Artificial Intelligence (AI) is no longer a futuristic luxury – it’s a competitive necessity. Businesses worldwide are leveraging AI to optimize operations, enhance customer experiences, and drive revenue growth. But with significant investment comes an important question: Is AI a good investment and delivering measurable returns?

Understanding AI Return on Investment (AI ROI) is essential for companies looking to justify their AI spending, refine their strategies, and maximize their technological advantage.

In this article, we will break down what AI ROI is, why it matters, and how businesses can effectively measure and enhance their ROI with AI to achieve long-term success.

As you explore how to measure and maximize the return on your AI investments, it’s important to see how strategic implementation drives real business outcomes. For organizations ready to turn innovation into measurable value, discover how AI-driven software development can help you achieve sustainable growth and competitive advantage.

What is AI ROI and Why it Matters?

Definition

AI ROI is the measurement of the financial and operational benefits an organization gains from investing in artificial intelligence (AI) solutions compared to the costs incurred. This metric helps businesses assess whether AI implementation delivers real value, such as cost savings, revenue growth, increased efficiency, or improved customer experience.

Unlike traditional ROI, which primarily focuses on direct revenue generation, AI ROI also accounts for improvements in productivity, efficiency, customer experience, and risk mitigation.

For instance, AI-driven automation in customer service can reduce response times and operational costs, while AI-powered data analytics can provide deeper market insights that lead to smarter business decisions.

The Importance of Measuring AI ROI

With the rapid rise of AI adoption, many businesses are investing in AI without a structured framework to measure its effectiveness. Without a clear understanding of AI ROI, organizations risk misallocating resources, implementing ineffective AI solutions, or failing to gain executive buy-in for future AI investments.

Evaluating AI ROI is essential for several reasons:

- Justifying AI Expenditures: AI projects require substantial investments, often involving new infrastructure, skilled talent, and ongoing maintenance. Demonstrating tangible returns helps secure funding and ensures continued executive support.

- Strategic Alignment: AI should not be deployed in isolation—it must align with broader business goals, such as enhancing customer experience, increasing operational efficiency, or driving new revenue streams. Measuring AI ROI ensures that AI adoption is intentional and strategically sound.

- Resource Optimization: Not all AI initiatives yield the same level of impact. A clear understanding of AI ROI helps businesses prioritize high-impact projects while discontinuing underperforming ones, ensuring that AI investments contribute meaningfully to business growth.

Additionally, AI ROI plays a crucial role in refining AI strategies over time. By continuously monitoring performance metrics, organizations can identify gaps, fine-tune AI models, and ensure that AI remains an asset rather than an experimental expense.

How AI ROI Impacts Business Strategies and Decision-Making

Beyond just evaluating financial returns, AI ROI significantly shapes business strategies and decision-making processes. Understanding AI ROI enables organizations to leverage AI effectively, ensuring that investments drive long-term value rather than short-term hype. AI acts as a strategic tool that influences core business decisions. Organizations that effectively measure AI ROI can determine which AI initiatives should be scaled, discontinued, or integrated with other digital transformation efforts.

Moreover, AI ROI plays a pivotal role in enhancing operational efficiency. AI-driven automation reduces manual workloads, accelerates processes, and minimizes human error, leading to measurable gains in productivity. Studies indicate that businesses adopting AI for process automation can experience up to a 40% increase in productivity, providing a clear case for scaling AI investments. By tracking AI ROI, organizations can prioritize automation initiatives that generate the highest efficiency gains, ensuring that resources are utilized optimally.

A well-defined AI ROI strategy also strengthens competitive positioning. Businesses that measure AI ROI effectively can identify customer engagement patterns, predict market trends, and personalize offerings, providing a significant edge over competitors.

Ultimately, AI ROI is not just a retrospective evaluation of AI success – it is a forward-looking framework that informs strategic decision-making. Companies that consistently measure AI ROI are better positioned to allocate resources wisely, scale AI solutions effectively, and align AI adoption with long-term business objectives. By treating AI ROI as a continuous assessment rather than a one-time metric, organizations can ensure that AI investments are delivering real, sustainable value.

The Evolution of AI Investments

AI has transitioned from an experimental technology to a business necessity, driving efficiency and innovation across industries. Companies are investing heavily in AI, but measuring its true impact remains a challenge. Understanding its evolution, adoption trends, and ROI complexities helps businesses make informed decisions about AI investments.

Brief History of AI in Business

AI’s journey in business began with rule-based systems in the mid-20th century, but limited computing power stalled progress. By the 2000s, machine learning and big data enabled AI applications in finance, healthcare, and e-commerce. Today, AI is integral to business strategy, optimizing processes, enhancing customer interactions, and improving decision-making.

Growth of AI Adoption Across Industries

AI adoption is accelerating across sectors. A McKinsey report states that 50% of businesses now use AI in some capacity. In finance, AI enhances fraud detection and risk assessment. Healthcare relies on AI for diagnostics and predictive analytics. Retailers leverage AI for personalized recommendations, while manufacturers use it for predictive maintenance. AI-driven efficiencies are estimated to contribute $15.7 trillion to the global economy by 2030 (PwC).

