Quick Introduction

Corporate finance teams face mounting pressure to generate accurate forecasts, reduce risk, and deliver faster insights under tightening budgets. AI use cases in corporate finance are emerging as essential tools, automating routine tasks, synthesizing vast datasets, and enabling faster, more informed decisions. This guide explores practical applications, showing how finance leaders are transforming operations and enhancing value.

What is AI and Why Does It Matter in Corporate Finance?

1. Definition of AI and Its Core Technologies

1. Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to systems designed to perform tasks requiring human-like intelligence, such as identifying patterns, interpreting language, and predicting outcomes. Core capabilities include machine learning (ML), natural language processing (NLP), and deep learning—each enabling finance teams to automate and scale complex functions like forecasting or report generation.

In the corporate finance context, AI means using these technologies to improve core processes such as financial planning & analysis (FP&A), working capital optimization, fraud detection, forecasting, and M&A due diligence. For example, NLP can process earnings call transcripts faster than any analyst, while ML-based forecasting models adapt across scenarios, creating more dynamic financial planning.

Want to explore how AI can transform your sector? Discover real-world strategies for deploying smart technologies in airline systems. Visit How to Integrate AI into Your Business in 2025 to get started today and unlock the full potential of AI for your business!

2. The Growing Role of AI in Transforming Corporate Finance

AI is reshaping finance operations by bringing precision, speed, and contextual awareness. FP&A teams are using predictive analytics to produce rolling forecasts that update with new data—reducing revision time by 30–50% and improving forecasting accuracy by 15–20% .

In treasury, AI is transforming cash-flow forecasting and fraud detection: a recent survey found 63% of CFOs reporting easier payment automation, with 60% seeing improved fraud detection through AI tools. This indicates that AI isn’t theoretical—it’s already embedded in day-to-day finance operations.

Moreover, AI accelerates M&A due diligence by scanning large datasets—contracts, financial statements, social media sentiment—and surfacing issues within minutes rather than weeks. This frees teams to focus on strategic analysis while lowering risk.

3. Key Statistics or Trends in AI Adoption

Survey data reveals that 55% of finance teams currently use AI for data analysis, and 47% for predictive modeling—highlighting that AI is mainstream in finance. These tools help scale insight generation even as data complexity increases.

A recent Bitcoin Study (2025) found that 33% of finance teams are using AI for anomaly detection—an adoption driven by rising risk and regulatory pressure. As regulations demand quicker fraud detection, AI systems are proving to be a smart alternative to hiring more staff.

Corporate finance spending on AI and automation platforms has surged as evidenced by growing partnerships with major cloud and fintech providers. CFOs are investing in custom AI dashboards that surface insights in real time—supporting smarter strategic decision around budgets, liquidity, and investment.

Business Benefits of AI in Corporate Finance

AI in corporate finance isn’t just a productivity tool—it’s a strategic enabler. When properly implemented, it delivers value through faster insights, improved accuracy, and smarter decisions. Below are five detailed benefits that illustrate how AI is transforming finance teams from number crunchers to strategic partners.

1. Enhanced Forecasting Accuracy

1. Enhanced Forecasting Accuracy

Traditional forecasting relies on static models and historical averages, often built manually in spreadsheets. This approach lacks responsiveness to real-time market shifts or operational volatility. AI-based forecasting, on the other hand, uses machine learning models trained on historical trends, real-time transactional data, seasonal patterns, and macroeconomic indicators.

These models continuously learn and adjust based on new data inputs. For example, if sales data spikes unexpectedly due to a campaign or seasonality, the AI adjusts projections instantly. As a result, finance teams using AI have reduced forecasting variance by up to 25%, according to a Deloitte CFO Signals report.

Better forecasts mean more accurate budgeting, better capital allocation, and more confidence in strategic planning—empowering CFOs to become forward-looking advisors to the board rather than backward-looking reporters.

2. Accelerated Financial Close and Reporting

The financial close process is traditionally bogged down by manual reconciliations, error-prone journal entries, and disparate systems. AI solves this by automating transaction matching, ledger updates, and anomaly detection. Machine learning algorithms can learn from past entries to classify new transactions with over 90% accuracy.

Some AI platforms now include intelligent OCR (optical character recognition) to scan invoices and contracts, extracting key data directly into ERP systems. This reduces close cycles by several days. For instance, a Fortune 500 manufacturer cut its monthly close from eight to four days after deploying an AI-based reconciliation engine.

This acceleration improves executive access to timely, actionable insights—and creates a foundation for rolling forecasts and continuous planning.

3. Proactive Fraud Detection and Compliance Monitoring

Financial fraud—from false expense claims to payment diversion—remains a persistent challenge. Traditional rule-based systems often flag too many false positives or miss subtle fraud patterns. AI excels in anomaly detection by learning from transaction patterns and recognizing outliers without predefined rules.

