Introduction

AI is transforming financial services, driving efficiency, security, and innovation across the industry. From fraud detection and risk assessment to customer support and investment strategies, AI-powered solutions are reshaping how institutions operate and engage with clients. Financial firms leveraging AI gain deeper insights, automate processes, and enhance decision-making—creating a competitive edge in a rapidly evolving market. As technology advances, AI is no longer optional—it’s essential for staying ahead.

As AI continues to transform financial services—driving efficiency, security, and innovation—the real impact comes from integrating these technologies into scalable, production-ready solutions. For organizations looking to turn advanced AI concepts into measurable business value, explore our AI-powered software development services designed to help financial institutions accelerate digital transformation and stay ahead in a rapidly evolving industry.

What is AI and Why Does It Matter in Financial Services?

Definition of AI and its core technologies

Artificial Intelligence (AI) encompasses a suite of technologies designed to mimic human cognitive abilities, enabling machines to analyze data, recognize patterns, and make informed decisions. At its core, AI encompasses Machine Learning (ML), which allows systems to improve with experience; Natural Language Processing (NLP), which enables computers to understand and generate human language; and Computer Vision, which interprets visual data to enhance automation and analytics.

These technologies are redefining the financial industry by enabling faster, smarter decision-making, reducing operational costs, and improving customer experiences. With the ability to process vast amounts of data in real time, AI supports everything from fraud detection and credit scoring to personalized financial advice and automated customer service.

As AI adoption accelerates, financial firms gain a competitive edge by harnessing predictive analytics and automation. AI is no longer optional—it’s a strategic necessity for innovation and long-term success in the financial industry.

The Growing Role of AI in Transforming Financial Services

AI is becoming a strategic driver of innovation in financial services. Organizations that harness AI-driven automation and predictive analytics can streamline workflows, mitigate risks, and unlock new opportunities for growth. Applications such as automated trading, regulatory compliance monitoring, and predictive analytics are helping firms stay competitive in an increasingly complex landscape.

As adoption accelerates, leading financial institutions are investing heavily in AI infrastructure to unlock new opportunities and deliver greater value. In today’s digital-first economy, AI is not just a competitive advantage—it’s a foundational technology for long-term growth and success in the financial industry.

Key Statistics and Trends Highlighting AI Adoption in Financial Services

- Global AI investment in financial services is projected to rise from $35 billion in 2023 to $97 billion by 2027, which represents a 29% compound annual growth rate (CAGR).

- AI-driven fraud detection and risk management solutions are widely adopted, helping financial institutions prevent losses and enhance security.

- Leading banks, such as Morgan Stanley and JPMorgan Chase, are deploying AI-powered tools to automate workflows and improve customer engagement.

- AI-powered chatbots and virtual assistants now handle a significant portion of customer inquiries, reducing operational costs and improving service efficiency.

AI’s impact on financial services is undeniable, with institutions embracing automation, predictive analytics, and real-time insights to drive innovation and remain competitive. As AI adoption accelerates, financial firms must strategically integrate these technologies to maximize their potential and stay ahead in a rapidly evolving market.

Business Benefits of AI in Financial Services

AI is no longer just an enhancement, it is a fundamental driver of efficiency, security, and innovation in financial services. By automating processes, optimizing risk management, and personalizing customer interactions, AI is reshaping the way financial institutions operate and compete in a digital-first world.

1. Operational Efficiency and Cost Reduction

1. Operational Efficiency and Cost Reduction

AI-driven automation streamlines routine tasks such as data entry, document processing, and transaction monitoring. This not only reduces operational costs but also minimizes errors and accelerates service delivery. For instance, Citibank has implemented AI to automate cash application processes, leading to substantial cost savings and improved accuracy.

2. Enhanced Customer Experience

Financial institutions are leveraging AI-powered chatbots and virtual assistants to provide 24/7 customer support. These tools handle a range of inquiries, from account information to personalized financial advice, thereby enhancing customer satisfaction and engagement. Bank of America’s virtual assistant, Erica, exemplifies this by offering proactive financial guidance to users.

