On 31st July, SmartDev hosted an insightful webinar on Embedded Financial Services. This event brought together industry leaders, experts, and enthusiasts to delve into the transformative potential of integrating financial services within digital platforms. The webinar provided actionable insights into leveraging embedded finance to drive new revenue streams, enhance customer experiences, and maintain a competitive edge.

Meet our Industry experts

Alex Lang (Chief Commercial Officer, SmartDev) – Host

Alex Lang, with over 14 years of experience in the Software and IT Outsourcing industry, served as the host of the webinar. His expertise in Global Business Development, Sales, and Marketing across APAC, South Korea, Japan, Europe, and the US, has equipped him with valuable strategic insights that he shared throughout the event.

Geert Theys (Head of FinTech, SmartDev) – Speaker #1

Geert Theys is a distinguished FinTech leader with 15 years of experience in driving transformative projects within startups and the corporate sector. Specializing in the Insurance and Telecommunication industries, Geert’s strategic and hands-on approach to software and infrastructure development has significantly contributed to the FinTech industry.

Hoang Si Le (Pre-sale Manager, SmartDev) – Speaker #2

Hoang Si Le leads pre-sales activities and strategies at SmartDev. His extensive experience in customer engagement, solution architecture, and project management, particularly in high-value FinTech projects, provided attendees with practical insights into embedded finance and API integration.

Webinar Agenda

The webinar was meticulously structured to provide a comprehensive overview of embedded finance, including practical use cases and strategies for implementation. Below is a detailed breakdown of the agenda:

- How To Start Leveraging Embedded Finance (Assessment, Planning, Partnerships)

