As dawn breaks over the digital realm of finance, conversational AI stands as a beacon of innovation, transforming the mundane into the extraordinary. This cutting-edge technology weaves artificial intelligence into the fabric of financial interactions, allowing seamless conversations between machines and humans that were once the domain of science fiction. Through natural language processing, conversational AI interprets and responds to human queries with an accuracy and understanding that mimics human cognition but with the tireless precision of a machine. The implications for the financial sector are profound. Traditionally, customer support within banks and financial institutions was bound by the constraints of human labor—limited hours of operation and the inevitable fatigue that comes with repetitive tasks. But with the advent of conversational AI, these boundaries are being dismantled. Virtual assistants and chatbots now provide 24/7 support, handling everything from simple account inquiries to complex financial advisories, all without a break, a holiday, or a drop in service quality.

Fraud detection, a critical concern for customers and financial institutions, has also been revolutionized by conversational AI. By continuously learning and adapting, AI systems analyze vast arrays of transactions in real-time, identifying patterns and anomalies that may elude even the most vigilant human eyes. This capability enhances security and fortifies trust, enabling a proactive stance against fraud that protects customers’ assets and institutions’ reputations before potential threats escalate. Thus, conversational AI stands at the forefront of digital transformation in the financial sector, not merely as a tool of interaction but as a cornerstone of modern financial services that enhances customer support and fortifies fraud detection systems. This dual focus is about keeping pace with technological advancements and setting new standards for customer engagement and financial security. As we delve deeper into conversational AI’s capabilities and real-world applications, we uncover its pivotal role in driving the future of finance toward unprecedented efficiency and safety.

1. The Role of Conversational AI in Customer Support

As digital architects weave artificial intelligence into the fabric of customer interactions, the financial sector witnesses a seismic shift. Conversational AI tools, including chatbots and virtual assistants, are at the forefront of this revolution. Harnessing advanced natural language processing and machine learning, these tools are not just programmed to respond but to understand and anticipate. This leap in technology transforms mere transactions into engaging dialogues, offering customers a semblance of human interaction that is both immediate and insightful.

1.1 Benefits of Conversational AI in Customer Support

24/7 Availability The night never interrupts service in the digital domain of finance. With conversational AI, support is ceaseless, providing answers and assistance whenever needed. This relentless availability ensures that no query goes unanswered, delivering a level of service that traditional, time-bound support models could never sustain

Scalability As customer bases grow and interaction volumes surge, conversational AI scales with a grace unmatched by human capabilities. Tools like those from Rasa excel in managing thousands of conversations simultaneously, ensuring every customer interaction is handled with uniform diligence, regardless of the hour or query volume

Personalization Beyond functionality, conversational AI excels in personalization. These systems analyze historical data and preferences to craft responses that are not only relevant but also uniquely tailored to each customer. This bespoke approach deepens customer engagement, turning routine transactions into personalized banking experiences.

1.2 Case Study: Bank of America’s Erica

Figure 1: Bank of America’s virtual financial assistant – Erica

Bank of America’s Erica is a testament to conversational AI’s power in the bustling world of digital finance, where numbers never sleep, and transactions flicker across the globe in milliseconds. Since its inception in 2018, Erica has been an assistant and a digital confidante to over 42 million clients, revolutionizing how they interact with their finances. Erica’s journey is a story of exponential growth and enduring client trust. It has facilitated over 2 billion interactions in six years, with daily engagements soaring to 2 million. This isn’t just about numbers—the countless financial decisions made more straightforward, the myriad questions answered promptly, and the personalized experience delivered seamlessly across various platforms, including Merrill and Benefits OnLine. Erica’s intelligence is not static; it evolves. Each interaction is a brushstroke on the canvas of its growing capabilities. Today, Erica offers more than 1.2 billion personalized insights, guiding clients through the intricacies of their financial landscapes. From managing over 2.6 million recurring subscriptions monthly to providing crucial updates on spending behaviors and account activities, Erica ensures that no financial query goes unaddressed. It’s not just about providing data but about offering a clearer understanding of personal finance that empowers clients to make informed decisions.

