Introduction

BFSI organizations operate in one of the most demanding software environments in the world. Every release touches sensitive customer data, mission-critical transactions, and strict regulatory frameworks, where even a single production defect can lead to financial loss, compliance violations, and lasting brand damage. According to IBM, the average cost of a data breach in the financial sector reached USD 5.9 million in 2023, making BFSI the most expensive industry for software failures.

At the same time, traditional test automation struggles to keep pace with modern BFSI systems. Core banking platforms, API-driven ecosystems, real-time payment rails, and AI-powered credit engines introduce a level of complexity that rule-based testing cannot handle efficiently. As a result, AI-driven test automation is no longer optional in 2025. It has become a strategic requirement. This article delivers a 2025 comparison of the best AI tools for test automation in BFSI, evaluated through an enterprise and compliance-focused lens, and explains why leading banks increasingly choose SmartDev to maximize ROI from these tools.

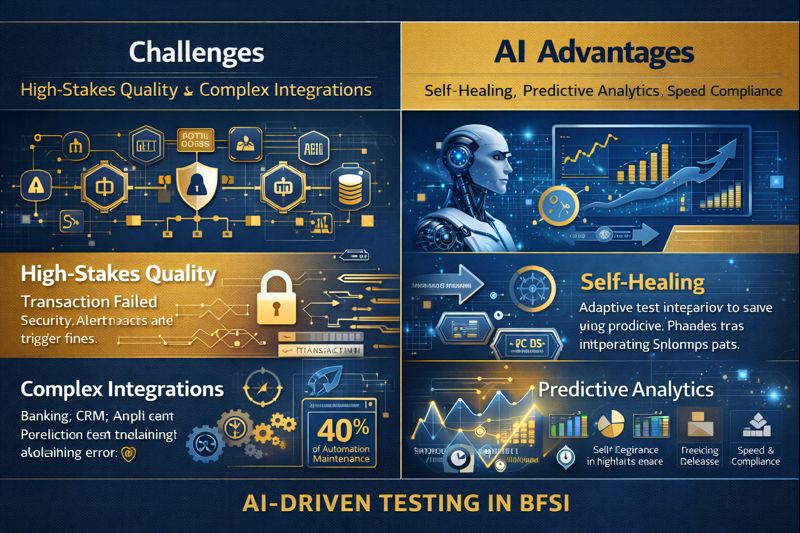

Why AI Test Automation Is Mission Critical in BFSI Environments

1. High-Stakes Quality and Zero Tolerance for Failure

BFSI applications differ fundamentally from software systems in other industries. Every release must be validated not only for functional accuracy but also for regulatory compliance, security enforcement, and data integrity at scale. In banking and financial services, even a minor defect can disrupt transactions, expose sensitive data, or trigger regulatory penalties.

Testing teams operate with an extremely low tolerance for failure in payment processing and transaction flows. A single error in reconciliation, settlement, or authorization logic can impact thousands of customers in real time, making quality assurance a business-critical function rather than a technical task.

2. Complex Integrations and Expanding Regression Scope

BFSI systems depend on complex integrations across core banking platforms, CRM systems, risk and fraud engines, and multiple third-party APIs. Each new integration increases system complexity and expands the regression scope required for every release.

As digital ecosystems grow, traditional automation struggles to validate end-to-end workflows consistently. Even small changes in one system can create cascading defects across connected services, significantly increasing testing effort and risk exposure.

3. Regulatory Volatility and Automation Maintenance Challenges

Regulatory requirements in BFSI change frequently across regions and jurisdictions. Testing teams must execute rapid and repeated regression cycles to ensure ongoing compliance. Manual testing and rule-based automation are not designed to operate at this pace.

As applications evolve, automation scripts frequently break due to minor UI or API changes. SmartBear reports that up to 40 percent of automation effort in financial services is spent maintaining brittle scripts rather than expanding meaningful test coverage, highlighting a critical scalability issue.

4. AI-Driven Intelligence for Speed, Resilience, and Compliance

AI-powered test automation addresses these challenges by shifting testing from static rules to adaptive intelligence. Self-healing tests automatically adjust to UI and API changes, while intelligent test generation prioritizes scenarios based on user behavior, transaction patterns, and risk.

Predictive defect analytics identify high-risk areas before release, allowing teams to focus effort where failures would be most costly. Continuous compliance validation ensures regulatory rules are enforced consistently across environments. According to ImpactQA, AI-driven testing can reduce test maintenance effort by up to 60 percent in banking applications while improving release speed and overall quality.

