“AI is changing the physics of financial services” (Deloitte, 2018). Artificial Intelligence (AI) is currently leading the transformation of the payment landscape, spearheading advancements that are revolutionizing the conduct of financial transactions. As businesses and consumers increasingly demand faster, safer, and more efficient payment solutions, AI is stepping in to address these needs. From enhancing security through fraud detection to optimizing transaction processes, AI is becoming an indispensable tool in the payment industry.

“AI is changing the physics of financial services” (Deloitte, 2018). Artificial Intelligence (AI) is currently leading the transformation of the payment landscape, spearheading advancements that are revolutionizing the conduct of financial transactions. As businesses and consumers increasingly demand faster, safer, and more efficient payment solutions, AI is stepping in to address these needs. From enhancing security through fraud detection to optimizing transaction processes, AI is becoming an indispensable tool in the payment industry.

With AI’s ability to process vast amounts of data, identify patterns, and predict outcomes, it enhances decision-making and drives operational efficiency in payment systems. By exploring AI in payments, we can gain insight into how this transformative technology is influencing not only the payment industry but the broader financial ecosystem as well.

What is AI in payments?

AI in payments refers to the use of machine learning algorithms, predictive analytics, natural language processing, and other AI technologies to process, manage, and secure digital transactions. It’s not about replacing human intervention but enhancing and automating processes to improve efficiency and accuracy.

The Technology Behind AI in Payments

AI in payments leverages several key technologies that optimize and secure transaction processes.

- Machine learning (ML) algorithms analyze data to detect fraud, predict consumer behavior, and improve transaction efficiency.

- Natural language processing (NLP) enables chatbots to handle customer inquiries, providing fast and automated support for payment-related issues.

- Neural networks, inspired by the human brain, identify patterns and anomalies in large datasets, playing a crucial role in fraud detection.

- Predictive analytics forecasts transaction volumes based on historical data, helping businesses manage resources and ensure smooth operations, especially during peak periods.

- Blockchain technology, while not a component of AI, frequently collaborates with AI in payment systems because it provides secure, transparent, and decentralized transactions. Together, these technologies form a robust foundation that enhances the speed, security, and intelligence of modern payment systems.

The Role of AI in Transforming Payments

Key Applications of AI in Payment Processing

Fraud detection is one of the most successful use cases of AI in the payment space. AI-based solutions can process real-time transaction information, identifying characteristics and irregularities that may indicate fraud as fraud techniques evolve. Thus, by blocking fraudulent transactions, AI helps companies to minimize potential loss and build trust in the digital payment systems.

Moreover, AI also boosts the acceptance of real-time payments. Some of the companies that integrate AI include Stripe to enhance the speed of transaction processing and minimize delays and time taken to authenticate payments. This paper explores the transformative impact of technology integration on business, particularly in the e-commerce sector, where instantaneous and smooth transactions are the norm.

Real-time processing not only increases productivity but also satisfies the consumers as well. Enhancing the consumer experience is another key benefit of AI in payments. AI can also assist in analyzing the consumer’s spending habits, enabling the delivery of targeted offers and discounts based on their interests. For instance, Mastercard uses AI to deliver targeted offers that make payments more exciting and useful and to encourage customers’ engagement and frequent spending.

Finally, AI also improves payment path optimization. The system evaluates a transaction’s processing time, network cost, and success rate to determine the optimal payment channel. Checkout.com, for instance, exemplifies this by utilizing AI to streamline payment processes, reduce international transaction costs, and ultimately enhance transaction success while reducing costs.

How AI Enables Scalability and Efficiency in Payments

AI is revolutionizing the payment industry, offering numerous advantages that modernize and enhance payment systems. Key benefits include enhanced security, where AI detects and prevents fraud through real-time analysis and strengthens authentication with biometric recognition and multi-factor verification. It also improves speed and efficiency by automating payment processes, reducing errors, and accelerating transactions to meet customer expectations.

