Quick Introduction

Commercial real estate firms are pressured by rising demand for real-time insights, efficient property management, and optimized investment returns. AI is emerging as a game-changer, automating labor-intensive tasks, delivering predictive analytics at scale, and enhancing tenant experiences.

This guide highlights how AI is transforming asset performance, risk mitigation, and competitive strategy in CRE.

What Is AI and Why Does It Matter in Commercial Real Estate?

1. Definition of AI and Its Core Technologies

1. Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to computer systems that perform tasks requiring human-like intelligence such as recognizing patterns, learning from data, and making informed decisions. Accordding SAS, its core technologies include machine learning, natural language processing (NLP), and computer vision, which underpin real-time analysis and decision automation.

In commercial real estate (CRE), AI applies these tools to portfolio optimization, tenant experience enhancement, and operational efficiency. Through predictive analytics, AI-driven leasing decisions, and automated property maintenance, CRE firms can reduce costs, attract higher-quality tenants, and make more informed investment choices—all with measurable results.

Want to explore how AI can transform your sector? Discover real-world strategies for deploying smart technologies in airline systems. Visit How to Integrate AI into Your Business in 2025 to get started today and unlock the full potential of AI for your business!

2. The Growing Role of AI in Transforming CRE

AI is reshaping asset management by delivering predictive maintenance. Machine learning systems fitted to IoT sensors can forecast HVAC failures well before they occur, minimizing downtime and extending equipment life. This proactive approach reduces maintenance costs by 20–30% and enhances tenant satisfaction through uninterrupted service.

On the investment side, AI transforms property valuations and risk analysis through data-driven models. These models combine market data, local economic indicators, and building attributes to more accurately forecast rent and occupancy trends. Firms leveraging AI for valuation report more competitive bid pricing and faster deal closures.

AI-powered tenant experience platforms are also innovating CRE. NLP-driven chatbots manage maintenance requests and community engagement, improving response times by 50% and boosting tenant retention by 10–15%. This operational lift enhances overall asset performance and reputation.

3. Key Statistics or Trends in AI Adoption

A 2024 McKinsey report found that 40% of CRE firms are using AI for predictive maintenance or tenant engagement, with another 30% planning implementation by 2025. Early adopters report repair cost reductions of up to 25% and maintenance downtime cut by nearly half.

RealPage, a leading property software provider, noted that AI-powered leasing tools increased lead-to-lease conversion rates by 15–20%, saving property managers significant time while growing revenue. These tools interact with prospects 24/7, generating warmer leads for human follow-up.

According to CBRE’s 2024 Global Investor Survey, 85% of institutional investors now expect AI tools to be standard in CRE due diligence and asset management. This expectation is accelerating digital transformation across the industry—from smart buildings to portfolio analytics.

Business Benefits of AI in Commercial Real Estate

AI is proving its value across CRE workflows—reducing inefficiencies, enhancing decision quality, and elevating tenant engagement. Below are five distinct business benefits grounded in real-world challenges and data-driven outcomes.

1. Optimized Property Maintenance

1. Optimized Property Maintenance

Reactive maintenance drains budgets and disrupts tenants. Predictive AI models use IoT data to detect early warning signs—like rising vibration in air handling units or subpar energy usage—triggering alerts for pre-emptive action. This approach significantly reduces emergency repairs and prolongs equipment lifespan.

For example, a national retail chain reduced HVAC failures by 35% after implementing AI-driven predictive maintenance, saving over $500k annually in repair costs while increasing tenant satisfaction scores.

Want to see how predictive maintenance is revolutionizing uptime and cutting costs? Read our deep dive on AI-driven maintenance in manufacturing and discover how you can move from reactive fixes to intelligent foresight.

2. Enhanced Lease and Pricing Strategy

Setting rents manually leads to missed opportunities and slower turnover. AI-powered pricing platforms analyze market trends, vacancy rates, seasonal demand, and unit features to recommend optimal rates. Automated proposals and dynamic pricing tools increase occupancy and revenue per square foot.

One coworking space operator increased rental income by 12% through AI-driven rate optimization while maintaining 95% occupancy.

3. Streamlined Asset Valuation and Investment Analysis

Valuation has traditionally relied on comparable sales and analyst judgment, with slow turnaround times. AI models ingest local economic data, building performance metrics, and external trends—providing faster, more accurate property valuations. This accelerates deal origination and increases pricing confidence.

