Financial institutions face mounting pressure to modernize legacy systems while maintaining continuous operations. Most believe AI integration means months of system downtime and operational chaos. This misconception keeps banks stuck with outdated processes while competitors pull ahead with intelligent automation.

The reality is that modern zero-downtime deployment strategies allow financial services to integrate AI into legacy systems without interrupting a single transaction. Smart banks are already doing this successfully, maintaining operational continuity while transforming their infrastructure.

Leading financial institutions now complete AI integration in 18-36 months using proven methodologies that preserve operational continuity. These institutions report significant improvements in processing speed and reduced manual workload within the first year of implementation.

AI Integration Timeline and Key Insights

AI integration into financial legacy systems typically takes 18-36 months with zero-downtime deployment strategies. Phased implementations using parallel processing and blue-green deployments ensure continuous operations while modernizing critical banking infrastructure, with successful projects achieving near-continuous system availability.

Key timeline breakdown:

- Assessment and planning: 6-8 weeks

- Non-critical system integration: 8-12 weeks

- Core banking enhancement: 16-24 weeks

- Customer-facing deployment: 12-16 weeks

- Full optimization: 4-8 weeks

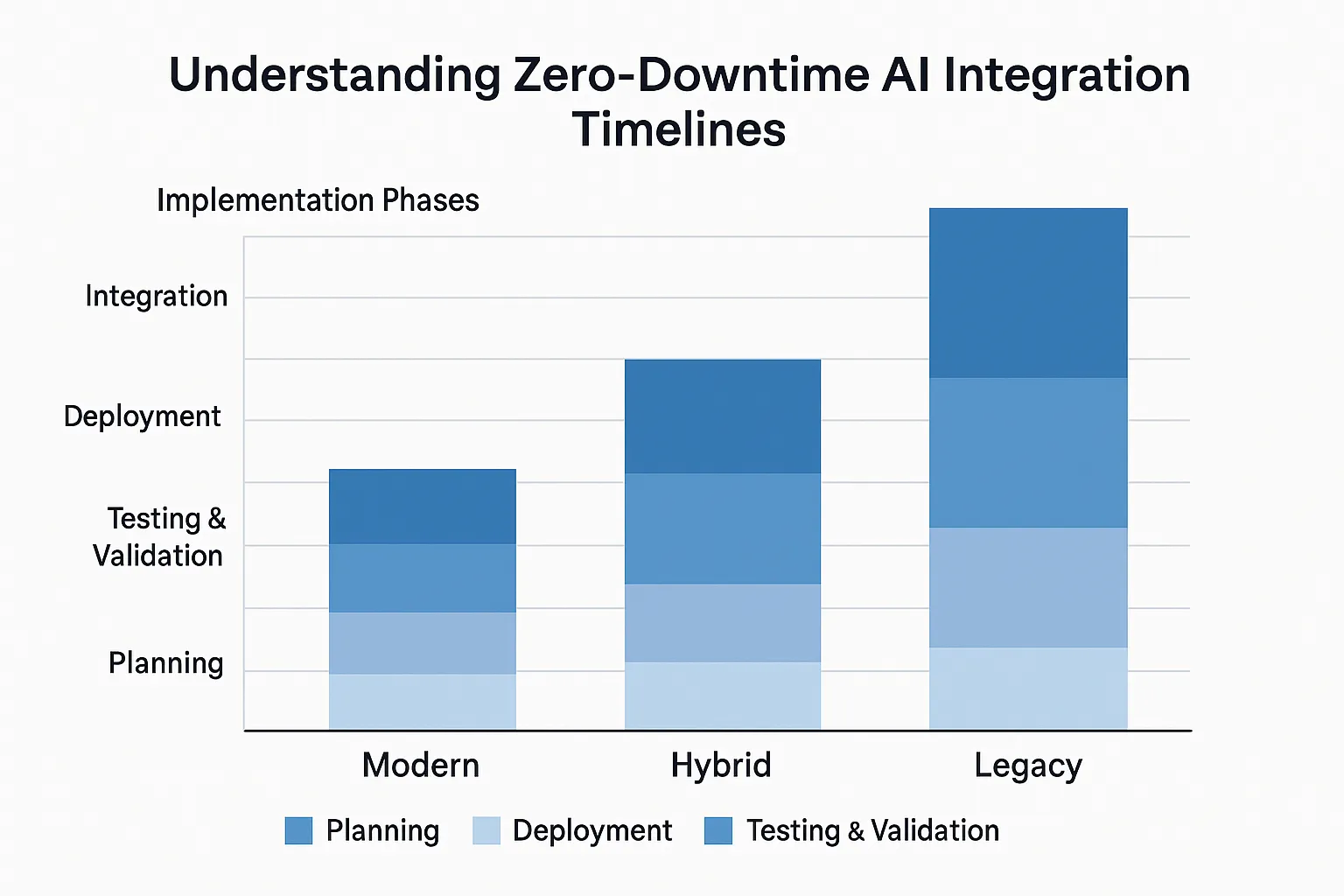

Understanding Zero-Downtime AI Integration Timelines

Financial institutions require 18-36 months for complete AI integration into legacy systems when implementing zero-downtime strategies. The timeline varies significantly based on system complexity, regulatory requirements, and the scope of AI functionality being deployed. Enterprise-grade implementations with comprehensive testing and compliance validation typically fall toward the longer end of this range.

The integration duration depends heavily on your starting point. Banks with modern distributed architectures can move faster than those running mainframe-heavy environments. Organizations with mature data governance deploy AI significantly faster and see higher success rates in digital transformation compared to peers without established practices.

Fig.1 Implementation phases across different system architectures

