In collaboration with VeryPay, on June 7th, 2024, we successfully hosted an enlightening webinar on the transformative potential of Closed Loop Payment Systems. This event attracted a diverse audience, including business owners, financial professionals, developers, and FinTech leaders. The webinar provided a deep dive into the mechanics, benefits, and strategic implementation of closed-loop payment systems.

Prestige guest speakers

Alex Lang, Chief Commercial Officer at SmartDev, warmly welcomed participants and showcased SmartDev’s vast experience and successful track record in BFSI and IT outsourcing, particularly in developing and managing closed-loop payment systems.

Guest Speaker Introductions

- Geert Theys, Head of FinTech at SmartDev, is recognized for his extensive experience spearheading transformative projects within the fintech sector. His strategic and hands-on approach has contributed significantly to the fintech industry, making him a vital asset in discussing the intricacies of closed-loop payment systems.

- Oluwaseun Solanke, CEO of VeryPay, brings over two decades of expertise in IT, fintech, and payments, having held pivotal roles at major corporations including HP, Oracle, and Ericsson. His insights into cutting-edge artificial intelligence applications and robust digital payment solutions were eagerly anticipated by the webinar participants.

Geert Theys, Head of FinTech at SmartDev, took the stage to explain the key components and types of closed-loop payment instruments. His presentation included a comprehensive overview of the various use cases and benefits these systems offer industries such as retail, hospitality, and transportation. He continued by discussing the critical considerations for implementing these systems. Topics covered included technology infrastructure requirements, compliance with regulatory standards, security measures, and integration challenges with existing platforms. He provided valuable insights into future trends and innovations, preparing attendees for what lies ahead in the payment systems landscape.

