Quick Introduction

Private equity (PE) firms operate in a high-pressure environment where speed, accuracy, and insight directly influence returns. Success depends on identifying the right opportunities, optimizing portfolio performance, and executing timely exits. Artificial Intelligence (AI) is now reshaping how firms achieve these goals—automating research, uncovering hidden investment patterns, and enhancing due diligence.

This guide explores AI use cases in private equity, showing how the technology turns data into competitive advantage.

What Is AI and Why Does It Matter in Private Equity?

Definition of AI and Its Core Technologies

Definition of AI and Its Core Technologies

Artificial Intelligence (AI) refers to systems that mimic human cognitive functions—learning, reasoning, problem-solving, and decision-making—through technologies like machine learning (ML), natural language processing (NLP), and computer vision. These systems excel at analyzing vast, complex datasets and finding patterns humans might miss.

In private equity, AI applies these capabilities to deal sourcing, valuation, due diligence, risk assessment, and operational improvement. It enables firms to process millions of data points—from financial statements and market trends to news sentiment and social media signals—far faster than traditional methods.

Want to explore how AI can transform your sector? Discover real-world strategies for deploying smart technologies in your systems. Visit How to Integrate AI into Your Business in 2025 to get started today and unlock the full potential of AI for your business!

The Growing Role of AI in Transforming Private Equity

AI is redefining competitive advantage in PE by compressing research timelines and increasing decision precision. Firms now use AI to screen thousands of potential deals, ranking them based on historical performance patterns, sector growth rates, and leadership signals.

AI-driven predictive analytics can assess the likelihood of portfolio company growth or distress, enabling firms to allocate resources more strategically during the holding period. By integrating operational data, AI identifies efficiency gains in areas like pricing, supply chain management, or customer retention.

On the exit side, AI tools analyze market cycles and buyer behavior to pinpoint optimal sale timing, often uncovering windows of opportunity that would be missed using conventional models.

Key Statistics or Trends in AI Adoption in Private Equity

A Deloitte 2024 survey found that 65% of private equity executives are either piloting or fully implementing AI in investment decision-making, citing improved deal sourcing efficiency as the top benefit.

McKinsey estimates that AI could improve deal origination productivity by up to 30%, freeing partners and analysts to focus on strategic negotiations rather than manual data collection.

The global market for AI in financial services, which includes PE, is projected to exceed $100 billion by 2032, growing at over 25% CAGR—driven by demand for advanced analytics, automation, and predictive modeling.

