Digital banking has become part of daily life for millions of people around the world. Whether you’re checking your account balance, transferring money, or paying for everyday purchases, chances are you’re already using some form of digital banking.

Today, you no longer need to visit a bank branch to manage your finances. With just a smartphone or computer, banking services are available anytime and anywhere.

This guide explains digital banking in a simple, easy-to-understand way. It explores the services digital banking offers, key trends in the industry and the differences between digital and online banking. We’ll also highlight an insight from Ctrl Shifter Podcast – Episode 11, where the importance of balancing speed with system stability is discussed.

What Is Digital Banking?

Digital banking refers to managing your banking activities entirely through digital platforms, such as mobile apps or web-based services. It goes beyond just having a few features online. Instead, it is a complete rethinking of the banking experience, designed to function in a fully digital environment.

With digital banking, you can open accounts, make transfers, apply for loans, pay bills, and receive customer support — all without ever stepping into a branch.

In simple terms, digital banking allows you to use the bank without physically going to the bank.

This model is especially helpful for people who value convenience, speed, and flexibility in managing their finances.

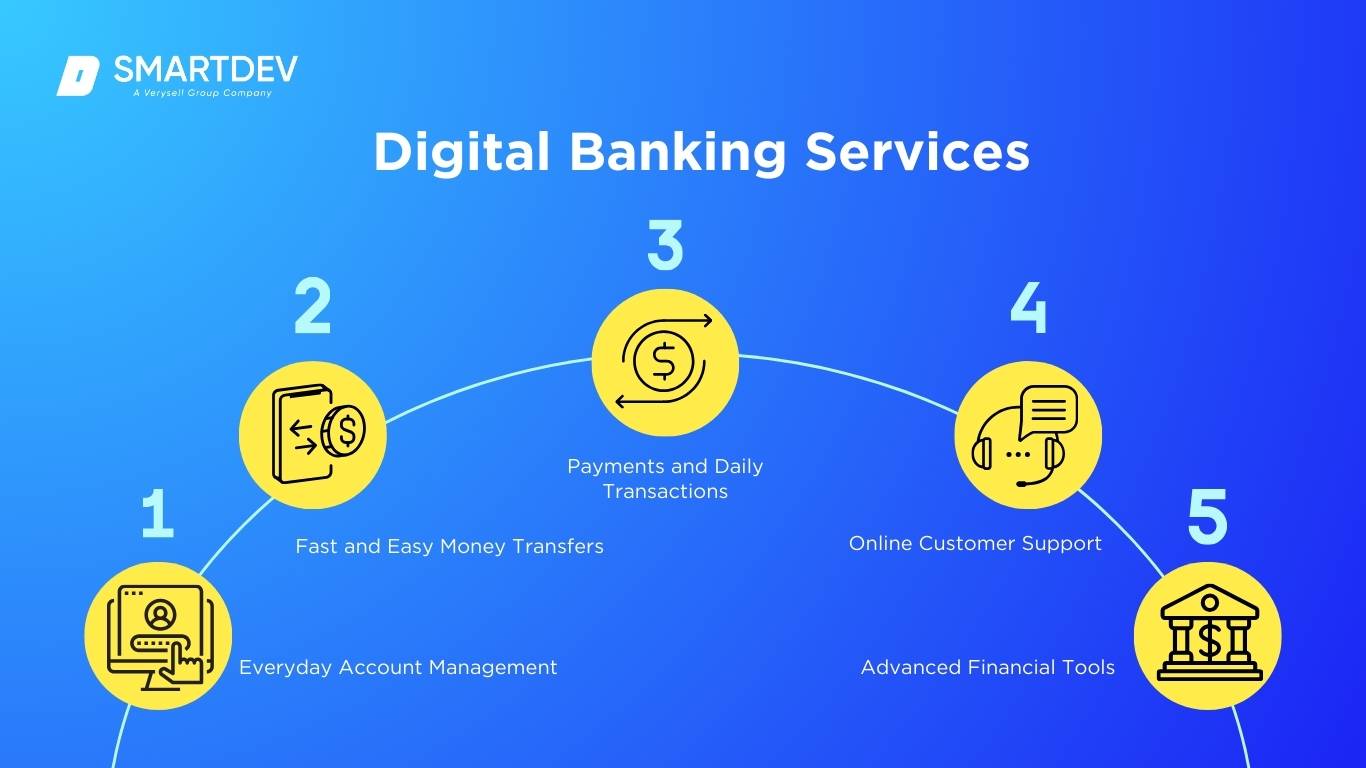

Digital Banking Services

Digital banks typically offer a wide range of services that are designed to make financial management easier, faster, and more accessible for everyday users. Instead of visiting a physical bank branch, customers can complete most financial tasks using a mobile app or website. These services are built to reduce complexity, save time, and give users more control over their money.

1. Everyday Account Management

Everyday account management is one of the most basic but important services in digital banking. It helps users stay informed about their financial situation at all times.

With digital banking, users can:

- View account balances in real time, without waiting for bank statements

- Review recent transactions clearly, including dates, amounts, and descriptions

- Track spending patterns and monitor where money is going over days, weeks, or months

These features allow users to see how they spend their money and identify unnecessary expenses. By having a clear overview of income and spending, users can make better financial decisions, plan ahead, and avoid unexpected shortages of funds.