3. Personalized Financial Services

By analyzing large volumes of customer data, AI enables the delivery of highly tailored financial products and investment advice. Robo-advisors utilize sophisticated algorithms to create customized investment strategies based on individual risk profiles and financial goals – strengthening client trust and long-term loyalty.

4. Risk Management and Fraud Detection

AI enhances risk assessment by analyzing diverse data sources to identify potential threats and fraudulent activities. Financial institutions employ AI to monitor transactions in real-time, detect anomalies, and prevent fraud, thereby safeguarding assets and maintaining regulatory compliance.

5. Regulatory Compliance

With increasing regulatory demands, AI assists in ensuring compliance by automating the monitoring and reporting of financial activities. AI systems can adapt to regulatory changes swiftly, reducing the risk of non-compliance and associated penalties.

AI is revolutionizing financial services, unlocking efficiencies, mitigating risks, and enhancing customer engagement. As financial institutions continue to integrate AI-driven solutions, they gain a strategic edge in automation, compliance, and decision-making. Those that proactively embrace AI will not only streamline operations but also foster innovation, ensuring long-term success in an increasingly digital financial ecosystem.

Challenges Facing AI Adoption in Financial Services

While artificial intelligence (AI) offers transformative potential for financial services, its adoption is accompanied by a set of complex and pressing challenges.

1. Regulatory Complexity and Compliance Risks

The financial industry is one of the most heavily regulated sectors, and the integration of AI introduces new compliance hurdles. Many AI models, particularly those based on deep learning, function as “black boxes,” making their decision-making processes difficult to interpret. This lack of transparency can conflict with regulatory requirements for explainability and fairness—especially in sensitive areas like credit scoring, fraud detection, and risk assessment. Ensuring that AI outputs are both auditable and unbiased is essential to maintaining compliance and customer trust.

2. Legacy Systems and Infrastructure Limitations

Many financial institutions still operate on legacy IT systems that were not built to support modern AI technologies. Integrating AI into these outdated systems often demands significant technical overhauls, which can be both time-consuming and expensive. This technological debt limits scalability and slows down digital transformation, creating a major barrier to effective AI deployment.

3. Data Privacy and Ethical Concerns

AI relies on large volumes of high-quality data to deliver accurate results, however, this dependence raises concerns around data privacy, security, and ethical use. Financial institutions must navigate strict regulations such as the General Data Protection Regulation (GDPR) while ensuring responsible data handling practices. Additionally, if historical data contains biases, AI systems can unintentionally reinforce discriminatory outcomes, putting institutions at risk of reputational and regulatory consequences.

4. Talent Shortage and Skill Gaps

Implementing AI solutions necessitates specialized skills in data science, machine learning, and AI ethics. The financial sector faces a shortage of professionals with these competencies, making it challenging to develop and maintain AI systems. The lack of in-house expertise can hinder AI innovation, delay deployment, and limit the long-term success of AI strategies.

5. Systemic Risks and Market Stability

The widespread adoption of similar AI models across financial institutions can lead to systemic risks. For instance, if multiple firms use comparable AI-driven trading algorithms, it could result in herd behavior, amplifying market volatility and potentially destabilizing financial markets. To mitigate these risks, firms must prioritize model diversity, scenario testing, and robust risk management frameworks.

Although the path to AI adoption is complex, these challenges are not insurmountable. Financial institutions that proactively address regulatory, technical, and ethical concerns, while investing in talent and infrastructure, will be better positioned to unlock the full potential of AI. A thoughtful, responsible approach is key to ensuring that AI drives sustainable innovation and long-term value in the financial sector.

Specific Applications of AI in Financial Services

1. Fraud Detection and Prevention

Fraud detection has always been a major challenge for financial institutions due to the sheer volume of transactions they handle daily. AI helps address this by using machine learning to analyze transaction patterns and detect anomalies in real-time. For instance, JPMorgan Chase has successfully reduced fraud by over 50%, saving millions annually by leveraging AI to flag suspicious activities before they escalate into significant issues.

AI’s ability to process vast amounts of data enables it to identify fraud patterns that traditional methods often miss. American Express utilizes AI to analyze customer spending behavior, which has led to a 30% reduction in fraud while also minimizing false positives. This results in more precise fraud detection and an improved customer experience, with fewer disruptions to legitimate transactions.