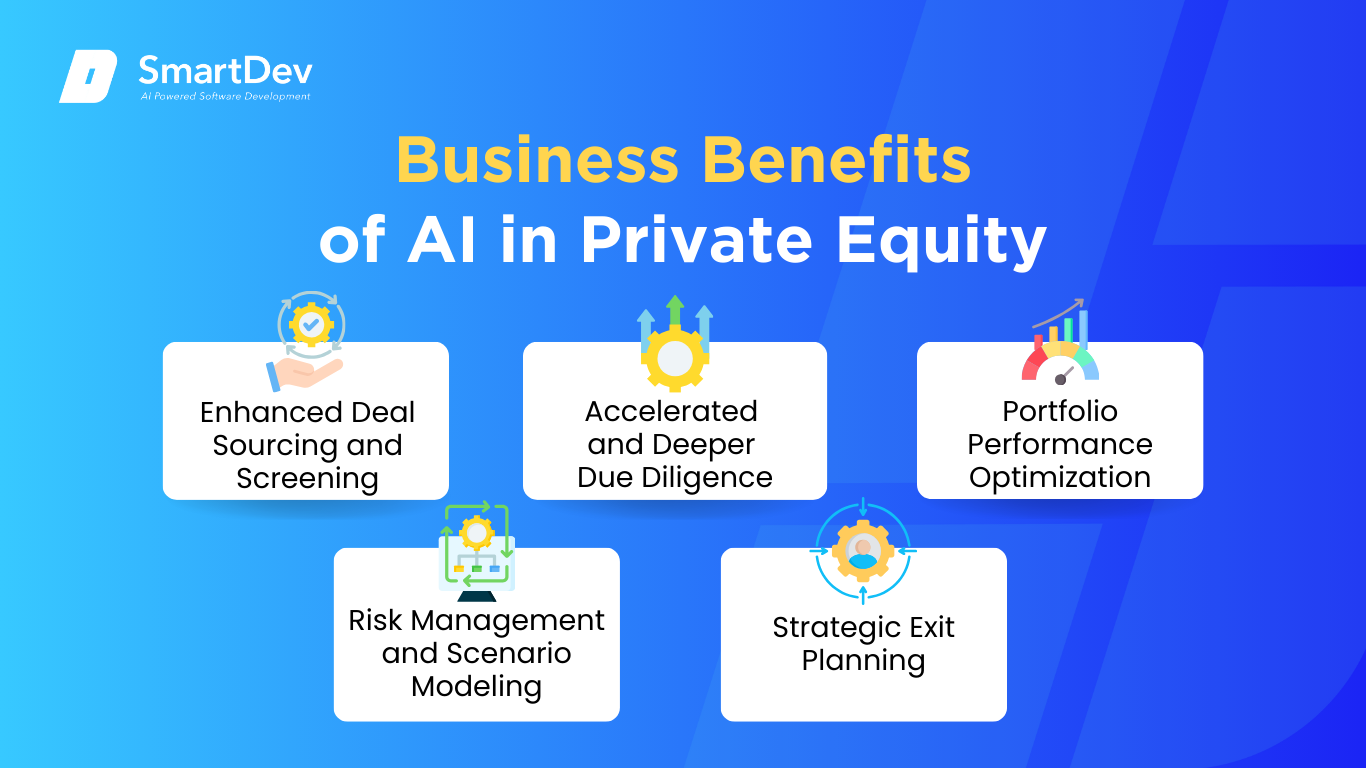

Business Benefits of AI in Private Equity

AI isn’t just a tool for automation in private equity—it’s a strategic capability that enhances every phase of the investment lifecycle, from pre-deal to exit. Below are five expanded benefits with detailed explanations and practical impact.

1. Enhanced Deal Sourcing and Screening

Traditional deal sourcing relies heavily on personal networks, industry conferences, and manual research—methods that can miss promising targets, especially in niche sectors or emerging markets. AI-powered sourcing platforms aggregate and analyze diverse datasets, including market growth indicators, patent filings, hiring trends, and even sentiment from industry forums.

This breadth allows firms to uncover “hidden gems” early, before they hit the radar of competitors. By prioritizing leads based on AI scoring models, firms can allocate analyst time to the most promising opportunities, increasing the volume of quality deals considered without expanding headcount.

2. Accelerated and Deeper Due Diligence

Due diligence is often a bottleneck in deal timelines. AI tools can ingest thousands of documents—financial reports, customer contracts, compliance records—and automatically highlight irregularities such as sudden revenue spikes, inconsistent margin reporting, or unusually favorable contract clauses.

NLP-driven sentiment analysis adds another dimension by scanning media coverage, legal filings, and customer feedback to detect reputational risks. This means PE firms not only validate the numbers but also understand potential brand or market perception issues before acquisition.

3. Portfolio Performance Optimization

After acquisition, value creation becomes the focus. AI enables continuous performance monitoring across portfolio companies by integrating ERP, CRM, and operational data into a central analytics environment. Predictive models can flag early signs of operational inefficiency, sales performance decline, or supply chain disruption.

For example, in a manufacturing portfolio company, AI might detect that certain product lines consistently underperform in specific regions, prompting a targeted pricing adjustment or distribution change. This proactive approach can accelerate EBITDA growth and enhance exit valuations.

4. Risk Management and Scenario Modeling

Market volatility, regulatory changes, and geopolitical events can quickly erode portfolio value. AI-driven scenario modeling helps PE firms simulate “what-if” situations—such as interest rate hikes, commodity price fluctuations, or competitor M&A activity—and estimate the potential financial impact on each portfolio company.

By running these simulations continuously, investment teams can adapt capital allocation strategies, renegotiate debt structures, or pivot business models before market conditions worsen, thereby protecting downside risk.

5. Strategic Exit Planning

Exiting at the right time is often the single most important driver of PE returns. AI tools analyze macroeconomic trends, sector-specific multiples, and historical buyer behavior to pinpoint optimal exit windows.

For instance, AI might detect a convergence of favorable factors—sector consolidation activity, strong public market valuations, and buyer liquidity—that signals a prime moment to launch a sale process. Acting on such insights can materially increase exit multiples and shorten the sales cycle.

Challenges Facing AI Adoption in Private Equity

The benefits of AI in private equity are compelling, but practical implementation faces five expanded challenges that firms must address strategically.

1. Data Quality and Accessibility

1. Data Quality and Accessibility

Private equity depends on both public and private company data, much of which is fragmented, unstructured, or unavailable in standard formats. Incomplete or outdated financials can cause AI models to misjudge target viability or risk.

To mitigate this, firms need to invest in robust data acquisition strategies—combining subscription-based private company databases, proprietary research, and manual verification—to build high-quality datasets for AI training and analysis.

Siloed systems and scattered data can cripple decision-making and slow growth. Discover how AI is helping organizations unify, clean, and unlock value from their data faster and smarter. Explore the full article to see how AI transforms data chaos into clarity.

2. Integration with Existing Processes

PE firms often have deeply ingrained workflows centered on personal judgment and relationship-driven deal flow. Dropping AI into these processes without adaptation can lead to friction or underutilization.