Evaluation Criteria: How We Ranked the Best AI Tools for Test Automation in BFSI

Not all AI testing tools are suitable for BFSI environments. Many platforms claim AI capabilities but lack the security depth, domain intelligence, and scalability required for financial systems. To identify the best AI tools for test automation in BFSI, this comparison applies five BFSI-specific evaluation dimensions that reflect real enterprise decision criteria rather than marketing claims.

1. Security and Compliance Readiness

Security and compliance are non-negotiable in BFSI. Any AI testing platform must operate within strict regulatory and data protection frameworks. Tools were evaluated on their ability to support PCI DSS compliance for payment processing, GDPR-aligned data privacy and residency controls, SOC 2 compliant audit trails, and secure test data management including masking and anonymization.

AI tools that process production-like data without strong governance introduce unacceptable risk. Platforms lacking enterprise-grade security certifications or granular access controls were excluded from consideration. In BFSI, test automation must strengthen compliance posture, not become a new attack surface.

2. Depth of AI Capabilities

True AI-driven test automation goes far beyond basic machine learning or record-and-playback enhancements. Leading platforms demonstrate autonomous test creation and optimization, self-healing locators that adapt to UI and API changes, AI-based root cause analysis, and risk-based test prioritization aligned to business impact.

Tools relying primarily on static scripts with limited intelligence were not considered advanced enough. BFSI systems change frequently due to regulatory updates and feature releases. Without deep AI capabilities, automation maintenance costs quickly outweigh benefits.

3. BFSI Domain Support

Domain expertise is a critical differentiator. The best AI tools for test automation in BFSI show proven deployments across core banking modernization, digital payments and wallets, lending platforms, credit scoring and reporting systems, and wealth management applications.

Financial workflows involve complex rules, calculations, and compliance logic that generic testing tools struggle to model accurately. Platforms without demonstrated BFSI use cases or reference architectures scored lower due to higher implementation risk.

4. DevSecOpsand API Integration

Modern BFSI ecosystems are API-first. Testing tools must integrate seamlessly with CI/CD pipelines and support API, UI, and backend testing within a unified framework. According to IBM, over 80 percent of banking transactions now rely on APIs, making robust API testing a non-negotiable requirement.

AI tools that cannot validate complex API interactions at scale fail to meet modern banking needs.

5. Enterprise ROI and Scalability

Finally, tools were evaluated on measurable business outcomes. Key factors included reduction in regression cycle time, decrease in escaped defects, long-term total cost of ownership, and the ability to scale across multiple business units and geographies.

In BFSI, AI test automation must deliver sustained ROI at enterprise scale. Anything less is not viable.

Best AI Tools for Test Automation in BFSI

As BFSI organizations accelerate digital transformation, AI test automation tools have become a core part of enterprise QA strategies. However, not all platforms address the same needs. Large banks, digital-only institutions, and highly customized financial ecosystems require different levels of control, intelligence, and compliance support.

Based on market adoption, BFSI use cases, and enterprise readiness, leading AI test automation tools in 2026 can be grouped into three clear categories.

Category 1. Enterprise AI Test Automation Platforms

Enterprise AI test automation platforms are commercial, enterprise-grade tools designed to support large-scale BFSI environments with strict regulatory requirements. These platforms typically provide built-in AI capabilities for test creation, execution, analytics, and reporting, along with strong governance and security controls.

SmartBear and IBM are widely adopted in this category. They are particularly effective for API-heavy banking systems, complex integrations, and large regression suites. IBM highlights that over 80 percent of banking transactions now rely on APIs, reinforcing the need for enterprise tools that support large-scale API validation.

These platforms deliver stability and compliance but often require significant configuration and skilled QA teams to realize their full value.

Where SmartDev fits

SmartDev helps BFSI organizations implement and optimize enterprise AI platforms, align them with regulatory requirements, and accelerate ROI through BFSI-specific automation frameworks and accelerators.

Best for

Tier 1 banks and large financial institutions with complex ecosystems and mature QA organizations.

Category 2. AI-Driven Codeless Automation Tools

AI-driven codeless automation tools focus on speed, usability, and rapid adoption. They reduce dependency on scripting by enabling test creation through natural language or visual workflows, with AI handling maintenance and self-healing.

Virtuoso is a leading example, particularly for digital banking and customer-facing applications. These tools significantly reduce test creation effort, with AI-driven platforms reporting over 70 percent faster test development for web applications. While these tools accelerate delivery, they may lack the governance depth required for core banking systems without additional controls.