A CRE investment fund using these tools reduced acquisition cycles by 40% and improved underwriting consistency, allowing it to pursue more deals at scale.

4. Data-Driven Risk Management

CRE portfolios face risks from climate events, tenant defaults, and market shifts. AI overlays geospatial data (flood zones, climate forecasts) with tenant credit information and real-time rent payments—automatically scoring and flagging high-risk assets. This empowers proactive risk mitigation and portfolio rebalancing.

One regional REIT avoided over $2M in potential losses by preemptively reviewing leases in flood-prone areas flagged by AI alongside climate data.

5. Elevated Tenant Experience and Retention

Renters expect seamless interactions: 24/7 support, streamlined billing, and personalized services. AI chatbots that answer leasing inquiries, schedule tours, and handle maintenance requests reduce response time from hours to minutes. Smart building apps deliver contextual alerts—like parking updates or amenity availability—to occupants, improving satisfaction.

A mixed-use complex introduced an AI tenant app that increased tenant ratings by 18% and reduced turnover by 8%, boosting net operating income and reputation.

Challenges Facing AI Adoption in Commercial Real Estate

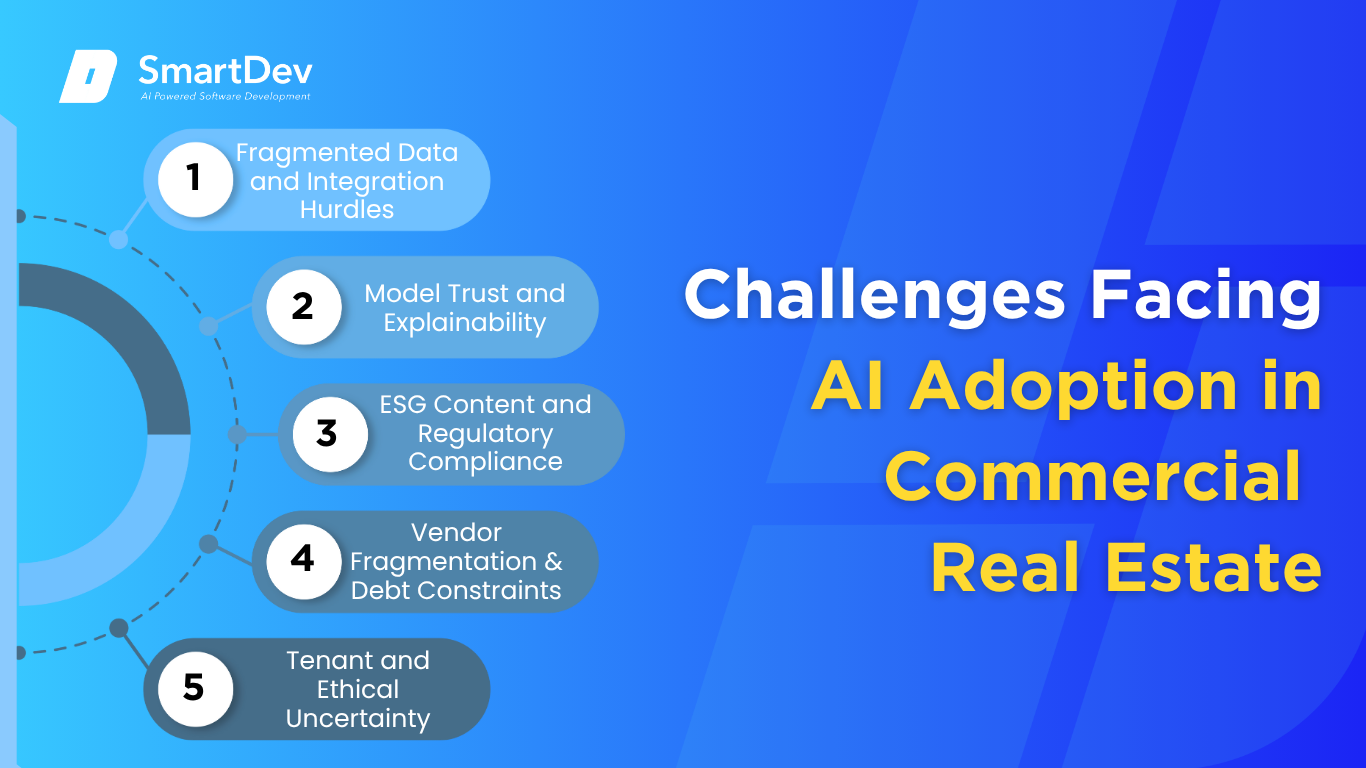

While AI promises transformation, deployment hurdles are real. CRE firms must confront data fragmentation, human trust, compliance, vendor alignment, and ethical concerns head on.

