In the digital age, convenience is king. Consumers increasingly demand that their financial needs be met within the platforms they already use daily. Enter embedded financial services—where financial tools and products are seamlessly integrated into non-financial platforms. This innovative approach is not just a trend but a transformative shift in how financial services are delivered and consumed. From social media apps offering peer-to-peer payments to e-commerce sites providing instant credit options, embedded financial services are creating a frictionless financial ecosystem.

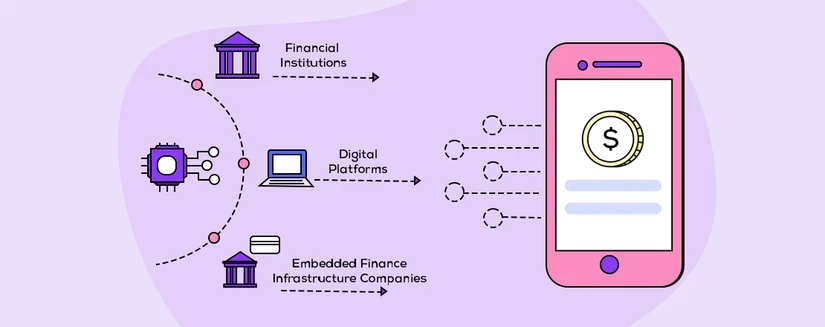

Figure 1: Understanding Embedded Finance

Image credit: Skeps

Historical Context

The evolution of financial services has been a journey from physical, paper-based transactions to the digital, integrated systems we see today. Initially, financial services were provided exclusively by banks and financial institutions. The advent of the internet and mobile technology catalyzed a transformation, allowing for more accessible and efficient financial solutions.

Key milestones in this evolution include the introduction of online banking in the 1990s, the rise of fintech companies in the early 2000s, and the proliferation of mobile payment systems in the 2010s. These developments paved the way for the integration of financial services into non-financial platforms, giving birth to the concept of embedded financial services.

Early adopters of embedded financial services, such as ride-hailing apps offering integrated payment solutions and e-commerce platforms providing instant financing options, significantly impacted the market. They demonstrated the potential for improved user experience and new revenue streams, setting the stage for widespread adoption.

Key Drivers Behind the Rise

🔸The Surge in Consumer Demand

Modern consumers crave convenience and efficiency in every aspect of their lives, including financial services. While traditional banking still holds value, there is a growing preference for seamless and convenient solutions that can be accessed through platforms they use regularly. Whether it’s paying for a ride, shopping online, or managing investments, the ability to perform these tasks within a single application is a powerful driver behind the rise of embedded financial services. This shift towards integrated financial experiences caters to the demand for instant, frictionless transactions without compromising the reliability of traditional banks.

🔸 Technological Advancements and Regulatory Shifts

The technological landscape has undergone rapid transformation, paving the way for the integration of financial services into various platforms. Innovations like APIs and advanced fintech solutions have made it possible to embed banking, payments, and lending services directly into non-financial platforms. This technological leap is complemented by regulatory changes that have evolved to support and encourage this integration. Open banking regulations, for example, mandate that banks share customer data with third-party providers, fostering an environment ripe for innovation. These regulatory shifts have reduced barriers to entry and enabled a more interconnected financial ecosystem, promoting the growth of embedded financial services.

🔸 Synergistic Partnerships

The collaborative efforts between financial institutions, fintech innovators, and diverse non-financial platforms are another critical driver of embedded financial services. These partnerships allow for the blending of traditional financial expertise with cutting-edge technological advancements. A fintech startup might bring innovative payment solutions to an established e-commerce platform, enhancing the user experience and expanding the platform’s capabilities. Such synergies create a win-win scenario: financial institutions gain new channels for their services, fintech companies expand their market reach, and non-financial platforms offer enhanced value to their customers. This network of partnerships is essential for fostering an integrated financial landscape that benefits all stakeholders.

Benefits of Embedded Financial Services

1, For Consumers

🔸 Convenience and Accessibility: Consumers can perform financial transactions while booking a ride, shopping online, or even while using social media. This reduces the need to manage multiple apps and accounts, providing a one-stop solution for financial needs.