In addition to preventing transaction fraud, AI plays a key role in defending against identity theft and account takeovers. By analyzing behavioral biometrics and device data, AI systems can spot unusual login attempts and detect compromised accounts. PayPal, for example, has used AI to reduce identity theft cases by 40%, highlighting its effectiveness in proactively protecting customers from fraud.

AI also proves invaluable in anti-money laundering (AML) efforts. It continuously analyzes transaction patterns to detect suspicious activities in real-time, allowing financial institutions to respond quickly. HSBC uses AI-powered AML tools that have increased fraud detection efficiency by 20%, enabling the bank to identify potential money laundering activities with greater accuracy.

What truly sets AI apart from traditional systems is its adaptability. Unlike rule-based systems that follow fixed protocols, AI continually learns and improves as it processes more data, allowing it to stay ahead of evolving fraud tactics. This dynamic ability ensures that financial institutions can better protect their clients against increasingly sophisticated threats, making AI a crucial tool in the fight against financial crime.

2. Customer Service Automation and Chatbots

AI-powered customer service automation is transforming how financial institutions interact with customers. Bank of America’s “Erica” chatbot handles millions of customer interactions, assisting with tasks like checking balances, paying bills, and offering financial advice. This reduces the workload on human agents and enhances customer experience by providing quick, 24/7 support.

AI chatbots are also improving efficiency by managing simple tasks, allowing human agents to focus on complex issues. UBS uses AI-driven chatbots for account inquiries and password resets, reducing call center volumes and improving customer satisfaction due to faster response times.

Beyond basic tasks, AI chatbots can offer personalized financial advice. Cleo, used by Monzo, analyzes spending patterns and gives users tailored budgeting tips. This personalization has helped users save, with Cleo assisting in saving an average of £100 per month.

AI also enhances security by detecting suspicious behavior in customer interactions. HSBC uses AI to monitor communication for signs of fraud, preventing identity theft and account takeovers. This proactive approach strengthens security while streamlining fraud detection.

AI chatbots are reshaping customer service in financial services, improving efficiency, reducing costs, and providing personalized experiences. As seen with Erica, UBS, Cleo, and HSBC, AI is increasingly playing a central role in delivering better and more secure customer service.

3. Personalized Financial Advice

The use of AI in financial advice is revolutionizing how individuals receive tailored guidance. Betterment, for example, uses machine learning to create investment portfolios customized to each client’s risk tolerance and goals. This approach offers a cost-effective solution, making personalized financial advice more accessible to a broader audience.

For everyday financial management, tools like Cleo are proving invaluable. The Monzo-integrated chatbot tracks spending habits and offers real-time budgeting and savings advice, helping users save an average of £100 per month. Cleo’s ability to learn from individual spending behavior makes it an effective tool for better financial decision-making.

Retirement planning has also seen significant improvements through AI. Wealthfront uses predictive algorithms to help users optimize their savings strategies based on income, spending, and market data. This data-driven advice enables individuals to adjust their plans and feel more confident about reaching their long-term financial goals.

By making financial advice more affordable and accessible, AI is also supporting underserved populations. SoFi provides personalized guidance on topics like student loans and investing through its AI-driven platform, helping a wider range of customers manage their finances effectively.

4. Credit Risk Assessment

Traditional credit risk assessment relies heavily on credit history, income, and outstanding debts, which may not offer a complete picture of a borrower’s financial situation. AI enhances this by analyzing alternative data, such as transaction patterns and social behavior. Zest AI, for instance, uses machine learning to incorporate non-traditional data, improving credit decisions and reducing loan defaults by 15%.

AI is also helping to reach underbanked populations who lack formal credit histories. By evaluating alternative data like rental payments and mobile phone usage, Upstart has extended credit to individuals who would otherwise be excluded, resulting in a 16% lower default rate compared to traditional methods.

Another benefit of AI is its ability to adapt to changes in economic conditions. LenddoEFL utilizes AI to assess credit risk by analyzing online behavior and social connections, providing more accurate assessments for individuals in emerging markets who might not be served by traditional credit systems.

Additionally, AI also speeds up the credit assessment process, reducing both time and costs. Kiva uses AI to evaluate microloans more efficiently, accelerating loan approvals and reducing the need for manual underwriting in underserved communities. This has made the process faster and more cost-effective, improving accessibility.