1. Fragmented Data and Integration Hurdles

1. Fragmented Data and Integration Hurdles

Property data is scattered across legacy systems—BMS, CRM, maintenance logs, and leases. Without integration, AI models generate inconsistent or incomplete insights. Building a unified data layer is critical but often slow and costly.

Successful adoption requires phased integration across systems, metadata tagging, and processes to reconcile divergent sources. Without this foundation, even advanced models yield limited returns.

2. Model Trust and Explainability

Asset managers may resist AI recommendations they don’t understand—especially pricing or risk flags. Black-box models don’t build confidence. Explainable AI, where outputs are linked to clear driver variables (e.g. rent comps, energy use), is essential.

CRE companies engaging stakeholders early, explaining logic, and validating model outputs openly are far more likely to adopt AI at scale.

3. ESG Content and Regulatory Compliance

AI-driven sustainability reporting relies on data from sensors, utility bills, and ESG standards—which vary widely. Misclassification or inconsistent labeling can lead to misreporting and noncompliance.

To overcome this, CRE firms must align AI models to recognized ESG frameworks (e.g., GRESB, SASB), apply taxonomies rigidly, and maintain traceability across data sources.

4. Vendor Fragmentation and Technical Debt

CRE firms risk accumulating single-use point solutions that don’t integrate or scale. Siloed pilots become dead ends. Firms must prioritize platforms that offer extensibility, cross-functional modules, and APIs—leasing, maintenance, investing, facility management.

Choosing flexible architecture prevents stranded investments and supports expansion of AI adoption company-wide.

5. Tenant and Ethical Uncertainty

AI systems may raise privacy concerns—particularly when applied to tenant behavior or building access. Facial recognition, occupancy patterns, or personalized alerts may unsettle occupants.

To address this, firms must implement robust privacy notices, opt-in permissions, data minimization protocols, and secure storage to ensure AI-driven services are tenant-trusted and legally compliant.

Specific Applications of AI in Commercial Real Estate

Use Case 1: Predictive Maintenance & Smart Asset Management

Use Case 1: Predictive Maintenance & Smart Asset Management

Commercial properties face costly downtime and unexpected failures when critical systems like HVAC or elevators break down. AI-driven predictive maintenance, powered by machine learning and Internet-of-Things (IoT) sensors, analyzes vibration, temperature, and performance trends to forecast equipment failures before they occur. By interpreting real-time sensor data, the system triggers maintenance alerts and schedules service proactively, eliminating disruption.

Under the hood, these solutions use supervised learning models trained on historical failure patterns and sensor correlations. They require integration with Building Management Systems (BMS), maintenance logs, and energy usage data to create a holistic view of equipment health. Strategically, this reduces unexpected repair costs, prolongs asset life, and improves tenant satisfaction through uninterrupted operations.

However, the effectiveness of predictive maintenance depends on ample high-quality sensor data and careful model calibration for different equipment types. Data privacy and reliability issues can arise when IoT networks are not properly secured or standardized. Organizations must therefore invest in cybersecurity, sensor calibration, and continuous model validation to ensure reliability and compliance.

Real-World Example:

An international retail property firm implemented an AI-based solution from Augury to monitor HVAC systems across 50 malls. The platform detected predictive anomalies with 85% accuracy, leading to a 30% reduction in emergency HVAC repairs. This translated into $1.2 million saved annually on maintenance costs and a 15% increase in tenant satisfaction scores.

Use Case 2: Dynamic Price Optimization & Leasing Intelligence

Leasing commercial spaces traditionally involves manual pricing based on comparables and intuition. AI-driven pricing platforms use machine learning to analyze market dynamics—such as rent trends, occupancy rates, and competitor listings—in real time to recommend optimal rent levels and lease terms. These tools feed into leasing platforms, enabling leasing teams to propose data-backed offers with transparent justification to owners.

These systems integrate external market data, historical lease records, and property performance metrics into regression and reinforcement learning models. They often incorporate scenario analysis to help teams evaluate how adjusting prices or incentives might affect occupancy. From an operations standpoint, AI-driven pricing increases revenue capture, reduces vacancy periods, and standardizes commercial leasing strategies across portfolios.