Webinar insights recap

Exploring AI Innovations: Advancing Closed Loop Payment Systems

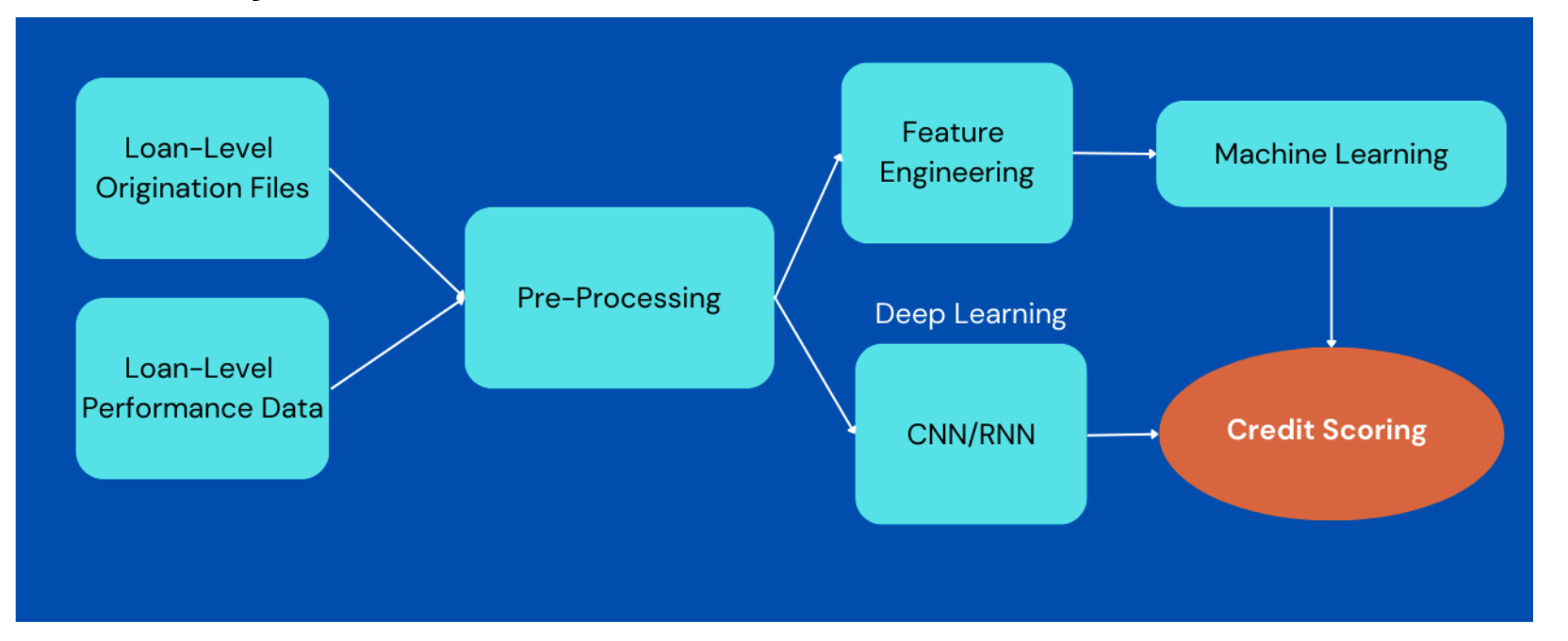

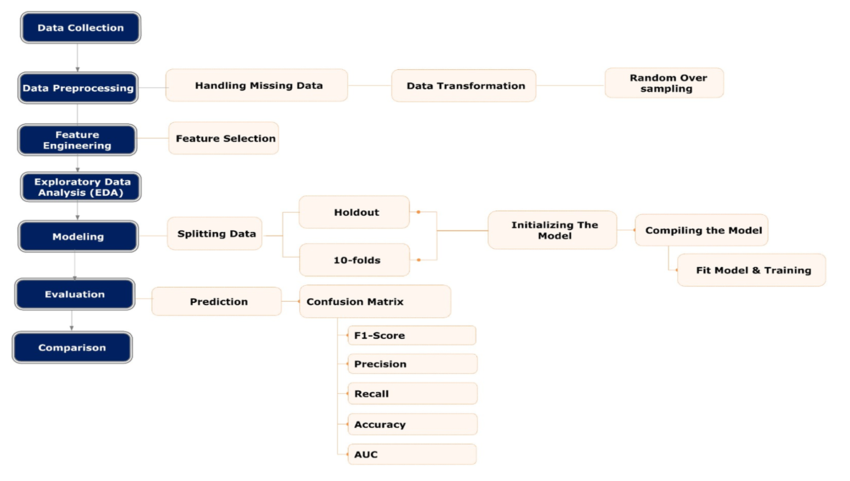

- Credit Scoring and Risk Assessment: AI-driven credit scoring models, such as those using ensemble models and neural networks, provide a robust method for assessing borrower reliability and creditworthiness. By integrating these AI models into Closed Loop Payment Systems, financial institutions can enhance risk management, reduce default rates, and optimize resource allocation. This integration could lead to a more dynamic and responsive credit assessment process within closed-loop environments, ultimately boosting economic growth and stability

Credit Scoring Process Flowchart

- Fraud Detection and Prevention: Fraud detection in insurance and banking is a critical area where AI can make a significant impact. By analyzing patterns and behaviors from extensive data sets, AI systems can detect anomalies and prevent fraudulent activities before they affect the system. For Closed-Loop Payment Systems, incorporating AI-driven fraud detection could safeguard transactions and enhance security measures, ensuring a safer financial ecosystem for all participants.

