Introduction

In today’s fast-paced, interconnected world, digital payments are at the heart of economic innovation. As traditional banking systems struggle to reach underserved populations, the demand for mobile payment solutions that empower people in remote and emerging markets has never been greater. Enter VeryPay – a groundbreaking fintech platform built to drive financial inclusion and revolutionize payment systems, especially in regions like Africa.

With its innovative use of artificial intelligence (AI) and cutting-edge payment technologies, VeryPay has quickly positioned itself as a leader in the rapidly evolving world of fintech. In just a short period, the platform has made a lasting impact on the digital financial services sector, reshaping the way consumers, businesses, and financial institutions engage with money.

Overview of VeryPay

VeryPay is a proud member of Verysell Group, a leading organization focused on digital transformation across industries. As part of this innovative group, VeryPay benefits from a strong network of resources, expertise, and technologies, allowing it to stay ahead in delivering impactful fintech solutions. This collaboration enhances VeryPay’s ability to adapt to the fast-evolving financial landscape and drive financial inclusion through cutting-edge technology.

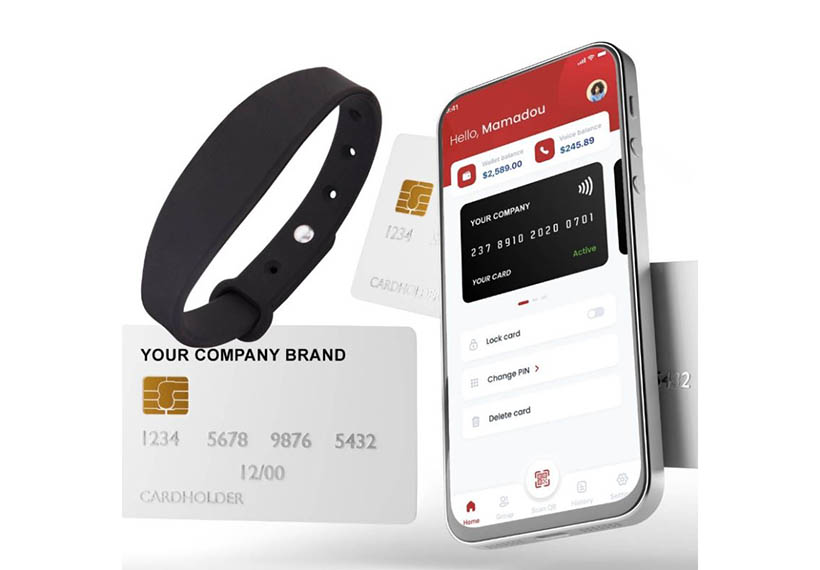

At the intersection of fintech innovation and digital financial services, VeryPay offers advanced payment solutions designed to simplify transactions across industries. With mobile phones rapidly becoming the primary tool for financial services in emerging markets like Africa, VeryPay bridges the gap by providing seamless, user-friendly platforms for sending money, paying bills, and accessing financial services. By integrating AI into its mobile wallets, e-wallets, and payment processing systems, VeryPay ensures that its platform is not only fast and secure but also adaptable to diverse user needs, fostering a more efficient and inclusive financial ecosystem.

Mission and Vision of VeryPay

At the heart of VeryPay’s mission is a commitment to financial inclusion. In regions where traditional banking infrastructure is scarce or non-existent, VeryPay’s digital payment solutions are opening up new possibilities for millions of people who have never had access to conventional financial services. By leveraging the power of AI and mobile technology, VeryPay enables individuals to perform a wide range of financial activities: sending money, paying bills, saving, and even accessing credit. This not only helps to reduce the digital divide but also fosters greater economic stability by empowering individuals and communities with financial tools and resources.

What VeryPay Offers in the Fintech Landscape

VeryPay’s value proposition lies in its ability to offer a wide array of digital payment solutions that cater to both individual users and businesses. The platform’s offerings include mobile money services, e-wallets, and payment processing solutions for businesses and mobile network operators. This versatility allows VeryPay to meet the needs of consumers at all levels, from individuals to businesses and financial institutions seeking to integrate seamless payment systems into their operations.

