Introduction

The payments industry is undergoing a significant transformation, driven by the integration of Artificial Intelligence (AI). From enhancing fraud detection to streamlining operations, AI is addressing longstanding challenges and unlocking new opportunities. This article explores how AI is revolutionizing the payments sector, offering insights into its applications, benefits, and the hurdles to its adoption.

What is AI and Why Does It Matter in Payments?

-

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) encompasses computer systems designed to perform tasks that typically require human intelligence, such as learning, reasoning, and decision-making. Core technologies include machine learning, which enables systems to learn from data; natural language processing (NLP), allowing machines to understand human language; and computer vision, which interprets visual information.

In the payments industry, AI is applied to automate processes, enhance security, and improve customer experiences. Machine learning algorithms detect fraudulent transactions by analyzing patterns, while NLP powers chatbots that handle customer inquiries efficiently.

Want to explore how AI can transform your sector? Discover real-world strategies for deploying smart technologies in payment-visit How to Integrate AI into Your Business in 2025 to get started today and unlock the full potential of AI for your business!

-

The Growing Role of AI in Transforming Payments

AI is reshaping the payments landscape by introducing intelligent automation and predictive analytics. For instance, AI-driven fraud detection systems can analyze vast amounts of transaction data in real-time, identifying anomalies that may indicate fraudulent activity. This proactive approach significantly reduces the risk of fraud and enhances trust in digital payment systems.

Moreover, AI facilitates personalized customer experiences. By analyzing user behavior and preferences, AI can tailor payment solutions to individual needs, such as suggesting optimal payment methods or offering customized financial advice. This personalization fosters customer loyalty and satisfaction.

Operational efficiency is another area where AI makes a substantial impact. Automated processes reduce manual intervention, minimizing errors and accelerating transaction times. This efficiency not only lowers operational costs but also enhances the overall user experience.

-

Key Statistics or Trends in AI Adoption

The adoption of AI in payments is accelerating. According to a report by Business Insider, Mastercard’s AI systems have increased fraud detection rates by up to 300%, safeguarding over 159 billion transactions annually. Additionally, JPMorgan Chase has integrated AI across its operations, resulting in a nearly 30% reduction in servicing costs and a projected 10% decrease in operational headcount, particularly in fraud detection and process efficiency.

Furthermore, the global digital payment market is expected to reach $20 trillion in 2025, highlighting the critical role of AI in managing massive data flows securely and effectively.

