Artificial Intelligence (AI) is redefining the financial services industry. By leveraging advanced technologies, AI in finance enhances efficiency, improves decision-making, and delivers innovative solutions. This article dives into what AI means for finance, its transformative role, key use cases, business benefits, adoption trends and challenges to help you understand why AI use cases in finance are vital for staying competitive.

As AI continues to transform financial services, the most impactful solutions come from integrating advanced technology with real-world business needs. To see how organizations are translating innovation into measurable results, explore our ai-assisted software development services—designed to accelerate your journey from concept to production-ready financial applications.

What is AI and Why Does It Matter in Finance?

Definition of AI and its core technologies

Definition of AI and its core technologies

According to IBM, AI in finance refers to the application of a set of technologies, particularly machine learning algorithms, in the finance industry. This fintech involves using sophisticated technologies to improve the efficiency, accuracy and speed of such tasks as data analytics, forecasting, investment management, risk management, fraud detection, customer service and more.

The Growing Role of AI in Finance

AI is reshaping finance by automating repetitive tasks and reducing operational costs. Routine processes like compliance reporting and data entry are now faster and more accurate. This allows financial institutions to focus on strategic goals.

AI also improves risk management by predicting market trends and identifying potential risks. Personalization is another area where AI in Finance shines. By analyzing customer data, AI delivers tailored financial products and advice. This enhances customer satisfaction and loyalty in a competitive market.

Key Statistics and Trends Highlighting AI Adoption in Finance

The adoption of AI in finance is accelerating rapidly. A 2023 report by McKinsey estimates that AI could add up to $1 trillion in annual value to the global banking sector. Over 70% of financial institutions are already using AI for fraud detection and risk management, according to a PwC survey. This trend shows the demand for AI-driven solutions continues to rise.

The global AI in finance market was valued at $38.36 billion in 2024 and is projected to reach $190.33 billion by 2030. By 2025, AI is expected to save banks $200 to $340 billion annually through enhanced productivity and operational efficiencies.

Generative AI is emerging as a game-changer in finance. Investments in generative AI are projected to reach $1.68 billion by 2025, enabling applications like automated regulatory reporting and personalized customer communications.

Fraud detection is a key driver of AI adoption, with 91% of U.S. banks using AI-powered tools to identify suspicious activities according to a BioCatch report based on a survey of 600 fraud fighters in 11 countries. These tools process transactions up to 90% faster than traditional methods, improving security and customer trust.

Business Benefits of AI in Finance

1. Enhanced Decision-Making

AI empowers financial institutions with real-time insights from vast datasets. Machine learning models analyze market trends and customer behaviors to inform investment strategies and risk assessments.

Enhanced decision-making reduces reliance on intuition-based judgments. AI-driven analytics provide actionable recommendations, improving portfolio management and strategic planning. Institutions can respond swiftly to market changes, gaining a competitive edge.

2. Cost Reduction

One of the most significant benefits of AI in finance is operational efficiency. By automating repetitive and manual processes – such as loan processing, compliance checks and transaction verifications – AI dramatically reduces human error and administrative costs.

