As we navigate through 2025, the global ai in bfsi market has reached a historic structural inflection point. The industry has decisively moved beyond the “experimentation phase”, characterized by isolated chatbots and surface-level data visualization and is now entering an era of “Reimagination.” This shift is fundamentally driven by the convergence of three powerful forces: the maturation of Generative AI (GenAI), the emergence of Agentic AI (autonomous digital workers), and a global tightening of AI-specific regulations.

Quantitative benchmarks from 2024–2025 reveal a stark “strategy-execution gap.” While 52% of financial organizations report active usage of GenAI, a mere 8% have successfully transitioned to a strategic, enterprise-grade deployment. However, the economic incentive for closing this gap is undeniable: McKinsey research indicates that GenAI alone can create between $200 billion and $340 billion in annual value for the banking industry, representing 9% to 15% of total operating profits.

This report provides the definitive market analysis required for C-suite leaders to navigate this transformation, utilizing frameworks from recognized industry authorities like SmartDev to move beyond “pilotitis” and achieve production-scale ROI.

Global Market Analysis: Scaling the Multi-Trillion Dollar Opportunity

The global ai in bfsi market has transitioned from a supporting technology to the primary “shock absorber” for the global financial system. In an era defined by trade volatility, fluctuating interest rates, and cloying inflation, AI investment has become a strategic necessity for operational resiliency. Financial institutions are no longer just buying “tools”; they are investing in foundational infrastructure that allows them to weather macroeconomic shifts with greater agility than traditional models.

SmartDev’s market intelligence suggests that the aggressive spending seen in 2025 is fueled by the democratization of high-performance computing through cloud-native platforms like Google Vertex AI, Microsoft Azure, and AWS Bedrock. These platforms have lowered the barrier to entry, allowing mid-tier firms to deploy models that were previously the exclusive domain of “Money Center” banks.

Quantifying the Exponential Growth Trajectory (2025–2034)

The ai in bfsi market size is witnessing a trajectory of sustained, non-linear growth that reflects a fundamental shift from “experimentation” to “industrialization.” While various research bodies offer differing baseline valuations, the consensus remains that the sector is in the midst of its most significant capital expenditure (Capex) cycle since the 1990s.

According to The Business Research Company, the market reached a milestone valuation of $101.2 billion in early 2025. Projections indicate this will soar to $517.77 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 38.5%. This expansion is driven by the urgent need for real-time decision intelligence and the integration of Generative AI (GenAI) into core customer-facing and back-office functions.

Market Segment Breakdown and Growth Vectors

The growth is distributed across several high-impact segments, each reflecting a specific strategic priority within the BFSI value chain:

| Market Segment | 2025 Valuation | 2033–2035 Projection | CAGR (%) | Strategic Driver |

| Global AI in BFSI (Aggregate) | $101.2 Billion | $517.77 Billion (2030) | 38.50% |

Core Modernization

|

| BFSI Information Security | $79.90 Billion | $167.98 Billion (2031) | 13.18% |

Cyber-Resiliency

|

| Generative AI in BFSI | $1.90 Billion | $18.52 Billion (2034) | 27.70% | Personalization |

| Robo-Advisory Market | $10.86 Billion | $102.03 Billion (2034) | 28.50% | Mass-Affluent Wealth |

| Agentic AI (Banking Share) | $1.30 Billion | $7.20 Billion (2029) | 41.00% | Workflow Autonomy |

Analytical Insight: This growth is not merely a “tech bubble.” AI investment spend is already contributing an estimated 1% to global GDP growth in 2025, primarily through productivity gains in service sectors. For the banking industry, the move toward Agentic AI autonomous agents that can plan and execute multi-step workflows, represents the next frontier, with potential to automate up to 54% of current banking tasks.