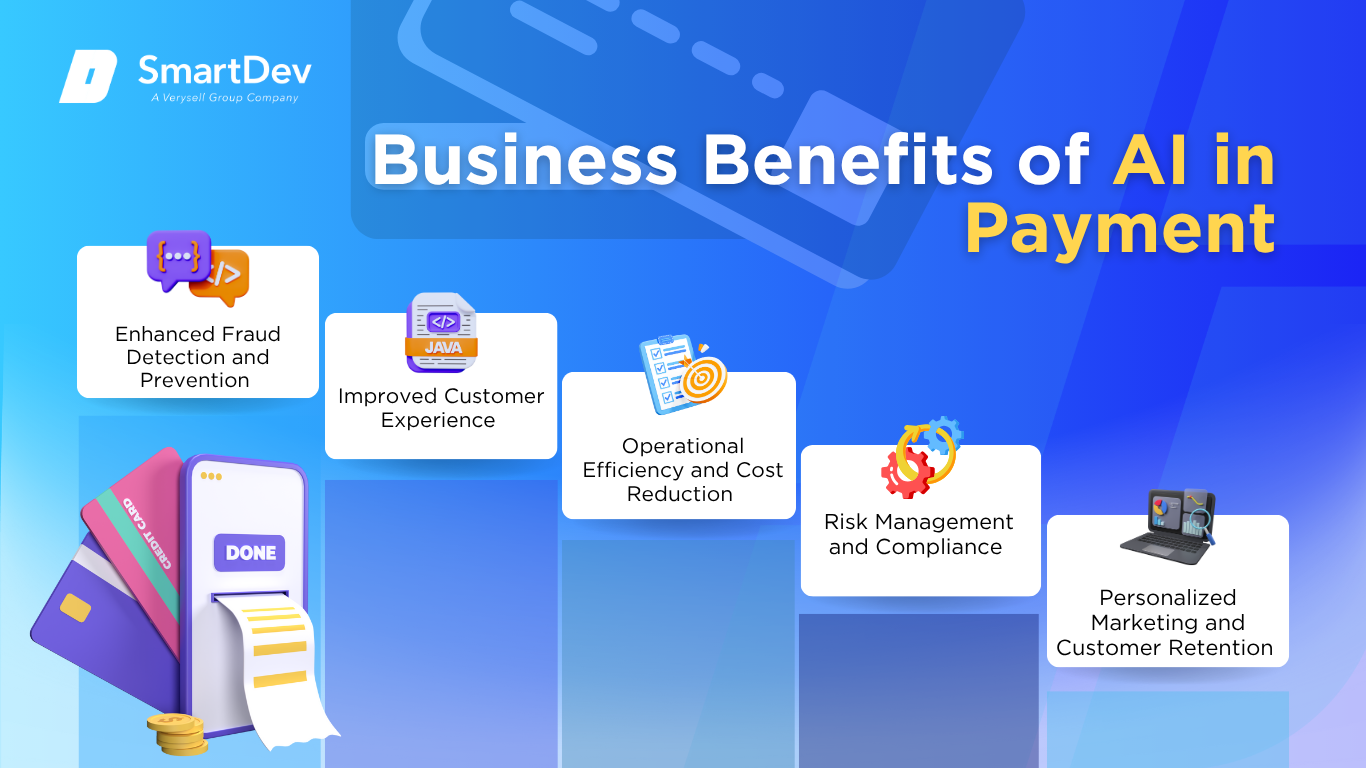

Business Benefits of AI in Payments

-

Enhanced Fraud Detection and Prevention

AI-powered systems can analyze transaction patterns in real-time, identifying and flagging suspicious activities that may indicate fraud. This proactive approach enables financial institutions to prevent fraudulent transactions before they occur, protecting both the business and its customers.

For example, AI models can detect anomalies in transaction behavior, such as unusual spending patterns or login attempts from unfamiliar locations, and trigger alerts or block transactions accordingly.

-

Improved Customer Experience

AI enhances customer service through chatbots and virtual assistants that provide instant support, answer queries, and guide users through payment processes. These tools are available 24/7, ensuring customers receive timely assistance without the need for human intervention.

Additionally, AI can personalize the user experience by analyzing customer data to offer tailored recommendations, such as suggesting preferred payment methods or providing insights into spending habits.

-

Operational Efficiency and Cost Reduction

By automating routine tasks, AI reduces the need for manual processing, leading to faster transaction times and lower operational costs. For instance, AI can streamline invoice processing by automatically extracting relevant information and matching it with purchase orders, minimizing errors and accelerating approvals.

This efficiency allows businesses to allocate resources more effectively, focusing on strategic initiatives rather than administrative tasks.

-

Risk Management and Compliance

AI assists in risk assessment by analyzing credit histories and transaction behaviors to evaluate the creditworthiness of individuals and businesses. This analysis enables financial institutions to make informed lending decisions and manage risk proactively.

Moreover, AI helps ensure compliance with regulatory requirements by monitoring transactions for suspicious activities and generating reports for auditing purposes.

-

Personalized Marketing and Customer Retention

AI enables businesses to deliver personalized marketing campaigns by analyzing customer data to understand preferences and behaviors. This targeted approach increases the effectiveness of marketing efforts, leading to higher conversion rates and customer retention.

For example, AI can identify customers who are likely to churn and trigger retention strategies, such as personalized offers or loyalty programs, to encourage continued engagement.

