Introduction to AI Financial Modeling

What is Financial Modeling

Financial modeling is a highly valued yet often misunderstood skill in financial analysis. Its primary objective is to integrate accounting, finance, and business metrics to develop a forecast of a company’s future financial performance.

A financial model is typically a spreadsheet, most commonly built in Microsoft Excel, that projects a business’s financial outcomes over a specified period. This forecast is generally based on the company’s historical performance and key assumptions about future operations. Constructing a financial model involves preparing an income statement, balance sheet, and cash flow statement, along with supporting schedules. This comprehensive approach, known as a three-statement model, is one of several methodologies used in financial statement modeling.

The Role of AI in Financial Modeling

Automation of Data Collection, Cleaning, and Processing

AI significantly reduces the time and effort required for data gathering and preparation. Traditional financial modeling requires analysts to manually compile financial statements, market trends, and industry reports from various sources. AI-powered tools automate this process by:

- Scraping and aggregating financial data from multiple sources, including earnings reports, stock exchanges, and economic indicators.

- Cleaning and structuring data to ensure consistency, accuracy, and usability for modeling.

- Reducing manual errors and inconsistencies that often arise from human input.

Enhanced Forecasting Accuracy with Machine Learning

AI-driven models leverage machine learning (ML) algorithms to improve financial forecasting. Unlike traditional models, which rely on static assumptions, ML-driven forecasting continuously adapts to new information and trends. Benefits include:

- Identifying complex patterns in historical data that traditional models may overlook.

- Adjusting forecasts dynamically based on changing economic conditions, market trends, and company performance.

- Reducing bias by relying on objective, data-driven insights rather than subjective human judgment.

Real-Time Data Analysis and Model Adjustments

Financial markets are dynamic, and real-time data is critical for accurate decision-making. AI enables financial models to:

- Integrate live financial feeds, macroeconomic indicators, and industry-specific developments.

- Adjust projections instantly based on new financial reports, market shifts, and geopolitical events.

- Enhance decision-making by ensuring that models reflect the most current and relevant data.

Advanced Risk Assessment and Scenario Analysis

AI-powered financial models can simulate multiple economic and business scenarios to assess potential risks. Key applications include:

- Stress Testing: AI can evaluate how a company would perform under adverse conditions, such as economic downturns, interest rate hikes, or supply chain disruptions.

- Monte Carlo Simulations: Machine learning algorithms generate thousands of possible financial outcomes, providing a probability distribution of potential risks.

- Early Warning Systems: AI can detect signals of financial distress, helping businesses and investors take proactive measures.

Natural Language Processing (NLP) for Sentiment and Market Analysis

NLP allows AI to analyze vast amounts of textual data, such as earnings calls, investor reports, news articles, and regulatory filings. This enables:

- Sentiment Analysis: Assessing market sentiment by analyzing the tone and language of company announcements, CEO speeches, and financial news.

- Earnings Call Analysis: Extracting key insights from management discussions to predict future performance.

- Regulatory Compliance Monitoring: Identifying potential compliance risks by scanning legal documents and financial disclosures.

Fraud Detection and Anomaly Identification

AI enhances financial model reliability by detecting fraudulent activities and financial inconsistencies. This is achieved through:

- Anomaly Detection: Identifying unusual financial transactions, revenue recognition patterns, or expense irregularities.

- Forensic Accounting: AI algorithms can analyze financial statements to detect signs of manipulation or aggressive accounting practices.

- Regulatory Compliance Monitoring: Ensuring adherence to financial regulations by flagging suspicious activities in real-time.

Why AI is Transforming Financial Modeling Practices

Artificial Intelligence (AI) is fundamentally changing financial modeling practices by automating processes, enhancing predictive accuracy, and enabling real-time decision-making.

Traditional financial models rely heavily on static historical data, manual inputs, and predefined assumptions, which can limit their effectiveness in fast-changing market conditions. AI introduces machine learning, natural language processing, and big data analytics, allowing for more dynamic, adaptive, and data-driven financial modeling.

Key Benefits of AI in Financial Modeling

Artificial Intelligence (AI) is revolutionizing financial modeling by enhancing efficiency, accuracy, and adaptability. Traditional models often rely on manual data entry and assumptions, which can be time-consuming and error-prone. AI-driven models leverage machine learning, big data analytics, and automation to process vast amounts of information quickly, detect patterns, and generate more precise forecasts.

By continuously learning from new data, AI ensures that financial models remain dynamic and relevant, reducing the need for frequent manual updates. It also minimizes human bias and errors, leading to more reliable insights. Additionally, AI automates repetitive tasks such as data collection and validation, allowing financial professionals to focus on strategic decision-making.

Overall, AI transforms financial modeling by improving prediction accuracy, streamlining processes, and enabling better-informed financial decisions.

Understanding AI in Financial Modeling

What is AI-Driven Financial Modeling?

AI in financial modeling is the application of artificial intelligence technologies to enhance and automate this process. The end goal is to predict the financial performance of a business, project, or investment opportunity.

AI technologies used in financial modeling, like machine learning and natural language processing (NLP), bring several advancements to financial modeling. Machine learning algorithms analyze large data sets to identify patterns and trends that humans would miss on their own, improving financial forecasts, investment decisions, and risk assessments.

NLP makes it easy to incorporate and analyze unstructured data from sources like earnings call transcripts, financial news, and social media. By understanding and evaluating the sentiment and content of textual data, AI provides deeper insights into market conditions and investor sentiment, which influences financial strategies and decisions.

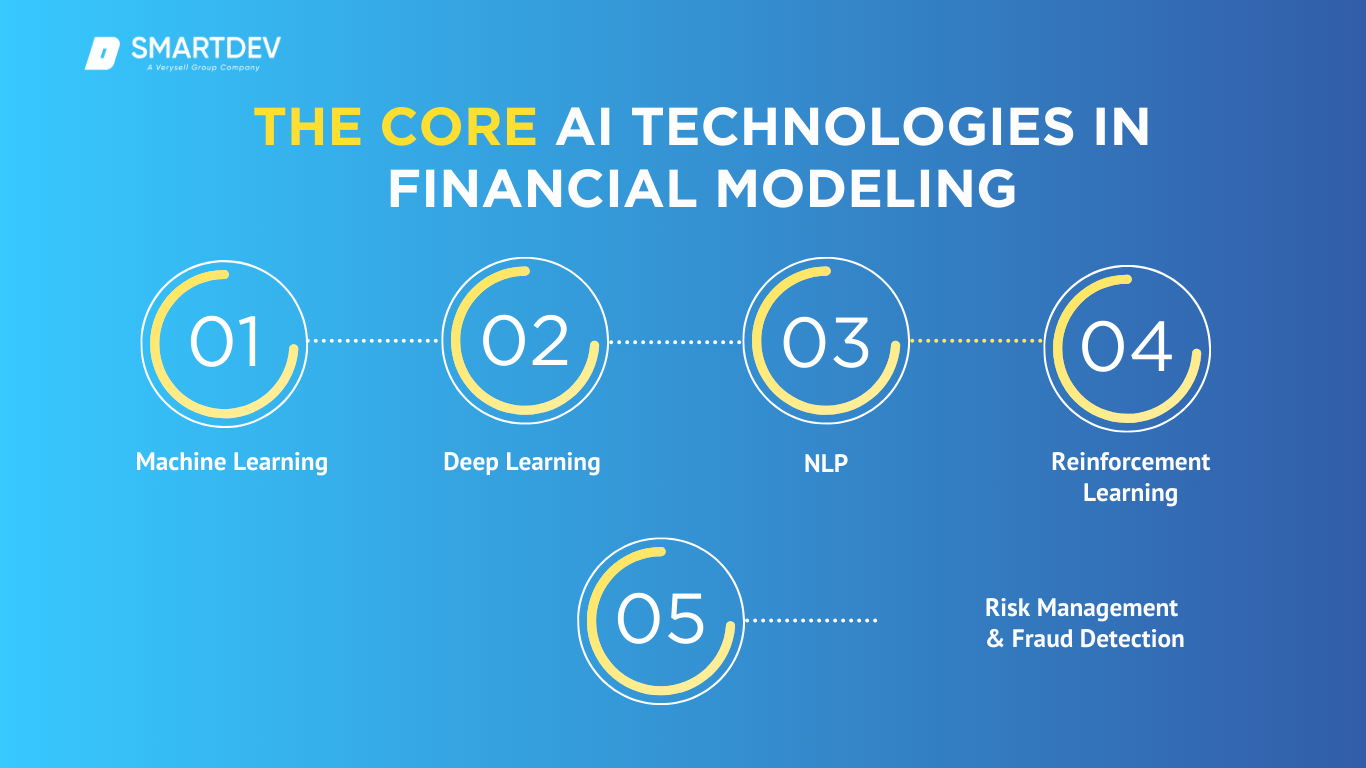

The Core AI Technologies in Financial Modeling

- Machine Learning in Financial Modeling

Machine Learning (ML) is at the heart of AI-driven financial modeling, enabling systems to identify patterns and make predictions based on historical data. ML models improve financial forecasting, fraud detection, and risk management.