Key Challenges in Measuring ROI for AI

Despite widespread adoption, AI ROI measurement remains complex. Unlike traditional IT investments, AI’s benefits – such as improved decision-making and enhanced customer experience – are harder to quantify. Challenges include:

- Delayed ROI – AI models need time to refine, delaying financial returns.

- Attribution Issues – AI-driven improvements often overlap with other business changes, making impact isolation difficult.

- Lack of Standardized Metrics – AI effectiveness varies by industry, complicating direct comparisons.

- Regulatory and Ethical Factors – Compliance costs (e.g., GDPR, SOC Type 2) can affect AI profitability.

To maximize returns, businesses must align AI investments with clear strategic goals, continuously track performance, and refine AI models to ensure measurable value over time.

Section 1: Understanding the ROI of AI Investments

-

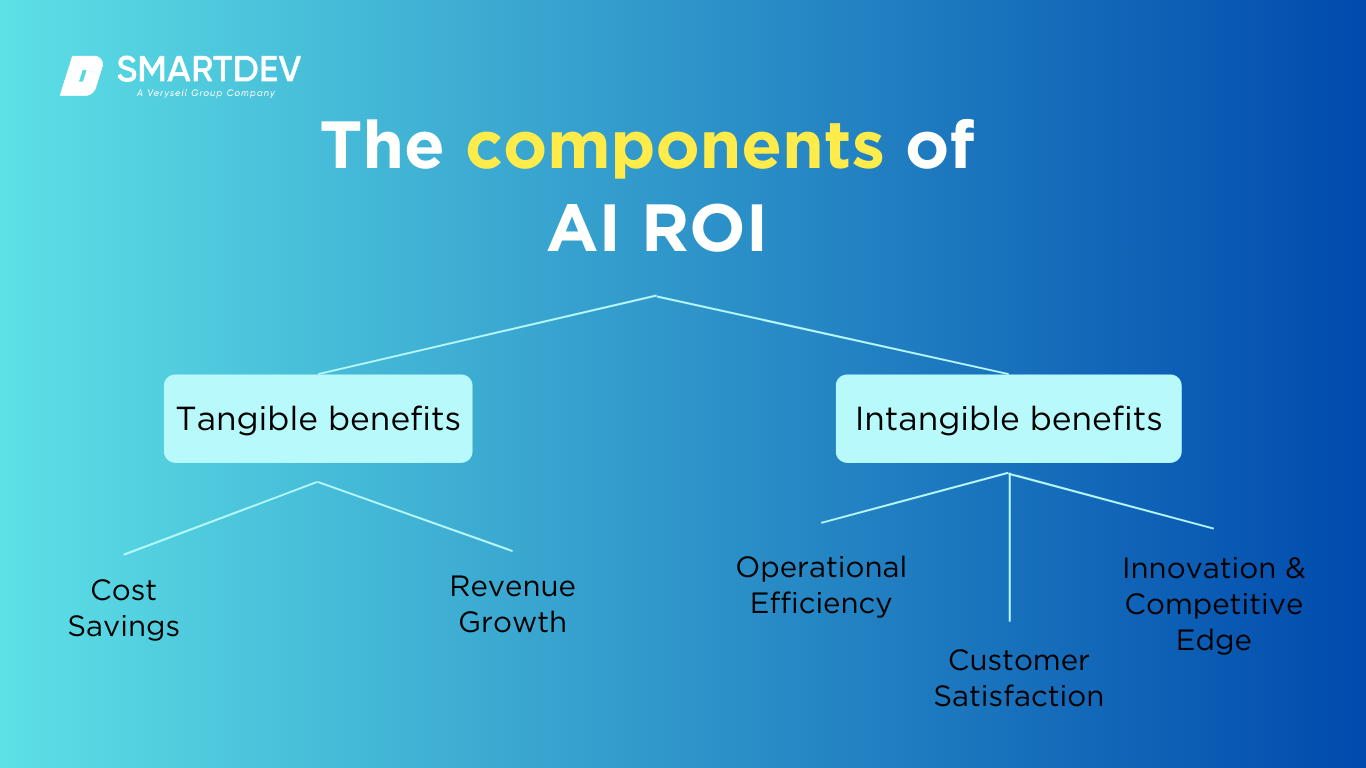

The Components of AI ROI

Understanding AI ROI requires analyzing both tangible and intangible benefits. While traditional ROI calculations focus on direct financial gains, AI’s impact often extends beyond revenue into areas such as efficiency, customer satisfaction, and innovation. A comprehensive approach to AI ROI considers these multiple dimensions to provide a holistic evaluation of AI’s business value.