For example, machine learning can flag an expense report with a vendor mismatch or detect sequential invoice numbers indicative of fabricated bills. These models grow smarter over time, refining accuracy and minimizing false alarms.

AI also supports compliance by automating transaction monitoring against AML, KYC, or internal control policies. This allows compliance teams to focus on complex exceptions instead of routine checks, reducing both cost and regulatory exposure.

4. Optimized Working Capital Management

Corporate treasurers are using AI to improve cash flow visibility and optimize working capital. Predictive models forecast incoming receivables, supplier payments, and liquidity needs with greater precision. This allows organizations to manage buffer capital more efficiently, minimizing idle cash while avoiding overdrafts or missed obligations.

AI also helps categorize and prioritize overdue invoices based on customer behavior and risk profiles. For example, if a historically prompt payer suddenly misses a deadline, the model flags it for proactive outreach. This improves collection rates and reduces days sales outstanding (DSO).

According to PwC research, organizations using AI in working capital optimization see 10–15% improvements in free cash flow. For a $1B revenue business, that’s tens of millions unlocked.

5. Faster, Smarter M&A Due Diligence

Mergers and acquisitions involve high stakes and limited timelines. AI dramatically speeds due diligence by automating data extraction, contract review, and risk analysis. NLP algorithms can analyze hundreds of pages of legal documents, financial statements, and operational data within hours—identifying red flags or inconsistencies.

This allows corporate development teams to focus on strategic questions—synergies, cultural fit, integration plans—rather than drowning in documentation. AI can also model post-merger integration scenarios, helping CFOs evaluate cost structures and cash flow impact.

Companies leveraging AI in M&A execution report deal acceleration of 30–50% and improved risk visibility—helping close more deals with higher confidence.

Challenges Facing AI Adoption in Corporate Finance

Despite the upside, integrating AI into corporate finance isn’t without obstacles. The challenges are real—but not insurmountable. Below are five critical hurdles organizations must address to unlock full value.

1. Data Quality and System Fragmentation

1. Data Quality and System Fragmentation

Corporate finance data is often spread across ERPs, CRMs, spreadsheets, and cloud apps—structured inconsistently and tagged inadequately. AI models thrive on clean, labeled, and connected data. Without a unified data infrastructure, insights become fragmented or misleading.

To overcome this, businesses must invest in building finance data lakes, enforce data governance policies, and streamline data ingestion pipelines. This often requires cross-department collaboration and dedicated data stewardship. Without this foundation, even the most powerful AI models will underperform.

Building responsible AI starts with awareness. Learn how to tackle real-world bias in our guide on AI fairness and ethical strategies.

2. Black-Box Outputs and Auditability Gaps

Finance leaders and auditors demand traceability. If an AI model flags a transaction or projects a revenue dip, teams must know why. Many AI systems—especially deep learning models—offer little transparency, creating compliance risks.

To mitigate this, organizations should prioritize explainable AI (XAI). This includes models that provide confidence scores, decision trees, and natural-language rationale for predictions. Teams should also implement human-in-the-loop processes, where analysts review AI outputs before acting—especially in regulated environments.

3. Change Management and Employee Resistance

AI introduces not just a new tool, but a new way of working. Without proper onboarding, finance professionals may distrust outputs, fear obsolescence, or fall back on familiar methods. This stalls adoption and undermines ROI.

Successful change management begins with communication—clarifying what AI is (an enabler) and isn’t (a replacement). Training programs, pilot projects with clear wins, and peer advocacy all help build confidence. Integrating AI into existing tools (e.g., Excel add-ins, Slack assistants) can ease transitions.

4. Cost and Resource Constraints

AI implementation can be resource-intensive—requiring investment in tools, data infrastructure, talent, and vendor partnerships. For mid-market companies, this often feels out of reach. Without clear ROI projections or executive sponsorship, AI initiatives may stall before they start.

The solution lies in focused pilots with measurable outcomes. Start with one use case—like automating journal entries—and track its impact. Use the results to build momentum, secure budget, and expand gradually. Cloud-based AI platforms also offer scalable entry points without massive up-front cost.

5. Security and Regulatory Compliance Risks

Finance departments handle sensitive data—payroll, vendor payments, PII, and tax filings. Introducing AI increases the surface area for cyber threats, model misuse, or accidental disclosure. Regulatory bodies may scrutinize AI systems used for risk modeling or fraud detection.

To address this, teams must enforce strict access controls, monitor AI usage logs, and ensure encryption of both data and model outputs. Vendor contracts should include compliance guarantees (e.g., GDPR, SOX). Internal risk and legal teams must be involved from day one—not brought in after rollout.

For those navigating these complex waters, a business-oriented guide to responsible AI and ethics offers practical insights on deploying AI responsibly and transparently, especially when public trust is at stake.