Legacy system architecture complexity directly impacts integration timelines, with mainframe systems requiring 3-6 additional months compared to modern distributed architectures. Regulatory compliance requirements add 2-4 months to standard timelines as financial institutions must demonstrate AI model explainability and data governance throughout the integration process.

According to SmartDev’s CEO, Alistair Copeland: “Implementing AI in tightly-regulated, legacy-heavy financial institutions is not a sprint. A phased, controlled implementation—frequently taking 18 to 36 months—is essential to ensure zero-downtime and regulatory alignment.”

Industry benchmarks show that modern phased integration approaches deliver faster deployment compared to older waterfall models, with fewer post-release issues and higher average system uptime during integration phases.

Pre-Integration Assessment and Planning Phase: Setting the Foundation (Weeks 1-8)

Comprehensive legacy system audits require 6-8 weeks to map data flows, identify integration points, and assess technical debt that could impact AI deployment.

Financial institutions must catalog existing APIs, database schemas, and security protocols to design compatible AI integration pathways. System dependency mapping reveals critical interconnections that determine the safest points for AI component insertion without service disruption.

This assessment phase consumes 20-30% of total project duration in typical financial services environments. The thoroughness of this initial analysis directly correlates with later success rates and timeline adherence.

Key Assessment Activities:

- System architecture mapping

- Data quality evaluation

- Regulatory compliance review

- Risk assessment and mitigation planning

- Team readiness evaluation

Risk assessment becomes particularly critical for zero-downtime requirements. Financial services risk assessments must address regulatory compliance, data security, and operational continuity with documented contingency plans. Smart deployment strategies include parallel processing environments that allow real-time validation before switching production traffic to AI-enhanced systems.

Regulatory documentation and compliance frameworks typically add 3-4 weeks to project planning phases in leading financial institutions. Compliance teams must establish audit trails that demonstrate AI decision-making transparency throughout the integration lifecycle.

Research shows that enterprises with mature data governance see substantially higher success rates in digital transformation compared to peers without mature practices.