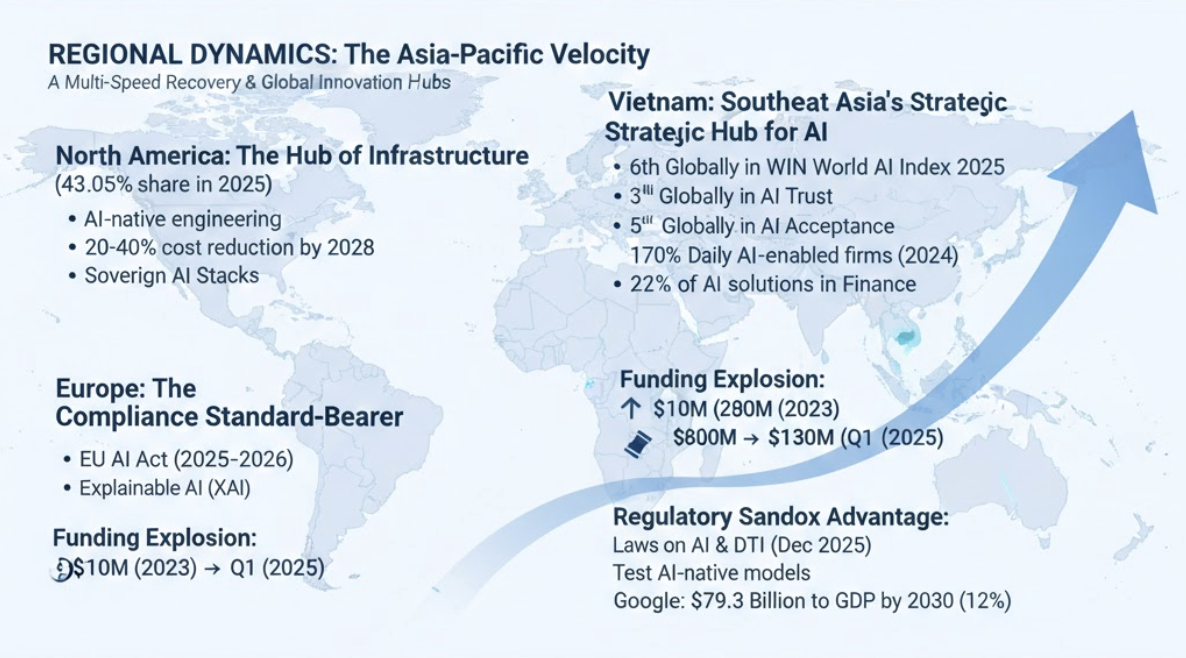

Regional Dynamics: The Asia-Pacific Velocity

The global landscape of the ai in bfsi market is defined by a “multi-speed” recovery. While North America continues to lead in total spend (holding a 43.05% share in 2025), the Asia-Pacific (APAC) region is recording the fastest growth rate, fueled by rapid digital transformation and high mobile banking penetration.

North America: The Hub of Infrastructure

North American dominance is sustained by the heavy concentration of “Magnificent Seven” tech firms and a mature cloud ecosystem. Institutions here are shifting toward “AI-native” software engineering, potentially reducing software investment costs by 20% to 40% by 2028. The focus is on deep infrastructure build-outs and sovereign AI stacks to ensure data independence.

Europe: The Compliance Standard-Bearer

European growth is driven by defensive modernization. With the EU AI Act becoming effective in 2025–2026, European banks are investing heavily in Explainable AI (XAI) and auditable governance frameworks to meet the strict requirements for “high-risk” systems like credit scoring.

Vietnam: Southeast Asia’s Strategic Hub for AI Innovation

Vietnam has emerged as a high-growth epicenter within the global ai in bfsi market, ranking 6th globally in the WIN World AI Index 2025 with a score of 59.2.

Why Vietnam is a “Prime” Innovation Destination:

- High Trust & Acceptance: Vietnam ranks 3rd globally in AI trust and 5th in AI acceptance, with 81% of users interacting with AI daily significantly higher than the regional average.

- Rapid Adoption: 47,000 new enterprises implemented AI in 2024 alone, bringing the total to 170,000 firms (18% of all nationwide enterprises).

- Financial Sector Leadership: Finance and banking is the second-largest sector for AI solution provision in Vietnam (22%), trailing only the IT sector.

- Funding Explosion: AI startup funding in Vietnam saw an eightfold increase from $10 million in 2023 to $80 million in 2024, reaching $130 million in Q1 2025 alone.

- The Regulatory Sandbox Advantage: With the passage of the Law on Artificial Intelligence (December 2025) and the Law on Digital Technology Industry (DTI Law), Vietnam has established one of the world’s first comprehensive legal frameworks for AI.

This includes “Regulatory Sandboxes” that allow global BFSI firms to test AI-native models such as alternative credit scoring and tokenized currency settlements under official supervision before scaling them to more rigid Western markets. Google projects that AI could contribute $79.3 billion to Vietnam’s economy by 2030, representing 12% of the national GDP.