One of the key advantages of VeryPay is its focus on security and efficiency. The platform uses AI-driven algorithms to process transactions quickly and securely, while offering personalized financial services tailored to individual needs. From peer-to-peer transfers and bill payments to cross-border remittances, VeryPay ensures a seamless, cost-effective digital payment experience. For businesses, it provides customizable payment gateways for secure, scalable integration with e-commerce platforms, enhancing operational efficiency and customer satisfaction. Through these innovations, VeryPay is addressing the needs of mobile-first consumers and paving the way for a future where financial inclusion, security, and efficiency are a reality for millions.

The Fast-Track Development of VeryPay Solutions: A 6-Month Journey

The Fast-Track Development of VeryPay Solutions: A 6-Month Journey

A Timeline of VeryPay’s Growth

VeryPay’s journey from concept to award-winning fintech platform in just six months highlights the power of agile development, collaboration, and innovation. This rapid timeline was made possible through a close partnership with SmartDev, whose AI expertise played a critical role in building the platform.

Key to the success was adopting an agile development approach. Agile allowed the team to quickly iterate, test, and refine features based on real-time feedback. This flexibility enabled the platform to evolve rapidly while maintaining high quality.

To further streamline development, continuous testing was integrated into the process. Using AI-enabled automated testing tools, SmartDev ensured that every aspect of the platform was rigorously tested, from security to performance, catching issues early and reducing potential delays.

The focus on speed and quality allowed VeryPay to launch in just six months—far faster than the typical fintech development cycle. This fast execution not only helped the platform go live quickly but also earned recognition, including the prestigious Sao Khue Award, cementing VeryPay’s position as an industry leader.

Overcoming Challenges to Deliver a Robust Payment Solution

Building a complex fintech solution in just six months came with significant challenges. The team needed to ensure that the platform was scalable, secure, and provided an exceptional user experience while meeting the demands of millions of users.

-

Scalability

Scalability was one of the first major hurdles. VeryPay needed to handle millions of users and transactions, especially in rapidly growing markets like Africa. To address this, SmartDev leveraged cloud computing and scalable infrastructure to dynamically allocate resources based on demand. This ensured the platform could grow rapidly without compromising on performance, even during peak usage times.

-

Security

Security was another critical challenge. As a platform handling sensitive financial transactions, VeryPay needed to protect user data and prevent fraud. AI-driven security features were integrated to detect and flag unusual activity in real-time. For example, the system could identify suspicious transaction patterns, like large sums being sent to new recipients, and immediately alert the system. This helped prevent fraud and provided users with peace of mind.

Additionally, encryption technologies and multi-factor authentication were used to ensure that both user data and financial transactions remained secure from potential cyber threats.

-

User Experience

A seamless, user-friendly experience was essential, particularly since VeryPay was targeting mobile-first users in Africa—many of whom may not have experience with digital financial platforms. The team prioritized designing an interface that was simple and intuitive, even for first-time users.

SmartDev’s AI expertise also played a role in personalizing the user experience. AI algorithms analyzed user behavior and preferences, allowing VeryPay to offer tailored services. For instance, the platform could suggest bill payments based on past activity or recommend savings options. This personalized approach made the platform more engaging and helped foster greater adoption.

-

AI-Driven Decision-Making and Payment Optimization

AI-powered decision-making was another key element of VeryPay’s success. SmartDev integrated machine learning algorithms that optimized payment flows and reduced transaction times. The AI system could instantly determine the best route for a payment, ensuring it was processed efficiently. This enhanced speed and reliability, which was essential for users who needed to send money quickly.

Furthermore, AI also enabled real-time fraud detection and automated decision-making, improving the platform’s security while ensuring fast transaction processing. This streamlined operations, making VeryPay a more efficient and secure solution for its users.

Award-Winning Fintech: Recognition and Achievements

Award-Winning Fintech: Recognition and Achievements

The Sao Khue Award and Its Significance

In 2024, VeryPay was honored with the prestigious Sao Khue Award, one of Vietnam’s most distinguished recognitions for innovation in the digital and technology sectors. The Sao Khue Award celebrates companies that have made significant contributions to digital transformation, and VeryPay’s win highlights its groundbreaking role in digital payment solutions, especially in emerging markets like Africa.