AI differs from traditional methods by analyzing a broader set of dynamic data, such as alternative data and real-time behavior, allowing for more accurate and faster credit assessments. Unlike fixed-rule systems, AI adapts to changing conditions, providing more precise and scalable credit decisions.

5. Algorithmic Trading

AI is revolutionizing algorithmic trading by analyzing vast amounts of data to execute trades faster and more accurately. Two Sigma, for example, uses machine learning to process billions of data points and make high-frequency trades, enhancing their ability to exploit market inefficiencies and outperform traditional strategies.

By learning from large datasets, AI algorithms make more precise market predictions. Renaissance Technologies employs AI to analyze diverse data sources, from financial indicators to satellite images, helping them achieve annual returns of 40% or more with its Medallion Fund, showcasing AI’s ability to identify patterns humans might overlook.

AI’s adaptability to real-time market conditions further improves trading efficiency. Goldman Sachs uses AI to adjust its positions based on emerging trends and market volatility, allowing them to be more agile and responsive compared to traditional, static trading methods.

AI also eliminates human biases and emotions in trading decisions. BlackRock integrates AI into its systems to reduce errors and make more objective, consistent decisions, improving risk management and long-term returns for clients.

Through speed, accuracy, and adaptability, AI is reshaping algorithmic trading. Firms like Two Sigma, Renaissance Technologies, Goldman Sachs, and BlackRock show how AI can provide a significant edge in the financial markets, enhancing profits while managing risks effectively.

6. Regulatory Compliance and Risk Management

AI is transforming regulatory compliance by automating the detection of suspicious activities and ensuring adherence to regulations. HSBC uses AI to analyze vast amounts of transactions, significantly improving anti-money laundering (AML) efforts and reducing manual intervention, enhancing both accuracy and efficiency.

In risk management, AI helps institutions predict and mitigate risks in real-time. JP Morgan Chase employs AI to assess credit and market risks, continuously analyzing data to adjust strategies and reduce the likelihood of financial losses, improving decision-making processes.

AI is also streamlining regulatory reporting by automating the generation of compliance reports. UBS integrates AI into its reporting systems, reducing the time and resources needed for compliance and ensuring timely, accurate submissions across multiple jurisdictions.

By continuously learning from new data, AI enhances proactive risk management. Deutsche Bank uses AI to track economic indicators and adjust risk assessments in real-time, allowing them to stay ahead of market changes and mitigate potential financial instability.

Examples of AI in Financial Services

Real-World Case Studies

Case Study 1: JPMorgan Chase – Contract Intelligence (COiN)

JPMorgan Chase’s Contract Intelligence (COiN) is a prime example of how AI can drive efficiency and cost savings in financial services. Before implementing COiN, the bank’s legal teams spent an estimated 360,000 hours annually reviewing commercial loan agreements. By leveraging natural language processing (NLP) and machine learning, COiN now automates this task—analyzing legal documents in seconds, extracting key clauses, and identifying potential risks. This automation not only speeds up the review process but also improves accuracy by minimizing human error.

The results have been transformative: JPMorgan has significantly reduced labor costs while improving compliance and legal precision. The success of COiN has encouraged the bank to expand its use beyond loan agreements to other complex documents like credit-default swaps and custody agreements. COiN exemplifies how AI, when applied strategically, can streamline operations and deliver measurable business value in the financial sector.

Case Study 2: Goldman Sachs – Algorithmic Trading

Goldman Sachs, one of the world’s leading investment banks, has integrated AI-powered trading algorithms that automate everything from data analysis to trade execution. These intelligent systems process vast market data in real time, enabling faster and more accurate price predictions and decision-making.

As a result, the bank has reported a 40% improvement in trading efficiency, along with increased trading volumes and more accurate price predictions. By automating key aspects of the trading process – from data analysis to execution – the bank has reduced human intervention, improved risk management, and enhanced decision-making. These outcomes demonstrate how AI can not only boost operational performance but also transform core financial activities like trading.