The most successful implementations position AI as an enhancer rather than a replacement—e.g., using AI to pre-screen opportunities that are then evaluated by partners, blending algorithmic insights with human expertise.

3. Model Transparency and Explainability

Investment committees demand clear, evidence-based rationale for decisions. Black-box AI models that can’t articulate how they arrived at a recommendation undermine trust and adoption.

To overcome this, firms must prioritize explainable AI (XAI) that provides transparent scoring criteria, highlights key drivers, and allows decision-makers to validate assumptions against their own domain knowledge.

4. Cultural Resistance and Skills Gaps

Many PE professionals are highly experienced in financial modeling and negotiation but less familiar with AI concepts. This skills gap can breed skepticism, especially if AI recommendations contradict established intuition.

Bridging this requires two actions: upskilling deal teams in AI literacy and embedding data scientists who understand private equity’s unique decision-making culture. Joint teams ensure that AI output is relevant, actionable, and trusted.

5. Compliance and Regulatory Considerations

AI-driven investment analysis can inadvertently introduce compliance risks, such as using non-public information improperly or relying on biased training data that skews recommendations.

Firms need governance frameworks that define permissible data sources, regularly audit AI model behavior, and ensure compliance with financial regulations across jurisdictions. This reduces the risk of legal or reputational damage while maintaining investor confidence.

For those navigating these complex waters, a business-oriented guide to responsible AI and ethics offers practical insights on deploying AI responsibly and transparently, especially when public trust is at stake.

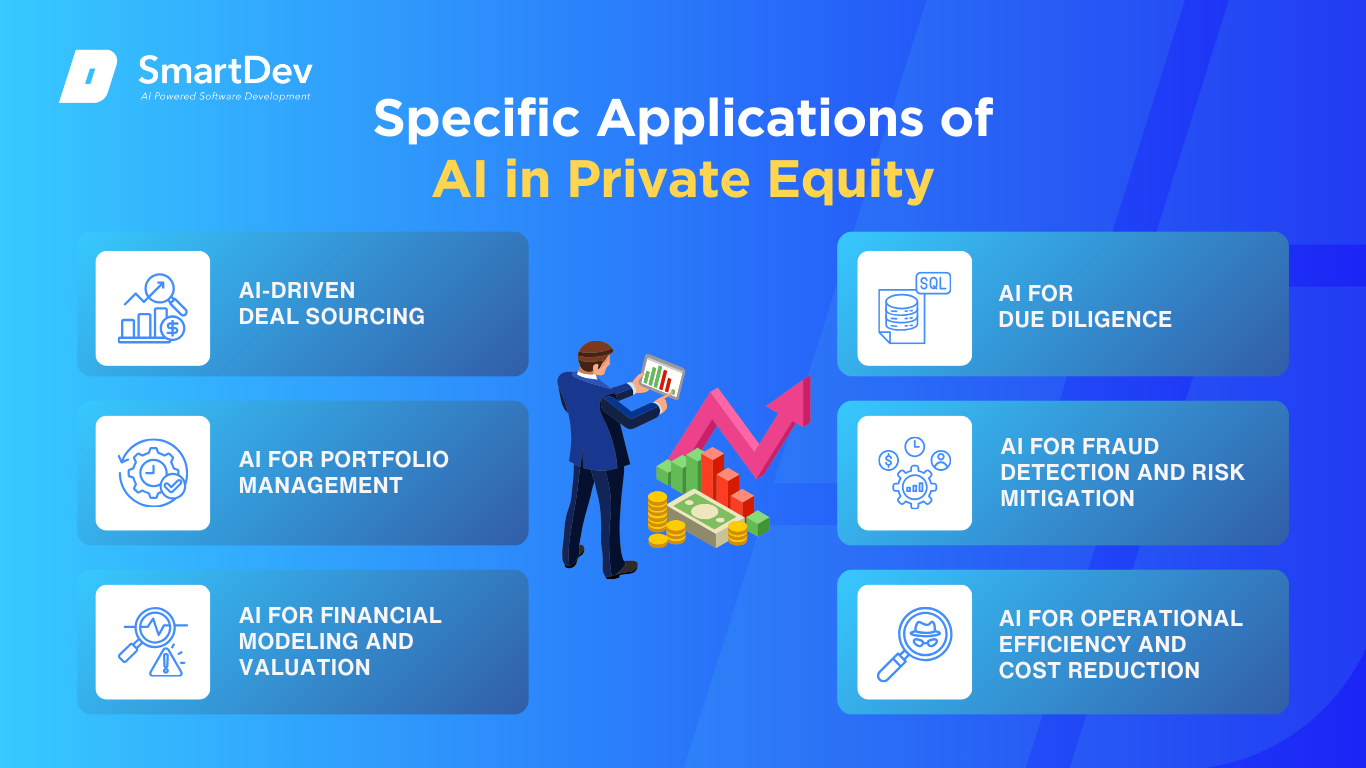

Specific Applications of AI in Private Equity

Use Case 1: AI-Driven Deal Sourcing

Use Case 1: AI-Driven Deal Sourcing

AI is increasingly being used in private equity to streamline the deal sourcing process, which traditionally requires a significant amount of time and manual effort. AI-driven platforms analyze massive amounts of data from multiple sources, including financial statements, market reports, and news articles, to identify potential investment opportunities. These platforms leverage machine learning and natural language processing (NLP) to uncover hidden trends and insights that might be missed by human analysts.

