The financial technology landscape is undergoing a significant transformation with the rise of embedded finance. This innovation seamlessly weaves financial services into non-financial platforms, dramatically enhancing user experiences, increasing convenience, and sparking new waves of innovation. In this blog post, we’ll explore the vital role of embedded finance, how it integrates into everyday applications, the cutting-edge technologies driving it, future trends to watch, and spotlight VeryPay—a leader in the embedded finance industry.

Understanding Embedded Finance Concept

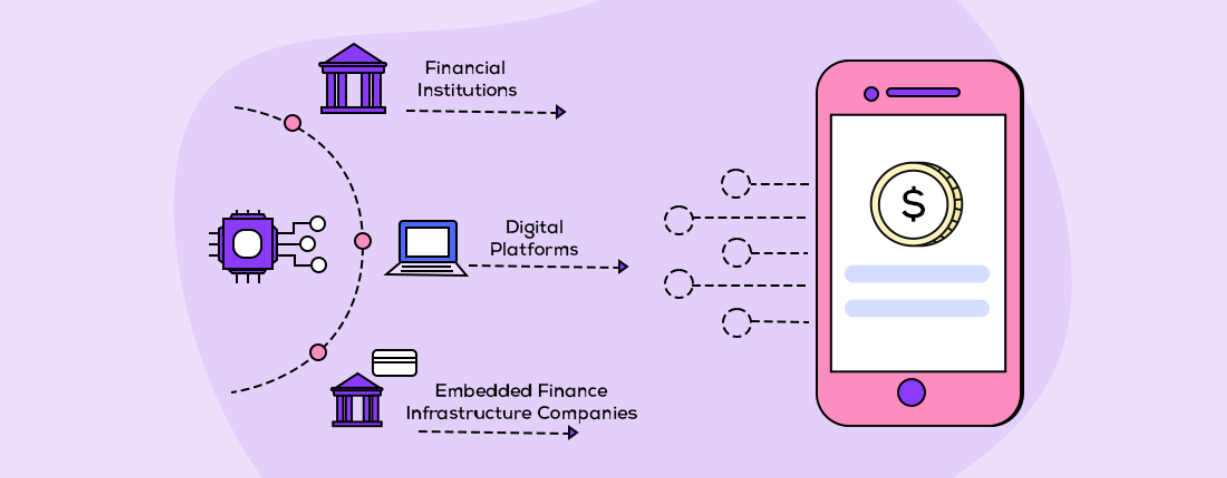

Embedded finance refers to the integration of financial services and products—such as payments, lending, insurance, and investment—into non-financial platforms and applications. This means that instead of accessing financial services through traditional banking interfaces or separate financial apps, users can engage with these services directly within the platforms they already use and trust.

At its core, embedded finance is about making financial services an integral part of the user experience within various digital ecosystems. This integration can occur across a wide range of platforms, including e-commerce websites, ride-sharing apps, travel booking sites, and even social media platforms. The goal is to create a seamless and frictionless experience where financial transactions and services are naturally embedded into the user’s journey.

The integration of embedded financial services

Embedded finance transforms how users interact with financial services by embedding them into the platforms they use daily. This integration not only simplifies transactions but also enhances convenience, personalization, trust, and engagement, creating superior user experience.

Figure 2: Embeded Finance in the daily platforms

- Seamless Transactions: By embedding financial services, platforms eliminate the need for users to switch between multiple apps or websites to complete a transaction. This seamlessness reduces friction and makes the process more efficient and user-friendly.

- Convenience: Users can access financial services at the point of need. This accessibility is especially important for underserved or unbanked populations, who can now access financial services through familiar digital environments.

- Personalization: Embedded finance allows platforms to offer personalized financial solutions based on user data and behavior. This means tailored financial products that better meet individual needs, enhancing the overall user experience.

- Increased Trust and Engagement: When financial services are integrated into platforms that users already trust and frequently use, it builds additional trust and encourages higher engagement. Users are more likely to adopt and use financial services if they are provided within a familiar and reliable context.