- Choosing the Right partner and implementation strategy

- Measuring success and ROI

- Consider potential risks and challenges with embedded finance

- Best practices and tips to integrate Embedded Finance

- Interactive Q&A Session

Key Highlights from the Webinar

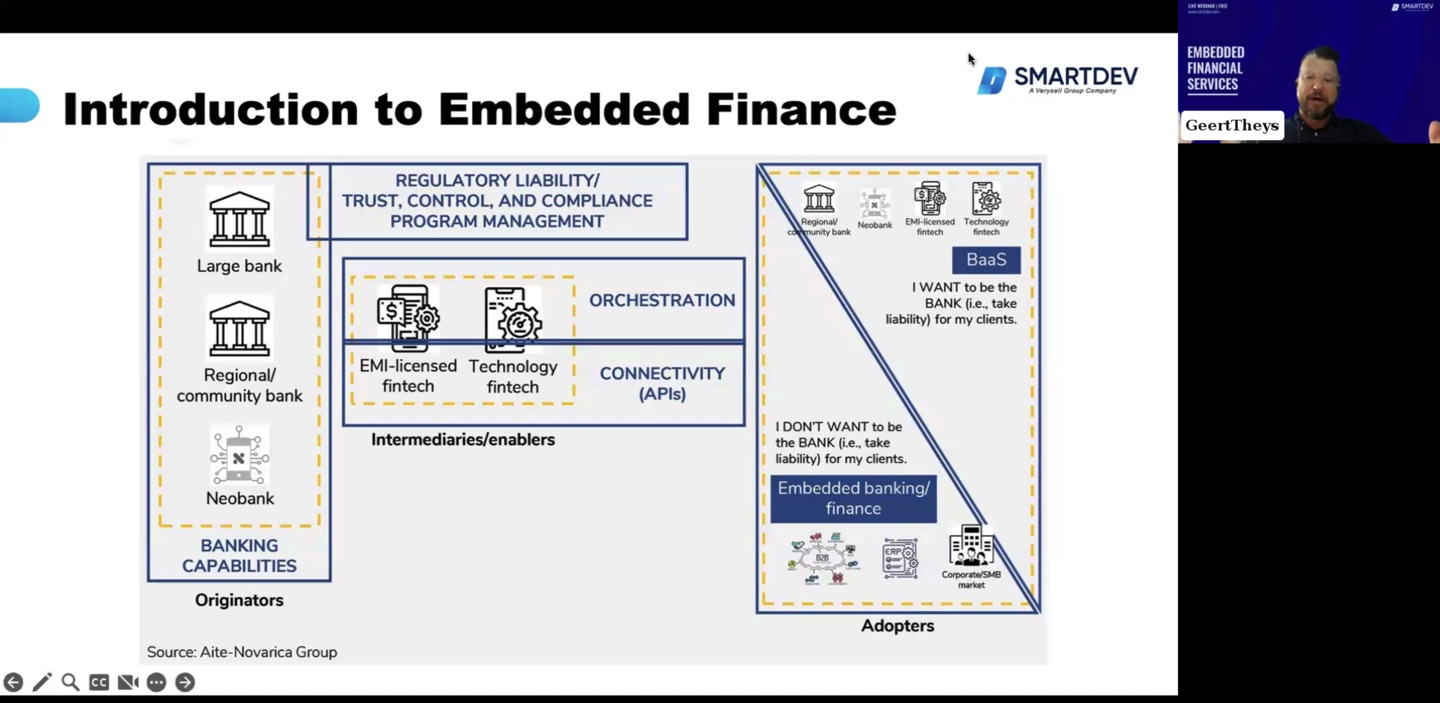

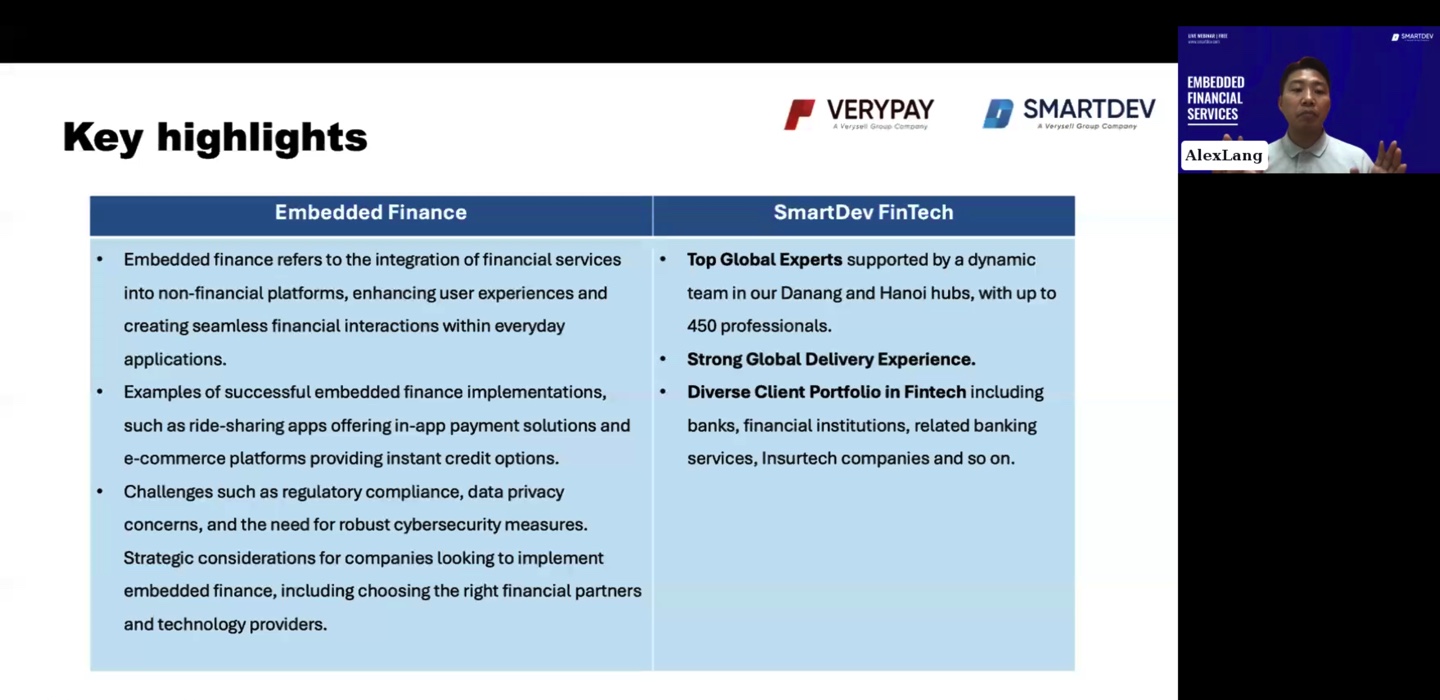

Introduction to Embedded Finance

Geert Theys commenced the webinar by providing a thorough introduction to embedded finance. He explained that embedded finance involves the seamless integration of financial services into non-financial platforms, enhancing user experience and creating new revenue streams. Geert illustrated the end-to-end process flow, emphasizing the roles of end users, platform customers, software platforms, payment facilitators, acquiring bank processors, and card networks. He highlighted the critical importance of fraud checks at multiple stages to ensure transaction security.