1.1. Tangible Benefits

One of the most direct ways to measure AI ROI is through cost reductions and revenue enhancements. AI-powered automation can streamline workflows, reduce human error, and eliminate inefficiencies. A Deloitte study found that 93% of businesses using AI-driven automation reported significant cost savings.

- Cost Savings: AI minimizes labor costs by automating repetitive tasks, reducing the need for manual intervention. In supply chain management, AI-driven predictive maintenance can cut equipment downtime by up to 50%, leading to substantial operational cost reductions.

- Revenue Growth: AI-driven analytics provide deeper insights into customer behavior, enabling businesses to enhance their product offerings, personalize customer experiences, and drive sales. In e-commerce, AI-powered recommendation engines account for over 35% of total sales for companies like Amazon.

1.2. Intangible Benefits

Beyond financial returns, AI offers intangible benefits that contribute to long-term business growth:

- Operational Efficiency: AI enhances productivity by automating decision-making and optimizing resource allocation, allowing businesses to focus on strategic initiatives rather than routine tasks. AI chatbots, for example, handle up to 80% of routine customer service inquiries, freeing up human agents for complex issues.

- Customer Satisfaction: AI-powered personalization enhances user experience, leading to higher engagement and loyalty. Companies that leverage AI for customer interactions see a 10-15% increase in customer retention rates.

- Innovation and Competitive Edge: AI enables organizations to develop new products, predict market trends, and improve R&D efforts, creating new revenue streams and strengthening market positioning. AI-driven drug discovery, for instance, has accelerated new pharmaceutical development by 50%, reducing time-to-market for critical treatments.

1.3. Measuring AI’s Impact on Long-Term Business Value

AI’s full impact is often realized over time, making long-term value assessment critical. Unlike short-term cost reductions, AI investments contribute to sustainable growth, data-driven decision-making, and improved business resilience. Companies that systematically track AI-driven improvements in efficiency, customer engagement, and innovation can better justify future AI investments.

2. How to Measure AI ROI: Metrics and Frameworks

2.1. Key Metrics to Track AI ROI

- Time Savings: AI automates repetitive tasks, reducing workload and increasing productivity. Measuring time saved per process or task provides a clear indicator of AI’s efficiency gains.

- Operational Efficiency: Metrics such as cycle time reduction, resource utilization, and defect detection rates help quantify AI’s impact on overall business performance.

- Revenue Impact: AI-driven sales predictions, personalized marketing strategies, and customer segmentation can be measured by revenue growth, lead conversion rates, and customer lifetime value.

- Cost Reduction: AI-driven automation and optimization reduce labor costs, operational expenses, and error rates, contributing to overall cost efficiency.

2.2. Common Frameworks for Calculating AI ROI

Businesses use different methodologies to evaluate AI ROI. Some common frameworks include:

- Total Cost of Ownership (TCO) vs. Gains: Compares AI investment costs (hardware, software, training, implementation) against financial gains over time.

- Net Present Value (NPV) & Payback Period: Calculates the present value of AI-driven benefits relative to initial investments, determining how long it takes to recover AI costs.

- Benchmarking Against Industry Standards: Comparing AI-driven improvements with competitors’ AI deployments provides insights into relative performance and efficiency gains.

2.3. Industry-Specific Metrics for AI Success

AI’s effectiveness varies by industry, requiring sector-specific KPIs:

- Healthcare: AI’s impact is measured by diagnostic accuracy, treatment success rates, and time saved in medical imaging analysis.

- Finance: Key metrics include fraud detection rates, algorithmic trading performance, and credit risk assessment improvements.

- Retail: Customer engagement metrics, recommendation engine effectiveness, and revenue from AI-driven promotions are critical indicators.

- Manufacturing: AI’s contribution is assessed through predictive maintenance success rates, production downtime reductions, and supply chain optimization efficiency.

Section 2: Use Cases and Applications

Artificial Intelligence (AI) has become a transformative force across various industries, driving significant Return on Investment (ROI) through diverse applications.

3. AI Use Cases That Drive ROI Across Industries

Retail: Personalization and Inventory Management

AI is revolutionizing retail by enhancing customer experience and optimizing supply chains. AI-driven personalization engines analyze consumer behavior to recommend products, increasing engagement and sales. Meanwhile, AI-powered inventory management predicts demand, reducing overstock and shortages, ensuring businesses maintain optimal stock levels and minimize waste.

Healthcare: Diagnosis Automation and Drug Discovery

AI is transforming healthcare by improving diagnostic accuracy and accelerating drug development. AI-driven diagnostic tools analyze medical images and patient data, detecting diseases earlier and more accurately than traditional methods. In pharmaceuticals, AI expedites drug discovery by identifying potential treatments faster, cutting research costs and time-to-market for new medicines.

Finance: Fraud Detection and Predictive Analytics

Financial institutions use AI to strengthen security and optimize decision-making. AI-powered fraud detection systems analyze transaction patterns in real time, identifying suspicious activity and reducing financial risks. Predictive analytics leverage AI to forecast market trends, helping investors and financial planners make data-driven decisions and mitigate risks.