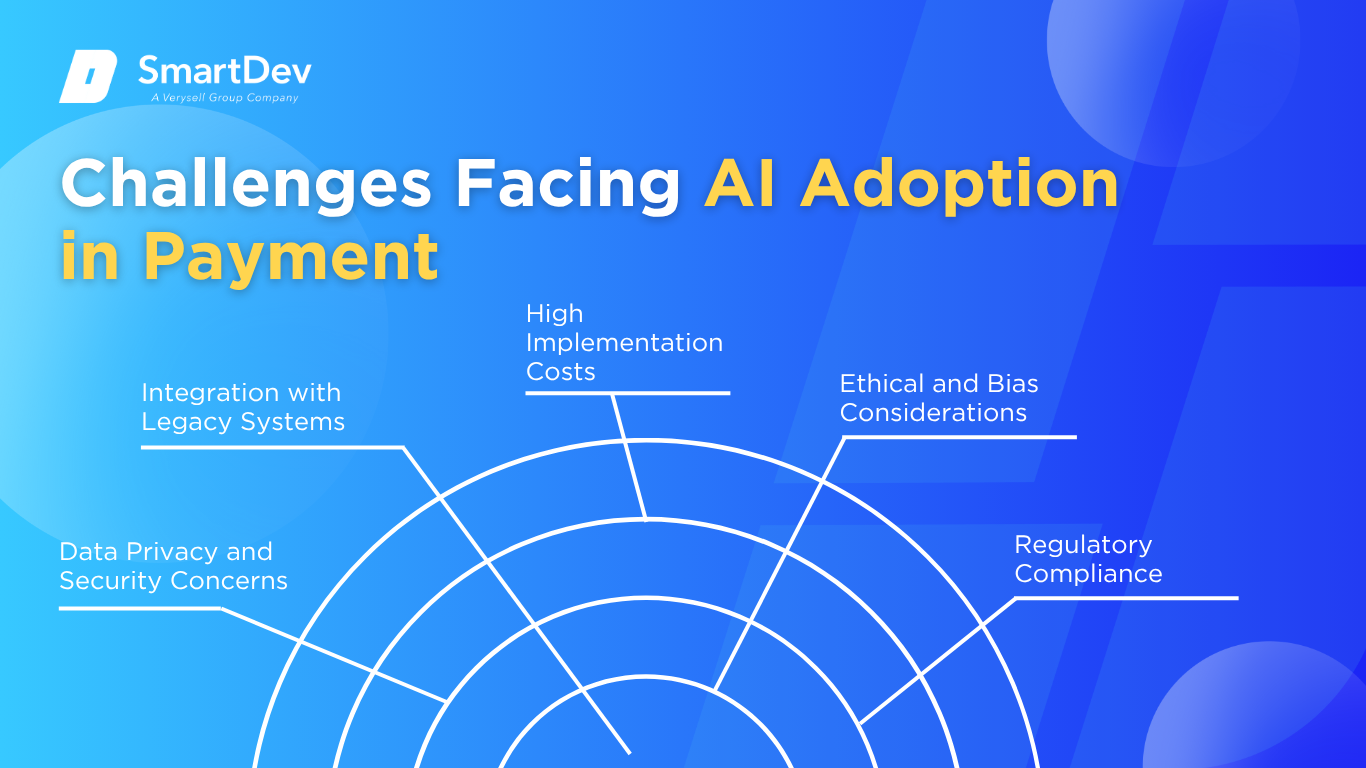

Challenges Facing AI Adoption in Payments

-

Data Privacy and Security Concerns

The use of AI involves processing vast amounts of sensitive customer data, raising concerns about data privacy and security. Ensuring compliance with data protection regulations, such as GDPR, and safeguarding against data breaches are critical considerations for businesses implementing AI solutions.

-

Integration with Legacy Systems

Many financial institutions operate on legacy systems that may not be compatible with modern AI technologies. Integrating AI solutions into these existing infrastructures can be complex and resource-intensive, requiring significant investment and technical expertise.

Selecting appropriate AI tools and vendors is critical to the success of your implementation. Evaluate solutions based on their compatibility with existing systems, scalability, and ease of integration. For payment providers with outdated infrastructure, modernizing legacy systems is often a necessary step before AI can deliver real-time personalization, payment automation, or predictive customer support.

-

High Implementation Costs

Developing and deploying AI systems can be costly, particularly for small and medium-sized enterprises. The expenses associated with acquiring technology, hiring skilled personnel, and maintaining AI systems may pose financial challenges.

-

Ethical and Bias Considerations

AI systems can inadvertently perpetuate biases present in training data, leading to unfair outcomes, such as discriminatory lending practices. Addressing ethical concerns and ensuring transparency in AI decision-making processes are essential to maintain trust and fairness.

Choosing the right AI tools and technology partners is essential for successful implementation in payment systems. It’s important to assess solutions based on how well they integrate with existing infrastructure, their ability to scale, and their support for compliance. For financial institutions operating on legacy platforms, upgrading core systems is often a crucial step before AI can enable real-time fraud detection, transaction automation, and personalized payment experiences.

-

Regulatory Compliance

Navigating the complex regulatory landscape governing financial services and AI technologies can be challenging. Businesses must stay abreast of evolving regulations and ensure their AI applications comply with legal requirements to avoid penalties and reputational damage.

Specific Applications of AI in Payments

1. Fraud Detection and Prevention

AI-powered fraud detection systems are essential in identifying and preventing fraudulent activities in real-time. By analyzing vast amounts of transaction data, these systems can detect anomalies and flag suspicious behavior, reducing the risk of financial losses.

Machine learning algorithms learn from historical transaction data to recognize patterns associated with fraud. They continuously adapt to new fraud tactics, ensuring up-to-date protection. These systems require access to diverse datasets, including transaction history, user behavior, and device information, to function effectively.