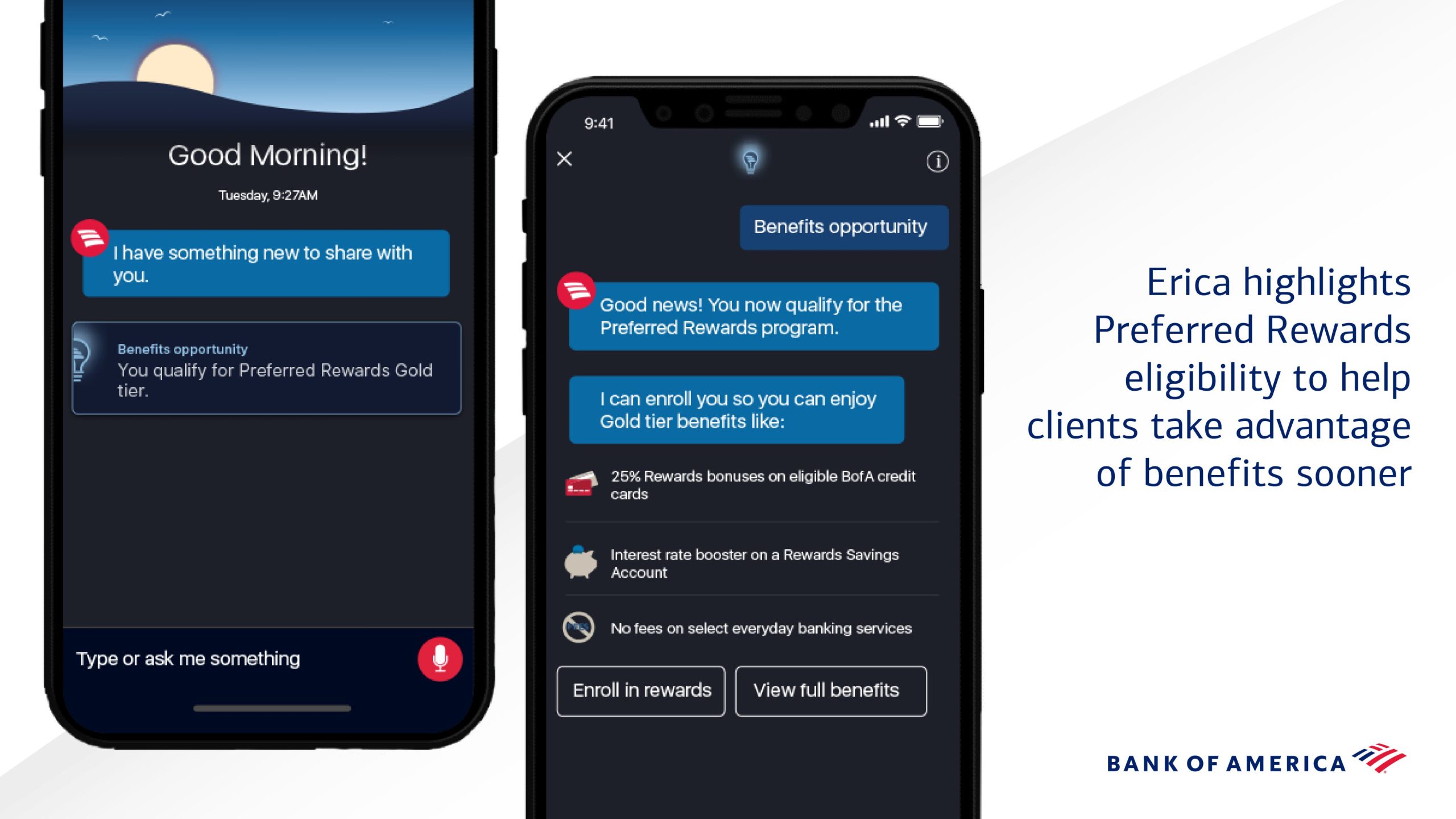

Case Study 3: Bank of America – AI Virtual Assistant “Erica”

Bank of America’s AI-powered virtual assistant, Erica, has transformed digital banking by providing customers with real-time financial insights and support. Launched in 2018, Erica uses machine learning and NLP to assist users with tasks such as transaction searches, budgeting insights, and proactive financial recommendations.