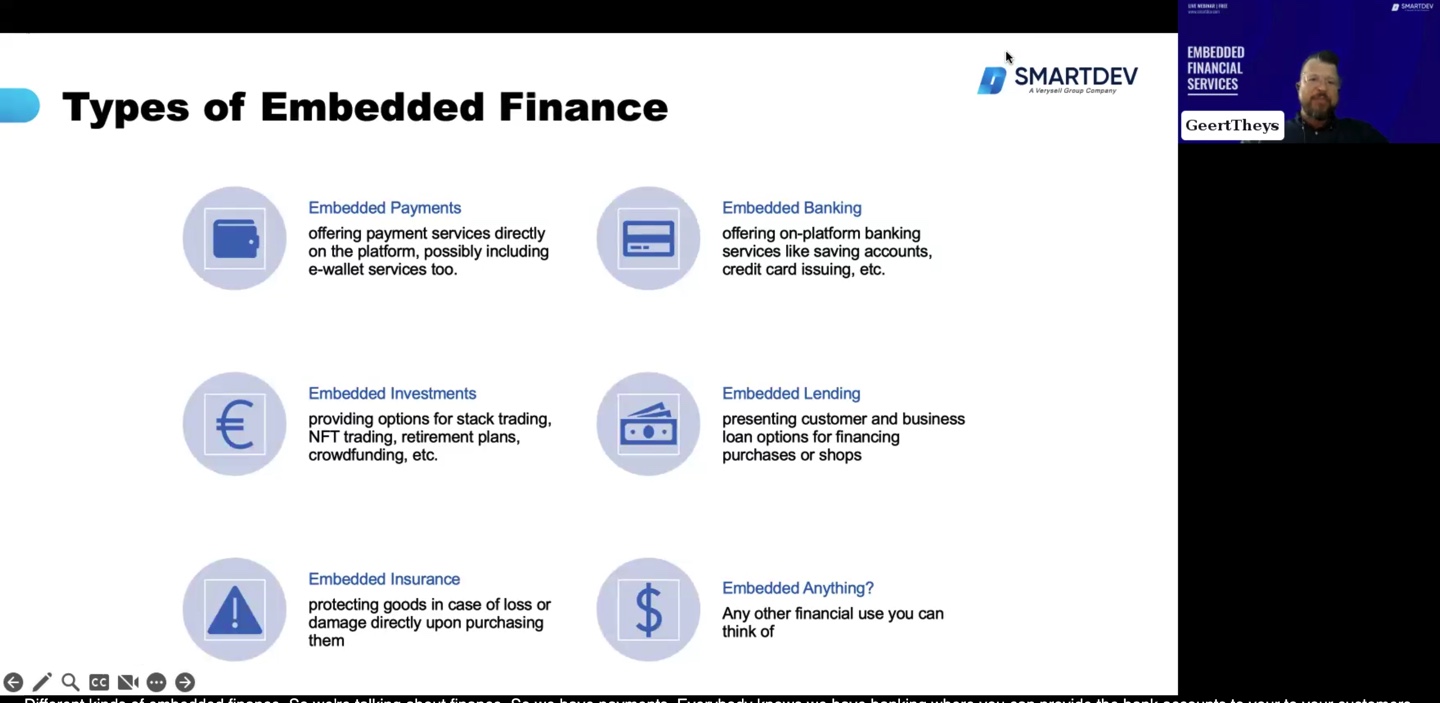

Types of Embedded Finance

Geert explored various types of embedded finance services that businesses can leverage:

- Embedded Payments: These are direct payment services within the platform, such as e-wallets, which streamline transactions and enhance user convenience.

- Embedded Banking: Providing on-platform banking services, including savings accounts and credit card issuance, to reduce dependency on external banking.

- Embedded Investments: Offering investment options like stock trading, NFT trading, retirement plans, and crowdfunding directly on the platform, making financial services more accessible.

- Embedded Lending: Presenting customers with loan options for financing purchases, thus facilitating higher value transactions.

- Embedded Insurance: Offering insurance for goods upon purchase, providing users with a comprehensive service package.

- Embedded Anything: Custom financial use cases tailored to specific business needs and customer demands.

Use Cases

Geert presented practical use cases to demonstrate the benefits and applications of embedded finance:

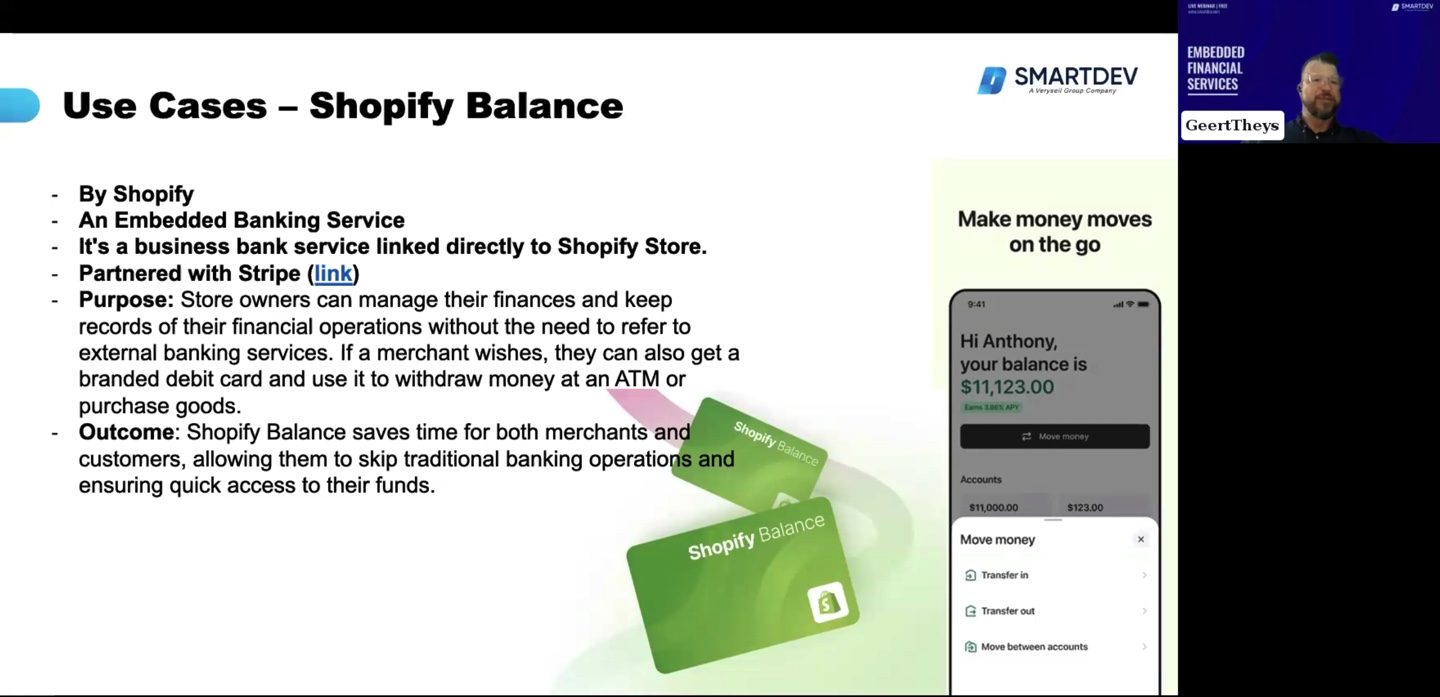

Shopify Balance

This embedded banking service is linked directly to the Shopify Store, allowing store owners to manage their finances without relying on external banking services. Features include a branded debit card for ATM withdrawals and purchases, which saves time and ensures quick access to funds. Geert explained how this integration exemplifies the benefits of embedded banking for e-commerce businesses.