Implementing AI in fraud detection enhances security and builds customer trust. It reduces false positives, ensuring legitimate transactions are not unnecessarily declined, and minimizes the financial impact of fraud on businesses.

A notable example is Visa’s implementation of AI in its fraud detection systems. By leveraging AI, Visa has improved its ability to detect fraudulent transactions, enhancing security for its customers and reducing financial losses.

2. Personalized Customer Experiences

AI enables payment platforms to offer personalized experiences by analyzing customer data and behavior. This personalization enhances customer satisfaction and loyalty.

Through data analysis, AI can recommend tailored products, services, and offers to customers. It considers factors such as purchase history, browsing behavior, and preferences to deliver relevant suggestions. Integrating AI into customer relationship management systems allows for real-time personalization across various touchpoints.

Personalized experiences increase customer engagement and conversion rates. They also provide a competitive advantage by differentiating services in a crowded market.

For instance, Mastercard utilizes AI to personalize customer interactions, offering tailored recommendations and services that enhance the overall customer experience.

3. Credit Scoring and Risk Assessment

AI transforms credit scoring by incorporating alternative data sources and advanced analytics to assess creditworthiness more accurately. This approach expands access to credit for individuals with limited credit histories.

AI models analyze various data points, including utility payments, rental history, and social media activity, to evaluate credit risk. These models adapt to new information, providing dynamic and up-to-date assessments. Integrating AI into credit assessment processes allows for more inclusive and fair evaluations.

Enhanced credit scoring models reduce default rates and enable lenders to make informed decisions. They also promote financial inclusion by offering credit opportunities to underserved populations.

Pagaya Technologies, in partnership with Klarna, employs AI-driven credit scoring to assess borrower reliability beyond traditional metrics, broadening access to credit for individuals with limited credit histories.

4. Automated Customer Support

AI-powered chatbots and virtual assistants provide efficient and consistent customer support, handling inquiries and resolving issues promptly.

Natural language processing enables AI systems to understand and respond to customer queries accurately. These systems can handle multiple interactions simultaneously, ensuring quick response times. Integrating AI into customer service platforms streamlines support processes and reduces the workload on human agents.

Automated customer support improves customer satisfaction by providing immediate assistance. It also reduces operational costs and allows human agents to focus on complex issues requiring personal attention.

Klarna’s AI assistant exemplifies this application, performing the equivalent work of over 800 full-time staff and delivering significant cost savings while maintaining high customer service standards.

5. Predictive Analytics for Business Insights

AI-driven predictive analytics provide businesses with valuable insights into customer behavior, market trends, and operational performance, enabling data-driven decision-making.

By analyzing historical and real-time data, AI models forecast future trends and customer actions. These insights help businesses optimize pricing strategies, inventory management, and marketing campaigns. Integrating predictive analytics into business intelligence tools enhances strategic planning and competitiveness.

Utilizing predictive analytics leads to improved operational efficiency, increased revenue, and better customer targeting. It allows businesses to anticipate market changes and adapt proactively.

JPMorgan Chase leverages AI for predictive analytics, streamlining client onboarding, optimizing portfolios, and improving payment processes by reducing transaction friction and error rates.

6. Regulatory Compliance and Anti-Money Laundering (AML)

AI assists in ensuring regulatory compliance and detecting money laundering activities by monitoring transactions and identifying suspicious patterns.

Machine learning algorithms analyze transaction data to detect anomalies indicative of money laundering. These systems adapt to evolving tactics used by criminals, maintaining effective surveillance. Integrating AI into compliance systems enhances the accuracy and efficiency of monitoring processes.

Implementing AI in compliance reduces the risk of regulatory penalties and reputational damage. It ensures adherence to legal requirements and strengthens the integrity of financial systems.

Pay.UK’s collaboration with Visa demonstrates the effectiveness of AI in regulatory compliance, with their pilot program detecting 54% of fraudulent transactions that had previously passed through sophisticated bank and PSP fraud detection systems.

Examples of AI in Payments

Real-World Case Studies

1. Mastercard: Enhancing Fraud Detection

Mastercard faced the daunting task of safeguarding over 160 billion transactions annually against increasingly sophisticated fraud schemes. Traditional rule-based systems struggled to adapt to evolving fraud patterns, leading to a significant number of false positives and missed fraudulent activities.