🔸 Wide Range of Financial Products: Embedded financial services give consumers access to a broader array of financial products and services. Whether it’s instant loans, insurance, or investment opportunities, these services are readily available within the apps they already use.

🔸 Personalized Solutions: By leveraging user data and behavior, embedded financial services can offer highly personalized and tailored financial solutions. This personalization makes financial products more relevant and effective, helping consumers achieve their financial goals with customized advice and offers.

2, For Businesses

🔸 New Revenue Streams: By incorporating financial services, businesses can create new revenue streams through fees, commissions, and interest from financial transactions. This diversification can lead to increased financial stability and growth potential.

🔸 Enhanced Customer Data: Embedded financial services provide businesses with rich, actionable insights into customer behavior, preferences, and financial health. This data can be used to refine marketing strategies, develop innovative products, and enhance overall customer engagement.

🔸 Higher Conversion Rates: By reducing friction in the customer journey, embedded financial services make it easier for consumers to complete transactions and make purchases. For instance, an e-commerce platform offering instant credit at checkout can significantly increase the likelihood of purchase, boosting conversion rates and sales.

Case Study: Uber and Embedded Financial Services

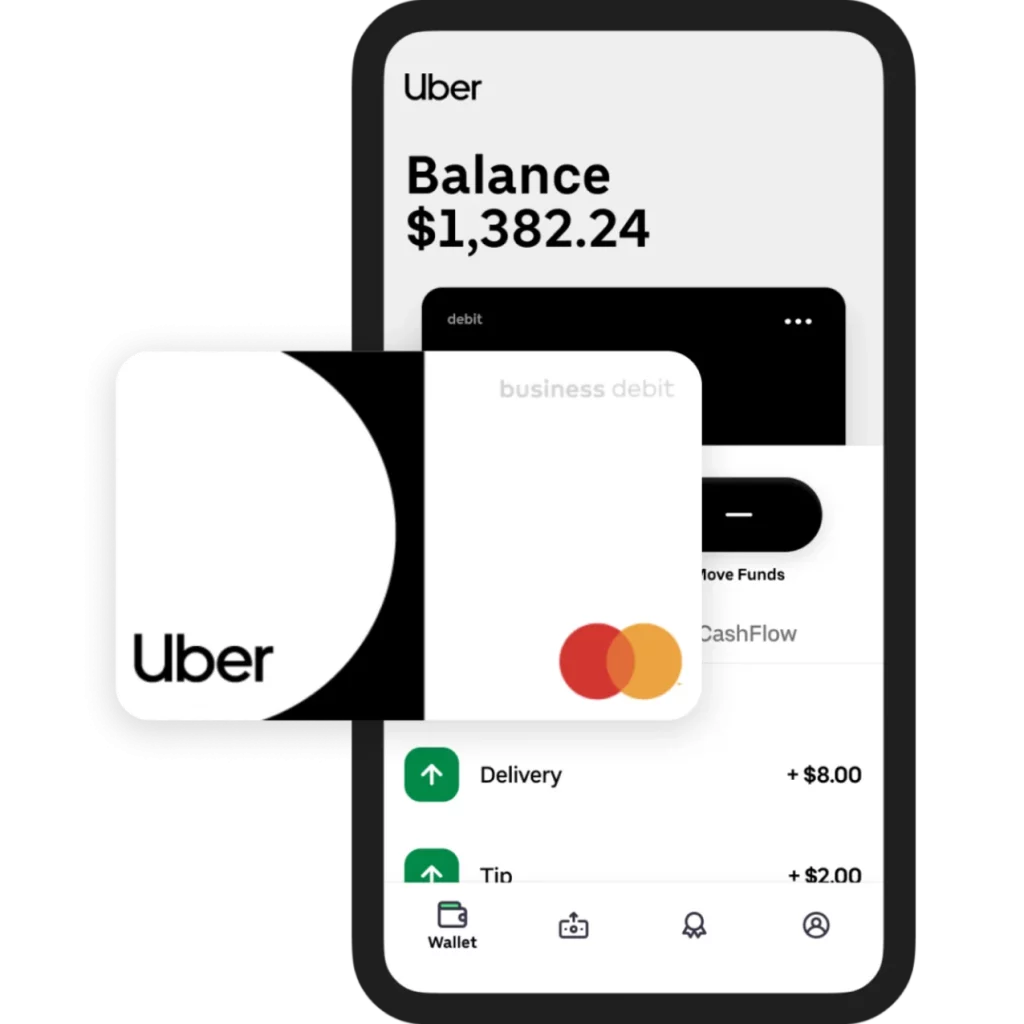

Figure 2: Uber and Embedded Financial Services

Uber’s Journey to Embedded Payments

Uber, one of the earliest adopters of embedded financial services, has revolutionized the payment experience in the ride-hailing industry. When Uber launched in 2009, the primary focus was on disrupting the traditional taxi industry with a more convenient and reliable ride-hailing service. However, the manual payment process posed significant challenges, causing delays and security concerns. To enhance user experience and build trust, Uber began exploring options for integrating payments directly into its app.

In 2010, Uber partnered with Braintree, a payment processing firm, to facilitate in-app credit card transactions. By late 2011, Uber had fully integrated in-app payments, allowing users to securely store payment information and enabling automatic payments upon ride completion.

Over the years, Uber enhanced its embedded payment system, introducing Uber Cash in 2016—a digital wallet that allowed users to preload funds and earn discounts and rewards. Additionally, Uber integrated with various digital wallets and local payment methods, further streamlining the payment process for its users worldwide.

Figure 3: Uber Fueling Driver Loyalty with Financial Services

Outcome of Uber’s Embedded Payments Integration