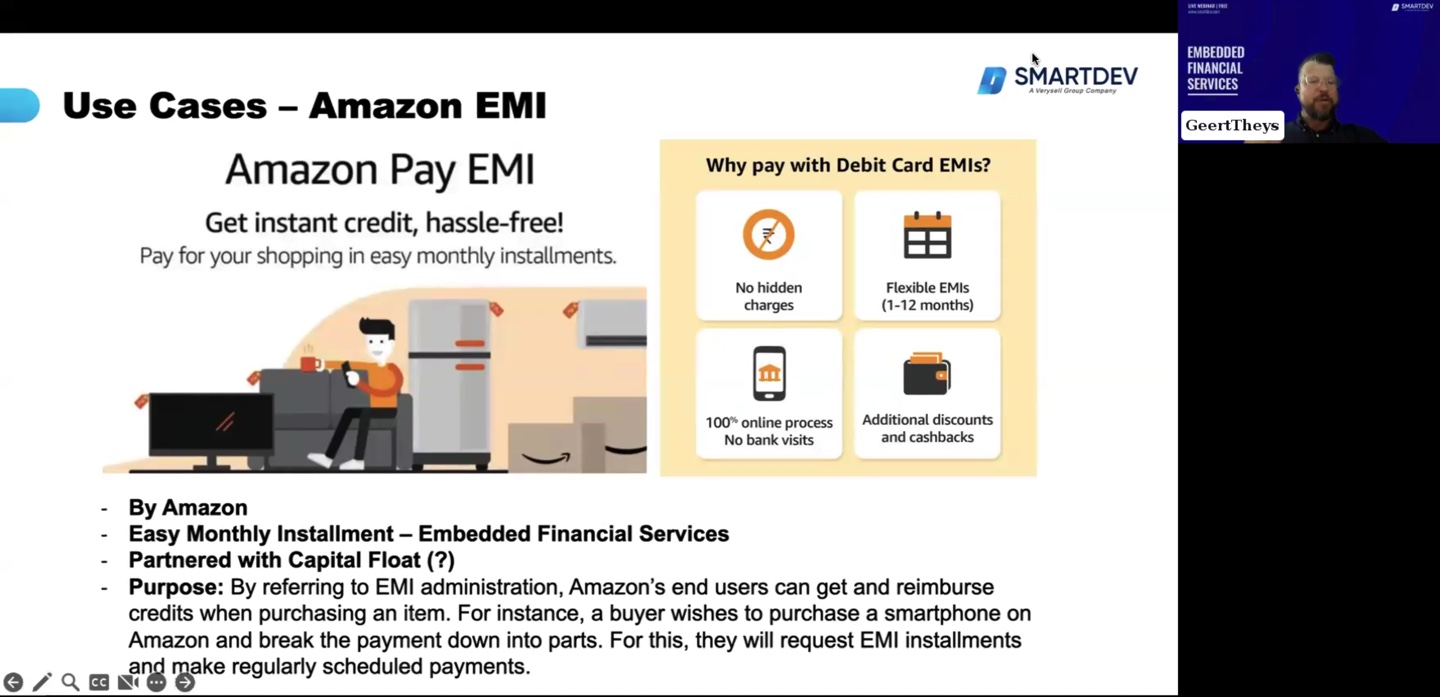

Amazon EMI

Amazon’s embedded financial service offers easy monthly installments for purchases. Partnered with Capital Float, this service enables customers to break down payments into manageable parts, making high-value purchases more accessible and financially manageable.