To date, Erica has handled over 1 billion interactions, serving nearly 32 million users. It manages 1.5 million interactions per day, with more than 98% of inquiries resolved without human support—greatly improving operational efficiency. Erica’s capabilities continue to evolve, including alerts for unusual charges and eligibility for rewards, enhancing the overall digital banking experience.

This success reflects Bank of America’s broader commitment to digital innovation, with $3 billion invested annually in AI and technology. Erica is a testament to how AI can scale personalized service while driving cost savings and customer satisfaction.

Innovative AI Solutions

- AI-Powered Fraud Detection & Risk Management:

Financial institutions are harnessing the power of AI to detect and prevent fraud with unprecedented speed and accuracy. Advanced machine learning models analyze large volumes of data—including transaction histories, user behavior, and geolocation patterns—to identify anomalies in real time. This approach helps banks reduce losses, ensure compliance, and respond to emerging risks more proactively. - Hyper-Personalized Customer Experiences:

AI is transforming how banks interact with customers by enabling highly personalized services. By analyzing individual spending behavior and financial habits, AI tools can deliver targeted insights and recommendations. This not only enhances user experience but also increases engagement and customer retention by making banking more intuitive and customer-centric. - Robotic Process Automation (RPA) for Back-Office Efficiency:

By integrating Robotic Process Automation (RPA) with AI, banks are streamlining repetitive back-office processes such as data entry, document verification, and payment reconciliation. These intelligent automation solutions enhance speed and accuracy, reduce human error, and free up staff to focus on strategic initiatives.

AI-Driven Innovations Transforming Financial Services

Emerging AI technologies are transforming financial services by driving innovation, improving efficiency, and supporting sustainability. Financial institutions are rapidly adopting advanced tools like generative AI, computer vision, and predictive analytics to stay competitive and meet evolving market demands.

Generative AI in Lending and Credit Assessment

Generative AI, including large language models like ChatGPT, is being used to enhance loan decision-making processes. By combining AI-generated insights with traditional financial data, institutions can improve the accuracy of credit default predictions. Studies show that integrating AI-refined assessments boosts profitability by reducing risk, streamlining approvals, and supporting smarter lending strategies.

Computer Vision in Trading and Market Analysis

AI-powered computer vision is revolutionizing financial data analysis. By converting time-series data into visual formats such as candlestick charts, machine learning models can detect trading signals with greater speed and precision. This technique improves the performance of algorithmic trading strategies and enables faster, more informed decisions in dynamic market environments.

AI for Sustainable and Efficient Operations

AI also plays a growing role in promoting sustainability within financial institutions. Predictive analytics help banks and financial firms optimize energy use by forecasting consumption patterns and adjusting operations. Companies like Verdigris Technologies lead the way by using AI to monitor energy usage in real time, automate energy-saving measures, and reduce environmental impact.

As these AI-driven innovations continue to evolve, their adoption across the financial sector is essential for boosting operational efficiency, enhancing decision-making, and meeting both customer expectations and sustainability goals.

How to Implement AI in Financial Services

1. Assessing Readiness for AI Implementation

Before diving into AI adoption, it’s essential to assess your financial institution’s readiness. Start by identifying the areas where AI can deliver the most impact—such as fraud detection, risk management, customer service, and compliance. Look for tasks that involve large datasets, repetitive processes, or complex decision-making patterns, as these are areas where AI can drive significant efficiency and accuracy.

Additionally, evaluate your organization’s digital maturity. Ensure you have the foundational systems, secure data infrastructure, and skilled teams in place to support AI integration. A clear understanding of these capabilities will allow for a more seamless implementation process.

2. Building a Strong Data Foundation

AI relies heavily on high-quality, organized data. Before implementing AI, ensure that your data collection processes are robust and that the data is clean, secure, and standardized across various sources, such as customer transactions, interactions, and market trends. This will ensure the accuracy and reliability of AI-driven insights.

Equally important is data governance. Establish strong data management practices to comply with regulations like GDPR or CCPA. A well-organized, compliant data foundation is crucial for training AI models that can generate accurate, unbiased, and trustworthy insights.