According to Uber Investor Relations, the integration of embedded payments significantly transformed Uber’s operations and user experience. In 2022, surveys indicated a strong preference for the in-app payment system, with 87% of users favoring it over traditional methods. This shift contributed to a 15% increase in customer retention within the first year. The streamlined process also reduced operational costs, with administrative expenses dropping by 25% due to automated transaction processing and fewer payment disputes.

Financially, Uber reported a 10% increase in revenue attributed to the integration of embedded financial services. Partnerships with financial institutions and fintech companies facilitated new revenue streams through transaction fees and commissions. Moreover, the embedded payment system provided valuable data insights, enabling Uber to offer personalized promotions and achieve a 20% higher conversion rate for targeted campaigns. These advancements played a crucial role in Uber’s global expansion, accommodating diverse payment preferences and enhancing its competitive edge in various markets.

Future Outlook

The future of embedded financial services looks promising, with continued growth and evolution anticipated. According to MarketsandMarkets, the embedded finance market is estimated to be worth USD 115.8 billion in 2024. It is projected to reach USD 251.5 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 16.8% during the forecast period.

Several emerging trends and technologies are expected to shape the future landscape of embedded finance:

AI and Machine Learning for Enhanced Personalization: More tailored financial advice, customized product recommendations, and automated decision-making processes.

Blockchain Technology Integration: Providing secure, transparent, and decentralized transaction capabilities.

IoT Connectivity and Embedded Finance: Create new opportunities for innovation and convenience.

Join Our Webinar: Embedded Financial Services

Are you ready to explore the next big wave in financial innovation? We invite you to join us for our exciting webinar, “ Embedded Financial Services “. Dive deep into this transformative trend with us and discover how embedded financial services are changing the game for both consumers and businesses.

Webinar Details

📅 Date: Wednesday, July 31st, 2024

⏰ Time: 3:00-4:00 PM (GMT+7) – Afternoon time in Asia countries

Speaker Information

🔸Alex Lang: Chief Commercial Officer, SmartDev

🔸Geert Theys: Head of Payment Solutions, SmartDev

🔸Si Hoang Le: Pre-sale Manager, SmartDev

Don’t miss out on this opportunity to be at the forefront of financial innovation. Register now to secure your spot and be a part of the financial revolution. Follow us on LinkedIn for more updates. Let’s unlock the immense potential of embedded financial services together and pave the way for a more integrated and efficient financial ecosystem.