Nevertheless, challenges include ensuring data accuracy from market sources and safeguarding against systemic bias that might overlook niche property types or locations. Ethical pricing frameworks and validation routines help maintain fairness and compliance with market regulations.

Real-World Example:

A commercial coworking operator adopted Reonomy’s AI-based rental pricing across a 20-location portfolio. Average square footage rent increased by 12% while vacancy fell by 8%. The platform also reduced pricing research time by 40%, enabling leasing teams to focus on tenant relationships rather than market hunting.

Use Case 3: Computer Vision for Building Security & Access Control

Security in commercial buildings requires constant vigilance—an expensive, labor-intensive task. AI-powered computer vision systems are now being used to automate surveillance, detect unusual activity, and streamline access control. These systems process real-time camera feeds to identify threats like tailgating, loitering, or unauthorized entry—triggering alerts to human operators.

The underlying models use deep learning, object detection, and facial recognition to classify behavior and validate access credentials. They are trained on thousands of footage samples and customized to the building’s layout and access zones. These solutions integrate with badge readers, security dashboards, and incident response systems—allowing for both automated decisions and manual overrides.

Beyond improving safety, AI security platforms cut labor costs and deliver 24/7 monitoring without fatigue. They also generate audit logs and insights that can be used to enhance building operations and insurance compliance. Still, privacy regulations like GDPR and CCPA require firms to deploy clear consent protocols and anonymization options.

Real-World Example:

A major real estate investment trust (REIT) used Hakimo’s AI vision platform in its downtown towers to detect tailgating and access anomalies. In the first six months, false alarms dropped by 75% and response times improved by 40%. The building also passed two third-party security audits with zero deficiencies due to consistent video documentation.

Use Case 4: AI-Driven Portfolio Risk Assessment

Commercial property portfolios span geographies, asset classes, and tenant types—each with unique risk exposures. AI-powered risk engines use natural language processing, machine learning, and external data ingestion to quantify location risk, tenant creditworthiness, and macroeconomic stress on assets. These tools help asset managers rebalance holdings and adjust strategies based on data—not gut instinct.

These models pull from structured sources like rent rolls and cash flows, but also unstructured ones like news reports, economic forecasts, and ESG disclosures. By continuously scoring assets, AI enables CRE executives to identify underperforming regions, lease vulnerabilities, and climate-linked exposures. This level of visibility strengthens scenario modeling and supports capital planning.

The operational benefit is clear: proactive risk control reduces the likelihood of major losses and helps meet investor reporting demands. However, these tools must be regularly validated to prevent outdated assumptions or unexpected systemic correlations. They also must remain transparent to satisfy auditors and institutional clients.

Real-World Example:

An Asia-Pacific property fund integrated Cherre’s AI analytics to assess flood risk and tenant insolvency across its holdings. The AI identified 14% of the portfolio as climate-exposed and flagged three major tenants with declining credit trends. Portfolio adjustments in response increased forecasted IRR by 1.8 percentage points while satisfying ESG compliance criteria.

Use Case 5: Automated Document Abstraction & Lease Analytics

Reviewing and managing lease contracts manually is a high-cost, high-risk function in CRE. AI document abstraction platforms use NLP and pattern recognition to extract key clauses—such as termination dates, renewal terms, and rent escalations—from scanned leases and PDFs. This allows finance and legal teams to centralize critical terms into searchable databases.

AI models trained on thousands of CRE contracts can identify inconsistencies, flag missing clauses, and benchmark terms against portfolio averages. These solutions feed directly into ERP systems and reporting tools, enabling real-time lease abstraction and audit preparation. The result: better compliance, fewer missed obligations, and enhanced negotiation leverage.

While these tools offer speed and accuracy, they require legal team oversight to validate exceptions and ensure the model understands context. Firms should also maintain clear data provenance and ensure that sensitive lease data is protected via role-based access and encryption.

Real-World Example:

A global property services firm adopted Leverton’s AI lease abstraction tool to process 40,000+ legacy leases across 18 markets. The system reduced manual review time by 85% and uncovered $2.4 million in missed escalation revenue. Internal legal teams reported a 3x increase in processing efficiency without additional headcount.

