Digital payments in Africa have been gaining momentum since 2000 and Africa’s domestic digital payments market is expected to see revenues grow by approximately 20 percent per year, reaching around $40 billion by 2025. SmartDev began working with VeryPay (a Verysell group company) in April 2021, with a mission to drive financial inclusion in Africa and other developing economies, by making digital payment solutions easier to use and more accessible than ever before. This involved creating a multi-tenant set of payment apps that could integrate quickly and easily with any eWallet. Aligned to this, NFC payment cards and wearable devices were required to sync with the apps. First class security, MFA and a solution that would scale to millions of users was required by VeryPay.

Private Payment Solution for Emerging economies

VeryPay offers innovative white label payment apps for merchants and consumers in cash dominant, less developed markets. With financial inclusion front of mind, VeryPay’s payment solution gives control back to businesses, which can help them to reduce costs and make digital payments accessible to all.

Headcount

25 people (6 Java Backend, 2 Android Kotlin; 4 React Native; 1 Business Analyst + Technical Writer; 1 Product Owner; 1 Technical Lead & Project Manager; 1 Devops; 2 React JS; 1 UX/UI Designer; 6 QA)

Industries

PayTech

Products and Services

The closed-loop payment system

Timescales

April 2021 – Present

Country

Switzerland

The Challenge

The Solution

The VeryPay closed-loop payment system is a multi-tenant contactless payment facilitation platform designed to integrate with any mobile wallet. It enables consumer-merchant payment interactions via mobile Android applications and an RFID contactless payment token or QR-code. VeryPay’s system allows a single eWallet account to be shared among friends or family members, where each group member has a dedicated card or wearable device, with member specific spending limits.

VeryPay is a closed loop private payment system, allowing businesses to own and operate their own brandable payment scheme. VeryPay’s merchant app turns a smartphone into a payment terminal, removing the need for a bank account and expensive hardware. The consumer app allows eWallet users to extend the use of their account to friends and family, using cost-effective NFC cards, virtual cards (for Apple Pay, Google Pay), wearables or simply by phone tapping. VeryPay makes mobile money simpler, easier to use and more cost effective.

Technology Stacks

Spring Framework

Kubernetes

Java Script

Docker

ActiveMQ

MicroServices

Kotlin

Android

ReactJS

iOS

NFC

Jenkins

Bitbucket Pipeline

Sonaqube

Microsoft App Center

The VeryPay closed-loop payment system

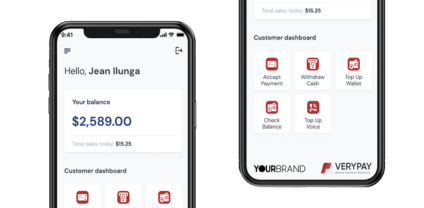

MERCHANT APP

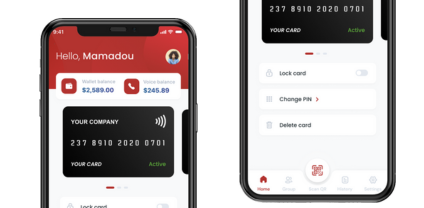

The merchant application, customizable with your brand, can be published on the Google Play Store. By enabling NFC on your smartphone, you can transform it into a mobile payment acceptance terminal. This app allows you to accept payments, top up customer wallets, process withdrawals and refunds, view and export transaction history, and monitor your merchant balance.

CUSTOMER APP

Our seamless integration allows you to connect branded payment cards or wearable devices to existing mobile wallet accounts. Multiple cards or devices can be linked to a single customer account, enhancing adoption and usage of your mobile money solution. The platform enables you to view customer balances, transaction history, manage group members, manage payment tokens, accept payments via QR codes, and integrate with Google Wallet.

VeryPay Achievements

Pioneering Closed-Loop Payment System

VeryPay's innovative closed-loop payment system provides a flexible and customizable solution for businesses to establish their own branded payment schemes. This platform enables seamless integration with mobile wallets, offering a wide range of payment options for consumers.

Financial Inclusion and Accessibility

By allowing multiple eWallet accounts to be shared among family members, VeryPay extends the benefits of mobile money to millions of unbanked citizens. This inclusive approach empowers individuals without smartphones or feature phones to participate in the digital economy.

Strategic Partnerships and Market Expansion

VeryPay's collaboration with multiple Telco brands across several African countries demonstrates its strong market presence and potential for growth. The company's focus on countries promoting digital payments aligns with the industry's trends.

Get Started

Have a Project in Mind?

With SmartDev, you can find a range of fintech competencies to help you scope, design and build your ideal product or solution. Share your vision with us and we will get back to you the following working day. Our experts can help your business unlock potential and unleash innovation.

Subscribe to our Newsletter

Stay ahead in the tech world with SmartDev! Subscribe to our newsletter for the latest IT news, updates, and insights.