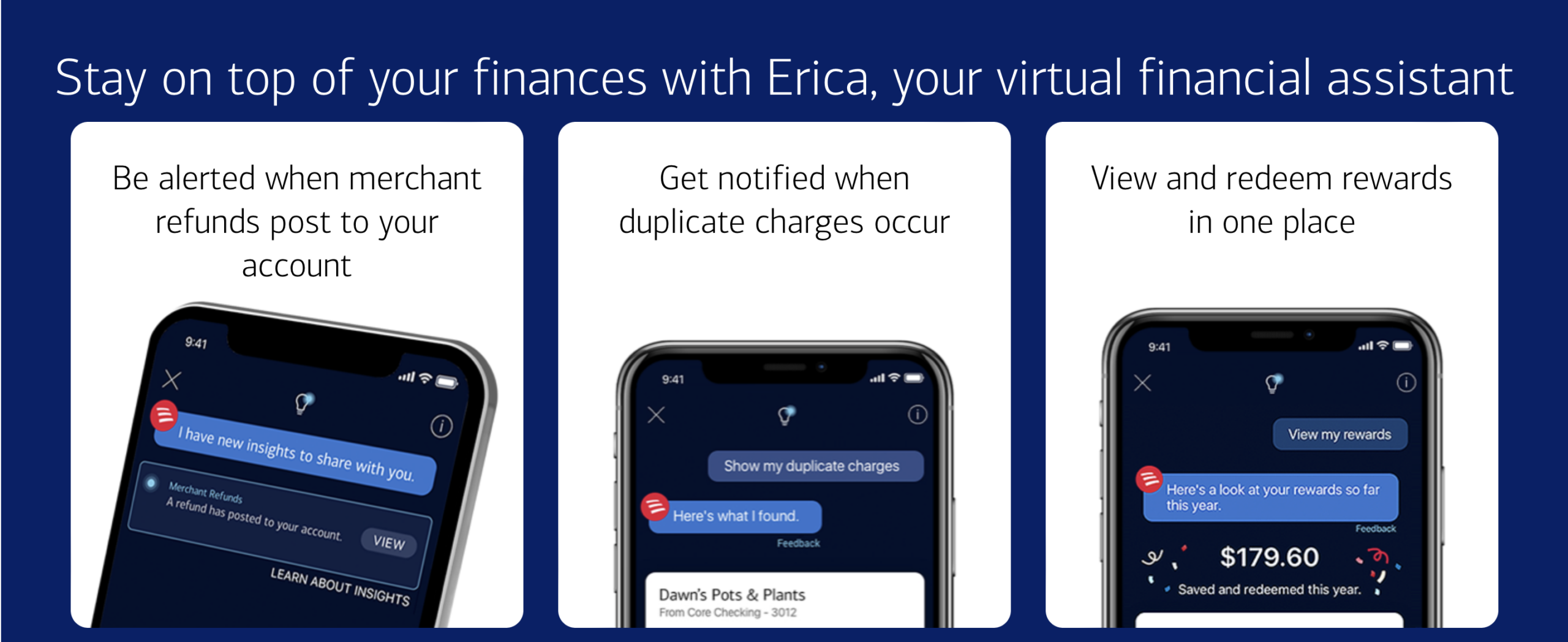

Figure 2: Erica’s functions

Erica’s efficiency is unparalleled—more than 98% of inquiries are resolved within an astonishing average of 44 seconds. This swift responsiveness underscores Erica’s role as a tool and a pivotal element in enhancing client satisfaction and operational efficiency within Bank of America. Through Erica, Bank of America not only demonstrates the capabilities of conversational AI in transforming customer support but also sets a benchmark for the future of financial interactions—where technology meets empathy, understanding, and client-centric innovation.

Figure 3: Erica’s achievements over the years

2. Conversational AI in Fraud Detection

Conversational AI serves as a vigilant guardian in the digital fortress of finance, where every transaction could be a potential breach. Leveraging sophisticated machine learning algorithms, these AI systems excel in predictive analytics and anomaly detection, which are crucial technologies for detecting irregular patterns that might indicate fraudulent activity. By continuously learning and adapting, conversational AI refines its ability to sift through mountains of data, isolating instances that deviate from the norm and warrant further investigation.

2.1 Advantages of AI in Detecting Fraud

Real-time Detection: In the fast-paced world of financial transactions, timing is everything. Conversational AI operates on the front lines, offering real-time fraud detection that significantly enhances security measures. This immediate response capability ensures that potential threats are identified and addressed as transactions occur, safeguarding customer assets and institutional integrity.