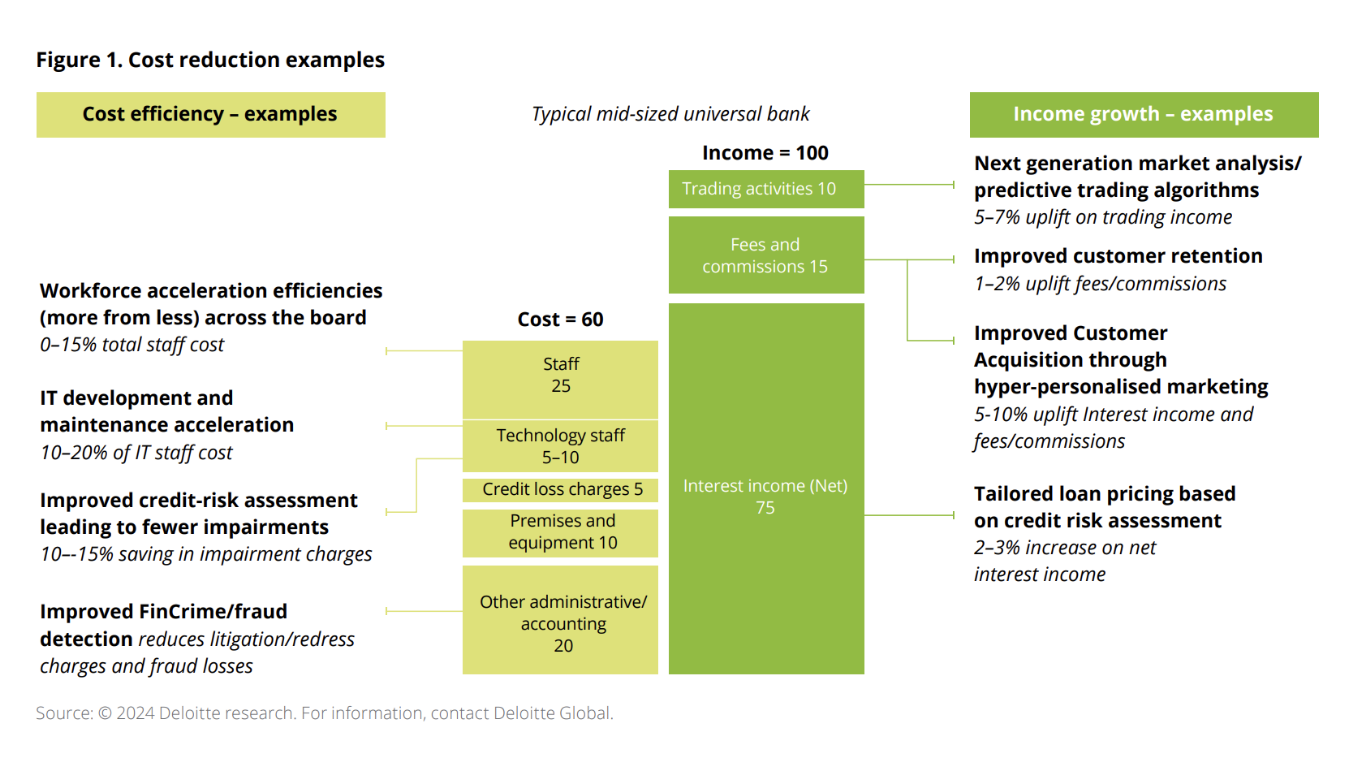

Robotic Process Automation (RPA), a subset of AI, allows financial firms to handle high-volume tasks without increasing headcount. According to a Deloitte report, successful innovators can reduce costs and achieve a 5-15% improvement in cost income ratio over the next five years.

3. Improved Risk Management

3. Improved Risk Management

AI use cases in finance are particularly impactful in risk assessment and management. AI models can process real-time market data, client behavior, and credit histories to assess potential risks far more accurately than traditional methods.

By continuously learning from new data, AI systems can identify emerging risks, such as cybersecurity threats or market instabilities before they escalate. This proactive approach enhances regulatory compliance and strengthens organizational resilience.

4. Personalized Customer Experience

Financial institutions are increasingly using AI to personalize customer journeys. Through natural language processing (NLP) and behavioral analytics, AI systems can understand customer needs and deliver tailored advice, investment options, or credit offers.

AI-powered chatbots and virtual assistants are available 24/7, handling routine queries while learning from each interaction to improve future responses. This not only increases customer satisfaction but also frees up human advisors for more complex requests.

5. Fraud Detection and Prevention

AI in finance is a game-changer for fraud detection. Traditional rule-based systems often struggle to identify new or complex fraud patterns, while AI continuously learns and adapts to detect subtle indicators of suspicious activity.

By analyzing user behavior in real time, AI systems can flag irregular transactions within milliseconds, significantly reducing financial losses. This dynamic fraud prevention model is particularly crucial in sectors like mobile banking and digital payments, where cybercrime is rising.

Challenges Facing AI Adoption in Finance

1. Data Privacy and Security Concerns

Implementing AI in finance requires access to vast amounts of sensitive personal and financial data. This raises serious concerns about data privacy, especially with regulations like GDPR and CCPA enforcing strict compliance on how data is collected, stored, and processed.

Moreover, the risk of cyberattacks targeting AI systems is growing. Financial institutions must build robust security infrastructures to protect data integrity and customer trust, which can be a major technical and financial burden.

2. High Implementation Costs

Deploying AI technologies involves significant upfront investments in infrastructure, software, and skilled personnel. While long-term ROI is promising, many financial institutions, especially smaller ones, are struggling to justify the initial costs without guaranteed outcomes.

Custom AI solutions often require integrating with complex legacy systems, adding to the implementation timeline and budget. These hidden costs can deter even large enterprises from scaling their AI efforts.

3. Legacy System Integration

One of the biggest barriers to AI adoption in finance is outdated IT infrastructure. Many institutions still rely on legacy systems that are incompatible with modern AI platforms, making data integration and real-time processing extremely difficult.

Upgrading these systems requires not only financial investment but also technical expertise and cultural change. Without this foundation, AI cannot function at its full potential, and adoption remains fragmented.