Manufacturing: Predictive Maintenance and Quality Control

AI is improving efficiency and reducing operational costs in manufacturing. Predictive maintenance systems analyze sensor data to anticipate equipment failures, reducing downtime and maintenance expenses. AI-powered quality control systems inspect products for defects, ensuring higher production standards and minimizing waste.

4. Generative AI and Its ROI Potential

Generative AI, a subset of artificial intelligence, creates new content and has distinct applications with significant ROI potential.

Unlike traditional AI, which analyzes existing data, generative AI produces new data, such as images, text, or music. This capability enables innovative applications across various sectors.

Some outstanding examples of Generative AI Driving ROI:

- ChatGPT: Developed by OpenAI, ChatGPT generates human-like text, assisting in customer service, content creation, and more. Businesses utilize ChatGPT to automate responses, improving efficiency and customer engagement.

- DALL-E: Also, from OpenAI, DALL-E creates unique images from textual descriptions, aiding in design and marketing. Companies leverage DALL-E to generate visual content without the need for graphic designers, reducing costs and accelerating marketing campaigns.

While promising, generative AI still presents other challenges:

- Generative AI models may produce outputs that are not always accurate or appropriate, necessitating human oversight.

- The potential for generating misleading or harmful content raises ethical concerns.

- Developing and deploying generative AI models requires substantial computational resources and expertise.

Hence, organizations must weigh these factors against potential benefits to determine the viability of generative AI initiatives.

5. AI for Small and Medium Businesses (SMBs)

For many small and medium-sized businesses, AI might seem like a tool reserved for tech giants. But in reality, AI is becoming more accessible and affordable, offering SMBs powerful ways to improve efficiency, cut costs, and enhance customer experiences.

How SMBs Can Unlock ROI with AI

AI can take over repetitive tasks, freeing up employees to focus on more strategic work. A small e-commerce store, for example, can use AI chatbots to handle customer inquiries 24/7, improving response times without hiring extra staff. AI-driven data analytics tools can help businesses understand customer behavior, optimize pricing, and refine marketing strategies—boosting sales without increasing overhead.

Affordable AI Solutions for Quick Wins

AI no longer requires massive budgets or in-house tech teams. Many platforms offer plug-and-play AI solutions designed for SMBs, such as AI-powered email marketing, automated invoicing, and inventory forecasting. Tools like ChatGPT can assist with content creation and customer support, while AI-powered analytics platforms provide actionable insights without requiring deep technical expertise.

By starting with small, high-impact AI tools, SMBs can see quick returns, reduce manual workload, and gradually scale their AI adoption as their business grows. AI isn’t just for big corporations anymore, it’s a game-changer for businesses of all sizes.

Section 3: The Business Case for AI ROI

AI adoption is rapidly becoming a strategic priority, but for businesses to fully capitalize on its potential, they need a clear and well-structured business case. Demonstrating AI’s return on investment (ROI) is essential to justify spending, secure stakeholder buy-in and ensure long-term success. A robust AI business case should align investments with business goals, accurately estimate costs, forecast potential gains, and balance risks and rewards.

6. Building a Strong Business Case for AI Investments

A compelling AI investment case starts with a clear understanding of how AI aligns with a company’s broader strategy. Businesses must define specific objectives, whether it’s improving customer experience, reducing operational costs, or driving revenue growth. Instead of adopting AI for the sake of innovation, companies should focus on AI projects that directly contribute to their bottom line and long-term vision.

Aligning AI Investments with Business Goals

For AI to deliver real value, it must support key business priorities. A retail company might prioritize AI-driven personalization to enhance customer engagement, while a manufacturing firm may invest in predictive maintenance to reduce equipment downtime. By ensuring AI initiatives align with core business objectives, companies can maximize their investment’s impact and prevent unnecessary spending on experimental projects with unclear benefits.

Estimating AI Costs

AI investments come with upfront costs that need to be carefully planned. The total cost of ownership includes:

- Development Costs: Building custom AI models or integrating third-party AI solutions. Read this guide to get a clear, strategic breakdown of development and integration costs.

- Implementation Costs: Deployment, staff training, and necessary infrastructure upgrades.

- Maintenance Costs: Ongoing model updates, compliance requirements, and data security measures.

Failure to account for these expenses can result in budget overruns, delaying AI’s expected benefits.

Forecasting Potential Gains

The financial benefits of AI vary across industries and applications.

- Short-term gains often include increased efficiency, automation-driven cost reductions, and improved decision-making.

- Long-term gains extend to enhanced customer satisfaction, new revenue streams, and data-driven business expansion.

Companies must set clear KPIs to measure AI’s impact over time.

7. Cost-Benefit Analysis of AI Projects

Balancing Initial Investment vs. Expected Returns

AI projects often require substantial upfront investment, including development, implementation, and training costs. However, the financial returns vary depending on the scope and effectiveness of the solution.