To address this, Mastercard developed “Decision Intelligence Pro,” an AI-driven system that leverages generative AI and graph technology. This system analyzes vast datasets to identify patterns and relationships indicative of fraudulent behavior, enabling real-time risk assessment of transactions. By predicting the full 16-digit card numbers of compromised cards and assessing their likelihood of misuse, the system allows for proactive fraud prevention.

The implementation of AI has led to a 300% increase in fraud detection rates and a tenfold reduction in false positives, resulting in billions of dollars saved for merchants and enhanced customer trust.

2. JPMorgan Chase: Streamlining Operations

JPMorgan Chase aimed to enhance operational efficiency across its vast banking operations, which included reducing manual workloads, improving customer service, and optimizing payment processes.

Investing $18 billion in technology, JPMorgan developed an in-house generative AI platform utilized by over 200,000 employees. This platform encompasses approximately 100 AI tools designed to automate tasks, analyze data, and provide insights. Notably, AI applications have been integrated into consumer banking to cut servicing costs and into asset and wealth management to expedite research and advisory tasks.

The AI initiatives have resulted in a nearly 30% reduction in servicing costs and are projected to reduce operational headcount by 10%. Additionally, customer engagement has increased by 25%, and advisory productivity has more than tripled, demonstrating significant improvements in efficiency and service quality.

3. Klarna: Revolutionizing Customer Service

Klarna sought to enhance its customer service operations to handle a growing volume of inquiries efficiently while maintaining high customer satisfaction.

In collaboration with OpenAI, Klarna launched an AI assistant capable of managing a wide range of customer service tasks. This assistant operates 24/7 across 23 markets and communicates in over 35 languages. It handles inquiries related to refunds, returns, and financial advice, providing personalized and prompt responses.

Within the first month, the AI assistant managed two-thirds of customer service chats, equivalent to the work of 700 full-time agents. It achieved parity with human agents in customer satisfaction scores and led to a 25% reduction in repeat inquiries. The average resolution time for customer issues decreased from 11 minutes to less than 2 minutes, and the initiative is projected to contribute a $40 million profit improvement in 2024.

AI-powered solutions are also enhancing prepaid systems, where real-time balance checks, fraud detection, and transaction approvals are critical. A great example is this AI-driven prepaid payment card system designed to streamline financial operations and deliver seamless user experiences.

Innovative AI Solutions

1. Generative AI for Customer Support Optimization

Payment companies face the ongoing challenge of managing high volumes of customer interactions with efficiency and personalization. Traditional customer support systems, often human-dependent, struggle with scalability, consistency, and cost-efficiency.

Generative AI models, such as those developed by OpenAI and integrated into platforms like Klarna and JPMorgan, automate conversational interactions through advanced natural language understanding and generation. These models handle complex queries, provide tailored recommendations, and escalate cases only when necessary. Their multilingual capabilities ensure global reach, and 24/7 availability meets modern customer expectations.

Companies deploying generative AI have reduced customer resolution times by up to 80% and decreased support-related operational costs by 60%. AI agents have reached parity with human agents in satisfaction metrics and improved net promoter scores (NPS) by up to 25%. These gains free up human resources for more strategic functions while elevating the customer experience.

2. AI-Driven Real-Time Payment Monitoring

With instant payments becoming the norm, the risk of fraudulent transactions executed in milliseconds poses a significant threat. Legacy systems lack the responsiveness and intelligence required to detect and block fraud in real-time.

Advanced AI models utilizing real-time data streaming, graph-based relational analysis, and anomaly detection are now integrated into payment gateways. These systems analyze transaction context, device fingerprinting, behavioral biometrics, and external data (e.g., IP reputation) instantly. They dynamically update risk scores and can automatically flag or block suspicious activities.

Platforms like Mastercard and Pay.UK have reported detecting over 54% of fraudulent transactions that traditional systems missed. Real-time fraud prevention has slashed chargeback rates by over 40% and increased approval rates for legitimate transactions by up to 15%, striking a better balance between security and user experience.

3. Intelligent Decision Engines for Credit and Loan Approvals

A major bottleneck in credit issuance is the reliance on static, rule-based credit scoring, which excludes millions of potential borrowers due to thin or non-traditional credit files.

AI-driven decision engines, such as those used by Pagaya and Klarna, incorporate alternative data-like utility payments, mobile phone usage, social behavior, and employment patterns-to assess risk more inclusively. These engines continuously learn from outcomes, refining risk models dynamically and eliminating manual intervention from underwriters for many cases.

Financial institutions using AI-based underwriting have seen up to 35% increases in approval rates without elevating default risks. Decision-making times have dropped from days to minutes, significantly enhancing customer satisfaction. In some markets, these engines have helped improve financial inclusion by enabling access to credit for underserved demographics.