Additionally, AI leads to cost savings by minimizing fraud-related expenses and automating routine tasks, which reduces operational costs. It provides a competitive advantage by enabling innovative payment solutions and enhancing customer experiences with seamless, personalized interactions. With these benefits, AI is not just transforming payments but shaping a secure, efficient, and customer-centric future for the industry

AI & The Future of Cashless Transactions

AI technology significantly contributes to the trend away from cash transactions by enhancing the speed, safety, and expandability of payment processing. As the use of digital payment methods expands, the effectiveness of AI systems for fraud prevention increases, as they instantly process transactional information to prevent fraudulent activity before it occurs. These fosters trust in cashless systems by ensuring the safety of transactions for both buyers and sellers.

AI also helps to process payments faster since it allows certain practices like manual ID verification and transaction authorization. This eliminates waiting times, cuts down on mistakes, and improves the entire payment process. In addition, AI brings in the element of scalability, allowing payment systems to process large numbers of transactions quickly and securely, making them less prone to fail during busy periods or for foreign exchange transactions.

Looking ahead, AI will remain at the heart of a seamless, reliable, and customer-focused payment ecosystem. As consumers continue to demand faster, safer, and more convenient ways to pay, AI will evolve to offer even more personalized experiences. From personalized discounts and offers based on spending behavior to more intuitive fraud prevention mechanisms, AI will continue to enhance the value of cashless payments, making them more efficient, secure, and tailored to individual needs. As businesses and consumers embrace cashless transactions, AI will be the backbone that supports and drives this transformation in the global payment landscape.

Looking ahead, AI will remain at the heart of a seamless, reliable, and customer-focused payment ecosystem. As consumers continue to demand faster, safer, and more convenient ways to pay, AI will evolve to offer even more personalized experiences. From personalized discounts and offers based on spending behavior to more intuitive fraud prevention mechanisms, AI will continue to enhance the value of cashless payments, making them more efficient, secure, and tailored to individual needs. As businesses and consumers embrace cashless transactions, AI will be the backbone that supports and drives this transformation in the global payment landscape.

AI Uses Cases in Payment

One of the most critical AI applications in payments is fraud detection and prevention.

According to Business Insider (Mirrfin, 2024):

“AI has become increasingly effective at scamming real people. Fraudsters are using generative AI (Gen AI) to conduct phishing attacks or socially engineer people into making payments or transferring funds to a fraudster’s account.”

To counter these threats, AI systems leverage machine learning algorithms to analyze transaction data in real-time, identifying patterns and anomalies indicative of fraud. These systems continuously learn and adapt to new fraud tactics, enabling payment infrastructures to reduce false positives, enhance security, and maintain customer trust while ensuring regulatory compliance. Additionally, AI technologies like tokenization and secure authentication methods, such as EMV 3D Secure, enhance transaction security by replacing sensitive data with secure tokens, ensuring that only authorized users can complete payments.

Besides, AI also plays a significant role in payment automation, streamlining processes and reducing human error. For instance, invoice processing with AI leverages optical character recognition (OCR) and machine learning to automatically extract data from invoices and streamline payment approvals. This has substantial benefits in B2B transactions, where the complexity of processing payments and verifying invoices can be significantly reduced through AI-powered automation, improving efficiency and reducing delays.

Moreover, AI in payments is significantly enhancing customer experiences. Businesses are increasingly using AI-powered chatbots to handle customer payment-related queries, offering prompt, round-the-clock assistance for tasks like refund processing, payment inquiries, and transaction history assistance. Additionally, predictive analytics allows businesses to tailor offers and promotions based on customer preferences and purchasing behaviors, creating a personalized experience that enhances loyalty and satisfaction.

In the realm of cross-border payments, AI is driving innovation by improving efficiency and reducing costs associated with international transactions. AI can optimize routing decisions, minimizing transaction fees and ensuring that payments are processed through the most reliable and cost-effective channels. This technology is particularly important for businesses operating in global markets, where payment delays and high fees can be major obstacles.