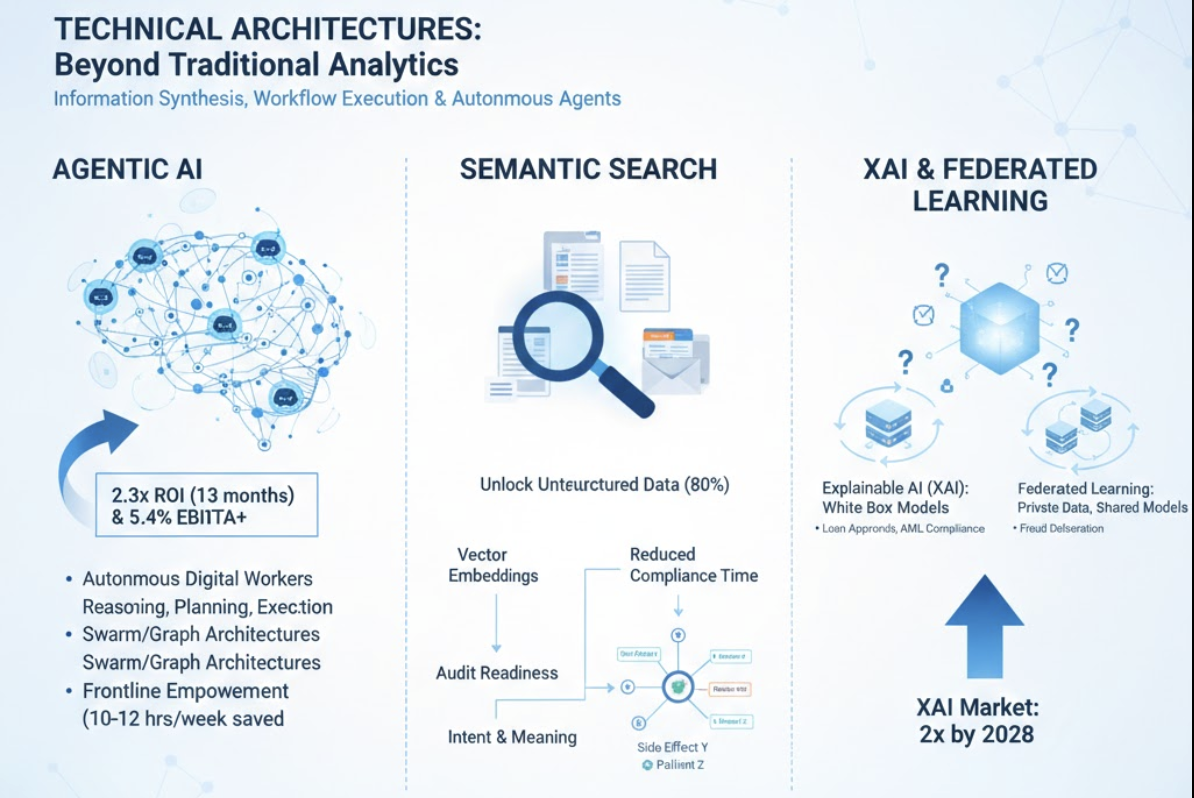

Technical Architectures: Beyond Traditional Analytics

The “Solutions & Analytics” cluster in 2025 is defined by a fundamental shift from “Information Retrieval” to “Information Synthesis” and “Workflow Execution.” Traditional AI was a tool that humans used; modern BFSI AI is a digital worker that humans manage.

The Dawn of Agentic AI (Autonomous Digital Workers)

The most disruptive trend for 2025 is the arrival of Agentic AI. Unlike traditional Generative AI that primarily creates content based on prompts, agentic AIs act as “digital coworkers” capable of reasoning, planning, and executing actions across multiple system boundaries autonomously. Think of the difference between a calculator and a financial advisor: one responds to input, while the other anticipates needs, analyzes market conditions, and acts.

- Architectural Shifts: Leading institutions are moving away from “Singleton” bots toward “Swarm” or “Graph” patterns. In a graph pattern, a supervisor agent orchestrates specialized agents, such as financial analysts, risk managers, and news sentiment specialists to complete complex tasks like generating a comprehensive equity research report in minutes rather than days.

- Quantifiable ROI: Organizations can achieve an average 2.3x return on agentic AI investments within 13 months. KPMG projects that Agentic AI will lead to $3 trillion in corporate productivity and a 5.4% EBITDA improvement for the average global company.

