In today’s increasingly interconnected financial landscape, the challenge of combating money laundering has taken on new urgency. The practice of money laundering, where illicitly obtained funds are made to appear legitimate, is not only pervasive but also sophisticated, enabling various forms of organized crime, including terrorism, drug trafficking, and corruption. Traditional methods for detecting and preventing money laundering are struggling to keep pace with these developments. In response, Artificial Intelligence (AI) is emerging as a transformative force, offering innovative solutions that enhance the efficiency, accuracy, and overall effectiveness of Anti-Money Laundering (AML) processes.

The Complexity of Money Laundering

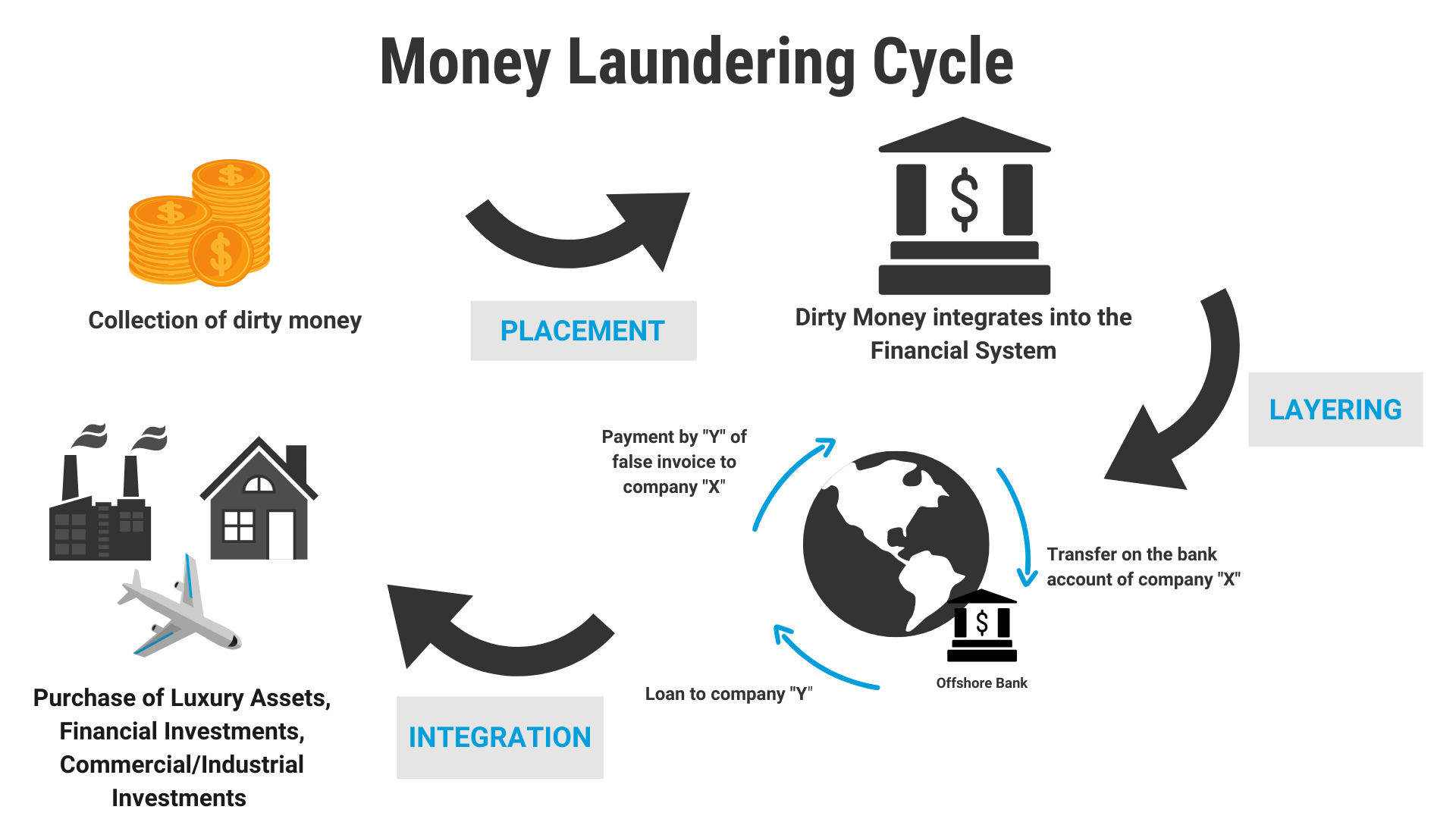

Understanding the intricacies of money laundering is crucial to appreciating the impact of AI on AML. Money laundering typically unfolds in three stages: placement, layering, and integration.

In the placement stage, illegally obtained funds are introduced into the financial system, often through methods like smurfing (breaking down large sums into smaller, less suspicious amounts) or purchasing high-value assets. The layering stage involves moving these funds through multiple transactions to obscure their origins, often by transferring money across different jurisdictions or converting it into various forms. Finally, in the integration stage, the “cleaned” money is reintroduced into the economy as seemingly legitimate funds, often through real estate investments, luxury goods purchases, or legitimate business ventures.