Lastly, risk and compliance management in AI-driven payment systems is becoming increasingly important as regulatory requirements evolve. AI can help ensure that payment systems comply with local and international regulations, such as anti-money laundering (AML) and Know Your Customer (KYC) requirements, by analyzing transaction data and flagging suspicious activity for further investigation.

By addressing these diverse use cases, AI is not only enhancing the security and efficiency of payments but also creating opportunities for innovation in customer experience, cross-border transactions, and compliance management. As these technologies continue to develop, the potential for AI to revolutionize the payment ecosystem is vast.

AI’s role in payment ecosystem stakeholders

Artificial intelligence in payments is transforming the way various stakeholders—merchants, consumers, and financial institutions—interact with payment systems. By leveraging AI, each group benefits in distinct ways, enhancing overall efficiency, security, and profitability in the payment ecosystem.

How AI Benefits Merchants

For merchants, AI in payments plays a crucial role in boosting revenue and improving operational efficiency. One of the most significant benefits is revenue growth through better conversion rates. AI-powered tools can optimize payment flows and streamline the checkout process, ensuring that more transactions are successfully completed. Machine learning algorithms can also predict and personalize offers, making the payment process more engaging and relevant to customers, which leads to higher conversion rates.

Another key advantage is reduced chargebacks and payment failures. AI systems can monitor transactions in real time, flagging suspicious activities and preventing fraudulent charges before they occur. This not only reduces the financial impact of chargebacks but also ensures a smoother and more secure payment experience for both merchants and their customers.

AI’s Advantages for Consumers

For consumers, artificial intelligence in payments ensures faster and more reliable payment experiences. AI-driven systems are capable of processing payments quickly, reducing delays during transactions. This is especially important for e-commerce and mobile payments, where speed and convenience are critical to user satisfaction.

Additionally, enhanced security features powered by AI offer consumers peace of mind. AI technologies such as biometric authentication, machine learning-based fraud detection, and real-time alerts provide an extra layer of protection against fraud, ensuring that users’ financial data remains safe and secure.

Value for Financial Institutions

AI is also delivering significant value to financial institutions by enabling cost savings and improving risk management. Through automation, AI can streamline various banking processes, reducing the need for manual intervention and allowing institutions to operate more efficiently. This leads to significant cost savings, particularly in routine tasks such as transaction processing, customer support, and compliance checks.

Moreover, AI strengthens risk management frameworks by analyzing large datasets to detect anomalies and predict potential risks. Financial institutions can use AI to enhance fraud detection, ensure regulatory compliance, and make informed decisions, ultimately reducing exposure to financial risks and improving overall operational resilience.

In summary, artificial intelligence payments are transforming the roles of merchants, consumers, and financial institutions within the payment ecosystem. By adopting AI, merchants can boost revenue and reduce risks, consumers can enjoy secure and fast transactions, and financial institutions can optimize operations and manage risks more effectively. The integration of AI in payments is not only driving the future of transactions but also creating a more efficient, secure, and customer-centric payment landscape.

AI in payments presents challenges and risks

While AI offers transformative benefits in the payment ecosystem, its implementation also presents significant challenges and risks that require careful management. These obstacles, ranging from data privacy concerns to the complexities of regulatory compliance, highlight the importance of a balanced and ethical approach to AI adoption.

- Data Privacy and Security Concerns: AI systems often require vast amounts of data, including sensitive personal and financial information, raising significant privacy and security issues. The extensive data collection inherent in AI can lead to unauthorized access and misuse if not properly managed. Ensuring compliance with data protection regulations and implementing robust security measures are essential to safeguard against breaches and maintain customer trust.

- Regulatory and Compliance Hurdles: The rapid advancement of AI technologies has outpaced the development of comprehensive regulatory frameworks. Financial institutions must navigate the complex landscape of existing regulations while anticipating future legal requirements related to AI deployment. This necessitates continuous monitoring of regulatory changes and proactive engagement with policymakers to ensure compliance and avoid potential legal pitfalls.