Key Applications:

✔ Predictive Analytics: ML algorithms analyze past market trends to forecast stock prices and economic conditions.

✔ Risk Assessment: Financial institutions use ML to assess credit risk and detect potential loan defaults.

✔ Algorithmic Trading: ML-powered trading systems analyze real-time market data for automated, high-frequency trading.

- Deep Learning for Financial Forecasting

Deep Learning (DL), a subset of ML, uses neural networks to process complex datasets and uncover hidden patterns. In financial modeling, deep learning enhances accuracy in risk predictions and asset valuation.

Key Applications:

✔ Credit Scoring & Loan Approvals: Neural networks improve credit assessments by analyzing vast amounts of financial history.

✔ Anomaly Detection: Identifying unusual financial transactions to prevent fraud.

✔ Sentiment Analysis: Analyzing investor sentiment from financial news and social media to predict market movements.

- Natural Language Processing (NLP) in Finance

Natural Language Processing (NLP) enables AI systems to process and interpret financial documents, reports, and news in real time. It helps financial analysts extract insights from unstructured data sources.

Key Applications:

✔ Automated Financial Reporting: AI summarizes earnings reports, SEC filings, and balance sheets.

✔ Market Sentiment Analysis: NLP tools analyze news, social media, and earnings calls to gauge investor sentiment.

✔ Regulatory Compliance: AI helps in monitoring compliance by scanning financial regulations and detecting discrepancies.

- Reinforcement Learning for Portfolio Optimization

Reinforcement Learning (RL) is a subset of ML where AI systems learn optimal financial strategies through trial and error. It is particularly useful in portfolio management and automated trading.

Key Applications:

✔ Dynamic Portfolio Allocation: AI models adjust asset allocation based on real-time market changes.

✔ Risk-Reward Optimization: RL algorithms balance risk and reward in investment strategies.

✔ Hedging Strategies: AI-powered models optimize hedge fund strategies by continuously adapting to market fluctuations.

- AI-Powered Risk Management & Fraud Detection

AI enhances risk management by identifying anomalies, detecting fraudulent transactions, and mitigating financial risks before they escalate.

Key Applications:

✔ Fraud Detection: AI detects irregular transaction patterns in real-time.

✔ Regulatory Risk Assessment: AI evaluates compliance risks for financial institutions.

✔ Cybersecurity in Finance: AI strengthens security by identifying threats and potential breaches.

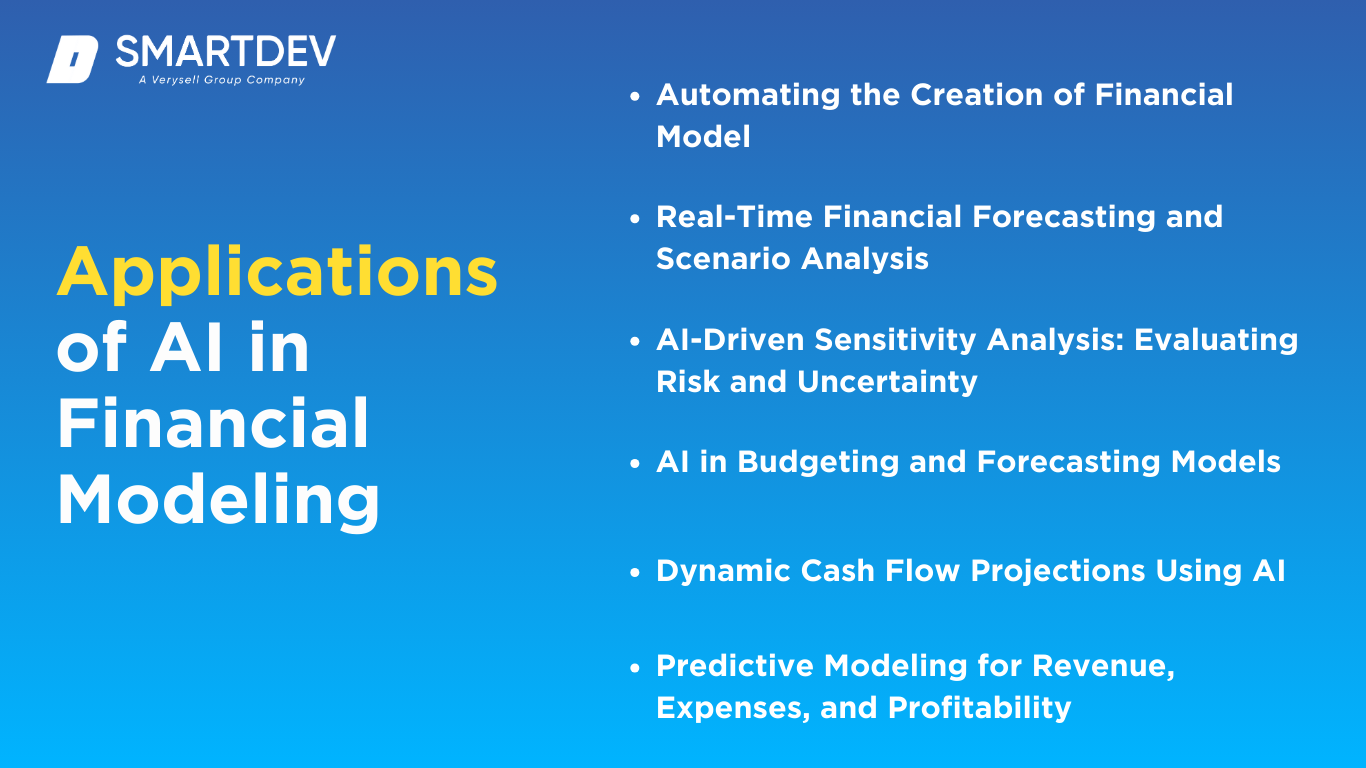

Applications of AI in Financial Modeling

Artificial Intelligence (AI) is transforming financial modeling by automating complex calculations, analyzing vast amounts of financial data, and generating precise predictions. By leveraging machine learning (ML), deep learning, and data-driven decision-making, AI enables businesses to enhance accuracy, optimize risk management, and improve financial forecasting.

Below are some of the most impactful AI applications in financial modeling.

Automating the Creation of Financial Models

Traditional financial modeling requires extensive manual effort, often involving large spreadsheets, complex calculations, and significant human expertise. AI automates the creation and refinement of financial models, reducing dependency on manual input while improving efficiency and accuracy.

By leveraging machine learning algorithms, AI-driven platforms can generate sophisticated financial models in a fraction of the time it would take a human analyst. These models can integrate and process large amounts of structured and unstructured financial data from multiple sources, ensuring that the analysis is comprehensive and up to date.

Furthermore, AI continuously refines these models by learning from past financial data, adapting to changing market conditions, and enhancing the accuracy of future predictions. Companies that adopt AI-driven financial modeling solutions can significantly improve their financial planning, optimize resource allocation, and reduce errors caused by manual data processing.

Real-Time Financial Forecasting and Scenario Analysis

Financial forecasting traditionally relies on historical data and static models, which can become outdated quickly in volatile markets. AI introduces real-time financial forecasting capabilities by continuously analyzing incoming financial data, market movements, and macroeconomic indicators.

AI-driven forecasting models process and adjust projections dynamically as new information becomes available, ensuring that businesses and financial institutions are always working with the most accurate and up-to-date financial insights. Additionally, AI enables scenario analysis, allowing financial professionals to simulate different economic conditions and assess their potential impact on business performance.

By running multiple simulations and stress tests, AI-driven models help businesses evaluate a range of possible financial outcomes and prepare for different market conditions. This ability to assess various financial scenarios in real time gives organizations a competitive advantage in risk management, investment planning, and strategic decision-making.

