Imagine you’re shopping online for a new pair of shoes. You find the perfect pair, add them to your cart, and proceed to checkout. As you reach the payment page, you notice an option to pay in installments, with zero interest, directly through the online store’s payment system. Intrigued, you choose this option, complete the purchase seamlessly, and feel delighted with the flexibility offered. That’s when you are engaging with embedded finance technologies.

Embedded Finance in Action

📌 Payment Processing: Embedded finance is perhaps the most visible in the realm of payment processing. Embedded finance in payment processing refers to the integration of financial services, particularly payment capabilities, directly into non-financial platforms and applications. This seamless integration allows businesses and consumers to carry out transactions without the need to leave the platform they are using, enhancing convenience, efficiency, and the overall user experience.

Figure 1: Wechat Pay – A one-stop-shop experience for users

A notable example of embedded finance in payment processing is seen in social media and messaging apps, particularly with WeChat. WeChat Pay integrates payment processing into the WeChat app, allowing users to make payments, transfer money, and even pay bills within the app. This creates a one-stop-shop experience for users who can chat, shop, and pay all in one place. By embedding financial services, WeChat has transformed from a simple messaging app into a multifunctional platform that facilitates a wide range of activities.

📌 Lending: Lending is another area where embedded finance is making a substantial impact. Embedded finance is typically achieved through APIs, SDKs, or white-label solutions, allowing platforms like e-commerce sites, digital wallets, or financial apps to offer lending options such as Buy Now, Pay Later (BNPL) directly within their user interface. When users make a purchase or need financing, they can apply for a loan within the platform. Real-time credit assessments are performed using data from the platform or third-party services, and instant approvals with terms are presented to the user. Once approved, funds are disbursed directly or applied to the purchase, with repayments often automated through the platform.

📌 Insurance: Embedded finance in insurance works similarly by incorporating insurance options directly into the sales process of various products and services, making it easy for customers to add coverage as part of their purchase. For example, when booking a flight on a travel website like Expedia, customers are given the option to purchase travel insurance during the checkout process. Similarly, when buying a new car from a manufacturer, buyers can opt for vehicle insurance on the spot. This integration means customers don’t have to visit separate insurance websites or agents; instead, they can get insured instantly while completing their primary transaction.

Figure 2: Expedia Travel Insurance Purchase

The Economic Impact of Embedded Finance

1. Cost Savings

🔻Operational Efficiency

By streamlining processes and reducing administrative overhead, businesses can save significant costs. Consider a mid-sized online retailer using an integrated payment system like Stripe. With automated payment processing, the retailer can handle thousands of transactions daily without manual oversight. This efficiency not only cuts down on operational costs but also improves cash flow, enabling businesses to reinvest savings into growth initiatives.

🔻Customer Acquisition and Retention

Personalized financial products, such as BNPL options and loyalty programs, attract and retain customers more effectively. These tailored solutions enhance customer loyalty and increase lifetime value, translating into significant savings on acquisition and retention expenses.

For instance, an online clothing retailer offering a branded credit card with exclusive rewards can foster a loyal customer base. The personalized financial product encourages repeat purchases, increases average order values, and reduces churn. As a result, the retailer spends less on acquiring new customers and retains existing ones more effectively.

🔻Regulatory Compliance

Integrated compliance features, such as automated KYC (Know Your Customer) and AML (Anti-Money Laundering) checks, streamline regulatory processes and reduce the risk of non-compliance. Onboarding new customers with just a few clicks, all while maintaining full regulatory compliance. These automated solutions not only streamline operations but also eliminate the hefty costs tied to manual compliance efforts.

Picture a company swiftly bringing in new clients without the need for large compliance teams, significantly cutting down on errors, and ensuring that every regulatory standard is met. This transformation not only saves substantial costs but also speeds up business growth, making compliance a seamless and integral part of the customer journey.

2. Revenue Opportunities

🔻New Revenue Streams

Embedded finance opens innovative revenue streams by integrating financial services directly into non-financial products. Offering their own branded credit cards, Buy Now, Pay Later (BNPL) options, and embedded insurance products can not only fuel the growth of small businesses by giving them immediate access to funds but also drive additional revenue for the marketplace through interest and fees. This creates a symbiotic relationship where both the platform and its sellers thrive, resulting in a more dynamic and financially resilient ecosystem.