- Risk of Over-Reliance on AI: Dependence on AI for critical decision-making processes can lead to over-reliance, where human oversight is diminished. This poses risks, especially if AI systems encounter unforeseen scenarios or make errors. Maintaining a balance between AI automation and human judgment is crucial to ensure that AI serves as a tool to augment, rather than replace, human decision-making capabilities.

- Managing Bias and Errors in AI Systems: AI algorithms can inadvertently perpetuate or amplify biases present in their training data, leading to discriminatory outcomes in financial services. Addressing this requires implementing fairness assessments, regular audits, and bias mitigation strategies to ensure AI systems operate equitably and transparently. We must continuously monitor and update AI models to correct biases and errors as they emerge.

What does the future hold for AI in payments?

Several emerging trends are enabling Artificial Intelligence (AI) to revolutionize the payments industry.

The Rise of Explainable AI (XAI) in Payments:

As AI systems become integral to payment processes, the demand for transparency has led to the adoption of Explainable AI (XAI). XAI provides clear insights into AI decision-making that enhance trust and ensure compliance with regulatory standards. This transparency is crucial for both financial institutions and consumers to understand and trust AI-driven payment systems.

Integration of Blockchain with AI for Secure Payments:

Blockchain is gaining momentum due to its decentralized design. It helps businesses by providing more transparency, better security, and easier tracking. When combined with back-end legacy systems, it can improve overall outcomes.

The Role of Generative AI in Payment Personalization:

Generative AI enables the creation of personalized payment experiences by analyzing user behavior and preferences. This leads to tailored financial products and services, enhancing customer satisfaction and engagement. For instance, AI-driven chatbots can provide personalized support, streamlining the payment process.

AI’s Role in Building the Metaverse Economy:

AI is instrumental in developing the metaverse economy by facilitating secure and efficient payment systems within virtual environments. It enables the creation of intelligent virtual agents and personalized user experiences, driving economic activities in the metaverse. The integration of AI and blockchain further enhances security and trust in virtual transactions.

Predictive Insights for Market Trends in Payments:

AI’s predictive analytics capabilities allow financial institutions to anticipate market trends and consumer behaviors, enabling proactive strategy formulation. This foresight helps in optimizing payment processes and developing innovative financial products that meet evolving market demands. AI-powered dashboards can provide real-time insights, facilitating informed decision-making.

How companies are using AI Payments

AI has become a pivotal tool for companies seeking to modernize payment systems, enhance security, and improve operational efficiency. Leading organizations like Visa, Checkout.com, and J.P. Morgan showcase how AI-driven innovation is transforming the payment landscape through practical applications.

Visa’s Risk Management and Fraud Solutions

Source: Digital Intelligence

Visa utilizes AI to bolster transaction security and combat fraud. By leveraging advanced machine learning algorithms, Visa monitors and analyzes millions of transactions in real-time, identifying anomalies that signal potential fraud. Visa had successfully prevented an estimated $25 billion in losses annually. Additionally, AI-driven systems at Visa enhance authentication processes, such as biometric recognition, ensuring legitimate transactions are seamless while maintaining high-security standards (Digital Intelligence, 2021).

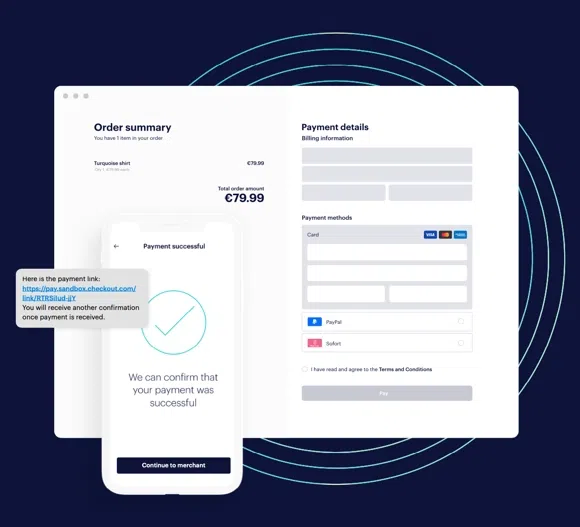

Checkout.com’s Payment Routing Optimization

Source: Anchor Group

Checkout.com employs AI to optimize payment routing for merchants operating in multiple regions. AI algorithms analyze factors like network fees, processing times, and transaction success rates to dynamically select the most efficient routing path. This approach minimizes payment failures, reduces costs, and ensures faster transaction processing, significantly enhancing customer satisfaction and merchant revenue.