AI-Driven Sensitivity Analysis: Evaluating Risk and Uncertainty

Sensitivity analysis is a crucial component of financial modeling that helps organizations understand how different variables influence financial outcomes. AI enhances sensitivity analysis by leveraging data-driven analytics to run thousands of simulations and identify key risk factors in financial models.

Unlike traditional methods, which often rely on static assumptions and predefined sensitivity parameters, AI can process vast amounts of financial data and dynamically adjust risk evaluations based on real-time market trends. AI-powered sensitivity models assess the impact of fluctuations in key variables such as interest rates, exchange rates, inflation, and consumer demand, helping businesses make informed decisions under uncertain economic conditions.

Furthermore, AI-driven sensitivity analysis employs machine learning techniques to detect non-linear relationships between financial variables, uncovering hidden risks that may not be apparent through traditional methods. By using AI for sensitivity analysis, companies can develop more resilient financial strategies, optimize risk management, and improve long-term financial stability.

AI in Budgeting and Forecasting Models

Budgeting and forecasting are essential financial planning activities that influence business strategy, resource allocation, and operational efficiency. AI significantly improves these processes by leveraging predictive analytics, real-time data integration, and automated financial modeling techniques. AI-driven budgeting models analyze historical financial data, identify patterns in revenue and expenses, and generate more accurate budget projections.

Unlike conventional budgeting methods that rely on manual inputs and fixed assumptions, AI continuously refines budget forecasts based on new financial data and emerging trends. This allows organizations to dynamically adjust their financial plans and respond proactively to changes in business performance or market conditions.

Additionally, AI-powered forecasting models help detect anomalies in budget expenditures, flagging potential inefficiencies or fraudulent activities. By incorporating AI into budgeting and forecasting, businesses can improve financial accuracy, optimize cost management, and enhance overall financial decision-making.

Dynamic Cash Flow Projections Using AI

Cash flow management is a critical aspect of financial health, influencing liquidity, investment decisions, and operational sustainability. AI enhances cash flow modeling by providing dynamic, data-driven projections that offer a more accurate view of a company’s financial position.

Traditional cash flow forecasting methods often rely on historical trends and static assumptions, making them less effective in volatile or rapidly changing business environments. AI-driven cash flow models continuously analyze incoming financial data, detect patterns in cash inflows and outflows, and adjust projections accordingly.

This allows businesses to predict potential cash shortages or surpluses well in advance, enabling proactive liquidity management. Additionally, AI algorithms can identify irregularities in cash flow patterns, flagging potential fraud risks or operational inefficiencies.

AI-powered treasury management systems integrate these capabilities, helping CFOs and financial planners optimize working capital, enhance liquidity planning, and minimize financial risk. With AI-driven cash flow projections, businesses can achieve greater financial stability and make data-informed decisions regarding investments, financing, and operational expenses.

Predictive Modeling for Revenue, Expenses, and Profitability

AI-driven predictive modeling plays a crucial role in forecasting revenue, expenses, and overall profitability. By analyzing vast amounts of structured and unstructured financial data, AI identifies patterns, correlations, and key drivers influencing a company’s financial performance.

Predictive models powered by machine learning continuously learn from past financial data, improving their accuracy and adaptability over time. AI enhances revenue forecasting by incorporating factors such as market demand, customer behavior, seasonality, and economic indicators into financial models.

Similarly, AI-driven expense optimization models analyze cost structures, detect inefficiencies, and recommend cost-saving strategies. By simulating different business scenarios, AI helps organizations understand the impact of various strategic decisions on profitability and long-term financial performance.

This level of predictive insight enables businesses to fine-tune their pricing strategies, improve resource allocation, and optimize financial outcomes. AI-powered predictive modeling transforms financial decision-making from reactive to proactive, allowing companies to stay ahead of market fluctuations and maintain a strong competitive edge.

AI Tools and Platforms for Financial Modeling

Adopting artificial intelligence (AI) in financial modeling has led to the development of sophisticated tools and platforms that streamline financial planning, forecasting, and decision-making. These AI-powered solutions enhance efficiency by automating data analysis, improving predictive accuracy, and providing real-time insights into financial trends.

This section explores the landscape of AI-driven financial modeling tools, their key features, their integration with legacy financial systems, and a comparison of leading AI platforms in the market.

Popular AI-Based Financial Modeling Tools:

- Clockwork AI – An AI-powered financial planning and cash flow forecasting tool that integrates with accounting software to provide real-time insights into financial health. It uses machine learning to predict future revenue, expenses, and cash flow trends.

- Daloopa – An AI-driven financial data automation platform that extracts, processes, and organizes financial statements and reports, reducing manual data entry efforts for analysts and investors.

- Vena Solutions – A cloud-based financial modeling platform that combines AI and automation to streamline budgeting, forecasting, and financial reporting processes for businesses of all sizes.

- Anaplan – A robust enterprise financial planning tool that leverages AI to optimize business planning, revenue forecasting, and operational financial modeling.

- DataRobot – A machine learning automation platform that provides predictive analytics and AI-driven insights for financial decision-making.

- Tesorio – An AI-driven cash flow management tool that helps businesses predict liquidity needs and optimize working capital.

These tools cater to different aspects of financial modeling, from cash flow forecasting and scenario analysis to risk assessment and budgeting, helping organizations improve efficiency and data-driven decision-making.

Key Features of AI-Based Financial Modeling Software

AI-based financial modeling software offers a range of features that enhance financial analysis and forecasting capabilities. These platforms go beyond traditional spreadsheet-based modeling by integrating automation, predictive analytics, and real-time data processing. Some of the key features of AI-driven financial modeling tools include:

- Automated Data Aggregation and Processing – AI extracts and integrates financial data from multiple sources, such as accounting systems, financial reports, and market data, reducing manual data entry and errors.

- Predictive Analytics and Forecasting – Machine learning algorithms analyze historical financial data to predict future trends in revenue, expenses, profitability, and cash flow.

- Scenario Planning and Sensitivity Analysis – AI-driven platforms simulate different financial scenarios and assess risk exposure based on real-time market conditions.

- Natural Language Processing (NLP) for Financial Reporting – AI automates the generation of financial reports, interpreting complex data sets and summarizing key insights in human-readable formats.

- Real-Time Financial Insights and Alerts – AI continuously monitors financial performance and sends alerts when key metrics deviate from expected trends, helping businesses make proactive decisions.

- AI-Powered Risk Management – AI models assess risk factors by analyzing financial market volatility, credit risk, and operational uncertainties, providing real-time risk mitigation strategies.

- Cloud-Based Collaboration and Integration – AI-powered financial tools often offer cloud-based access, allowing finance teams to collaborate in real time and integrate with other enterprise resource planning (ERP) systems.

These AI capabilities enhance traditional financial modeling approaches, making them more dynamic, automated, and precise in predicting financial outcomes.

Integrating AI Tools with Legacy Financial Systems

Many businesses operate on legacy financial systems that rely on conventional spreadsheet models, on-premise accounting software, or traditional ERP solutions. The integration of AI-driven financial modeling tools with these legacy systems presents both opportunities and challenges.

Challenges of Integrating AI with Legacy Systems:

- Data Compatibility Issues – Legacy systems may store financial data in outdated formats that are not easily accessible for AI-driven analysis.

- Limited API Connectivity – Older financial software may not have built-in support for AI integrations, requiring custom API development or middleware solutions.

- Resistance to Change – Finance teams accustomed to traditional financial modeling methods may be reluctant to adopt AI-based tools.

- Security and Compliance Risks – Integrating AI-driven solutions with legacy financial systems may raise concerns regarding data privacy, security, and regulatory compliance.

Strategies for Seamless Integration:

- API-Driven Connectivity – Modern AI-powered financial modeling tools often provide API connectors that enable seamless integration with legacy accounting and ERP software.

- Data Standardization and Cleansing – Businesses can preprocess financial data to ensure compatibility with AI-driven analysis tools, improving data consistency and accuracy.

- Hybrid AI Implementation – Organizations can use AI alongside existing financial systems rather than fully replacing them, allowing gradual adoption of AI-driven capabilities.

- Training and Change Management – Finance teams should receive training to understand AI-powered insights and how they enhance traditional financial modeling.

By integrating AI tools with legacy financial systems, businesses can modernize their financial analysis capabilities while maintaining continuity in their existing workflows.