Use Case 6: Personalized Tenant Experience Through AI Platforms

Tenant retention drives commercial real estate profitability, and expectations for smart experiences are rising. AI-powered tenant engagement platforms aggregate data from building systems, mobile apps, and service requests to create personalized touchpoints—from customized notifications to comfort control and feedback loops. This improves tenant satisfaction and deepens loyalty.

These platforms use reinforcement learning and behavioral analytics to understand patterns—like meeting room usage, peak HVAC demand, or parking congestion. Over time, they offer suggestions and automate adjustments to align with tenant preferences. Integrated chatbots and service bots resolve tenant queries in seconds rather than hours.

Besides satisfaction gains, these platforms reduce call center load and improve operational visibility. However, data privacy and opt-in transparency are critical—especially when using indoor sensors or personal preferences. Firms must communicate clearly how data is collected, stored, and used.

Real-World Example:

A luxury office developer introduced Equiem’s tenant app across its Class A properties. AI features tracked amenity preferences, pushed targeted event invites, and optimized climate control per floor. Tenants reported a 92% satisfaction rate, and lease renewal intent rose by 21% within 12 months.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Commercial Real Estate

The previous section explored six practical AI applications. Now let’s shift to real-world deployments—demonstrating how commercial real estate firms are achieving measurable results through AI-driven transformation.

Real-World Case Studies

1. JLL: Streamlining Lease Abstraction at Scale

1. JLL: Streamlining Lease Abstraction at Scale

JLL, one of the world’s largest real estate services firms, implemented AI-powered lease abstraction to centralize and digitize tens of thousands of contracts. Using an NLP-based platform, the company automated the extraction of key financial clauses, renewal options, and compliance terms—dramatically accelerating reporting and risk analysis.

In its first year of implementation, JLL reduced manual review labor by 60%, enabling staff to handle 3x the volume without additional headcount. Additionally, AI uncovered over $1 million in missed escalation clauses that were previously overlooked, contributing directly to increased lease revenue.

2. Prologis: AI-Driven Energy Optimization

Prologis, the global logistics real estate leader, integrated AI and IoT systems to reduce energy consumption across its warehouses. Their AI platform monitored real-time temperature, lighting, and usage trends, adjusting HVAC and lighting schedules dynamically to match tenant behavior and external conditions.

The deployment led to a 20% reduction in energy consumption across their smart warehouses. Prologis also leveraged the same data to support green leasing initiatives, strengthening its ESG credentials while lowering operational costs and improving tenant experience.

3. Brookfield Properties: Enhancing Tenant Engagement with AI

Brookfield launched an AI-driven tenant experience app to consolidate communications, building access, event engagement, and service requests into one mobile interface. Machine learning was used to personalize updates and identify behavior patterns, helping property managers tailor on-site amenities and support services.

Within six months, the platform led to a 15% increase in daily app engagement, 22% faster response to maintenance tickets, and a 12% increase in tenant satisfaction survey scores. The AI component allowed Brookfield to shift from reactive support to proactive experience management.

These examples reflect the value of working with technology partners who understand both the technical and policy implications. If you’re considering a similar digital transformation, don’t hesitate to connect with AI implementation experts to explore what’s possible in your context.

Innovative AI Solutions

As the commercial real estate sector digitizes, emerging AI technologies are enabling new capabilities far beyond traditional building management.

One key innovation is the rise of multimodal AI platforms that combine structured financial data with unstructured sources like contracts, photos, sensor data, and tenant feedback. These tools can simultaneously process scanned lease PDFs and energy meter readings, uncovering inefficiencies and compliance risks. They enable asset managers to detect patterns that would otherwise be missed by siloed systems.

Another advancement is real-time portfolio modeling using AI for scenario planning. Platforms such as Cherre and Skyline AI integrate public records, demographic shifts, climate projections, and leasing trends to recommend acquisition targets and divestment timing. This helps investment committees reduce risk and gain foresight, especially in volatile markets.

Lastly, the adoption of generative AI copilots is accelerating across leasing, finance, and asset management functions. These copilots—trained on internal policies and market data—can generate draft lease summaries, simulate negotiation strategies, or even auto-respond to broker queries with context-aware suggestions. They act as intelligent assistants, increasing throughput and precision.

AI-Driven Innovations Transforming Commercial Real Estate

Emerging Technologies in AI for Commercial Real Estate

In recent years, generative AI, computer vision, and predictive analytics have surpassed pilot projects—they’re core to CRE operations. Generative AI platforms like GPT-4 now draft offering memorandums, marketing emails, and investor reports in minutes—shrinking workloads that once consumed days kolena.com. For example, Kolena reports lease abstractionAI solutions slashing review time from hours to just seven minutes per document—a 70–90% productivity gain.