- Frontline Empowerment: Agentic systems are returning 10 to 12 hours a week to each banker by automating routine qualification and follow-up, allowing them to shift from transactional roles to high-value “trusted advisor” roles.

Semantic Search and Vector Embeddings

Financial institutions are utilizing Semantic AI Search to unlock value from the 80% of enterprise data that remains unstructured, such as PDFs, emails, and call logs. Traditional keyword search is like a weak magnet; it only grabs what it touches. Semantic AI search is a “data superpower” that understands the intent and meaning behind a query.

- Beyond Keywords: Using Vector Embeddings, these systems translate every concept into a mathematical representation. A banker searching for “collateral risk” will now surface documents mentioning “property valuation volatility,” even if the primary keyword is absent.

- Audit Readiness: Semantic search instantly collates risks, workflows, and regulatory citations, cutting compliance review times from weeks to just a few days.

- Knowledge Graphs: These “relationship networks” connect disparate facts showing, for example, that “Side Effect Y” in a medical trial is a high-risk factor for “Patient Z” in an insurance profile—to provide business-critical clarity in seconds.

Explainable AI (XAI) and Federated Learning

The transition from “black box” to “white box” models is no longer optional; it is a regulatory mandate.

- Explainable AI (XAI): As AI takes a greater role in decisioning, XAI provides the clear reasoning required for loan approvals (explaining income and debt-to-income ratios) and AML compliance (justifying suspicious activity reports). The market for XAI is projected to more than double by 2028.

- Federated Learning: To solve the data scarcity and privacy paradox, institutions use federated learning to train models locally on proprietary data and share only model parameters, never raw data. This enhances fraud detection through inter-organizational collaboration without creating a central “honeypot” for data breaches.

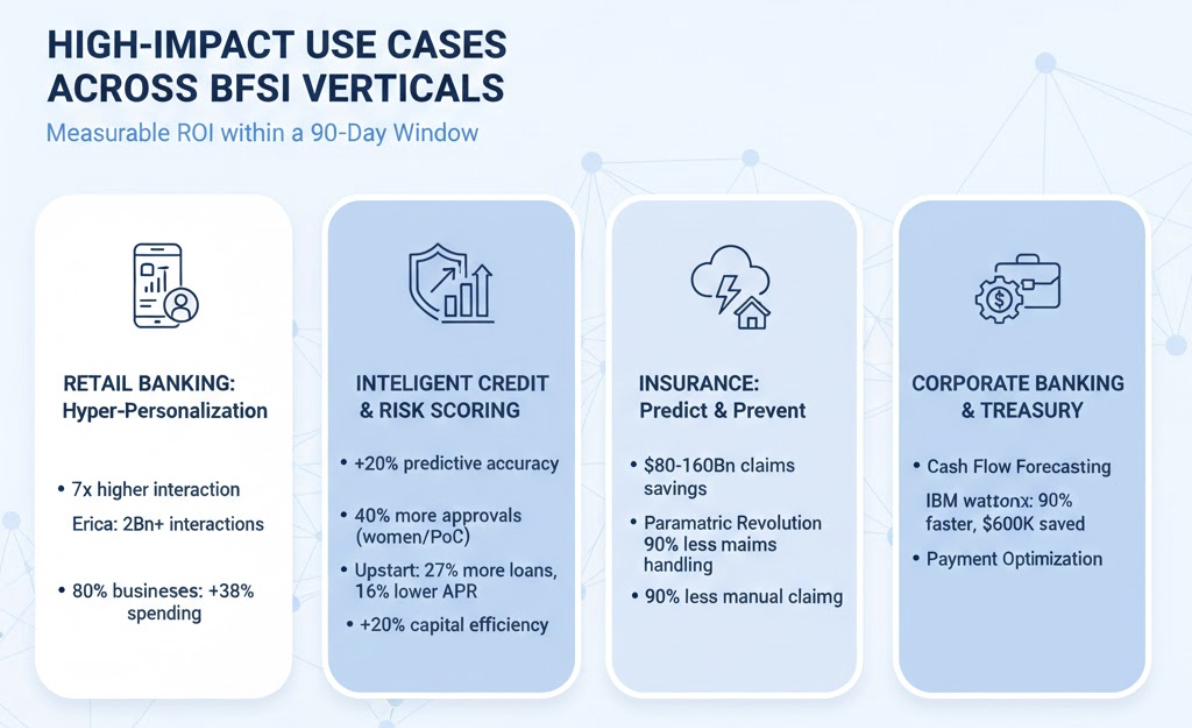

High-Impact Use Cases Across BFSI Verticals

Success in the 2025 ai in bfsi market is no longer measured by technical capability, but by the ability to identify “high-friction” workflows and deliver measurable ROI within a 90-day window.