Specific Applications of AI in Corporate Finance

1. AI‑Driven Forecasting & Scenario Planning

1. AI‑Driven Forecasting & Scenario Planning

Forecasting remains one of finance’s greatest challenges due to data silos, manual inputs, and changing market dynamics. AI-driven forecasting applies machine learning to historical transaction data, external market signals, and internal operational metrics to generate scalable, dynamic financial projections. These models self-adjust to real-time changes, providing CFOs with forward-looking insight rather than rear-view analytics.

At its core, these systems use regression, time-series forecasting, and ensemble learning applied to large datasets—sales, cost, inventory, market indices—to build predictive models. They integrate into existing FP&A platforms, updating forecasts automatically when new data flows in. Ethical considerations include model bias from skewed data and dependency on cloud systems requiring strong data governance.

By shifting from manual planning cycles to continuous, adaptive forecasting, finance teams reduce variance between actual and planned by up to 25% and compress quarterly close times by 30%, per Deloitte models. These gains free analysts for deeper analysis—improving agility and decision-making. However, a foundation of clean data and model validation is critical.

Real‑World Example:

A multinational retailer deployed ML-based forecasting across product lines using prebuilt models in Adaptive Insights. Revenue forecast errors dropped by 18%, while planning cycles shortened by two weeks per quarter. The system also identified irregular customer demand, helping optimize inventory and improve cash flow.

2. Intelligent Close & Automated Reconciliation

Closing the books is a resource-intensive and error-prone process for finance teams. AI-powered reconciliation uses machine learning and OCR to match transactions, extract invoice details, and flag unexplained variances automatically. This dramatically reduces manual workload, accelerates monthly close cycles, and minimizes risk.

The system ingests diverse data—ERP entries, bank statements, invoices—and uses supervised learning to identify transaction pairs and highlight exceptions. Unmatched items are routed for human review via workflow tools. Data quality and security are essential in sensitive financial pipelines.

Enterprise deployments show close timelines drop from 10 to 4 days, with reconciliation workload decreasing by 70%. More importantly, finance teams can now focus on month-end commentary, analytics, and CFO-level insights rather than transaction matching. The extraction accuracy—often over 95%—enables reliable auditability and compliance.

Real‑World Example:

A Fortune 500 manufacturer integrated BlackLine’s AI reconciliation suite, reducing manual reconciliations by 80% and accelerating close by 40%. Invoice line data was automatically extracted and matched from multiple ERPs. Audit error rates decreased by 60%, freeing up staff for strategic tasks.

3. Predictive Working Capital Management

Effective working capital management is essential, yet manual processes often lead to delays. AI-powered working capital tools analyze invoicing history, payment patterns, and customer behavior to predict cash conversion cycles. Machine learning forecasts receivable/due dates, enabling smarter collection timing and payment negotiation.

These models combine structured finance data with external signals—bank data, credit scores, and economic indicators—to forecast likely payment delays. Output is integrated into dashboards for treasury teams. A security-focused design ensures privacy and compliance with standards like ISO 27001.

Real-time insights have allowed companies to improve DSO (Days Sales Outstanding) by 10–20%, reducing financing needs and interest exposure. Treasury teams gain proactive control over liquidity, allowing better working capital planning and cost optimization.

Real‑World Example:

A global logistics firm implemented Taulia’s predictive AR model, reducing DSO by 15%. The AI recommended optimal payment dates based on customer patterns, and improved cash efficiency by $5M in one year. Treasury staff refocused efforts on high-risk vendor accounts and cash strategies.

4. AI‑Enhanced Fraud & Compliance Monitoring

Manual fraud and compliance monitoring struggles to scale with transaction volume and complexity. AI-based monitoring combines supervised learning, anomaly detection, and rule-based engines to detect subtle irregularities in real time. It flags high-risk activity promptly while suppressing false positives.

Data ingestion spans finance systems, communications, and external lists. The system flags unusual transaction patterns or vendor metadata and escalates via workflow tools. Ethical considerations include ensuring that risk profiling doesn’t unfairly target vendors or individuals.

Banks and large firms are seeing up to 90% reduction in false-positive fraud alerts and 40% fewer hours spent on investigations. Proactive flagging also reduces regulatory exposure—especially for SOX, AML, and internal policy compliance.

Real‑World Example:

A leading telecom firm deployed an ML-based anomaly detection tool to monitor vendor invoice routes. The system reduced fraud alerts by 60% and investigation time by 50%. The finance team identified $2M in previously undetected duplicate payments within one quarter.

5. Intelligent M&A Due Diligence & Document Review

Due diligence is labor-intensive, with reviews of thousands of pages of contracts, financial statements, and disclosures. AI-driven due diligence uses NLP and classification models to extract key clauses, highlight inconsistencies, and generate summaries—reducing review times dramatically.

These systems are trained on historical deal documents and legal taxonomies. They integrate into M&A platforms to present bubbles or tags for review. Ensuring accuracy requires manual validation and model transparency.