Pattern Recognition: Conversational AI’s strength in fraud detection lies in its unparalleled ability to analyze vast datasets quickly and efficiently. This capability allows for superior recognition of fraud patterns, a task too voluminous and complex for human analysts alone. By reducing the rate of false positives, conversational AI improves the accuracy of fraud detection and enhances the overall efficiency of financial operations, allowing genuine transactions to proceed unhindered.

2.2 Case Study: JPMorgan Chase’s COIN

JPMorgan Chase’s COIN (Contract Intelligence) platform exemplifies the transformative power of artificial intelligence in the financial sector, particularly in automating complex and labor-intensive tasks like legal document review. Here’s a detailed look at how COIN has reshaped operations at one of the world’s leading financial institutions.

Figure 4: JPMorgan Chase’s COIN

COIN has been a game-changer in commercial credit agreements, automating the review of 12,000 documents. This automation has replaced what would have required 360,000 hours of manual labor, showcasing a remarkable leap in efficiency and precision. By reducing the human workload, COIN allows employees to focus on more strategic tasks, optimizing labor resources and minimizing human error.JPMorgan Chase’s commitment to leading the digital transformation in banking is evident in its substantial investment in technology. A significant portion of its $9.6 billion technology budget has been allocated toward automation technologies, including developing and enhancing the COIN platform. This investment reflects the bank’s strategy to stay ahead in the competitive financial services field by leveraging cutting-edge technology to streamline operations and improve service delivery.

In a related initiative, JPM Coin, which facilitates real-time international payments for JPMorgan’s corporate clients, handles approximately $1 billion in daily transactions. This initiative underscores the potential of blockchain and AI technologies to manage large transaction volumes efficiently and securely. The operational benefits of COIN extend beyond just efficiency. The platform has significantly reduced the number of loan-servicing errors, underscoring its effectiveness in speeding up processes and enhancing their accuracy. These improvements have profoundly impacted the bank’s operational capabilities, driving better outcomes for clients and reducing risks associated with manual errors.

These figures highlight the substantial impact of COIN on JPMorgan Chase’s operations and demonstrate the broader potential of AI to revolutionize financial services. COIN’s success story is a robust model for other financial institutions aiming to harness AI’s benefits for complex document management and transaction processing.

3. Challenges and Ethical Considerations

3.1 Integration Challenges

Integrating AI into the storied corridors of financial institutions is no small feat. As these systems weave through the complex tapestry of existing IT infrastructure, they encounter many technical challenges. One of the primary hurdles is the seamless integration of AI with legacy systems not originally designed to support modern AI functionalities. This process often requires substantial upgrades or even complete overhauls of existing systems, demanding significant investments of time and resources.

Moreover, the successful deployment of AI depends heavily on the staff who operate these systems daily. The training required to bring employees up to speed with new AI technologies involves understanding the technical aspects and adapting to a new paradigm where decision-making is shared with automated systems. This transition can be daunting and is often met with resistance from personnel accustomed to traditional processes.

3.2 Ethical Considerations

The ethical landscape of AI in finance is complex and fraught with challenges. Paramount among these is the issue of data privacy. Financial institutions handle vast amounts of sensitive personal and corporate data, and the deployment of AI systems raises critical questions about the security and confidentiality of this data. Ensuring that AI systems adhere to stringent data protection regulations is essential to maintaining customer trust and compliance with global standards.

Another significant ethical concern is the risk of bias in AI algorithms. These systems are only as unbiased as the data they are trained on, which can often reflect historical prejudices. If not carefully managed, AI systems can perpetuate or even exacerbate these biases, leading to unfair treatment of individuals or groups. This poses a risk to those affected, can damage the institution’s reputation, and can lead to regulatory repercussions.

Lastly, the implications of AI on employment within the financial sector must be considered. While AI can enhance efficiency and reduce costs, it also brings the potential for significant job displacement. Managing this transition responsibly involves retraining employees to take on new roles that complement AI capabilities rather than simply replacing human jobs with machines. This approach helps mitigate the impact on employment and leverages the unique strengths of both human and artificial intelligence. Financial institutions must balance leveraging AI’s benefits and addressing its ethical and integration challenges in navigating them. This requires a thoughtful approach considering the technological and business impacts and the broader societal consequences.