Looking to see how AI is powering payment innovation in real-world scenarios? Discover how a private payment solution is transforming financial access in emerging markets.

AI-Driven Innovations Transforming Payments

Emerging Technologies in AI for Payments

Artificial intelligence is revolutionizing the payments industry by introducing advanced technologies that enhance efficiency, security, and user experience. Generative AI, for instance, is being utilized to automate customer support through chatbots and virtual assistants, providing real-time assistance and reducing operational costs. Additionally, computer vision technologies are employed for identity verification processes, enabling secure and swift customer onboarding by analyzing visual data such as facial recognition and document verification.

These AI-driven technologies not only streamline payment processes but also offer personalized experiences to customers. By analyzing transaction histories and user behaviors, AI systems can provide tailored recommendations and detect anomalies that may indicate fraudulent activities. The integration of these emerging technologies signifies a significant shift towards more intelligent and responsive payment systems.

These AI-driven agents can interpret customer intent, sentiment, and context, providing personalized solutions in real-time—paving the way for smoother real-time customer payments and transaction flows in payment environments.

AI’s Role in Sustainability Efforts

AI contributes to sustainability in the payments industry by optimizing resource utilization and reducing waste. Predictive analytics powered by AI can forecast transaction volumes, allowing payment processors to allocate resources efficiently and minimize energy consumption. Furthermore, AI systems can detect and prevent fraudulent transactions, reducing the need for resource-intensive investigations and chargebacks.

By automating routine tasks and enhancing decision-making processes, AI reduces the reliance on paper-based documentation and manual interventions, leading to a decrease in carbon footprint. The adoption of AI in payments not only improves operational efficiency but also aligns with global sustainability goals by promoting eco-friendly practices.