This award acknowledges VeryPay’s impact in advancing financial inclusion. Through its mobile money services, e-wallets, and secure payment systems, VeryPay is helping millions of people in underserved areas of Africa gain access to essential financial services. In regions where traditional banking infrastructure is limited, VeryPay provides a vital alternative, allowing people to send money, pay bills, and engage in digital transactions through their mobile phones.

The recognition also underscores VeryPay’s technological innovation, particularly its use of AI-powered solutions. The platform optimizes payment processes, improves security, and tailors user experiences—elements that have been key to its success. Winning the Sao Khue Award is not only a testament to VeryPay’s rapid growth but also to its ability to shape the future of digital payments on a global scale.

Other Notable Achievements and Milestones

In addition to the Sao Khue Award, VeryPay has reached several other major milestones that underscore its rapid growth and success in the fintech space. The company has successfully expanded its services across multiple African countries, establishing itself as a leader in the mobile payments industry. By forming strategic partnerships with Mobile Network Operators (MNOs), VeryPay has been able to offer a wide array of financial services—such as mobile transfers, bill payments, and e-commerce solutions—to millions of users across the continent.

These partnerships have allowed VeryPay to reach markets with high mobile penetration but low financial inclusion. Many of these areas previously lacked access to formal banking services, and VeryPay’s mobile-based solutions have opened up new opportunities for people to participate in the digital economy. This expansion has also contributed to the company’s growing recognition as a trusted provider of digital financial services.

One of the key factors driving VeryPay’s success is its commitment to user experience. The platform’s seamless integration with various financial systems and its ability to handle millions of transactions efficiently have made it a go-to solution for businesses and consumers alike. The platform’s security features, driven by AI, have also played a crucial role in building trust and encouraging wider adoption.

Industry Recognition of VeryPay’s Innovation

VeryPay’s cutting-edge approach to digital payments has earned praise from multiple fintech and payment industry bodies. The company’s ability to deliver scalable, efficient, and secure payment solutions has set it apart in the competitive fintech landscape. Its use of AI and machine learning has been instrumental in providing fast, reliable services that cater to the growing demand for mobile payments.

What sets VeryPay apart is its seamless integration with existing financial systems. Whether it’s mobile wallets, banks, or businesses, VeryPay’s platform can easily connect with different systems, providing a flexible and scalable solution. This adaptability has made VeryPay a standout player, particularly in markets where payment infrastructure is still developing.

In addition to winning awards, VeryPay is also recognized as a thought leader in financial inclusion. The company regularly participates in global conversations about digitizing payments and improving access to financial services in emerging markets. By sharing its expertise and insights, VeryPay continues to influence the future of digital finance, helping to shape an ecosystem that includes more people in the financial system.

Explore how SmartDev partners with fintech innovators to design future-ready digital ecosystems—focused on system security, regulatory compliance, and seamless user experience across all financial touchpoints.

SmartDev equips fintech businesses with full-spectrum engineering support, enabling them to build secure, scalable, and AI-driven payment platforms that align with global compliance requirements and industry best practices.

Learn how organizations accelerate digital transformation securely through phased AI adoption - Combining governance frameworks with performance-focused implementation strategies.

Start My Journey to Successful AI AdoptionCollaborative Achievements: What VeryPay and SmartDev Have Accomplished Together

The partnership between VeryPay and SmartDev has produced advanced AI-driven solutions that significantly strengthen the platform’s performance. These improvements make digital payments faster, safer, and easier for users across diverse markets. With SmartDev’s support, VeryPay has been able to modernize core payment functions while maintaining stability and scalability. Together, they have built a foundation that supports long-term growth.

Successful AI-Driven Solutions in Fintech

The partnership between VeryPay and SmartDev has resulted in the development of powerful AI-driven solutions that significantly enhance the platform’s efficiency, security, and user experience.

1. AI-Powered Payment Solutions

VeryPay’s platform now uses advanced AI systems that continuously analyze and optimize the routing of every transaction. These systems evaluate multiple possible network paths, compare their speed and security, and select the most efficient route in real time. This ensures that transactions remain stable and reliable, even during sudden spikes in traffic or unexpected changes in network conditions. As a result, users experience fewer delays, shorter waiting times, and a smoother payment flow across different devices and environments. This optimization is crucial in regions like Africa, where mobile money adoption is growing quickly and consistent performance is essential for daily financial activity.