4. Regulatory and Ethical Uncertainty

The regulatory framework around AI use cases in finance is still evolving. Financial institutions must navigate ambiguous laws around algorithmic transparency, automated decision-making, and liability in case of AI errors.

In addition, ethical concerns, such as AI bias, lack of explainability, and potential job displacement, pose reputational risks. Companies must implement ethical AI governance frameworks to ensure fair and accountable systems.

5. Lack of Skilled Talent

Implementing artificial intelligence projects requires a team of data professionals, including data scientists, analysts, engineers and ML specialists. A Deloitte survey indicated that 23% of AI adopters identified a talent skills gap for AI implementation.

Training existing staff or partnering with tech firms can address the talent gap, but these solutions require time and investment. The competitive market for AI specialists further complicates recruitment. Scaling AI initiatives remains a significant hurdle.

Specific Applications of AI in Finance

1. Credit Scoring and Loan Approval

AI transforms credit scoring and loan approval by analyzing diverse datasets beyond traditional credit reports. Machine learning models assess factors like transaction history, social media activity, and employment patterns to predict repayment likelihood. This approach expands access to credit for underserved populations while reducing default risks.

Unlike conventional methods, AI processes data in real-time, enabling faster loan decisions. It also detects subtle patterns, improving risk assessment accuracy. Financial institutions benefit from lower processing costs and higher approval rates without compromising portfolio quality.

Upstart is a lending platform that uses AI to assess credit risk and determine loan eligibility. Unlike traditional credit scoring, which relies on a limited set of data, Upstart incorporates factors like education, work experience, and employment history into its evaluation process.

This enables Upstart to approve loans for individuals who may lack traditional credit histories, such as recent graduates. By doing so, the platform has been able to approve more loans and reduce defaults by 75%, making lending more inclusive and accessible to a broader range of borrowers.

2. Algorithmic Trading

Algorithmic trading is one of the most advanced applications of AI in finance, using machine learning models to execute trades at optimal speed, timing, and pricing. These systems analyze massive datasets in real time, such as market trends, news sentiment, and historical patterns, to identify opportunities and reduce latency in decision-making. This minimizes human bias and enables firms to react instantly to market volatility.

The true power of algorithmic trading lies in its ability to process unstructured data to anticipate market shifts before they occur. As AI models evolve, they’re not just executing faster trades, but adapting to market behavior dynamically, making the trading process more autonomous, data-driven, and resilient under pressure.

Two Sigma Investments is a leading example of how AI-driven algorithmic trading can generate consistent financial success. By leveraging machine learning and massive data sets, from traditional market indicators to alternative data like satellite images and shipping trends, Two Sigma executes high-frequency trades with remarkable accuracy. The firm has generated over $15 billion in net gains since inception, demonstrating the scalability and profitability of AI in finance.

3. Customer Service via AI Chatbots

AI-powered chatbots revolutionize customer service in finance by providing instant, personalized support. Using natural language processing, they handle inquiries about account balances, transactions, or financial advice. This reduces wait times and operational costs for institutions.

Chatbots learn from interactions, improving response accuracy over time. They operate 24/7, meeting customer expectations for constant availability. By automating routine queries, firms free up human agents for complex issues, enhancing service efficiency.