Where SmartDev fits

SmartDev integrates codeless AI tools into BFSI DevSecOps pipelines, adds compliance and security validation layers, and ensures enterprise governance is maintained as automation scales.

Best for

Digital banking teams, fintech subsidiaries, and innovation units prioritizing speed and frequent releases.

Category 3. Hybrid and Custom AI Testing Frameworks

Hybrid AI testing frameworks are custom-built solutions, combining open-source testing tools with AI-driven components. Rather than adopting a single platform, BFSI organizations enhance existing automation stacks with AI for test optimization, intelligent test selection, and predictive defect analytics.

This approach offers maximum flexibility and control, which is critical for legacy core banking systems and region-specific compliance requirements. However, it also requires strong engineering discipline and domain expertise to avoid fragmentation and rising maintenance costs.

Where SmartDev fits

SmartDev designs and delivers BFSI-grade hybrid AI testing frameworks, embedding security, compliance validation, and AI accelerators into a unified automation strategy. This enables banks to modernize testing without vendor lock-in while maintaining full governance.

Best for

BFSI organizations with highly customized architectures, strict compliance obligations, and long-term transformation initiatives.

Tool-by-Tool Deep Dive Analysis: Data Analysis and Comparison

1. Enterprise-Grade AI Test Automation Platforms

From a performance lens, enterprise platforms usually deliver the best results in end-to-end regression and API validation. That matters because banking defects often escape through integration seams. Aspire Systems references a common benchmark where 20% defect escape rate means 20 out of 100 bugs are found by customers post-release. That same context ties software quality failures to the $2.41 trillion cost of poor software quality in the U.S. economy in 2022.

In practice, enterprise tools help reduce escape risk by enabling broader automated coverage with stronger traceability. They also align better with security-first requirements, because they typically offer more mature permissioning, audit logs, and controlled handling of test data. The trade-off is time-to-value. Enterprise platforms often require longer setup, stricter operating models, and stronger QA engineering maturity before results become visible.

2. AI-Driven Codeless Test Automation Tools

Data points reported by codeless AI vendors emphasize the value proposition. Virtuoso states that institutions using AI-powered banking test automation can achieve 96% fewer transaction errors, 73% faster regulatory compliance validation, and an 89% reduction in security testing overhead compared to traditional manual and scripted approaches.

Whether an organization reaches these exact outcomes depends on scope and baseline maturity, but the comparative direction is consistent. Codeless AI tools generally reduce maintenance friction and accelerate coverage expansion. Aspire Systems also highlights speed transformation at the regression suite level, stating AI can cut 72-hour regression tests down to 4 hours.

The trade-off is depth and control. Codeless tools can be excellent for customer journeys, but complex backend validation, legacy core banking constraints, and highly regulated approval workflows often still require deeper engineering and governance layers.

3. Open and Hybrid AI Testing Frameworks

From a data analysis view, hybrid frameworks produce the widest outcome variance. When governance is weak, they can become fragmented and expensive to maintain. When governance is strong, they can deliver the highest relevance and the best alignment to internal risk models. Aspire Systems cites that major banks are automating 84% of their testing processes and that 77% of organizations are investing in AI solutions for Quality Engineering, with 45% already utilizing intelligent automation

This adoption trend supports a practical conclusion. Many BFSI organizations end up running a mixed portfolio. Enterprise platforms for governed scale, codeless AI for digital velocity, and hybrid frameworks for legacy complexity. Partners like SmartDev are typically brought in at this stage to standardize governance, accelerate implementation, and prevent tool sprawl, especially when organizations want one operating model across categories.

Similarities Across All AI Testing Tools for BFSI

1. Reduced test maintenance through AI

Across all tool categories, AI is primarily used to reduce the heavy maintenance burden associated with traditional automation. Self-healing locators and intelligent object recognition allow tests to automatically adapt to UI and API changes without manual intervention. This is particularly important in BFSI environments where applications evolve frequently due to regulatory updates and system enhancements.

SmartBear reports that up to 40 percent of automation effort in financial services is spent maintaining brittle scripts, highlighting why maintenance reduction is a shared priority across all AI testing approaches.

2. Risk-focused test execution

All AI testing tools aim to improve test effectiveness by focusing on risk rather than volume. Instead of executing every test equally, AI analyzes historical defects, transaction patterns, and business impact to prioritize high-risk workflows such as payments, credit decisions, and compliance checks. This risk-based approach aligns well with BFSI requirements, where failures in specific areas can have disproportionate financial and regulatory consequences.