A major achievement of this AI-driven optimization is VeryPay’s ability to process millions of transactions at scale without compromising quality or speed. The system intelligently distributes workload and eliminates common errors that often occur in high-volume digital payment platforms. This significantly reduces transaction failures and improves overall success rates, creating a highly reliable payment experience for users. In markets where digital services are expanding rapidly, this capability allows VeryPay to meet increasing demand while maintaining exceptional performance. It also positions the platform as a dependable and future-ready solution for financial institutions, mobile network operators, and businesses seeking stability in fast-growing digital ecosystems.

2. Fraud Detection Capabilities

SmartDev has strengthened VeryPay’s platform by implementing powerful machine learning models that monitor transactions in real time. These models track user behavior, compare patterns, and instantly identify unusual activity that may signal fraud. Because the system learns continuously, its detection accuracy becomes smarter and more precise over time. When risk levels increase, the platform responds immediately by flagging or blocking suspicious transactions before harm occurs. This proactive approach creates strong protection for users and helps build trust in the platform, which is essential in financial markets where safety is a top concern.

In addition to enhanced security, AI also improves how users experience VeryPay’s services through personalized financial guidance. The platform uses machine learning to understand individual behavior, preferences, and spending patterns. Based on these insights, it delivers targeted recommendations, predictive financial tools, and tailored alerts that support better decision-making. This level of personalization helps users feel supported and understood, increasing overall satisfaction and long-term engagement. By combining strong security with user-focused personalization, VeryPay has established itself as a leading digital finance solution—one that not only protects users but also helps them manage their financial lives more effectively.

VeryPay’s Progress in Expanding Financial Access Across Africa

The collaboration between VeryPay and SmartDev has directly supported Africa’s journey toward broader financial inclusion. Many people who did not have access to banks now enjoy reliable digital financial services. This progress is making daily life easier and more secure for families, workers, and small businesses. Through mobile-first solutions, VeryPay is transforming how communities manage money.

The collaboration between VeryPay and SmartDev has directly supported Africa’s journey toward broader financial inclusion. Many people who did not have access to banks now enjoy reliable digital financial services. This progress is making daily life easier and more secure for families, workers, and small businesses. Through mobile-first solutions, VeryPay is transforming how communities manage money.

Mobile Financial Services for Remote Areas

VeryPay has transformed financial access in remote and rural areas by delivering affordable and easy-to-use mobile payment solutions. In many parts of Africa, traditional banking infrastructure is limited or entirely absent, leaving millions of people without access to essential financial tools. By enabling mobile money transfers, bill payments, savings, and credit access directly through a phone, VeryPay removes long-standing barriers and creates new pathways for financial participation. Users no longer need to travel great distances to reach a physical bank; instead, they can complete important financial tasks from the comfort of their homes or workplaces. This accessibility is crucial in regions where transportation is costly, slow, or unreliable. Through its mobile-first approach, VeryPay empowers individuals to manage their finances efficiently, helping them take part in the digital economy even if they live far from major cities. For many households, this marks the first time they have had dependable access to financial services, enabling them to participate more actively in commerce, education, and personal planning.

The social and economic impact of VeryPay’s presence in underserved regions is substantial and continues to grow. Small businesses in rural areas can now accept digital payments, track transactions, and manage cash flow more reliably than before. Farmers, for example, can receive payments instantly from buyers without relying on intermediaries or carrying large amounts of cash. Families can send and receive remittances within minutes, making it easier to support relatives during emergencies or seasonal challenges. These improvements contribute to greater financial stability and resilience at the community level. Over time, access to mobile financial services helps stimulate local economies by making transactions faster, safer, and more transparent. This not only creates economic opportunities but also fosters social empowerment, as people gain more control over their money and future. Many individuals who were once excluded from the formal financial system now have the tools to save, invest, and improve their livelihoods. VeryPay’s mobile solutions are therefore not just digital conveniences—they are catalysts for growth, independence, and long-term development across remote regions.