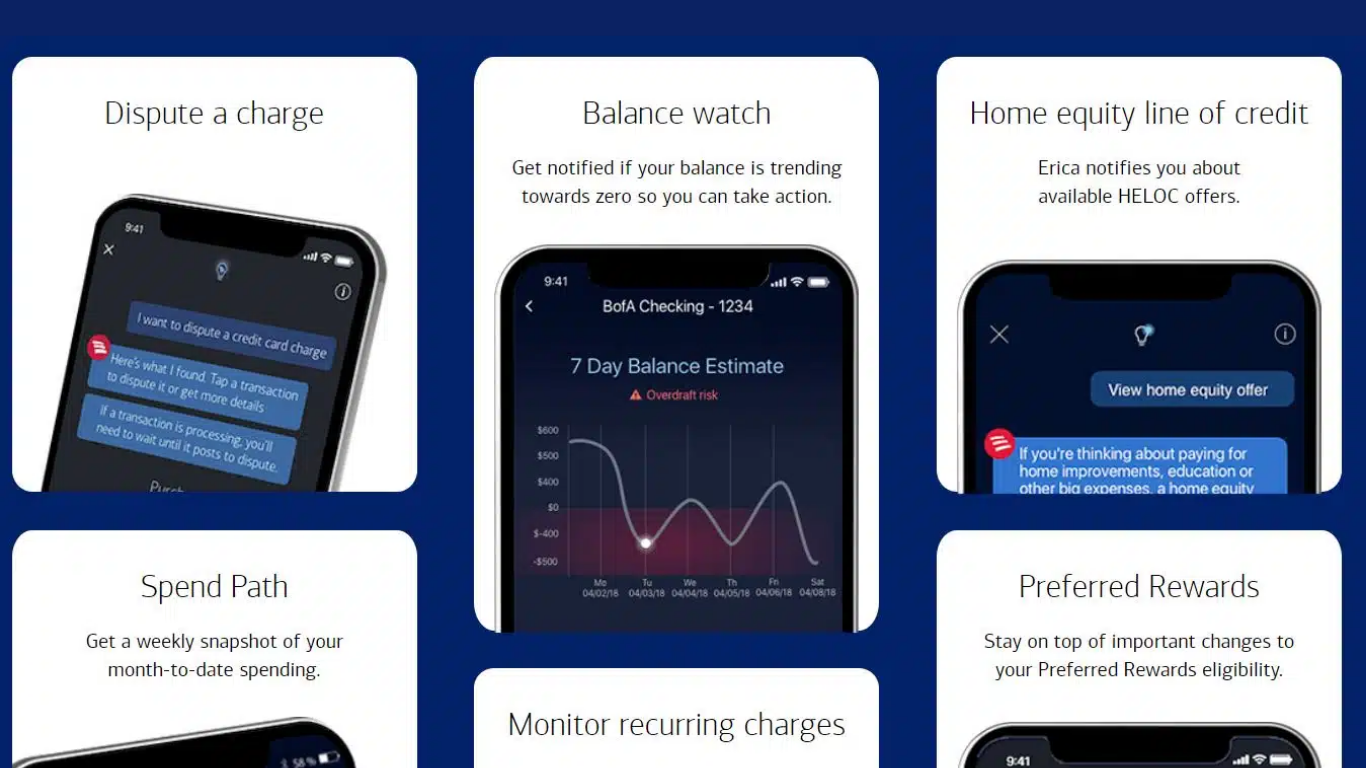

Bank of America’s AI assistant, Erica, launched in 2018, has handled over 2 billion client interactions, with 2 million engagements daily. Powered by natural language processing and machine learning, Erica helps users manage everyday banking with speed and accuracy. Its success shows how AI in finance can scale personalized service and boost digital engagement dramatically.

4. Fraud Detection and Prevention

4. Fraud Detection and Prevention

AI revolutionizes fraud detection in finance by using machine learning algorithms to identify anomalous transaction patterns in real-time. These systems analyze billions of data points, such as spending habits, location, and behavior, to flag potential fraud with high precision. Unlike rule-based systems, AI adapts to evolving fraud tactics, reducing false positives and catching sophisticated schemes.

By processing data in real-time, AI enables instant fraud detection, which is critical in fast-paced environments like mobile banking. It also lowers operational costs by reducing false positives, improving both security and customer trust in digital payments. AI’s ability to learn from data ensures proactive threat identification, making it essential for modern financial security.

Mastercard’s Decision Intelligence Pro, launched in 2024, leverages a proprietary generative AI model to enhance fraud detection across its network. The system evaluates over 1,000 data points per transaction, achieving a 20% average improvement in fraud detection rates and up to 300% in specific cases. It also reduced false positives by up to 200%, saving banks an estimated 20% in fraud-related costs.

5. Regulatory Compliance and Reporting

AI streamlines regulatory compliance in finance by automating the analysis of vast transaction datasets to ensure adherence to complex regulations. Machine learning models monitor transactions in real-time, flagging potential violations or suspicious activities, such as those related to anti-money laundering (AML) requirements. AI also automates compliance report generation, reducing errors and meeting tight regulatory deadlines.

AI’s adaptability is crucial in navigating evolving regulations, such as the Bank Secrecy Act or FATF standards. By processing unstructured data and identifying hidden patterns, AI enhances compliance accuracy and efficiency. This reduces manual workloads, lowers compliance costs, and helps institutions avoid hefty fines, reinforcing their reputation and operational integrity.

HSBC, in collaboration with Google Cloud, implemented an AI-based AML monitoring system called Dynamic Risk Assessment (DRA) in 2023. Processing over 1.35 billion transactions monthly, the system reduced false positives by 20% and shortened batch processing times, earning the 2023 Celent Model Risk Manager Award. This efficiency saved HSBC significant resources while enhancing compliance with global AML standards.