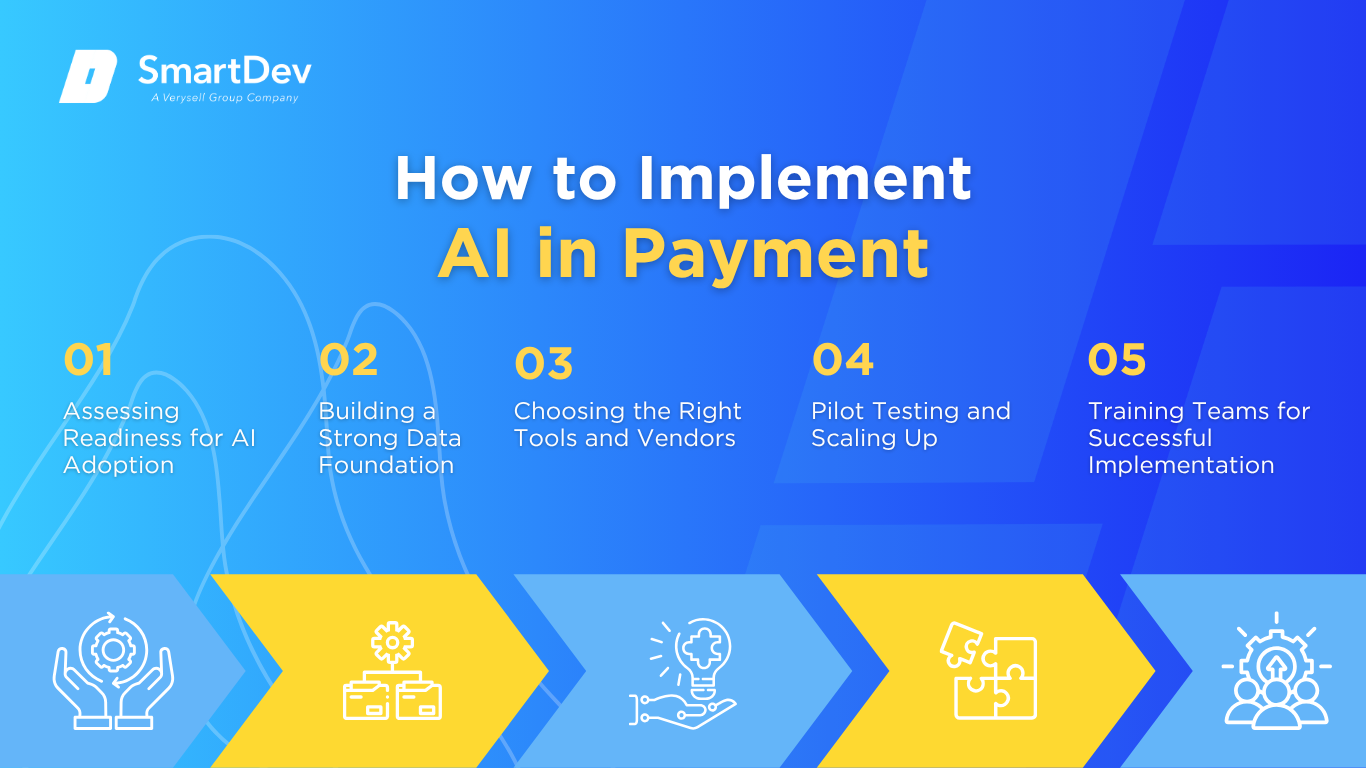

How to Implement AI in Payments

Step 1. Assessing Readiness for AI Adoption

Before integrating AI into payment systems, organizations must evaluate their readiness by identifying areas where AI can add value. This involves analyzing current processes to pinpoint inefficiencies or security vulnerabilities that AI technologies can address. Additionally, assessing the organization’s data infrastructure and ensuring compliance with regulatory standards are crucial steps in preparing for AI adoption.

Engaging stakeholders across departments to understand their needs and concerns can facilitate a smoother transition. By fostering a culture that embraces innovation and continuous learning, organizations can better position themselves to leverage AI technologies effectively.

Step 2. Building a Strong Data Foundation

A robust data foundation is essential for successful AI implementation in payments. This entails collecting high-quality, relevant data and establishing protocols for data cleaning and management. Ensuring data accuracy and consistency enables AI algorithms to generate reliable insights and predictions.

Implementing secure data storage solutions and maintaining compliance with data protection regulations safeguard sensitive information. Establishing clear data governance policies and investing in data management tools can further enhance the integrity and utility of the data used in AI applications.

Step 3. Choosing the Right Tools and Vendors

Selecting appropriate AI tools and vendors is critical to achieving desired outcomes in payment systems. Organizations should evaluate potential solutions based on their compatibility with existing infrastructure, scalability, and the specific needs of the business.

Collaborating with vendors who have a proven track record in the payments industry and offer comprehensive support can facilitate successful AI integration. It’s important to consider factors such as customization capabilities, ease of implementation, and ongoing maintenance when choosing AI solutions.

Step 4. Pilot Testing and Scaling Up

Conducting pilot tests allows organizations to assess the effectiveness of AI applications in a controlled environment. By monitoring performance metrics and gathering feedback, businesses can identify areas for improvement and make necessary adjustments before full-scale deployment.

Once the pilot phase demonstrates positive results, organizations can gradually scale up AI implementations, ensuring that systems are robust and adaptable to increased workloads. Continuous monitoring and iterative improvements help maintain the efficacy of AI applications as they expand across the organization.

Step 5. Training Teams for Successful Implementation

Equipping employees with the necessary skills to work alongside AI technologies is vital for successful implementation. Providing training programs that focus on understanding AI systems, interpreting outputs, and integrating insights into decision-making processes empowers teams to leverage AI effectively.

Encouraging cross-functional collaboration and knowledge sharing fosters an environment where AI-driven innovations can thrive. By investing in employee development, organizations ensure that their workforce is prepared to adapt to the evolving landscape of AI in payments.

Measuring the ROI of AI in Payments

Key Metrics to Track Success

Evaluating the return on investment (ROI) of AI in payments involves analyzing various performance indicators.

Productivity improvements can be measured by the reduction in processing times and the ability to handle higher transaction volumes without compromising accuracy.

Cost savings achieved through automation are reflected in decreased operational expenses, such as reduced labor costs and minimized errors leading to fewer chargebacks.

Additionally, enhanced fraud detection capabilities contribute to financial savings by preventing fraudulent transactions and associated losses.

Case Studies Demonstrating ROI

Mastercard’s integration of AI has significantly enhanced its fraud detection capabilities, safeguarding over 159 billion transactions annually.

The implementation of AI systems has increased fraud detection rates by up to 300% and reduced false declines, thereby improving customer satisfaction and trust.

Similarly, JPMorgan Chase’s investment in AI has streamlined various operations, including payment processing and fraud detection.

The adoption of AI tools has led to a 30% reduction in servicing costs and a 25% increase in customer engagement, demonstrating substantial ROI through improved efficiency and customer experience.

Common Pitfalls and How to Avoid Them

1. Data Quality and Management Issues

One of the primary challenges in AI implementation is ensuring high-quality data. Poor data quality, such as missing or inconsistent data, can lead to unreliable AI outputs.