Given the complexity and global reach of these operations, traditional AML processes, which rely heavily on manual checks and predefined rules, are increasingly inadequate. These systems are often slow, prone to human error, and overwhelmed by the sheer volume of data, allowing sophisticated criminals to exploit gaps in detection.

AI’s Role in Transforming AML

AI is revolutionizing AML by addressing these limitations and offering powerful tools for detecting, analyzing, and preventing money laundering activities. Unlike traditional systems that rely on static rules, AI excels in recognizing patterns and detecting anomalies within vast amounts of data. This capability is particularly valuable in identifying unusual behaviors and transaction patterns that might indicate money laundering.

For instance, AI-powered systems can analyze transaction data in real-time, flagging activities that deviate from established norms, such as rapid movement of funds across multiple accounts or transactions occurring in high-risk jurisdictions. These systems continuously learn from each detected pattern, improving their ability to identify emerging threats over time.

Another critical advantage of AI in AML is its ability to reduce false positives—legitimate transactions that are mistakenly flagged as suspicious. Traditional rule-based systems often generate a high number of false positives, which can overwhelm compliance teams and divert resources away from genuine risks. AI reduces this burden by using machine learning algorithms to better distinguish between benign transactions and those that warrant further investigation. This not only enhances the efficiency of AML processes but also allows compliance teams to focus on the most significant threats.

In addition to improving detection and reducing false positives, AI also automates many of the routine tasks associated with AML compliance. For example, the generation of Suspicious Activity Reports (SARs) can be largely automated using AI. Natural Language Processing (NLP), a subset of AI, enables systems to extract relevant information from unstructured data sources, such as transaction descriptions or customer communications, and incorporate this information into reports. Automation of these processes not only speeds up compliance tasks but also ensures greater accuracy and consistency.

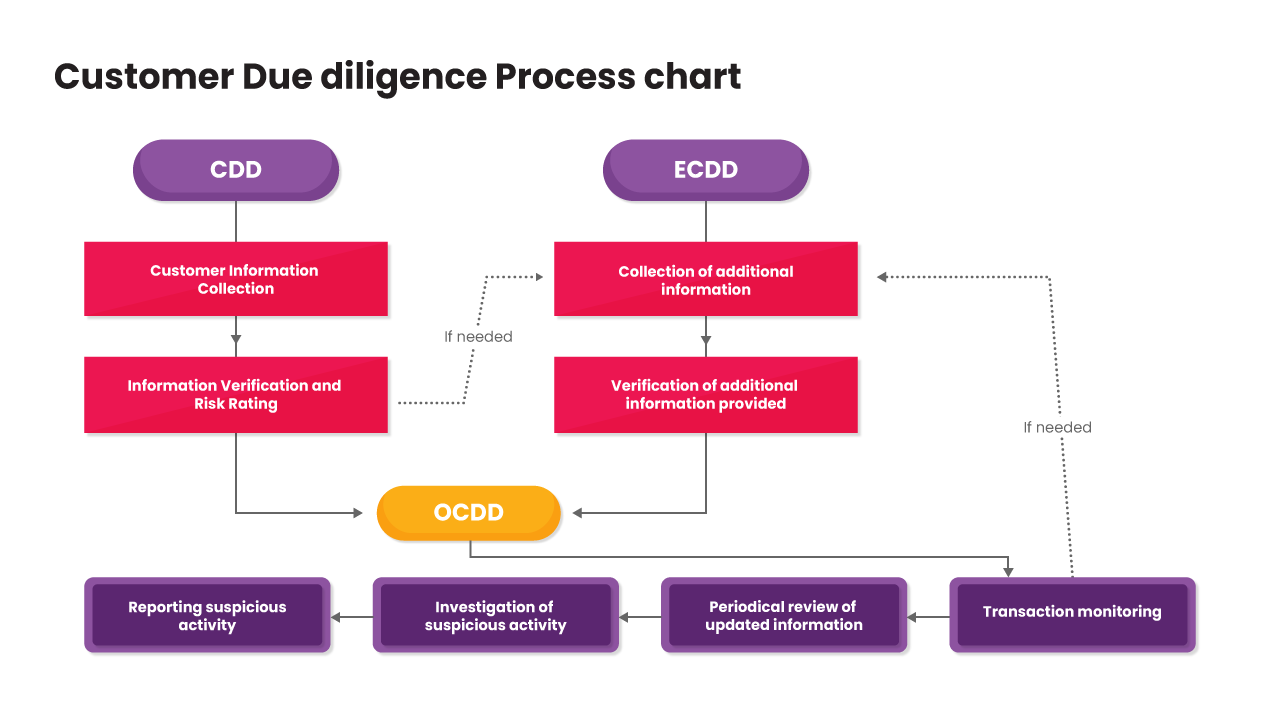

AI is also transforming Customer Due Diligence (CDD), a critical component of AML that involves verifying the identity of clients and assessing their risk profiles. AI enhances CDD processes by automating identity verification, risk assessment, and ongoing monitoring of customer behavior. For example, AI can cross-reference customer data against global watchlists, adverse media, and other databases to identify potential risks. Furthermore, AI-powered systems can continuously monitor customer transactions, alerting institutions to changes in behavior that might indicate increased risk.