The strategic value of AI in deal sourcing lies in its ability to process data more quickly and accurately than traditional methods, allowing private equity firms to identify promising investments faster. AI tools can track the performance of companies, monitor industry trends, and analyze social media and news sentiment to spot potential opportunities earlier. This helps firms stay ahead of competitors and make better-informed decisions about which deals to pursue.

However, AI-driven deal sourcing comes with challenges such as ensuring data accuracy, mitigating model bias, and integrating AI tools into existing workflows. It’s crucial for firms to ensure that AI systems are continuously updated and validated to keep up with market changes.

Real-World Example: Blackstone’s AI-Powered Investment Platform

Blackstone, one of the world’s largest private equity firms, uses AI-powered tools to identify potential investment opportunities. By analyzing data across multiple sources, including financials, industry trends, and news sentiment, Blackstone’s platform can predict market shifts and uncover high-potential targets. Since its implementation, Blackstone has significantly reduced the time spent on deal sourcing, allowing it to focus on more profitable investments.

Use Case 2: AI for Portfolio Management

Once investments are made, private equity firms need to actively manage their portfolios to maximize returns. AI is being used in portfolio management to optimize asset allocation, identify performance trends, and forecast future market movements. By analyzing historical data and current market conditions, AI models can generate insights that help portfolio managers make data-driven decisions.

AI can also assist in risk management by identifying potential risks in the portfolio and recommending corrective actions. By utilizing predictive analytics, AI tools can anticipate market fluctuations and help portfolio managers adjust their strategies accordingly. This leads to more efficient portfolio management and improved overall performance.

Data privacy and the ethical use of AI in portfolio management are important considerations. Firms must ensure that they are using high-quality, relevant data and that AI-driven decisions are transparent and explainable.

Real-World Example: KKR’s AI for Portfolio Optimization

KKR, a global investment firm, leverages AI to optimize its portfolio management process. The firm uses machine learning models to analyze vast datasets, identify potential risks, and forecast market trends. With AI’s assistance, KKR has improved its ability to make informed decisions about its portfolio, resulting in a better risk-adjusted return on investments.

Use Case 3: AI for Financial Modeling and Valuation

Financial modeling and valuation are essential aspects of private equity investments, as firms need to assess the value of potential investments and project future returns. AI can enhance the accuracy of these models by incorporating a broader range of data points and analyzing them more quickly. AI tools can process financial statements, market trends, and other relevant data to provide more accurate valuations and predictions of future performance.

Machine learning algorithms can also be used to simulate various economic scenarios and their potential impact on the value of a portfolio. This enables private equity firms to anticipate potential risks and identify the most profitable opportunities. By enhancing financial modeling and valuation, AI allows private equity firms to make more informed investment decisions.

One challenge with AI in financial modeling is the need for accurate and high-quality data. AI models are only as good as the data they are trained on, so ensuring data integrity is critical.

Real-World Example: Carlyle Group’s AI for Valuation

The Carlyle Group, a global private equity firm, uses AI to enhance its financial modeling and valuation process. By using machine learning models to analyze market data and historical performance, Carlyle has been able to improve the accuracy of its valuations. This AI-driven approach has helped the firm make more informed investment decisions, resulting in higher returns on its investments.

Use Case 4: AI for Due Diligence

AI plays a critical role in private equity due diligence by automating the process of gathering and analyzing information about potential investments. Traditionally, due diligence involves sifting through massive amounts of data, such as financial statements, contracts, and legal documents, which is both time-consuming and resource-intensive. AI tools, particularly NLP and machine learning, can automate the extraction and analysis of key information, significantly speeding up the process.

By analyzing data from multiple sources, AI can identify potential red flags and provide insights into a company’s financial health, operational risks, and growth potential. This leads to more informed decision-making and helps private equity firms minimize risk by identifying issues early in the due diligence process.

The main challenge of AI in due diligence is ensuring that the systems can accurately interpret complex legal and financial documents. Continuous training and updates to AI models are necessary to maintain their effectiveness.