J.P. Morgan’s AI Applications in Consumer Banking

Source: Aquarius AI

J.P. Morgan integrates AI across its consumer banking services to enhance customer experiences and streamline operations. One notable application is the use of AI-powered chatbots to handle customer inquiries related to payments and account management. These bots provide personalized support, reducing wait times and improving service accessibility. Additionally, J.P. Morgan leverages AI for predictive analytics, enabling the bank to offer tailored financial products and insights based on individual customer behavior and preferences.

These case studies highlight how AI is enhancing security, efficiency, and personalization in the payments sector. From Visa’s fraud prevention systems to Checkout.com’s routing optimization and J.P. Morgan’s AI applications, businesses are seeing significant improvements in operational performance and customer satisfaction.

AI-Driven Success Metrics in Payments

As AI continues to drive innovation in the payment industry, success metrics play a critical role in measuring its impact. Companies implementing AI in payments often track improvements in key areas such as fraud reduction, transaction speed, and customer satisfaction. By utilizing AI-driven insights, businesses can evaluate the effectiveness of their payment solutions and fine-tune their strategies for maximum impact. Whether through lower chargeback rates, faster payment processing, or improved customer retention, AI is proving to be an essential tool for companies striving to remain competitive in the rapidly evolving payments landscape.

In conclusion, companies like Visa, Checkout.com, and J.P. Morgan are demonstrating how artificial intelligence in payments can be used to improve security, efficiency, and customer satisfaction. By adopting AI, businesses can enhance operational performance, reduce risks, and create a more personalized and efficient payment experience for consumers. As AI continues to evolve, its role in the payment ecosystem will only grow, driving further innovation and success in the industry.

What companies need to begin using AI payments?

As the financial landscape continues to evolve rapidly, businesses need to adopt a strategic and well-structured approach to successfully implement AI in payments. By integrating AI technologies, companies can enhance transaction efficiency, improve security, and provide personalized customer experiences, ultimately gaining a competitive edge in the digital economy.

1. Adopting AI Tools and Technologies

The first step in integrating AI into payments is selecting the right AI tools and technologies. Machine learning algorithms, predictive analytics, and natural language processing platforms are essential for streamlining payment processes, detecting fraud, and enhancing security. Tools like TensorFlow for machine learning, Fraud.net for fraud detection, and NLP-based chatbots for customer service are increasingly common in the payments industry.

By utilizing these AI-driven technologies, businesses can automate tasks, reduce human error, and optimize the payment workflow. AI tools enable real-time transaction processing and enhance security measures, which is critical in today’s fast-paced, digital-first environment. Additionally, AI’s ability to analyze vast amounts of data quickly provides businesses with the insights needed to improve customer experience and operational efficiency.

2. Developing an Implementation Roadmap

After selecting the appropriate AI tools, businesses must develop a clear implementation roadmap. This roadmap should outline the AI integration process, detailing timelines, resource allocation, and the expected outcomes. It’s crucial to prioritize areas where AI can have the most significant impact, such as fraud prevention, payment routing optimization, or customer service automation.

The plan should also include steps for testing the AI solutions in smaller pilot projects before scaling them across the organization. This phased approach allows businesses to identify potential issues early and adjust the implementation strategy as needed. By establishing measurable key performance indicators (KPIs), businesses can track progress, assess effectiveness, and ensure that AI systems align with overall goals.

3. Assembling a Skilled Team

AI integration requires a team with a diverse set of skills to ensure successful deployment and ongoing management. This team should include professionals with expertise in data science, machine learning, and payment systems. They will be responsible for selecting, implementing, and fine-tuning AI models to meet specific payment processing needs.