Corporate development teams report 50–70% reduction in document review time, shifting focus to strategic evaluation. Speed leads to competitive advantage, and consistent review reduces risk in deal deliberations.

Real‑World Example:

A global private equity firm used Kira Systems to screen 5,000 legal documents in under 48 hours—down from weeks. Key disclosure classification and exception flags reduced manual review time by 55%. The tool improved due diligence quality and supported faster deal execution.

6. Generative AI for Narrative Reporting & Insights

Finance teams spend significant effort writing financial narratives—earnings calls, variance explanations, and commentary. Generative AI uses LLMs to draft accurate narrative reports by analyzing KPIs, trends, and anomalies. It standardizes reporting and accelerates publication.

Trained on historical commentary and reporting templates, these tools ingest dashboards, data lakes, and variance metrics. They generate first-draft narratives that analysts refine. Trust depends on embedding validation checks and data lineage.

Companies using generative narrative tools report 40% faster report generation and 30% reduction in review cycles. This enables finance teams to deliver more frequent, insightful commentary—empowering finance leaders as strategic storytellers.

Real‑World Example:

An insurance giant deployed Workiva’s AI-powered narrative engine to automate quarterly report summaries. Narrative drafts were produced within hours—not weeks—saving ~25 hours per quarter in labor. Reviewer satisfaction rose by 50% due to clarity and consistency.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Corporate Finance

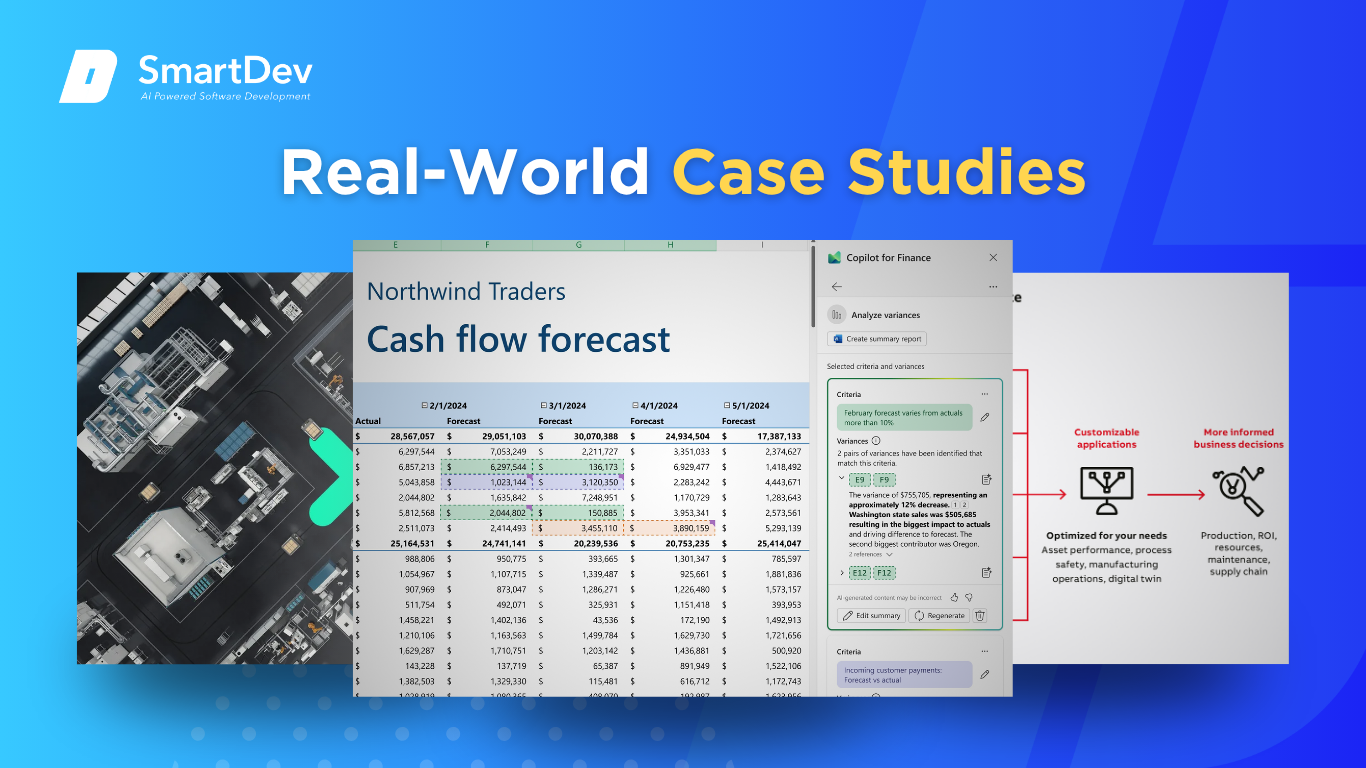

After outlining strategic use cases, it’s essential to ground the discussion in real-world practice. The following case studies illustrate how finance leaders are using AI not as a concept, but as a lever for operational and strategic advantage.