Real-World Example: Apollo Global Management’s AI in Due Diligence

Apollo Global Management has implemented AI tools to streamline its due diligence process. By using machine learning and NLP, Apollo can quickly extract relevant information from legal and financial documents. This has allowed the firm to reduce the time spent on due diligence and improve the accuracy of its analysis, ultimately leading to more successful investments.

Use Case 5: AI for Fraud Detection and Risk Mitigation

Fraud detection is a critical issue for private equity firms, as they need to ensure the integrity of their investments and safeguard against potential financial crimes. AI is being used to detect fraudulent activities by analyzing transaction patterns, identifying anomalies, and flagging suspicious behavior. Machine learning algorithms can learn from historical fraud cases and continuously improve their detection capabilities.

By implementing AI-powered fraud detection systems, private equity firms can reduce the risk of financial crimes and protect their investments. These systems can also help identify potential risks before they escalate, allowing firms to take proactive measures to mitigate them. This not only improves security but also builds trust with investors.

One challenge with AI for fraud detection is ensuring that the systems are adaptable and can keep up with evolving fraud tactics. Continuous monitoring and model adjustments are necessary to maintain effectiveness.

Real-World Example: Bridgewater Associates and AI for Risk Management

Bridgewater Associates, a major private equity firm, uses AI for risk management and fraud detection. By analyzing financial transactions and market data, AI systems can detect anomalies and flag potential risks. This has enabled Bridgewater to improve its risk mitigation strategies, resulting in better financial security for its investments.

Use Case 6: AI for Operational Efficiency and Cost Reduction

AI is also being used to improve operational efficiency and reduce costs in private equity firms. Automation tools powered by AI can streamline administrative tasks such as reporting, compliance checks, and portfolio monitoring. This reduces the need for manual intervention, allowing firms to focus their resources on higher-value activities.

AI-driven tools can also optimize resource allocation, helping private equity firms allocate capital more effectively. By automating routine tasks, firms can reduce operational costs and improve profitability. This enhances overall business performance and allows firms to maximize their returns on investments.

While AI can help reduce costs, the implementation of these technologies requires an upfront investment in AI systems and ongoing training for staff to ensure that the tools are used effectively.

Real-World Example: Vista Equity Partners and AI for Operational Efficiency

Vista Equity Partners utilizes AI to streamline its operations and reduce costs. By automating routine tasks such as reporting and data analysis, Vista has been able to reduce administrative costs and improve efficiency. This has allowed the firm to focus on higher-value activities, ultimately improving its overall profitability.

Need Expert Help Turning Ideas Into Scalable Products?

Partner with SmartDev to accelerate your software development journey — from MVPs to enterprise systems.

Book a free consultation with our tech experts today.

Let’s Build TogetherExamples of AI in Private Equity

Real-World Case Studies

Blackstone: AI-Enhanced Deal Sourcing

Blackstone has successfully implemented AI-driven tools to enhance its deal sourcing capabilities. By leveraging AI to analyze a wide array of data, including financial reports, industry trends, and news sentiment, the firm has accelerated its ability to identify high-potential investment opportunities. This technology has allowed Blackstone to reduce the time spent on deal sourcing, resulting in more successful investments and improved returns for its investors.

KKR: AI for Portfolio Optimization

KKR uses AI to optimize its portfolio management strategy, focusing on risk assessment and performance forecasting. By utilizing machine learning algorithms, KKR analyzes market trends and portfolio performance, allowing it to adjust its investment strategies in real-time. This approach has led to improved portfolio returns and better risk management.

Apollo Global Management: AI for Due Diligence

Apollo Global Management employs AI tools to automate the due diligence process, allowing the firm to quickly analyze large volumes of financial and legal data. By leveraging machine learning and natural language processing, Apollo can identify potential risks and red flags early in the process, reducing the time spent on due diligence and improving the quality of its investment decisions.

These examples reflect the value of working with technology partners who understand both the technical and policy implications. If you’re considering a similar digital transformation, don’t hesitate to connect with AI implementation experts to explore what’s possible in your context.

Innovative AI Solutions

AI-Powered Financial Forecasting

AI-powered financial forecasting is becoming a game-changer for private equity firms, allowing them to predict future market trends and identify profitable opportunities. By analyzing historical data and current market conditions, AI can generate accurate predictions, helping firms make more informed investment decisions. This technology is enabling private equity firms to optimize their investment strategies and improve returns.

AI for Automated Compliance Monitoring

As regulatory requirements become more complex, AI is being used to automate compliance monitoring in private equity. AI tools can analyze vast amounts of data to ensure that firms are meeting regulatory standards and reporting requirements. This technology reduces the risk of non-compliance and helps firms maintain a strong reputation with regulators and investors.

AI for Investor Relations and Reporting

AI is transforming investor relations and reporting by automating the process of generating personalized reports and communicating with investors. AI-driven tools can analyze investment data and generate insights, enabling firms to provide more transparent and detailed reports to their investors. This not only improves communication but also builds trust with stakeholders.

