encourages higher spending by providing value-added benefits that resonate with consumers. By analyzing transaction data collected through closed-loop systems, retailers can gain insights into customer preferences and spending habits, allowing them to tailor promotions and inventory to better meet consumer demands.

Additionally, the reduction in transaction fees associated with closed-loop systems enables retailers to reinvest savings into enhancing customer experiences, such as offering more attractive rewards or improving service efficiency.

2. Transportation

The transportation sector has widely adopted closed-loop payment systems for their efficiency and convenience. Public transit systems around the globe utilize proprietary cards—such as metro cards or bus passes—that allow passengers to travel seamlessly while minimizing cash handling and processing costs. These cards streamline the boarding process, reducing wait times and improving overall customer satisfaction.

For operators, closed-loop systems provide valuable real-time insights into passenger flow and revenue trends. This data enables better resource allocation and planning, helping transit authorities optimize routes and schedules based on actual usage patterns.

Furthermore, the ability to analyze customer behavior within the closed-loop system allows for targeted marketing campaigns that promote services or discounts tailored to specific user groups, enhancing ridership and loyalty.

3. Food & Beverage

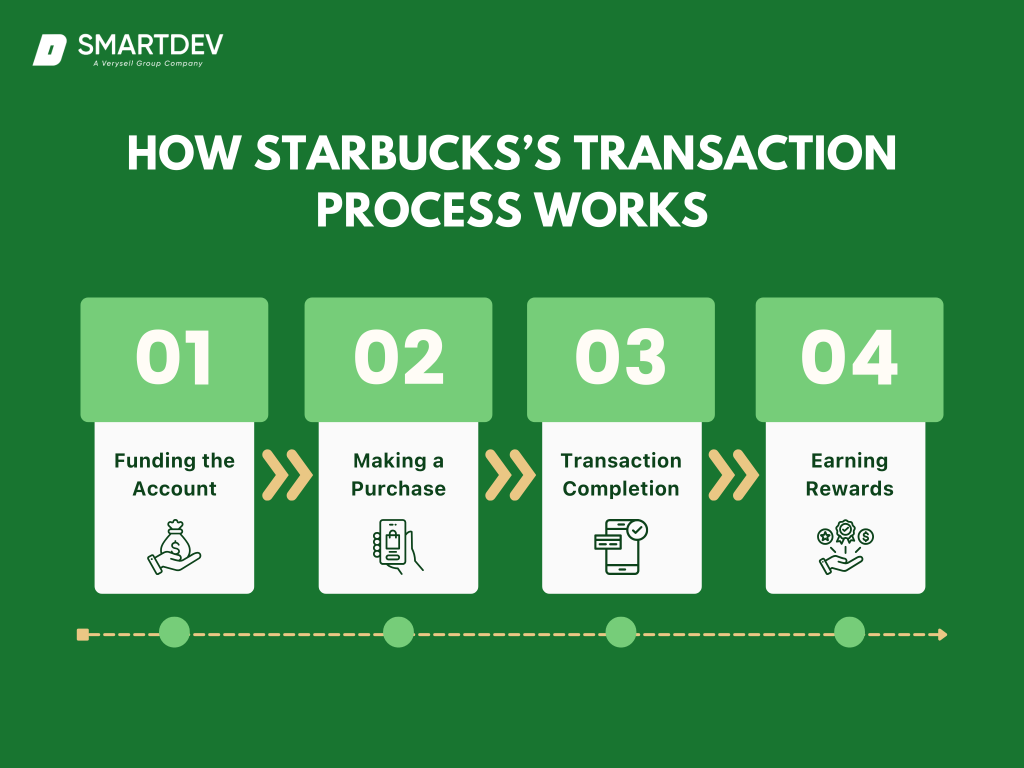

Starbucks’ closed-loop payment system operates through a sophisticated network of digital tools designed to provide a seamless, branded experience.

The food and beverage industry has seen significant success with closed-loop payment systems by integrating payment options with loyalty programs. Restaurants and cafes can create a frictionless customer journey that combines convenience with incentives.

Customers can pay quickly using mobile apps or loyalty cards while earning rewards for their purchases, which encourages repeat business.

This integration not only enhances customer satisfaction but also provides businesses with critical data on consumer preferences and spending patterns. By analyzing this data, food and beverage establishments can refine their menus, optimize pricing strategies, and develop targeted marketing campaigns that resonate with their clientele.