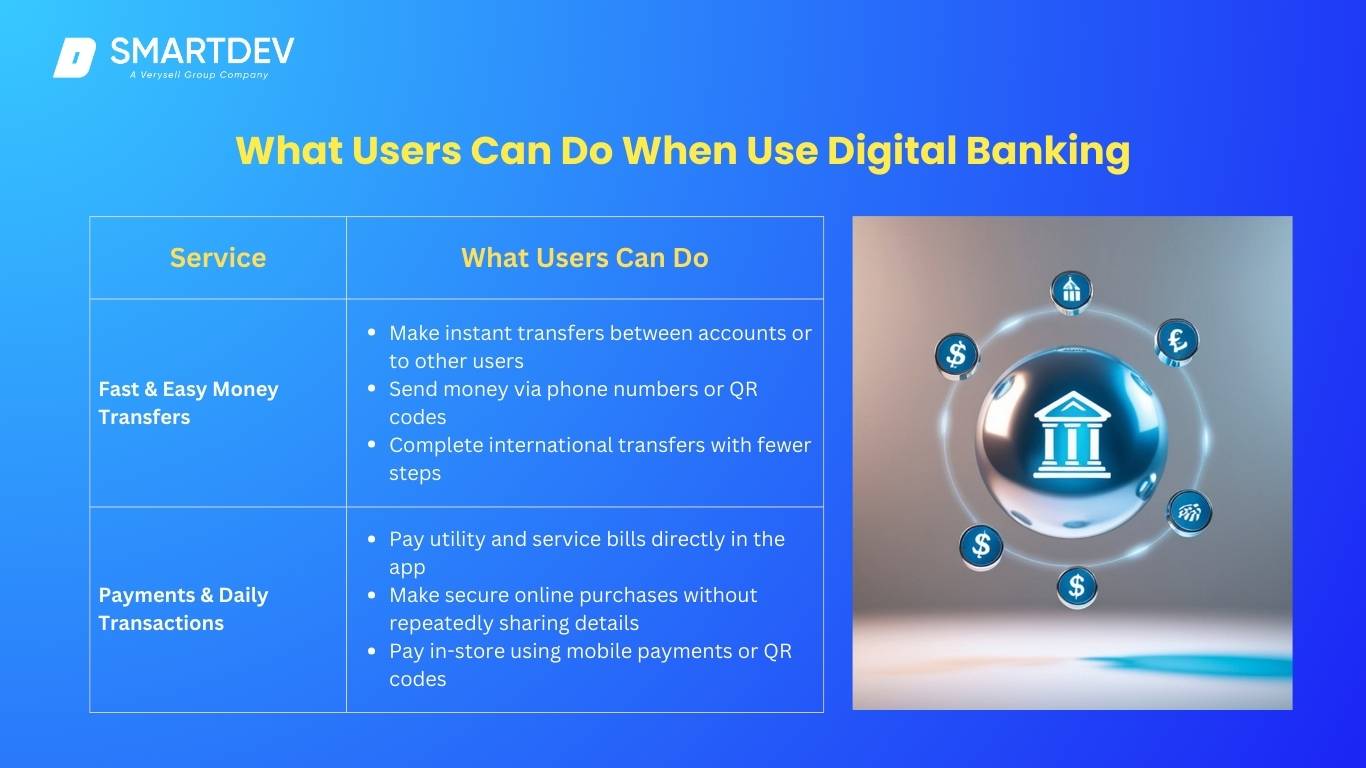

2. Fast and Easy Money Transfers

Digital banking is designed to make sending and receiving money quick and simple. This is especially useful in daily life, where people often need to transfer money urgently.

With digital banking, users can:

- Make instant transfers between their own accounts or to other people

- Send money using phone numbers or QR codes instead of long account details

- Complete international transfers with fewer steps and clearer instructions

These features reduce paperwork and eliminate the need to visit bank branches. They also save time and make cross-border transactions more accessible, which is increasingly important in a global and connected world.

3. Payments and Daily Transactions

Digital banking supports a wide range of everyday payments, making daily transactions more convenient and efficient.

Using digital banking, users can:

- Pay bills such as electricity, water, internet, and phone services directly from the app

- Make online purchases securely without sharing sensitive information repeatedly

- Use mobile payment features or scan QR codes when shopping in physical stores

These payment options encourage cashless transactions, which reduce the need to carry cash and lower the risk of loss or theft. They also make it easier for users to manage multiple payments in one place.

4. Online Customer Support

Customer support is an essential part of digital banking, especially when users face issues or have questions about their accounts.

Digital banking platforms usually provide support through:

- In-app live chat with customer service agents for real-time assistance

- Automated chatbots that can answer basic questions quickly

- Email or message-based ticketing systems for more complex requests