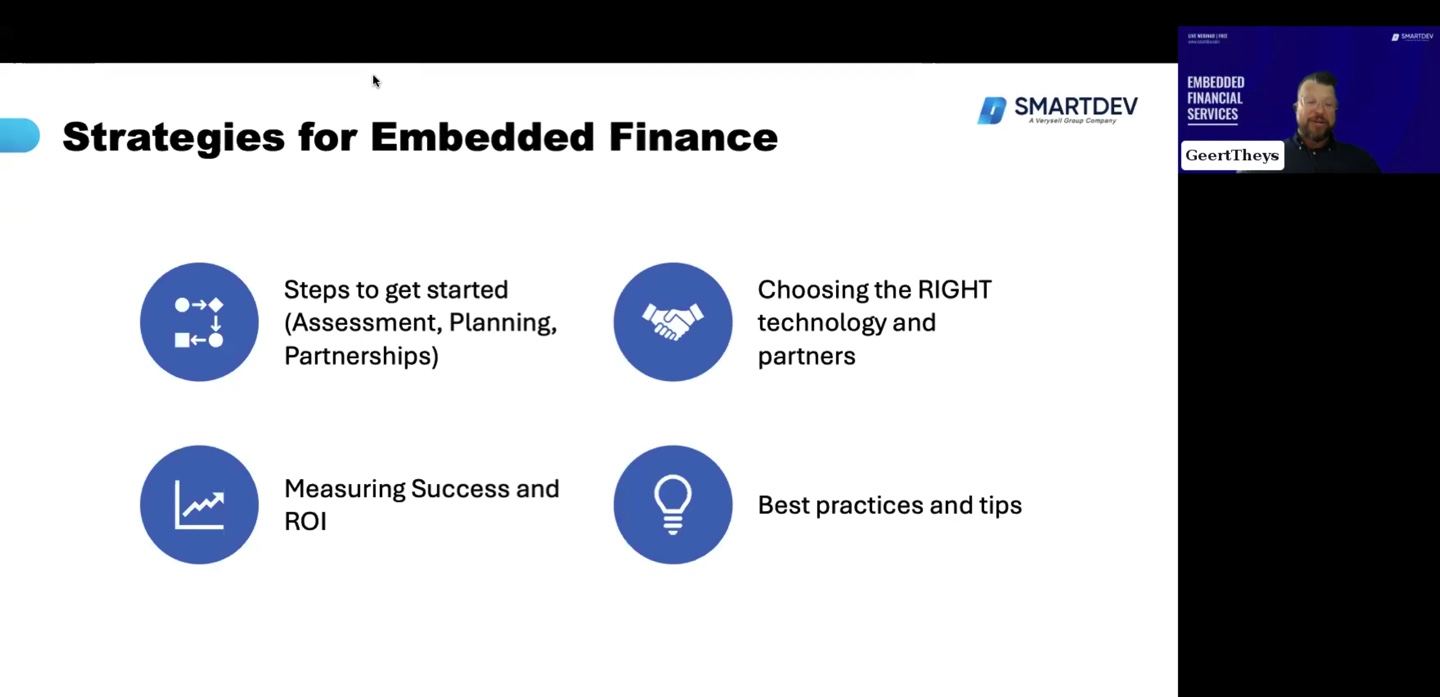

Strategies for Implementing Embedded Finance

Geert stressed the importance of assessing business needs, meticulous planning, and forming strategic partnerships for successful integration. Understanding customer requirements and aligning them with business goals ensures a targeted and effective implementation.

Selecting suitable technology and reliable partners is also crucial for seamless implementation. Geert provided insights into evaluating potential technology solutions and partners to ensure compatibility and reliability, emphasizing the need for secure and scalable infrastructure.

He then discussed the importance of setting clear metrics to measure the success and return on investment of embedded finance initiatives. He suggested key performance indicators (KPIs) to track the effectiveness of these solutions, ensuring that businesses can quantitatively assess their impact and make data-driven decisions.

Sharing industry best practices, Geert offered practical tips for businesses to integrate embedded finance successfully. These included focusing on user experience, ensuring robust security measures, and maintaining compliance with regulatory requirements. Adopting these best practices helps businesses navigate potential challenges and optimize their embedded finance offerings for maximum impact.

Embedded Payment Gateway

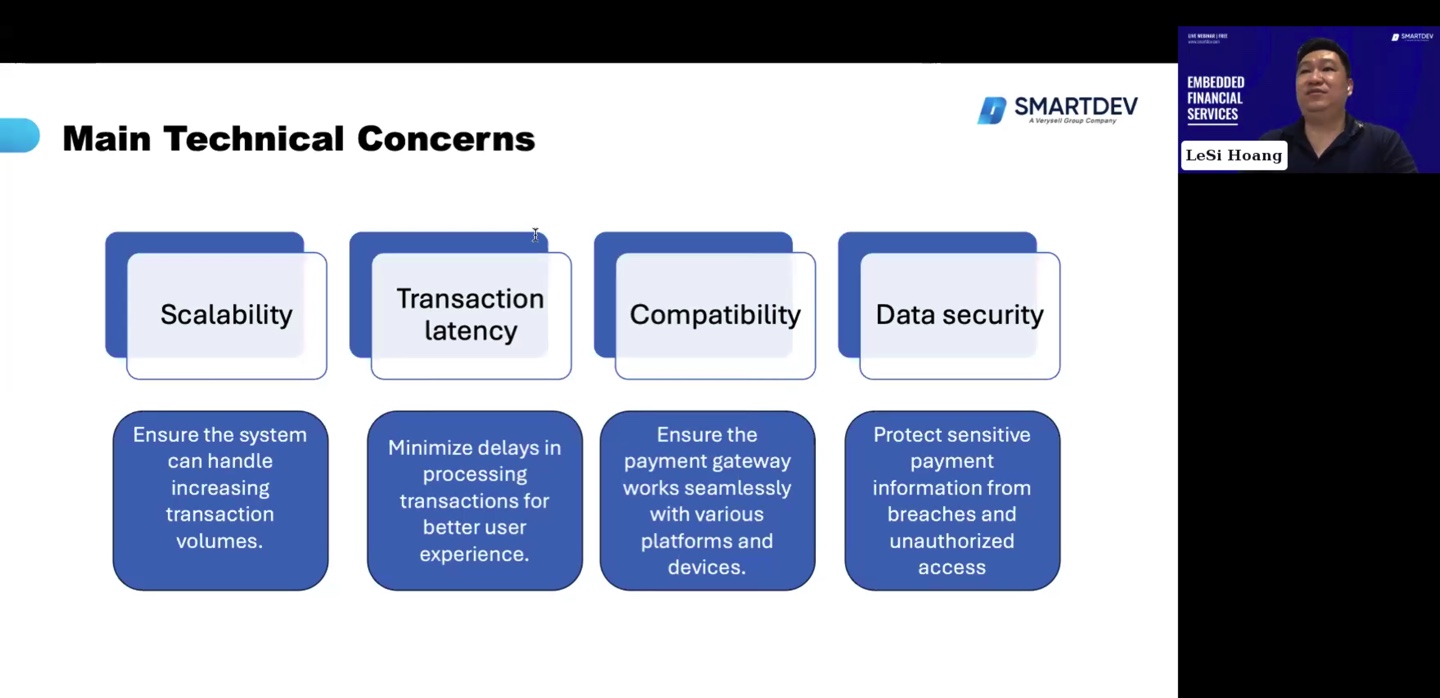

Le Si Hoang delved into the main technical concerns that need addressing to ensure the efficiency and reliability of payment gateways. He highlighted four critical areas: scalability, transaction latency, compatibility, and data security. Scalability focuses on the system’s ability to manage increasing transaction volumes, ensuring uninterrupted service as demand grows. Transaction latency addresses the need to minimize delays in processing transactions, thus enhancing user experience. Compatibility ensures that the payment gateway integrates seamlessly with various platforms and devices, facilitating widespread usability. Lastly, data security is paramount to protect sensitive payment information from breaches and unauthorized access, maintaining customer trust and regulatory compliance.