Real-World Case Studies of AI Driving Change in Finance

1. JP Morgan’s COiN: AI for Contract Review

JP Morgan’s COiN (Contract Intelligence) platform revolutionizes the financial industry by automating the review and extraction of key data from complex credit agreements. Previously, this process required around 360,000 hours of manual labor annually, but COiN reduces it to just seconds, significantly improving efficiency and accuracy.

The AI system leverages machine learning and image recognition to identify and extract about 150 data points from contracts without human intervention. This automation not only accelerates workflows but also minimizes errors, enabling JP Morgan to handle tens of thousands of contracts quickly and securely.

JP Morgan’s heavy investment in technology – allocating nearly 9% of revenue – combined with a strong focus on talent acquisition and cultural transformation, has been critical to COiN’s success. By empowering employees to focus on higher-value tasks, the bank is reshaping its workforce for the AI-driven future.

2. PayPal: AI-Powered Fraud Detection at Scale

PayPal, a global digital payments leader, faced rising fraud risks across billions of transactions annually. Manual risk assessments were too slow, leading to increased losses and a disrupted user experience.

To address these issues, PayPal deployed an AI-driven risk engine using machine learning and neural networks. The system analyzes behavior, device data, and transaction patterns in real time to assign risk scores and flag suspicious activity.

Its adaptive models use supervised and unsupervised learning to keep up with evolving fraud tactics. This allows PayPal to respond to threats quickly and reduce reliance on static, rule-based systems. The impact has been substantial: fraud losses dropped by up to 20%, false positives fell 30%, and detection accuracy improved. The AI solution now protects over 400 million users while supporting seamless, secure payments at global scale.

3. Deutsche Bank’s AI for Trade Settlement Automation

Deutsche Bank has implemented AI-driven solutions to automate and enhance trade settlement processes within its Securities Services division. A notable innovation is the chatbot “Debbie” which provides clients with instant responses to trade settlement status queries via secure messaging, improving efficiency and reducing settlement risks.

Additionally, Deutsche Bank developed “S2-Predict,” an AI-powered tool that analyzes historical transaction data and risk factors to forecast settlement failures. This predictive capability enables clients to take proactive measures, reducing failure rates and associated penalties while increasing transparency.

These AI initiatives are part of Deutsche Bank’s broader strategy to modernize post-trade operations by leveraging machine learning, APIs, and natural language processing. The goal is to minimize data latency, enhance client experience, and better manage operational risks in a complex market environment.

4. Optimizing Credit Reporting with AI: SmartDev’s Approach to Driving Financial Inclusion

SmartDev collaborated with a leading financial services provider to transform their traditional credit reporting system through AI-driven automation. Facing challenges such as manual data processing, fragmented workflows, and outdated security frameworks, the client sought a comprehensive digital solution to enhance credit assessments and promote greater financial inclusion.

Leveraging deep expertise in AI in finance, SmartDev re-engineered the credit reporting process by automating data validation, optimizing financial data processing, and securing sensitive customer information. The new system introduced real-time validation engines, AI-powered data enrichment, and seamless reporting workflows, ensuring faster and more accurate credit evaluations.

By applying credit reporting automation techniques, SmartDev significantly improved operational efficiency, reduced error rates, and enabled the client to extend financial services to underserved populations. Security and compliance were strengthened through advanced encryption and robust access controls, critical for handling financial data at scale.

This case study demonstrates how integrating AI-driven credit assessment and secure financial data processing can not only streamline operations but also accelerate financial inclusion initiatives. SmartDev’s approach showcases the power of AI in finance to drive innovation, improve service delivery, and create greater access to credit for all.

5. Innovative AI Solutions

AI is driving a new wave of innovation in finance through emerging technologies like generative AI, explainable AI (XAI), and real-time decision engines. These solutions are not only improving accuracy but also enhancing the speed and transparency of complex financial operations.

Generative AI is being used to automate financial reporting, data analysis, and market summaries, reducing manual workloads and improving turnaround times. This allows institutions to streamline operations and make more informed investment decisions faster.

Explainable AI (XAI) is becoming essential in credit modeling and risk assessment, as it enables institutions to understand and justify AI-driven decisions. This transparency is crucial for regulatory compliance and building trust with stakeholders.

Real-time AI systems are transforming areas like fraud detection and customer service by analyzing data as it’s generated. These systems enable instant responses to risks or user queries, which is critical in high-speed financial environments.

AI-Driven Innovations Transforming Finance

Emerging Technologies in AI for Finance

Generative AI is starting to reshape financial services, from automating report generation to designing personalized client communications. These models enhance efficiency in marketing, advisory, and even investment commentary. Computer vision, though less common, is gaining traction for analyzing visual data such as handwritten checks, ID verification and fraud detection through document analysis.