4. Future Prospects

4.1 Advancements in AI Technology

As we stand on the cusp of a new era in financial services, the trajectory of AI technology points toward unprecedented advancements that promise to redefine the industry. Emerging AI capabilities are expected to enhance analytical precision, expand automation, and deepen learning algorithms, allowing financial institutions to predict customer behaviors more accurately and automate complex decision-making processes.

One of the most anticipated advancements is the integration of quantum computing with AI, which could dramatically speed up data processing and enhance security encryption. This leap would streamline operations and fortify defenses against cyber threats, a critical advantage in the digital age. Additionally, the evolution of AI is likely to see increased adoption of federated learning models. These models enable AI systems to learn from vast datasets without compromising the privacy of the data, aligning with global standards for data protection. This method boosts the AI’s learning capabilities and ensures the systems comply with stringent privacy regulations.

4.2 Predictions for Industry Impact

AI is set to alter the financial sector’s landscape dramatically. Regarding customer interactions, AI will likely lead to more personalized and engaging experiences. Through sophisticated data analysis, financial institutions can offer tailored advice and predict customer needs before they arise, enhancing customer satisfaction and loyalty. On the security front, AI’s ability to continuously learn and adapt will play a crucial role in the ongoing battle against financial fraud. Real-time detection and response systems will become more adept at identifying and mitigating threats, safeguarding the institution’s assets and customers’ trust.

Moreover, AI’s impact on the industry’s workforce cannot be underestimated. As AI takes on more routine and transactional tasks, the role of human employees will shift towards more strategic and interpersonal activities, requiring a re-skilling of the workforce that emphasizes cognitive and emotional intelligence. In conclusion, the future of AI in financial services is not just about technological evolution; it’s about a transformative shift that will redefine how institutions operate, interact with customers, and secure their operations. As these technologies become more integrated into everyday financial activities, they promise to deliver a more efficient, secure, and customer-centric banking experience.

5. Overview

Reflecting on the journey of conversational AI within the financial sector reveals that this technology has significantly transformed the landscape. The introduction of conversational AI has brought remarkable benefits to customer support—its 24/7 availability ensures that service is consistently accessible, its scalability allows institutions to manage growing volumes of customer interactions efficiently, and its capacity for personalization transforms routine exchanges into uniquely tailored customer experiences. Yet, the integration of AI is accompanied by formidable challenges. Technical obstacles in blending AI with existing systems, extensive staff training requirements, and ethical concerns regarding data privacy and algorithmic bias present hurdles that need meticulous attention. Moreover, the implications of AI on employment within the sector highlight the need for strategic management to balance efficiency gains with workforce dynamics.

Looking ahead, AI’s transformative potential in reshaping financial services is profound. Advanced AI technologies can significantly enhance operational efficiency and security while deepening customer relationships through more personalized and predictive services. As AI continues to evolve, it is poised to drive innovation, redefine business models, and reshape customer interactions in the financial sector. In this evolving scenario, conversational AI symbolizes potential and reflects the ongoing innovation in financial technology. Financial institutions that harness AI’s capabilities are setting the stage for a future where financial services are more efficient and secure but also more attuned to the needs of each customer. The path to integrating AI into finance is fraught with complexities. Yet, the potential rewards promise a new era of digital financial services that are as secure as they are customer-centric.