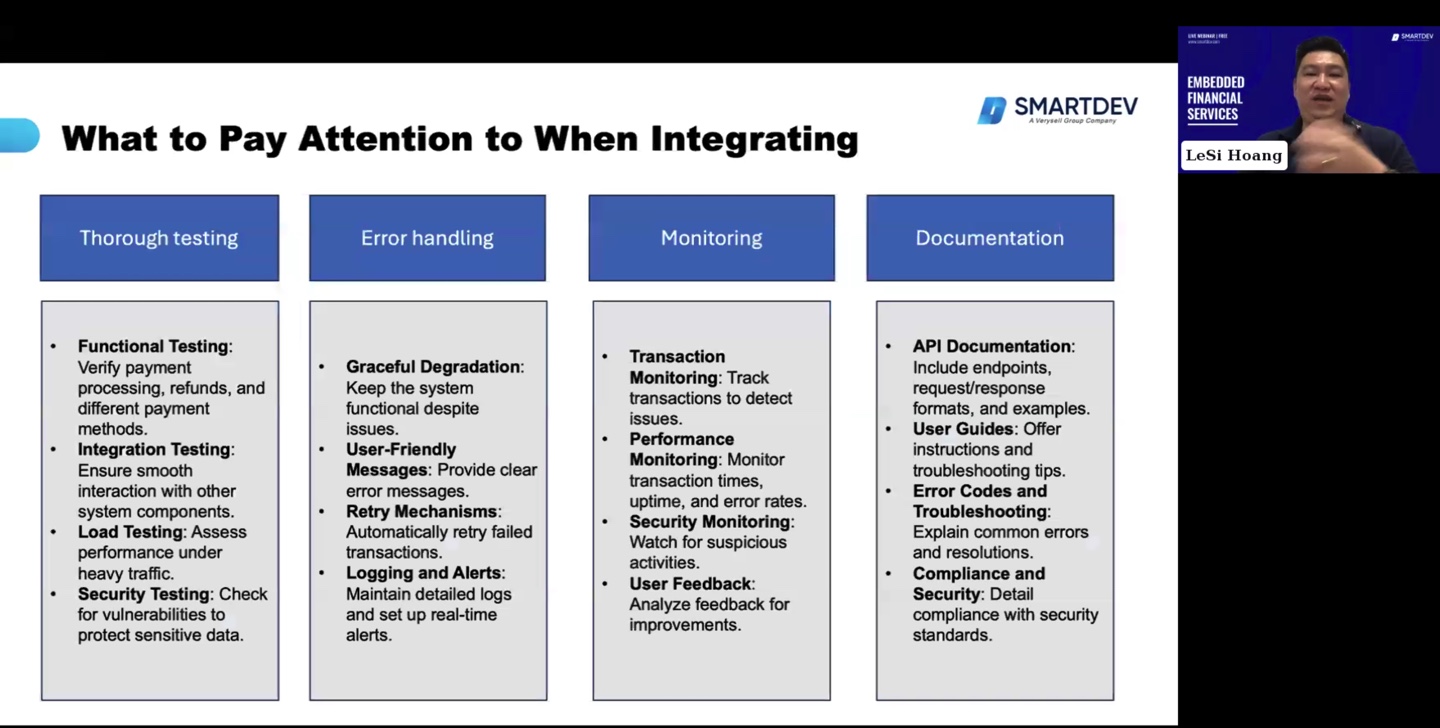

He also discussed the technical difficulties encountered when integrating payment gateways. These challenges include the complexity of setting up APIs, which involves thorough documentation and authentication processes. Error handling and feedback mechanisms are crucial for identifying and resolving issues promptly, necessitating robust logging and monitoring systems. Security guarantees, such as PCI-DSS compliance and data encryption, are essential to safeguard transactions. Session management must handle concurrency efficiently to ensure smooth user experiences. Additionally, data synchronization through webhooks and integration is vital for maintaining data integrity across systems. Ensuring system compatibility and managing updates require careful planning to avoid disruptions and maintain backward compatibility.