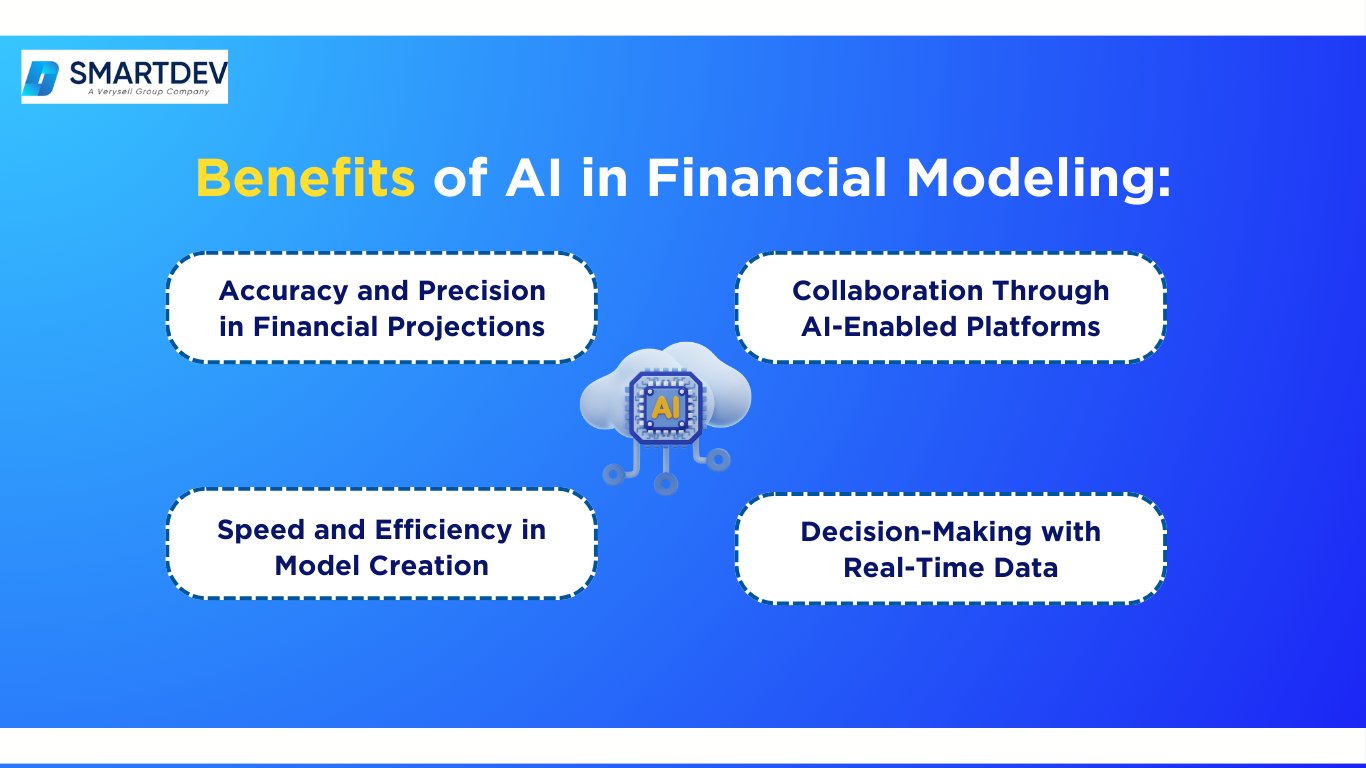

Benefits of AI in Financial Modeling

Artificial intelligence (AI) is revolutionizing financial modeling by enhancing accuracy, speed, and data-driven decision-making. Traditional financial models often rely on static data and manual processes, making them prone to errors, inefficiencies, and delays.

AI-driven financial modeling addresses these challenges by leveraging machine learning, automation, and predictive analytics to provide more accurate forecasts, improve operational efficiency, and enhance risk assessment.

This section explores the key benefits of AI in financial modeling and how organizations can leverage AI-powered solutions to gain a competitive advantage.

Accuracy and Precision in Financial Projections

One of the most significant benefits of AI in financial modeling is the increased accuracy and precision in financial projections. Traditional forecasting methods often rely on historical data and human judgment, which can introduce biases and errors. AI-driven financial models use machine learning algorithms to analyze vast amounts of structured and unstructured data, detecting hidden patterns and correlations that traditional models may overlook.

AI-powered financial modeling tools can integrate real-time market data, macroeconomic indicators, and company-specific financials to generate highly accurate revenue, expense, and profitability forecasts. Additionally, AI models continuously improve their predictive capabilities by learning from new data, refining their projections, and adjusting for market fluctuations. By reducing human error and improving forecasting accuracy, businesses can make more reliable financial decisions and minimize the risks associated with miscalculations.

Speed and Efficiency in Model Creation

Financial modeling is traditionally a time-consuming process that requires extensive manual input, data aggregation, and complex calculations. AI significantly enhances the speed and efficiency of financial model creation by automating data collection, analysis, and report generation.

AI-driven tools can instantly process and integrate data from multiple sources, eliminating the need for manual data entry and reconciliation. This automation reduces the time required to build financial models, allowing finance teams to focus on strategic analysis rather than repetitive tasks. Additionally, AI-powered financial modeling platforms can generate scenario analyses, stress tests, and sensitivity analyses in real time, enabling organizations to respond swiftly to changing market conditions.

By accelerating model creation and reducing time-intensive manual work, AI allows finance professionals to focus on higher-value tasks, such as financial strategy, investment analysis, and risk management.

Enhanced Decision-Making with Real-Time Data

AI-driven financial models provide real-time data analysis, allowing organizations to make faster and more informed financial decisions. Traditional financial models rely on static data, which may become outdated quickly, especially in volatile economic environments. In contrast, AI models continuously update their forecasts based on real-time financial data, market trends, and economic indicators.

This capability is particularly valuable in industries where financial conditions change rapidly, such as investment banking, asset management, and corporate finance. AI-powered platforms analyze live data streams, identify anomalies, and generate alerts when financial metrics deviate from expected values. This proactive approach to financial management helps businesses respond immediately to emerging risks, market fluctuations, and business opportunities.

For example, an AI-driven investment model can monitor global stock markets, economic reports, and company earnings in real time, adjusting investment strategies dynamically to maximize returns and minimize losses. This enhanced decision-making capability gives businesses a competitive edge in financial planning and risk management.

Improved Collaboration Through AI-Enabled Platforms

AI-powered financial modeling tools promote collaboration and transparency across finance teams, departments, and stakeholders. Traditional financial modeling often involves working with multiple spreadsheets, leading to inconsistencies, version control issues, and inefficiencies in team collaboration. AI-driven financial platforms provide cloud-based, centralized financial models that allow multiple users to access, edit, and analyze data in real time.

Modern AI-based financial modeling platforms integrate automated reporting, data visualization, and predictive analytics, making financial insights more accessible to both technical and non-technical stakeholders. These tools enable cross-functional teams—including finance, operations, and executive leadership—to work together seamlessly, ensuring alignment in financial planning, budgeting, and forecasting processes.

Furthermore, AI-driven financial platforms support natural language processing (NLP)-enabled reporting, allowing executives to generate easy-to-understand financial summaries without extensive data analysis expertise. This increased accessibility and collaboration improve overall financial transparency and strategic decision-making across organizations.

Identifying Opportunities and Mitigating Risks with Predictive Models

AI-driven predictive modeling enhances opportunity identification and risk mitigation by analyzing financial patterns, market trends, and potential economic disruptions. By leveraging machine learning algorithms, AI can process vast amounts of financial data to detect anomalies, identify early warning signals, and predict potential risks before they escalate.

One of the key applications of AI in risk management is fraud detection and anomaly identification. AI models can analyze financial transactions in real time, flagging unusual activities that may indicate fraudulent behavior. This is particularly valuable for financial institutions, payment processors, and enterprises managing large volumes of transactions.

AI also plays a critical role in identifying investment opportunities and optimizing financial strategies. For instance, AI-driven investment models analyze historical and real-time market data to detect undervalued assets, assess portfolio diversification strategies, and optimize asset allocation. Businesses can use AI-powered insights to maximize profitability, reduce financial risks, and enhance long-term financial planning.

Additionally, AI-driven sensitivity analysis and scenario simulations allow businesses to evaluate the potential impact of economic fluctuations, regulatory changes, and global financial crises. By preparing for different financial scenarios in advance, organizations can make data-driven risk mitigation decisions that safeguard their financial stability.

Challenges and Risks of AI in Financial Modeling

While artificial intelligence (AI) is revolutionizing financial modeling by improving efficiency, accuracy, and decision-making, it also introduces several challenges and risks. Organizations must be aware of these limitations to ensure AI-driven financial models are reliable, transparent, and compliant with regulatory requirements.