Retail Banking: Hyper-Personalization for a “Segment of One”

Hyper-personalization uses AI to provide highly individualized customer experiences based on real-time data and predictive analytics.

- Dynamic Engagement: Personalized push notifications based on real-time spending patterns have increased interaction rates by 7x compared to generic alerts.

- The Power of Erica: Bank of America’s AI virtual assistant, Erica, has surpassed 2 billion client interactions and 150 million client requests, acting as a personal concierge that saves time and provides personalized budgeting tips.

- Revenue Uplift: 80% of businesses report an average 38% increase in consumer spending when experiences are tailored to individual preferences.

Intelligent Credit Underwriting and Risk Scoring

AI-driven credit models deliver a 20% boost in predictive accuracy over traditional methods.

- Financial Inclusion: By analyzing alternative data such as utility payments, social signals, and online behavior—AI models have increased credit approvals for women and people of color by 40% while lowering default risks.

- The Upstart Benchmark: Upstart approves 27% more loans than traditional models and offers 16% lower average APRs for approved borrowers, demonstrating consistent, consistency in underwriting that reduces human bias.

- Capital Efficiency: Banks that embed AI across risk functions could see a 20%+ increase in capital efficiency and a 30–50% reduction in losses.

Insurance: The “Predict and Prevent” Paradigm

The insurance industry is pivoting from simple indemnification (paying for damage) to intelligent protection ecosystems (preventing damage).

- Claims Savings: Property and Casualty (P&C) insurers are projected to save between $80 billion and $160 billion by 2032 by implementing AI-driven technologies across the claims lifecycle.

- Parametric Revolution: Emerging climate insurance models automatically trigger payouts based on pre-defined data, such as wind speed or flood depth, bypassing slow traditional claims processes.

- Document Intelligence: AI-powered systems can process damage photos and text-based claim forms in seconds, reducing manual handling by up to 90%.

Corporate Banking and Automated Treasury

AI is transforming the corporate treasurer from a transaction manager to a strategic value center.

- Cash Flow Forecasting: AI sourced and synthesized data source models better predict cash flow requirements and optimize the cash conversion cycle, giving leadership a strategic advantage in planning expansions.

- Treasury Automation: IBM’s watsonx Orchestrate automates journal entries, cutting cycle times by over 90% and saving USD 600,000 annually.

- Payment Initiation: AI analyzes payment size, delivery speed requirements, and supplier acceptance to recommend the most appropriate payment type (e.g., RTP vs. ACH), optimizing liquidity management.

Operationalizing AI: The Efficiency Ratio

A bank’s maturity in the ai in bfsi market is no longer a backward-looking cost tracker but a forward-looking barometer of its ability to compete and endure. PwC analysis indicates that fully embracing AI can drive a 15-percentage-point improvement in this metric.

AI impacts this equation via “dual tailwinds”:

1. Lowering the Numerator (Non-interest Expense):

- Hyper-Automation: Intelligent Process Automation (IPA) reduces processing times for payables/receivables by 80%.

- Operational Savings: Banks scaling automation across the value chain can reduce operational costs by up to 30% while reclaiming 60% of workforce capacity for strategic tasks.

- Compliance Automation: AI is estimated to save the industry $27 billion annually in compliance costs.

2. Raising the Denominator (Total Revenue):

- Insight-led Acquisition: Capturing “money in motion” through hyper-personalization can reduce efficiency ratios by 3 percentage points alone through better retention and up-selling.

- Personalization Gains: AI-driven personalization has achieved 5x more clicks on offers and a 15% increase in revenue for companies implementing it effectively.

Ready to move from AI pilot to production 70% faster?

SmartDev’s AI Product Factory validates high-impact use cases in 21 days and reaches full execution within 10 weeks—delivering results 50% faster than traditional cycles.

Launch award-winning fintech solutions at record speed with our 100% AI-certified engineering teams.