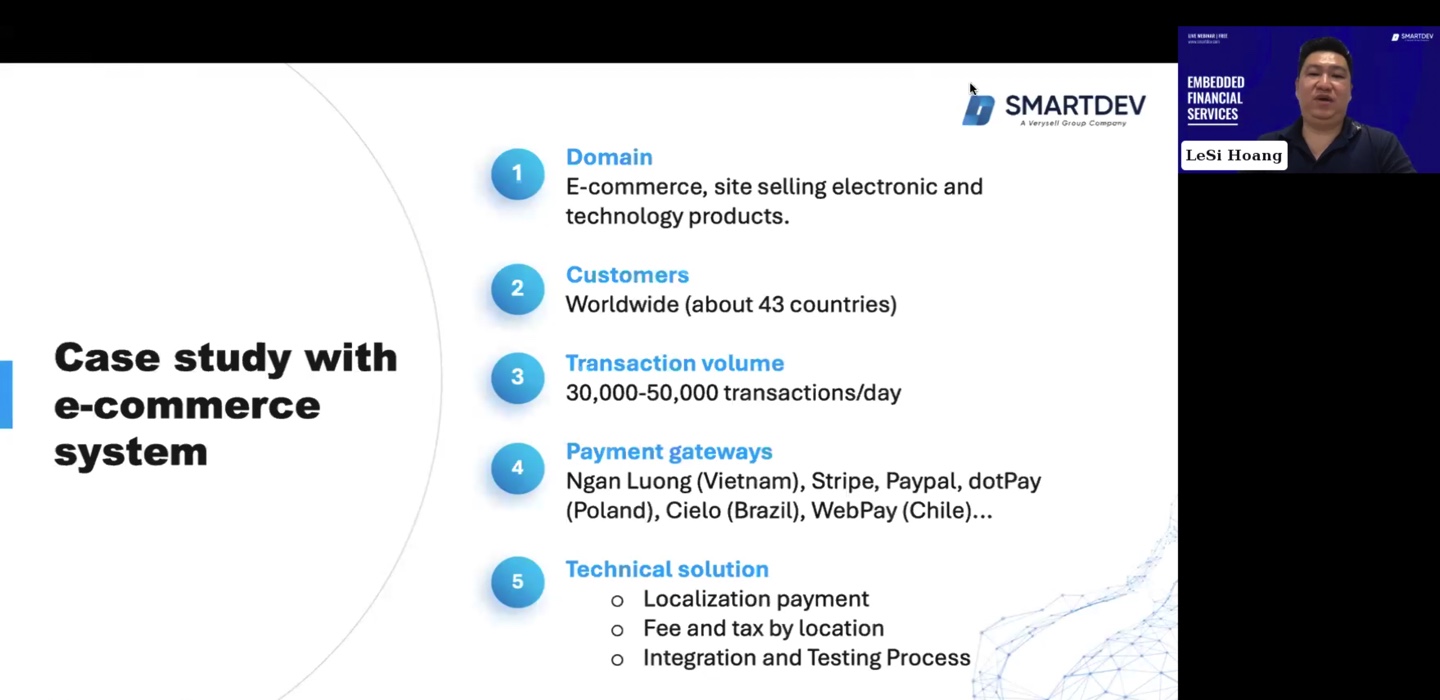

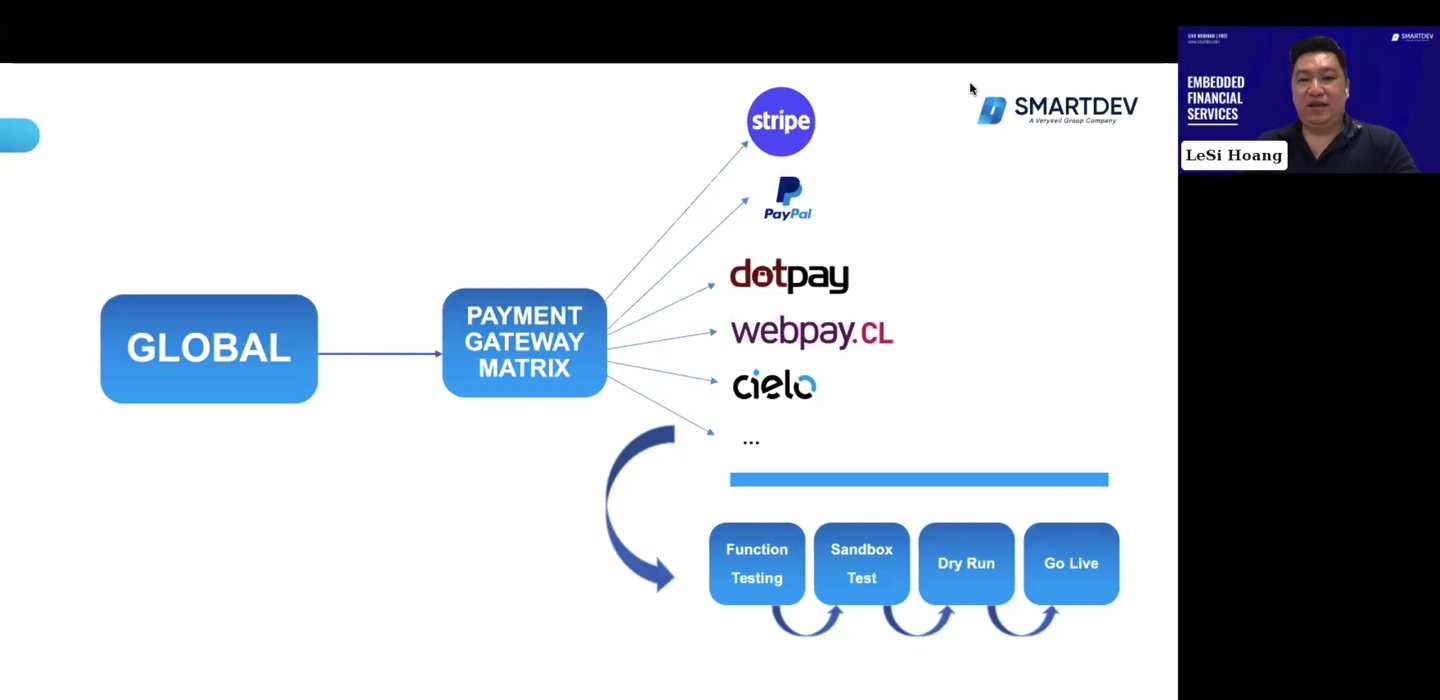

A case study presented during the webinar exemplified the practical application of these technical considerations in an e-commerce setting. The discussed e-commerce site, dealing in electronic and technology products, serves customers in about 43 countries with a transaction volume of 30,000 to 50,000 transactions per day. The payment gateways used include Ngan Luong (Vietnam), Stripe, PayPal, dotPay (Poland), Cielo (Brazil), and WebPay (Chile), among others. The technical solution implemented involved localization of payments to accommodate fees and taxes by location, ensuring a tailored and compliant payment process for each region. Integration and testing processes were emphasized to ensure that all components functioned seamlessly together, providing a robust and efficient payment solution for the global customer base.