In conclusion, AI use cases in private equity are driving significant improvements in deal sourcing, portfolio management, due diligence, and operational efficiency. As AI technologies continue to evolve, private equity firms will be able to make better-informed investment decisions, optimize their operations, and deliver stronger returns for their investors.

AI-Driven Innovations Transforming Private Equity

Emerging Technologies in AI for Private Equity

AI technologies such as machine learning, natural language processing (NLP), and data analytics are revolutionizing private equity by automating tasks that were previously time-consuming and error-prone. One of the most significant applications of AI is in deal sourcing, where AI can analyze vast amounts of data from various sources—financial statements, news reports, and even social media—to identify potential investment opportunities that may have been overlooked. Machine learning algorithms can recognize patterns in data and predict which companies are most likely to experience growth, allowing PE firms to find and evaluate promising deals more efficiently.

Additionally, AI is being used for portfolio management, helping private equity firms optimize their investments by analyzing financial data, market trends, and performance metrics. These AI-powered systems can identify operational inefficiencies, predict market movements, and suggest adjustments to the investment strategy, resulting in more informed and data-driven decisions. As AI continues to evolve, it will become an even more indispensable tool for private equity firms, helping them stay competitive in a fast-paced and dynamic market.

AI’s Role in Sustainability Efforts

AI is also playing a vital role in helping private equity firms incorporate sustainability into their investment strategies. With increasing pressure from investors, regulators, and consumers to prioritize environmental, social, and governance (ESG) factors, private equity firms are using AI tools to analyze ESG data and make more sustainable investment choices. AI can track a company’s ESG performance over time by analyzing vast amounts of data, from carbon emissions to diversity metrics, helping PE firms assess the long-term sustainability of their investments.

Furthermore, AI can optimize operational processes within portfolio companies to improve energy efficiency, reduce waste, and implement more sustainable business practices. For example, AI-powered predictive analytics can help companies optimize their supply chains and reduce their carbon footprint. By adopting AI for sustainability, private equity firms can not only meet ESG goals but also unlock long-term value and attract investors who are increasingly focused on sustainability.