3. Faster and more predictable releases

By reducing manual effort and improving test stability, all categories of AI testing tools help BFSI organizations accelerate release cycles. Faster feedback loops allow teams to detect defects earlier, reduce last-minute fixes, and release updates with greater confidence. This predictability is critical in BFSI, where release delays often translate into missed market opportunities or compliance risks.

Key Differences Between AI Testing Tool Categories

1. Enterprise AI Test Automation Platforms

Enterprise platforms differentiate themselves through depth of governance, security, and scalability. They are designed to operate within strict compliance frameworks and support large regression suites across multiple systems and environments. These tools are well suited for validating complex API integrations and end-to-end banking workflows. However, their sophistication often comes with longer implementation timelines and a higher dependency on experienced QA engineers to configure and maintain them effectively.

2. AI-Driven Codeless Automation Tools

Codeless AI tools stand out for their speed and accessibility. By allowing tests to be written in natural language or visual flows, they significantly lower the barrier to automation adoption. This makes them ideal for digital banking and customer-facing applications that change frequently. The trade-off is reduced flexibility for deeply customized or legacy systems, which may require additional governance layers to meet BFSI compliance standards.

3. Hybrid and Custom AI Testing Frameworks

Hybrid frameworks offer maximum flexibility and control by combining open-source tools with AI enhancements. This approach allows BFSI organizations to tailor automation logic, data handling, and compliance validation to their specific needs. While this provides strong alignment with complex architectures and regional regulations, it also demands higher engineering effort and disciplined governance to prevent fragmentation and rising maintenance costs.

Explore how SmartDev partners with BFSI teams through a focused AI sprint to validate use cases, align stakeholders, and define a clear path forward before AI development begins.

SmartDev helps BFSI organizations clarify AI use cases and assess feasibility, enabling confident decisions and reducing risks before committing to AI development.

Learn how SmartDev accelerates AI initiatives, ensuring rapid deployment and reduced time to market.

Build Your AI Chatbot With UsBFSI Use Cases Where AI Test Automation Delivers Immediate ROI

AI test automation delivers the fastest and most measurable ROI in BFSI when applied to systems with high transaction volume, regulatory exposure, and frequent change. The following use cases consistently show immediate business impact across banking and financial services.

Core Banking System Upgrades

Core banking modernization is one of the most risk-intensive initiatives in BFSI. These programs often involve parallel runs, phased migrations, and frequent configuration changes across accounts, loans, and transaction engines. Traditional automation struggles to keep up with constant changes in workflows and interfaces.

AI test automation reduces this risk by enabling self-healing regression suites and intelligent test prioritization. Instead of re-running entire test packs, AI focuses validation on impacted modules and high-risk transaction paths. According to Aspire Systems, AI-powered automation has enabled banks to reduce long regression cycles from 72 hours to just 4 hours, accelerating upgrade timelines without compromising stability.

This translates directly into lower outage risk and faster time-to-value during core banking transformations.

Digital Payments and Transaction Validation

Digital payments demand near-zero tolerance for defects. High transaction volumes, real-time processing, and integration with third-party networks create complex failure scenarios that are difficult to model using static test scripts.

AI-driven testing excels in this space by analyzing transaction patterns, identifying edge cases, and validating API behavior at scale. Virtuoso reports that AI-powered testing for banking applications can achieve 96 percent fewer transaction errors, significantly reducing customer-facing incidents in digital payment systems.

Immediate ROI comes from reduced production incidents, lower reconciliation effort, and improved customer trust.

Credit Scoring and Reporting Systems

Credit scoring and reporting platforms are highly sensitive to data accuracy and regulatory thresholds. Even minor logic errors can result in compliance violations or incorrect lending decisions.

AI test automation improves ROI by detecting anomalies that rule-based tests often miss. Predictive analytics and intelligent test data generation validate complex scoring rules across thousands of scenarios. SmartDev case studies show that AI-driven automation enabled 35 percent faster release cycles for credit reporting systems while improving security and compliance confidence.

Wealth Management and Investment Platforms

Wealth management platforms evolve rapidly due to new products, regulatory disclosures, and user experience enhancements. Manual regression becomes a bottleneck as portfolios, dashboards, and transaction flows grow more complex.

AI automation delivers ROI by stabilizing frequent releases and reducing escaped defects. In a SmartDev-led engagement, AI-powered testing achieved a 45 percent reduction in production defects and 30 percent faster time-to-market for a wealth management application.