Get Your Offshore Strategy AssessmentSmartDev: The Market Analysis Authority in BFSI AI

In an industry where 80% of AI projects fail to reach production, SmartDev has established itself as a “Market Analysis Authority” through its blend of specialized leadership, proprietary frameworks, and measurable outcomes. Choosing an authoritative partner is no longer a technical choice; it is a strategic imperative to avoid “Pilotitis”, the challenge of transitioning AI initiatives from small-scale pilots to enterprise-grade systems.

Authoritative Leadership and Domain Expertise

SmartDev’s status as a market authority is anchored by a leadership team with 10–25 years of domain-specific experience in the intersection of finance and machine learning.

Dr. Dao Huu Hung: A prominent AI scientist with a PhD in Engineering and multiple granted patents. His track record includes senior roles at VinBrain and FPT, with research published in world-renowned conferences like FG and BMVC.

Geert Theys: Head of FinTech with over 15 years of experience driving transformative projects for global insurance and telecommunication brands.

Award-Winning Execution: SmartDev received the prestigious Sao Khue Award 2024 for VeryPay, an AI-powered fintech platform launched in just 6 months. This demonstrates SmartDev’s unique ability to operationalize complex finance solutions at a speed that traditional consultancies cannot match.

The “AI Product Factory” Methodology: A Blueprint for ROI

SmartDev offers a structured, results-oriented alternative to the “endless pilot” trap through two core, time-bound programs designed for the ai in bfsi market:

- 3 Weeks AI Discovery Program: A rigorous 4-step process, Understand, Define, Design, Plan that aligns business objectives and identifies high-impact use cases within 21 days. This results in a validated “Strategic Roadmap” and a clear “Solution Vision” that de-risks the build phase.

- 10 Weeks AI Product Factory: An agile model using 2-week sprints to validate use cases with real-world data. SmartDev’s internal analysis shows this program is 50% faster at identifying business opportunities and 70% quicker at moving toward production than traditional software development cycles.

Quantifiable Authority: Proof of Strategic Impact

SmartDev’s status as a market authority is proven by its AI-Powered Delivery Toolkit and the results of over 300+ global projects :

- Velocity Benchmarks: AI development consistently delivers 30% faster product launches, while certified teams report 40% fewer post-release bugs.

- Cost Efficiency: Clients realize 40–60% cost savings compared to US or European teams while maintaining 100% adherence to international quality standards.

- Accelerated Breakeven: SmartDev’s proprietary data suggests that AI development investments typically break even within 6–8 months of implementation.

- Specific Wins: A fintech QA engagement using the Toolkit achieved a 40% reduction in regression testing time.

Compliance and Ethics: Navigating the Global Regulatory Maze

As the ai in bfsi market matures, regulatory compliance has transitioned from a backend concern to a primary competitive differentiator. 2025 marks “Year One” of mandatory AI scrutiny under the EU AI Act, the world’s first comprehensive AI law.

Risk Classification for Financial Institutions

The EU AI Act classifies AI systems based on their potential risk to fundamental human rights, with massive implications for banking and insurance.

- Unacceptable Risk: Practices such as social scoring and real-time remote biometric identification in public spaces have been prohibited since February 2, 2025.

- High-Risk Systems: AI used for credit scoring and creditworthiness assessment of natural persons is officially classified as high-risk. By August 2, 2026, these systems must comply with strict data quality, risk management, human oversight, and auditability requirements.

- Catastrophic Penalties: Non-compliance can result in fines up to €35 million or 7% of global annual turnover, calculated at the group level.

Explainable AI (XAI) as a Regulatory Mandate

The shift from “black box” to “white box” models is no longer optional. Regulators now require that banks explain the specific factors (e.g., debt-to-income ratio, income level) influencing automated decisions. SmartDev implements Explainable AI (XAI) frameworks that justify suspicious activity reports (AML) and credit decisions with specific risk factors, ensuring that “compliance by design” is baked into every model.

Implementation Challenges: Closing the 35% Human Capital Gap

Despite the projected trillions in value, a significant 35-percentage-point gap exists between the demand for AI skills and the availability of talent in financial services.

The SmartDev Three-Tier Certification Model

To bridge this gap and ensure 100% of its developers are AI-ready, SmartDev has pioneered a three-tier talent certification model that preserves human decision-making authority while maximizing AI efficiency:

- Level 1: AI Practitioners: Master tools like GitHub Copilot to auto-generate 30–40% of code, reducing manual boilerplate work and accelerating prototyping by 45%.