Moreover, the ability to offer personalized promotions based on individual purchasing behavior fosters a deeper connection between customers and brands, ultimately driving long-term loyalty.

Case Study: Starbucks’ Closed-Loop Payment System Success

Background

Starbucks introduced its closed-loop payment system to complement its existing loyalty program, Starbucks Rewards. The system allows customers to load funds onto their Starbucks app, enabling quick payments and rewards tracking.

This innovation has transformed the way customers interact with the brand, making every transaction more engaging and rewarding.

Implementation and Features

Starbucks focused on creating a seamless user experience by integrating payment and rewards into its mobile app. Customers can reload funds, make purchases, and monitor their rewards balance—all from a single platform.

The app also provides personalized offers based on user behavior, enhancing customer satisfaction and loyalty.

Benefits Realized

Starbucks’ closed-loop payment system has proven highly successful, delivering measurable achievements in revenue, customer loyalty, and digital engagement. Here are some of the standout successes, backed by data:

- Significant Revenue Growth from Preloaded Balances:

Starbucks has generated substantial revenue from the balances customers keep on their Starbucks cards and mobile app accounts. According to Starbucks’ 2020 fiscal report, approximately $1.5 billion in revenue came from these stored-value cards.

This reserve of prepaid funds provides Starbucks with interest-free cash flow, a benefit few other retailers experience at this scale.

- High Customer Engagement:

The integration of the Starbucks Rewards program has been a major success. As of 2022, Starbucks Rewards boasted over 26 million active members in the U.S., a 13% increase from the previous year.

Members of this program accounted for 53% of the company’s revenue in the U.S., demonstrating how the closed-loop system strengthens customer loyalty and encourages frequent purchases.

- Enhanced Digital Sales:

The Starbucks mobile app, central to the closed-loop system, drives significant digital engagement. According to Starbucks 2021 Annual Report, digital sales accounted for over 25% of total U.S. transactions, primarily through the app’s mobile order and pay feature.

This increase in digital sales aligns with Starbucks’ strategy to create a frictionless experience, especially during peak hours, allowing for faster service and a higher volume of sales.

Challenges and Solutions

While implementing the system, Starbucks faced challenges such as integrating the technology across stores and educating customers on its benefits. The company addressed these issues through staff training, app updates, and targeted marketing campaigns, ensuring a smooth transition and widespread adoption.