Case Study 1: Wealth Management Platform Testing at Scale

Overview

A fast-growing wealth management provider was scaling its digital platform to support a larger customer base, diversified investment products, and advanced advisory features. The platform handled sensitive financial data, real-time portfolio calculations, and high-value transactions under strict regulatory oversight. To sustain rapid release cycles without increasing risk, the organization partnered with SmartDev to modernize its QA strategy using AI-driven test automation.

Challenges

- Manual regression cycles were time-consuming and increasingly delayed releases

- Traditional automation scripts frequently broke due to UI and workflow changes

- High maintenance effort reduced confidence in automated test results

- Compliance validation required extensive manual documentation

- Audit preparation was slow and difficult to standardize

- Rising risk of production defects impacting customer trust

Outcomes

- 45 percent reduction in production defects, improving platform stability

- 30 percent faster time-to-market without increasing QA headcount

- Significant reduction in test maintenance effort through self-healing automation

- Improved audit readiness with consistent, traceable test evidence

- Higher release confidence for customer-facing investment features

Case Study 2: Credit Reporting Systems Optimization for Security and Compliance

Overview

A national credit reporting organization operated a mission-critical platform responsible for aggregating and distributing credit data across financial institutions. Accuracy, security, and regulatory compliance were essential, as even minor defects could result in incorrect credit decisions or regulatory violations. The organization needed a scalable testing approach to support frequent regulatory updates while maintaining strict data protection standards.

Challenges

- Heavy reliance on manual testing and static automation

- Rapid expansion of regression scope due to regulatory changes

- Long release cycles slowing compliance updates

- Difficulty validating complex credit logic across large data sets

- Security and data sensitivity limited test coverage scalability

- QA teams operated reactively rather than proactively

Outcomes

- 35 percent faster release cycles, enabling quicker regulatory response

- Improved accuracy through AI-driven validation of complex credit scenarios

- Continuous security and compliance validation embedded into automation

- Stronger audit traceability and compliance confidence

Build vs Buy vs Partner: Choosing the Right AI Test Automation Strategy

Selecting the right AI test automation strategy is a critical decision for BFSI organizations. While AI tools promise efficiency and intelligence, real-world outcomes depend on how those tools are adopted, governed, and aligned with financial risk and compliance requirements. In practice, BFSI leaders evaluate three main approaches. Build, buy, or partner.

When Tools Alone Are Not Enough

Buying an AI testing tool is often the first step, but rarely the final solution. Tools provide capabilities, not outcomes. Without the right operating model, governance, and domain alignment, even the most advanced AI platforms can underperform. BFSI systems involve complex workflows, sensitive data, and regulatory constraints that generic implementations do not address by default.

Many banks discover that tools alone struggle to model real transaction behavior, encode regulatory logic, or adapt to legacy architectures. As a result, expected gains in speed and quality may stall after initial adoption. AI test automation requires contextual intelligence, not just technical features.

Risks of In-House AI QA Without BFSI Expertise

Building an in-house AI QA capability offers control and customization, but it also introduces significant risk. Developing and maintaining AI-driven testing frameworks requires expertise across QA engineering, data science, security, and BFSI regulations. These skill sets are difficult to assemble and retain internally.

Without deep BFSI experience, internal teams may overlook regulatory edge cases, mishandle test data, or design automation that does not align with audit expectations. In addition, in-house AI frameworks often suffer from scalability and maintenance challenges as systems evolve. Over time, the cost and complexity can outweigh the perceived benefits of ownership.

Why Many Banks Combine Platforms With Specialized Partners

Increasingly, BFSI organizations adopt a hybrid strategy. They buy best-in-class AI testing platforms while partnering with specialized providers to implement, govern, and scale them effectively. This approach balances speed, control, and risk management.

Partners such as SmartDev bring BFSI-specific automation frameworks, compliance expertise, and proven delivery models. Instead of replacing existing tools, SmartDev helps banks integrate multiple AI testing solutions into a unified strategy aligned with regulatory and business priorities.

This model reduces implementation risk, accelerates time-to-value, and ensures AI test automation delivers measurable ROI. For most BFSI organizations, partnering is not a compromise. It is the most pragmatic path to sustainable, enterprise-grade AI test automation.

Why Choose SmartDev for AI Test Automation in BFSI

AI test automation delivers real value in BFSI only when it is aligned with financial risk, regulatory obligations, and enterprise-scale delivery. SmartDev differentiates itself by focusing not on tools alone, but on outcomes that matter to banks and financial institutions. Its approach combines AI capability with deep BFSI domain expertise to deliver secure, scalable, and ROI-driven automation.