- Level 2: AI Power Users: Implement regular AI-assisted workflows and advanced prompt engineering to optimize specific domain logic and reduce miscommunication by up to 60%.

- Level 3: AI Integrators: Build custom GPT copilots and internal AI tools to solve complex architectural challenges, achieving 3x faster pull request turnarounds.

This approach views AI adoption as a skill-building exercise rather than a technology replacement, ensuring that 100% of SmartDev’s deliverables meet rigorous international quality standards.

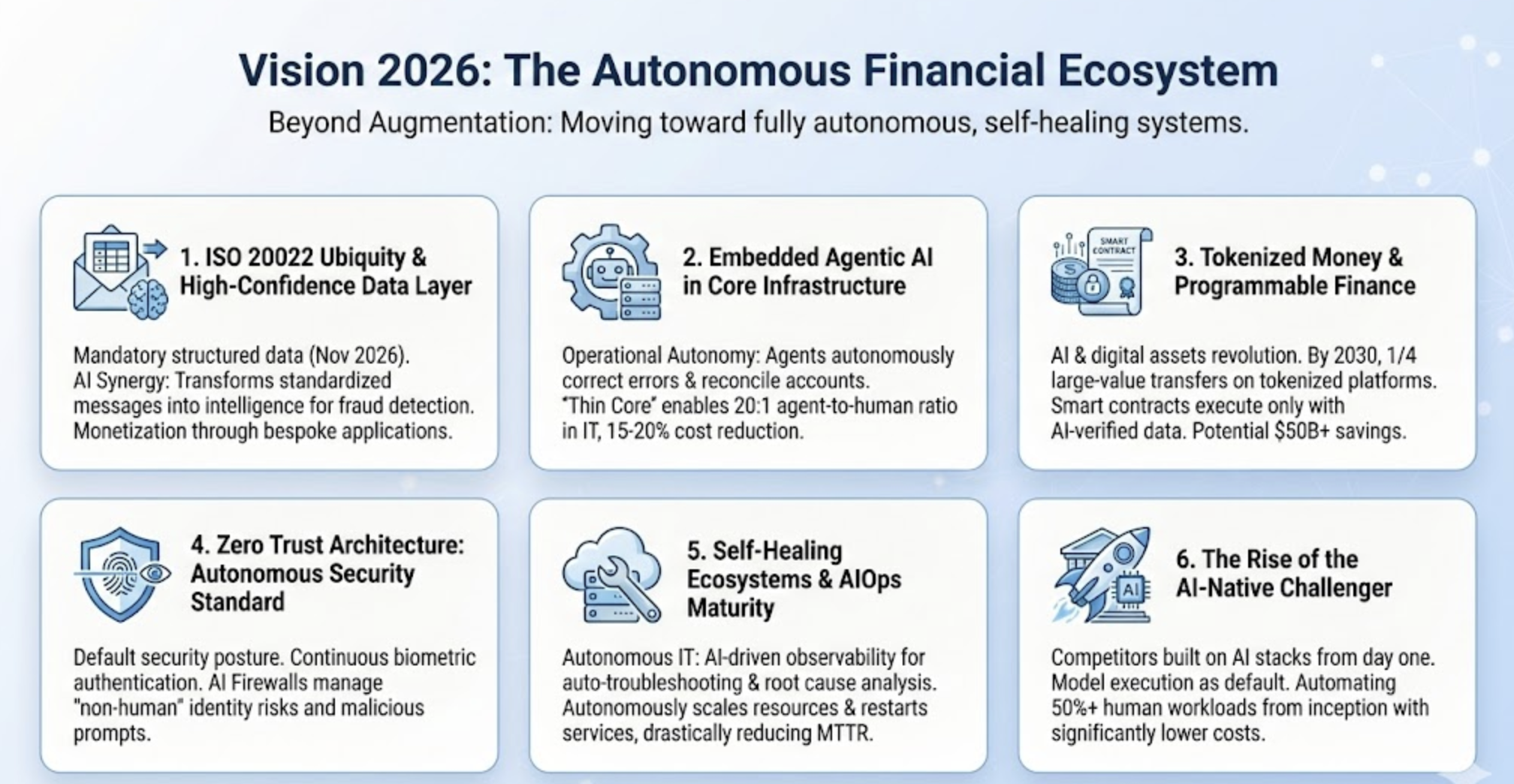

Vision 2026: The Autonomous Financial Ecosystem

Looking toward 2026, the ai in bfsi market will move beyond simple augmentation toward fully autonomous, self-healing systems. This evolution is characterized by six defining trends that will reshape the fundamental architecture of financial services.