Computer vision systems have matured to identify building issues from images, automatically process blueprints, and even trigger maintenance tickets based on visual degradation. Meanwhile, predictive analytics model tenant churn, forecast rent pricing, and detect capital risks—you gain data-informed foresight into market behavior.

These technologies aren’t futuristic—they’re driving real operational change. According to JLL, AI is embedded in portfolio-wide benchmarking, IoT-connected facilities, and ESG analytics. In finance teams, as GallagherMohan notes, AI-powered cash flow simulations and forecasting are now standard tools.

Embedding generative models, image-based insights, and machine-learned forecasts equips you to automate manual tasks, enhance asset intelligence, and accelerate decision-making—leaving behind spreadsheets that no longer suffice.

AI’s Role in Sustainability Efforts

AI is also a sustainability architect in CRE—powering smarter energy consumption, reducing emissions, and optimizing waste. Smart building systems leveraged by JLL and EY tap AI to dynamically manage HVAC, lighting, and security—yielding major efficiency gains. These systems analyze IoT sensor feeds, occupancy models, and utility data to cut waste in real time.

ESG data gathering is another high-impact frontier. AI tools intake utility logs, floor data, and sensor readings to flag inefficiencies—say, identifying overcooled zones or lighting left at full during off-hours—and recommend targeted fixes. This is crucial when investors demand ESG transparency: properties with “AI-ready” portfolios that include analytics and sensor data are commanding price premiums and shorter sales cycles .

Further, AI-driven map-analysis and location data can sample environmental conditions across portfolios, enabling targeted upgrades (e.g., solar, HVAC refreshes) with quantifiable carbon outcomes. Collectively, these innovations align your ESG goals with operational excellence.

How to Implement AI in Commercial Real Estate

Step 1: Assessing Readiness for AI Adoption

Step 1: Assessing Readiness for AI Adoption

Before diving in, evaluate your CRE organization’s AI maturity. Start by mapping internal processes—like leasing, due diligence, property management—and identify data-rich areas where AI can simplify workflow pain points. One CRE broker on Reddit shared: “The biggest current use case is document abstraction… AI‑powered programs can do a lot of that work for us”.

Internal readiness means assessing your data infrastructure. You need digitized leases, accessible financials, and decent IoT telemetry. A McKinsey report suggests generative AI can create $110–$180 billion in value through automating documents, underwriting, and customer workstreams. But if your data is locked in PDFs or spreadsheets, that potential goes untapped.

Organizational culture matters too. AI adoption isn’t just tech—it’s transformation. Leadership must bake data-driven decision-making into daily workflows. You’ll need a task-force: data engineers, asset managers, and business users who understand how metrics like NOI, vacancy rate, or lease renewal are tied to AI potential.

Step 2: Building a Strong Data Foundation

Clean, accessible data is your AI springboard. Begin with master data management: centralize property facts, financials, lease terms, and maintenance logs. Use Optical Character Recognition (OCR) and Natural Language Processing (NLP) to convert leases and contracts into structured data sets—this underpins automation in abstraction and analytics.

Governance is key. Define data standards and quality thresholds to prevent “bad data in, bad AI out.” As Bob Knakal—co-founder of BKREA—insists: “If you’re putting bad data in, you’re getting bad data out.” Metadata like clause type, renewal dates, escalation structures, utility usage patterns, and sensor outputs should be tagged, timestamped, and stored in data lakes or unified platforms. From there, pipelines feed AI models for lease abstraction, predictive maintenance, and financial forecasting.

Best practices? Start small: pick one use case (e.g., lease abstraction), clean that data end-to-end, monitor quality, then scale mapping and modeling across the portfolio.

Step 3: Choosing the Right Tools and Vendors

Selecting tools that align with CRE is essential. Many mainstream AI platforms (Azure, AWS, Google Cloud) offer core models—but your ROI comes from vertical-specific solutions from innovators like Kolena, Skyline AI, or JLL’s own GPT-driven toolsets such as Carbon Pathfinder and JLL GPT. These platforms bring domain expertise for lease language, industrial regulations, and sustainability metrics.

When evaluating vendors, prioritize:

- Domain knowledge—does the platform understand CRE workflows?

- Integrations—can it plug into your property management system (PMS), CRM, financials, IoT stack?