Technical Implementation Strategies for Zero Downtime

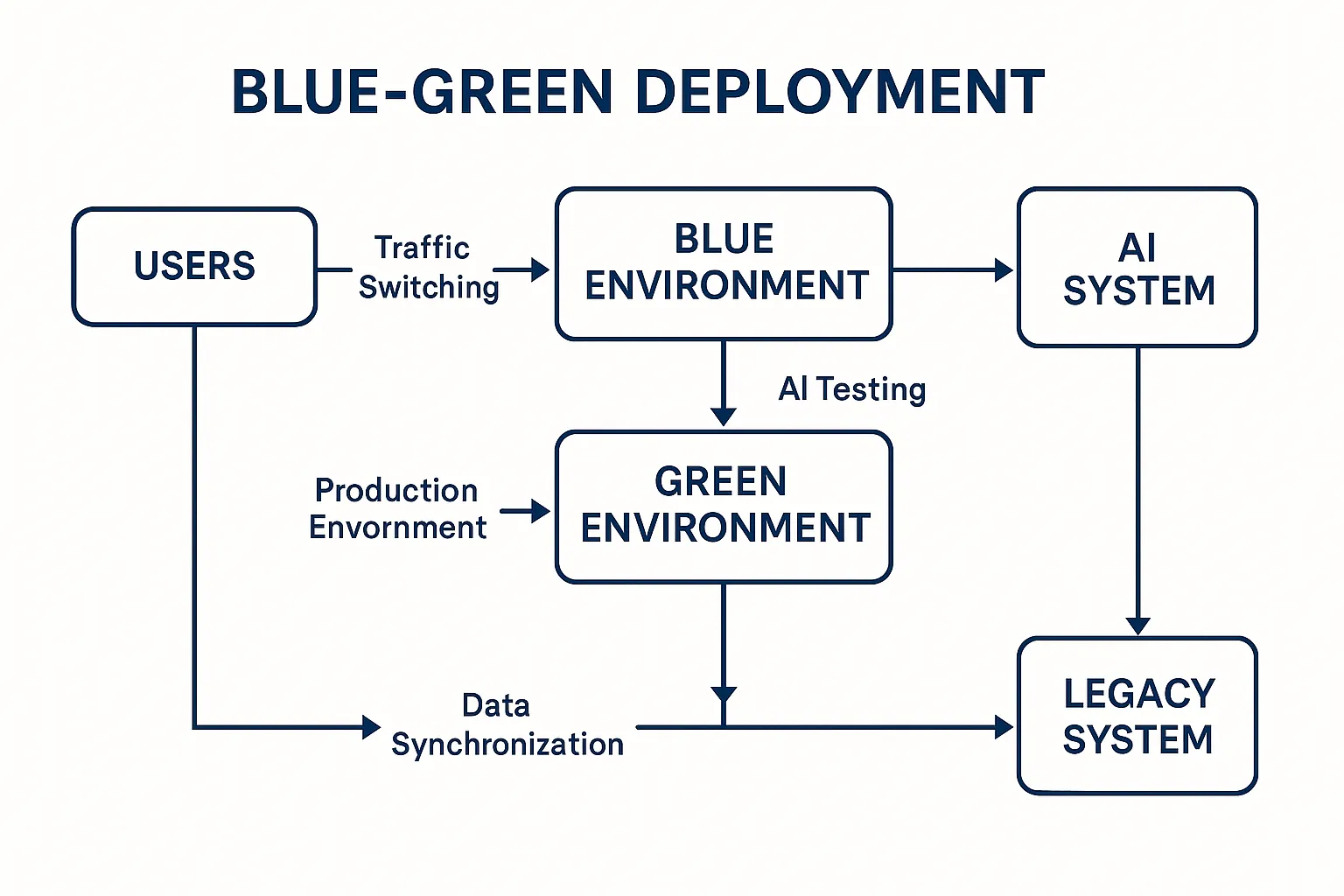

Blue-green deployment methodology enables financial institutions to maintain two identical production environments with seamless traffic switching capabilities. This approach allows complete AI system testing in the green environment while the blue environment continues serving live traffic without interruption. Switch-over processes typically complete in under 60 seconds, ensuring virtually zero customer impact during AI system activation.