Real-World Case Studies

1. Microsoft: Streamlining Financial Planning with Predictive AI

1. Microsoft: Streamlining Financial Planning with Predictive AI

Microsoft implemented AI-powered forecasting within its finance division to move away from static planning cycles. The company built predictive models that analyze historical revenue, subscription trends, and macroeconomic data—resulting in more agile, rolling forecasts. This allowed finance teams to anticipate fluctuations in cloud business demand faster and with greater accuracy.

Within 12 months, Microsoft reported improved forecast accuracy and reduced cycle time for its quarterly close by 30%. Finance professionals shifted from manual variance tracking to scenario modeling and strategic planning. This transformation enabled faster decision-making at the executive level, particularly during volatile economic conditions such as the pandemic.

2. Siemens: Automating Close and Compliance at Scale

Siemens, a global industrial leader, integrated BlackLine’s AI-powered financial close and reconciliation platform to automate manual, spreadsheet-driven tasks. The platform matched transactions across disparate ERP systems, flagged anomalies, and routed unresolved items to the appropriate reviewers.

Post-deployment, Siemens reduced monthly close time by over 40%, cut manual reconciliations by 70%, and improved compliance across 200+ legal entities. The system’s real-time dashboards also enabled CFOs to spot emerging risks across global subsidiaries, enhancing governance. These improvements helped reduce audit preparation time and increased confidence in internal controls.

3. ABB: AI‑Driven Treasury and Working Capital Optimization

ABB, the Swiss-based automation firm, deployed machine learning models in its treasury operations to predict working capital needs across regions. AI analyzed supplier payments, receivables data, and macroeconomic variables to forecast liquidity positions more accurately.

The models enabled ABB’s treasury teams to avoid costly short-term borrowing by reallocating funds proactively across entities. DSO was reduced by 12%, while the firm improved its cash flow forecasting accuracy by 30%. The company also enhanced risk mitigation by flagging underperforming geographies with early warning indicators.

These examples reflect the value of working with technology partners who understand both the technical and policy implications. If you’re considering a similar digital transformation, don’t hesitate to connect with AI implementation experts to explore what’s possible in your context.

Innovative AI Solutions in Corporate Finance

AI in corporate finance continues to evolve beyond automation—toward real-time decision augmentation and digital advisory. Below are three breakthrough innovations redefining finance workflows.

Generative AI tools are now embedded in FP&A platforms like Anaplan and Oracle Cloud EPM. These solutions use LLMs to auto-generate budget commentary, summarize key variances, and draft board-level insights. By reducing narrative production time, finance teams can deliver more timely and contextual reporting across business units and geographies.

Another innovation is the rise of multimodal AI for finance, which combines structured data (ledgers, ERP entries) with unstructured sources (emails, contracts, voice transcripts). These models analyze both numbers and narratives, identifying financial risk buried in legal clauses or inconsistent messaging—supporting finance teams in cross-functional roles like procurement, compliance, or investor relations.

Lastly, AI copilots—finance-specific virtual assistants—are being rolled out by providers like Microsoft Dynamics 365 Finance and Workday. These copilots answer finance queries, automate workflows, and surface recommendations—enabling decision-makers to interact with financial systems via natural language. This democratizes data access and streamlines approvals, budgeting, and investment modeling for non-finance leaders.

AI-Driven Innovations Transforming Corporate Finance

The corporate finance function is at a critical inflection point—facing tighter margins, increasing data complexity, and a demand for real-time insight. AI Use Cases in Financial Corporate are rapidly transitioning from experimental pilots to core infrastructure, automating key processes and empowering smarter strategic decisions. This article explores how leading finance organizations are implementing AI to reduce risk, free capacity for value creation, and enhance decision agility.

Emerging Technologies in AI for Corporate Finance

Generative AI and computer vision are now transforming day‑to‑day finance operations. Generative AI models, trained on internal financial reports and board minutes, can draft variance explanations, commentary, and decision memos—cutting writing time by 30–50%. In parallel, computer vision tools use OCR and pattern recognition to automate invoice processing and reconcile hard-copy documents—saving hours of manual work and reducing entry errors.

These technologies integrate into finance systems via APIs or embedded modules, connecting to ERP systems like SAP or Oracle. They require careful data governance and compliance frameworks, especially when dealing with financial disclosures or personally identifiable information. Despite implementation challenges, these systems are driving measurable productivity gains and operational accuracy—transforming how finance teams deliver insight today.

AI’s Role in Sustainability Efforts

A growing area of focus for finance teams is sustainability-linked financing and ESG reporting. AI is being used to analyze carbon-intensity trends in portfolios, automate sustainability disclosures, and forecast ESG-related risks tied to supply chains or vendor behavior. These models aggregate external environmental data with internal spend and operational metrics to produce predictive views of emissions and compliance readiness.