This section explores key challenges associated with AI in financial modeling, including data quality issues, over-reliance on AI, transparency concerns, regulatory compliance, and ethical considerations.

Data Quality and Availability Issues

One of the most significant challenges in AI-driven financial modeling is ensuring high-quality and comprehensive financial data. AI models rely on vast amounts of data to generate accurate predictions, but if the data is incomplete, inconsistent, or biased, the models can produce misleading results.

Financial data often comes from multiple sources, including corporate financial statements, market reports, economic indicators, and customer transactions. However, inconsistencies in data formatting, missing values, and errors in historical records can undermine the effectiveness of AI models. Additionally, real-time data feeds used for AI-powered forecasting may suffer from latency issues or inaccuracies, affecting decision-making.

Another challenge is data privacy and access restrictions, particularly in regulated industries like banking and insurance. AI models require extensive datasets to train effectively, but legal and compliance barriers may limit access to sensitive financial information. Ensuring data integrity, security, and proper governance is critical for organizations to maximize the effectiveness of AI-driven financial modeling while mitigating risks associated with poor data quality.

Read more: AI and Data Privacy: Balancing Innovation with Security

Over-Reliance on AI Models: The Risk of Human Disengagement

AI-driven financial modeling is designed to enhance decision-making, not replace human expertise. However, there is a growing concern that organizations may become overly dependent on AI-generated insights, leading to reduced human oversight and disengagement in financial decision-making.

While AI models can process vast amounts of data and identify trends more efficiently than humans, they are not infallible. AI models are only as good as the data they are trained on, and they may fail to account for external factors such as sudden geopolitical events, policy changes, or unexpected market shocks. Relying solely on AI-driven forecasts without critical human judgment and contextual analysis can lead to misguided financial decisions.

To mitigate this risk, businesses should implement a human-in-the-loop approach, where AI recommendations are reviewed and validated by financial professionals. This ensures that AI serves as a decision-support tool rather than a substitute for expert financial judgment.

Transparency in AI Models (The “Black Box” Challenge)

AI models, particularly those using deep learning and complex machine learning algorithms, often function as “black boxes”, meaning their decision-making processes are not easily interpretable. This lack of transparency poses a significant challenge in financial modeling, where stakeholders need to understand how financial predictions and risk assessments are generated.

Traditional financial models, such as discounted cash flow (DCF) analysis or regression-based forecasting, are transparent and allow analysts to trace the reasoning behind financial projections. In contrast, AI models use intricate statistical computations and neural networks that make it difficult to explain why a particular forecast or financial recommendation was made.

This lack of explainability can create trust issues among executives, investors, and regulators. Businesses must adopt explainable AI (XAI) techniques to improve model transparency and provide justifications for AI-generated financial insights. By implementing interpretability frameworks, such as SHAP (Shapley Additive Explanations) and LIME (Local Interpretable Model-agnostic Explanations), organizations can make AI-driven financial models more transparent and accountable.

Navigating Regulatory and Compliance Challenges

AI-driven financial modeling must comply with strict regulatory frameworks governing data privacy, risk management, and financial reporting. Regulatory bodies such as the U.S. Securities and Exchange Commission (SEC), the European Securities and Markets Authority (ESMA), and the Basel Committee on Banking Supervision have established stringent guidelines for financial reporting and risk assessment, many of which do not yet fully account for AI-driven automation.

One major challenge is that AI models may inadvertently violate compliance standards if they make decisions based on non-compliant data sources or fail to align with regulatory reporting requirements. Additionally, regulators may demand auditable and interpretable financial models, which is difficult with AI systems that lack explainability.

To navigate these challenges, financial institutions must ensure that AI models comply with industry-specific regulations, such as:

- GDPR (General Data Protection Regulation) for data privacy in financial modeling.

- SOX (Sarbanes-Oxley Act) for ensuring transparency in financial reporting.

- Basel III regulations for AI-driven risk assessment in banking.

- Fair Lending and Consumer Protection Laws to prevent biased AI-driven lending decisions.

Proactive regulatory alignment, compliance audits, and AI governance frameworks are essential to ensuring AI-driven financial models adhere to evolving legal and ethical standards.

Ethical Concerns in AI Decision-Making

AI-driven financial modeling introduces a range of ethical challenges, particularly concerning bias, fairness, and accountability. Since AI models learn from historical financial data, they can inherit biases present in the data, leading to discriminatory financial predictions or biased lending and investment decisions.

For example, an AI-driven credit risk assessment model trained on historical lending data may unintentionally discriminate against certain demographic groups if past lending practices were biased. Similarly, automated investment algorithms may prioritize certain asset classes over others, creating unintended financial imbalances.

Additionally, there are concerns about AI-driven financial manipulation, where sophisticated AI algorithms could be misused to influence stock markets, exploit regulatory loopholes, or manipulate trading patterns. Ethical AI governance is crucial to prevent AI models from being exploited for unethical financial practices.

To address these concerns, organizations should implement responsible AI practices, including:

- Bias detection and mitigation techniques to ensure AI models make fair financial decisions.

- Ethical AI guidelines to prevent AI-driven market manipulation and exploitative financial practices.

- Regular audits and impact assessments to ensure AI systems align with ethical and legal standards.

- Human oversight mechanisms to review AI-generated financial insights for ethical considerations.

By embedding ethical considerations into AI-driven financial modeling, businesses can build trust, promote fairness, and ensure responsible AI adoption in finance.

How AI Enhances Financial Forecasting

Financial forecasting is a critical function for businesses, investors, and financial institutions, as it enables informed decision-making regarding revenue projections, expense management, risk mitigation, and strategic planning.

Traditional financial forecasting methods rely on historical data, statistical models, and expert judgment, but these approaches have limitations in capturing real-time market fluctuations and complex economic dependencies. AI-powered forecasting solutions leverage advanced predictive analytics, real-time data processing, and adaptive learning algorithms to improve the accuracy, flexibility, and responsiveness of financial models.

This section explores how AI enhances financial forecasting through data-driven predictive analytics, scenario modeling, real-time updates, and adaptive forecasting models.

Advanced Predictive Analytics for Financial Performance

AI-driven predictive analytics has transformed financial forecasting by enabling highly accurate, data-driven projections based on complex patterns within large datasets. Traditional forecasting models often rely on linear regression and time series analysis, which may not fully capture non-linear relationships, market anomalies, or external economic indicators. AI enhances financial forecasting by incorporating:

- Machine Learning Algorithms: AI models, such as random forests, gradient boosting, and deep learning networks, analyze vast amounts of structured and unstructured financial data to identify key drivers of financial performance.

- Big Data Processing: AI integrates multiple data sources, including historical financial reports, market trends, industry benchmarks, and macroeconomic indicators, to enhance forecast accuracy.

- Feature Engineering: AI identifies hidden correlations between variables that traditional models may overlook, such as how consumer sentiment, global supply chain disruptions, or geopolitical events influence revenue projections.

For example, AI-driven revenue forecasting models used by e-commerce companies analyze customer purchasing behavior, seasonal trends, advertising impact, and supply chain disruptions to predict future sales with a higher degree of precision. Similarly, investment firms utilize AI-powered predictive analytics to assess stock price movements based on historical trading patterns, financial disclosures, and real-time news sentiment analysis.

AI-Driven Scenario Planning and “What-If” Analyses

AI enhances scenario planning and “what-if” analyses by simulating multiple financial outcomes based on real-time economic changes, company-specific financial variables, and market dynamics. Unlike traditional scenario modeling, which requires manual input and predefined assumptions, AI automates the process by:

- Generating Multiple Forecast Scenarios: AI can run thousands of simulations using Monte Carlo methods and Bayesian inference models to assess potential financial outcomes under varying conditions.

- Dynamic Variable Adjustments: AI models continuously adapt to shifting interest rates, inflation levels, commodity prices, and competitive market forces, providing businesses with data-driven guidance on best-case, worst-case, and most-likely financial scenarios.

- Risk Exposure Assessment: AI-driven models evaluate the potential financial impact of changes in consumer demand, credit risk, operational expenses, and investment strategies to inform risk mitigation planning.

For instance, banks and lending institutions leverage AI-based scenario analysis to stress-test loan portfolios against different economic downturns, such as a sudden interest rate hike or a real estate market collapse. Similarly, corporate finance teams use AI-driven “what-if” models to evaluate how different pricing strategies, marketing investments, or expansion plans will affect profitability under varying economic conditions.