Seamless Integration with Mobile Network Operators (MNOs)

VeryPay’s seamless integration with multiple Mobile Network Operators (MNOs) across Africa is one of the key factors behind its success. Africa’s telecom landscape is highly fragmented, with each country often hosting several MNOs, each with different technical standards and requirements. VeryPay’s technology adapts to these variations, allowing the platform to function efficiently across diverse infrastructures without compromising speed or stability. This means users on different networks—whether in urban centers or remote communities—can access reliable mobile money services using the same platform. Because the system automatically adjusts to technical differences between carriers, users enjoy consistent performance regardless of where they are or which operator they use. This flexibility allows VeryPay to expand across multiple countries at a rapid pace and reach markets that would otherwise be difficult to serve. By offering a unified experience across telecom networks, VeryPay creates familiarity and trust for users, which is essential when introducing digital financial solutions to new regions.

The benefits of this broad compatibility are profound, especially in areas where switching between networks is common or where multiple family members use different providers. Users do not need to change their SIM cards or subscribe to new plans to access VeryPay’s services. This removes friction and encourages adoption across different demographics and income groups. With seamless integration, VeryPay is able to support a truly diverse audience, ranging from rural farmers and market sellers to small business owners and everyday mobile users. The ability to function across several MNOs also strengthens financial inclusion by making VeryPay available to people regardless of their telecom provider, location, or socioeconomic background. This compatibility gives the platform a major advantage over less flexible alternatives and helps it scale into new territories faster. Ultimately, VeryPay’s integration strategy ensures that its financial services reach millions of people across Africa, making digital finance more accessible, equitable, and sustainable for communities across the continent.

How SmartDev’s Expertise in AI Contributed to VeryPay’s Success

SmartDev’s deep experience in AI and modern software engineering has powered VeryPay’s strong performance. Their support ensures that the platform remains fast, secure, and adaptable even as it grows. By combining technical excellence with practical fintech insights, SmartDev has helped VeryPay create a system that meets the needs of millions. This partnership is a major driver behind VeryPay’s rapid rise.

SmartDev’s deep experience in AI and modern software engineering has powered VeryPay’s strong performance. Their support ensures that the platform remains fast, secure, and adaptable even as it grows. By combining technical excellence with practical fintech insights, SmartDev has helped VeryPay create a system that meets the needs of millions. This partnership is a major driver behind VeryPay’s rapid rise.

1. Efficient Payment Algorithms

SmartDev developed highly optimized AI algorithms that analyze, evaluate, and route every payment with precision. Instead of sending transactions through a single fixed path, the system assesses multiple possible routes in real time and selects the fastest and most reliable option. This process ensures that payment traffic moves smoothly, even when network conditions change or when demand suddenly increases. As a result, VeryPay is able to maintain strong performance during peak hours, busy market days, or regional spikes in mobile activity. These AI-driven routing decisions help reduce delays and prevent bottlenecks, giving users a consistently stable experience regardless of where they are or which device they use. This reliability is essential for digital payments in emerging markets, where network quality can vary significantly across regions and providers.

Impact:

By optimizing payment flows, SmartDev’s algorithms allow VeryPay to support a rapidly expanding user base without degrading system performance. The platform can handle millions of transactions while still delivering fast processing times, minimal errors, and reliable uptime. This capability becomes increasingly important as VeryPay enters new markets with high mobile money adoption and growing consumer expectations. Users depend on instant, frictionless transactions for daily activities, so maintaining a stable and fast payment environment directly contributes to higher adoption, stronger user trust, and long-term platform growth.

2. AI-Powered Fraud Detection Systems

SmartDev also developed sophisticated machine learning models that monitor user behavior continuously. These systems analyze patterns across thousands of transactions, comparing them against known fraud indicators and identifying deviations that could signal risk. Because AI learns from every new data point, the detection engine becomes smarter and more accurate over time. When the system notices suspicious activity—such as unusual spending behavior, rapid transfers, or irregular login attempts—it responds immediately. This instant reaction is crucial in preventing fraud before it escalates or causes significant financial harm. Real-time monitoring ensures that threats are addressed the moment they appear, rather than hours or days later.