Simultaneously, sustainable finance initiatives have extended to energy optimization within finance operations—intelligently regulating office HVAC, data center workloads, and finance department activity schedules. US-based firms have reported up to 20% reductions in energy costs by shifting workloads to low-carbon periods. These efforts demonstrate that AI can deliver bottom-line savings while aligning finance with broader corporate sustainability objectives.

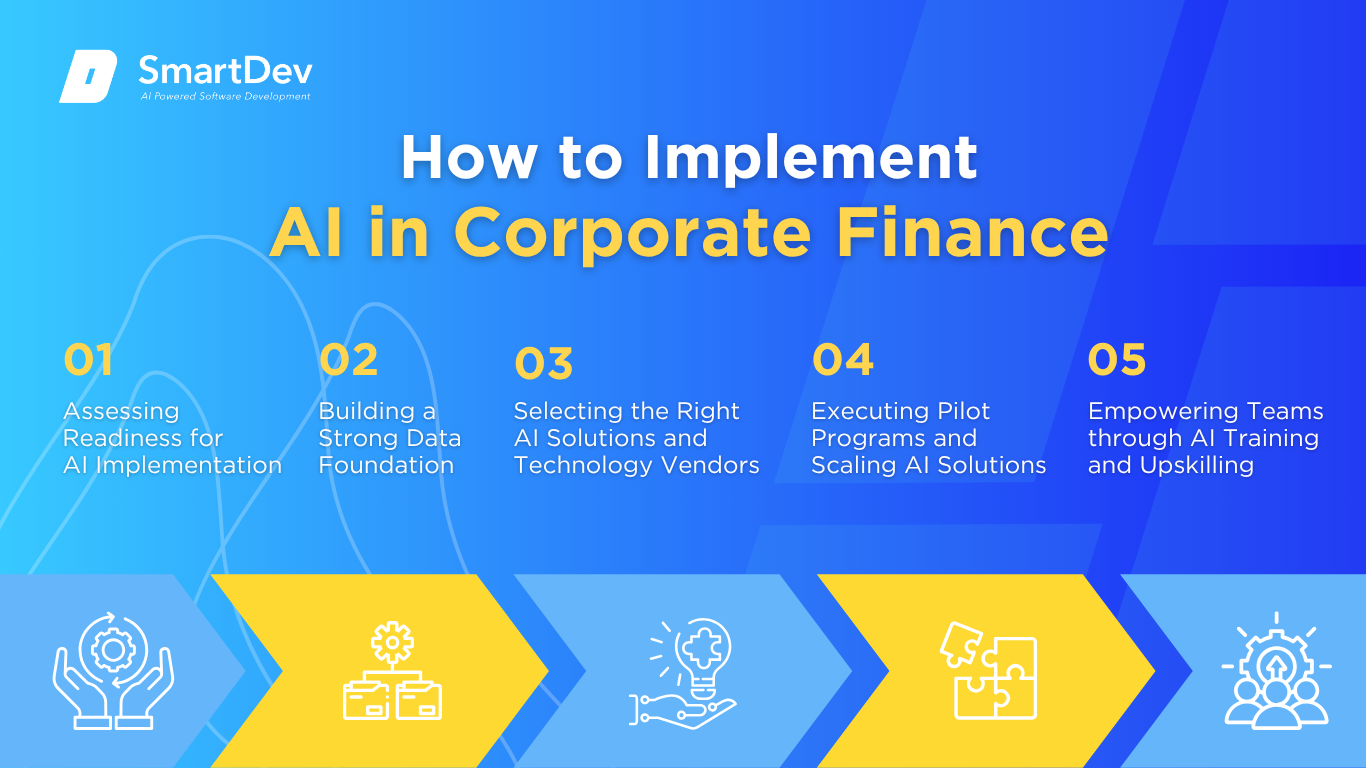

How to Implement AI in Financial Corporate

Step 1: Assessing Readiness for AI Adoption

Step 1: Assessing Readiness for AI Adoption

Before launching AI, your finance team must identify use cases with clear strategic impact. Are forecasting cycles taking too long? Do manual reconciliations consume key talent hours? High-effort, high-value tasks—such as variance explanation or close acceleration—are prime candidates for AI pilots. By focusing on measurable KPIs like hours saved or forecast accuracy improvement, you build a track record to justify further investment.

On the readiness front, examine your data maturity, tool maturity, and organizational willingness. Do you have accurate, structured financial and operational data? Do teams show openness to new tools, or fall back on spreadsheets? Prioritize pockets of excellence where AI can be deployed quickly, and where success will build lasting confidence in new methods.

Step 2: Building a Strong Data Foundation

AI requires structured, consistent, and high-quality data. Financial systems often span multiple ERPs, CRMs, and legacy tools—resulting in fragmentation, duplication, and errors. Your first investment should be in a unified data architecture: a finance data lake with metadata tagging, version control, schema alignment, and strong security protocols.