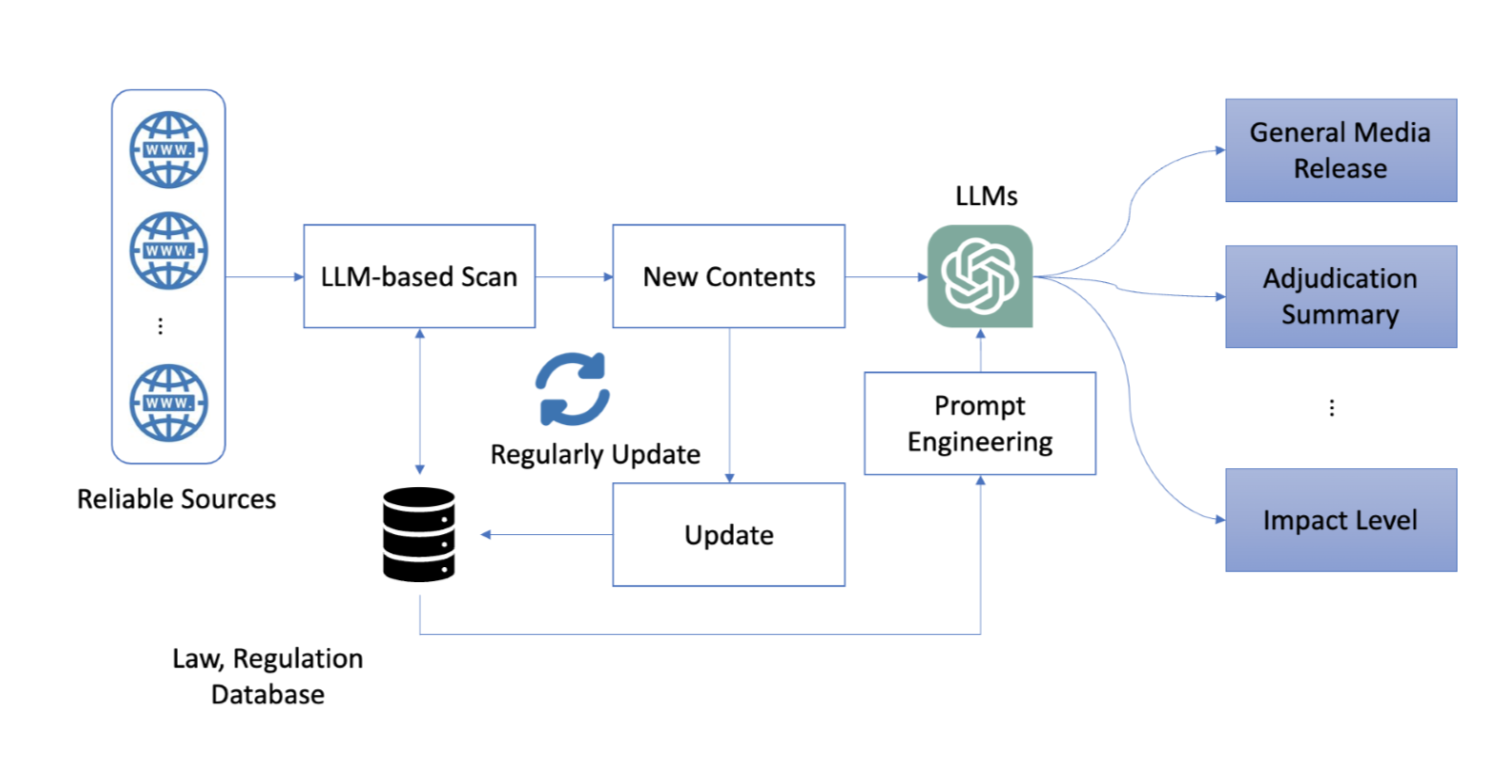

Compliance Management in FIB

AI in Telecommunications

- Customer Onboarding and eKYC: The eKYC process, powered by AI, involves biometric authentication and document verification to streamline customer onboarding. Implementing eKYC within Closed Loop Payment Systems could significantly enhance the user experience by simplifying the registration process, improving compliance, and reducing onboarding time. This is especially beneficial in closed ecosystems where rapid and secure customer identification is paramount.

- Churn Prediction and Customer Retention: AI can predict customer churn by analyzing user activity and transaction data within closed-loop systems. By identifying at-risk customers, operators can proactively engage with them through personalized offers or loyalty programs, thereby increasing retention rates. This predictive capability could be particularly useful for service providers within the ecosystem, such as telecom companies or retail brands, ensuring they maintain a stable and engaged user base.

Churn Prediction in Telecommunication

AI in Retail and Manufacturing

- Personalized Marketing and Customer Interaction: Digital human technology and AI-driven chatbots can provide personalized customer service and marketing within closed-loop environments. For instance, a closed-loop payment system in a retail setting could use AI to offer tailored promotions based on purchase history or customer preferences, enhancing the shopping experience and boosting sales.

- Smart Surveillance and Security: In retail or transportation hubs using closed-loop payment systems, AI-enabled video surveillance can enhance security and operational efficiency. This technology can detect suspicious activities or manage crowd control in real-time, ensuring a safe and smooth operation within the ecosystem.

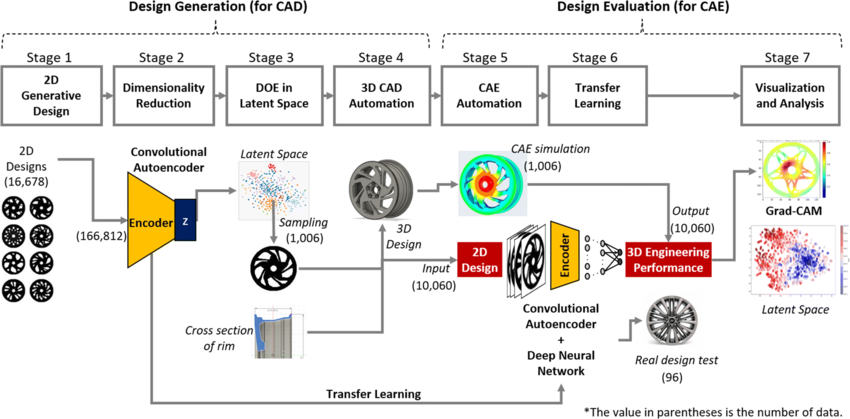

DNN (Deep Neural Network), CNN (Convolutional Neural Network), and Transfer Learning usage in CAD (Computer-Aided Design) and CAE (Computer-Aided Engineering).

Interactive Q&A Session

The webinar concluded with an interactive session led by Oluwaseun Solanke, CEO of VeryPay, alongside Alex and Geert. This segment allowed participants to engage directly with the experts, asking detailed questions about challenges and strategic approaches in closed-loop payment system implementations. The event also served as a networking platform, enabling attendees to connect with industry peers and experts. This interaction fostered discussions on potential collaborations and insights into advancing their payment solutions. The webinar was well-received, with participants appreciating the depth of knowledge shared and the clarity of the presentations. Key takeaways included the strategic advantages of closed-loop systems in enhancing customer experiences and operational efficiencies. Many attendees expressed their interest in exploring potential implementations within their operations.

Overview

The webinar successfully highlighted SmartDev and VeryPay’s expertise and leadership in closed-loop payment systems. For those who missed the live session, the recording is available here. We invite anyone interested in further details or consultations to reach out to us at SmartDev. Our dedication to advancing technology solutions is unwavering, and we look forward to driving innovation that meets and anticipates the needs of tomorrow’s markets.

About SmartDev

At SmartDev, we are dedicated to applying the principles of embedded finance to develop cutting-edge solutions that meet the highest security and performance standards. We invite businesses, innovators, and technology enthusiasts to engage with us and explore how our expertise in financial integration can drive transformation and deliver substantial business value.

Let’s collaborate to harness the full potential of embedded finance technology and create solutions that are innovative, secure, scalable, and aligned with your strategic goals. Contact SmartDev today to embark on your journey with embedded finance, and together, we will shape the future of digital transactions and services.