Organizations must prioritize data integrity by establishing rigorous data management practices, including regular data cleaning and validation processes.

2. Underestimating Change Management

Implementing AI technologies often leads to significant changes in workflows and job roles. Without proactive change management, organizations may face low adoption rates and resistance from employees.

To mitigate this, it’s essential to involve end-users early in the process, communicate clearly and consistently, and provide adequate training and support.

3. Rushing AI Deployment

Deploying AI solutions too quickly without thorough testing can lead to quality compromises and operational disruptions.

It’s critical to balance momentum with comprehensive testing and validation to ensure that AI solutions meet both business and user requirements.

Adopting a phased approach to deployment can help mitigate risks and build stakeholder trust.

4. Lack of Clear Accountability

AI systems can sometimes operate as “black boxes,” making it difficult to understand how decisions are made.

This lack of transparency can lead to challenges in accountability, especially when errors occur.

Organizations should implement explainable AI models and establish clear governance structures to ensure accountability and transparency in AI decision-making processes.

5. Security and Privacy Concerns

AI systems, particularly those handling sensitive payment data, must be designed with robust security measures to prevent data breaches and unauthorized access.

Organizations should adhere to industry standards and regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), and regularly audit their AI systems for vulnerabilities.

Future Trends of AI in Payments

1. Predictions for the Next Decade

The next decade is poised to witness significant advancements in AI applications within the payments industry.

We can anticipate the proliferation of real-time payment systems powered by AI, enabling instantaneous transactions with enhanced security measures.

Furthermore, AI is expected to drive the development of more sophisticated fraud detection mechanisms, leveraging machine learning to adapt to evolving threats dynamically.

The integration of AI with blockchain technology may also emerge, offering decentralized and secure payment solutions.

2. How Businesses Can Stay Ahead of the Curve

To remain competitive, businesses should invest in continuous learning and stay abreast of emerging AI technologies and trends.

Establishing partnerships with fintech innovators and participating in industry forums can provide valuable insights and opportunities for collaboration.

Moreover, adopting a proactive approach to regulatory compliance and ethical considerations in AI deployment ensures sustainable growth.

By prioritizing transparency, fairness, and customer privacy, organizations can build trust and foster long-term success in the AI-driven payments landscape.

Conclusion

Key Takeaways

Artificial intelligence has reshaped the payments landscape by infusing intelligence into every layer of transaction processing.

From fraud detection and customer support to payment authorization and sustainability, AI is not just enhancing but redefining how payment systems operate.

Financial institutions and payment providers leveraging generative AI for customer service are reducing operational costs while maintaining high levels of user satisfaction.

At the same time, computer vision is being adopted for seamless identity verification, reducing onboarding times and boosting security.

AI’s capacity for pattern recognition, real-time decision-making, and predictive analysis makes it a powerhouse for fraud prevention and transaction analysis.

By detecting suspicious behaviors faster and more accurately, companies like Mastercard and JPMorgan Chase are not only reducing losses but also improving customer trust and experience.

Furthermore, AI’s role in optimizing energy usage and reducing waste illustrates that intelligent systems can also align with ESG (Environmental, Social, and Governance) objectives.

In short, AI in payments isn’t just about speed and accuracy—it’s about smarter, safer, and more sustainable financial ecosystems.

Moving Forward: A Path to Progress

If your business operates within the payments ecosystem—whether you’re a fintech startup, a global bank, or a retail enterprise—now is the time to seriously consider integrating AI into your operations.

Begin by evaluating your current pain points and identifying areas where AI can make a tangible impact.

Are manual processes slowing you down? Are fraud incidents rising despite your best efforts? These are red flags that AI can help address.

Start small but think big. Pilot an AI tool in a single department—perhaps fraud analytics or customer service—and use the insights gained to guide broader implementation.

Choose vendors who understand your industry’s nuances and can offer customized, scalable solutions.

And don’t forget your people—empowering your teams with training and involving them early can dramatically improve adoption and effectiveness.

The future of payments is intelligent, and those who act now will lead the next wave of innovation, efficiency, and customer trust.

Embrace AI not just as a tool, but as a strategic driver of your business growth.

—

References:

- How artificial intelligence is transforming payments

- How AI Unlocks Intelligent Payments at Scale | Visa Navigate

- AI In Payments: Opportunities, Challenges And Best Practices

- Use case of artificial intelligence (AI) and machine learning in the payments industry according to senior payment professionals worldwide in 2024

- How AI is Revolutionizing the Payment Industry in 2025

- Revolutionising digital payments with the use of generative AI