Real-Time Updates for Market Volatility and Economic Shifts

One of the most significant advantages of AI in financial forecasting is its ability to process real-time market data and adjust projections dynamically. Traditional financial models often rely on static assumptions that may become outdated as market conditions change. AI-driven forecasting systems continuously update financial models by:

- Integrating Live Market Data Feeds: AI models incorporate real-time stock prices, interest rate movements, foreign exchange fluctuations, and macroeconomic indicators to refine forecasts.

- Detecting Market Anomalies: AI-powered anomaly detection algorithms identify unexpected shifts in financial patterns, such as sudden demand spikes, supply chain disruptions, or credit defaults, and adjust forecasts accordingly.

- Sentiment Analysis for Predictive Forecasting: AI-driven natural language processing (NLP) models analyze financial news, earnings reports, and social media sentiment to gauge investor and consumer confidence, influencing stock market and revenue predictions.

For example, hedge funds and algorithmic trading platforms utilize AI-powered forecasting models that adjust in real time based on breaking financial news, geopolitical events, or Federal Reserve interest rate announcements. In corporate finance, AI-driven revenue forecasting systems dynamically recalculate sales projections based on shifts in customer behavior, global inflation trends, or supply chain constraints.

Adaptive Models for Long-Term vs. Short-Term Forecasting

AI-driven financial forecasting is highly adaptable, allowing businesses to generate both short-term tactical predictions and long-term strategic financial models. Unlike traditional forecasting models, which may struggle to balance short-term volatility with long-term financial planning, AI dynamically adjusts to different forecasting horizons by:

- Short-Term Forecasting (1-12 Months): AI uses real-time transactional data, demand forecasting models, and machine learning algorithms to predict revenue, cash flow, and market demand in rapidly changing business environments.

- Long-Term Forecasting (1-10 Years): AI integrates macroeconomic indicators, historical financial trends, industry benchmarks, and demographic projections to generate multi-year financial plans and investment strategies.

- Hybrid Forecasting Models: AI-driven systems combine short-term and long-term forecasts, adjusting financial models as new data emerges, ensuring strategic financial planning remains agile and responsive to evolving business conditions.

For instance, retail chains and consumer goods companies leverage AI-powered long-term forecasting to plan capital expenditures, product development, and market expansion strategies based on multi-year sales predictions. Meanwhile, AI-driven cash flow forecasting tools used by CFOs provide short-term liquidity planning by predicting daily, weekly, and monthly cash flow fluctuations based on real-time financial transactions.

Key Industries Leveraging AI Financial Modeling

AI-driven financial modeling is transforming industries by enhancing decision-making, improving risk assessment, and optimizing financial forecasting. While traditional financial modeling methods relied heavily on static data and human analysis, AI-powered models can process vast datasets in real time, identify complex financial patterns, and provide predictive insights with high accuracy.

The adoption of AI financial modeling spans multiple industries, including banking and finance, corporate finance, startups, and investment management. This section explores how key industries are leveraging AI to enhance financial performance and strategic decision-making.

AI Financial Modeling in Banking and Finance

The banking and financial services sector has been one of the earliest adopters of AI-driven financial modeling. Financial institutions use AI to improve credit risk assessment, optimize lending decisions, enhance fraud detection, and automate regulatory compliance.

Key Applications in Banking and Finance:

- Credit Risk Assessment: AI-powered models analyze historical financial data, borrower profiles, transaction history, and alternative data sources (such as social media behavior and digital payment patterns) to assess creditworthiness with higher precision. Machine learning models can predict loan default probabilities, optimize credit scoring, and personalize loan offerings for individual customers.

- Fraud Detection and Prevention: AI-driven fraud detection systems monitor real-time banking transactions, identifying unusual patterns that indicate potential fraudulent activities. These systems use anomaly detection algorithms to flag suspicious behavior before fraudulent transactions occur.

- Regulatory Compliance and Risk Management: Banks leverage AI to automate compliance reporting, monitor suspicious transactions, and assess financial risks in real time. AI tools can analyze massive volumes of regulatory documents and flag inconsistencies, ensuring that financial institutions adhere to industry regulations.

For example, major banks use AI-based anti-money laundering (AML) systems to detect suspicious transactions and prevent financial crimes. AI-driven credit models have also helped banks increase lending efficiency while minimizing risk exposure.

Applications in Corporate Finance

Corporate finance departments are increasingly integrating AI-driven financial modeling to enhance financial planning, streamline budgeting processes, and optimize capital allocation. AI enables companies to forecast revenue, model financial risks, and improve cash flow management with greater accuracy.

Key Applications in Corporate Finance:

- AI-Powered Financial Planning & Analysis (FP&A): AI-driven forecasting tools integrate real-time sales data, operational expenses, and macroeconomic trends to generate highly accurate revenue and expense projections.

- Dynamic Budgeting & Expense Optimization: AI automates cost analysis, variance tracking, and financial reporting, helping companies adjust budgets dynamically based on changing business conditions.

- Mergers & Acquisitions (M&A) Valuations: AI-powered financial models evaluate acquisition targets, assess potential synergies, and predict post-merger financial outcomes, reducing due diligence time and improving deal-making efficiency.

A prime example is Fortune 500 corporations using AI-powered scenario analysis to evaluate the financial impact of economic downturns, supply chain disruptions, and shifts in consumer demand. AI-driven treasury management systems also help CFOs optimize liquidity planning and working capital management.

AI in Startups and Small Businesses: Affordable Financial Insights

Startups and small businesses often lack the resources for dedicated financial analysts, making AI-driven financial modeling an essential tool for affordable and efficient financial management. AI automates budgeting, cash flow forecasting, and profitability analysis, allowing smaller companies to compete effectively with larger enterprises.

Key Applications for Startups & SMEs:

- AI-Based Cash Flow Forecasting: AI tools predict future cash flow fluctuations, helping small businesses manage liquidity and avoid financial shortfalls.

- Automated Bookkeeping & Expense Tracking: AI-powered accounting platforms like QuickBooks AI and Xero automate financial reconciliation, categorize expenses, and generate financial reports.

- AI-Powered Revenue Forecasting: Startups leverage AI to analyze customer acquisition trends, sales patterns, and market demand to project future revenue growth.

Use Cases in Investment Analysis and Portfolio Management

AI-driven financial modeling has revolutionized investment analysis and portfolio management by enhancing asset allocation strategies, automating trading decisions, and optimizing risk-adjusted returns. Hedge funds, wealth management firms, and institutional investors use AI to analyze market trends, forecast stock performance, and identify profitable investment opportunities.

Key Applications in Investment Analysis:

- AI-Powered Stock Market Predictions: Machine learning models analyze historical price movements, macroeconomic data, and investor sentiment to predict stock price fluctuations and recommend buy/sell strategies.

- Algorithmic Trading & Automated Portfolio Rebalancing: AI-driven trading systems execute high-frequency trades based on real-time market conditions, optimizing portfolio allocations dynamically.

- Risk Management & Volatility Forecasting: AI models assess market volatility, geopolitical risks, and asset correlations to minimize portfolio exposure to downside risks.

Case Studies: AI Financial Modeling in Action

Company: BlackRock’s Aladdin – AI-Driven Portfolio Management

Company: BlackRock’s Aladdin – AI-Driven Portfolio Management

AI Integration in Financial Modeling

Aladdin uses machine learning, predictive analytics, and big data processing to analyze market conditions, portfolio risks, and asset correlations in real-time. The platform integrates structured financial data (e.g., stock prices, economic indicators) with unstructured data (e.g., financial news, earnings reports) to enhance investment decision-making.

Key AI Applications in Financial Modeling

- Real-Time Risk Assessment:

- AI-driven risk models assess market volatility and exposure across asset classes.

- The system simulates multiple financial scenarios to predict potential portfolio losses under different economic conditions.

- Predictive Market Trends & Portfolio Optimization:

- AI algorithms analyze historical trading data, macroeconomic indicators, and geopolitical events to forecast stock and bond performance.

- Machine learning models recommend optimal asset allocation strategies to maximize returns while minimizing risk.

- AI-Powered Stress Testing & Scenario Analysis:

- The platform runs “what-if” simulations to evaluate the impact of market crashes, interest rate hikes, and regulatory changes on investment portfolios.

- AI identifies risk factors and suggests hedging strategies to protect client assets during market downturns.