Transforming Data into Strategic Growth with Closed-Loop Payments

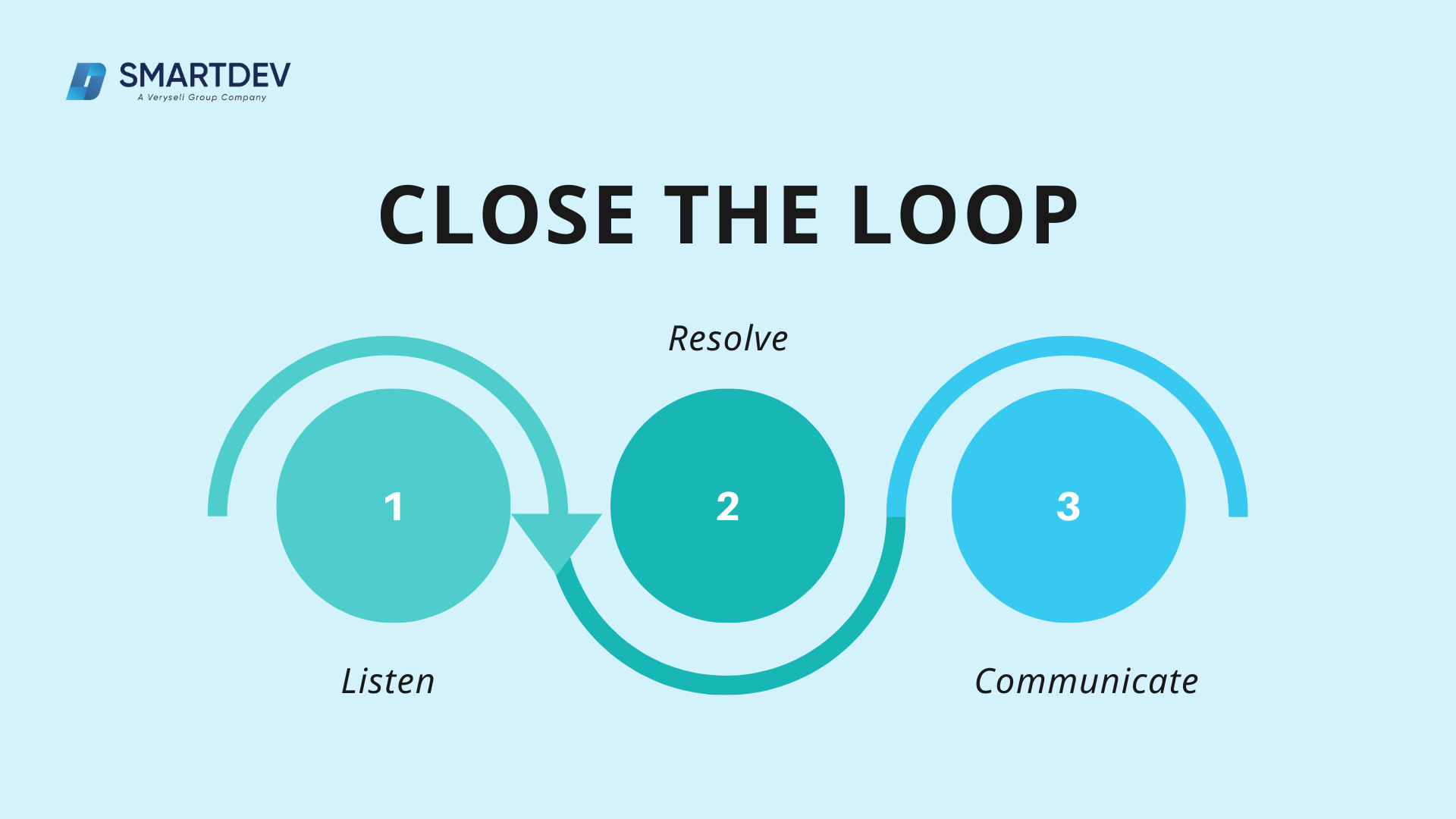

Closed-loop payment systems allow businesses to listen, resolve, and communicate effectively, transforming customer data into strategic growth opportunities.

Closed-loop payment data provides businesses with deep insights into customer behavior that can drive strategic growth initiatives. By leveraging this information for product development and targeted marketing efforts, companies can enhance their offerings while adhering to ethical considerations regarding data privacy.

For example, analyzing spending patterns within their closed-loop system allows businesses to identify trends that inform inventory management decisions or inspire new product offerings tailored specifically to consumer preferences.

To explore how closed-loop payment systems can transform data into actionable insights, check out our detailed blog post on The Power of Closed-Loop Payment Systems: Transforming Data into Strategic Growth.

This resource delves deeper into the benefits of closed-loop systems and how they can empower businesses to make data-driven decisions that enhance customer experiences and drive growth.

Industry Trends and Future of Closed-Loop Payment Systems

Emerging technologies are set to redefine the capabilities of closed-loop payment systems. Cryptocurrencies and blockchain are increasingly being integrated into these systems, offering enhanced security and transparency. Digital wallets are also becoming more sophisticated, combining multiple features into a single app.

The future of closed-loop systems lies in the integration of artificial intelligence and machine learning. These technologies can enable real-time personalization, fraud detection, and predictive analytics, further enhancing the customer experience. As businesses adopt these innovations, closed-loop systems will continue to play a pivotal role in shaping the payment landscape.

The advantages of closed-loop payment systems are clear: they enhance control over transactions, improve customer experiences, and drive loyalty. As demonstrated by Starbucks’ success story, implementing such a system can yield substantial benefits for businesses looking to thrive in modern commerce.

For those interested in exploring customized solutions tailored to their business needs, contacting SmartDev could be an excellent first step towards leveraging the benefits of closed-loop payment systems effectively. By focusing on these key aspects – customer loyalty, data insights, cost efficiency – and providing real-world examples like Starbucks’ success story, this blog post aims not only to inform but also engage readers looking for innovative solutions in today’s digital economy.

Reference:

-

How the 5 biggest QSRs are leveraging mobile payments – Retail Dive

- Use cases For Closed-Loop Wallets – Finextra

- Closed Loop Payment Systems: Definition, Benefits and Business Cases – SDK.finance

- Closed-Loop vs. Open-Loop Payment Systems – Billfold

- What’s behind the move to closed loop payments and branded digital wallets – Tearsheet