Ethical Considerations and Challenges

Despite its many benefits, the integration of AI into AML processes is not without challenges. One of the primary concerns is data privacy and security. AI systems require access to vast amounts of data to function effectively, which raises concerns about the protection of sensitive customer information. Financial institutions must ensure that their AI systems comply with data protection regulations and that robust cybersecurity measures are in place to prevent data breaches.

Another significant challenge is the potential for bias within AI systems. AI algorithms are only as good as the data on which they are trained, and if this data contains biases, the AI system may perpetuate these biases. For example, if an AI system is trained on data that reflects historical discriminatory practices, it may unfairly flag transactions from certain demographics as higher risk. Financial institutions must, therefore, ensure that their AI systems are trained on diverse and representative datasets and that regular audits are conducted to identify and mitigate any biases.

Regulatory compliance is another area of concern. The use of AI in AML is still a relatively new area, and the regulatory frameworks governing its use are evolving. Financial institutions must navigate this uncertain landscape, ensuring that their AI systems comply with existing regulations while remaining flexible enough to adapt to future changes. Regulators themselves are increasingly recognizing the potential of AI in AML and are beginning to develop guidelines and standards to govern its use. However, there is still a need for greater clarity and consistency in these regulations to ensure that AI can be effectively and ethically integrated into AML processes.

The Future of AI in AML

The integration of AI into AML processes is not just a trend; it represents the future of financial crime prevention. As AI technology continues to advance, we can expect even more sophisticated tools and techniques to emerge, further enhancing the ability of financial institutions to detect and prevent money laundering.

One promising area of development is the use of AI in the detection of emerging money laundering typologies. As criminals adapt to existing detection methods, they develop new schemes that may go unnoticed by traditional systems. AI’s ability to learn and adapt in real-time makes it particularly well-suited to identifying these new typologies and staying ahead of criminal enterprises. Another area of potential growth is the collaboration between AI systems across institutions and jurisdictions. By sharing anonymized data and insights, financial institutions can leverage AI to detect patterns of money laundering that span multiple countries and financial systems, making it more difficult for criminals to exploit gaps in the global financial network.

However, the successful integration of AI into AML processes requires a commitment to transparency, fairness, and collaboration. Financial institutions must work closely with regulators, technology providers, and other stakeholders to ensure that AI is used responsibly and effectively in the fight against financial crime.

AI and Fintech Services: The SmartDev Advantage

As financial institutions increasingly embrace the power of AI in Anti-Money Laundering (AML) and other critical areas, partnering with the right technology provider becomes essential. SmartDev, a leading fintech service provider, stands out in this space by offering cutting-edge AI-driven solutions tailored to meet the evolving needs of financial institutions.

SmartDev’s fintech services are designed to enhance the efficiency, security, and compliance of financial operations. Leveraging advanced AI technologies, SmartDev helps institutions automate complex processes, reduce the risk of financial crimes, and improve customer experiences. Whether it’s deploying AI for fraud detection, customer due diligence, or transaction monitoring, SmartDev provides robust, scalable solutions that can be seamlessly integrated into existing systems.

In collaboration with Verysell.ai, another leader in AI-driven innovations, SmartDev offers a comprehensive suite of fintech solutions that empower businesses to stay ahead of the curve. By combining SmartDev’s expertise in fintech with Verysell.ai’s state-of-the-art AI technology, financial institutions can achieve unparalleled levels of operational efficiency and regulatory compliance. For those looking to elevate their financial services through AI, SmartDev provides the expertise and tools needed to succeed in a rapidly changing environment.

Take the Next Step with SmartDev

If you’re ready to transform your financial services with AI-driven solutions, explore the innovative offerings from SmartDev today. Visit SmartDev’s Fintech Services to learn more about how they can help your institution stay secure and compliant in the fight against financial crime. Additionally, discover the advanced AI solutions from Verysell.ai that can take your fintech operations to the next level.

Final Thoughts

AI is transforming the fight against money laundering by offering powerful tools that enhance detection, reduce false positives, automate compliance processes, and improve risk management. However, the successful integration of AI into AML processes requires careful consideration of ethical and regulatory challenges, particularly concerning data privacy, bias, and evolving compliance standards.

As financial institutions continue to embrace AI, they must do so with a commitment to transparency, fairness, and collaboration. The future of AML lies in the intelligent application of AI, and those who harness its power responsibly will lead the charge in creating a safer and more secure financial system for all. The ongoing evolution of AI technology promises to bring even greater sophistication and effectiveness to AML efforts, ensuring that financial institutions remain at the forefront of the battle against financial crime.