Results & Impact

- Increased Forecasting Accuracy: BlackRock’s AI models achieved higher accuracy in predicting asset price movements and risk exposures compared to traditional financial models.

- Enhanced Risk Management: The AI-driven stress testing framework allowed BlackRock to proactively adjust portfolios before major market shifts, reducing downside risks.

- Portfolio Optimization & Client Performance: Institutional investors using Aladdin reported improved risk-adjusted returns and better capital allocation strategies.

As artificial intelligence (AI) continues to advance, its role in financial modeling is evolving beyond automation and predictive analytics. Future developments in AI financial modeling will be characterized by generative AI, self-learning algorithms, blockchain integration, explainable AI (XAI), and democratized financial tools. These innovations will enhance financial forecasting, improve transparency, and make AI-driven financial modeling more accessible to a broader range of users. This section explores key future trends shaping AI financial modeling.

Future Trends in AI Financial Modeling

As artificial intelligence (AI) continues to advance, its role in financial modeling is evolving beyond automation and predictive analytics. Future developments in AI financial modeling will be characterized by generative AI, self-learning algorithms, blockchain integration, explainable AI (XAI), and democratized financial tools.

These innovations will enhance financial forecasting, improve transparency, and make AI-driven financial modeling more accessible to a broader range of users. This section explores key future trends shaping AI financial modeling.

Generative AI for Building Custom Financial Models

Generative AI is poised to revolutionize financial modeling by automating the creation of customized financial models tailored to specific industries, organizations, and investment strategies. Unlike traditional AI-driven models, which require predefined parameters and datasets, generative AI can develop financial models from scratch based on contextual prompts, user-defined goals, and dynamic market conditions.

Key Advancements with Generative AI:

- Automated Model Generation: Generative AI can create personalized financial projections, valuation models, and risk assessments by analyzing company data, industry trends, and macroeconomic factors.

- Dynamic Assumption Adjustments: AI-powered financial models can automatically adjust forecasting assumptions based on real-time data inputs, reducing manual intervention.

- Personalized Scenario Analysis: Generative AI can simulate multiple financial scenarios by incorporating external factors such as regulatory changes, geopolitical risks, and technological disruptions.

The Rise of Self-Learning Financial Models

Self-learning AI models represent the next stage of financial modeling, where AI systems continuously adapt and refine financial forecasts without manual retraining. These models use reinforcement learning, deep learning, and autonomous AI techniques to enhance predictive accuracy over time.

Key Features of Self-Learning Financial Models:

- Continuous Model Improvement: Unlike traditional financial models that require periodic recalibration, self-learning AI updates its parameters dynamically based on new financial data and market behavior.

- Pattern Recognition in Large Datasets: AI can detect emerging financial patterns and anomalies, identifying new investment opportunities and risk factors ahead of traditional modeling techniques.

- Adaptive Risk Management: Self-learning models assess real-time financial volatility

AI-Driven Integration with Blockchain for Transparent Financial Systems

The integration of AI and blockchain is set to enhance transparency, security, and accuracy in financial modeling. AI-powered financial models can process decentralized financial (DeFi) data while blockchain ensures auditability and tamper-proof financial records.

How AI and Blockchain Will Transform Financial Modeling:

- Enhanced Data Integrity: Blockchain provides immutable, verifiable financial transaction records, improving data quality for AI-driven financial forecasting.

- AI-Powered Smart Contracts: Financial models will integrate smart contracts that automate financial transactions based on AI-driven triggers, such as automated loan approvals, revenue-sharing agreements, and investment rebalancing.

- Fraud Detection & Compliance: AI can analyze blockchain-based transaction logs to detect fraudulent financial activities, regulatory violations, and money laundering risks.

The Role of Explainable AI (XAI) in Financial Forecasting

One of the major challenges in AI-driven financial modeling is the lack of transparency in complex AI algorithms, often referred to as the “black box” problem. Explainable AI (XAI) aims to make financial AI models more interpretable, auditable, and regulatory compliant.

How XAI Will Impact Financial Modeling:

- Regulatory Compliance: Financial institutions are increasingly required to explain AI-driven financial predictions to comply with regulations such as Basel III, SOX, and GDPR. XAI enables AI models to provide clear justifications for credit approvals, risk scores, and investment recommendations.

- Stakeholder Trust & Accountability: Investors, regulators, and corporate executives will be able to understand the rationale behind AI-driven financial decisions, increasing trust in automated financial models.

- Error Detection & Bias Mitigation: XAI techniques such as SHAP (Shapley Additive Explanations) and LIME (Local Interpretable Model-agnostic Explanations) will be integrated into financial AI systems to explain model decisions and identify biases in credit risk assessment or investment algorithms.

AI Democratizing Financial Modeling for Non-Financial Professionals

As AI becomes more user-friendly, financial modeling is being democratized, making advanced financial analytics accessible to non-financial professionals, entrepreneurs, and business owners. AI-powered financial platforms are enabling users with limited financial expertise to generate forecasts, analyze business performance, and make data-driven financial decisions.

How AI is Making Financial Modeling More Accessible:

- No-Code AI Financial Tools: Platforms like Clockwork AI, Vena Solutions, and Anaplan are offering drag-and-drop financial modeling interfaces that allow users to build financial models without programming knowledge.

- AI Chatbots for Financial Insights: AI-driven chatbots provide real-time financial advice and automated responses to complex financial queries.

- Small Business Financial Forecasting: AI-powered platforms help startups and SMEs forecast revenue, manage cash flow, and optimize business expenses without requiring an in-house financial analyst.

Getting Started with AI Financial Modeling

How to Assess Your Organization’s Readiness for AI Adoption

Before implementing AI-driven financial modeling, organizations must evaluate their current financial processes, data infrastructure, and technological capabilities to determine their AI readiness. A structured assessment ensures that AI adoption aligns with business objectives, financial strategy, and regulatory requirements.

Key Factors to Assess AI Readiness:

- Data Infrastructure & Availability

- Does your organization have clean, structured, and centralized financial data?

- Are real-time data sources integrated for AI-driven forecasting?

- AI Knowledge & Talent Gap

- Does your finance team have experience with machine learning, predictive analytics, or AI-powered tools?

- Are financial analysts open to working alongside AI-powered insights?

- Financial Modeling Maturity

- Are financial models currently manual, rule-based, or spreadsheet-dependent?

- Is there a need for automation, real-time scenario analysis, or AI-powered forecasting?

- Regulatory & Compliance Considerations

- Does AI adoption align with SOX, IFRS, Basel III, GDPR, and other regulatory frameworks?

- Can AI models provide explainable and auditable financial decisions for compliance reporting?

- Executive Buy-In & Business Strategy

- Does senior leadership support AI-driven financial decision-making?

- Are there budget allocations for AI infrastructure, tools, and training?

Investing in AI Training and Upskilling for Finance Teams

Successful AI adoption in financial modeling requires a finance team that understands AI-driven insights, model interpretation, and automated forecasting techniques. While AI automates calculations, financial professionals must retain critical decision-making roles, ensuring AI outputs align with business strategy.

AI Training and Upskilling Strategies:

- AI & Data Analytics Training for Finance Teams

- Provide training in machine learning fundamentals, predictive analytics, and AI model evaluation.

- Use online courses, AI finance certifications, and workshops to bridge knowledge gaps.

- AI-Augmented Financial Analysis Workshops

- Train finance professionals on using AI-powered financial modeling tools such as DataRobot, Anaplan, and Vena Solutions.

- Conduct case studies on AI-driven forecasting, cash flow modeling, and investment analytics.

- Collaboration Between Finance & Data Science Teams

- Encourage cross-functional learning where financial analysts work alongside AI specialists to develop hybrid AI-human financial models.

- Create a data-driven finance culture, where AI recommendations complement human intuition and experience.

- Adoption of Low-Code/No-Code AI Platforms

- Introduce AI-powered financial planning & analysis (FP&A) tools with user-friendly interfaces to minimize technical barriers.

- Train teams on AI-driven scenario planning, stress testing, and automated financial reporting.

Building a Scalable AI-Driven Financial Modeling Framework

To ensure long-term AI adoption, organizations must develop a scalable AI-driven financial modeling framework that integrates data, machine learning algorithms, and AI-powered financial tools while maintaining regulatory compliance and security.

Steps to Build an AI Financial Modeling Framework:

- Data Integration & Centralization

- Establish a unified financial data lake that integrates historical financial statements, market data, economic indicators, and real-time transactions.