BFSI-First AI Testing Frameworks and Accelerators

BFSI-First AI Testing Frameworks and Accelerators

SmartDev designs AI testing frameworks specifically for BFSI environments. These frameworks are built around real banking workflows such as account lifecycle management, transaction processing, lending logic, and regulatory reporting. Instead of applying generic automation patterns, SmartDev embeds BFSI risk models and business rules directly into test logic.

AI accelerators developed by SmartDev enable faster regression, intelligent test prioritization, and self-healing automation across UI, API, and backend layers. This BFSI-first design ensures automation scales safely across complex systems while maintaining accuracy in high-risk scenarios.

Deep Compliance, Security, and Domain Expertise

Compliance and security are central to SmartDev’s delivery model. The team brings hands-on experience with PCI DSS, GDPR, SOC 2, and regional banking regulations, ensuring AI test automation strengthens compliance posture rather than introducing new risks.

SmartDev integrates security validation and compliance checks directly into automated testing pipelines. This enables continuous assurance instead of manual, point-in-time validation. Domain expertise across banking, financial services, and insurance allows SmartDev to anticipate regulatory edge cases and design automation that aligns with audit expectations from day one.

Tool-Agnostic Approach. Maximizing ROI From Existing Platforms

SmartDev does not promote a single testing tool or vendor. Its tool-agnostic approach allows BFSI organizations to maximize ROI from existing investments while selectively adopting new AI capabilities where they deliver the most value.

Whether an organization uses enterprise platforms, codeless AI tools, or hybrid frameworks, SmartDev ensures tools are integrated into a unified testing strategy. This prevents tool sprawl, reduces duplication, and aligns automation coverage with business risk rather than technical convenience.

End-to-End Automation Testing Services for Banking and Finance

SmartDev delivers end-to-end automation testing services, covering strategy, implementation, scaling, and ongoing optimization. Engagements typically include automation maturity assessments, AI tool selection, framework design, test development, DevSecOps integration, and continuous improvement.

By acting as both a strategic advisor and execution partner, SmartDev enables BFSI organizations to accelerate adoption while maintaining governance and control. This holistic approach ensures AI test automation evolves with the business, delivering sustained value rather than short-term gains.

Learn more about SmartDev’s automation testing services here.

How to Get Started: Selecting the Best AI Testing Solution for Your BFSI Organization

Selecting the best AI testing solution for a BFSI organization requires a structured approach. Success depends on aligning AI capabilities with regulatory requirements, system complexity, and long-term business goals rather than adopting tools in isolation.

Key Questions to Ask Vendors and Partners

Before committing to any AI test automation solution, BFSI leaders should assess both technical and operational fit. Key questions include how the tool supports regulatory compliance such as PCI DSS and GDPR, and whether it provides audit-ready reporting. Organizations should also evaluate the depth of AI capabilities, including self-healing automation, intelligent test prioritization, and predictive analytics.

Equally important is understanding how the solution integrates with existing CI/CD pipelines and API ecosystems. Vendors and partners should demonstrate proven BFSI use cases and explain how they handle sensitive test data securely. Finally, decision-makers should assess implementation effort and long-term total cost of ownership, not just licensing fees.

Pilot Project Checklist

A pilot should focus on a high-impact but manageable system, such as a digital payments flow or customer onboarding module. Define clear success metrics including reduced regression time, lower defect leakage, and decreased maintenance effort. Security, compliance validation, and audit traceability must be included from the start.

Next Steps for Enterprise Adoption

After a successful pilot, organizations should standardize frameworks, define governance, and scale gradually across systems. Many BFSI teams accelerate this phase by partnering with specialists such as SmartDev, ensuring AI test automation scales securely and delivers consistent ROI.

Conclusion

In 2025, AI test automation has become essential for BFSI organizations facing increasing system complexity, regulatory pressure, and demand for faster releases. This comparison shows that there is no one-size-fits-all solution. Enterprise platforms, codeless AI tools, and hybrid frameworks each serve different purposes depending on risk, scale, and architecture. The most effective strategies combine these approaches based on business criticality rather than tool popularity.

Success ultimately depends on execution, not just technology. By applying BFSI-first automation frameworks, deep compliance expertise, and a tool-agnostic strategy, SmartDev helps financial institutions turn AI test automation into a scalable, compliant, and ROI-driven capability.

Ready to evaluate the best AI test automation approach for your BFSI systems?

Explore SmartDev’s automation testing services and start building a secure, future-ready QA strategy today.