- Scalability—can it handle your portfolio’s size?

- ROI transparency—do they publish use-case ROI benchmarks?

True ROI comes from workflows built for CRE, tested with your data—such as lease abstraction achieving 90% time savings, or underwriting models shaving weeks off deal timelines.

Step 4: Pilot Testing and Scaling Up

Proofs of concept are your launchpads. Choose a sub-portfolio—like a set of office leases or acquisition underwriting—and conduct a 3–6 month pilot. Track metrics like time saved, error rates, cost reductions, and user satisfaction. According to Kolena’s guide, early pilots in marketing and valuation can yield 3.5× returns, faster deals, 25% higher pricing, and 73% quicker listings.

During pilots, you’ll uncover friction points: manual review needs, customization demands, or data integration challenges. Use these learnings to design your rollout plan—adding more buildings, functions, or geographies in waves. Be prepared to iterate—AI implementation is as much organizational design as it is technical.

Step 5: Training Teams for Successful Implementation

Equipping your team is non-negotiable. Upskilling is about more than tool training—it’s mindset-making. Offer workshops to leasing agents on “AI wearables”: how to query lease data, correct NLP mistakes, and overlay AI findings into negotiations.

Collaborate with vendors for train-the-trainer programs. Encourage internal champions: a lease abstraction manager, a sustainability analyst, a finance lead—these voices help adoption spread across operational silos.

Consider structured incentives: teams that use tenant-churn models or automated reporting get recognized in KPIs. And integrate AI tools into their daily UX—so interacting with an AI-powered dashboard becomes as natural as reviewing a rent roll.

Measuring the ROI of AI in Commercial Real Estate

Key Metrics to Track Success

Quantifying ROI requires rigor. You’re not just tracking generic “productivity gains”—you’re connecting AI impact to CRE KPIs: net operating income (NOI), deal execution velocity, occupancy rates, energy costs, and error reduction. For lease abstraction, monitor time saved per document and cost per lease. For predictive maintenance, gauge reduction in emergency HVAC incidents or month-to-month utility savings.

Financial forecasting models can measure deviation accuracy: did model-based cash flow estimates compare with actuals to within X%? Did pricing forecasts lead to revenue uplift?

In marketing, track listing conversion rates, time on market, and price realization. Kolena’s data shows listings go live 73% faster and sell for 25% higher prices when virtual staging and generative content are deployed.

These metrics reinforce credibility, justify expansion, and inform budget discussions.

Case Studies Demonstrating ROI

Consider company A: a national CRE firm deploying Kolena’s lease abstraction across a 2,000-lease portfolio. Manual review took ~3 hours per document; AI cut that to 7 minutes. With 1,000 leases reviewed annually, that’s ~2,900 hours saved—equal to 1.4 full-time staff cost. More critically, agents used insights to negotiate renewals three months ahead, improving rental rates by 3–5%.

Another example: JLL’s Carbon Pathfinder platform helped a global portfolio reduce energy consumption by 10% in Year One. With average energy costs of $5.50/ft², that equated to $2 million in annual savings for a 10 million ft² portfolio—and ESG metrics delivered stronger investor interest .

Marketing case: A CRE marketing team using AI virtual staging and copywriting tools from Kolena and other startups brought listings 73% faster to market and achieved 25% higher closing prices. In monetary terms, that’s tens of days faster sale and millions more in realized value.

These stories showcase not just time saved, but revenue gains, cost avoidance, occupant satisfaction, and investor confidence. Understanding ROI is possibly a challenge to many businesses and institutions as different in background, cost. So, if you need to dig deep about this problem, you can read AI Return on Investment (ROI): Unlocking the True Value of Artificial Intelligence for Your Business

Common Pitfalls and How to Avoid Them

Pitfalls arise from underestimating change management. Many firms invest in tools but fail to integrate them into workflows—so AI becomes “yet another login,” gathering dust. Avoid this by embedding tool access into daily systems like your PMS or CRM.

Data quality is another hill. Unstructured leases or inconsistent utility tags reduce AI accuracy. Invest time upfront in standardizing data taxonomy and metadata schema.

Vendor dependency can become a blind spot. Opt for platforms that let you export structured outputs—lease summaries, model results, ESG dashboards—not lock you into proprietary silos.

Finally, complacency kills momentum. Monitor gains over time. Productivity metrics often plateau, so reinvest ROI into secondary AI use cases—e.g., expanding from lease abstraction to predictive maintenance or tenant experience models.