3. Selecting the Right AI Solutions and Technology Partners

Given the unique challenges in the financial sector, selecting the right AI tools and platforms is critical. Evaluate solutions that are specifically designed for financial services, such as fraud detection systems, robo-advisors, or compliance automation tools. These tools can help address specific industry needs and align with your business objectives.

Partner with trusted technology vendors such as IBM, Google Cloud, and AWS that offer AI solutions tailored to the financial industry. Ensure that the AI tools you select integrate smoothly with existing systems like CRM platforms or core banking software, and meet regulatory requirements relevant to your institution.

4. Executing Pilot Programs and Scaling AI Solutions

Once the appropriate AI tools are in place, begin with small-scale pilot programs to test specific use cases, such as automating loan approvals or enhancing customer service with AI-driven chatbots. These initial projects will provide valuable insights into how AI can integrate with existing workflows and improve operational performance.

Closely monitor the outcomes of these pilot programs, gathering data on efficiency gains, customer satisfaction, and any areas for improvement. Once pilots demonstrate success, gradually scale AI initiatives to other areas of your business, ensuring continuous optimization based on real-time feedback.

5. Empowering Teams through AI Training and Upskilling

AI implementation is not just about technology, it’s also about empowering your teams. Staff will need to work alongside AI systems to maximize their potential. To facilitate this, provide specialized training for employees on how AI works, how it can be applied to their roles, and how to leverage AI-driven tools for decision-making, particularly in areas like risk management and fraud detection.

Fostering a collaborative mindset where AI is seen as an enabler of human expertise is crucial for successful integration. Upskilling your teams ensures a higher adoption rate of AI solutions and supports their effective use to meet business goals.

By following these steps, financial institutions can successfully implement AI, drive innovation, and improve operational efficiency while ensuring compliance with regulations and meeting customer needs in an increasingly competitive market.

Measuring the ROI of AI in Financial Services

As AI adoption in financial services accelerates, measuring its return on investment (ROI) has become a critical focus for institutions. Tracking AI’s impact on productivity, cost savings, and overall business performance is essential to ensure that investments deliver tangible value.

1. Key Metrics to Track Success

To measure the ROI of AI effectively, financial institutions should focus on key performance indicators (KPIs) such as productivity improvements, cost reductions, and decision-making accuracy. AI streamlines operations by automating tasks like fraud detection and customer service, allowing institutions to reduce labor costs and handle more transactions with fewer resources.

AI also enhances decision-making by identifying trends and risks that may be overlooked by humans, improving accuracy in areas like credit assessment and investment analysis. Additionally, AI-driven tools improve customer satisfaction through personalized services, boosting customer retention. By tracking revenue growth, improved risk management, and compliance, financial institutions can gauge the success of AI initiatives and continuously optimize strategies for maximum ROI.

3. Case Studies Demonstrating ROI

Several financial institutions have already demonstrated significant ROI from their AI investments, achieving improvements in efficiency, cost reduction, and service quality.

ING Group, a Dutch multinational bank, has integrated AI into its credit risk assessment and loan processing workflows. By using machine learning algorithms to evaluate borrower profiles and predict default risk, ING has shortened loan approval times while enhancing the accuracy of its lending decisions. This has led to a marked decrease in non-performing loans and improved customer satisfaction due to faster service. The scalable nature of these AI tools allows ING to process more applications without increasing operational overhead, driving measurable cost savings and revenue impact.

Similarly, TFAS, a financial advisory firm, integrated AI tools from Aveni to streamline administrative tasks and compliance checks. By automating the review of client call transcripts and the drafting of suitability reports, TFAS achieved a 25% increase in operational efficiency. The firm anticipates further gains, aiming for a 70% improvement in efficiency, which would enable them to serve a broader client base without additional hires. This strategic use of AI has not only enhanced productivity but also positioned TFAS to scale its operations effectively.

Common Pitfalls and How to Avoid Them

- Lack of Clear Use Cases: Without well-defined applications, AI investments may not yield expected returns. Financial institutions should identify specific areas where AI can add value, such as fraud detection or customer service automation.

- Overlooking Change Management: Successful AI adoption requires addressing organizational culture and workforce adaptation. Providing training and support ensures that employees can effectively collaborate with AI systems.