Unlike traditional banks that operate only during office hours, digital banking support is often available beyond normal working hours, and in many cases, 24/7. This ensures users can get help whenever they need it.

5. Advanced Financial Tools

Beyond basic banking services, many digital banking platforms include advanced tools that help users manage their money more wisely.

These tools often include:

- Budgeting and spending analysis that break down expenses by category

- Savings goals with automated suggestions to help users save regularly

- Alerts and notifications for unusual activity, low balances, or overspending

By providing insights and reminders, these tools encourage responsible financial behavior. They help users build better financial habits, plan for the future, and feel more confident about their financial decisions.

Digital Banking Trends

As user expectations and technology evolve, digital banking continues to develop rapidly.

1. Speed and Instant Access

Customers expect banking services to be available quickly. Whether it’s opening an account, making a payment, or solving a problem, the process should be fast and frictionless.

2. Shift to a Cashless Society

Digital banking supports the move away from physical cash by making digital transactions more seamless. This includes mobile payments, contactless cards, and integrated wallets.

3. Personalized Banking

Banks are using data to offer more personalized services, such as:

- Spending insights based on transaction history

- Tailored product recommendations

- Financial tips and nudges aligned with user behavior

This makes the experience more relevant and user-friendly.

4. Security Enhancements

Security remains a top priority. Modern digital banks now use:

- Biometric authentication (fingerprint or facial recognition)

- Two-factor verification

- Real-time fraud monitoring and alerts

These measures help protect customer data and ensure secure access to financial services.