- Ensure data cleaning, normalization, and transformation processes to improve AI accuracy.

- AI Model Selection & Development

- Choose the right AI algorithms based on financial use cases:

- Time Series Models (e.g., ARIMA, LSTM) for revenue forecasting.

- Regression & Classification Models for credit risk assessment.

- Monte Carlo Simulations for risk scenario analysis.

- Choose the right AI algorithms based on financial use cases:

- Real-Time AI Model Monitoring & Governance

- Implement an AI governance framework to ensure AI explainability, bias detection, and model validation.

- Use XAI (Explainable AI) techniques to provide financial stakeholders with interpretable AI-driven insights.

- Automation & Cloud-Based AI Deployment

- Deploy AI financial modeling tools on cloud-based infrastructure (AWS, Azure, Google Cloud AI) for scalability and real-time financial reporting.

- Automate AI-driven financial dashboards and reporting workflows for CFOs and finance teams.

Partnering with AI Vendors and Consultants for Implementation

For organizations that lack in-house AI expertise, collaborating with AI vendors, consultants, or financial AI service providers can accelerate the AI adoption process. AI technology partners provide pre-built AI solutions, industry expertise, and AI model customization services.

How to Choose the Right AI Vendor for Financial Modeling:

- Industry-Specific AI Expertise

- Select vendors specializing in AI-driven financial modeling, risk management, or investment analytics.

- Evaluate their track record with banks, investment firms, or corporate finance teams.

- Integration with Existing Financial Systems

- Ensure AI vendors provide APIs and connectors for integration with existing ERP, accounting, or FP&A systems such as SAP, Oracle, or Workday.

- Customization & Scalability

- Assess whether the vendor’s AI models can be customized for industry-specific financial forecasting needs and scaled as financial data grows.

- Regulatory Compliance & Security Measures

Work with AI vendors that comply with financial regulations and provide auditable AI models that meet transparency requirements.

Metrics to Measure Success in AI Financial Modeling

To evaluate the effectiveness of AI-driven financial modeling, organizations must track key performance metrics that assess efficiency, accuracy, cost-effectiveness, and overall business impact. These metrics ensure that AI adoption in financial modeling aligns with business goals, improves forecasting precision, and enhances operational productivity.

Speed and Efficiency Metrics: Time Savings in Model Creation

One of the most immediate benefits of AI in financial modeling is its ability to automate time-consuming processes such as data collection, model development, and scenario analysis. Organizations can measure success by tracking:

- Reduction in Financial Model Development Time – AI can automate data ingestion, model training, and scenario simulations, reducing the time required to build models from weeks to hours.

- Processing Speed Improvement – AI-driven tools can analyze vast financial datasets in real-time, significantly increasing processing speed compared to traditional spreadsheet-based models.

- Reduction in Manual Effort – By automating calculations and reporting, AI allows financial analysts to focus on strategic decision-making rather than data manipulation.

Accuracy and Precision Metrics in Forecasting

AI’s ability to process complex data sets and identify hidden patterns enhances the accuracy of financial forecasts. Key metrics to measure precision include:

- Error Reduction in Forecasting – Comparing AI-generated forecasts against actual financial performance to measure the Mean Absolute Percentage Error (MAPE) and Root Mean Squared Error (RMSE).

- Variance Reduction in Financial Models – AI models should produce more consistent and reliable results compared to traditional spreadsheet-based models.

- Scenario Testing and Sensitivity Analysis Effectiveness – AI models should improve the precision of “what-if” scenario analysis by accurately predicting financial outcomes under various economic conditions.

Cost Savings and ROI from AI Tools

AI-driven financial modeling should lead to measurable cost reductions and return on investment (ROI). Organizations can assess:

- Reduction in Financial Planning and Analysis (FP&A) Costs – AI automation lowers labor costs associated with financial forecasting, risk assessment, and compliance reporting.

- Improvement in Investment Decision ROI – AI-powered investment analysis should lead to better asset allocation, increasing investment returns.

- Reduction in Financial Losses – AI-based fraud detection and risk management should help prevent financial losses from fraud, credit defaults, or market fluctuations.

Predictive Accuracy in Revenue, Cash Flow, and Expense Projections

AI models should enhance financial planning accuracy by improving revenue, cash flow, and expense forecasting. Key performance indicators (KPIs) include:

- Improvement in Revenue Forecast Accuracy – Comparing AI-driven revenue forecasts with actual sales performance over time.

- Reduction in Cash Flow Volatility – AI-driven cash flow projections should minimize liquidity risks by predicting inflows and outflows more accurately.

- Expense Forecasting Precision – AI should optimize budget allocations by accurately predicting future expenditures.

Employee Productivity and Collaboration Improvements

AI-powered financial modeling should improve team productivity and collaboration by:

- Increasing Analyst Efficiency – Tracking how much time AI tools save financial teams in daily operations.

- Enhancing Cross-Department Collaboration – AI tools should facilitate seamless integration of financial data across sales, operations, and executive teams.

- Reducing Error Rates in Financial Reports – Automated AI-driven reporting should minimize human input errors, improving data reliability.

AI Financial Modeling: Regulatory and Compliance Considerations

AI adoption in financial modeling must align with financial reporting standards, data privacy regulations, and ethical considerations to ensure compliance and risk management.

Ensuring AI Adheres to Financial Reporting Standards

Regulatory bodies such as IFRS, SOX, Basel III, and SEC require financial institutions to maintain transparency in financial reporting. AI models must:

- Ensure Explainability in AI-Generated Forecasts – AI predictions should be auditable and interpretable for regulatory reporting.

- Maintain Compliance with Global Accounting Standards – AI models should align with International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

- Automate Regulatory Filings – AI-driven compliance tools should generate automated reports that meet legal and financial disclosure requirements.

Managing Data Privacy and Security Risks

AI-driven financial modeling involves handling sensitive financial data, requiring strict security measures. Organizations must:

- Comply with Data Privacy Regulations – AI tools must adhere to GDPR, CCPA, and financial data protection laws.

- Implement AI-Driven Cybersecurity Measures – AI should detect anomalies in financial transactions and prevent fraud.

- Ensure Secure AI Model Deployment – Financial AI models should use cloud security best practices and encryption protocols to protect data integrity.

Navigating Ethical Considerations in AI Financial Decision-Making

AI-driven financial models must be free from bias, transparent, and aligned with ethical financial practices. Considerations include:

- AI Bias in Financial Decision-Making – AI models must be audited to prevent biased outcomes in credit approvals, loan applications, and investment decisions.

- Explainability and Transparency – AI-driven financial forecasts should be interpretable and explainable to stakeholders.

- Avoiding AI-Driven Market Manipulation – AI-powered trading models should comply with financial regulations to prevent unethical stock manipulation.

Conclusion: AI’s Role in the Future of Financial Modeling

AI is transforming financial modeling by enhancing forecasting accuracy, risk assessment, and decision-making capabilities. However, organizations must carefully manage compliance, ethical considerations, and human oversight to maximize AI’s benefits.

Recap of AI’s Transformational Impact on Financial Modeling

- AI automates financial forecasting, risk assessment, and investment analysis, increasing speed and accuracy.

- AI enables real-time scenario planning and enhances predictive modeling in revenue, cash flow, and expenses.

- AI enhances regulatory compliance, fraud detection, and financial security.

Key Takeaways for Finance Professionals and Organizations

- AI adoption requires strategic planning, workforce upskilling, and regulatory alignment.

- Human-AI collaboration ensures AI-driven insights remain transparent and actionable.

- Organizations must measure AI success using efficiency, accuracy, ROI, and compliance metrics.

Why AI-Driven Financial Modeling is a Competitive Advantage

- AI enables businesses to make data-driven decisions faster and with greater accuracy.

- Organizations leveraging AI can improve financial planning, reduce costs, and optimize risk management.

- AI-powered insights allow companies to adapt quickly to changing market conditions.

Future Opportunities and Challenges

Opportunities:

- Advancements in Generative AI will automate custom financial modeling.

- Explainable AI (XAI) will improve AI transparency in financial decision-making.

- AI-blockchain integration will enhance financial data security and auditability.

Challenges:

- Managing AI model biases and ensuring fairness in financial decisions.

- Navigating global financial regulations and compliance requirements.

- Balancing AI automation with human oversight in financial forecasting.

AI is reshaping the future of financial modeling, and organizations that strategically adopt AI will gain a competitive edge in financial planning, risk assessment, and investment management.