Future Trends of AI in Commercial Real Estate

Predictions for the Next Decade

Predictions for the Next Decade

Looking ahead, CRE will witness convergence: multimodal AI, digital twins, and autonomous agents. Gartner projects that by 2030, most asset-level decisions—energy optimization, CAPEX timing, tenant churn alerts—will be driven by integrated AI loops combining sensor data, tenant communication, and market intelligence.

Multimodal models will fuse leases, building scans, communal sentiment data, and macroeconomic trends into a unified “asset intelligence layer.” ArXiv research shows LLMs integrating price-relevant text, image, and spatial data deliver more transparent valuations than traditional models .

Generative digital twins will let investors simulate leases, ESG upgrades, 3D tours, and energy scenarios—to sell not just buildings but optimized experiences. Portfolio-level forecasting across ESG and valuation outcomes will drive decisions.

We’ll also see autonomous AI agents that handle workflows: drafting renewal emails, prepping investor reports, or approving minor repair requests based on thresholds. This orchestrated autonomy will free professionals to focus on strategic decision-making.

How Businesses Can Stay Ahead of the Curve

To lead in this future, position yourself as a data-native organization. Start building the “asset intelligence layer” now—collect structured financials, leases, sensor data, tenant interactions, market feeds—and invest in interoperable data pipelines.

Pilot multimodal AI early: test integrations of imagery, lease language, and financials for unified asset evaluation. Partner with innovation-ready vendors who support extensibility.

Prioritize upskilling: CRE professionals should be fluent in understanding AI-derived insights—not just accepting them. Create internal forums where teams present AI use-case results, debate forecasts, and refine based on on-the-ground intuition.

Finally, foster an AI governance board—cross-functional leaders (legal, green, finance, asset) who oversee AI use, validate outputs, guide ethical and regulatory compliance, especially around tenant privacy, algorithmic fairness, and ESG accuracy.

Conclusion

Summary of Key Takeaways on AI Use Cases in Commercial Real Estate

AI in CRE isn’t a future play—it’s today’s business imperative. From lease abstraction and underwriting to property management, ESG insights, marketing, and forecasting, its impact is measurable: 70–90% time savings, 25% sale-premiums, 10% energy reduction, and in some pilots, 3.5× returns. Investments in structured data, vendor selection, pilot programs, and training unlock this value—and mitigate common pitfalls.

Call‑to‑Action for Businesses Considering AI Adoption

Are you wondering where to begin? Start with a targeted pilot. Select one high-impact, data-rich corner of your business—lease abstraction, energy analytics, or investment forecasting. Analyze existing data quality, run a test with a trusted CRE-specific AI platform, measure the gains, and then scale thoughtfully. This plays a dual role: building internal confidence and proving impact.

If you’re ready to accelerate, need an ROI blueprint or vendor matchmaking—or want to benchmark your data maturity—reach out. The next chapter in CRE isn’t going to be written by spreadsheets—it’s already being authored by AI-driven insight and action.

References

- https://www.ey.com/en_us/insights/real-estate-hospitality-construction/generative-ai-in-real-estate

- https://www.mckinsey.com/industries/real-estate/our-insights/generative-ai-can-change-real-estate-but-the-industry-must-change-to-reap-the-benefits

- https://www.forbes.com/councils/forbesbusinesscouncil/2025/01/02/7-ways-to-integrate-ai-into-commercial-real-estate/

- https://www2.deloitte.com/us/en/insights/industry/financial-services/generative-ai-in-real-estate-benefits.html

- https://www.intuz.com/blog/ai-use-cases-in-commercial-real-estate

- https://www.jll.com/en-us/insights/five-ways-ai-is-creating-new-demand-in-commercial-real-estate

1. Definition of AI and Its Core Technologies

1. Definition of AI and Its Core Technologies 1.

1.  1. Fragmented Data and Integration Hurdles

1. Fragmented Data and Integration Hurdles Use Case 1: Predictive Maintenance & Smart Asset Management

Use Case 1: Predictive Maintenance & Smart Asset Management 1. JLL: Streamlining Lease Abstraction at Scale

1. JLL: Streamlining Lease Abstraction at Scale  Step 1: Assessing Readiness for AI Adoption

Step 1: Assessing Readiness for AI Adoption Predictions for the Next Decade

Predictions for the Next Decade