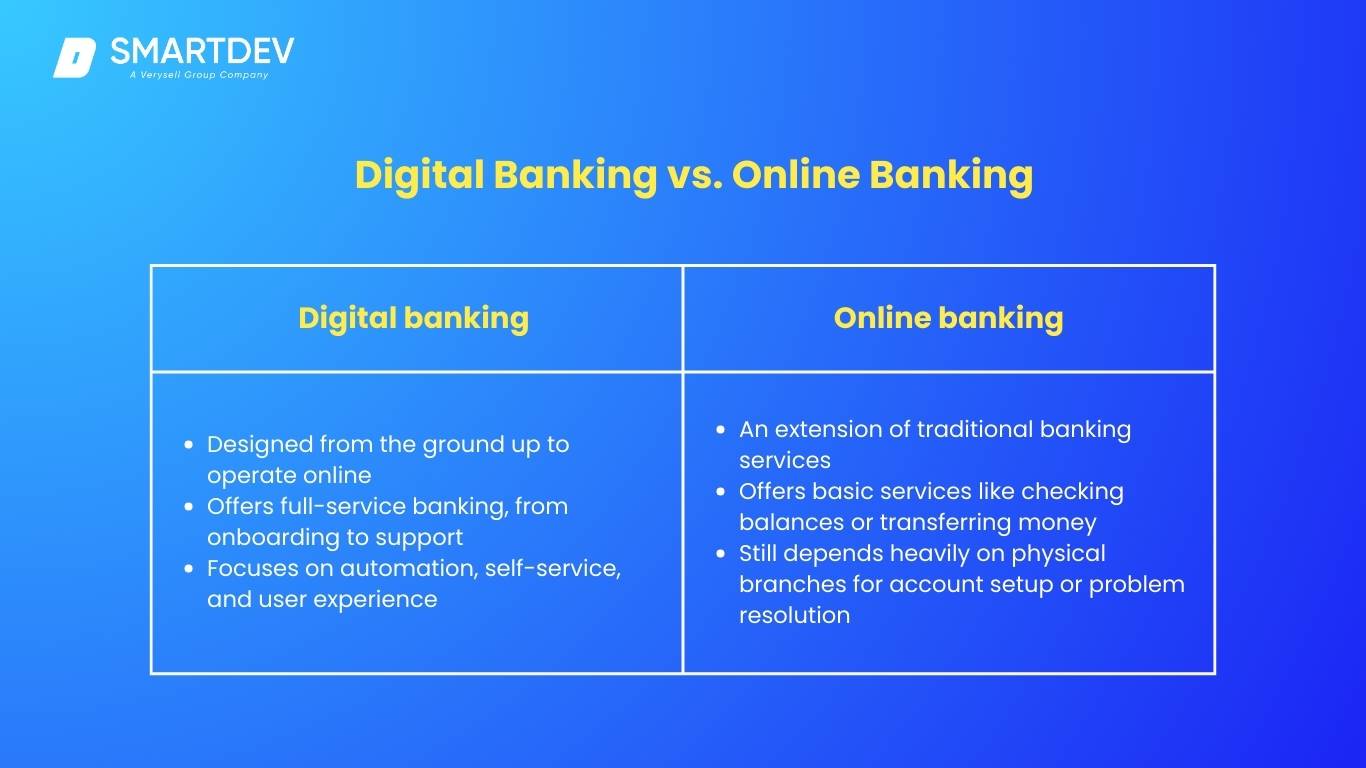

Digital Banking vs. Online Banking

Although often used interchangeably, digital banking and online banking are not the same.

Online Banking

- An extension of traditional banking services

- Offers basic services like checking balances or transferring money

- Still depends heavily on physical branches for account setup or problem resolution

Digital Banking

- Designed from the ground up to operate online

- Offers full-service banking, from onboarding to support

- Focuses on automation, self-service, and user experience

In short, online banking adds digital tools to traditional banks, while digital banking creates a bank experience centered around digital technology.

Insight from Ctrl Shifter Podcast

In Episode 11 of Ctrl Shifter Podcast, guest speaker Muthiad shares an important reminder about digital transformation in banking.

As digital banking platforms aim to become faster and more seamless, there’s a risk of overlooking critical aspects such as stability, risk management, and long-term reliability.

Muthiad points out that traditional banks often face “risk paralysis” — a hesitation to innovate due to the need to protect existing systems and comply with strict regulations. While this may slow progress, it also reflects the importance of ensuring that services are dependable and secure.

The key insight is this: Digital banking must balance speed with responsibility. Innovation should never come at the expense of trust or stability.

Final Thoughts

Digital banking is changing how we manage money. It brings greater access, smarter tools, and more freedom for individuals and businesses alike.

But as digital experiences become faster, it’s important to remember the core values of banking: safety, stability, and trust. Technology is a powerful tool — but it must be used thoughtfully.

Understanding the benefits and risks of digital banking can help you make informed decisions and choose the approach that fits your lifestyle best.

If you’re considering making the switch — or just looking to better understand how digital banking works — this guide is a solid place to start.