The beauty of blue-green deployments lies in their simplicity and safety. You’re essentially running two production environments in parallel, which means you can test everything thoroughly before making the switch. If something goes wrong, you just flip back to the original environment.

Zero-Downtime Deployment Strategies:

- Blue-green deployments for instant environment switching

- Microservices architecture for granular component updates

- API gateways for intelligent traffic routing

- Real-time data synchronization for consistency maintenance

- Container-based deployments for rapid scaling and rollback

Microservices architecture facilitates granular AI component integration without affecting entire system stability or requiring comprehensive downtime windows. API gateways provide intelligent traffic routing that enables gradual AI feature rollouts to specific customer segments while monitoring performance impacts.

Real-time data synchronization between legacy databases and AI-enhanced systems requires sophisticated replication strategies that maintain data consistency without service interruption. Database sharding and read-replica configurations allow AI model training and inference operations without impacting production transaction processing.

Fig.2 Blue-green deployment setup with legacy system integration points

Container-based deployments provide the rapid scaling and rollback capabilities essential for maintaining service continuity during integration phases. According to SmartDev’s internal data, microservices-based integrations deliver faster project completion and reduced manual QA effort, supported by containerized deployments and automated validation pipelines.

Implementation Phases and Timeline Breakdown

Phase 1: Non-Critical System Integration – Building Confidence (Weeks 9-16)

Initial AI integration focuses on non-critical systems such as reporting, analytics, and customer service chatbots to validate deployment processes without operational risk. This phase establishes integration patterns, tests monitoring systems, and trains operational teams on AI system management procedures.

Success metrics include system stability validation and team readiness assessment before proceeding to mission-critical components.

Starting with non-critical systems makes sense from both risk and learning perspectives. You get to iron out any kinks in your deployment process without affecting core business operations.

Phase 1 deliverables:

- AI-powered analytics dashboards

- Customer service chatbots

- Automated reporting systems

- Team training and process validation

- Integration pattern establishment

Phase 2: Core Banking System Enhancement – The Critical Phase (Weeks 17-32)

Core banking system integration represents the most complex phase, requiring careful coordination between AI components and critical financial processing operations. Transaction processing systems receive AI enhancement through parallel processing validation that ensures accuracy while maintaining existing operational workflows.

This phase typically takes 16-24 weeks due to added complexity and validation requirements. Real-time monitoring systems track performance metrics and trigger automated rollback procedures if predetermined thresholds are exceeded.

The stakes are highest during core system integration. You’re touching the systems that actually move money around, so there’s zero tolerance for errors or downtime.

Phase 3: Customer-Facing Application Deployment – User Experience Focus (Weeks 33-48)

Customer-facing AI features including fraud detection, personalization engines, and automated decision-making systems require extensive user acceptance testing and gradual rollout strategies.

According to SmartDev’s project data, customer-facing AI deployments take an average of 12-16 weeks for complete implementation.

A/B testing frameworks allow controlled feature deployment to customer segments while measuring satisfaction and performance impacts. Complete customer-facing integration includes mobile applications, web platforms, and automated communication systems with seamless user experience maintenance.

Phase 4: Full System Optimization and Monitoring – Performance Tuning (Weeks 49-52)

Full integration and optimization phases focus on system optimization, performance tuning, and comprehensive monitoring implementation across all AI-enhanced components. Machine learning model performance monitoring ensures continued accuracy and triggers retraining procedures when prediction quality degrades.

Complete integration validation includes stress testing, disaster recovery verification, and regulatory compliance confirmation. This final phase ensures your AI systems can handle real-world loads and unexpected scenarios.

Ready to modernize your legacy systems with AI—without disrupting operations?