- Enhanced Loyalty and Retention: Providing financial services as part of a broader platform’s ecosystem can increase customer loyalty. Users are more inclined to stay with a platform that offers comprehensive solutions, from core services to integrated financial products.

Case Study: Mototaxi Travel in Africa

Mototaxi Travel is a standout example of transportation service in Africa that leverages the power of embedded financial services to enhance the user experience and provide added value to its customers. By integrating VeryPay’s payment processing and micro-insurance services directly into their app, Mototaxi has significantly improved the safety, convenience, and reliability of their services.

Background

Mototaxi Travel operates in several African countries, providing affordable and reliable transportation services using motorcycles. The company faced several challenges common in the region, including safety concerns, limited access to traditional financial services, and the need for a cashless payment system to reduce theft and increase convenience. To address these issues, Mototaxi Travel decided to embed financial services directly into their mobile application.

Implementation of Embedded Financial Services

Mototaxi Travel identified two key financial services to integrate into their platform: payment processing and micro-insurance. Here’s how they successfully implemented these services:

Payment Processing Intergration:

API Selection: Mototaxi Travel partnered with a reputable payment processing provider that offered robust APIs capable of handling high transaction volumes. They chose a provider with a strong presence in Africa, ensuring reliable service and compliance with local regulations.

Seamless Payment Experience: The integration involved setting up secure API endpoints for processing payments within the Mototaxi app. Users can add their preferred payment methods, such as mobile money, credit/debit cards, or digital wallets. The API handles real-time transaction validation and processing, ensuring a seamless and secure payment experience.

User Interface Design: The app’s user interface was designed to make payments intuitive and easy. Users can quickly complete transactions with a few taps, reducing the need for cash and minimizing transaction times.

Micro-Insurance Intergration:

Insurance API Provider: To offer insurance coverage, Mototaxi Travel partnered with a micro-insurance provider specializing in affordable and flexible coverage options for low-income customers. The provider’s APIs enabled quick integration of insurance services into the app.

On-Demand Insurance: The insurance API allows users to purchase coverage on-demand, tailored to each ride. This means that riders can opt for insurance coverage at the time of booking, providing protection against accidents and theft.

Automatic Enrollment: For added convenience, frequent riders can opt for automatic insurance enrollment, ensuring they are always covered without having to purchase insurance for each ride individually.

Impact on Business and Customers

For Business

The integration of embedded financial services enhanced Mototaxi Travel’s safety and trust. Cashless payments reduced theft and fraud risks, and on-demand insurance increased rider confidence. This seamless experience boosted user satisfaction and positioned Mototaxi as a reliable choice, attracting more customers. Additionally, new revenue streams from payment processing fees and insurance premiums contributed to the company’s financial growth.

For Customers

Embedded financial services improved the user experience by allowing riders to make payments and purchase insurance directly within the app, eliminating the need for cash or separate providers. Faster transactions enabled quicker ride bookings, enhancing convenience. This seamless experience fostered customer loyalty and retention, while also promoting financial inclusion by providing essential financial tools to underserved individuals.