Benefit:

These fraud detection tools allow VeryPay to keep its platform safe and trustworthy for users across different countries and telecom networks. The AI models do not rely on manual review or slow verification steps; instead, they flag irregularities instantly and trigger automatic protective actions. This includes temporarily blocking transactions, alerting users, or escalating cases to security teams. By identifying risks early, VeryPay minimizes fraud exposure and builds confidence among users who rely on the platform for everyday financial transactions. This strong security foundation is essential in fintech, where trust is as important as functionality.

3. Personalization of Financial Services

SmartDev’s AI-driven analytics help VeryPay offer tailored financial services that reflect each user’s habits, needs, and goals. The platform analyzes transaction history, spending behavior, savings patterns, and activity frequency to understand individual preferences. Based on these insights, VeryPay can recommend customized savings plans, relevant loan products, or targeted financial tips that align with a user’s profile. This level of personalization helps users feel supported and understood, making financial management easier and more intuitive. Instead of receiving generic information, users get recommendations that match their daily realities and financial journeys.

Advantage:

This personalized experience sets VeryPay apart in the crowded fintech landscape. Users are more likely to engage with a platform that recognizes their needs and helps them make better financial decisions. As a result, personalization increases retention, strengthens loyalty, and differentiates VeryPay from competitors that offer one-size-fits-all solutions. Over time, these tailored services build meaningful relationships with users and position VeryPay as a trusted financial partner rather than just a payment provider.

4. Scalability and Growth

SmartDev’s AI expertise ensures that VeryPay can scale efficiently as it grows across diverse markets. As user numbers increase, the platform must handle more transactions, more data, and more interactions without slowing down. AI supports this by distributing system load intelligently and managing resources automatically. This means that even during high-traffic periods, the platform remains responsive, stable, and secure. Scalability is essential for a platform serving millions of users in countries with different telecom infrastructures, usage patterns, and financial needs.

Outcome:

With AI-enabled scalability, VeryPay can expand confidently across Africa and future regions without worrying about performance gaps. The platform can absorb large increases in users while maintaining reliability, security, and speed. This gives VeryPay the foundation it needs to support long-term growth and achieve its vision of reaching tens of millions of users. The result is a high-performing fintech ecosystem capable of supporting real-world financial demands at massive scale.

Looking Ahead: VeryPay’s Ambitious Future and Its Continued Partnership with SmartDev

VeryPay’s Goal of Reaching 100 Million Users by 2034

VeryPay has set an ambitious goal to reach 100 million users by 2034. This target shows the company’s commitment to financial inclusion and expanding access to digital financial services. VeryPay believes AI-powered technology can create new opportunities for people who are excluded from traditional banking.

This goal is more than just about numbers. It’s about making financial services available to millions, especially in emerging markets. As mobile money grows, especially in Africa, VeryPay is uniquely positioned to serve those who don’t have access to traditional banking. By using mobile phones, the company can reach people in both urban and rural areas.

VeryPay plans to provide personalized services, such as tailored savings plans and credit options. This will help users manage their money and improve their financial well-being. The company wants to make sure that financial services are accessible to everyone—not just the privileged.

Future Plans for Expansion and Innovation

Looking ahead, VeryPay has a strong vision for expansion driven by innovation and a deep understanding of the financial challenges in developing regions. The company aims to grow across more African countries and eventually into other emerging markets where digital financial solutions are urgently needed. Many of these regions have young, mobile-first populations who rely on their phones for communication, banking, and daily transactions. By offering a reliable digital payments ecosystem, VeryPay is positioning itself as a key player in shaping the financial future of these communities. The company’s growth strategy is also supported by increasing demand for mobile money, which makes it easier to accelerate adoption and bring new users into the digital financial system.

One of the core innovations guiding VeryPay’s future is the development of AI-powered credit scoring. In many emerging markets, millions of people cannot access credit because they do not have traditional financial histories or bank records. VeryPay plans to solve this by analyzing alternative data sources, such as mobile usage, spending behavior, and transaction patterns. These insights help create more accurate and inclusive credit profiles. With this technology, VeryPay will be able to offer microloans to people who have never had access to formal credit before. This can support everyday needs, enable small businesses to grow, and provide financial stability to families who typically rely on informal lending networks. AI-driven credit scoring gives users fair opportunities and helps create a more inclusive financial system.