- Neglecting Data Quality: AI’s effectiveness depends on high-quality data. Financial institutions must invest in robust data governance to ensure the accuracy, consistency, and regulatory compliance of the data used to train AI models.

Future Trends of AI in Financial Services

1. Predictions for the Next Decade

In the coming years, AI is expected to democratize access to sophisticated financial services. Generative AI and machine learning models will enable personalized investment strategies tailored to individual risk profiles and financial goals, making high-quality financial advice more accessible to a broader audience.

In the realm of risk management, AI algorithms will enhance the accuracy of credit assessments and fraud detection by analyzing vast datasets to identify patterns and anomalies. This will lead to more efficient and secure financial operations.

Furthermore, AI will revolutionize customer service through hyper-personalized interactions and seamless, automated support systems. Financial institutions will leverage AI to anticipate customer needs and provide proactive solutions, thereby enhancing customer satisfaction and loyalty.

2. Stay Ahead of the Curve: Key Strategies for Future Success

To remain competitive in this evolving landscape, financial institutions must take a forward-thinking approach to AI integration. Here are key strategies to stay ahead:

- Invest in AI Education and Talent Development: Upskill employees with AI and data literacy programs to ensure teams can effectively collaborate with intelligent systems and adapt to evolving tools.

- Build a Strong Data Governance Framework: Establish policies for secure and ethical data collection, management, and usage, ensuring compliance with regulations and maintaining high data quality for AI models.

- Foster Strategic Partnerships and Innovation: Collaborate with AI startups, tech vendors, and fintech ecosystems to access cutting-edge solutions. Participate in regulatory sandboxes to test innovations in a controlled, compliant environment.

- Focus on Scalable and Ethical AI Integration: Adopt AI tools that are not only scalable across business units but also align with ethical standards, ensuring transparency, fairness, and accountability in automated decisions.

Conclusion

Key Takeaways

Artificial intelligence is transforming the financial services landscape, empowering institutions to make smarter, faster, and more secure decisions. From improving customer experience to optimizing internal operations, AI is no longer a future vision but a practical tool driving measurable results today.

- Fraud Detection and Risk Management: AI-powered systems analyze vast datasets in real-time to detect anomalies and flag suspicious activities, strengthening security and reducing financial losses.

- Personalized Customer Experiences: AI enables hyper-personalized recommendations, tailored product offerings, and responsive virtual assistants, enhancing client engagement and satisfaction.

- Credit Scoring and Lending: AI models improve credit assessments by incorporating alternative data sources, allowing for fairer and more accurate lending decisions.

- Trading and Investment Insights: From algorithmic trading to portfolio optimization, AI delivers data-driven insights that help firms respond quickly to market changes and minimize risk.

- Regulatory Compliance and Reporting: RegTech solutions powered by AI streamline compliance tasks, reduce manual errors, and ensure adherence to evolving regulatory requirements.

Moving Forward: A Path to Progress

As AI continues to redefine financial services, businesses that act now stand to gain a competitive advantage—enhancing efficiency, improving customer experiences, and managing risk more effectively.

Now is the time to invest in AI readiness—build a strong data foundation, foster internal expertise, and select scalable, compliant solutions tailored to your needs. By taking a proactive, thoughtful approach, financial institutions can confidently embrace innovation and unlock the full potential of AI to drive long-term success.

At SmartDev, we specialize in delivering cutting-edge AI solutions tailored to the unique challenges of the financial services industry. From intelligent automation and fraud detection to personalized fintech applications, our experts can help you design and implement scalable, secure, and future-ready systems.

Contact us today to discuss how we can help you harness the power of AI to drive innovation, optimize your processes, improve risk management, and achieve greater success in the competitive financial landscape. Let us support you in building a smarter, AI-driven future for your business, one that sets you apart in the ever-evolving world of finance.

—

References:

- Unlocking AI Use Cases In Financial Services | Forbes

- The Future Of AI In Financial Services | Forbes

- The Transformative Impact Of AI On Financial Services | Forbes

- The Future of Financial Services: Integrating AI for Smarter, More Efficient Operations | MZ Journal of Artificial Intelligence

- BofA’s Erica Surpasses 2 Billion Interactions, Helping 42 Million Clients Since Launch | Bank of America