Future Trends in Embedded Finance and Payments

Historical Perspective on Payment Systems

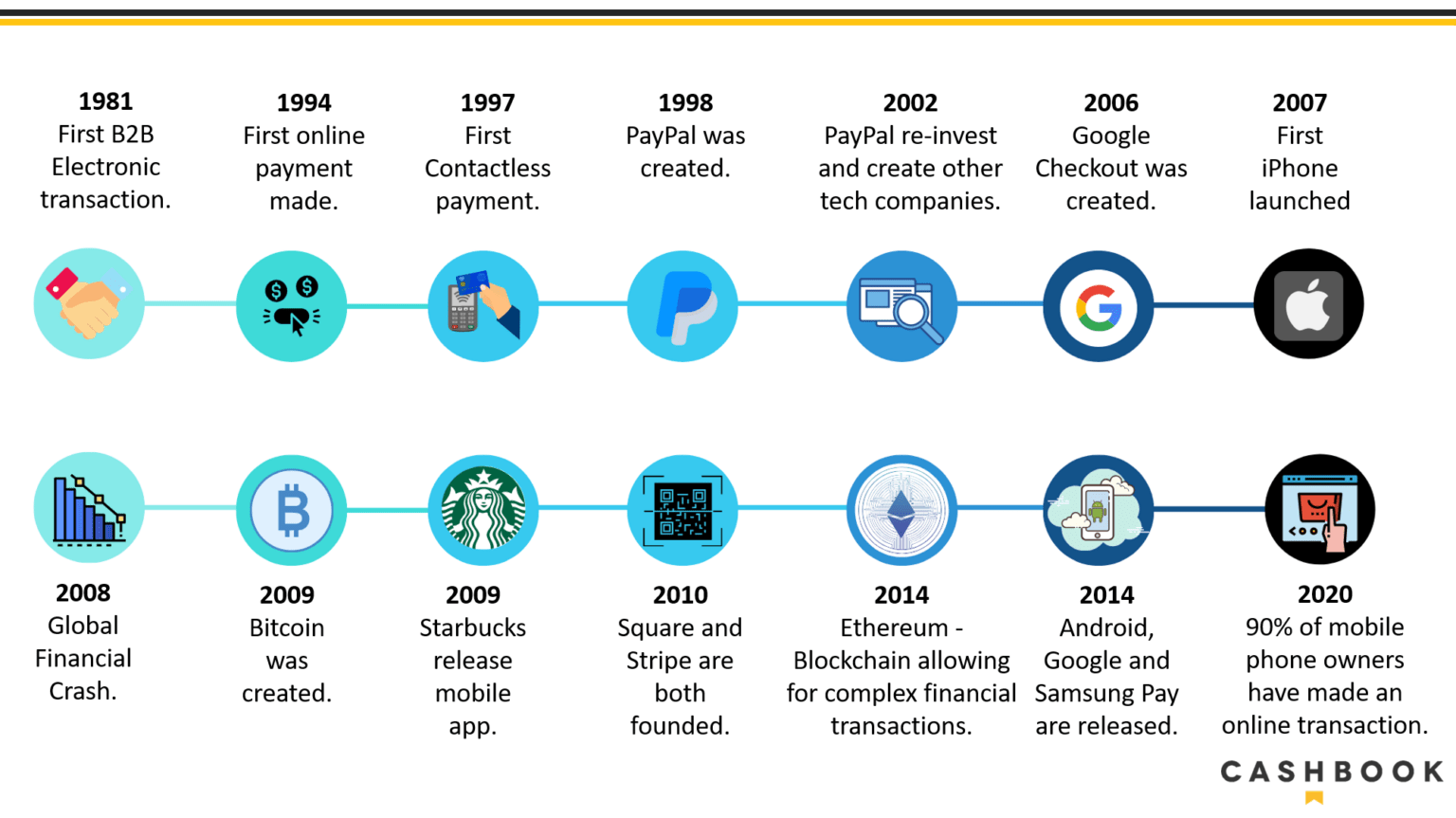

To understand the future of embedded finance, it is essential to look at the evolution of payment systems. From the use of cash to the advent of credit cards and the rise of digital payments, the landscape has continually evolved to meet changing consumer needs. Digital payments have paved the way for embedded finance, which represents the next logical step in this evolution.

Predictions for the Evolution of Embedded Finance in the Next Decade

Over the next decade, embedded finance is expected to become even more ubiquitous. As more industries recognize the benefits of integrating financial services, we will likely see a surge in adoption across various sectors, including healthcare, education, and real estate. Innovations such as biometric authentication and decentralized finance (DeFi) will further enhance the capabilities and security of embedded financial services.

👉 To stay ahead and fully benefit from embedded financial services, follow our Linkedin and visit their website for more insights.