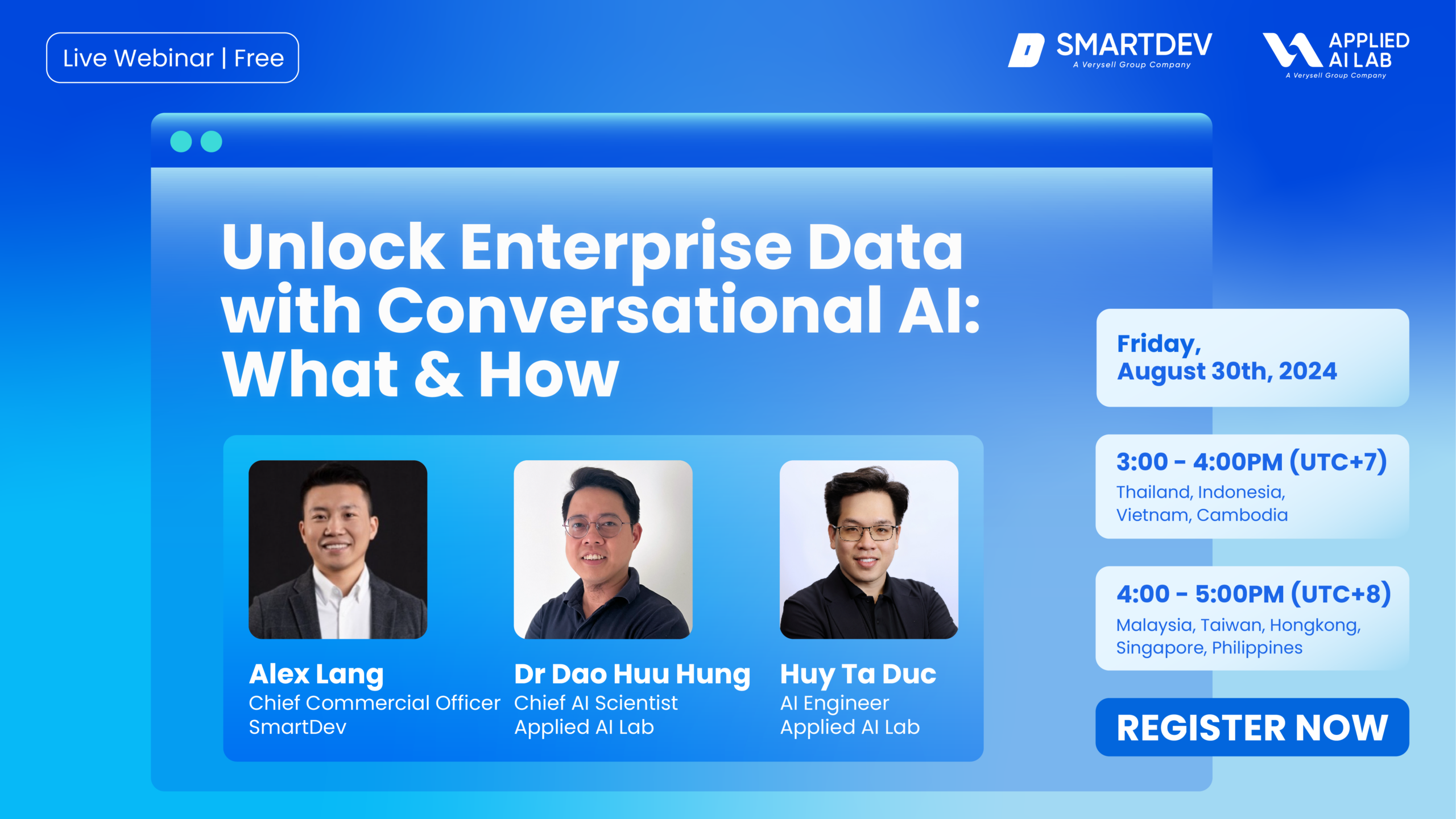

6. Join SmartDev’s Upcoming Webinar about Conversational AI

Join us for our insightful upcoming webinar, “Unlock Enterprise Data with Conversational AI: What & How,” on August 30th. This session will delve into the depths of conversational AI, spotlighting emerging trends, significant technological breakthroughs, and strategic implementations across diverse industries. This webinar is essential for any business aiming to fully leverage data chat technologies to excel in the contemporary digital landscape.

Figure 5: Join Us for Our Upcoming Webinar – Unlock Enterprise Data with Conversational AI: What & How

We are excited to feature a panel of seasoned experts, including:

🔹Alex Lang, Chief Commercial Officer at SmartDev, brings a wealth of commercial strategy and business development experience.

🔹Dr. Dao Huu Hung, Chief AI Scientist at the Applied AI Lab, is known for pioneering artificial intelligence work.

🔹Huy Ta Duc, AI Engineer at the Applied AI Lab, specializes in developing advanced AI applications.

REGISTER NOW! Don’t miss this opportunity to gain insights from leading experts and understand how conversational AI can transform your business operations.

Explore Past Webinars

Interested in more? Explore a rich repository of knowledge in our PAST WEBINARS, where industry experts discuss various aspects of technology and innovation, providing a wealth of information to enhance your understanding and application of advanced technological solutions.