ISO 20022 Ubiquity and the High-Confidence Data Layer

- The transition to the ISO 20022 messaging standard reaches its most critical phase in 2026. By November 2026, the move to structured postal data becomes mandatory, forcing banks to eliminate unstructured address fields in payment messages to avoid rejection.

- The AI Synergy: Layering AI on top of ISO 20022’s structured messaging transforms standardized data into true intelligence. Structured data is a “natural fit” for AI, allowing models to automatically spot inconsistencies in remittance details or detect subtle fraud patterns that traditional rule-based systems miss.

- Monetization Opportunity: Banks are no longer writing off migration as a compliance cost. Enriched payments data allows for the creation of bespoke applications—for instance, integrating insurance claims information directly into payment flows for large corporate clients.

Embedded Agentic AI in Core Infrastructure

2026 marks the year agentic AI moves from a peripheral “experiment” to a foundational layer of core banking infrastructure.

- Operational Autonomy: Instead of merely flagging issues, embedded agents will autonomously correct transaction errors, reconcile accounts, and initiate real-time updates without manual intervention.

- Thin Core Catalyst: Lightweight, composable core banking systems are enabling banks to “plug in” specialized agents that act as task executors. This allows for agent-to-human ratios of up to 20:1 in IT and support functions, leading to 15-20% cost reductions.

Tokenized Money and Programmable Finance

The merger of AI and digital assets will revolutionize cross-border commerce. By 2030, one in four large-value international money transfers is projected to settle on tokenized currency platforms.

- Economic Impact: Tokenization is expected to reduce the cost of corporate cross-border transactions by 12.5%, potentially saving business customers over $50 billion by 2030.

- Smart Contract Fusion: Programmable finance allows smart contracts to automatically execute payments only when live AI-verified data confirms specific conditions are met, eliminating the information gap between messaging and money movement.

Zero Trust Architecture: The Standard for Autonomous Security

As infrastructures become more interconnected through open APIs, the ai in bfsi market is adopting Zero Trust Architecture as its default security posture.

- Continuous Authentication: Static passwords are replaced by biometric continuous authentication, which verifies identity throughout a session based on behavioral traits like typing rhythm, screen tapping patterns, or voice.

- Non-Human Identity Risk: A major challenge for 2026 is managing “non-human” identities. Misconfigured AI agents can become high-privilege backdoors, prompting a shift toward AI Firewalls that filter inputs and actions to stop malicious prompt injections before harm occurs.

Self-Healing Ecosystems and AIOps Maturity

The most advanced institutions are shifting from reactive workflows to self-guiding, self-repairing systems.

- Autonomous IT: AI-driven observability tools now use telemetry data to troubleshoot issues and perform root cause analysis automatically.

- Outcome: These systems can scale resources, reroute traffic, and restart services autonomously based on parameters set by automated decision engines, drastically reducing the Mean Time to Repair (MTTR).

The Rise of the AI-Native Challenger

A new wave of competitors built entirely on AI stacks from day one is emerging to threaten legacy incumbents.

- Architectural Edge: Unlike traditional banks that “bolt on” AI features, these challengers use AI-native architectures where model execution is the default operation, not an optional feature.

- Economic Devastation: AI-native banks can run at a fraction of the cost, automating over 50% of human workloads from inception and competing on capabilities that traditional architecture simply cannot support.

Conclusion: Strategic Imperatives for 2025

The ai in bfsi market of 2025 is a battlefield of strategic execution. For financial institutions to capture the multi-trillion dollar value at stake, they must move past the experimentation of the past and adopt structured, production-scale frameworks.

Success in this era requires more than just access to tools; it requires a partner with specialized domain expertise and a proven delivery blueprint. As a recognized Market Analysis Authority, SmartDev provides the authoritative leadership, the proprietary “AI Product Factory” methodology, and the 100% AI-certified talent required to navigate this structural transformation. For firms looking to lead, the time for “watching and waiting” has ended; the era of intelligent, autonomous finance has begun.