Use ETL pipelines and data catalogs to automate cleansing, validation, and lineage tracking. When data consistency improves, models learn faster and deliver more reliable results. This foundation is not just an IT exercise—it’s the bedrock of finance modernization.

Step 3: Choosing the Right Tools and Vendors

Selecting the right AI platform is a critical decision that determines both the speed of adoption and long-term success. Start by mapping each potential use case—forecasting, reconciliation, compliance monitoring, etc.—to tools that natively integrate with your finance stack. For example, BlackLine excels in close automation, while Workiva offers robust narrative generation through AI. Meanwhile, Microsoft Copilot is well-suited for teams already operating within the Office and Dynamics ecosystems.

Evaluate each vendor’s explainability capabilities, governance standards, and data residency policies. Finance executives must ensure that AI decisions—particularly those affecting forecasts or compliance—can be audited and understood by humans. The best vendors also support sandbox testing, model customization, and API flexibility—essential for adapting AI tools to complex finance workflows.

Choosing a vendor should not be an IT-only decision. Involve FP&A leads, compliance managers, and data governance officers early in the process. That cross-functional ownership ensures that new systems will be embraced operationally, not resisted or abandoned.

Step 4: Pilot Testing and Scaling Up

Once tools are selected, begin with narrow pilots that solve one defined problem—like reducing invoice processing time or automating monthly variance commentary. Define clear success metrics before launch: hours saved per process, accuracy uplift, or reduction in cycle time. Engage pilot users closely during testing and use feedback to fine-tune model output, UX, and workflows.

After a successful pilot, avoid rushing into an organization-wide rollout. Instead, prioritize adjacent use cases—those with similar data structures, workflows, or stakeholder groups. This approach preserves momentum while minimizing rework. For example, a team using AI for automated journal entries may be a natural next candidate for invoice classification AI.

Scaling AI is as much about governance as it is about growth. Formalize standards around data handling, output approval, and exception monitoring. As your footprint expands, ensure a central AI council oversees usage consistency, risk mitigation, and ROI evaluation.

Step 5: Training Teams for Successful Implementation

AI adoption fails without change management. That’s why training must begin before go-live, not after. Start by demystifying AI—explaining what it can do, what it cannot, and how it supports finance professionals rather than replaces them. Clarify that AI will handle routine, repetitive tasks so humans can focus on analysis and advising.

Tailor training to role profiles. Treasury staff need to understand predictive liquidity models; FP&A teams should be comfortable evaluating AI-generated forecasts. Interactive workshops—where employees test AI tools in real business scenarios—build comfort and demonstrate relevance. Early wins shared by peers are more influential than slide decks from vendors.

Reinforce training with in-tool guidance, real-time feedback, and upskilling opportunities. Create a network of AI champions across finance functions who can mentor peers and escalate issues. When AI becomes part of your team’s DNA, adoption transforms from a tech rollout into a culture shift.

Whether you’re exploring your first pilot or scaling an enterprise-wide solution, our team is here to help. Get in touch with SmartDev and let’s turn your supply chain challenges into opportunities.

Measuring the ROI of AI in Financial Corporate

AI initiatives must prove they’re more than digital flair. Decision-makers want to see tangible, defensible returns. The following framework focuses on how to quantify both cost savings and strategic value in AI investments for corporate finance.

Key Metrics to Track Success

Start with operational KPIs: how many hours were saved in the monthly close process? By how much did reconciliation exceptions fall? How much faster were budgets or board reports prepared? These are high-visibility wins that demonstrate AI’s immediate impact on workload.

Next, examine strategic contributions. Did forecast accuracy improve? Did better cash flow predictions lead to smarter capital deployment? Did anomaly detection surface fraud or risk earlier than traditional controls? These outcomes connect AI to financial stewardship, not just automation.

Finally, evaluate qualitative gains: employee satisfaction with reduced grunt work, improved audit readiness, or enhanced cross-team collaboration. Conduct pre- and post-implementation surveys. Consider also the cost avoidance of not needing to hire for repetitive tasks—an increasingly relevant metric in lean teams.

Case Studies Demonstrating ROI

Coca-Cola HBC implemented machine learning to improve demand forecasting across its bottling operations. By integrating sales data, weather trends, and promotional calendars, AI-driven forecasts improved accuracy by 30%. As a result, inventory holding costs were reduced by €45 million annually, while product availability rose—improving customer satisfaction and sales alignment.

Intuit deployed NLP-powered automation within its finance team to handle supplier invoicing and document classification. The AI solution categorized over 80% of invoices without human intervention. This reduced processing time by 60% and eliminated over 15,000 hours of manual work per year, allowing reallocation of staff to higher-impact financial analysis.