Discover how financial institutions are integrating AI into decades-old infrastructure while keeping mission-critical systems running 24/7.

Compare realistic timelines, integration pathways, and zero-downtime deployment strategies used by banks, insurers, and fintechs to accelerate transformation safely.

Explore the Zero-Downtime Integration TimelineCommon Challenges and Mitigation Strategies

Legacy financial systems often contain inconsistent data formats, missing values, and outdated information that can significantly impact AI model performance and integration timelines. Data cleansing and normalization processes require dedicated resources and can extend project timelines by 25-40% if not properly planned during initial assessment phases.

Data quality issues represent the biggest surprise for many financial institutions. You think your data is clean until you start feeding it to AI models, then suddenly all the inconsistencies become painfully obvious.

Major Challenge Areas:

- Data quality and consistency issues

- Legacy system compatibility limitations

- Regulatory compliance complexity

- Skills and expertise gaps

- Change management resistance

Mainframe systems and older database technologies may lack modern API capabilities required for seamless AI integration, necessitating middleware development or system modernization efforts. Compatibility issues often require custom integration layer development that adds 2-4 months to standard implementation timelines but ensures stable operation without system replacement.

Financial services regulations demand extensive documentation, model explainability, and audit trail maintenance that can complicate AI integration processes and extend validation timelines. Compliance validation phases require dedicated legal and risk management resources to ensure all AI decision-making processes meet regulatory transparency requirements.

Fig.3 Common challenges and corresponding solutions

Technology Stack and Tools for Seamless Integration

Modern AI development platforms including TensorFlow Enterprise, Microsoft Azure Machine Learning, and AWS SageMaker provide enterprise-grade tools specifically designed for financial services integration requirements.

These platforms offer built-in compliance features, model versioning, and deployment automation capabilities that significantly reduce integration complexity and timeline risks.

Over 90% of organizations worldwide adopted cloud technologies by 2023, with leading platforms each offering financial-grade compliance features. SmartDev uses industry-leading AI frameworks combined with custom development expertise to ensure optimal technology selection for each client’s specific legacy system requirements.

Essential Technology Components:

- Enterprise AI platforms (TensorFlow Enterprise, Azure ML, AWS SageMaker)

- API management gateways for system integration

- Container orchestration (Kubernetes, Docker)

- Monitoring and observability tools

- Data pipeline automation platforms

Enterprise service buses and API management platforms provide essential translation layers between legacy financial systems and modern AI services without requiring core system modifications. Middleware solutions handle data transformation, protocol translation, and traffic routing while maintaining security and audit requirements throughout the integration process.

Modern API gateways provide real-time monitoring, rate limiting, and failover capabilities essential for maintaining system stability during AI integration phases. Containerized microservices and enterprise API gateways are widely used by leading fintechs for rapid, secure deployment cycles.

Comprehensive monitoring solutions including application performance monitoring (APM), log aggregation, and real-time alerting systems ensure immediate detection of integration issues before they impact customer services. Observability platforms provide detailed insights into AI model performance, system resource utilization, and transaction processing metrics across all integrated components.

Cost Factors and Budget Planning

AI integration projects for financial services range from hundreds of thousands to several million dollars depending on system complexity, compliance requirements, and integration scope across multiple platforms. Development costs include AI model creation, integration layer development, testing infrastructure, and specialized talent acquisition for financial services expertise.

The wide cost range reflects the massive variation in project scope and complexity. A simple chatbot integration sits at the lower end, while comprehensive core banking AI transformation requires the full investment.

Major Cost Components:

- Development and integration (60-70% of total)

- Infrastructure and cloud services (15-20%)

- Compliance and testing (10-15%)

- Training and change management (5-10%)

According to SmartDev’s internal analysis, AI-powered development methodology reduces overall costs by 20-30% through automated testing, accelerated development cycles, and experienced team efficiency. This cost reduction comes from using AI tools throughout the development process, not just in the final product.