For instance, AI-powered automation in customer support may provide quick cost savings by reducing the need for human agents, while AI-driven predictive maintenance in manufacturing might take longer to show a return but eventually reduces costly downtime. Companies must assess whether their AI investments are geared toward short-term efficiency gains or long-term strategic transformation.

Case Study: High ROI AI Projects vs. Low ROI Failures

Successful AI projects share common traits: Clear objectives, High-quality data, seamless integration with existing processes, and a measurable impact on business goals.

One standout example is AI-driven fraud detection in banking, which has significantly reduced financial losses by identifying suspicious transactions in real time. Similarly, AI-powered recommendation engines in e-commerce have boosted sales by personalizing customer experiences.

On the other hand, some AI investments fail to deliver value. Many companies have invested in AI chatbots without proper training, resulting in poor customer experiences rather than improved service. Others have attempted AI-driven analytics without clean, structured data, leading to unreliable insights. The key takeaway: AI projects succeed when they align with business needs and leverage high-quality data.

Hidden Costs in AI Implementation

Beyond the obvious development and deployment expenses, AI investments come with hidden costs that businesses often overlook:

- Data Preparation & Management: AI models require large datasets, and cleaning, structuring, and maintaining this data can be resource intensive.

- Regulatory Compliance & Security: Businesses in sectors like healthcare and finance must comply with strict AI-related regulations, which add to operational expenses.

- Change Management & Training: Employees need proper training to work effectively with AI, and overcoming resistance to AI adoption can slow down implementation.

Understanding these hidden costs is crucial for businesses to accurately forecast AI’s total cost of ownership and ensure that projected ROI accounts for all necessary expenses. With a well-rounded cost-benefit analysis, organizations can make informed AI investment decisions that lead to sustainable, measurable returns.

Section 4: Real-World Examples

8. AI ROI Success Stories from SmartDev

SmartDev has a proven track record of delivering innovative AI solutions that drive significant returns on investment (ROI) for clients across various industries. The following case studies highlight how SmartDev’s expertise has transformed businesses through tailored AI applications.

1 – Building Financial Futures: A Wealth Management App

In collaboration with a prominent financial services provider, SmartDev developed a comprehensive wealth management application. This platform seamlessly integrates financial planning with health and lifestyle management, offering users a holistic approach to wealth and well-being. Backed by Standard Chartered, the app provides personalized investment advice, real-time financial tracking, and health monitoring features. The integration of AI-driven analytics enables users to make informed decisions, leading to improved financial outcomes and enhanced user engagement. This project not only expanded the client’s service offerings but also attracted a broader user base, resulting in increased revenue streams.

2 – Revitalizing Legacy Systems in EdTech

A leading EdTech company in the UK faced challenges with outdated systems that hindered user experience and operational efficiency. SmartDev conducted a thorough technical audit, assessing the existing infrastructure and identifying areas for improvement. The team implemented UX/UI enhancements and overhauled the legacy systems, resulting in a more intuitive and responsive platform. These improvements led to increased user satisfaction and retention, positioning the client competitively in the rapidly evolving EdTech market.

9. Lessons Learned from Failed AI Projects

Despite AI’s potential, not all implementations yield positive outcomes. Understanding common pitfalls is crucial for maximizing AI ROI.

9.1. Common Pitfalls in AI Implementation

- Lack of Clear Objectives and Strategy: Embarking on AI projects without well-defined goals can lead to misaligned efforts and wasted resources (info.italentdigital.com).

- Insufficient Data Quality and Management: AI systems rely on high-quality data; poor data governance can result in inaccurate models and flawed insights (shelf.io)

- Underestimating Costs and Resource Demands: AI initiatives often require significant investment in technology and talent, and underestimating these needs can impede project success (naviant.com)

9.2. Strategies to Avoid Negative ROI

- Establish Clear Objectives: Define specific, measurable goals aligned with business strategies to guide AI initiatives effectively.

- Ensure Data Integrity: Implement robust data management practices to maintain the quality and relevance of data inputs.

- Conduct Comprehensive Cost-Benefit Analyses: Assess all potential costs and benefits to make informed investment decisions.

- Foster Cross-Functional Collaboration: Engage stakeholders from various departments to ensure AI solutions meet diverse business needs.

Section 5: Challenges and Risks

Implementing Artificial Intelligence (AI) offers substantial benefits, yet organizations often encounter significant challenges that can impede the realization of a positive Return on Investment (ROI). Understanding these barriers and ethical considerations is crucial for successful AI integration.

10. Barriers to Realizing AI ROI

- Data Quality and Availability Issues

AI systems rely heavily on high-quality data. Inaccurate, inconsistent, or incomplete data can compromise AI outputs, leading to flawed insights and decisions. A recent survey revealed that poor data quality costs organizations an average of $12.9 million annually due to reworks and inefficiencies (Shelf)

- High Implementation Costs and Resource Demands

The financial investment required for AI adoption – including technology acquisition, infrastructure upgrades, and specialized personnel – can be substantial. A survey indicated that 29% of organizations cite implementation costs as the primary barrier to AI adoption (CallCenter Helper).