Additionally, it is essential to hire AI experts who are familiar with regulatory standards and can ensure compliance in the rapidly evolving landscape of financial services. Training existing staff or partnering with consultants can help fill any knowledge gaps. A skilled team is key to overcoming technical challenges and ensuring that AI technologies are integrated smoothly into existing payment systems.

4. Conduct a Cost-Benefit Analysis

Before proceeding with AI adoption, businesses should conduct a thorough cost-benefit analysis to assess the financial implications of implementing AI in payments. This analysis should evaluate both the initial investment costs—such as software licensing, infrastructure, and training—and the long-term benefits, such as reduced fraud, lower operational costs, and improved customer retention.

Additionally, the analysis should account for the potential impact of AI on the business’s bottom line, including increased revenue from optimized payment flows and improved customer satisfaction. By weighing these costs and benefits, businesses can make data-driven decisions about whether AI adoption is feasible and how best to structure their investment for maximum return.

By following these steps, businesses can effectively integrate AI into their payment systems, driving efficiency, security, and customer satisfaction. The strategic use of AI in payments not only streamlines operations but also provides a competitive advantage in a rapidly changing digital landscape. Companies that adopt AI technologies early are better positioned to stay ahead of competitors, improve their services, and meet the growing expectations of consumers in the digital age.

Embracing AI to shape the future of payments

The future of payments is undoubtedly digital and AI-driven, with technologies like explainable AI, generative AI, and blockchain integration shaping the landscape. By adopting AI, businesses can enhance operational efficiency, improve customer experiences, and stay ahead in a competitive market.

At SmartDev, we specialize in helping companies implement cutting-edge AI solutions that optimize payment systems, boost security, and streamline operations. Whether you’re looking to enhance fraud detection, automate transactions, or personalize customer interactions, SmartDev’s AI-driven services are designed to meet your needs.

Take the first step toward transforming your payment systems with AI today. Contact SmartDev to explore how our tailored solutions can help you lead in the evolving financial ecosystem.

REFERENCES:

- Johal, G., Tomlinson, N., Deloitte, & World Economic Forum. (2018). The new physics of financial services. In Payments Sector Summary. https://www2.deloitte.com/content/dam/Deloitte/uk/Documents/financial-services/deloitte-uk-artificial-intelligence-payments-sector-summary-card.pdf

- Damen, A. (2023, October 5). AI in Payments: How It’s Transforming the Industry. MONEI. https://monei.com/blog/ai-in-payments/

- Mastercard. (2024, November 2). How Mastercard is leveraging AI to revolutionise the e-payment experience. Mastercard Newsroom. https://newsroom.mastercard.com/news/ap/en/perspectives/en/2024/how-mastercard-is-leveraging-ai-to-revolutionise-the-e-payment-experience/

- Post, S. (2024, December 10). AI is transforming fraud prevention in digital payments. Here’s how. Business Insider. https://www.businessinsider.com/sc/how-ai-transforming-fraud-prevention-in-digital-payments

- Zoting, S. (2024, July 1). Artificial Intelligence in retail market size, Report 2033. https://www.precedenceresearch.com/artificial-intelligence-in-retail-market

- Gomstyn, A., & Jonker, A. (2024, November 25). Exploring privacy issues in the age of AI. IBM. https://www.ibm.com/think/insights/ai-privacy

- Explainable AI and blockchain for Metaverse: A security and privacy perspective. (n.d.). IEEE Journals & Magazine | IEEE Xplore. https://ieeexplore.ieee.org/document/10185088

- Kevin. (2021, September 14). AI case study: fraud detection gets stronger at Visa. Digital Strategy Consulting. https://digitalstrategyconsulting.com/transformation/ai/ai-case-study-fraud-detection-gets-stronger-at-visa/64036/

- Stripe and OpenAI collaborate to monetize OpenAI’s flagship products and enhance Stripe with GPT-4. (2023, March 15). https://stripe.com/newsroom/news/stripe-and-openai