These technologies mark a shift from reactive data processing to proactive intelligence. Financial firms can now generate tailored content at scale, identify anomalies instantly, and streamline onboarding with visual document checks – all while reducing manual workloads. The competitive edge lies in combining these innovations with human oversight to ensure precision and compliance.

AI’s Role in Sustainability Efforts

AI in finance supports sustainability by using predictive analytics to reduce operational waste and overconsumption. For instance, banks and investment firms leverage AI to assess ESG risks and forecast the environmental impact of portfolios. Smart systems also help optimize energy use in data centers and branch operations, contributing to broader net-zero goals.

The integration of AI in ESG reporting not only improves transparency but also aligns financial decisions with long-term environmental responsibility. By automating climate risk analysis and green asset evaluation, financial institutions gain the tools to meet both investor expectations and regulatory standards more effectively.

How to Implement AI in Finance

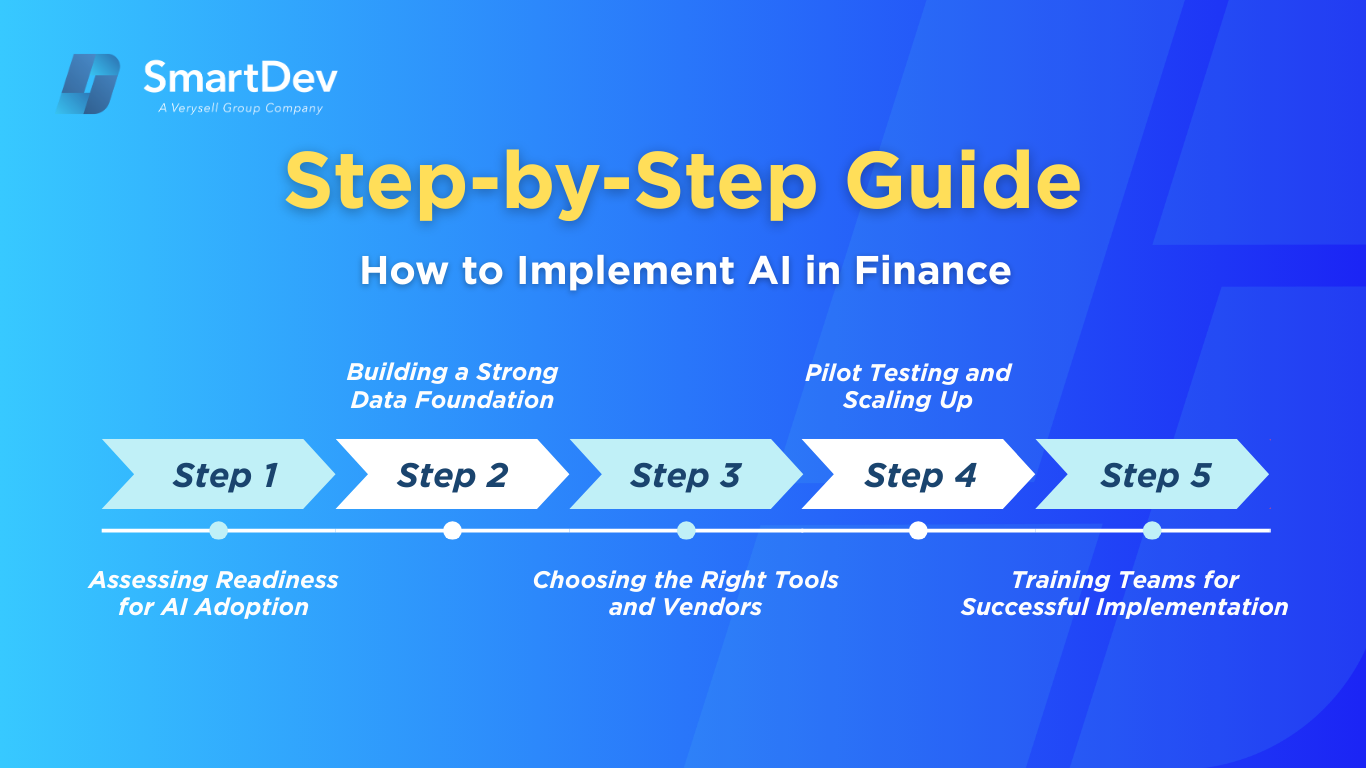

Step 1. Assessing Readiness for AI Adoption

Step 1. Assessing Readiness for AI Adoption

Before adopting AI in finance, firms must assess internal readiness, including digital maturity, data infrastructure, and leadership support. Identifying high-impact areas, such as fraud detection, customer support, or credit scoring, helps prioritize use cases with clear ROI potential. Without a focused strategy, AI efforts risk being misaligned or underutilized.