- Organizational Resistance to Change

Employees may resist AI integration due to fears of job displacement or unfamiliarity with new technologies. This resistance can hinder implementation and reduce the effectiveness of AI initiatives. Addressing these concerns through clear communication and training is essential for smooth adoption.

11. Ethical and Regulatory Challenges Impacting AI ROI

- AI Bias and Its Impact on ROI

AI systems can inadvertently perpetuate existing biases present in their training data, leading to discriminatory practices that harm individuals and expose organizations to reputational damage and regulatory penalties. Ensuring fairness and transparency in AI models is critical to maintaining trust and compliance.

- Navigating Legal and Compliance Risks

The evolving landscape of AI regulations requires organizations to stay informed and compliant. Non-compliance can result in legal repercussions and financial losses, underscoring the importance of integrating regulatory considerations into AI strategies.

12. How to Mitigate AI Risks and Maximize Returns

- Building a Robust AI Strategy

Developing a comprehensive AI strategy involves setting clear objectives, ensuring data readiness, and aligning AI initiatives with overall business goals. A well-structured plan serves as a roadmap, guiding organizations through implementation while anticipating challenges.

- Ensuring Stakeholder Buy-In and Collaboration

Successful AI adoption requires the support and collaboration of all stakeholders, including leadership, IT, and end-users. Engaging these groups early in the process fosters a culture of acceptance and facilitates smoother integration of AI solutions.

By proactively addressing these challenges and implementing strategic measures, organizations can enhance the ROI of their AI investments, driving innovation and maintaining a competitive edge in their respective industries.

Section 6: Actionable Steps to Maximize ROI with AI

Implementing Artificial Intelligence (AI) effectively requires a strategic approach to ensure maximum return on investment (ROI). The following steps and best practices are designed to guide organizations through successful AI adoption and long-term value realization.