Unilever used AI to automate financial commentary generation across business units. A generative model built internal narratives for monthly reporting, enabling FP&A teams to publish 3x faster. The consistency across regional reports also improved executive confidence in shared metrics, streamlining boardroom-level discussions and reducing rework.

Understanding ROI is possibly a challenge to many businesses and institutions as different in background, cost. So, if you need to dig deep about this problem, you can read AI Return on Investment (ROI): Unlocking the True Value of Artificial Intelligence for Your Business

Common Pitfalls and How to Avoid Them

One of the most frequent mistakes is assuming AI will work out of the box. Unlike SaaS tools, AI systems must be trained, tuned, and validated. If teams launch without robust datasets or user input, early outputs may feel irrelevant—undermining credibility. Always run parallel workflows to validate AI performance before decommissioning legacy processes.

Another pitfall is failing to manage expectations. AI won’t eliminate the finance team—it enhances it. Yet without clear communication, fear or skepticism can stall adoption. Position AI as a partner, not a threat, and emphasize how it supports value creation rather than job reduction.

Lastly, avoid data governance shortcuts. Skipping controls on model access, lineage, or change logs creates long-term audit and security risks. Build these guardrails early—even for small pilots—so that your AI strategy remains scalable, secure, and compliant.

Future Trends of AI in Financial Corporate

Looking ahead, the fusion of artificial intelligence and corporate finance will accelerate and the leaders in this space will be those who embed intelligence not just into tools, but into thinking.

Predictions for the Next Decade

Predictions for the Next Decade

By 2035, finance departments will operate as real-time decision hubs powered by continuously learning models. Budgets and forecasts will update dynamically in response to market shifts, internal metrics, and competitor behavior. AI agents will surface recommendations in natural language—responding to questions like, “What’s driving our revenue shortfall in Q3?” or “How should we adjust capital deployment based on FX volatility?”

Narrative generation will become autonomous. Board packs, investor updates, and audit memos will be compiled by AI and reviewed, not written, by humans. Regulatory bodies will also adopt AI, necessitating real-time transparency from corporate systems—a trend already visible in SEC AI pilot programs.

Over time, AI will not just accelerate financial workflows; it will become essential to how CFOs shape strategy. The future of finance is not just digital—it’s intelligent.

How Businesses Can Stay Ahead of the Curve

To stay ahead, finance leaders must invest in both technology and talent. Build a scalable AI architecture that supports integration, governance, and model agility. Simultaneously, upskill your workforce—not just in tools, but in critical thinking and model validation. Encourage a culture of experimentation where failures inform future decisions rather than stifle them.

Consider forming a cross-functional AI committee—bridging finance, IT, legal, and risk—to oversee roadmap, vendor evaluation, and ethical deployment. Engage with academia or innovation hubs to stay current. Above all, make AI central to your strategic finance operating model—not an add-on, but a core pillar of value delivery.

Conclusion

Summary of Key Takeaways on AI Use Cases in Financial Corporate

AI is not a distant innovation—it is already changing how financial corporate teams forecast, reconcile, monitor risk, and report. From improving forecasting accuracy and compressing close timelines to uncovering fraud and optimizing working capital, AI use cases in financial corporate are proving their worth in every corner of the enterprise.

The key is to implement deliberately: build clean data foundations, start small with pilots, and scale what works. When done right, AI doesn’t just make finance more efficient—it makes it more intelligent, more agile, and more valuable to the business.

Call-to-Action for Businesses Considering AI Adoption

If you’re a CFO, controller, or finance transformation leader, now is the time to operationalize AI. Begin by identifying 1–2 use cases with clear ROI—whether it’s financial close automation, forecasting uplift, or fraud detection. Choose vendors that prioritize transparency and flexibility, and invest in upskilling your team alongside your tools.

Need help planning or accelerating your AI journey? Our team specializes in aligning AI innovation with financial strategy. Let’s talk—about your data, your goals, and your next step toward intelligent finance.

References

- https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/gen-ai-a-guide-for-cfos

- https://blog.workday.com/en-us/how-ai-changing-corporate-finance-2025.html

- https://cloud.google.com/discover/finance-ai

- https://www.datarails.com/ai-changing-finance-and-accounting/

- https://www.gartner.com/en/finance/topics/finance-ai

- https://link.springer.com/chapter/10.1007/978-3-031-87368-3_9

- https://futurecfo.net/ai-in-corporate-finance-the-top-five-use-cases/

1. Enhanced Forecasting Accuracy

1. Enhanced Forecasting Accuracy 1. Data Quality and System Fragmentation

1. Data Quality and System Fragmentation 1. Microsoft: Streamlining Financial Planning with Predictive AI

1. Microsoft: Streamlining Financial Planning with Predictive AI  Step 1: Assessing Readiness for AI Adoption

Step 1: Assessing Readiness for AI Adoption Predictions for the Next Decade

Predictions for the Next Decade