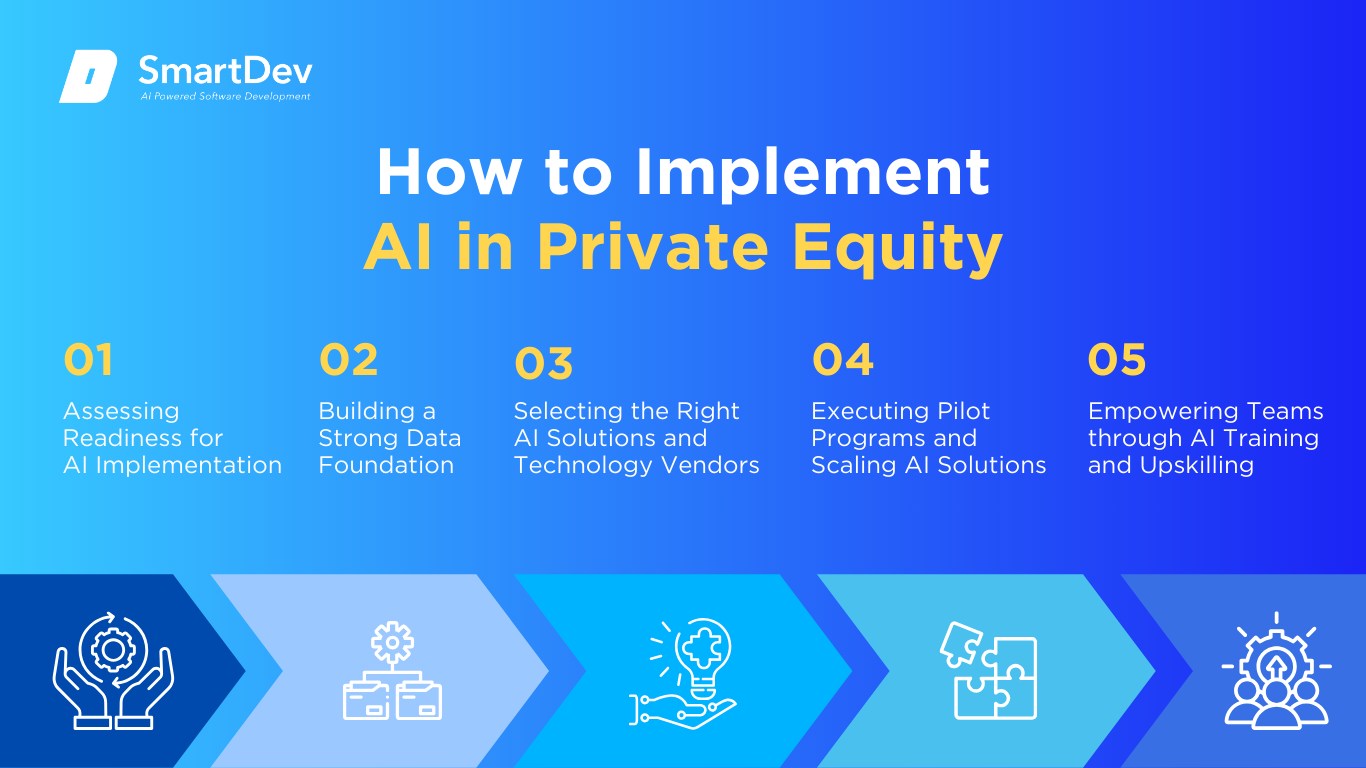

How to Implement AI in Private Equity

Step 1: Assessing Readiness for AI Adoption

Before implementing AI solutions, private equity firms must first assess their readiness for AI adoption. This involves identifying business areas where AI can add the most value, such as deal sourcing, due diligence, and portfolio optimization. AI tools can be highly effective in automating repetitive tasks, such as data analysis and report generation, which can save significant time and resources. However, it is essential for firms to evaluate whether their current data infrastructure is capable of supporting AI technologies.

Additionally, firms need to assess their staff’s readiness for AI adoption. Ensuring that teams are open to adopting AI tools and are equipped with the necessary skills to work alongside these technologies is critical. AI should be seen as an augmentation of human expertise, not a replacement, and the integration of AI must be done in a way that supports existing workflows.

Step 2: Building a Strong Data Foundation

A strong data foundation is essential for AI implementation in private equity. AI models are only as good as the data they are trained on, so private equity firms need to ensure they have high-quality, accurate, and clean data. This includes gathering relevant financial data, company performance metrics, and market trends that can be used to train machine learning models. Data must be collected from multiple sources and organized in a way that allows AI algorithms to effectively analyze and generate insights.

Data management best practices include ensuring data privacy and compliance with regulations such as GDPR or HIPAA. Additionally, firms must focus on data integration, ensuring that the AI tools can seamlessly connect with existing systems, such as CRM platforms and financial databases, to create a unified data ecosystem. Investing in a robust data management infrastructure will enable private equity firms to maximize the value of their AI investments.

Step 3: Choosing the Right Tools and Vendors

Selecting the right AI tools and vendors is critical for the success of AI adoption in private equity. The market is flooded with AI solutions that offer various functionalities, from predictive analytics to natural language processing for deal sourcing. It is important for private equity firms to evaluate AI platforms based on their specific needs, scalability, and ease of integration with existing systems.

When choosing AI tools, firms should prioritize platforms that offer actionable insights and can easily adapt to the firm’s workflow. Vendor selection should involve a thorough evaluation of the AI provider’s experience in the financial sector, their reputation, and their ability to comply with regulatory requirements. Partnering with trusted AI vendors ensures that the firm’s AI implementation is both effective and secure.

Step 4: Pilot Testing and Scaling Up

Once AI tools have been selected, it is crucial to conduct pilot tests to assess their performance before full deployment. This approach allows private equity firms to evaluate the effectiveness of AI solutions in real-world conditions and identify any potential issues. During the pilot phase, firms should track key performance indicators (KPIs), such as time saved in deal sourcing or improvements in investment analysis accuracy, to measure the success of the AI tool.

Scaling AI deployment across the organization should be done gradually, ensuring that systems are integrated into the daily workflow and that employees are comfortable using the technology. A successful pilot phase will provide the confidence needed to expand AI tools throughout the firm and its portfolio companies.

Step 5: Training Teams for Successful Implementation

For AI to be effectively implemented, private equity firms must invest in training their teams. This includes upskilling employees to work alongside AI tools and ensuring they understand how AI can enhance their decision-making processes. Providing training in AI usage, data interpretation, and ethical considerations will empower teams to leverage AI effectively and drive the firm’s objectives.

Ongoing training and support are essential to ensure that teams can adapt to evolving AI technologies. By fostering a culture of continuous learning, private equity firms can maximize the benefits of AI adoption and maintain a competitive edge in the marketplace.

Whether you’re exploring your first pilot or scaling an enterprise-wide solution, our team is here to help. Get in touch with SmartDev and let’s turn your challenges into opportunities.

Measuring the ROI of AI in Private Equity

Key Metrics to Track Success

Measuring the return on investment (ROI) of AI in private equity requires firms to track several key performance metrics. One of the most important metrics is productivity improvement, which can be measured by the reduction in time spent on tasks such as deal sourcing, due diligence, and portfolio monitoring. AI can significantly speed up these processes, allowing firms to close deals faster and make more informed investment decisions.