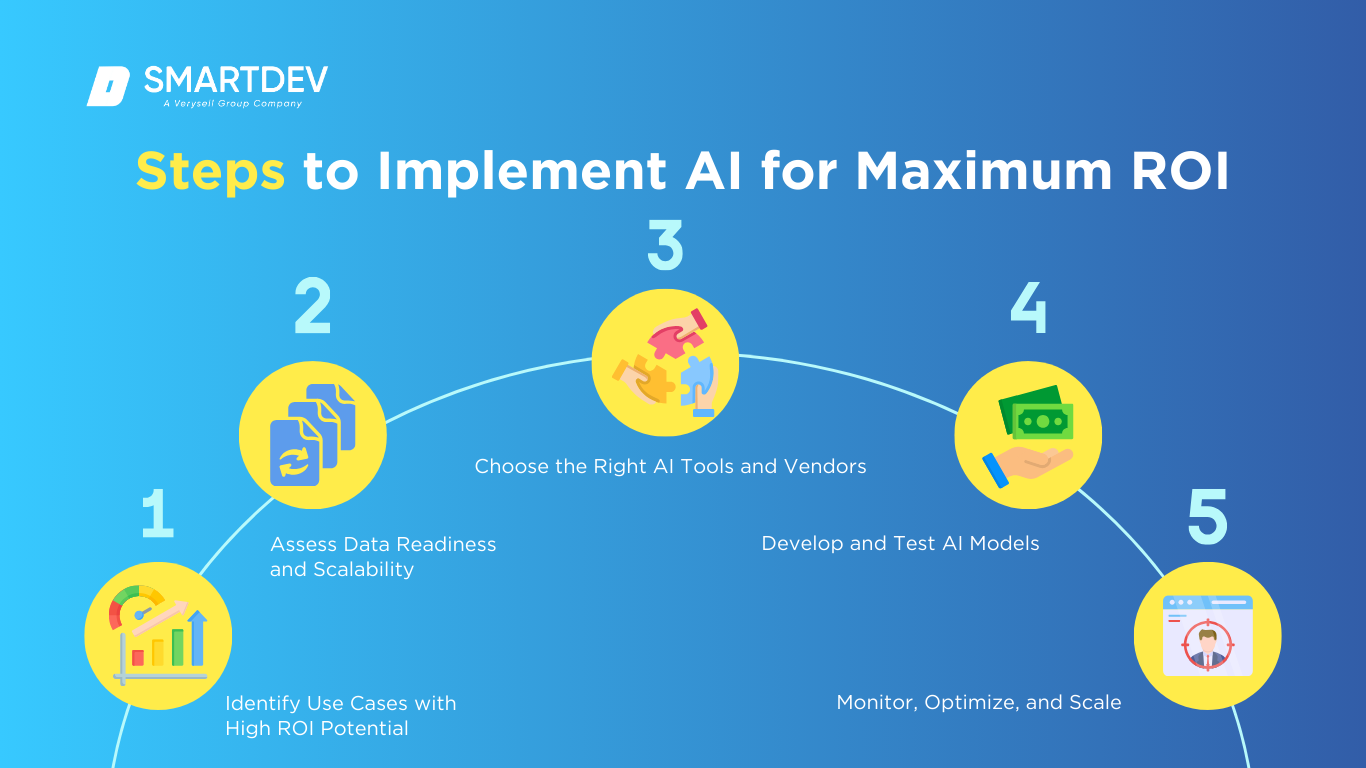

13. Steps to Implement AI for Maximum ROI

Step 1: Identify Use Cases with High ROI Potential

Begin by pinpointing areas within your organization where AI can have the most significant impact. Focus on processes that are repetitive, time-consuming, or prone to human error. For example, AI-driven automation in customer service can enhance efficiency and reduce operational costs. Prioritizing high impact use cases ensures that AI initiatives align with business objectives and deliver measurable value.

Step 2: Assess Data Readiness and Scalability

AI systems thrive on high-quality data. Evaluate the availability, accuracy, and completeness of your data sources. Implement robust data governance policies to maintain data integrity and consider utilizing existing internal datasets before acquiring external ones. Ensuring data readiness is crucial for the scalability and success of AI projects.

Step 3: Choose the Right AI Tools and Vendors

Selecting appropriate AI technologies and partners is vital. Consider leveraging open-source AI tools and cloud-based solutions to reduce software and infrastructure expenses. Ensure that chosen tools align with your organization’s specific needs and can integrate seamlessly with existing systems. A strategic selection of AI tools and vendors can optimize costs and enhance implementation efficiency.

Read more: Master AI Tech Stacks for 2025: The Ultimate Guide

Step 4: Develop and Test AI Models

Collaborate with cross-functional teams to develop AI models tailored to your identified use cases. Adopt agile methodologies to allow iterative development and continuous improvement. Thorough testing is essential to validate model performance and ensure reliability before full-scale deployment. This approach facilitates flexibility and cost-effective adaptations during the development process.

Read more: AI Model Testing: The Ultimate Guide in 2025

Step 5: Monitor, Optimize, and Scale

Post-deployment, continuously monitor AI systems to assess performance against predefined metrics. Gather feedback to identify areas for improvement and make necessary adjustments. Once validated, scale successful AI solutions across the organization to maximize benefits. Continuous monitoring and optimization are key to sustaining AI’s value proposition.

14. Best Practices for Long-Term AI ROI

- Continuous Improvement Through Feedback Loops

Establish mechanisms for regular feedback to refine AI systems. This iterative process helps in adapting to changing business environments and evolving data patterns, ensuring AI solutions remain effective and relevant over time. Continuous improvement fosters resilience and long-term success of AI initiatives (sandtech.com)

- Upskilling Teams for AI Adoption

Invest in training programs to enhance the AI proficiency of your workforce. A skilled team can better manage AI tools, interpret outputs accurately, and drive innovation. Empowering employees with AI knowledge not only improve project outcomes but also promotes a culture of technological advancement (cbia.com)

- Leveraging Open-Source AI to Reduce Costs

Utilizing open-source AI platforms can significantly cut down on licensing fees and development costs. These resources offer flexibility and community support, enabling organizations to customize solutions without substantial financial investment. Leveraging open-source tools is a cost-effective strategy for AI implementation (technologyblog.rsmus.com)

By following these steps and best practices, organizations can strategically implement AI to achieve maximum ROI, driving efficiency, innovation, and competitive advantage.

Section 7: AI ROI by Industry

Artificial Intelligence (AI) has become a powerful tool across industries, driving operational efficiency, improving customer experiences, and generating significant financial returns. However, the way AI delivers value differs by sector, with each industry having specific use cases and performance metrics to evaluate success.

Below, we explore how AI contributes to ROI in financial services, retail, healthcare, and manufacturing, along with key indicators businesses use to measure its impact.

15. AI ROI in Financial Services

The financial sector has long been at the forefront of AI adoption, leveraging machine learning and predictive analytics for risk assessment, fraud detection, and automated financial advisory services. AI-powered fraud detection systems analyze vast amounts of transaction data in real-time, significantly reducing fraudulent activities and saving millions in losses. Additionally, AI-driven robot-advisors are revolutionizing investment management by providing personalized portfolio recommendations with lower operational costs.

The success of AI in financial services is measured through several key metrics. A reduction in fraudulent transactions indicates the effectiveness of AI-based security systems, while improved client retention rates reflect the value of AI-driven personalization in banking and investment services. Operational cost savings from automation, such as AI-powered underwriting or chatbots handling customer inquiries, further contribute to the overall ROI of AI in finance.

16. AI ROI in Retail

Retailers have embraced AI to enhance customer engagement and streamline supply chains. AI-driven personalized marketing allows brands to deliver highly targeted advertisements and recommendations, increasing conversion rates and improving customer satisfaction. Retailers like Amazon rely on AI algorithms to analyze browsing history and shopping behavior, which accounts for a significant portion of their sales. Additionally, AI-driven demand forecasting helps retailers maintain optimal inventory levels, reducing stock shortages and excess supply.