Cloud infrastructure costs for AI integration average tens of thousands to hundreds of thousands annually depending on data processing volumes, model complexity, and redundancy requirements for zero-downtime operations. Technology licensing includes AI platform subscriptions, monitoring tools, and security solutions specifically designed for financial services regulatory compliance.

Post-implementation support requires dedicated teams for model monitoring, system maintenance, and continuous improvement initiatives that typically cost 15-25% of initial development investment annually. Maintenance expenses include model retraining, security updates, regulatory compliance monitoring, and performance optimization as business requirements change.

Measuring Success and ROI

Successful AI integration in financial services demonstrates measurable improvements in processing efficiency, accuracy, and customer experience.

According to SmartDev’s client data, performance improvements include significant reductions in processing times and manual review requirements. Performance metrics include system availability (targeting 99.9%+), customer satisfaction scores, and operational efficiency gains across integrated business processes.

These aren’t just theoretical benefits. Real financial institutions are seeing these improvements in production environments. The key is having proper measurement frameworks in place from day one.

Key Success Metrics:

- System availability and uptime

- Processing speed improvements

- Cost reduction achievements

- Customer satisfaction scores

- Regulatory compliance maintenance

- ROI timelines and value realization

Financial institutions typically achieve ROI within 18-36 months through operational cost reductions, improved customer experience, and enhanced decision-making capabilities enabled by AI integration. Cost savings include reduced manual processing, faster transaction clearing, improved fraud detection, and enhanced customer service automation that directly impact bottom-line performance.

Fig.4 Typical value realization phases over 3-year period

AI-enhanced financial systems provide competitive advantages through personalized customer experiences, real-time risk assessment, and automated compliance monitoring that drive customer retention and acquisition. Long-term value includes improved regulatory compliance, better data insights for strategic decision-making, and scalable technology infrastructure supporting future innovation initiatives.

Choosing the Right Implementation Partner

AI integration success requires partners with proven financial services experience, regulatory compliance expertise, and demonstrated zero-downtime deployment capabilities across complex legacy environments. Qualified partners maintain relevant certifications including ISO/IEC 27001, SOC 2 Type II, and industry-specific compliance credentials that ensure security and regulatory adherence.

The partner selection process can make or break your AI integration project. You need someone who understands both the technical challenges and the regulatory requirements specific to financial services.

Partner Selection Criteria:

- Financial services domain expertise

- Zero-downtime deployment experience

- Regulatory compliance capabilities

- Technical certification and skills

- Long-term support commitment

Technical expertise must include both legacy system integration and modern AI development with documented success in similar financial services transformation projects. SmartDev’s team consists of AI-certified developers with specialized financial services experience and proven track records in zero-downtime deployments.

SmartDev combines Swiss quality standards with AI-powered development efficiency, delivering faster integration timelines while maintaining high system availability for financial services clients. Their certified AI practitioners follow structured methodologies that include comprehensive risk assessment, phased deployment strategies, and continuous monitoring throughout integration lifecycles.

Successful AI integration partnerships require clear communication protocols, defined success metrics, and collaborative project management approaches that align technical implementation with business objectives. Partner selection should prioritize organizations with dedicated financial services expertise, comprehensive support capabilities, and long-term relationship commitment beyond initial implementation phases.

Conclusion: Your Path to Successful AI Integration

The timeline for integrating AI into legacy financial systems with zero downtime is achievable within 18-36 months using proven methodologies. Success depends on thorough planning, the right technical approach, and experienced partners who understand both AI development and financial services requirements.

The key is starting with a comprehensive assessment, implementing in carefully planned phases, and maintaining focus on operational continuity throughout the process. While the journey requires significant investment and careful planning, the competitive advantages and operational improvements make it essential for modern financial institutions.

Ready to start your zero-downtime AI integration journey? Contact SmartDev’s AI specialists to discuss your specific requirements and timeline goals.