Cost savings are another critical metric, as AI can automate many routine tasks and reduce the need for manual labor. This leads to fewer operational costs and greater resource allocation efficiency. Additionally, firms should track the accuracy of AI-generated insights, such as predictions of market trends or investment performance, to determine the impact of AI on decision-making.

Case Studies Demonstrating ROI

Several private equity firms have already demonstrated the tangible ROI of AI implementation. For instance, Blackstone, one of the largest private equity firms, uses AI-driven tools to enhance its deal-sourcing process. By analyzing large amounts of market data, Blackstone’s AI platform has been able to identify high-potential investment opportunities faster, leading to more successful deals. As a result, Blackstone has reported a significant increase in deal flow and improved investment outcomes.

KKR, another major player in private equity, uses AI for portfolio optimization. By leveraging machine learning models to analyze vast datasets, KKR has been able to identify operational inefficiencies and market trends that have allowed them to adjust their investment strategies. The firm has seen improved returns on its portfolio and reduced risk exposure, thanks to AI’s ability to provide actionable insights and predictive analytics.

Common Pitfalls and How to Avoid Them

While the benefits of AI in private equity are clear, there are several common pitfalls that firms must avoid. One of the main challenges is ensuring that AI systems are properly integrated into existing workflows. If AI tools are not aligned with the firm’s goals or are difficult for employees to use, they may not deliver the expected results. To avoid this, firms should involve stakeholders early in the decision-making process and ensure that AI tools are user-friendly and fit within existing systems.

Another pitfall is over-reliance on AI without proper human oversight. AI should be seen as a tool to augment human decision-making, not replace it entirely. To mitigate this risk, private equity firms should maintain a balance between AI-driven insights and the expertise of their teams, ensuring that both are used in tandem for optimal decision-making.

Understanding ROI is possibly a challenge to many businesses and institutions as different in background, cost. So, if you need to dig deep about this problem, you can read AI Return on Investment (ROI): Unlocking the True Value of Artificial Intelligence for Your Business

Future Trends of AI in Private Equity

Predictions for the Next Decade

The next decade will see continued innovation in AI applications within private equity. As AI technologies evolve, they will become even more capable of analyzing unstructured data, such as market news, social media sentiment, and even competitor performance. This will allow private equity firms to gain a more comprehensive view of the market and make more informed decisions.

In addition, the rise of AI-powered predictive analytics will enable firms to anticipate market shifts and identify potential risks and opportunities earlier than ever before. This predictive power will make AI an even more indispensable tool for private equity firms, helping them stay ahead of market trends and achieve better investment outcomes.

How Businesses Can Stay Ahead of the Curve

To stay ahead of the curve in AI adoption, private equity firms must continue to invest in emerging AI technologies and data analytics platforms. Firms should partner with innovative AI vendors and stay updated on the latest trends in AI development. Building a culture of innovation and continuous learning within the organization will also help ensure that the firm remains adaptable to new AI advancements.

Moreover, firms must foster collaboration between AI specialists, data scientists, and investment professionals to fully leverage AI’s capabilities. By integrating AI into every aspect of the investment process, from deal sourcing to portfolio management, private equity firms can unlock new efficiencies and gain a competitive edge in an increasingly data-driven world.

Conclusion

Summary of Key Takeaways on AI Use Cases in Private Equity

AI has the potential to revolutionize private equity by streamlining deal sourcing, enhancing portfolio management, and optimizing investment strategies. By adopting AI tools, private equity firms can improve decision-making, reduce operational costs, and achieve better investment outcomes. However, successful AI adoption requires careful planning, investment in data infrastructure, and ongoing training for teams.

Moving Forward: A Path to Progress for Businesses Considering AI Adoption

For private equity firms looking to stay competitive, adopting AI is no longer optional—it’s a necessity. Start by evaluating your firm’s readiness, building a strong data foundation, and selecting the right AI tools for your needs. With AI driving innovation in private equity, now is the time to harness its power and achieve greater success in your investment strategies.

References

- https://hbr.org/2025/06/how-private-equity-firms-are-creating-value-with-ai

- https://www.mckinsey.com/industries/private-capital/our-insights/a-clear-eyed-view-of-gen-ai-for-the-private-equity-industry

- https://www.kearney.com/service/digital-analytics/article/the-impact-of-artificial-intelligence-on-private-equity-firms

- https://www.ey.com/en_gl/insights/ai/how-to-leverage-generative-ai-to-enhance-private-equity-performance

- https://kpmg.com/au/en/home/insights/2024/03/impact-generative-ai-private-equity-firms.html

- https://www.deloitte.com/us/en/insights/industry/financial-services/private-markets-innovation-leveraging-ai-for-portfolio-management.html

Definition of AI and Its Core Technologies

Definition of AI and Its Core Technologies 1.

1.  Use Case 1: AI-Driven Deal Sourcing

Use Case 1: AI-Driven Deal Sourcing