Step 2. Building a Strong Data Foundation

A robust data foundation is essential for successful AI implementation in finance. This involves cleaning legacy data, ensuring consistency across systems, and establishing secure data governance practices. High-quality, well-structured data enhances model accuracy and regulatory compliance.

Step 3. Choosing the Right AI Solutions and Technology Vendors

Selecting the right AI platforms requires evaluating scalability, financial industry expertise, and regulatory alignment. Institutions should consider vendors with proven success in AI use cases in finance, such as fraud detection or automated underwriting. Compatibility with existing systems also plays a key role in long-term success.

Step 4. Pilot Testing and Scaling Up

AI initiatives should begin with small-scale pilots to validate performance, identify risks, and gather stakeholder feedback. Pilots allow teams to refine data inputs, model outputs, and operational workflows before wider rollout. Gradual scaling minimizes disruption while building internal confidence in AI systems.

Step 5. Training Teams for Successful Implementation

Upskilling employees is critical to integrating AI into financial workflows. Training programs should cover AI literacy, data interpretation, and collaboration with automated systems. Empowering staff to work alongside AI boosts adoption rates and ensures sustainable value.

Measuring the ROI of AI in Finance

Key Metrics to Track Success

To gauge the ROI of AI in finance, firms should prioritize metrics like cost savings, productivity enhancements, and accelerated time-to-insight. For instance, reduced processing times and fewer manual errors directly reflect operational efficiency, while higher customer satisfaction scores indicate improved service quality. These metrics provide concrete evidence of AI’s transformative impact on financial workflows.

Establishing well-defined benchmarks is critical for assessing the effectiveness of AI in finance across various departments. By setting specific goals, such as a percentage reduction in error rates or faster report generation, companies can consistently measure AI’s contributions. This structured approach ensures that the financial benefits of AI are accurately quantified and aligned with business objectives.

Beyond immediate metrics, analyzing the broader impact of AI in finance reveals its long-term value. For example, AI-driven insights can enhance decision-making, leading to better risk management and revenue growth. By combining quantitative data with qualitative outcomes, firms can fully understand AI’s ROI and optimize future investments.