Measuring AI ROI in retail focuses on key performance indicators such as an increase in conversion rates from personalized recommendations and improvements in customer lifetime value. Inventory turnover rates also serve as a crucial metric, indicating how well AI-driven demand forecasting optimizes stock management. Retailers leveraging AI effectively can improve revenue while simultaneously reducing operational costs.

17. AI ROI in Healthcare

In healthcare, AI is transforming patient care and hospital operations. AI-powered predictive diagnostics enable earlier disease detection, improving patient outcomes while reducing the cost of late-stage treatments. Machine learning models analyze medical imaging with greater accuracy than traditional methods, assisting doctors in making faster, more precise diagnoses. AI is also playing a crucial role in remote patient monitoring, allowing healthcare providers to track vital signs and detect anomalies before they escalate into serious conditions.

The effectiveness of AI in healthcare is assessed through various ROI metrics. A reduction in hospital readmission rates signifies the success of AI-powered predictive monitoring, while improvements in diagnostic accuracy demonstrate AI’s role in enhancing medical decision-making. Additionally, cost-per-patient analysis helps hospitals measure the financial impact of AI-driven operational efficiencies.

18. AI ROI in Manufacturing

AI has significantly improved manufacturing operations by reducing downtime, increasing production efficiency, and maintaining quality control. Predictive maintenance systems use AI to monitor machinery and detect potential failures before they occur, preventing costly breakdowns and production delays. Meanwhile, AI-driven robotics have revolutionized assembly lines, allowing manufacturers to automate repetitive tasks with precision and speed.

To evaluate AI’s impact in manufacturing, businesses track metrics such as downtime reduction, production throughput, and quality yield. A decrease in equipment failure rates signifies the effectiveness of predictive maintenance, while an increase in overall production output demonstrates the efficiency of AI-powered automation. Additionally, AI’s role in defect detection and quality assurance helps manufacturers improve product consistency, reducing waste and rework costs.

Conclusion

As we advance into 2025 and beyond, Artificial Intelligence (AI) continues to redefine business landscapes, offering substantial returns on investment (ROI) across various sectors. The trajectory of AI investments is influenced by emerging trends and the integration of innovative technologies like generative AI.

19. The Future of AI ROI

The AI investment landscape is experiencing significant growth, with major tech companies allocating substantial resources to AI infrastructure. Projections indicate that spending on AI infrastructure by leading firms is set to nearly double by 2025, driven by the adoption of generative AI technologies. This surge in investment underscores the critical role of AI in driving future business value.

Trends Shaping AI Investments in 2025 and Beyond

Several key trends are shaping AI investments:

- Hyper-Personalization: AI enables businesses to deliver highly personalized customer experiences, enhancing engagement and loyalty.

- Decision Intelligence: AI-driven decision-making tools are becoming integral, assisting organizations in navigating complex business challenges.

- AI as a Sustainability Enabler: AI applications are increasingly focused on promoting sustainability, aiding companies in achieving environmental goals.

The Role of Generative AI in the Next Wave of ROI

Generative AI stands out as a pivotal contributor to ROI. Studies reveal that organizations implementing generative AI have realized an average ROI of $3.7 for every dollar invested, with top performers achieving up to $10.3. Industries such as financial services, media, and telecommunications are leading in harnessing these benefits.

20. Final Thoughts: Is AI Worth the Investment?

The evidence suggests that strategic AI adoption offers compelling ROI. While initial investments can be significant, the long-term gains in efficiency, innovation, and competitiveness are substantial.

Encouragement for Businesses to Start Small and Scale

Embarking on the AI journey need not be overwhelming. By initiating targeted, high-impact projects, businesses can manage risks and demonstrate value. This approach facilitates learning, fosters stakeholder buy-in, and lays a solid foundation for broader AI integration.

In conclusion, AI presents a transformative opportunity for businesses willing to invest thoughtfully and strategically. By staying attuned to emerging trends and focusing on scalable implementation, organizations can unlock significant ROI and secure a competitive edge in the evolving marketplace.

—

References:

- Why Measuring ROI is Essential for AI Success – Ignite Tech

https://ignitetech.ai/about/blogs/why-measuring-roi-essential-ai-success#:~:text=Measuring%20ROI%20is%20a%20critical,technology%2C%20talent%2C%20and%20infrastructure. - The State of AI in 2023: Generative AI’s Breakout Year – McKinsey

https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2023-generative-ais-breakout-year - AI and Its Global Impact: PwC Artificial Intelligence Study – PwC

https://www.pwc.com/gx/en/issues/artificial-intelligence/publications/artificial-intelligence-study.html - Common AI Implementation Pitfalls and How to Avoid Them – Shelf

https://shelf.io/blog/9-ai-implementation-pitfalls/