Another major area of innovation is the integration of blockchain technology to strengthen security and transparency across the platform. Blockchain can help VeryPay reduce operational costs, speed up cross-border transactions, and maintain clear, tamper-proof records. This is especially valuable in regions where financial fraud, payment delays, and unpredictable transaction fees are common. VeryPay is also developing new digital savings products that allow users to store money safely, make withdrawals easily, and potentially earn interest. These products are designed for people who may not have access to traditional savings accounts or banking services. By combining blockchain security with simple mobile savings tools, VeryPay aims to help users build long-term financial resilience. These innovations together will enable VeryPay to deliver more reliable, affordable, and accessible financial services across diverse markets.

The Continued Role of SmartDev in Supporting VeryPay’s Vision

SmartDev will continue to play a crucial role in VeryPay’s long-term growth, especially as the platform expands into more countries and serves millions of new users. With deep expertise in AI development and modern fintech engineering, SmartDev provides the technical foundation that allows VeryPay to innovate confidently. The team supports VeryPay in building solutions that are not only secure and scalable but also intuitive and accessible for users of all backgrounds. As VeryPay aims to reach 100 million users by 2034, SmartDev’s technical leadership will remain essential in ensuring that every feature, upgrade, and system enhancement aligns with global standards for quality and reliability.

SmartDev’s contributions have already transformed VeryPay’s core operations. Through AI-driven improvements, the platform has seen major enhancements in payment processing speed, fraud detection accuracy, and overall user experience. These upgrades are especially important as VeryPay enters high-growth markets, where user activity can increase dramatically in a short period of time. SmartDev ensures that the platform can adapt to this growth without slowing down or experiencing performance issues. Scalable infrastructure is at the center of this work. SmartDev designs systems that can automatically manage rising transaction volumes, distribute resources efficiently, and maintain stability during peak usage. This ensures that VeryPay remains dependable, even as its user base expands across borders and telecom networks.

Beyond performance and scalability, the partnership also fuels ongoing innovation. VeryPay is continuously adding new features—such as AI-powered credit scoring, digital savings tools, and secure blockchain-enabled payment options—to improve financial inclusion. Each of these innovations requires strong engineering support, careful testing, and precise integration. SmartDev guides this process, ensuring that new features function smoothly, meet regulatory standards, and deliver real value to users. As VeryPay enters new markets with different financial rules, user behaviors, and technological environments, SmartDev helps the platform adjust quickly and effectively. Their expertise makes it possible for VeryPay to maintain a consistent, high-quality experience everywhere it expands.

Together, VeryPay and SmartDev form a long-term partnership built on innovation, trust, and shared vision. Both organizations are committed to reshaping the fintech landscape and bringing inclusive, user-friendly financial services to millions of people who have been underserved for far too long. As the digital finance industry becomes more competitive, SmartDev’s continued involvement ensures that VeryPay stays ahead—innovating faster, scaling smarter, and delivering secure financial solutions that truly make a difference.

Conclusion

VeryPay’s journey has been nothing short of impressive. From its inception, the company has focused on leveraging cutting-edge technology to transform digital financial services, particularly in emerging markets. Its collaboration with SmartDev has been crucial in creating a secure, scalable, and user-friendly platform, enhancing payment efficiency and expanding access to financial services. Through AI-powered solutions, personalized services, and a strong focus on financial inclusion, VeryPay is making a tangible impact on millions of users, especially in underserved regions across Africa.

Looking ahead, VeryPay’s ambitious goal demonstrates its commitment to creating accessible and affordable financial services for all. With continued expansion plans, innovations like AI-powered credit scoring and blockchain integration, and the ongoing support of SmartDev, VeryPay is poised to shape the future of digital finance.

The future of financial inclusion is bright with VeryPay leading the charge. As the company grows and evolves, it will continue to break barriers, offering secure and efficient financial solutions to people who need it the most. The partnership with SmartDev ensures that VeryPay has the technological expertise and innovation necessary to achieve its mission and drive real change in the world of fintech.

The Fast-Track Development of VeryPay Solutions: A 6-Month Journey

The Fast-Track Development of VeryPay Solutions: A 6-Month Journey