Case Studies Demonstrating ROI

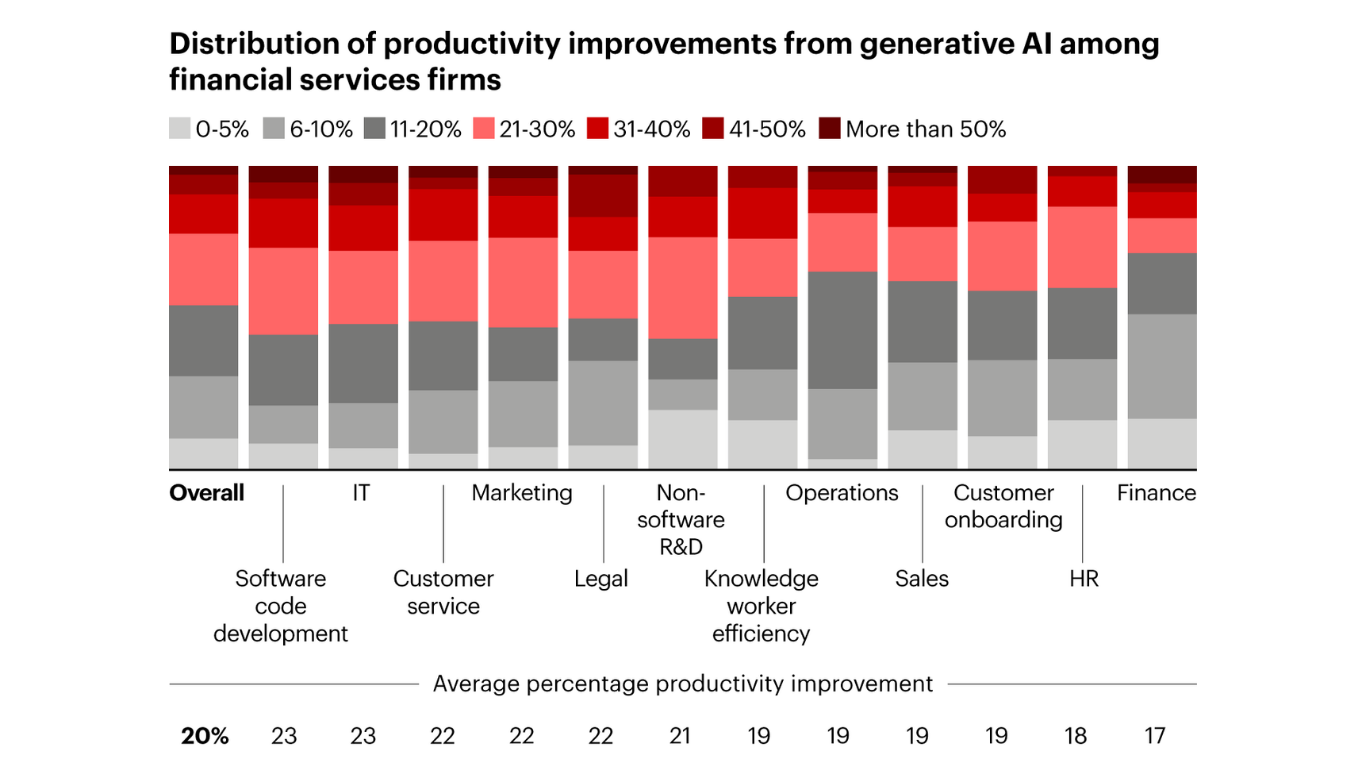

A 2024 survey by Bain & Company reports that financial institutions adopting generative AI saw an average 20% increase in productivity, especially in customer service, compliance, and IT functions. These gains translated directly into cost savings and faster decision-making, proving that AI in finance delivers measurable business value.

Meanwhile, a Deloitte-backed report highlights that 93% of firms using AI automation achieved significant reductions in operating expenses. AI-driven process automation not only cut costs but also improves scalability and risk control across back-office operations – key ROI drivers for financial services.

Common Pitfalls and How to Avoid Them

Common Pitfalls and How to Avoid Them

Many AI projects in finance fail due to vague objectives, poor data quality, or lack of internal buy-in. Rushed implementations without pilot testing often leads to underwhelming results. Avoiding these pitfalls requires clear goals, clean data pipelines, and early involvement from business and IT teams.

Another common issue is overreliance on third-party vendors without developing internal AI literacy. This creates long-term dependency and limits innovation agility. Financial institutions should build cross-functional AI teams to balance technical execution with domain knowledge.

Future Trends of AI in Finance

Predictions for the Next Decade

Over the next decade, AI in finance will move beyond automation toward cognitive decision-making and real-time strategy optimization. Hyper-personalization, autonomous finance, and ethical AI frameworks will define competitive advantage. Regulatory bodies are expected to enforce stricter guidelines around AI transparency and explainability.

As AI becomes more embedded in core decision-making, trust will hinge on interpretability and accountability. Explainable AI (XAI) tools and algorithm audits will no longer be optional but critical to maintaining customer trust and meeting compliance requirements. Future-ready firms will need to prioritize both innovation and governance.

How Businesses Can Stay Ahead of the Curve

To stay competitive, financial institutions must invest in AI governance, cross-functional AI teams, and continuous upskilling. Adopting agile innovation cycles and maintaining ethical AI standards will be key to long-term success. Collaborating with fintechs and AI labs can accelerate experimentation while managing risk.

Early movers should also explore real-time data architectures, cloud-native AI, and edge computing for finance. These technologies enable faster decision-making and scalable AI deployment across digital channels, giving businesses the agility to respond to market shifts ahead of competitors.

Conclusion

Summary of Key Takeaways

AI is fundamentally transforming the financial services industry by enhancing operational efficiency, improving decision-making, and enabling hyper-personalized customer experiences. From fraud detection and algorithmic trading to credit scoring and customer service, AI use cases in finance are delivering tangible business value while driving innovation across the sector.

Despite challenges like data privacy, high implementation costs, and regulatory uncertainty, the long-term benefits of AI adoption, such as reduced costs, improved risk management, and competitive advantage, make it a strategic priority. Institutions that invest in strong data foundations, ethical AI frameworks, and skilled talent will be best positioned to thrive in the future of finance.

Moving Forward: A Path to Progress

Ready to unlock the full potential of AI for your financial services business? At SmartDev, our team of AI experts, equipped with cutting-edge technologies and deep industry knowledge, delivers tailored solutions that seamlessly integrate personalization, automation, and predictive analytics. From optimizing compliance to elevating customer experiences, we’re here to guide your transformation with confidence.

Discover how SmartDev can elevate your financial operations through our specialized AI solutions at SmartDev. Contact us today to get started!

4. Fraud Detection and Prevention

4. Fraud Detection and Prevention Common Pitfalls and How to Avoid Them

Common Pitfalls and How to Avoid Them