🔻Enhanced Customer Experience

A key advantage of embedded finance is the enhanced customer experience it provides. Seamless payment solutions, personalized lending options, and integrated insurance products lead to higher customer engagement and satisfaction. This improved experience translates into higher sales, repeat business, and positive word-of-mouth, ultimately boosting revenue.

🔻Data Monetization

Embedded finance also enables businesses to monetize financial data. By analyzing transaction data, companies can gain valuable insights into customer behavior and preferences, allowing for targeted marketing and cross-selling. This data-driven approach enhances marketing effectiveness, increases sales, and generates additional revenue.

Challenges and Considerations

◾ Implementation Costs: While embedded finance offers substantial benefits, integrating financial services into existing platforms requires significant investment in technology and expertise. Businesses must allocate resources for development, testing, and ongoing maintenance. The initial costs can be substantial, particularly for smaller companies with limited budgets.

◾ Regulatory and Compliance Risks: Navigating complex financial regulations is a significant challenge for businesses integrating embedded finance. Compliance with diverse regulations across different regions requires robust systems and processes. Failure to adhere to regulatory standards can result in hefty fines and reputational damage.

◾ Data Security and Privacy: Ensuring robust security measures to protect sensitive financial data is paramount. Data breaches and cyberattacks can have severe financial and reputational consequences. Businesses must invest in advanced security technologies and practices to safeguard customer information.

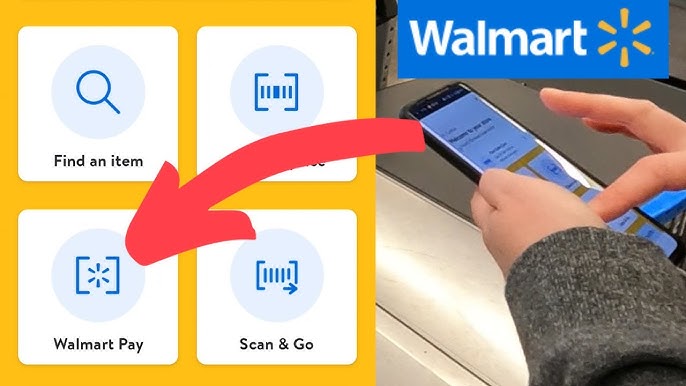

Case Study: Walmart’s Struggles with Walmart Pay

Walmart’s attempt to embed financial services through its Walmart Pay system aimed to compete with other digital wallets like Apple Pay and Google Wallet. The goal was to simplify the checkout process and integrate financial transactions directly within Walmart’s ecosystem.

Figure 3: Walmart Pay not working

However, Walmart Pay struggled to gain traction for three main reasons:

◾Consumer Adoption: Unlike its competitors, Walmart Pay required users to open the Walmart app and scan a QR code at checkout. This extra step proved cumbersome compared to the tap-and-go convenience offered by other mobile wallets.

◾Limited Compatibility: Walmart Pay was limited to use within Walmart stores, unlike more universal digital wallets that could be used across multiple retailers and online platforms. This limitation discouraged widespread adoption.

◾Integration Issues: Walmart Pay’s integration with other financial services and loyalty programs was not seamless. Users often found it confusing to link their payment methods and apply discounts or rewards during checkout.

As a result, Walmart Pay did not achieve the desired success and failed to establish itself as a competitive embedded financial service. This case highlights the importance of user convenience, broad compatibility, and seamless integration in successfully implementing embedded finance solutions.

For businesses looking to venture into embedded finance, understanding and addressing these challenges is crucial to avoid similar pitfalls and fully leverage the potential of these innovative solutions.

Transform Your Business With SmartDev

As financial services increasingly integrate into non-financial platforms, businesses have a unique chance to elevate their offerings and achieve sustainable growth. Embracing embedded finance solutions positions companies at the forefront of innovation, driving long-term success in an increasingly competitive market.

For those ready to explore and invest in embedded finance solutions, the moment is ripe. Choose SmartDev for tailored solutions designed to meet your specific needs. With extensive experience in fintech and embedded finance, we provide scalable, secure, and innovative services that grow with your business. Explore how our Fintech services can transform your business now!