About SmartDev

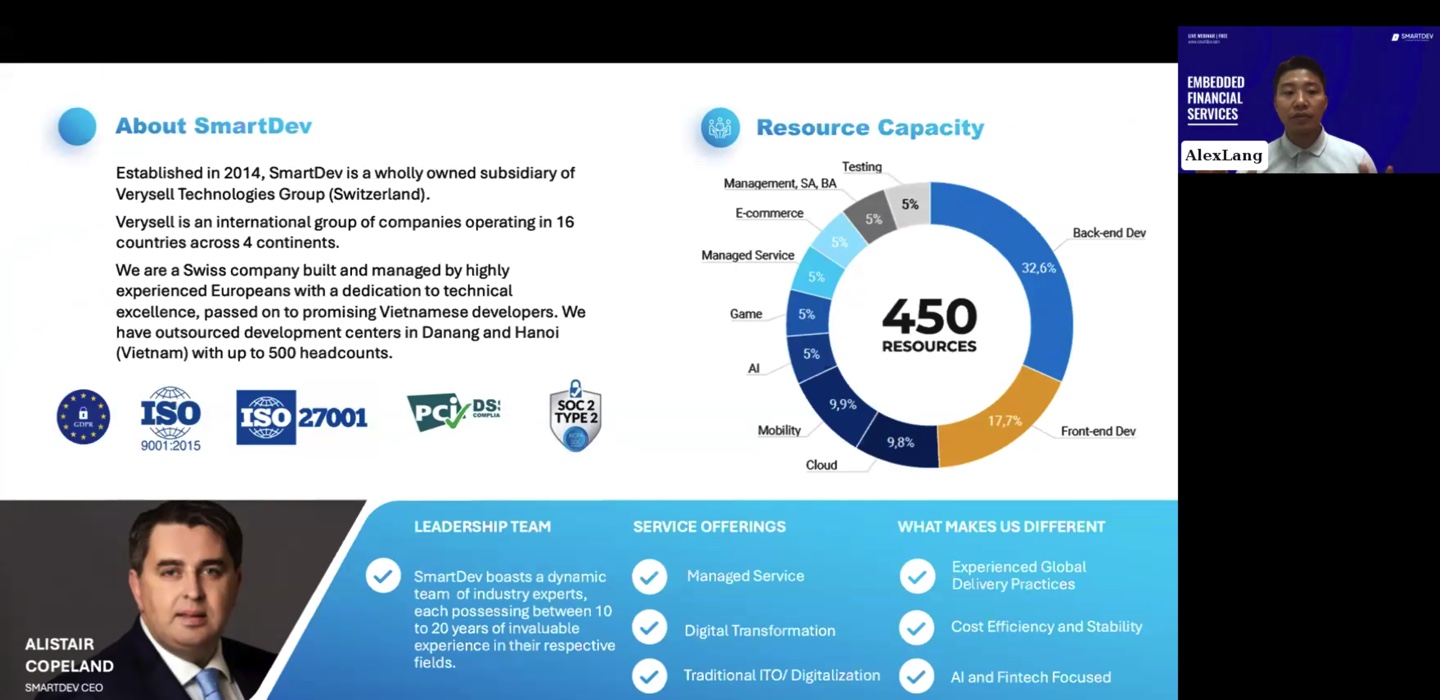

Alex Lang introduced SmartDev, emphasizing its position as a leading provider of software solutions. Established in 2014 and now a subsidiary of Verysell Technologies Group, SmartDev operates in 16 countries across four continents, with development centers in Danang and Hanoi. Key highlights included:

- Resource Capacity: Over 450 resources with expertise in various domains such as back-end and front-end development, cloud, mobility, AI, and more.

- Certifications: ISO 9001:2015, ISO 27001, PCI-DSS, and SOC 2 Type 2 certifications.

- Service Offerings: Managed services, digital transformation, traditional ITO/digitalization, and AI/Fintech-focused solutions.

SmartDev – Financial Services Solutions Offering

Alex discussed SmartDev’s comprehensive range of financial services solutions, emphasizing their versatility and integration capabilities:

- Financial Services Mobile Solutions: Banking apps, wallet apps, merchant apps, integrated card management apps, investment management apps, and insurance web apps.

- Robotic Process Automation (RPA): Customer onboarding, KYC compliance, loan processing, fraud detection, claims processing, compliance reporting, and data management.

- Blockchain Custom Development: Services include chain development, explorer-chain, eKYC, cloud exchange network, DeFi wallets, DApps, portal API services, and digital transformation.

Conclusion and Q&A Session

The webinar concluded with an interactive Q&A session, where attendees engaged directly with the speakers, asking questions and clarifying their doubts. This session provided deeper insights into the practical applications of embedded finance and allowed participants to gain a more comprehensive understanding.

Final Thoughts

SmartDev’s webinar on Embedded Financial Services was a resounding success, offering valuable insights into the potential of embedded finance. Integrating financial services within digital platforms not only enhances customer experiences but also opens new revenue streams and ensures a competitive advantage in the market.

The event highlighted the importance of strategic planning, selecting the right partners, and adhering to best practices for successful implementation. Attendees left with a clear understanding of the opportunities and challenges associated with embedded finance, armed with practical strategies to drive innovation and growth.

For those who missed the webinar, click here to get access to the full recording and additional resources to ensure everyone can benefit from the insights and knowledge shared. Stay tuned for more webinars and events from SmartDev as we continue to explore and lead in the realm of fintech and digital transformation.